Article 5. Urgent pension payment

1. Urgent pension payment is carried out to insured persons who have formed pension savings through additional insurance contributions for a funded pension, employer contributions, contributions for co-financing the formation of pension savings, income from their investment, funds (part of the funds) of maternal (family) capital aimed at the formation funded pension, income from their investment, upon reaching the ages of 60 and 55 years (men and women, respectively) and subject to the conditions entitling them to an old-age insurance pension (availability of the required insurance period and the established value of the individual pension coefficient), and to persons specified in Part 2 of Article 6 of the Federal Law of December 28, 2013 N 424-FZ “On Funded Pensions”, - upon reaching the age or the deadline determined in accordance with the Federal Law of December 28, 2013 N 400-FZ “On Insurance Pensions” as of December 31, 2021. (Part 1 as amended by Federal Law dated October 3, 2018 N 350-FZ) (see.

text in the previous edition) 2. Establishment and payment, including delivery, of urgent pension payments are made in the manner prescribed by Federal Law of December 28, 2013 N 424-FZ “On Funded Pension”, unless otherwise established by the legislation of the Russian Federation.( as amended by Federal Law dated July 21, 2014 N 216-FZ (see text in the previous edition)

3. The amount of a fixed-term pension payment is determined by the formula: SP = PN / T, where SP is the amount of a fixed-term pension payment; PN is the amount of pension savings generated through additional insurance contributions for a funded pension, employer contributions, contributions for co-financing the formation of pension savings , income from their investment, funds (part of the funds) of maternal (family) capital aimed at forming a funded pension, income from their investment, recorded in a special part of the individual personal account or in the pension account of the insured person’s funded pension as of the day from which he is assigned an urgent pension payment, but not less than the amount of guaranteed funds, determined in accordance with the Federal Law “On guaranteeing the rights of insured persons in the compulsory pension insurance system of the Russian Federation when forming and investing pension savings, establishing and making payments from pension savings” ;(ed. Federal laws dated December 28, 2013 N 410-FZ, dated July 21, 2014 N 216-FZ (see text in the previous edition) T - the number of months of the period for payment of an urgent pension payment, specified in the application of the insured person for the appointment of an urgent pension payment, which cannot be less than 120 months (10 years).

4. The amount of the fixed-term pension payment from August 1 of each year is subject to adjustment based on the amount of additional insurance contributions for the funded pension, employer contributions, contributions for co-financing the formation of pension savings, income from their investment, funds (part of the funds) of maternal (family) capital, aimed at the formation of a funded pension, income from their investment, which were not taken into account when determining the amount of pension savings for calculating the amount of an urgent pension payment upon its appointment or the previous adjustment provided for by this part. (as amended by Federal Law dated July 21, 2014 N 216 -FZ (see text in the previous edition)

5. Adjustment of the amount of urgent pension payment is carried out according to the formula: SV = SVk + PNk / T, where

SV – amount of urgent pension payment;

СВк – the established amount of urgent pension payment as of July 31 of the year in which the corresponding adjustment is made;

Pnk - the amount of pension savings generated from additional insurance contributions for a funded pension, employer contributions, contributions for co-financing the formation of pension savings, income from their investment, funds (part of the funds) of maternity (family) capital aimed at the formation of a funded pension, income from their investments, taken into account as of July 1 of the year from which the corresponding adjustment is made;

T – the number of months of the payment period specified in the insured person’s application for an urgent pension payment, reduced by the number of months that have elapsed from the date of assignment of an urgent pension payment as of July 31 of the year in which the corresponding adjustment is made. (as amended by the Federal Law dated 07/21/2014 N 216-FZ (see text in the previous edition)

6. If the death of the insured person occurred before the assignment of an urgent pension payment to him or before adjusting its size taking into account additional pension savings, the funds accounted for in a special part of the individual personal account or in the pension account of the funded pension (with the exception of funds (part of the funds) maternal (family) capital aimed at forming a funded pension, income from their investment) are paid to its legal successors in the manner prescribed by Part 6 of Article 7 of the Federal Law of December 28, 2013 N 424-FZ “On Funded Pension”. (as amended. Federal Law of July 21, 2014 N 216-FZ (see text in the previous edition)

