How are premium payments calculated?

A bonus is a payment that stimulates conscientious work and high-quality performance of work, which is awarded to employees at the discretion of the employer in the manner and conditions stipulated in the employment contract, collective agreement, and regulations on remuneration. The law does not oblige company owners to pay bonuses even if employees successfully complete complex tasks.

If the employer's obligation to pay a bonus is specified in the employment agreement, it is mandatory to pay the bonus.

In order for the accountant not to get confused in the methods of calculating bonuses, he needs to decide what kind of bonus payment should be calculated. Today there are the following varieties:

- Bonuses assigned based on the results of a certain period (month, quarter, half-year, year).

- One-time bonuses assigned suddenly when a special occasion appears, for example, completion of work on a large project, exceeding the quota, connecting to the services of a large client, proposing an innovative idea, etc.

- Bonuses directly related to success in work and not related to work in any way (for example, an anniversary bonus).

The bonus is transferred to the employee’s bank account or paid in cash simultaneously with the salary. Compliance with this procedure is most important if there is a bonus provision in the employment contract.

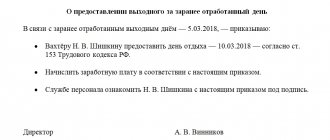

After calculating the amount of the bonus, you need to issue an order on its assignment (on Form T-11, if it is paid to one employee, and on Form T-11a, if the bonus is assigned to a group of employees), otherwise you may receive claims from the tax inspectorate, since they are not properly filed premiums cannot be taken into account when calculating the taxable base for income tax.

Calculation of average monthly salary

The calculation of normal working hours for this period in general can be obtained by dividing 40 hours by 5 and then multiplying by the total number of working days over a five-day working week in the period. The resulting result is reduced by the number of hours shortened in working days before the holidays. It is permissible to use summary accounting both for the company as a whole and for its divisions or associations of employees employed in areas with a continuous production cycle. Its implementation makes sense in those areas where, due to the nature of the work organization and production process, it is impossible to adhere to the weekly standard of working hours.

Firstly, in many enterprises the production process cannot be stopped, so the work schedule there is shifting. Secondly, some categories of employees cannot work for such an amount of time, since by law they are entitled to a reduction in labor standards. These are minors, people with disabilities, etc.

The method of calculating the amount of wages, when the salary is taken as the base value, is convenient for an accounting period of 1 month. As you know, the salary is set for performing work during a month of normal working hours.

How to calculate bonus for actual time worked

If the employee has not fully worked the period for which the bonus is calculated, the accountant is faced with the task of correctly calculating the bonus payment, and there are 2 options: calculate the bonus as if the employee worked throughout the entire period, or calculate the payment not in full.

The first option can be chosen if the subordinate worked only part of the pay period, and 2 conditions were met:

- the procedure for paying bonuses adopted at the enterprise regulates the proportional calculation of the amount in accordance with the actual time worked in the calendar year;

- The billing and bonus periods are the same.

Partial bonus payment can be calculated in the following situations:

- the calculation and bonus periods coincide, but the rules for assigning bonus payments in the organization suggest that the calculation will not take into account the actual time worked;

- the billing and bonus periods are not the same, or the bonus period partially falls within the billing period.

All about calculating man-hours: formula and related indicators

Info

At the enterprise level, in order to solve management problems, it is advisable to analyze these indicators not only for the enterprise as a whole, but also for workshops and other divisions of the enterprise, for all personnel, for workers. To study the use of working time, time funds calculated in man-days are used: Task Indicator July August Average payroll number of workers 1300 1280 Man-days worked 28600 29440 Man-hours worked 221650 226688 Find:

- the change in man-hours worked in August compared to July is general and due to changes in the average working day, changes in the average number of days of work per payroll worker and changes in the average payroll number of workers;

Solution

- Change in man-hours total (increased by 5038 man-hours)

We will carry out further calculations using indices.

An example of how to calculate bonuses for actual time worked

Employee of the enterprise Sakharov A.A. We plan to take annual leave according to the vacation schedule from January 16, 2015 to January 26 of the same year. In the billing period (from January 1 to December 31, 2015) Sakharov A.A.:

- went on a business trip (from April 18 to April 27);

- was on vacation (from June 16 to June 29);

- was ill and took sick leave (from October 17 to October 27).

