An order to approve a payslip is a legal act that introduces the form of an employer’s report on the composition of wages. The formation of wages must be carried out in strict accordance with the law and be as clear as possible for employees. To do this, the employer reflects information about all accruals and deductions in a special form - a calculation sheet.

- Form and sample

- Free download

- Online viewing

- Expert tested

FILES

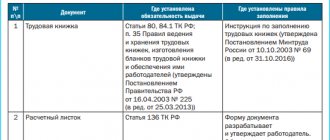

Legal basis for issuing an order

According to Article 136 of the Labor Code of the Russian Federation, the management of an enterprise is obliged to provide workers with information in writing:

- about the final amount of payment received;

- about the components of the total amount (remuneration for labor, compensation, financial assistance, etc.);

- about funds withheld for taxes and mandatory contributions.

This information is provided not every time the employee receives money, but after the calculation of wages for the month. If you provide information randomly each time, when manually selecting information from an accounting program, there is a possibility of forgetting about some employee or losing attention to the necessary data.

To avoid errors and violations when issuing information about the components of workers’ earnings, the management of the enterprise must necessarily approve the pay slip form.

A sample document on the composition of the salary is approved by the employer:

- in the form of an order (instruction);

- with the involvement of the elected trade union body.

The association of workers together with personnel services expresses its opinion regarding:

- convenient arrangement of information in the payment form;

- texts of the main points of the sheet;

- the procedure for putting the agreed form into effect.

After the pay slip form has been developed, an order for its approval is drawn up.

Who draws up the order

The order to prepare the order template is issued by the head of the organization. It is advisable to involve in the document development process:

- accounting employees;

- personnel officers;

- lawyers.

The agreed sample order for the introduction of the payslip form is approved by management.

An example of deciphering salary slips

Explanation of the pay slip

At the end of the month, each employee must receive a breakdown of the amount of his salary. This is documented in a document called a payslip.

When is the pay slip issued? Article 136 of the Labor Code of the Russian Federation provides for the obligation of the employer, when paying wages, to notify in writing each employee about the components of the salary. Thus, the day of issue is the days of salary payment. Payment of wages cannot be later than the 15th day of the next month - this date can be considered the last date for issuing transcripts.

Special provisions

Give pay slips to all employees without exception. Moreover, regardless of whether your employees work at your main place of work or are employed part-time. Otherwise, the employer will face punishment. We explained which ones at the end of the article.

Designate a responsible person, for example, a payroll accountant, who will process the information, generate and issue the invoice against signature. Introduce this employee to the new responsibilities also against signature.

To keep records of the issuance of pay slips, prepare an accounting journal in which the employee who received the document in hand will put his signature and the date of receipt. Such an algorithm of actions at the enterprise will protect management from penalties.

Let us repeat that issuing invoices is the direct responsibility of the employer. It is impossible to refuse to provide documents, even if the employee has written a written refusal to generate and issue a settlement.

Please note that the method of issuance (payment) of earnings does not matter. Consequently, the employer is obliged to issue a payment slip regardless of the method of payment (cash, card, savings book, etc.).

What is required

There is no approved form for the salary transcript form. There are requirements for information that the employer must explain to its employees and reflect on the pay slip:

- components of wages;

- accrued compensation in separate lines;

- total taxable income on the payslip;

- size and basis of deductions;

- the total amount to be paid.

We offer pay slips so you can use them later in your work.

Sample salary slip form in Excel

Order on approval of the pay slip form, sample

Wage

The wages reflect accruals that are made as remuneration for labor. This could be a salary, all possible bonuses, payment for work on holidays and weekends.

Taxes and deductions

Personal income tax (NDFL) must be included in the deductions. The payer of this tax is the employee. The employer is obliged to withhold personal income tax on all income of individuals. Some employees are entitled to deductions for this tax. The deductions themselves are not paid, they simply reduce the tax base. Due to deductions, the withheld personal income tax becomes less.

Let's take a closer look at situations with deductions

On January income of 20,000 rubles, the employee is required to withhold personal income tax at 13%. The amount of deductions will be 20,000 × 13 / 100 = 2,600 rubles.

If an employee is entitled to a deduction for the first child (in 2020, the deduction for the first child is 1,400 rubles), then the calculation of the deduction will be as follows.

First, we reduce the income by deduction:

20 000 – 1400 = 18 600.

