What is the length of service?

The length of service that affects pension contributions consists of various concepts that depend on various factors.

Job title

Public – this includes time associated with public service.

Insurance (labor) - includes work or other activities, during which certain funds are sent to the Pension Fund.

Special – here the citizen is given the opportunity to retire earlier than usual. The specifics are related to working in hazardous industries, in difficult climatic conditions, in places with high radiation.

There are several types of seniority in a position

Continuity

General, to which any time period of work can be attributed, when contributions to the Pension Fund were constantly made. This does not take into account breaks.

Continuous, which refers to the last period of time during which a person performed work duties in one or more organizations without taking breaks (or they lasted as long as allowed by law).

Total work experience is the summed duration of working periods and other activities that have a positive impact on society, until January 1, 2002.

About the total work experience

What periods are included in the length of service?

If the employer or the citizen himself makes transfers of insurance contributions to the pension fund, the length of service in most cases is calculated as follows: 1 day of employment is equal to 1 day of length of service. But there are periods during which the employee does not fulfill his job duties. Insurance premiums are not transferred, however, this time is counted towards the length of service in accordance with Article 12 of Federal Law N400-FZ:

- The period of military service.

- Parental leave for up to 1.5 years (no more than 6 years in total are taken into account).

- A period of temporary incapacity due to injury or illness.

- Time spent in custody in case of unfair criminal prosecution.

- The period of job search, subject to registration with the employment service and compliance with the rules of interaction with it.

- The period of care for a disabled person or a citizen over 80 years of age.

An important condition for accounting for time spent as a result of these circumstances is the existence of formal work before and after these periods.

With the introduction of a point system, socially significant activities are not only included in the length of service, but also imply the accrual of points for each year in the amount of:

- Army -1.8 points

- Maternity leave – from 1.8 points depending on the number of children

- Caring for a disabled person – 1.8 points

According to the new legislation, years of education, with the exception of advanced training and paid work experience, are no longer included in the total length of service. It is assumed that in the future the acquired level of qualification will provide a higher salary, which will allow one to receive more points.

Labor and insurance experience

A person’s work experience is the total time period during which he performed his work duties, did something useful for society, and other time specified by law is also included here - this is army service, maternity leave, etc.

Changes in the pension payment system provoked the emergence of a new term – insurance period. It refers to the total time when a citizen was engaged in work or other activities.

Important ! During this period, payments to the Pension Fund had to be made.

During the insurance period, payments to the Pension Fund must be made regularly

That is why people are so concerned about the question of whether a pension is related to work experience, or whether today only the amount of the insurance contribution is taken into account.

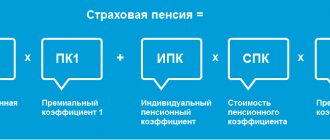

The amount of the insurance pension benefit is related to the number of fixed payments and the amount of the insurance pension. Moreover, the latter depends on the citizen’s personal number of pension points, which is related to the size of the salary and the time period for receiving it - length of service.

The government has established the minimum insurance period, with which a citizen can be provided with old-age insurance pension payments.

The importance of work experience

Does pension provision depend on length of service? Today's pension legislation provides that length of service is not the determining factor for calculating a pension. If previously the minimum period for calculating state assistance had to be at least 20 and 25 years - for men and women, respectively, now this indicator has only formal weight. Priority is paid to the unified social tax and insurance contributions to the Pension Fund, the total amount of which determines the amount of future pension payments. The minimum period for paying insurance premiums to receive state assistance after reaching retirement age is five years. So the minimum term in 2021 is also effectively five years.

Important! At the same time, do not underestimate the importance of the insurance period for the amount of the old-age pension. The longer the work experience, the higher the size of the pension capital. However, it is worth considering that only the period fully covered by insurance contributions is taken into account.

What are the rules for calculating experience?

Having dealt with the issue of the dependence of the size of pension payments on the length of service, it is necessary to find out by what rules the insurance period is calculated.

