In any production process, failures can occur, resulting in instead of finished products. A manufacturing defect is understood as a product that has gone through certain stages of processing, but does not meet the required characteristics and properties. However, this will not include products that are manufactured to increased requirements, since the characteristics of the finished product will not exactly correspond to the standard ones, but will be higher. Also, a downgrading of a product’s grade is not considered a defect, for example, the assignment of flour, initially produced as first-grade, to a second grade, established at the quality control stage.

As a rule, the organizational structure of manufacturing enterprises includes a quality control department, which is responsible for identifying defects and redirecting them for revision if necessary. Depending on the location of detection of defective products, defects are divided into:

- internal (identified by the quality control service, or directly by the workshop/warehouse employees);

- external (identified by the end user).

To minimize reputational risks, it is more profitable for an enterprise to identify defects either at the production or warehousing stage, this will avoid deterioration in the loyalty of product consumers to the brand.

Economically, external defects are more expensive for an enterprise, since in addition to the direct costs of producing the product, it includes sales costs, transportation costs, and also causes indirect damage to the company’s reputation.

Defects include products, parts or work that do not meet established standards or technical specifications in quality and cannot be used for their intended purpose or can be used only after correction.

| Buy ★ bestselling book “Accounting from scratch” for dummies (understand how to do accounting in 72 hours) > 8000 books purchased |

What to do if a manufacturing defect is identified?

At one of the stages: during the production process, storage of finished products in a warehouse, or after selling the goods to the final buyer, a defect is identified.

Responsible employees determine what type of “rejected products” are: (click to expand)

- correctable defects (products are subject to modification, after which they acquire all the required technical characteristics. It is important that the costs of modification are economically justified);

- irreparable defect (rework of rejected products is impossible, or the costs of rework are too high and not economically justified).

If a decision is made to eliminate product defects and the defect is considered correctable, then the product is sent to the workshop for revision. To the cost of repairable defects, the costs of materials, employee wages with deductions, etc. are added. Subsequently, the product is returned for sale.

If the defect cannot be corrected, the responsible employee determines what in the product can be usefully used in production, and what should be recycled? If the components retain their usefulness (for example, zippers in a tailoring workshop), they will be separated from the rejected product and used for their intended purpose in the production of similar products. The cost of useful scrap parts is determined by the price of possible use.

If an enterprise produces warranty products, then it is obliged to create a reserve for repairs. In this case, losses from defects are written off against the guarantee reserve (account 96).

When identifying rejected products, the person who caused the defect is always identified. The culprit may be a supplier of low-quality materials or an employee of the enterprise. A claim is submitted to the supplier. If it is recognized by the supplier, the amount of compensation paid by him is counted towards the reduction of defective expenses.

If an employee is found to be at fault, then the amount of expenses related to the marriage is established and is subject to deduction from wages. By law, you can deduct no more than 20% from your salary each month.

Accounting for production defects in the 1C program: Enterprise Accounting 8 edition 3.0

Published 05/11/2017 23:57 Author: Administrator Defects in production are considered to be products, semi-finished products, parts, work that do not meet established standards or technical conditions in quality. They will not be able to be used for their intended purpose. Although sometimes this is possible, but only after correction. Let's look at several examples of accounting for and correcting manufacturing defects in the 1C program: Enterprise Accounting 8 edition 3.0.

Manufacturing defects can be of several types: correctable or irreparable, and depending on the moment of detection, they are divided into internal or external. In this article we will dwell in detail on various examples of working with a fixable marriage.

To account for defective products, account 28 “Defects in production” is used. The debit of account 28 collects the costs of identified defects, and the credit reflects the amounts for writing off defective products. In our example, the organization “Tables and Chairs” is engaged in the production of tables and chairs for their subsequent sale. Let's start with the accounting policy settings. Here you must indicate that the costs will be taken into account on account 20.01. We check the box that our organization produces products.

If the defect was made during the production process, the products have not yet been transferred to the warehouse, the guilty person has been identified (deduction for the defect or additional payment for its correction is not made) and no additional materials are required to correct the defect, but only the labor resources of the employee, then The program should not perform any operations to reflect this situation. Let's consider a situation where a correctable defect was discovered, but the culprit was not identified.

The defect was corrected by an employee, who was additionally paid for this. No additional materials were used. For a better understanding, we will describe the entire production process, starting with the transfer of materials using the “Requirement-Invoice” document. We indicate the necessary materials for making the table.

Cost account – 20.01, item group – “Tables”, cost item – “Material expenses”.

We carry out the document. We see that our semi-finished products and materials were written off to the account on January 20.

Product output is reflected in the document “Production Report for a Shift”. We indicate that we produced 10 tables.