We multiply the resulting amount by 13%:

18 600 × 13 / 100 = 2418.

Due to the deduction for deduction, the employee will have an amount of 2,418 rubles (and not 2,600, as was the case in the first example).

Other payments

In addition to salary, an employee can receive various compensations and social benefits:

Deadlines for issuing pay slips

As you know, wages must be paid at least twice a month. That is, every fifteen days. However, employers have the right to make payments more frequently. But not less often. So what about pay slips, how often should they be issued?

If an advance has been paid, then there is no need to issue payslips. Prepare documents on final payments for the reporting month. There is no point in generating a payslip before.

Issue the document no later than the day on which the salary is issued.

There are no exceptions. Even if an employee goes on vacation in the middle of the pay period, it is not necessary to issue a pay slip in advance, but it is possible. For example, if an employee submits a written application for the issuance of a pay slip with vacation pay.

If an employee resigns, then it is necessary to prepare a pay slip. Issue the paper on the resigning employee's last working day. Along with the pay slip, issue a work book and a certificate in form No. 182n. Additionally, the employee may request other documents, for example, an extract from the dismissal order and so on.

Methods for transmitting a payslip

So, we have determined that it is mandatory to issue a payslip. We also determined the structure of the document, mandatory details and components. Now the question of how to issue a pay slip becomes relevant.

There are no problems with full-time employees. On the “significant” day you need to hand out payslips. And the fact of delivery must be endorsed in a special accounting journal. The recipient puts a signature and date of receipt.

What to do if the employee is not available on the day the pay slip is issued? If a hired specialist is on vacation or sick, or, for example, is a freelance (remote) employee, then agree on the procedure for issuing pay slips in advance.

For example, call an absent specialist and determine how to send him a pay slip. The following options are valid:

- By proxy, another person will receive it. For example, an employee broke his leg and is in the hospital. He cannot appear for a payment document, nor can he receive wages in cash from the organization’s cash desk. In this case, you will have to prepare a power of attorney to receive payments and/or wages. This method is used extremely rarely, as it is considered problematic in comparison with others.

- Sending the pay slip by registered mail with a list of attachments. Why order it with an inventory? Yes, because the inventory of the attachment will confirm that it was the pay slip that was sent to the employee. Provided that the document was sent within the established time frame, the inventory of the attachment will be confirmation that the employer has complied with the requirements of the law. For example, if a subordinate goes to court. However, you will have to pay for postal services.

- By email. The easiest, fastest and free way to send a pay slip is by email. Until recently, this method was considered illegal, but the situation has changed. Moreover, sending payslips by email can be provided for all workers, and not just for absent or remote workers. This is a small savings, but still a saving.

Please note that you cannot simply refuse to issue paper payslips in favor of electronic ones. It is necessary to consolidate such a decision in a collective agreement, an employment contract with an employee, or in a separate local regulatory act for the organization. This opinion was expressed by the Russian Ministry of Labor in Letter No. 14-1/OOG-1560 dated February 21, 2017, determining that sending payslips by email does not contradict the provisions of the law (Article 136 of the Labor Code of the Russian Federation).

Also, do not forget that the payslip contains personal data on wages. And it is unacceptable to transfer the document through third parties. In addition to violating current legislation, such an offense can provoke a conflict within the organization’s team. That is why it is necessary to appoint someone responsible for compliance with the procedure for issuing pay slips.

Responsibility for failure to issue a pay slip

For non-extradition, sanctions are provided, which are established by Article 5.27, paragraph 4 of the Code of Administrative Offenses of the Russian Federation. Let's take a closer look at their sizes:

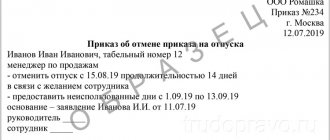

Contents of the order

Despite the fact that the obligation to draw up a document with the help of which the wage information form will be entered is regulated in the Labor Code of the Russian Federation, the structure of the order is not legally approved. Based on the general requirements for personnel and accounting documentation, the following necessary elements of such an order can be identified:

- name of the act (for example, “Order for approval of the calculation sheet”, “Order for the introduction of the calculation sheet”, etc.);

- serial number of the document in the organization;

- date and place of issue;

- instructions for entering the form;

- identification of responsible persons for correctly filling out the pay slip;

- Full name and position of the employee who is responsible for issuing pay slips to employees against signature.