The insurance pension period, similar to the labor period, remains for the working population during special periods of time. The list is specified in Article 12 of the Federal Law “On Insurance Pensions” No. 400-FZ:

- military service or equivalent;

- childcare time is one and a half years per child, the maximum period being six years;

- the period of care for a disabled person of the first group, an elderly citizen (over 80 years old) or a child with a disability;

- the time when the person was registered with the employment service and received unemployment payments;

- the time period during which the wife of a serviceman lived in regions where it was impossible to get a job, the same applies to the spouses of diplomatic workers outside the country;

- the period of time a person was in prison when the charge was subsequently dismissed.

The insurance period may continue even outside of the citizen’s direct work.

Work experience in the period before January 1, 2003 must be approved with the help of appropriate papers requested from management, in archives and other institutions that can provide the citizen with the necessary data on his work activity.

The list of documentation includes a work book, certificates, employment contracts in writing, agreements with notes on implementation, civil contracts, certificates on the periods of payment of mandatory insurance contributions to the social protection fund of the Ministry of Labor and Social Protection of the Russian Federation (hereinafter referred to as the Fund), on the amount of earnings funds (income), from where contributions were made.

Important ! All data is indicated in legislative acts.

When the condition for the necessary payments to the Pension Fund is met (if they were provided in the specified quantities), the pension period is accrued:

- individual entrepreneurs;

- notaries, lawyers, and other citizens who are self-employed;

- farm participants;

- other people who meet the conditions prescribed in Article 13 of Federal Law No. 400-FZ.

The length of service accumulated before 2002 is taken into account when calculating the old-age pension.

The work experience that a citizen had before the reform in 2002 is added to the total number of pension years. Points for the specified period are calculated based on the rules for revaluing the value of pension rights. In this case, it is also possible to perfectly view the dependence of pension payments on the time spent performing work duties.

The insurance period is calculated based on the calendar duration of a period of work or other activity, converting days into months, and months into years. When exceptions are allowed:

- if the citizen is a seasonal worker in some industrial sectors;

- if the citizen is a water transport worker during navigation periods.

Important ! For such people, their time of work is taken into account as a full year of experience (in the year when they performed their job duties).

If a person had seasonal work, it is counted as a year of experience

How work experience affects the amount of payment

For each employee, length of service will be calculated individually based on the documents they provide to the Pension Fund. Among other things, the insurance period may include other periods - caring for a child, an elderly person or a disabled person, service in the armed forces and others. Therefore, when applying for calculation of pension payments, you must prepare all documents. The following figures can also count on state support:

- notaries;

- individual entrepreneurs;

- lawyers;

- farm owners.

Such a concept as IPC appeared in our pension system not so long ago, therefore, for citizens who carried out the reform activities at that time, coefficients were not calculated, so today for them the calculation is carried out personally in the order of revaluation of the value of pension rights. And from this we can conclude that work experience for them also matters when calculating payments.

When submitting documents to the authorized body to calculate state benefits, employees count not only the years devoted to work, but also months and even days. Based on them, the payment will be further formed. Even from this we can conclude that when calculating an old-age pension, work experience is directly involved.

It is important to take into account that the exception is citizens whose work is seasonal; for them, the length of service will not include the number of months worked, but 1 season will be counted as one year worked.

Minimum experience

Having found out how much experience influences pension accruals, it is necessary to find out how many full years of this experience a citizen must have in order to have the right to receive pension payments after taking legal leave.

Important ! Until the reform in 2015, the shortest period of work that allowed a citizen to receive an insurance pension was five years.

But today this figure increases by a year every year. If in the 15th year the increase occurred up to 6 years, then in the 16th year - up to 7, and in the 17th year - up to 8. Accordingly, in 2021 you need to have at least 10 years of experience (Appendix 3 to the Federal Law of December 28 .2013 No. 400-FZ).

You must have at least 10 years of experience to retire (in 2019)

This gradual increase in the minimum length of service is planned to be completed by 2024 - then the figure will reach 15.

Requirements for length of service when calculating pensions

Until 2015, persons wishing to receive a pension were required to work for at least five years.