In this billing period, Sakharov A.A. received the following benefits at work:

- wages in the amount of 256 thousand rubles;

- bonus payment for the previous period in the amount of 20 thousand rubles (in March);

- bonus payments for the current billing period without taking into account the actual time worked in the amount of 27 thousand rubles .

So, bonus money was transferred to the employee’s account without taking into account the time worked, so you need to calculate the amount again, based on the number of days actually worked in the pay period. To do this, you need to find out how many days the employee works.

The total number of days worked in 2014 is 247 , Sakharov spent 6 days , rested for 10 days and was ill for 7 days . So, Sakharov A.A. actually worked: 247 days. – (6 days + 10 days + 7 days) = 224 days.

When calculating the average salary, you need to take into account the bonus paid at the end of the year:

27,000 rub. : 247 working days x 224 f.neg.days = 24,485 rub. 82 kop.

NTVP "Kedr - Consultant"

LLC "NTVP "Kedr - Consultant" » Services » Legal consultations » Labor disputes » On the legality of calculating wages based on actual time worked for an employee working according to a shift schedule, if the employer did not provide working hours

The employee works according to the shift schedule with which he was familiarized. The work schedule is designed in such a way that the employee does not work out the standard working time; accordingly, he is paid according to the time actually worked.

Question: Is this situation legal? Is it legal to underschedule hours? Is the employer obligated to pay employees extra for hours not worked (not through the employees’ fault, but in accordance with the schedule)? Where to go in such a situation?

Lawyer's answer

This situation is not legal. For the salary established in the employment contract, the employee must work a monthly standard of working hours per month. The monthly standard of hours is determined based on the duration of the working week established by the Labor Code of the Russian Federation for a specific category of workers. For most workers it is 40 hours.

During shift work, when it is impossible to ensure compliance with the working hours established by law, summarized recording of working hours is used.

When recording working hours in aggregate, the standard hours to be worked for the wages established in the employment contract are determined for the accounting period (month, quarter, year).

If, at the end of the accounting period, the employee works fewer hours than the norm established by law for this period, then there will be a shortfall due to the fault of the employer, since he did not provide the employee with work.

The employer must organize the work process so that during the accounting period the employee completes the full working hours. The employer is responsible for correctly planning the shift schedule and providing the employee with the work stipulated by the employment contract. Due to the fact that it is the employer who does not fulfill the terms of the employment contract and does not provide the employee with the opportunity to fulfill the standard working hours, he is obliged to compensate the employee for losses incurred.

In this case, remuneration should be made in an amount not lower than the average salary of the employee, calculated in proportion to the actual time worked.

So, if the accounting period is a month, the standard hours for the month in accordance with the law were 170 hours, but the employee worked only 162 hours according to the schedule, then (the situation of the applicant):

— payment based on the established salary is made for 162 hours,

— payment for 8 hours (170-162) is made in an amount not lower than the average hourly wage for the 12 calendar months preceding the paid month.

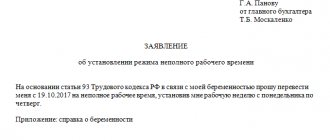

It should also be noted that by agreement with the employee, he can be assigned part-time work both upon hiring and subsequently. In this case, when working on a part-time basis, the employee’s payment is made in proportion to the time he worked or depending on the amount of work he performed.

At the same time, for employees working part-time (shift) and (or) part-time week, the normal number of working hours for the accounting period is correspondingly reduced.

If the employer violates labor legislation, the employee has the right to file a statement (in writing or electronically) with the state labor inspectorate at the employer’s location, with the prosecutor’s office, or directly with a statement of claim in court at the location of the organization or at his place of residence.

It should be noted that the period for an employee to apply to court for resolution of an individual labor dispute is 3 months from the day he learned or should have learned about a violation of his rights, and for disputes about dismissal - within one month from the date of delivery him copies of the dismissal order or from the date of issue of the work book.

To resolve an individual labor dispute regarding non-payment or incomplete payment of wages and other payments due to an employee, he has the right to go to court within one year from the date of the established deadline for payment of these amounts, including in the case of non-payment or incomplete payment of wages and other payments due to an employee upon dismissal.