7. In the event of the death of the insured person after the appointment of an urgent pension payment, the balance of pension savings (with the exception of funds (part of the funds) of maternal (family) capital aimed at forming a funded pension, income from their investment), accounted for in a special part of his individual personal account account or on a pension account of a funded pension that has not been paid to a deceased insured person in the form of an urgent pension payment, is subject to payment to legal successors in the manner prescribed by Part 6 of Article 7 of the Federal Law of December 28, 2013 N 424-FZ “On Cumulative Pension.” (as amended) Federal Law of July 21, 2014 N 216-FZ (see text in the previous edition)

8. The balance of funds (part of funds) of maternal (family) capital aimed at forming a funded pension, income from their investment, not paid to the deceased insured person in the form of an urgent pension payment, is subject to payment to legal successors from among the persons specified in Article 3 of the Federal Law dated December 29, 2006 N 256-FZ “On additional measures of state support for families with children”, in the manner prescribed by the Government of the Russian Federation. (as amended by Federal Law dated July 21, 2014 N 216-FZ) (see text in the previous edition )

9. In the absence of the persons specified in part 8 of this article, as well as in the event of the death of the insured person before the assignment of an urgent pension payment to him or before adjusting its size, funds (part of the funds) of maternity (family) capital aimed at forming a funded pension, income from their investments are transferred by the non-state pension fund to the Pension Fund of the Russian Federation. (as amended by Federal Law dated July 21, 2014 N 216-FZ) (see text in the previous edition)

10. Accrued amounts of urgent pension payments due to the insured person in the current month and remaining not received in connection with his death in the specified month are paid in the manner determined by parts 3 and 4 of Article 13 of the Federal Law of December 28, 2013 N 424-FZ “ On funded pensions.” (Part 10 introduced by Federal Law dated July 21, 2014 N 216-FZ)

What is a lump sum payment from a funded pension to pensioners?

According to the procedure for issuing pension savings funds dated February 8, 2012, some categories of people have the opportunity to receive them in the form of a whole amount, and not in parts throughout the year. This format for issuing funds is carried out by the Pension Fund of Russia and non-state pension funds in accordance with the Federal Law “On Compulsory Pension Insurance”. In accordance with it, a lump sum payment to pensioners is mandatory insurance coverage, that is, the pension insurance insurer is obliged to transfer it to the citizen on time. In addition, it is possible to receive an urgent payment generated using additional deposits. That is, if you have a question whether there will be lump sum payments to pensioners, then the answer is yes.

You can check the current amount of your pension savings (PS) at the Pension Fund branch located at your place of residence, bringing your passport and SNILS, or check it through the State Services Portal.

- Recommended articles to read:

- Social services for older people

- Diseases of old age

- Valuable tips on how to choose a boarding house

What are “pension savings”?

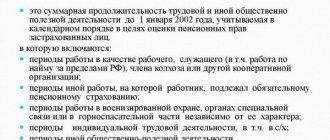

Pension savings are funds located in the individual account of a citizen insured in the state or non-state pension fund of the Russian Federation, accumulated by him during his working life. Includes (Article 3 of the Law “On Funded Pension”):

- Contributions to the funded part by the employer for compulsory pension insurance (OPI).

- Additional contributions paid by citizens under the State Co-financing Program, as well as the amounts of contributions transferred by the state.

- Maternity capital or part of it, aimed at the funded part of the labor (insurance) pension.

Savings can be formed in a state or non-state pension fund at the discretion of the insured person. A citizen also has the right to transfer his savings to other funds, but not more than once every five years .

A citizen has the right to designate legal successors to receive the unspent part of savings after his death by submitting an application to the fund in which the funded pension is formed.

Who is entitled to payments?

The payment can be made by the owner of pension savings in whose personal account the savings funds are placed.

And in the event of his death, his heirs (legal successors) can receive such a right.

