Which payslip form should I use?

The obligation to notify workers about the components of wages when paying them is established in Art. 136 Labor Code of the Russian Federation. Based on the literal interpretation of this provision, such a document should be issued 2 times a month each time payment for work is transferred.

In practice, a payslip is given to employees upon final payment for the month. And the Ministry of Labor, in letter No. 14-1/OOG-4375 dated May 24, 2018, recognized this state of affairs as acceptable.

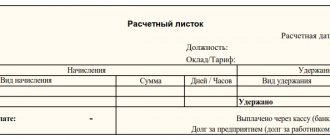

The standard form of the document in question is not approved . And the company can develop it in free form. However, the payslip necessarily include the following list of information:

- the amount of salary in the context of its structural elements ;

- a breakdown of other amounts paid to the employee and not related to wages;

- the amount and reason for deductions from wages;

- the total amount of earnings to be issued.

legal obligation to put any signatures or seals on pay slips. However, if a company decides to establish a similar procedure for their registration, this does not contradict current legal norms.

Important

The developed pay slip form must be approved by the head of the company. To do this, you can issue an appropriate order.

Filling out form T-61

THE FRONT SIDE MUST CONTAIN THE FOLLOWING INFORMATION:

— Name of the organization, OKPO code

— Number and date of document preparation

— Number of the employment contract and the date of its conclusion with the employee

— Full name, position, personnel number of the employee and the name of the structural unit in which he works (if any)

This is important to know: Can a pregnant woman be fired from her maternity position?

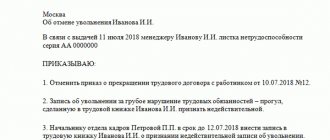

— Data on dismissal: date of termination of the employment contract, grounds for dismissal (article of the Labor Code of the Russian Federation), number and date of the order

— The number of days of unused vacation, as well as, if necessary, the number of days on vacation in advance (in this case, the amount for “extra” vacation days will be deducted from the calculations)

— Signature of the HR department employee and date of filling out the document

Column 1. Year of the billing period.

Column 2. We indicate 12 calendar months before the date of dismissal

Expert opinion

Lebedev Sergey Fedorovich

Practitioner lawyer with 7 years of experience. Specialization: civil law. Extensive experience in defense in court.

Column 3. The total amount of payments to the employee for each month of the billing period is recorded. If in any month the salary was increased or any allowances were made, then this is all taken into account in the indicated amount.

Column 4. The number of calendar days in the billing period (per year) is indicated. The number of calendar days in each month is taken to be a conditional number - 29.3 days, provided that the month has been fully worked out. If a month is not fully worked, calendar days are calculated using the formula: (29.3 days / Number of calendar days in a month) * Number of days worked

Column 5. To be filled in if summarized working time recording is established for the employee.

Column 6. The amount of average daily earnings is indicated. Calculated using the formula: Amount of accruals (line “Total” in column 3) / Number of calendar days (column 4 or 5)

Column 7. Number of vacation days used in advance.

Column 8. Number of unused vacation days.

Column 9. Amount of payments for unused vacation days. Calculated using the formula: (Column 8 – Column 7) * Column 6

TABLE “Calculation of payments”

Column 10. Amount of accrued salary.

Column 11. Amount of vacation pay (take the value from column 9).

Column 12. Other charges.

Column 13. Total amount of all charges (sum of columns 10, 11, 12).

Column 14. Personal income tax (income tax 13%), withheld from all charges (column 13).

Column 15. Other deductions.

Column 16. Total amount of all deductions (sum of columns 14 and 15).

Column 17. Debt of the organization to the employee (for example, some unpaid amounts for previous months).

Column 18. The amount of debt the employee owes to the organization.

Column 19. The total amount of money that the employee will receive after all deductions.

Calculated using the formula: Column 13 – Column 16 + Column 17 – Column 18.

Below the tables the total amount of payments is indicated in words and figures, as well as payroll or cash register data on the basis of which funds are paid from the cash desk.

How to give a payslip to an employee

The laws do not clearly regulate the procedure for transmitting pay slips. The following options are possible:

- in paper form - in person;

- by sending an electronic document by email;

- posting on a corporate resource in the employee’s personal account.

The chosen method must be enshrined in an employment contract, collective agreement, internal regulations or other local act regulating settlements with employees.

It is advisable to have evidence of the issuance of pay slips to the worker - in the form of a log book or an electronic mailing register.