Finished products are reflected in the debit of account 43.

Now, let’s say one table has a defect, it needs to be corrected without the use of additional materials. The correction will be carried out by employee M. O. Kovalev, payment for this work is 2000 rubles. We create an additional accrual for him.

Let’s call the accrual “Payment for correction of defects.” We are creating a new way for it to be reflected in accounting – “Correction of defective products.” We indicate the accounting account – 28 “Defects in production”. If we look at the document entries, we will see that the accrual of wages and the accrual of contributions to M. O. Kovalev are debited to account 28.

Let's generate a report "Turnover balance sheet" for account 28 and see that our expenses were collected on this account.

Next, you need to write off the costs of defects for the main production; for this we will use the “Operation” document. Debit – account 20.01, credit – 28, item group – “Tables”, amount – 2604 rubles.

Let's create the balance sheet for account 28 again and see that it is closed.

We close the month, select “References-calculations”, then the report “Cost calculation”. The report shows that when forming the cost price, expenses for defects were included, and the article “Losses from defects” appeared in the amount of 2,604 rubles.

Let's consider the second example: an external and correctable marriage. Our organization produced the table and sold it to the buyer. The buyer discovered defects in the table; they were found to be correctable under warranty. To correct the defect, additional material and transport services are required to travel to the buyer. The employee was also paid for correcting the defect. In this example, two situations are possible: our organization creates a reserve for warranty repairs or does not create it. Let's look at both. We create a reserve for warranty repairs, deducting 3,000 rubles monthly. Posting to debit 20.01 “Main production” and credit 96.09 “Other reserves for future expenses.”

I would like to draw your attention to the fact that these reserves will be taken into account when determining the cost of production.

Next, we write off the materials for warranty repairs using the “Demand-invoice” document.

On the “Cost Account” tab we indicate account 28, that is, we will write off the costs to “Defects in production”.

We look at the movement of the document: the materials were written off to account 28.

We reflect the costs of transportation services for an employee to travel to the buyer. Let's use the document “Receipt of services”.

We fill out the cost accounts, indicating the 28th account.

We look at the movements and see that transportation costs are also included in account 28.

We charge additional payment to employee Petrenko S.V. for warranty repairs, we indicate the accrual previously created by us - “Payment for correction of defects”.

Let's turn to the "Account Card" report for account 28. Let's look at the costs that were collected on it. The total cost is 1852 rubles.

Now we use our first option and write off expenses against the reserve. We create the document “Operation” - debit - account 96.09, credit - account 28.

We close the month and open the “Cost calculation” report. We do not see marriage expenses in the report, since they were repaid from the reserve.

The second situation: we do not create a reserve for warranty repairs, so expenses must be written off to account 20.01 “Main production” using the “Operation” document.

We form the SALT for account 28 and see that it has also closed.

We close the month and open the “Cost calculation” report. In this option, we do not create a reserve for warranty repairs; in fact, that is why we do not see this article in the report. In this example, the article “Losses from defects” appeared, which was taken into account when determining the cost of production.

Now let's look at marriage in the provision of services. Let’s assume that our organization also provides furniture repair services. Let's turn to the accounting policy and check the appropriate box.

We will hire an employee who will carry out the repairs. Let’s create a new accrual for it - “Payment by salary (repair)”, we will also create a new method of reflection - “Furniture repair”, we will indicate the account as 20.01, we will create a new item group, let’s call it “Furniture repair services”.

The organization “Tables and Chairs” sells services to the buyer for repairing furniture walls. Our organization used materials - screws, the rest of the materials were provided by the customer. Later, the client filed a claim for repair services. The organization must eliminate the deficiencies free of charge to the customer. This required additional materials: again screws and door handles. We reflect the transfer of materials with the document “Demand-invoice”.

We indicate the cost account as 20.01, the item group – “Furniture repair services.”

We look at the postings, the materials are written off to the debit of the account on January 20.

We reflect the implementation of services to the customer.

We look at the movement of the document.

We pay salaries to employees. Let's look at the movements. Our repairman received a salary, which is reflected in account 20.01 and the nomenclature group - “Furniture repair services.”

We close the month, look at the generation of the “Cost Cost Calculation” report. This certificate does not calculate the cost of services, but forms the actual cost of production.

Next we reflect on the correction of the defect. We generate a document “Request-invoice”, write off materials to correct deficiencies. As already mentioned, the employee will need screws and handles.

We indicate the cost account - 28 “Defects in production”.

The materials are written off to the debit of account 28. We will generate the “Account Card” report for account 28. Here we see the costs that are collected on this account to correct the defect.

Next, we charge the employee an additional payment for correcting the defect. We create another accrual - “Payment for repairing defects”, but we already indicate the nomenclature group “Furniture repair services”.