According to the law, the following can receive money:

- heirs related to the first (spouses, parents, children),

- or second stage (brothers, sisters, grandparents, grandchildren).

In addition to the legal heirs, the persons specified in the special will have the right to claim. The citizen who owns the account writes such a statement and leaves it with the Pension Fund.

After his death, this organization is obliged to notify the persons specified in the will that they can receive the money due to them under the will.

If we are talking about maternity capital, all issues related to payments will be regulated in accordance with Article 256 of the Federal Law. Guardians or adoptive parents (with the permission of the guardianship authorities) or children upon reaching adulthood will be able to receive the funds.

What is SPV?

Urgent pension payments are made from previously made contributions to the insurance accumulation fund, which are not classified as mandatory payments. Insured persons entitled to such payments can receive funds on a monthly basis. They independently determine the time period for their implementation, which cannot be less than 10 years.

Formation

SPV can be received only by those pensioners who previously carried out financial transactions related to depositing funds into a special account that has a savings status. Such contributions can be made:

- by the employer in the form of regular deductions from the employee’s salary;

- the applicant for the formation of a funded pension;

- by the state under a co-financing program;

- the applicant at the expense of maternal or family capital redirected to provide a funded pension.

Funds deposited into the account of the insured person are not subject to indexation. Their value can be increased by investing funds in financial markets, which is the main service of funded pension structures.

What contributions are formed from?

Each person has the opportunity to receive an urgent payment exclusively before forming their own savings through the following components:

- Voluntary contributions according to the state co-financing program.

- Secondary insurance premiums.

- Funds from maternity capital, which have a strict purpose - for the formation of the mother’s NPE.

If we consider the procedure for assigning a fixed-term pension, insurance contributions that go to replenish the private equity are not taken into account. They are taken into account exclusively when calculating the NPP, in other words, to create an open-ended payment.

Any citizen can form an NPP through voluntary contributions by making constant transfers to the account of certain amounts of money. Women have the opportunity to replenish their own maternity capital.

The money that is deposited into a person’s account does not undergo indexation. These funds increase solely due to investments taking place in the financial market. As a result of this procedure, savings may decrease or increase.

What pension savings are subject to urgent payment?

Accumulative pension funds that were transferred to the Fund by the insured person on a voluntary basis are subject to urgent payment, in addition to mandatory payments. Payments are made not only from funds transferred to the individual account, but also from income received through transactions on trading markets in which investments were involved.

Issues related to urgent payments to the population in the field of pension savings are regulated by the Federal Law “On the procedure for financing payments from pension savings” dated November 30, 2011 No. 360-FZ (as amended on June 29, 2015). It regulates the procedure for ensuring payments made from pension savings. Financial payments are controlled and regulated at the regional level. Representatives of local authorities have the right to establish their own requirements and restrictions, stipulated by the regulations put into effect.

When does the right to receive SPV arise?

Citizens of the Russian Federation who:

- have reached retirement age or have a preferential opportunity to retire early;

- took care in advance about the formation of a funded pension and regularly received contributions to their savings account, the amount of which exceeded the regulated amount calculated from accrued wages.

If part of the accumulated funds was not paid to the pensioner due to his death, then the rights to receive the remaining amount of money are transferred to the heirs.

How and where to exercise the right to receive SPV?

Registration of SPV is carried out at the branch of the Pension Fund where the applicant has a savings account. The procedure is carried out in several stages:

- preparation of the required set of documentation;

- submitting documents for consideration to the Pension Fund or Non-State Pension Fund;

- receiving a receipt stating that all documentation has been submitted for reconciliation;

- review and analysis of submitted information within 10 calendar days;

- receipt by the applicant of a decision on payment or refusal to provide it;

- fulfilling the requirements of PF representatives to finalize documents if an incomplete set of documents was submitted;

- payment of funds during the time period specified in the application.

The start date for processing payments is the day the package of documents is submitted to the Pension Fund. If the documents were sent by mail, the filing date is considered to be the day indicated on the stamp. If a person has not issued a self-employed person, then the money due by law will be paid to the pensioner along with standard pension payments.