With the adoption of a new law, new rules come into force in the country, and the minimum length of work experience increases every year. Thus, in 2015, a new minimum of 6 years of experience was established. Then every year this figure increases by 1 year. So, in 2016 it was necessary to have already 7 years of experience, and in 2021 - 8. The growth of the required minimum will stop only in 2025 at around 15 years.

Today, if you have 35 years of experience and provided that your salary corresponds to the average level of earnings in the country, you have the right to apply for a labor pension. Moreover, its size will be at least 40% of your average earnings. This coefficient directly depends on your experience.

Thus, the longer your experience and the later you retire, the higher the coefficient will be that affects your salary.

Pension

There are two types of pension payments:

- Insurance pension. The amount of money in this case is related to the length of service.

- Social pension. A citizen receives it when he has not worked the required minimum years.

Insurance pension

If a person is employed on an official basis, then in the future he will be able to receive insurance pension payments. Currently, women from 55 years of age and men from 60 years of age can receive a pension. Since 2019, the retirement age has increased (Federal Law “On Amendments to Certain Legislative Acts of the Russian Federation on the Appointment and Payment of Pensions” dated October 3, 2018 N 350-FZ)

Excerpt from Federal Law dated October 3, 2018 N 350-FZ

It is possible to take a well-deserved retirement ahead of the legal time if a citizen is fired due to layoffs, if he has 20 years of experience (for women) or 25 (for men). The amount of pension payments depends on the period worked by the person. This time can include time periods during which the employee could not perform his duties for a certain reason.

- Carrying a baby, caring for children. The period for each child is one and a half years, and the maximum permissible period of care is 6 years.

- Compulsory military service in the army, internal affairs bodies.

- Job search (applies to people registered with the Employment Service).

- Works that benefit society.

- Stay in places of deprivation of liberty (in case of undergoing rehabilitation).

- Caring for a disabled person of the first group, a disabled person from childhood, an elderly person (over 80 years old).

Important ! This is stated in Article 12 of the Federal Law of December 28, 2013 N 400-FZ (as amended on December 27, 2018) “On Insurance Pensions.”

Article 12 of the Federal Law of December 28, 2013 N 400-FZ (as amended on December 27, 2018) “On Insurance Pensions”

All these time periods are taken into account in the case when a person worked before or after them.

Note! Each socially significant non-work period involves receiving a given number of pension points. For example, a man served in the army for a year, which means he will receive 1.8 points. A year of caring for a child with a disability, a disabled person of the first group, or the first healthy child is assessed in the same way. After the birth of the second child, care for him is estimated at 3.6 points / year, and after the third it is already 5.4 points.

When calculating a pension, the number of pension points a citizen has must be taken into account.

Social pension

This type of pension payment is designed to protect the interests of citizens who are unable to obtain the minimum length of work experience due to health problems, life problems, and unofficial employment. The availability of a pension in the absence of minimum work experience is associated with a number of factors:

- Russian citizenship, permanent residence in the country for at least fifteen years.

- Completion of sixty years of age (women) and sixty-five (men), excluding citizens living in the Far North. Since the climate in this area is very harsh, the retirement age limit is also lowered by ten years.

If you have no work experience, your pension benefits will be very small. However, this issue is relevant for citizens who can receive money upon the loss of a breadwinner. Then the person receives both types of payments, if the second is not social, and is formalized:

- To the parents or wife of a soldier in the army who died during the fighting.

- To the families who survived the accident at the Chernobyl nuclear power plant.

- To the relatives of the deceased astronaut.

Article 5 of the Federal Law of December 15, 2001 N 166-FZ (as amended on December 27, 2018) “On state pension provision in the Russian Federation”

How many years were considered continuous? Is it necessary for a pension?

Continuous service should be understood as the period during which the employee worked without significant breaks in work. This concept was enshrined in Soviet law, and also existed in Russian labor legislation.

However, in 2006, the Constitutional Court of the Russian Federation issued an act according to which the relevant Soviet norms were declared to have lost their legal force, and continuous experience itself was no longer taken into account. This was due to the fact that this instrument contradicted the Constitution and the norms of the current labor legislation.