Important

All employees must be notified of the structure and amount of their salaries. Therefore, the employer is interested in bringing this information to every employee. If one of the employees refuses to receive a payslip, the company should insist on delivering it.

SEVEN MANDATORY DOCUMENTS

The table shows the documents that must be issued to each dismissed employee, with reference to the regulatory legal act that established this requirement. There you will also find information about the rules for filling out these documents.

Employment history

All personnel officers know that on the day of dismissal, it is necessary to hand over to the employee his work book with the entries made about hiring and dismissal. If this is not done, you will have to compensate for the earnings not received by the employee for the entire time the book was delayed.

To prove that the book was issued on time, the date of issue is recorded in the book of registration of the movement of work books and inserts in them. The form of the book is approved by Resolution of the Ministry of Labor of Russia dated October 10, 2003 No. 69 (as amended on October 31, 2016).

If an employee is absent from work on the day of dismissal, you need to send him a notice of the need to come for a work book or write consent to send it by mail. In this case, the employer is released from liability for the delay of the work book.

Pay slip

A payslip must be issued to each employee when paying wages (Part 1 of Article 136 of the Labor Code of the Russian Federation), regardless of whether he asked for it or not. Typically, a pay slip is issued on the day the salary is paid for the second half of the month, and upon dismissal, it must be issued upon final payment.

The Labor Code of the Russian Federation obliges to fix at the local level (in an order or in a local act) both the form of the sheet and the procedure for issuing it.

During inspections, state labor inspectors require confirmation that employees have received pay slips. If you're sending them by email, you can simply show the relevant messages. And the issuance of ordinary paper pay slips can only be confirmed by the employee’s receipt of it.

Keep a separate journal for recording the issuance of sheets or ask employees to sign the tear-off part of the sheet.

Let us remind you that failure to issue pay slips is a violation of labor legislation and is punishable under Part 1 of Art. 5.27 of the Code of Administrative Offenses of the Russian Federation (CAO RF): organizations face a fine of up to 50 thousand rubles, individual entrepreneurs - up to 5 thousand rubles.

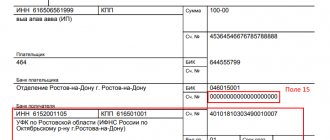

Certificate of earnings for two years

A certificate of the amount of earnings for the two calendar years that preceded the year of dismissal must also be presented on the day of dismissal without any additional statements from the employee.

Failure to issue this certificate is considered a violation, because without it the new employer will not be able to correctly calculate benefits for temporary disability and in connection with maternity. The courts believe that liability for failure to issue a certificate arises in accordance with Part 1 of Art. 5.27 Code of Administrative Offenses of the Russian Federation.

The form and rules for filling out the certificate are established by Order of the Ministry of Labor of Russia dated April 30, 2013 No. 182n (as amended on January 9, 2017).

An accountant usually prepares the certificate, but a personnel employee can also issue it along with other documents. Clause 3, Part 2, Art. 4.1 of Federal Law No. 255-FZ does not contain a direct requirement for written recording of the fact of issuing a certificate. But during inspections, inspectors look at whether the employer is fulfilling the established obligation and can fine him for the lack of documents confirming the issuance of a salary certificate to the employee.

Form SZV-M

This document confirms the insurance experience. It is necessary to prepare an extract from the SZV-M form for only one dismissed employee.

You cannot copy the entire report, otherwise you will reveal the personal data of other employees.

The form is given in Resolution of the Board of the Pension Fund of the Russian Federation dated February 1, 2016 No. 83p. You need to fill out all sections, but in section 4 indicate information about one employee. The form is usually prepared by an accountant. But any specialist can issue it, the main thing is to take confirmation that the employee received the document upon dismissal.

Form SZV-STAZH

The SZV-STAZH form does not replace the SZV-M form. This information confirms not only the insurance experience, but also the amount of insurance premiums. The report is new, it will be submitted only from 2021.

The form of the document and the procedure for filling out are established by Resolution of the Board of the Pension Fund of the Russian Federation dated January 11, 2017 No. 3p. The SZV-STAZH form must also be issued against signature.

This document is prepared by the person who submits reports to the Pension Fund of the Russian Federation, most often an accountant. The HR officer can also give it to the employee as part of the entire package.

Extract from section 3 “Personalized information about insured persons” of the calculation of insurance premiums

This information was previously contained in two forms, but in 2021 the Federal Tax Service of Russia was combined in a single report. The form reflects the employee’s income and contributions transferred from his income for the last three months of the reporting period in which the employee resigned, that is, from the beginning of the quarter to the day of dismissal. The accountant prepares the statement.

Keep in mind that this extract is also issued to citizens working under civil contracts.

Extract from DSV-3 “Register of insured persons for whom additional insurance contributions for a funded pension have been transferred and employer contributions have been paid”

This statement is not issued to all employees, but only to those for whom the employer makes additional insurance contributions for a funded pension in accordance with Federal Law No. 56-FZ dated April 30, 2008 (as amended on November 4, 2014).

Is it necessary to issue a pay slip upon dismissal and in what form?

There are 2 points of view regarding whether they are required to issue a payslip upon dismissal :

- Issuing a payment upon dismissal is actually a payment of wages, therefore, on the basis of Art. necessary to provide a payslip . However, in Art. 140 of the Labor Code of the Russian Federation, the term “wages” does not appear . Here we are talking only about the amounts that the employer owes.

- In Art. 84.1 and art. 140 of the Labor Code of the Russian Federation there are requirements for the issuance of a work book and full payment. All other Work-related documents are issued according to request employee. Therefore, a payslip upon termination of an employment relationship should be issued only if one of the following circumstances exists:

- the day of dismissal coincided with the date of payment of salaries to other employees;

- the dismissed employee formally requested its provision.

Thus, formally, the employer is not obliged to issue the employee a pay slip upon dismissal. However, if the employee requests such information, the employer must provide it. Its format is no different from the pay slip form in other cases. With the only exception that it contains elements of accruals characteristic of cases of dismissal. Namely:

- compensation for unused vacation;

- severance pay;

- other charges related to dismissal.

Read also

11.06.2020

Will the employer be fined for not having a certificate?

If management does not issue a pay slip to its employee, then he faces a fine. Organizations will have to pay up to 50,000 rubles, and individual entrepreneurs - up to 5,000 rubles.

The head of the company, in case of repeated violation, may be completely disqualified for a period of six months. All employees need to remember that it is the payslip that is a powerful argument in the event of litigation. Its issuance shows that on the day of receiving the salary, the subordinate was aware of all the components of the payment.

From this very day, the limitation period begins to count in the event of a dispute regarding insufficient payment of a sum of money. This should not be forgotten.

Dear readers, the information in the article may be out of date, take advantage of a free consultation by calling: Moscow +7

, St. Petersburg

+7 (812) 425-62-38

, Regions

8800-350-97-52

Mechanism for protecting your rights

If the employer does not transfer final payments to the dismissed employee or has made the payment in violation of the established procedure, then the question arises where to go to protect your rights (see Fired from work - what to do?). To effectively restore your damaged positions, you must strictly adhere to a certain algorithm.

Written appeal to the employer

First of all, it is wise to contact your former employer directly with a written request. In the appeal, indicate the need to provide detailed written explanations regarding the identified violations. Keep one copy of the application with a stamp of receipt from the employer. It may be needed in the future if it becomes necessary to go to court and will serve as evidence that measures have been taken to resolve the dispute out of court.

Trade union

If the first method does not bring positive results, then the next step is to contact the trade union organization at your former place of work. The main purpose of the functioning of trade unions is to protect the rights of workers and quite often they provide real assistance.

State Labor Inspectorate

Not all organizations have unions. In this case, you must contact the state labor inspectorate at the location of the organization. Officials will check compliance with labor laws and send a reasoned response within a month.

How to complain to the labor inspectorate about an employer? How to file a complaint?

There are often cases where labor inspectors perform their duties unprofessionally and conduct inspections superficially and incompetently. It is possible to appeal such actions to the city or district prosecutor's office. Prosecutors will not only assess the employer’s violations, but will also hold labor inspectorates accountable.

Statement of claim to court

The final stage of restoring the truth is filing a claim in court. The statement of claim must indicate in great detail all the circumstances, starting from the beginning of the employment relationship. After this, explain exactly which labor law norms were violated and the amount of appropriate compensation.

If you had to turn to a specialist to draw up a statement of claim, then the costs of his representation, as well as the costs of paying the state fee, can be borne by the defendant. All supporting documents must be attached to the statement of claim (employment contract, orders of appointment and dismissal, pay slip, copy of the pre-trial appeal to the employer and his response, other documents).

Special case: If the employment relationship is informal in nature, then it is necessary to prove the fact of its existence (see Working without a work book under an agreement or contract). Evidence may include witness statements, certificates of work completed and handed over, receipts or receipts for previously received payments. These documents must be attached to the relevant application. The employer is also responsible for improper registration of the employee.