Documentation

To receive an urgent pension, the applicant must prepare a set of documentation. It includes:

- an application for payment, which can be submitted to the Pension Fund branch or through the online service located on the official website of the organization;

- passport, which is the main document confirming the identity of the applicant;

- work book confirming the presence of insurance and non-insurance experience;

- SNILS;

- certificate of payment of insurance premiums.

How to calculate the size of the SPV?

When calculating SPV, the parameters of insurance premiums paid under the compulsory insurance regime are not taken into account. They are taken into account only to ensure perpetual payments.

The amount of the urgent payment depends on the time period specified by the applicant for payments in the application. The criterion is determined by the applicant independently; the insured person has the right to indicate the desired date for the payment. The size of the cash payment is determined in accordance with regulatory requirements using a formula represented by the quotient of the parameter regulating the amount of savings in the individual account and the selected payment period, which cannot be less than 120 months.

Calculation example : Pensioner Valery Pavlovich Litvinov had a sum of money in the amount of 240,000 rubles in his savings account. When he reached the age of 63, he applied to the Pension Fund to obtain urgent payments. He determined the desired payment period to be 228 months. These application parameters determined the possibility of receiving monthly assistance of 1,052 rubles.

One-time payment to pensioners: what else can pensioners expect in 2021

Increase in pension payments

In 2021, pension indexation will again follow the same pattern. That is, insurance pensions will increase by the level of actual inflation, and state pensions, including social ones, will rise taking into account the increase in the pensioner’s cost of living.

Starting from February, insurance pensions for non-working pensioners will rise to the inflation rate for 2021, or 5.8%. In addition to the insurance pension, up to 4,823.35 rubles. both the size of the fixed payment and the cost of the pension point will increase to 78.58 rubles. In 2016, this figure was 74.27 rubles.

From April 1, state pension benefits, including social benefits, will be increased by 2.6%. The procedure will affect both working and non-working pensioners.

From February 1, the monthly payment issued to federal beneficiaries will be indexed by 5.8%.

Citizens who were still working in 2021 will have their insurance pensions increased in August 2021. The largest increase in cash equivalent is three pension points.

Peculiarities of pension assignment

According to the pension formula used in Russia since 2015, to obtain the right to the insurance part of the pension in 2021, you must have 8 years of experience and 11.4 pension points.

In 2021, the maximum possible number of pension points is 8.26.

The payment period when calculating the funded pension in 2021 is 240 months. This figure is used exclusively to determine the volume of the funded part of the pension. The issuance of the pension itself is for life.

Any person has the opportunity to ask for each type of pension, while remaining at home. This is easy to do by submitting an application on the Pension Fund website in the “Personal Account” column. Here, if necessary, you can change the pension provider.

Extension of the moratorium on the formation of pension savings

The moratorium on the formation of pension savings has been officially extended to 2021. This is in no way a “freeze of pensions” or a “withdrawal of pension savings.” This concept means that 6% of insurance premiums, which could go to the funded part, are redirected to the insurance. That is, insurance premiums paid by the employer are fully included in the formation of the employee’s pension.

The moratorium does not prevent the transfer of savings to management companies or between pension funds if a person wishes. However, it is important to remember that it is not profitable to transfer savings from one insurer to another more often than once every 5 years, since this action reduces the accumulated investment income.

How to receive an immediate pension payment

An application for an urgent pension payment can be submitted to the territorial office of the Pension Fund of the Russian Federation. There you can also clarify the list of documents required to assign payments.

The funds will be paid to you within the period specified in the application.

If, upon retirement, you do not submit an application for an urgent pension payment, then the funds generated from additional contributions to you as part of a funded pension.

One of the important features of the urgent payment of pension savings is that in the event of the death of a pensioner, the balance of these funds can be paid to the heirs (successors).

From what funds is it paid?