Before the relevant determination was made by the Constitutional Court, the continuous period of work was applied in the following cases:

- To calculate benefits for temporary disability . The direct amount of benefits received on the basis of sick leave depended on the continuous period of work. The smaller it is, the correspondingly less amount of benefits the employee could count on.

- To calculate pension . Previously, an additional payment was accrued for continuous service. This was represented by certain preferences when assigning pensions to citizens.

It is also useful to read: Increase in pension after 50 years of service

Size

The rules for calculating a pension when a person has no work experience are related to the base rate - this is 3 thousand 626 rubles. At the same time, payments are subject to indexation every year (carried out in April in order to take into account inflation and the cost of living). In 1919, coefficients of 1.03 were used to make adjustments to the calculations, during which the pension payment amounted to 8 thousand 600 rubles. In a certain part of the regions of our country, the coefficient and minimum pension payment may be higher. However, if you move to another city, you will receive your pension according to local rules.

Important ! The time period when a person performed labor duties when making payments to the Pension Fund does not matter for the registration of a pension. You only need to provide data on your total length of service, the requirements for which are differentiated based on the category of the population to which the citizen belongs and the type of pension payment.

When calculating a pension, the number of pension points a citizen has must be taken into account.

The money received from pensions should not be less than the established minimum subsistence level for pensioners. If the amount is lower than that set by the state, then the remaining funds are credited as an additional benefit. The cost of living depends on the region of residence of the pensioner. For example, in Moscow in 1616 the amount reached 8 thousand 528 rubles.

The pension becomes larger if:

- the citizen has dependents;

- The pensioner's age exceeded 80 years.

Important ! It is unacceptable to receive old-age and disability pensions together. The latter ceases to be issued to a citizen when he reaches retirement age. When the pension amount is less than the amount of the disability benefit, the difference is always compensated in the form of side payments.

Current changes

According to the latest amendments, which came into force in 2015, the minimum period of work to receive an old-age pension will gradually increase until 2025, when it will be 15 years. Pension payments still consist of an insurance and savings component.

In 2015, the procedure for calculating pensions for mothers who took parental leave also changed. The pension coefficient for the first day of work is 0.85, and with the birth of each child, the pension coefficient will increase by the same value. Thus, the state is trying to have a positive impact on the birth rate in the country. An increased coefficient is also applied to those who have worked for more than 35 years.

Pension payments for insufficient length of service

When a citizen has not accumulated the minimum length of service established by the state, he is paid not an insurance pension, but a social pension. The amount of money is smaller.

Men from sixty years of age and women from fifty-five years of age can receive insurance pension payments. However, social pension requires an age increased by 5 years:

- women are paid it from the age of 60,

- for men - from 65 years old, respectively.

If the accumulated experience is not enough, the citizen receives a social pension

Important ! The volume of social pension payments is related to the average salary in the specific city where the potential pensioner lives.

Work experience since January 1, 2003 is approved based on personal accounting information available in the state social insurance system. More specifically, they take into account an extract from the individual personal account of the insured citizen, which can be obtained from the district department of the Fund.

When pension payments are assigned to a specific citizen (if they are assigned according to the rules established by law or if the citizen independently goes to the Pension Fund for this purpose), an extract can be requested by the district (city) department (department) for labor, employment and social protection.

It is necessary to obtain an extract from the individual personal account of the insured citizen

Delayed retirement

Having determined that experience, although not the most important criterion in modern Russia, cannot be done without it. And even more than that, when considering the issue of insurance pensions, one can note a pleasant innovation. Now a citizen, having worked 42/37 years (men/women), can retire early, that is, 2 years earlier.

But there is another important innovation in Russian legislation: the later a person applies for a pension, the larger it will be. But it’s not enough to just sit and wait for a year - you need to work all this time, thereby increasing the number of points and experience.

Late retirement will provide a significant increase in the amount of pension benefits. For example, if you work 5 years beyond the norm and retire not at 65/60 (men/women), but at 70/65, then the amount of the fixed payment will increase by 36%, and the value of accumulated points will increase by 45%.