A mandatory attachment to the document must be a sample pay slip.

The order must be drawn up on company letterhead. Otherwise, at the top of the document it is necessary to write down the full name of the employer, as well as its details.

The order is signed by the head of the enterprise or another employee authorized to sign personnel or accounting documents. The order also includes signatures:

- the chairman of the trade union committee on agreeing on the form of the sheet with the trade union;

- monitoring the execution of orders of officials.

To whom is it transmitted?

To ensure that pay slips are issued to employees only in the approved form, an order signed by the manager is submitted to the accounting department. The document is not personnel records, so it can be stored in accounting records. The order will be of particular importance during tax audits or requests from the Labor Inspectorate.

The pay slip itself is issued personally to the employee against signature. It is unacceptable to transfer the payslip to the head of the department or his colleagues without the employee’s consent.

The signature upon receipt of the sheet can be affixed both in the general register of signatures and in a tear-off receipt on the document itself.

An example of deciphering salary slips

Explanation of the pay slip

At the end of the month, each employee must receive a breakdown of the amount of his salary. This is documented in a document called a payslip.

When is the pay slip issued? Article 136 of the Labor Code of the Russian Federation provides for the obligation of the employer, when paying wages, to notify in writing each employee about the components of the salary. Thus, the day of issue is the days of salary payment. Payment of wages cannot be later than the 15th day of the next month - this date can be considered the last date for issuing transcripts.

Special provisions

Give pay slips to all employees without exception. Moreover, regardless of whether your employees work at your main place of work or are employed part-time. Otherwise, the employer will face punishment. We explained which ones at the end of the article.

Designate a responsible person, for example, a payroll accountant, who will process the information, generate and issue the invoice against signature. Introduce this employee to the new responsibilities also against signature.

To keep records of the issuance of pay slips, prepare an accounting journal in which the employee who received the document in hand will put his signature and the date of receipt. Such an algorithm of actions at the enterprise will protect management from penalties.

Let us repeat that issuing invoices is the direct responsibility of the employer. It is impossible to refuse to provide documents, even if the employee has written a written refusal to generate and issue a settlement.

Please note that the method of issuance (payment) of earnings does not matter. Consequently, the employer is obliged to issue a payment slip regardless of the method of payment (cash, card, savings book, etc.).

What is required

There is no approved form for the salary transcript form. There are requirements for information that the employer must explain to its employees and reflect on the pay slip:

- components of wages;

- accrued compensation in separate lines;

- total taxable income on the payslip;

- size and basis of deductions;

- the total amount to be paid.

We offer pay slips so you can use them later in your work.

Sample salary slip form in Excel

Order on approval of the pay slip form, sample

Wage

The wages reflect accruals that are made as remuneration for labor. This could be a salary, all possible bonuses, payment for work on holidays and weekends.

Taxes and deductions

Personal income tax (NDFL) must be included in the deductions. The payer of this tax is the employee. The employer is obliged to withhold personal income tax on all income of individuals. Some employees are entitled to deductions for this tax. The deductions themselves are not paid, they simply reduce the tax base. Due to deductions, the withheld personal income tax becomes less.

Let's take a closer look at situations with deductions

On January income of 20,000 rubles, the employee is required to withhold personal income tax at 13%. The amount of deductions will be 20,000 × 13 / 100 = 2,600 rubles.

If an employee is entitled to a deduction for the first child (in 2020, the deduction for the first child is 1,400 rubles), then the calculation of the deduction will be as follows.

First, we reduce the income by deduction:

20 000 – 1400 = 18 600.

We multiply the resulting amount by 13%:

18 600 × 13 / 100 = 2418.

Due to the deduction for deduction, the employee will have an amount of 2,418 rubles (and not 2,600, as was the case in the first example).

Other payments

In addition to salary, an employee can receive various compensations and social benefits:

Deadlines for issuing pay slips

As you know, wages must be paid at least twice a month. That is, every fifteen days. However, employers have the right to make payments more frequently. But not less often. So what about pay slips, how often should they be issued?

If an advance has been paid, then there is no need to issue payslips. Prepare documents on final payments for the reporting month. There is no point in generating a payslip before.

Issue the document no later than the day on which the salary is issued.