Since this type of security is due to those who have contributions within the framework of compulsory insurance, paid to the funded part in addition to the amount established by law, the following sources of its formation can be distinguished:

- voluntary contributions by the citizen himself, which he sent to his individual account as part of compulsory pension insurance in addition to employer contributions from his salary;

- funds transferred by the state within the framework of the Co-financing program (within 12 thousand rubles per year, the state doubled every thousand voluntarily contributed by a citizen);

- cash contributions that were transferred by the employer of an individual to his funded part in addition to those amounts that are mandatory;

- maternal (family) capital, which the mother ordered to increase her future pension.

The type of security under consideration includes not only the indicated amounts and types of payments themselves, but also the income that was received as a result of their investment. Income from the management of such deductions is accounted for separately, and therefore it is paid separately also within the framework of this type of security.

How is the amount of an immediate pension payment determined?

The amount of immediate pension payment is determined by the formula:

SP = PN / T

, Where

JV

— amount of immediate pension payment;

Mon

- the amount of pension savings formed from additional contributions, as of the day from which the urgent pension payment is assigned;

T

- the number of months of immediate pension payment specified in the application (this number cannot be less than 120 months).

The amount of the urgent pension payment from August 1 of each year is adjusted based on the amount of additional contributions that were not taken into account when calculating the amount of the urgent pension payment when it was assigned or the previous adjustment. In other words, if additional contributions were made, they are taken into account when adjusting.

Adjustment of the amount of immediate pension payment is carried out according to the formula:

SV = SVk + PNk / Tk

, Where

NE

— amount of immediate pension payment;

SVK

— the established amount of immediate pension payment as of July 31 of the year in which the corresponding adjustment is made;

PNk

- the amount of pension savings formed from additional contributions taken into account as of July 1 of the year from which the corresponding adjustment is made;

Tk

- the number of months of payment indicated in the application, reduced by the number of months that have elapsed since the date of assignment of the urgent pension payment as of July 31 of the year in which the corresponding adjustment is made.

Who is entitled to a lump sum payment to pensioners from the funded part of the pension?

This procedure can be carried out exclusively from the pension fund after retirement. Now let’s look at which pensioners have the opportunity to receive a lump sum payment:

- Persons born in 1967 and younger.

- Persons whose funded pension does not exceed 5% of the old-age pension. In this case, the fixed payment and the funded part, calculated as of the day of appointment of the latter, are taken into account.

- People who have a disability and survivors' pension, and people who have a state security pension, if they are not entitled to old-age benefits due to insufficient length of service or the number of points at the time of reaching the appropriate age.

- Members of the state co-financing program for the formation of pension savings. You could join the program until December 31, 2014. If from October 1, 2008 to December 31, 2014, you managed to submit an application and made at least one contribution before January 31, 2015, you are considered a participant.

- People who paid insurance contributions to the funded part in 2002-2004. Note that since 2005, such actions have ceased to be carried out due to changes in legislation. These are men born in 1953-1966, and women born in 1957-1966 if they still have pension funds.

In addition, a one-time payment is provided to pensioners of the Ministry of Internal Affairs. Also, persons who have lost their jobs in the Ministry of Internal Affairs are entitled to this benefit while maintaining their pension. A one-time payment to pensioners of the Ministry of Internal Affairs is issued if they are registered for the appointment of such a benefit while still in service.

Typically, a lump sum payment is not given to working pensioners. When dismissal due to staff reduction, the employer must simply assign severance pay.

Features of formation of urgent payment

If the above funds are available in an individual account, a citizen has the right to create security for them at his choice:

- Together with other money paid to the citizen in the form of the funded part of the insurance pension.

- In the form of an independent benefit (actually an urgent payment).

These types of security differ in the period by which the total amount is divided. In the first case, the period of receiving it is divided into a survival period, which is established by the state; in the second, it is determined by the citizen independently. At the same time, however, the period for receiving this type of security, indicated in the application of an individual, cannot be less than 120 months, i.e. 10 years.

Every year, the amount of this security, provided monthly, is subject to revision (only upward), since during this time additional contributions and income may be received, as well as additional income from investing the unpaid portion of the money.