Let's assume that Anna R. was born in 1990. decides to delay his retirement for 5 years. Having actually worked for 42 years instead of 37, she will receive an additional 10.43 points, provided that her salary is 20,000 rubles. at 2021 prices. Taking into account the increasing coefficient for late retirement, Anna will be assigned maintenance in the amount of 18,342.36 rubles. instead of 12,070 rub. The difference is RUB 6,272.36. – more than 50%. If the situation allows a woman to retire 10 years later, then she will be assigned a monthly allowance in the amount of 28,995.72 rubles, and this does not take into account the funded part of the pension.

How much will your pension increase due to your length of service?

Let's take a look at the information about the impact of work experience on the amount of pension payments of a citizen who has worked for a sufficiently large amount of time.

When the minimum length of service has been achieved, the pension capital, calculated in points, becomes larger due to a special coefficient.

Interesting ! The number of pension points for a person who continues to work after reaching retirement age increases at a rapid rate.

Important: since there is a minimum length of service, there is also a maximum length of service, which is taken into account when determining pension payments:

- for women – 40 years,

- for men - 45 years.

The maximum length of service taken into account is 40 and 45 years for women and men, respectively.

Important ! If you work for more than the specified number of years, then the extra years will not be taken into account during the formation of pension payments.

Additional payment for long service

So, we found out how pension depends on length of service. In fact, the more periods worked, the more accumulated coefficients will be. They, in turn, take an active part in the formation of pension payments. Basically, the issue of old-age security is of interest not only to citizens who have worked an insufficient number of years for one reason or another, but also to those pensioners who have retired and continue to work, thereby increasing their work experience.

On average, a citizen works for 30-35 years during his working life, so he is probably interested in the issue of additional payment for such a long period. In fact, the state rewards long work experience with additional points. If your work experience exceeds 35 years, you can receive an additional 1 bonus coefficient. If the experience is 40-45 years, then the amount of the additional payment will be equal to 5 points. For more than 50 years of experience, you can receive a fixed amount, namely 1063 rubles; in order to receive such a bonus, you need to apply yourself to the population center with supporting documents.

Please note that annually the pension fund calculates the amount of the monthly subsidy for citizens who continue to carry out their activities officially; there is no need to submit additional documents to receive the bonus; contributions from the employer are transferred to the personal account, the pension will increase automatically every year.

Also, at the legislative level, other citizens who work in conditions dangerous to life and health, in hazardous enterprises in government agencies, military units, police and others also receive additional old-age payments. Early retirement and additional benefits from the state are possible for them, for example, police officers can work for 25 years, reach 45 years of age and go on a well-deserved retirement. At the same time, the Ministry of Internal Affairs will deal with their pension provision, the same applies to the military.

Thus, we found out how length of service affects the size of the pension. Firstly, it allows some categories of citizens to retire early based on their years of service. Secondly, the greater the number of years worked, the higher the individual pension coefficient, which is directly involved in calculating the pension payment. For citizens who have no work experience at all or who have not reached the minimum limit, retirement will be postponed for 5 years, and they will be content with a social fixed payment equal to the subsistence level.

Who can retire early?

The work book is a confirmation of a citizen’s work experience, being the main document. If you do not have it or there is data recorded there that does not coincide with reality, there is no information about some time periods of work, then it is permissible to confirm the fact of your work with the help of certificates received on the basis of orders, personal accounts, statements related to the receipt of salaries. You can also use other documentation, written employment contracts, agreements with notes on their compliance.

The work book confirms the presence of a certain length of service

When studying in more detail the topic of the impact of pension payments on length of service, it is necessary to find out under what circumstances an employee can retire earlier than the statutory period - that is, if a man is under 60 years old and a woman is under 55 years old.

Important ! The legal basis justifying receiving a pension earlier than the specified period is indicated in Chapter 6 of Federal Law No. 400-FZ.

You can retire early in the following cases:

- if there is a labor requirement of the required duration, this applies to teachers, medical workers, rescuers, miners, fishing industry workers, and so on;

- for social reasons - if a citizen is visually impaired or injured during hostilities, this also applies to mothers of many children, persons with prescribed work experience in the Far North and similar areas.