There are no exceptions. Even if an employee goes on vacation in the middle of the pay period, it is not necessary to issue a pay slip in advance, but it is possible. For example, if an employee submits a written application for the issuance of a pay slip with vacation pay.

If an employee resigns, then it is necessary to prepare a pay slip. Issue the paper on the resigning employee's last working day. Along with the pay slip, issue a work book and a certificate in form No. 182n. Additionally, the employee may request other documents, for example, an extract from the dismissal order and so on.

Methods for transmitting a payslip

So, we have determined that it is mandatory to issue a payslip. We also determined the structure of the document, mandatory details and components. Now the question of how to issue a pay slip becomes relevant.

There are no problems with full-time employees. On the “significant” day you need to hand out payslips. And the fact of delivery must be endorsed in a special accounting journal. The recipient puts a signature and date of receipt.

What to do if the employee is not available on the day the pay slip is issued? If a hired specialist is on vacation or sick, or, for example, is a freelance (remote) employee, then agree on the procedure for issuing pay slips in advance.

For example, call an absent specialist and determine how to send him a pay slip. The following options are valid:

- By proxy, another person will receive it. For example, an employee broke his leg and is in the hospital. He cannot appear for a payment document, nor can he receive wages in cash from the organization’s cash desk. In this case, you will have to prepare a power of attorney to receive payments and/or wages. This method is used extremely rarely, as it is considered problematic in comparison with others.

- Sending the pay slip by registered mail with a list of attachments. Why order it with an inventory? Yes, because the inventory of the attachment will confirm that it was the pay slip that was sent to the employee. Provided that the document was sent within the established time frame, the inventory of the attachment will be confirmation that the employer has complied with the requirements of the law. For example, if a subordinate goes to court. However, you will have to pay for postal services.

- By email. The easiest, fastest and free way to send a pay slip is by email. Until recently, this method was considered illegal, but the situation has changed. Moreover, sending payslips by email can be provided for all workers, and not just for absent or remote workers. This is a small savings, but still a saving.

Please note that you cannot simply refuse to issue paper payslips in favor of electronic ones. It is necessary to consolidate such a decision in a collective agreement, an employment contract with an employee, or in a separate local regulatory act for the organization. This opinion was expressed by the Russian Ministry of Labor in Letter No. 14-1/OOG-1560 dated February 21, 2017, determining that sending payslips by email does not contradict the provisions of the law (Article 136 of the Labor Code of the Russian Federation).

Also, do not forget that the payslip contains personal data on wages. And it is unacceptable to transfer the document through third parties. In addition to violating current legislation, such an offense can provoke a conflict within the organization’s team. That is why it is necessary to appoint someone responsible for compliance with the procedure for issuing pay slips.

Responsibility for failure to issue a pay slip

For non-extradition, sanctions are provided, which are established by Article 5.27, paragraph 4 of the Code of Administrative Offenses of the Russian Federation. Let's take a closer look at their sizes:

Errors

Among the main errors when issuing an order to enter a payslip form, the most common are:

- Disregard by the employer of the opinion of the trade union body. If the committee considers any part of the wage determination sheet to be incorrect, the management of the enterprise needs to listen to the comments. No more than three working days are allotted for approval of the text, main points and information of the settlement document. After this, the employer and the union must come to a consensus. If this does not happen, the chairman of the trade union body may file a complaint with the territorial division of the state labor inspectorate or with the court.

- Lack of necessary elements in the payslip form. Despite the fact that the legislator has not established a sample document containing detailed information about wages, without certain information, a pay slip will not meet the interests of the employee. Therefore, in each document you need to specify:

- Full name, assigned personnel number and position of the employee;

- the period reflected in the sheet;

- actual time spent on work;

- accrued amounts of advance payment, compensation, salary (under Article 136 of the Labor Code of the Russian Federation);

- detailed information about deductions (for what, in what amount, etc.);

- the total amount payable for the specified period.

The employer does not have to sign the pay slip.

Sample pay slip for salary

Why is it needed?

The employer, represented by a budgetary organization, is obliged to notify employees monthly about the amount of wages paid by issuing a pay slip (Part 1 of Article 136 of the Labor Code of the Russian Federation). The legislation does not provide for a single sample form of a pay slip, however, Part 2 of Art. 136 of the Labor Code of the Russian Federation predetermines that the form of the document is developed by each organization independently. The purpose of the payslip is to tell the employee about the amount of salary received and the deductions made. It indicates the amount of personal income tax and the amount of additional (incentive, bonus) payments.