Existing types of payments

At the present time, Russian citizens can simultaneously use insurance pension provision along with a funded pension.

In a situation where a person has paid contributions to form a pension, during registration he can use one of several types of payments:

- Indefinite, which can be implemented until the end of a person’s life.

- Urgent, when paying money for a certain period.

- Lump sum, in which the payment of the amount is made one time.

For the insured person, the Pension Fund of the Russian Federation establishes a payment format, which will depend on the amount of funds that are in the individual account of any person.

If the amount is less than 5%, in this situation the Pension Fund has the authority to order payment of all the money at once. In addition, this type of issue is available in the event of a certain type of insurance event, which may include loss of a breadwinner, disability, etc.

Payments from pension savings

When transferring funds to the personal account of the insured person, the law provides for four options for accruing pension savings:

- Term - includes savings funds that are formed by making additional contributions within the framework of the state co-financing program, maternity capital funds and contributions at the expense of the employer.

- One-time - issuance of all savings accounted for in the account of the insured person, if their amount is 5% or less and the citizen has received the right to old-age insurance.

- Cumulative - paid monthly. Assigned if savings amount to more than 5% of the total amount of the insurance pension and the insured citizen has reached retirement age.

- Payment to legal successors - made in the event of the death of a person who had savings in his pension account. They are subject to issue to the legal successors or heirs of the insured person. The exception is maternity capital funds, which are paid to the spouse or children.

When can adjustments occur?

The amount for term security must be adjusted on August 1, and this must happen every year, based on the determination of any contributions paid and money that was not taken into account for investment in earlier periods at the time of setting the pension, or at the time of the previous adjustment.

The amount can be increased according to the following calculation: SV = SVk + PNk/T. The formula is deciphered as follows: SV - the amount of payment before adjustment, SVk - the amount after adjustment, PNk - the amount of savings that was not taken into account, T - period.

Conditions of appointment and necessary documents for processing urgent payment

A fixed-term pension is assigned if the insured person meets the following conditions:

- Assignment of an old-age pension according to the compulsory pension system, including early.

- Availability of savings that are intended for the formation of a funded pension, stored in an individual personal account.

Urgent payment is assigned for the period that the insured person indicates in the application for urgent payment, but this period must be at least 10 years .

If on the day of application the insured person forms savings in a non-state pension fund (NPF), the accrual is carried out by the fund in which the savings are formed. You can find out exactly where the funds are stored through the local branch of the Pension Fund , through the electronic portal of government services or through the territorial MFC .

The following documents are required for registration:

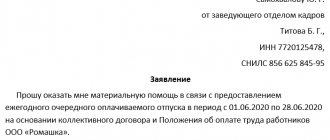

- statement;

- passport;

- SNILS;

- work record book and employment agreement from the last place of work.

If the application is not accompanied by a complete set of documents, the fund provides an explanation of the list of documents that the applicant needs to submit additionally. If missing documents are provided within three months, the day of application is considered the day the application was received . In the case of mailing - the date indicated on the postmark at the place of departure of this application.

Conditions of appointment

Just like other types of private equity, payments of an urgent nature can be established only for people who have the appropriate funds in their account. A fixed-term type of pension can be assigned in a situation where the AP will act as a recipient of an insurance pension strictly upon reaching a certain age.

To establish this type of security, a person must contact the NPF, and if the person is not a member there, then the Pension Fund. You can find out information at the Pension Fund of the Russian Federation, or you can also use the official website of the State Services.

In this case, it is necessary to provide the following documents:

- Passport of a citizen of the Russian Federation.

- Application according to a specific sample.

- Work book.

- SNILS.

Amount of immediate payment of funded pension

Pension savings located in the personal account of each insured citizen are formed from several parts. At the same time, a citizen who forms pension savings when the right to a labor (insurance) pension arises can:

- receive pension savings in the form of an urgent payment (except for compulsory pension insurance contributions);

- or as part of a funded pension, which is paid monthly based on the expected period of pension payment.