The state fee when considering labor disputes by the courts is not collected.

At the same time, the lawyer recommends that before contacting regulatory and supervisory authorities, prosecutors or courts, contact the employer directly to resolve any disagreements that have arisen.

Legal basis: In accordance with Article 22 of the Labor Code of the Russian Federation (hereinafter referred to as the Labor Code of the Russian Federation), the employer is obliged to provide employees with work stipulated by the employment contract.

Based on Article 91 of the Labor Code of the Russian Federation, working time is the time during which an employee, in accordance with the internal labor regulations and the terms of the employment contract, must perform labor duties, as well as other periods of time that, in accordance with this Code, other federal laws and other regulatory legal acts of the Russian Federation relate to working time.

Article 104 of the Labor Code of the Russian Federation establishes that when, due to the conditions of production (work) of an individual entrepreneur, in the organization as a whole, or when performing certain types of work, the established for this category of workers (including workers engaged in work with hazardous and (or) hazardous working conditions) daily or weekly working hours, it is allowed to introduce summarized recording of working hours so that the duration of working hours for the accounting period (month, quarter and other periods) does not exceed the normal number of working hours. The accounting period cannot exceed one year, and for recording the working time of workers engaged in work with harmful and (or) dangerous working conditions - three months.

The normal number of working hours for the accounting period is determined based on the weekly working hours established for this category of workers.

In accordance with Article 155 of the Labor Code of the Russian Federation, in case of failure to comply with labor standards or failure to fulfill labor (official) duties through the fault of the employer, remuneration is made in an amount not lower than the average salary of the employee, calculated in proportion to the time actually worked.

According to Article 139 of the Labor Code of the Russian Federation, in any mode of operation, the average salary of an employee is calculated based on the salary actually accrued to him and the time actually worked by him for the 12 calendar months preceding the period during which the employee retains the average salary. In this case, a calendar month is considered to be the period from the 1st to the 30th (31st) day of the corresponding month inclusive (in February - to the 28th (29th) day inclusive).

According to clause 13 of the Regulations on the specifics of the procedure for calculating average wages, approved. by Decree of the Government of the Russian Federation No. 922 dated December 24, 2007, when determining the average earnings of an employee for whom a summarized recording of working time is established, except in cases of determining the average earnings for paying for vacations and paying compensation for unused vacations, the average hourly earnings are used.

Average hourly earnings are calculated by dividing the amount of wages actually accrued for hours worked in the billing period, including bonuses and remunerations taken into account in accordance with paragraph 15 of the Regulations, by the number of hours actually worked during this period.

Average earnings are determined by multiplying average hourly earnings by the number of working hours according to the employee’s schedule in the period subject to payment.

In accordance with Article 93 of the Labor Code of the Russian Federation, by agreement of the parties to the employment contract, an employee, both upon hiring and subsequently, may be assigned part-time working hours (part-time work (shift) and (or) part-time work week, including with a split working day into parts). Part-time working hours can be established either without a time limit or for any period agreed upon by the parties to the employment contract.

At the same time, in accordance with Art. 104 of the Labor Code of the Russian Federation for employees working part-time (shift) and (or) part-time week, the normal number of working hours for the accounting period is correspondingly reduced.

In accordance with Art. 356 of the Labor Code of the Russian Federation The State Labor Inspectorate in the Urals carries out federal state supervision over compliance with labor legislation and other regulatory legal acts containing labor law norms, through inspections and issuing mandatory orders to eliminate violations.

In accordance with the Federal Law of January 17, 1992 No. 2202-1 “On the Prosecutor’s Office of the Russian Federation,” the main task of the prosecutor’s office is to exercise general supervision over compliance with the law, i.e. The prosecutor's office is not a specialized body for supervision and control in the field of labor. However, since labor legislation is part of the general legislative system, the prosecutor's office is authorized to exercise supervision in this area as well.

Based on Art. 392 of the Labor Code of the Russian Federation, an employee has the right to apply to the court for resolution of an individual labor dispute within three months from the day he learned or should have learned about a violation of his right, and in disputes about dismissal - within one month from the date he was given a copy of the order dismissal or from the date of issue of the work book.