When to issue a payslip

Don't know when pay slips are issued? It is provided to the employee regardless of the salary payment option: upon the accrual and transfer of wages to the employee’s card or at the time the employee receives the monthly cash remuneration in hand. Settlements are received by both main employees and employees working under civil contracts, to whom the employer also pays wages.

The document is issued only at the time of final payment; the form does not need to be provided on the day of advance payment in the organization or when transferring vacation pay. When directly transmitting calculations, the accountant must comply with the principle of confidentiality.

The fact that an employee has received a pay slip can be confirmed in the following ways:

- develop a detachable part of the document in which the employee will sign the form, thereby certifying the fact of receipt;

- keep a log of the issuance and receipt of pay slips.

Order on approval of the pay slip form

The formal form of the payroll sheet is developed by each employer independently and approved by order. order approving the form of the pay slip, it is suitable for both budgetary institutions and commercial and non-profit organizations.

How to fill out

The payroll form for employees must be filled out according to the rules. The following information must be displayed on the payslip:

- name of the organization and information about the unit;

- FULL NAME. employee;

- his personnel number;

- month for which accruals and deductions are made;

- the total amount of time worked for the month;

- accrued amount without taxes and other deductions;

- composition of wages.

The payslip itself consists of several sections:

- Total accrued. This block reflects information about all accruals made to the employee during the reporting period, that is, the entire composition of the salary is indicated. In addition to salary, this includes compensation, incentive and bonus payments, benefits, sick leave, vacation pay, work on holidays and weekends, calculation and compensation upon dismissal. The procedure for calculating income is also indicated here, and the days and hours worked for which you need to pay are written down.

- Total withheld. This block records all deductions made by the employer: personal income tax and insurance contributions, trade union dues and deductions under writs of execution (alimony).

- Total paid. The block is intended to reflect previously paid amounts for the reporting period (advance payment, vacation pay, etc.).

- To payoff. This section of the payslip specifies the total amount to be transferred (issued). It also reflects the employer's or employee's salary debt. At the end of the document, reference information is indicated - total income since the beginning of the year and applied deductions to personal income tax.

The pay slip is issued after the actual closing and payment of wages, so data on all amounts accrued during the month is entered into it. It specifies fines, compensation, incentives and bonus payments, overtime and work on weekends.

If the salary in an institution is calculated using specialized programs, then payslips are generated automatically in electronic form, based on data on accruals and payments made. The accountant can only print out the form and provide it to the employees for signature.

Sample salary slip in Excel

Procedure for issuing pay slips

A payslip is provided once a month upon payment of wages. The accountant should prepare in advance for the procedure for issuing invoices and print them out several days before the actual issuance of remuneration for work. The main thing to take into account is that the document cannot be issued after the funds have been transferred or issued. The deadline is the day the income is transferred.

When an employee is dismissed, he is given a pay slip on the last official working day, as well as other personal documents. The final payment must be made no later than the last business day.

If an employee gets sick or for some other reason cannot personally receive a document about his salary, the employer can send it by email or regular mail (registered mail). You should not give the form to third parties, since it contains information about the employee’s income, which is personal data that is not subject to disclosure (Article 7 152-FZ of July 27, 2006). Such a violation may result in administrative and criminal sanctions.

Responsibility for violation

Issuing invoices is the legal responsibility of every employer. That is why, for failure to comply with this requirement, a standard of administrative liability is established for each violator:

- a legal entity is subject to a fine in the amount of 30,000 to 50,000 rubles and the possibility of stopping the organization’s activities for up to 3 months is provided;

- for a responsible official - from 1000 to 5000 rubles;

- for an individual entrepreneur - from 1000 to 5000 rubles and the possibility of suspension of activities for 3 months.

If an employer has repeatedly violated the law, then a sanction is applied to him in the form of a ban on conducting any type of activity for the next three years.

Shelf life

In accordance with Order of the Ministry of Culture of the Russian Federation dated August 25, 2010 No. 558, the organization must preserve documents related to the formation and issuance of wages. Salary statements, payslips, as well as documents accompanying them must be stored for 5 years, provided that they have already been audited by regulatory authorities.