According to the legislative norms reflected in Article 5 of the law “On the procedure for financial payments from pension savings”, the amount of the urgent payment is determined on the date of its appointment . Depends on the period determined by the insured person, which is indicated in the application for the assignment of this accrual and the amount of accumulated funds in the citizen’s current account.

What funds are used to generate the urgent payment?

The formation of a fixed-term pension occurs only through contributions that the citizen has made additionally to the funded part of the pension. These include:

- voluntary contributions transferred under the State Co-financing of Pensions Program and accruals received from the state within the framework of this Program (the citizen’s contribution is doubled, but within amounts from 2 to 12 thousand rubles per year);

- additional contributions from employers (contributions paid to a funded pension in addition to contributions to compulsory pension insurance);

- maternity capital funds;

- income from investing the above funds (through a management company or non-state pension fund).

Formula for determining size

The amount of urgent payment is determined depending on the payment period , the decision of which is determined by the citizen himself, and is calculated using the following formula:

SP = PN / T,

Where:

- SP - the amount of the fixed-term pension;

- PN - the total amount of savings formed from additional insurance contributions for a funded pension;

- T - the number of months indicated at the request of the insured person in the application for a fixed-term pension, which cannot be less than 120 months.

Adjustment of immediate pension payment

According to Article 12 of Law No. 360-FZ of November 30, 2011, the amount of the urgent payment must be adjusted as a result of investing savings funds for citizens who have been assigned a pension, annually from the first of August of the year following the year of receipt of income.

The size of the adjustment depends on the amount of savings taken into account to determine the amount of savings and calculate the amount of the urgent payment when it was assigned or the previous adjustment. The results of investing funds also play a significant role.

The amount of adjustment is calculated using the formula:

SV = SVk + PNk / T,

Where:

- SV - urgent payment;

- СВк - the amount of urgent payment established as of July 31 of the year in which the adjustment is made;

- Pnk - the amount of savings funds that are formed from additional contributions taken into account as of July 1 of the year from which the corresponding adjustment is made;

- T - the number of months of the accrual period that the insured person indicated in the application, reduced by the number of months that have passed from the date of its appointment as of July 31 of the year in which the corresponding adjustment is made.

If there is no investment income, no adjustment is made until the following year.

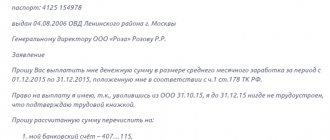

How to calculate payments?

The formula for calculating this payment is quite simple.

To determine the monthly payment, it is necessary to divide the entire amount of savings stored in a personal account in the Pension Fund (their accumulative part) by the number of months (for the payment period) specified by the recipient. She can't be less than 10 years old! Calculations are made based on the account status at the time (day) of the appointment of pension payments in accordance with the law.

Example:

The pensioner refused the required pension payments and worked for another year before retirement. After which I decided to apply for pension payments. The amount of savings amounted to 288,000 rubles. Including the additional year of service, the insurance coverage period reached nineteen years (or 228 months).

To determine monthly payments, you need to divide 288,000 by 228. The urgent payment will be 1,303 rubles per month.

The later a citizen applies for accrual of SPV, the larger amount he will receive monthly.

Example:

Having collected an amount of 240,000 rubles in the account over the entire period of work and applying for registration at the age of 60, you can receive 1,052 rubles per month (240,000 divided by 228 months related to the insurance period). At 63 years old, the payment will increase to 1,250 rubles (240,000 divided by 192 months).

This is due to the fact that the waiting period will be reduced by a year for every 12 months that have passed since the date of receipt of the rights to receive pension payments. You can defer the assignment of payments for a period not exceeding five years (according to Federal Law number 424). By law, the expected payment period is 18 years.

Assignment to successors after the death of the insured person

When receiving this type of benefit, a citizen has the right to appoint successors in advance, as well as distribute shares of funds between them to receive after his death. To do this, you must submit an application for distribution to the fund that creates savings. In the absence of such a statement, relatives are considered successors (i.e. 1st and 2nd line of heirs).