To resolve an individual labor dispute regarding non-payment or incomplete payment of wages and other payments due to an employee, he has the right to go to court within one year from the date of the established deadline for payment of these amounts, including in the case of non-payment or incomplete payment of wages and other payments due to an employee upon dismissal.

In accordance with Articles 28, 29 of the Code of Civil Procedure, the claim is brought to the court at the place of residence of the defendant. A claim against an organization is filed in court at the location of the organization. Claims for restoration of labor rights may also be brought to the court at the plaintiff’s place of residence.

Arbitrage practice.

The Dzerzhinsky District Court of Perm, in Decision No. 2-2196/14 dated August 29, 2014, stated that if, according to a shift schedule drawn up in advance by the employer (based on the results of the accounting period) in the organization, the working time of an employee for whom a summarized recording of working time is established, less than the norm, then there is a deficiency due to the fault of the employer. From Art. 155 of the Labor Code of the Russian Federation it follows that responsibility for the employee’s failure to comply with labor standards lies with the employer and he must reimburse the employee the average wage for the time not worked.

Consultation was given in November 2021 as part of the Republican competition “Professional Lawyer 2017”.

Consultant - Rinata Sergeevna Shaydullina, chief state labor inspector of the department of state supervision of labor protection of the State Labor Inspectorate in the Udmurt Republic

Common mistakes

Error: An employee who has been subject to disciplinary action expects to receive a bonus for the time actually worked, although the employment contract does not indicate the payment of bonuses.

Comment: Employees who have committed violations of labor discipline cannot qualify for a bonus. He can receive a bonus only if its payment is stated in the employment contract, and nothing is said about the reasons for deprivation of the bonus.

Error: The employer entered into an agreement with the employee, which states the obligation to pay a bonus. However, the text does not contain provisions on the grounds for deprivation of bonus payments. The employer did not pay the bonus at the end of the year on the basis that the subordinate did not work for the entire reporting period.

Comment: In this case, it is permissible to pay a bonus at the end of the year for the time actually worked, but not to deprive the employee of the bonus.

Working time, rest time, payment and labor standards

Russian labor legislation establishes a maximum measure of labor (maximum standard of working time), which employers, either independently or by agreement with representative bodies of workers or with the workers themselves, cannot exceed (exceptions to this rule are allowed only in cases established by law (Art. Art. 97, 99, 101 of the Labor Code of the Russian Federation and commentary thereto)).

The working hours regime has a very serious social aspect in terms of free time, which, according to K.

On the eve of holidays, the working hours of employees, except for those for whom reduced working hours are established, are reduced by one hour in both a five-day and a six-day work week.

Dear readers, if you see an error or typo, help us fix it! To do this, highlight the error and press the “Ctrl” and “Enter” keys simultaneously.

Answers to common questions about how to calculate bonuses for actual hours worked

Question No. 1: When I got a job, the employer invited me to familiarize myself with the employment contract, which stated his obligation to pay me a bonus. Nothing was said about the deprivation of the bonus. Did my employer act legally if he deprived me of my bonus payment after I committed absenteeism?

Answer: If the text of the employment contract does not state the reasons why an employee may be deprived of a bonus, then this payment is equal to the main income, and the employee cannot be deprived of a bonus.

Question No. 2: Is it necessary to include days spent on sick leave in the number of days actually worked when calculating the bonus for time actually worked? After all, during sick leave the employee is paid the average salary.

Answer: No, sick leave should not be included in the calculation.

Rate the quality of the article. Your opinion is important to us:

Man-hours: calculation (formula)

Then the data is summarized.

- In order for the calculation of man-hours to be accurate, it is necessary to maintain a working time sheet in which all data for each employee is entered. Time of arrival and departure from work, actual time worked. For example, it happens that a team of workers is on site, but cannot work due to untimely delivery of materials.

- You can calculate this indicator for each permanent employee, provided that he works for a whole month, 8 hours a day. If you work five days, you get: 21 working days multiplied by eight hours = 168 man-hours per day. Typically, this formula is used for normal working hours.

- If an organization employs ten people, then the total man-hours per day will be 80.