Subordinate to the “Main production” account (20).

Account type: Active.

Account type:

- Accounting by department

- Tax

Analytics for the account “20.01”:

| Subconto | RPM only | Total accounting | Accounting in currency |

| Nomenclature groups | No | Yes | Yes |

| Expenditures | Yes | Yes | Yes |

“Main production”: account 20 in accounting

The organization's expenses that are allocated to carry out operations on the main types of activities should be attributed to a special accounting account 20 “Main production”. It should not be assumed that such costs are associated only with production cycles. This accounting account is supposed to take into account the costs of selling products, performing work or providing services, which are enshrined in the constituent documentation as the main type of activity.

In other words, Accounting Account 20 for Dummies is used to record expenses for the activities for which the company was created.

What is included in the account

Account 20 reflects all costs associated with the main activity of the company.

Therefore, the following expenses should be taken into account on the account:

- Material costs are the cost of raw materials, materials, semi-finished products, fuel and others spent on production, that is, what forms the basis of the finished product.

- Costs of services and work of third-party companies involved in the creation of the finished product.

- Remuneration of key personnel with mandatory contributions to extra-budgetary funds.

- Depreciation charges for fixed assets involved in the creation of the finished product.

- Indirect costs that are superimposed on the cost of the finished product - costs of auxiliary production, non-production, factory overhead, sales costs, etc. - they should be reflected on account 20 in the case when the accounts for their accounting are closed at the end of the reporting period.

- Other costs for the production of finished products (taxes, duties, etc.)

The first items relate to direct costs - those that are directly related to production. The cost of the above expenses accumulates while the production process is taking place, and upon its completion they are all written off from account 20 to the cost of the finished product, work, service.

Attention! If the product did not pass technical control and was recognized as a manufacturing defect, the costs of its production previously recorded on account 20 should be written off to the production defect account (usually 28).

Features of accounting on an account 20

All expenses that the company incurs on its main activities or production are accumulated on active account 20. When accepting expenses for accounting, the accounting account is debited; when releasing finished products or providing services, the entries are credited.

A feature of accounting account 20 is that debit turnover cannot be greater than credit turnover. This means that the company cannot consume more raw materials than were written out from warehouses for the production process. Similar conditions apply to other types of expenses.

Postings to account 20 collect information about the cost of OP for the reporting period. In addition to inventories, the following can be written off as main production:

- salaries of key personnel;

- depreciation of equipment;

- administrative staff salaries;

- expenses for renting premises, paying for utilities;

- other expenses.

Example of an operation using account 20

The Integra enterprise produces oil and related products. The following costs were incurred as a result of the production process for Batch No. 400:

- 1000 rubles – purchase of milk;

- 300 rubles – purchase of sourdough;

- 2000 rubles – labor costs;

- 500 rubles – electricity costs;

- 200 rubles – taxes;

- 400 rubles – packaging;

- 100 rubles – delivery.

Total: 4500 rubles – production cost. 90 packs of butter were received for 50 rubles, which were transferred to the finished products warehouse. The accountant used the following entries:

All production costs are combined and formed on one account.

Dt. 45 – Kt. 20 – 4500 rubles – transfer of goods to the warehouse with subsequent write-off.

Summary: I produced oil for 4,500 rubles (cost price), and then the expenses were written off due to the transfer of the products to the warehouse.

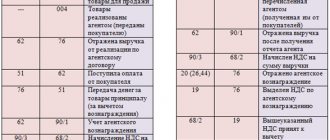

Account 20: accounting entries

Let's look at typical accounting entries for recording operations related to core activities.

| Operation | Account debit | Account credit |

| Inventories were transferred to our own production | 20 | 10 |

| Salaries and insurance contributions of personnel directly involved in the main activities are included in the OP | 20 | 70 69 |

| Services of third-party companies are included in the costs of OP | 20 | 60 |

| Write-off of management expenses reflected | 20 | 26 |

| General production costs are written off to OP | 20 | 25 |

| Returns for reworking of finished products that were found to be defective are reflected. | 20 | 43 |

| Manufacturing defects identified prior to sale are sent for processing | 20 | 28 |

| Amounts of taxes and fees are allocated to production needs | 20 | 68 |

| Deficiencies and losses are reflected within the norms in the production process, without persons at fault | 20 | 94 |

| Downtime and claims against contractors | 20 | 76/2 |

| Semi-finished products are sent to the production process | 20 | 21 |

| The costs of auxiliary production are reflected in the OP | 20 | 23 |

| The goods were written off for the company's production needs | 20 | 41 |

| Reflects the report issued to the employee for production needs | 20 | 71 |

| The employee was compensated for costs associated with the production process (compensation for fuel and lubricants for the use of a personal car, for example) | 20 | 73 |

| Work in progress was accepted as part of targeted financing | 20 | 86 |

| Work in progress is reflected as a contribution to the authorized capital of the organization | 20 | 80 |

| Excess work in progress is taken into account | 20 | 91/1 |

| The share of deferred expenses was attributed to the OP | 20 | 96 |

The concept of general business expenses and their composition

General business expenses mean the costs incurred by an organization for processes not directly related to production. Such expenses typically include:

- salaries of administrative and management personnel (including insurance premiums);

- costs for training personnel in non-working specialties (including advanced training, retraining);

- maintenance and maintenance of facilities not directly involved in the production process (non-production buildings, equipment, inventory, transport of management personnel);

- payment for consulting, information, audit and other services.

It should be noted that general business expenses include costs not only for repair and maintenance of fixed assets for non-production purposes, but also depreciation of fixed assets involved in the process of production management.

How to close a 20 account: 3 methods

At the end of the reporting period, for example a month, it is not necessary to close account 20. The debit balance in the account reflects the value of the company's work in progress. The company's accounting department needs to organize an inventory of work in progress while simultaneously checking workshops, warehouses and payroll records.

Postings for closing account 20 are generated when releasing finished products, when transferring produced material assets directly to customers, or when performing work or services.

Current accounting standards provide for three methods for closing accounting accounts 20:

- Direct method.

- Intermediate method.

- Direct sales of manufactured products.

IMPORTANT!

The company must independently determine the method of writing off costs from account 20. The decision must be documented, detailing the chosen method in the accounting policy.

Before closing account 20, the accountant must highlight the balances of work in progress. But only if there are such residues. If the production cycle does not include work in progress balances, account 20 is closed completely.

The procedure for accounting for general business expenses

To reflect generalized information about the costs incurred by the organization in connection with production management processes, an account is used. Amounts of expenses are collected according to Dt, write-off and reduction of non-production costs are reflected according to Kt.

At most industrial enterprises, the main source of non-production expenses is payments to employees of administrative departments and managers. Transactions for the attribution of expenses in this case are reflected in the following entries:

| Dt | CT | Description | Document |

| Calculation of salaries for employees of administrative and economic departments | Payroll sheet | ||

| Write-off of amounts of accountable funds previously issued to an employee of a non-production department | Advance report | ||

| 69.1.1 | Calculation of insurance premiums from the salaries of employees of non-production units (FSS) | Payroll sheet | |

| 69.3.1 | Calculation of insurance premiums from the salaries of employees of non-production departments (MHIF) | Payroll sheet |

When making settlements with counterparties for goods (work, services) received, non-production expenses are reflected in the following entries:

| Dt | CT | Description | Document |

| Expenses for purchased services are written off | Certificate of services rendered | ||

| 76 | Expenses for services purchased from other contractors were written off | Certificate of services rendered |

General business expenses in correspondence with production accounts are recorded in the following entries:

| Dt | CT | Description | Document |

| Write-off of semi-finished products of own production | Limit and intake statement | ||

| Reflection of auxiliary production work as expenses | Limit and intake statement | ||

| Reflection of service production work as expenses | Limit and intake statement |

Example of reflecting transactions on account 26

To determine the amount of general business expenses that fall on the main and auxiliary production, the accountant of Minotaur LLC made the following calculations:

- general operating expenses for main production RUB 290,259. (RUB 1,413,000 / RUB 1,667,800 * RUB 342,600);

- general business expenses for auxiliary production 341 rubles. (RUB 254,800 / RUB 1,667,800 * RUB 342,600).

The following entries were made in the accounting of Minotaur LLC:

| Dt | CT | Description | Sum | Document |

| 02 (10, , , 69, …) | Accounting for direct costs of main production | RUB 1,413,000 | Intake sheet, work completion certificate, payroll sheet, etc. | |

| 02 (10, , , 69, …) | Accounting for direct costs of auxiliary production | RUB 254,800 | Intake sheet, work completion certificate, payroll sheet, etc. | |

| 02 (10, , , 69, …) | Accounting for general business expenses | RUB 342,600 | Intake sheet, work completion certificate, payroll sheet, etc. | |

| Reflection of general business expenses for main production | RUB 290,259 | Accounting certificate-calculation | ||

| Reflection of general business expenses for auxiliary production | 341 rub. | Accounting certificate-calculation |

Tags: certificate of completion, asset, balance sheet, accountant, water supply, inventory, frame, loan, tax, expense, write-off, transport

Direct method of closing account 20

The direct method is used when the actual price of goods, works and services produced during the reporting period is unknown. Accounting is carried out according to conditional price indicators, for example, according to planned cost.

At the end of the reporting period, the cost of manufactured products is adjusted to actual cost figures.