Savings funds can be paid to legal successors (except for maternity capital funds) if the death of the insured occurs:

- before he was assigned a payment from savings funds or before its size was adjusted;

- after the appointment of an emergency pension. The assignee has the right to receive the unpaid balance of savings.

The balance of maternity capital funds aimed at forming a funded pension, and the income from their investment, is paid only to the child’s parent or directly to the children.

When making contributions to a non-state pension fund, provided there are no requests from legal successors for six months after the death of the insured person, the deceased’s savings are transferred to the reserve of this fund (except for maternity capital funds).

Is it possible to get money for a deceased relative?

If a citizen who is entitled to an urgent payment was unable to receive it before his death or did not receive it in full, then these funds (or part of them) can be received by his legal successors.

Reference! This right of relatives is not subject to inheritance law, and they themselves are not heirs. The law calls them legal successors and divides them into 2 stages (1st - spouse, children, parents; 2nd - brothers, sisters, grandparents, grandchildren).

A special succession procedure is provided for contributions aimed at forming a pension from maternity capital funds. Only the father or adoptive parent of the child can claim this money, and in his absence, the children of the deceased.

To receive money, you must submit an application to the Pension Fund within six months from the date of death of the insured person. The Pension Fund of the Russian Federation, within the 7th month after the death of a person, makes a decision on transferring savings to legal successors. The payment itself is made until the middle of the month following the month the decision was made (until the 15th day).

So, the urgent payment is made from funds that were transferred in excess of the contributions established by the state for compulsory pension insurance (the funded part). It is periodic in nature, paid monthly for a period of time chosen by the citizen himself, but not less than 10 years.

To receive it, a person must submit a corresponding application to the Pension Fund or Non-State Pension Fund (depending on where his contributions are stored). These funds are the exclusive property of the citizen and in the event of his death are subject to transfer to his relatives.

Receipt procedure

The procedure for assigning and receiving such benefits consists of several steps:

- Drawing up and sending an application by the insured person.

- The fund's decision to assign such a benefit.

- Delivery of this type of security to the recipient.

The application is submitted to the territorial body of the Pension Fund if the funds of the funded part are placed there. In the case of transfer of money under the management of a non-state PF, a similar application is submitted at the location of the representative office of the relevant fund.

After a positive decision is made, delivery of the cash security must be organized by the Pension Fund or Non-State Pension Fund in which the citizen has contributions. The delivery rules, as well as in more detail the specifics of establishing this type of security, are determined by the law “On Funded Pension” (Article 9).

Features of processing an urgent payment through a non-state pension fund

The calculation and transfer of urgent payments can be carried out not only by state institutions of the Pension Fund of the Russian Federation, but also by non-state pension funds. This happens if citizens transferred their savings to the management of a non-state pension fund by filling out an appropriate application.

A non-state pension fund has the right to establish an urgent additional payment only if the recipient has applied to the Pension Fund of Russia for registration of a pension.

Otherwise, the procedure for establishing, calculating and transferring funds completely coincides with similar rules regulated for government institutions of the Pension Fund of the Russian Federation. After the appointment of an urgent payment, the non-state pension fund is obliged to notify the Pension Fund authorities about this. The conditions for succession after the death of the account holder also do not differ from the option with a non-state pension fund, and the application of legal successors can be submitted not only through a non-state fund, but also through the territorial offices of the Pension Fund.

Sources

- https://www.Consultant.ru/document/cons_doc_LAW_122348/45089dcdf857abe9395d3c1a3009e19b6d551ca9/

- https://pensiya.molodaja-semja.ru/nakopitelnaya-pensiya/vidy-i-sroki-vyplat/srochnaya/

- https://insur-portal.ru/pension/srochnaya-pensionnaya-vyplata

- https://lawrecom.ru/srochnaya-pensionnaya-vyplata/

- https://pfrp.ru/faq/srochnaya-pensionnaya-vyplata.html

- https://lgoty-vsem.ru/pensiya/nakopitelnaya/srochnaya-pensionnaya-vyplata.html