If the organization does not have a program for the electronic generation of personal accounts and databases for each employee, the calculation sheets and the order for their approval must be preserved for 75 years.

The procedure for approving a payslip for wages using an order from the manager -

Art. 135 of the Labor Code of the Russian Federation establishes that the employer is obliged to notify the employee about the components of wages, the amounts and grounds for withheld amounts, as well as about the salary that is due to the employee in person.

The employee must be notified in writing. In practice, this means that the employer is obliged to issue a pay slip to the employed person.

There is no unified form for this document, therefore the law provides for the possibility of creating a sheet by the business entity itself. The form of the payslip must be approved by a local regulatory act, that is, an approval order.

The article describes typical situations. To solve your problem , write to our consultant or call for free:

How to approve a salary form?

If an organization uses an automated system for calculating employee earnings, then the easiest way is to use the salary sheet form specified by the program used.

In this case, it is possible to customize the program so that all the features of the enterprise are taken into account.

If wages are calculated manually, then the payslip for distribution to employees is created by the company’s specialists.

When developing a document, it is imperative to take into account the opinion of a trade union or other representative body of the workforce.

With the participation of such a body in the development of the document, a note is made on the payment sheet: “The opinion of the trade union organization has been taken into account.”

If at the time of creation there is no such organization, then the following inscription is placed on the payment sheet: “The representative body has not been created at the time of approval of the document form.”

Should the manager write an approval order?

Law No. 402-FZ “On Accounting” abolishes the mandatory use of unified forms of primary accounting documents.

The payslip is not a primary document; it performs an informational function.

In addition, a unified form approved by Goskomtsat has not been developed for the pay slip.

This means that the manager is not obliged to approve the form of such a document by order or other regulatory act.

Despite this, the vast majority of managers prefer to approve the form of the sheet by order, guided by legal and administrative expediency.

In the approval order, you can establish the person responsible for issuing information pay slips and designate the days on which the slips should be issued to employees.

Thus, the manager delegates authority and transfers responsibility for the preparation and issuance of sheets to a specific official.

How the certificate is issued to employees in electronic and paper form - read here.

How to place an order?

Initially, a leaf shape is made. It will be included as an annex to the approval order.

The order specifies the usual details of internal acts; name of the enterprise, date, the word “Order” and the name of the order: “On approval of the form of pay slip for wages.”

In the order that approves the form of the sheet, the following points are indicated:

- approval of the form of the document contained in the application;

- date of issue of pay slips to employees

- the person responsible for informing employees about the components of wages.

The presence of the application, date and signature of the manager are indicated.

How to apply

We will tell you how to correctly draw up an order to approve the form of pay slips. This order does not have a set template and is drawn up in any form.

Its text should contain:

- Information about the organization.

- Information about the document itself - registration number, city and date of publication.

- Preamble (basis) of the order - reference to Part 2 of Art. 136 of the Labor Code, according to which the employer operates.

- The administrative part is an indication of the validity of the “calculation” form and the date from which it will come into force.

- The indicative part is a list of responsible employees who will execute and monitor the implementation of the order. It is advisable to immediately indicate the employee who will hand over the sheets for signature to the staff in the future.

- Usually the order is supplemented with an appendix - a sample pay slip. This is also noted in the text.

- Place for a visa to familiarize all workers mentioned in the order.

>>>

After the order is approved by the manager, it is presented to the employees and signed by them. First - those who are responsible for its implementation, and then all the staff. It is convenient for this to use additional sheets with a list of employees, where they will put their signatures. The pay slip itself contains the following information:

1. Personal information – full name, personnel number.

2. Data about the period for which wages are paid.

3. Number of hours worked (days, shifts) during the accounting period.

4. All structural components of salary - accruals and deductions. In this case, each element of income or deductions must be recorded as a separate line. When checking, the combined lines will be regarded by the inspector as a gross error in the financial documents.

Pay slip. 6 questions that a HR manager should know the answers to

What charges may be mentioned? Wages, overtime, compensation for harm, work on holidays and weekends, bonuses, etc. If the company uses a social package with payments in kind, it is also written down on the payslip.

Deductions include: penalties and alimony, payments to budgetary funds (personal income tax, social insurance, Pension Fund, etc.), trade union dues, unearned advance or travel allowances, erroneously paid amounts.