Typical wiring:

| Operation | Account debit | Account credit |

| An adjustment to the cost of manufactured products is reflected | 43 | 20 |

| Identified deviations of the actual cost from the planned cost are written off to the cost of sales | 90/02 | 43 |

Typical postings for subaccounts of account 68

Debit entries:

D68 K50 – the amount of tax or fee was paid to the budget in cash from the cash register.

D68 K51 – the amount of tax or fee to the budget is transferred from the current account.

D68 K19 – VAT presented by suppliers is sent for deduction.

Loan transactions:

D70 K68.1 – personal income tax is withheld from employees’ salaries for payment to the budget.

D90.3 K68.2 – VAT is charged on goods, products, works, services sold for payment to the budget.

D91.2 K68.2 – VAT is charged on sold fixed assets and intangible assets.

D76.Advance K68.2 – VAT is charged on advances received from buyers.

D99 K68.4 – income tax has been accrued and must be paid to the budget.

D20 (26, 44, 91.2) K68.7 – transport tax payable has been accrued.

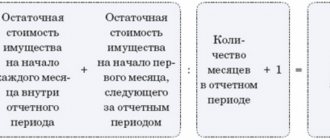

D26 (44, 91.2) K68.8 – property tax is assessed for payment to the budget.

D99 K68.11 – accrued for payment of UTII.

D99 K68.12 – a single tax of the simplified tax system has been accrued for payment to the budget.

Tax fines and penalties are also reflected in subaccounts depending on the type of tax. The debit of account 68 reflects the payment of penalties and fines, and the credit reflects their accrual for payment.

Account 68 is complex and has subaccounts, click on the link and read in more detail about the accounting objects: 68.1 - personal income tax calculations; 68.2 - payment of VAT; 68.3 - excise tax accounting; 68.4 - payment of income tax; 68.7 - transport tax; 68.8 - tax on property of the organization;

68.11 – payment of UTII; 68.12 – individual entrepreneur reporting on the simplified tax system.

Intermediate method

When using the intermediate method of closing account 20, account 40 “Product Output” is additionally used as an auxiliary account. This account is used to record deviations of the planned cost from the actual cost. The credit of account 40 reflects the planned cost, and the debit shows the actual cost.

At the end of the reporting period, the balance is written off proportionally: part - to account 43 “Finished products” and part - to subaccount 90/02 “Cost of sales”.

Typical transactions during the month:

| Operation | Account debit | Account credit |

| The receipt of finished products at the planned cost is reflected | 43 | 40 |

| Products sold are written off at planned cost | 90/02 | 43 |

At the end of the month, the accounting records reflect:

| Operation | Debit | Credit |

| The write-off of the actual cost of manufactured products is reflected | 40 | 20 |

| Corrective entries are reflected that bring the planned cost to actual figures. | 43 | 40 |

| 90/02 | 40 |

Accounting for calculations of taxes and fees (account 68). Postings

The accrual of taxes and their payment is reflected in account 68 “Calculations for taxes and fees”. For more convenient accounting, account 68 is divided into several sub-accounts, each of which takes into account different taxes. Such a division will make accounting more transparent and make it clear which tax is owed to the budget, and which tax the organization owes. Similarly, account 69 “Calculations for social insurance and security” is divided into subaccounts. In the article we will talk about the features of accounting for account 68, and also consider typical transactions and examples of transactions with taxes and fees.

Method of direct sales of released products

This method of accounting is used when manufactured products are sold to customers immediately and are not stored at the enterprise. In this case, production costs are written off to cost of sales. For example, services provided by organizations are closed on account 20 using the direct sales method.

Typical wiring:

| Operation | Debit | Credit |

| The actual cost of services provided is written off to cost of sales | 90/02 | 20 |

Interaction with other accounts

Based on the extensive classification of payments and wage deductions, a large number of items of settlements with employees are distinguished. That is why account 70 corresponds with the vast majority of other accounts. We list the main ones:

- For the loan - 20, 23, 25, 26, 28, 29, 44, 69, 84, 96;

- By debit - 50, 51, 52, 55, 68, 69, 71, 73, 76, 79, 94.

Receipt of wages by employees in kind is documented by posting to accounts 70 and 90. From the debit of account 70 to the credit of account 90 “Sales”, the amount of wages equal to the amount of goods issued is written off. And also from the debit of account 90 to the credit of account 43 “Finished products”, the transfer of goods (materials, products) to employees is registered.

The company's expenses allocated for the production and sale of manufactured products, the performance of specialized services/work in which the enterprise specializes are taken into account on account 20 “Main production”. That is, this account is used to record costs for the activities for which the company was created. Let us recall what operations are carried out using account 20, and what accounting records they are accompanied by.