There are certain cases in which you can retire early

The “Northern” pension can be received by:

- men who have reached 50 years of age / women who have reached 45 years of age, living in the Far North (FN), as well as hunters, fishermen, and reindeer herders who have worked for 25/20 years;

- women over the age of 50, with two or more children, who have worked for at least 12 years in the RKS or 17 in similar fields;

- men over 55 years old / women over 50 years old who have 25/20 years of experience, 15 of which relate to work in the RKS, or 20 in similar areas.

You can receive pension payments ahead of schedule if the employment service contacts the Pension Fund with a corresponding request. This applies to citizens of pre-retirement age who are registered there at least two years before retirement age.

Important ! The legal basis is found in Article 32 of the Law “On Employment in the Russian Federation” No. 1032-1 of April 19, 1991).

Excerpt from Article 32 of the Law “On Employment in the Russian Federation” No. 1032-1 of April 19, 1991

Contributions to the Pension Fund

In order to accumulate experience, you must regularly pay contributions to the Pension Fund. If a citizen works officially, then he has nothing to worry about - all contributions for him are paid by the employer, withholding a certain amount from his salary every month. If a citizen lives abroad, works unofficially or is self-employed, then the responsibility for paying contributions and developing work experience falls on his shoulders.

The minimum amount of contributions for the formation of length of service for a calendar year is 32,023.20 rubles.

The maximum amount is 284,240 rubles. You can pay the fee either as a one-time payment or in arbitrary amounts until December 31. THIS IS INTERESTING! How to refuse pension contributions to the Pension Fund →

To receive an insurance pension after the adoption of the law “On Improving the Pension System,” women must be 60 years old and men must be 65 years old. In this case, a coefficient of at least 18.6 points must be accumulated.

The system of pension coefficients (points) was introduced relatively recently - in 2015. The measure was adopted by the Pension Fund to simplify the calculation of the final pension, taking into account all contributions paid for each year of work.

The coefficient can be calculated from the amount of contributions paid divided by the standard amount (in 2021 it is equal to 207,720 rubles) and multiplied by 10. The amount of your contributions for the entire time can be found on the Pension Fund website.

If we assume that a person worked for 40 years and the amount of contributions is 2,000,000 rubles, then during his work he accumulated 96.2 points.

The final pension amount is calculated using the following formula:

Individual pension coefficient * Cost of one point + Fixed payment

The fixed payment as of 2021 is equal to 5686.25 rubles, and the cost of a pension point is 93 rubles.

In specific examples it looks like this:

- A resident of Moscow is retiring this year at the age of 55.5 years with 20 years of experience. Working in the metro, she received a salary of 80,000 rubles a month, and her employer contributed about 10,000 more to the Pension Fund for her. The amount of points she has accumulated is 115.5. Her insurance pension will be calculated as follows: 115.5 * 93 + 5686.25 = 10745 + 5686.25 = 16431. Taking into account the city social standard, she will be able to receive 3068 rubles in addition to her pension. The amount of the final pension is 19,500 rubles.

- A resident of the Irkutsk region was supposed to retire back in 2017 upon reaching 60 years of age. He is now 63 years old. He decided to apply for a pension only this year. During his experience, he accumulated 60 points. For deferment, the amount of the fixed payment will be multiplied by 1.24%. Thus: 60*93 + (5686.25*1.24) = 5580+7028.63 = 12,608.63.

Conversion of pension rights: what is it?

Conversion of pension rights is the correction of estimated data relating to a citizen’s length of service and earnings as of January 1, 2002. It was then that pension reforms began. For conversion into accounting, only that time period of a person’s labor activity up to the named date is taken.

After the start of the pension reform, all citizens performing work duties began to receive insurance contributions (they were made by their superiors). Until that moment, work experience had a fairly noticeable impact on the amount of the pension, as well as the average monthly salary for 2 years. But then this data ceased to be so important. Therefore, the authorities were faced with a problem, because it was necessary to sum up insurance payments with the money accrued to the citizen before the reform. The solution was to convert pension rights, which made it possible to obtain real cash capital.

Important ! In 2010, the increase was 10%; for employees who performed their duties until the 91st year, a percentage was added for each year of work experience.

In connection with the pension reform that began in 2002, it is now mandatory to take into account the frequency and amount of pension contributions made by a citizen

Preferential calculation of length of service

In some cases, early registration of a labor pension is possible. We are talking about payment “for length of service”. Such a payment is accrued if a citizen worked in particularly harmful, difficult conditions or was engaged in a certain socially useful type of activity:

- For residents of the Far North and territories equivalent to them, the age of possible retirement has been reduced by 7-10 years. There are requirements for general experience, the number of years lived in these regions and experience in a particular industry.

- Medical personnel and teachers are entitled to a pension after working 25-30 years in the profession.

- For pilots and military personnel, 20-25 years of service are enough to receive a pension.

- In a number of industries that involve harmful effects on human health, the minimum retirement age is set at 5 years lower than the generally accepted one.

- Civil servants previously received the right to a “long service” pension after 15 years of service. According to Law N143-FZ, adopted in May 2021, the required period of public service will gradually increase to 20 years by 2026.

Questions and answers

Question: Good afternoon, tell me what impact 11.5 years of work experience will have on the state. service from 1976 to 1987 on old-age pension?

Answer: The minimum work experience in the civil service is 16.6 years (in 2021). The pension amount is 45% of earnings. Thus, your existing service does not have any impact on pension payments.

Excerpt from Article 14 of the Federal Law of December 15, 2001 N 166-FZ (as amended on December 27, 2018) “On State Pension Security in the Russian Federation”

Question : My husband worked for 48 years. Is he entitled to a pension bonus for his length of service? Is it important that he carried out his work duties in the agricultural field?

Answer: Fulfilling work duties in the agricultural industry cannot be the reason for increasing pension payments or creating preferential length of service. The length of work experience has a direct impact on the amount of the pension, and the longer the length of service before January 1, 2002, the greater the pension payments will be.

Question : My work experience is continuous, reaching 37 years. I work from August '75 to February '12. Should I receive a pension supplement?

Answer : They should. An increase in pension payments to non-working pensioners in our country will begin in February 2017. Percentage – 5.4. In addition, payments have been increased by 0.4% since April. That is, if you are retired and not working, the increase percentage will be 5.8. Looking at specific figures, we can say that the pension will be 13 thousand 700 rubles, which means an increase of 500 rubles.

Question : I am a military retiree. After retirement he worked for more than 24 years. For some reason, the Pension Fund calculated that I was 16 years old with a few months. Are such actions legal? My second pension was taken into account from this length of service. Will the amount of my pension increase if I take into account my actual work experience in civilian life?

Answer : You should have had your entire insurance period calculated. Visit the Foundation again, asking for an explanation. You must make adjustments to the calculation.

All work experience must be taken into account

How to get a large pension?

Officially work

Pension is derived from wages. When you are officially working, 30% of your salary is insurance. These funds provide the right to free healthcare and good pensions. For example, 22% is allocated to the Fund. However, this only applies to “white” income. Salary in an envelope does not count. Be sure to find out whether your boss is contributing the required funds to the Pension Fund.

Earn more

The volume of pension payments is related to the volume of the current salary. The higher the salary, the more money is transferred to the Pension Fund; accordingly, when you retire, you will be well provided for. Pension points allow you not to depend on inflation. For the year, the maximum is 8.7 points. This is if you earn 85 thousand a month.

The higher the salary, the greater the pension will be

10k per month (minimum salary) gets you 1 point.

Work longer

Pension payments are influenced not only by salary, but also by length of service. If you work long hours, you will accumulate more points. And when you continue working after retirement age, you will receive even more points.

The pension also depends on the number of points earned

Save up

When you have the opportunity, save money yourself. With a gray income, you can save 5-10%, depositing it in the bank in various currencies. Although, of course, it is best to provide yourself with a white salary.

Other options: renting an apartment or garage, deposits in various currencies, shares. It is best to have sources of passive income.

So, length of service directly affects the size of the pension. That is why, if possible, it is worth working as much as possible, and the higher the salary, the greater the pension.