Since the adoption of Federal Law No. 35-FZ, the following information must be included in the extract:

- If there is a violation of the terms of payment of wages, compensation for it.

- Vacation payments.

- If an employee resigns, then the estimated amounts due to him or her.

- Other cash payments.

5. The total amount issued in hand.

Try for free, refresher course

Documentation support for work with personnel

- Meets the requirements of the professional standard “Human Resources Management Specialist”

- For passing - a certificate of advanced training

- Educational materials are presented in the format of visual notes with video lectures by experts

- Ready-made document templates are available that you can download and keep for your work

Try for free

Document form

The procedure for approving a leaflet is reflected in Art. 372 Labor Code of the Russian Federation. The document does not have a unified or recommended form. The employer must develop a draft form and send it for approval to the trade union committee, which can reject or approve the form within five working days.

The consent of the employer and the trade union is secured by the relevant regulatory act. If the union does not approve of the project, it can ask management to correct the comments made by amending the form. The legislation allows 3 working days to resolve the issue.

If the parties do not reach a unanimous decision, then the trade union committee has the right to file a complaint with the labor inspectorate or a lawsuit in court. The authorized body considers the appeal and, if a violation is detected, issues instructions to adjust the form of the salary slip.

All components of earnings must be reflected on the sheet in separate lines; combining them is considered an error. If the company has a social package or payment in kind, they are also included in this reporting form.

The left half of the sheet reflects the names and amounts of all accruals to the employee, and the right half shows deductions. The lower right part shows interim payments, for example, vacation pay, salary for the first half of the month.

Each organization develops the form independently, but it must have the following mandatory items:

- Full name, position and number on the employee's report card;

- the period during which the sheet was formed;

- time worked by the employee in days or hours;

- accruals by type and their total amount

- decoding of deductions and their total;

- amount to be issued.

The employer's seal and the director's signature are not placed on the sheet. This can only be done at the request of the employee.

The amount of deductions from total earnings should be no more than 20%, with the exception of cases established by law, for example, when paying alimony.

Deductions include:

- personal income tax;

- extrabudgetary contributions;

- professional contributions;

- unearned advance;

- deductions made by the calculator by mistake;

- alimony.

The main charges include:

- payment based on salary, piecework, etc.;

- bonuses;

- overtime;

- additional payments and allowances (harmfulness, length of service, category, etc.);

- work on holidays;

- sick leave;

- vacation pay;

- night;

- business trips;

- others.

The sheets must reflect the debt owed by the employer or employee at the beginning or end of the billing period, if any. The lines reflecting the issuance of earnings must contain the number and date of the relevant statements.

In addition to accruals and deductions, the sheet must reflect compensation for mistakes made by the employer, for example, compensation for late payment of vacation. This is regulated by Law No. 35-FZ adopted in 2012.

The list of form details can be supplemented with the amounts of personal income tax deductions provided to the employee. At enterprises with an automated accounting system, the form of salary slip generated by the accounting program is usually approved.

Order form for approval of salary slip

Procedure for notification of payment of earnings

According to the Labor Code of the Russian Federation, the employer must issue pay slips to employees. The fact of their transfer must be confirmed. But labor legislation does not contain a requirement to hand over salary slips to employees against signature. The employer has the right to independently develop a form for registering their issuance.

You can approve a special accounting journal in which the worker will sign upon receipt of the sheet. An alternative would be to compile a list of employees who will sign on it on a separate sheet.

You can add a column to the payroll slip where, upon receipt of the salary, the employee will sign for both the money and the piece of paper taken. The signature on the statement will indicate receipt of the payment document, and, consequently, the fulfillment by the employer of the obligation established in Art. 136 Labor Code of the Russian Federation.

The payslip can act as evidence in legal proceedings with the employer. This usually occurs in situations where the amount paid differs from that specified in the employment agreement, in case of illegal dismissal, etc.

Salary slip form

Personal income tax

It is mandatory for the employee to be provided with information about the amount of personal income tax (NDFL) withheld from the amount of remuneration. The tax rate is 13% of taxable income.

Employees often have questions about the procedure for withholding taxes from wages. It is difficult for the average person to understand which payments are taxable and which are not.