We again create account card 28, we see that the expenses for calculating salaries and contributions have been added here.

The total cost was 1951 rubles. We need to write them off as the debit of account 20.01. We considered a similar operation earlier.

Let's look at the balance sheet: for account 20 all expenses are closed, for account 28 it is the same.

We close the month, generate a certificate-calculation “Cost cost calculation” and see that the actual cost has increased by the amount of losses from defects.

I would like to note that when correcting a defect, it is not necessary to reflect the fact of providing data.

In the event that, upon discovery of any defect, it is necessary to deduct from the wages of the guilty person, we recommend you the article Deductions from wages in the 1C program: Enterprise Accounting 8

Author of the article: Tatyana Lukina

Did you like the article? Subscribe to the newsletter for new materials

Add a comment

JComments

Account 28 for recording marriage

To account for defects, account 28 is used. The account is active. During the month, a debit account turnover is formed, including production costs incurred during the creation of defective products, as well as rework costs. Credit turnover - amounts received from the culprits to reimburse expenses for the defect, as well as parts of the defect that have not lost their usefulness and are subject to return to production. The final balance is the amount of losses. It is subject to write-off at the end of each month. It is written off either to the costs of manufacturing similar products or to account 25.

It is advisable for manufacturing enterprises to maintain analytical accounting on account 28. The subaccounts for which analytics will be collected must be specified in the accounting policy. A special feature of analytical accounting of marriage is the ability to collect information in accounting on the reasons for the marriage and the persons through whose fault the marriage occurred. Such analytics allows you to track the sources of defects and improve the production process, increasing its efficiency.

Accounting for manufacturing defects is important for tax purposes. It affects the two most important taxes - income tax (IP) and VAT. You should understand the intricacies of tax accounting in a separate article. Now let's look at the most common cases.

Losses due to marriage are officially expenses that reduce the tax base of an NP. When calculating the costs of losses due to defects, it should be taken into account that only that part that could not be attributed to materials or to the guilty person can be attributed to expenses. Also, all business transactions involving marriage must be documented in the prescribed manner.

When accounting for VAT on internal defects, there are often controversial issues with the tax service. In order to avoid disputes, manufacturing enterprises “restore” VAT. With an external defect in tax accounting, everything is more clear: the company reduces the amount of VAT that it previously accrued and paid by the amount of VAT on the sale of the returned product.

Characteristics of 28 accounts in accounting

To account for defective production products in the Chart of Accounts, account 28 is used. It is active, as it reflects the cost of defective products and the cost of correcting them at the beginning of the period.

You might be interested in:

Postings for wages and taxes: how to reflect them correctly in 2021

The debit of account 28 reflects the cost of defects identified in production, as well as all costs incurred by the company to bring products to the standards required by regulations.

The credit of the account reflects the cost of the corrected finished product, or the cost of defects written off as costs due to the impossibility of correction, as well as the cost of material assets that can be used, amounts attributed to the guilty parties, etc.

The debit balance of account 28 is determined by adding the initial balance to the debit turnover of the account and subtracting from it the loan amounts for the period under review. Subaccounts 28 accounts

Analytical accounting for account 28 is built in accordance with the characteristics of the activities carried out by the enterprise.

Subaccounts to this account can be opened:

- By structural divisions where product defects occurred.

- In types of defective products.

- According to cost items for correcting defective products.

- Due to the reasons for the occurrence of defects in production.

- For the guilty persons, as a result of whose activities or inaction a defect occurred in production.

Example of using 28 count

In March 2021, an inspector discovered a defect at a plant producing parts for the defense industry. The controller classified it as not correctable. The acceptance committee found that the defect arose due to the fault of the milling machine operator.

The cost of creating the part amounted to 50,000 rubles, including the cost of casting, employee salaries with deductions, depreciation of equipment, maintenance and experimental work.

A rejected part can be scrapped for 12,000 rubles. It was decided to collect 10,000 rubles from the milling machine operator.

| Business transaction | Debit | Credit | Amount, rub. |

| Rejected part written off | 28 | 20 | 50 000 |

| The rejected part is accepted for accounting at the price of scrap metal | 10 | 28 | 12 000 |

| The amount of compensation for the marriage is allocated to the guilty person | 73 | 28 | 10 000 |

| Unreimbursed losses on defective parts were included in the costs of production of GP | 20 | 28 | 28 000 |

Blame it on the culprit

There is no specialized document for writing off the costs of defects to the responsible person, so the document “Other costs” with the transaction type “Write-off” is used. The tabular part indicates the cost item with the nature of “Defects in production” and the amount of costs. On the “Accounting” tab, select account 73.02 “Calculations for compensation for material damage.” The document will generate postings - see Table 3.

Table 3

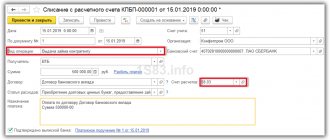

| Period | № | Account Dt | Subconto Dt | Number of Dt | Kt account | Subconto Kt | Number of CT | Sum |

| Document | Content | |||||||

| Organization | Magazine no. | |||||||

| 15.01.2007 18:50:38 | 1 | 73.02 | Avdeev A.A. | 28.01 | Workshop 1 | 500,00 | ||

| Other costs MSK00000002 dated January 15, 2007 | Cushioned furniture | Other costs | ||||||

| FurnitureStroyKomplekt plant | Marriage | |||||||

A fixable marriage. Calculation of the cost of partial defects (account 28)

As we said above, a marriage can be fixable or irreparable. Depending on this, different entries are made in accounting. Let's consider both cases, using examples. Let's start with postings for correctable defects.

Ivanov manufactured a defective part. Petrov corrected him.

Costs for correcting defective products: (click to expand)

- cost of materials 100 rubles,

- Petrov's salary is 500,

- insurance premiums from Petrov’s salary 180.

500 was withheld from Ivanov’s salary at a reduced rate. What transactions need to be reflected?

Postings for accounting for correctable defects

| Sum | Debit | Credit | Operation name |

| 100 | 28 | 10 | Material costs for correction are taken into account |

| 500 | 28 | 70 | The cost of salary for an employee correcting a defect is taken into account |

| 180 | 28 | 69 | Accrued insurance premiums from the salary of the employee who corrected the marriage were taken into account |

| 500 | 73 | 28 | Withheld from the salary of the guilty employee |

| 280 | 20 | 28 | Losses from defects are written off to the cost of production |

As we see from this example, if it is possible to correct the defect, then in the debit of the account. 28 collects all costs for correcting defective products.

From a loan account 28 the amount of these costs is written off to the cost of production in the debit of the account. 20 “Main production”, as discussed in the previous article.

If some fine is withheld from the guilty employee (we read about the employee’s financial liability), then the costs of correcting defective products are partially reduced, and the fine is written off from the credit account. 28 to the debit of the account. 73 “Settlements with personnel for other operations.”

We will consider account 73 in detail in the near future, do not forget to subscribe to our newsletter to learn about the release of new articles.

Accounting for defects during production

Let’s say that at the production stage it was possible to unambiguously determine whether the resulting product was defective or high-quality. The document “Production Report for a Shift” is drawn up in the system, while the defect has the direction of release “To costs” and the cost item has the nature of “Defect in production”, and the rest of the products have the direction of release “To warehouse”.

But if the quality cannot be determined unambiguously when releasing products, then the document “Production Report for the Shift” is also drawn up with the direction “To Warehouse”, but the quality of the product is set to something other than “New”, for example “Doubtful”. This is done in order to separate this release from other batches in warehouse accounting.

Next, product quality is checked. For high-quality products, a “Quality Adjustment” document is drawn up and the quality is set to “New”. For defects, a write-off from the warehouse is recorded using the document “Demand-invoice” for a cost item with the nature “Defects in production”.

An irreparable marriage. Calculation of the cost of final marriage (account 28)

Ivanov allowed an irreparable defect in the part.

According to the calculation, the actual cost of the final defect was:

- materials - 100 rub.,

- transportation costs - 20,

- salary - 500,

- insurance premiums - 180,

- general production expenses - 30.

500 were withheld from Ivanov. Returnable waste after writing off the defective part amounted to 80 rubles. What kind of wiring do we do?

First of all, we calculate the cost of the final defect: 100+20+500+180+30=830 rubles.

Postings for accounting for irreparable defects

| Sum | Debit | Credit | Operation name |

| 830 | 28 | 20 | The cost of the defective part has been written off |

| 500 | 73 | 28 | Deducted from an employee who allowed the production of a defective part |

| 80 | 10 | 28 | Returnable waste from rejects is entered into the materials warehouse for further use. |

| 250 | 20 | 28 | The remaining losses from defects are written off to the cost of production |

Defects in production can also be grouped according to the location of the defect: internal and external.

Material losses from marriage

In certain types of production, the key costs associated with defects are precisely material costs. The report on material losses due to unrecoverable defects shows what material is lost due to unrecoverable defects.

In this case, the largest share is occupied by losses in the positions “Steel 3 Circle D65” and “Steel 20 Sheet S12” - 18 and 13%, respectively. Consequently, the defect commission first of all needs to eliminate the causes of defects that cause the loss of these particular materials.