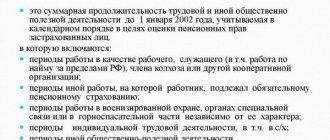

The total taxable income on the payslip can be calculated by subtracting from the total accrued benefits amounts that are paid by the employer but are not taxed. The most common ones include:

- maternity benefits;

- severance pay;

- travel expenses (with the exception of daily allowances of more than 700 rubles when traveling within the country and 2500 when traveling abroad);

- financial assistance (partially).

Contrary to the beliefs of many workers, income tax is withheld from sick leave payments, as well as from compensation for unused vacation, which is paid upon dismissal.

If you have children under the age of 18 or under the age of 24 studying full-time in educational institutions with state accreditation, then you are entitled to a standard tax deduction for each child, which will reduce your taxable income. At the same time, you will receive a deduction of 1,400 rubles for the first and second child, and 3,000 for the third and each subsequent one.

In order to receive a deduction, the employee must write an application addressed to the employer and attach to it a copy of the child’s birth certificate, a certificate of education (if the child is over 18 years old).

In conclusion, let us once again recall the need to develop a procedure for informing about wages that is simple and understandable for the average employee. You shouldn't take this formally. This will avoid many questions and conflict situations.

Why is it needed?

Why is it needed?

The obligation to issue a salary statement manually when paying it is assigned to the head of the organization in Article 136 of the Labor Code of the Russian Federation.

The text of this regulatory act establishes a procedure for bringing to the attention of workers information about accruals and deductions on their labor income.

Thus, the administration of the enterprise provides a written explanation to each worker about what components his wages were calculated from for a specific period of his work and indicates on what grounds the deductions were made.

The total in the document shows the amount of money that the employee should receive after carrying out all accounting transactions.

After the adoption of Federal Law No. 35-FZ, the list of accruals and deductions included in the salary statement was expanded.

Federal Law No. 35-FZ

Now you need to reflect the following points in separate lines:

- accrual of monetary compensation in case of violation of salary payment deadlines;

- funds paid during vacation;

- the amount of settlement payable upon dismissal of an employee;

- other monetary payments accrued to the employee.

Please note that handing over pay slips to the work team is not a right, but an employer’s responsibility.

Moreover, he must issue notifications when paying funds not only to permanent employees of the organization’s workforce, but also to part-time workers and workers temporarily hired to perform production tasks.

Workers must receive a payroll statement in all cases, both when funds are credited to a bank account or card, and when paid by other legal means.

Currently, there is no unified form of this document approved for all enterprises. Its type must be put into effect by a separate regulatory act for the organization - this is why an order is needed.

The form itself for the statement of accrual and deductions for wages is developed in accordance with the capabilities of the existing program used for accounting.

What percentage of the salary is the advance?

You can find the amount of the fine for non-payment of wages here.

What should a sheet be given to employees contain?

The following details are required in the payslip for issuance to employees:

- last name, first name and patronymic of the employee;

- Personnel Number;

- calculation period;

- days and hours worked;

- amounts and basis for calculation;

- amounts and reasons for deductions;

- amount in hand.

The accrual column details all types of income separately:

- accruals for time worked;

- regional allowances;

- bonuses for length of service;

- payment for night time;

- overtime pay;

- payment for work on holidays and weekends;

- allowances for working conditions;

- bonuses for class and other qualification bonuses;

- amounts of compensation for housing, utilities, compensation for transportation costs, etc.;

- monetary expression of income received in kind;

- penalties for wages not paid on time;

- amounts of vacation pay and compensation for unused vacation;

- amounts of accrued benefits for temporary disability for various reasons;

about how to understand the calculation sheet and decipher its lines.

Combining accruals into one line, say, “Additions,” is unacceptable.

The following information should be reflected in detail in the “Deductions” column:

- personal income tax;

- the amount of withheld voluntary insurance contributions (for example, for health insurance or voluntary pension contributions);

- amounts of previously paid advances;

- accountable funds for which the employee did not account;

- compensation for shortages and other material damage;

- withholding of overpaid amounts accrued as a result of accounting errors;

- union dues.

When developing a payslip form for distribution to employees, you should leave several empty columns both in the part that reflects the generation of income and in the part that reflects deductions.

During the production process, unexpected charges and deductions may occur.

In this case, the accountant manually marks which type of income or deduction has arisen.

Settlement documents are recorded in a journal or accounting sheet.

>Useful video

The procedure for approving a pay slip and important points during registration is described in detail in this video: