Bank commission: grounds for its calculation

The basis for charging commissions are agreements for maintaining a current account, servicing a deposit or issuing a loan. Within the framework of these agreements, the terms of the relationship between the organization and the bank are stipulated.

The following list of services for which commissions are paid can be distinguished:

- Ongoing maintenance of the current account with subsequent installation and maintenance of the Client-Bank program.

- Cash collection.

- Transactions of purchase and sale of foreign currency.

- Providing and maintaining a credit line.

- Property management on a trust basis.

- Rent of deposit boxes.

- Use of leased property.

For each type of banking services provided to the client, a separate agreement is drawn up, which details the conditions for the provision of these services, the amount and procedure for paying the bank commission.

Bank services: postings

Agafonova Polina Author PPT.RU April 23, 2021 Bank services are used by all organizations and entrepreneurs engaged in economic activities. Most of the services are provided by credit institutions on a paid basis; the fee for such services is called a bank commission.

In order to attract clients, financial institutions are constantly expanding their range of services, offering not only financial intermediation, but also software products in the form of personal accounts with a set of accounting functions and reporting forms.

The most popular services of credit institutions include:

- settlement and cash services for ruble and foreign currency accounts;

- remote management of settlement operations through a client bank;

- currency control;

- accepting and issuing cash;

- cash collection;

- SMS notifications about payment transactions;

- acquiring operations for accepting card payments;

- issuance and servicing of payment cards;

- factoring operations;

- provision of bank guarantees.

In accounting, expenses associated with servicing in credit institutions are classified as other expenses (clause 11, paragraph 6 of PBU 4/99 “Expenses of the organization”) and are reflected in account 91.02 “Other expenses and income.”

From the point of view of accounting entries, the list of the most common bank services can be divided into two types of operations: not subject to VAT and subject to VAT.

Let's look at the accounting entries for each type of transaction.

Reflection of bank commissions on accounting accounts

In accounting, bank commissions can be displayed in two ways:

- The first method is based on the use of current accounts 60 or 76 with the corresponding sub-account “Settlements with the bank”. Both of these accounts are suitable for accounting for banking services - the procedure for their use can be regulated in the accounting policy of the enterprise.

- The second method is more practical, since the commission is displayed without “intermediate” accounts, but directly to account 91.

Please note, according to the instructions for using the chart of accounts, correspondence of 91 accounts does not provide for payment for the services of credit institutions.

In practice, the second method of accounting for banking services is most often used.

Accounting for expenses for bank services

According to paragraph 11 of the Accounting Regulations “Expenses of the Organization” (PBU 10/99), approved by Order of the Ministry of Finance dated May 6, 1999 No. 33n, expenses for paying for banking services are classified as operating expenses. They are reflected in account 91 “Other income and expenses”.

In accounting, an entry is made for the amount of such costs:

Debit 91-2 Credit 51

– funds are transferred for services provided by the bank.

Example

In November 2003, Passiv LLC entered into a one-year agreement with the bank for the installation and annual maintenance of the Bank-Client system. The cost of installing and configuring the system amounted to 4,500 rubles. The monthly payment for system maintenance is 1000 rubles. In accordance with the Tax Code (subclause 3, clause 3, article 149 of the Tax Code), these services are not subject to VAT.

In the accounting of “Liability”, the listed transactions are reflected by the following entries:

Debit 60 Credit 51

– 5500 rub. (4500 rubles + 1000 rubles) – paid for the installation of the “Bank-Client” system and its maintenance services for November;

Debit 97 Credit 60

– 4500 rub. – the cost of installing the “Bank-Client” system is taken into account;

Debit 91-2 Credit 60

– 1000 rub. – system maintenance costs are reflected;

Debit 91-2 Credit 97

– 375 rub. (RUB 4,500: 12 months) – part of the system installation costs related to the reporting period was written off as non-operating expenses.

–end of example–

At the same time, there are a number of features for accounting for expenses for this type of bank remuneration, such as interest on loans provided to the borrower. In particular, the cost of paying interest on a loan raised to purchase fixed assets is included in their initial cost (clause 8 of PBU 6/01). Interest on loans and credits received is included in the initial cost of investment assets. This must be done before the 1st day of the month following the month in which such assets were accepted for accounting as fixed assets or a property complex (clause 30 of PBU 15/01). For expenses, the amount of interest is written off through depreciation.

Similarly, interest on borrowed funds raised for the acquisition of these inventories accrued before the accounting of inventories is taken into account (clause 6 of PBU 5/01).

Expenses for paying for bank services related to the acquisition of intangible assets (clause 6 of PBU 14/2000) are also included in their initial cost.

Accounting entries for bank commissions

| Account Dt | Kt account | Transaction amount, rub. | Wiring Description | A document base |

| Postings to the bank when using an “interim” account 60/76 | ||||

| 60 (76) | 51 | 1 450,00 | A bank commission has been debited from the company's current account (date of debit from the account) | Bank agreement, bank statement |

| 91-2 | 60 (76) | 1 450,00 | Bank commission is included in expenses | Bank agreement, bank statement |

| Bank commission is subject to VAT | ||||

| 60 (76) | 51 | 5 000,00 | Bank commission (including VAT) is written off for credit servicing | Bank agreement, bank statement, invoice |

| 19 | 60 (76) | 762,71 | VAT charged | Check |

| 68 | 19 | 762,71 | VAT displayed | Check |

| 91-2 | 60 (76) | 4 237,29 | Bank commission is included in expenses (excluding VAT) 5000 – 762.71 = 4237.29 | Bank agreement, account |

| Bank commission – “direct” display method | ||||

| 91-2 | 51 | 8 700,00 | Bank commission written off | Bank agreement, bank statement |

| Uniform write-off of bank commissions (within clearly defined time frames) | ||||

| 60 (76) | 51 | 9 450,00 | Bank commission paid (date of transfer) | Bank agreement, bank statement |

| 97 | 60 (76) | 9 450,00 | Inclusion of paid commission into deferred expenses (by date of transfer or evenly) | Banking agreement. Order on the accounting policy of the enterprise |

| 91-2 | 97 | 9 450,00 | Bank commission is included in expenses | Order on the accounting policy of the enterprise |

| If in tax accounting this commission is recognized as an expense at a time, and in accounting - evenly over a specified period, then a deferred tax liability arises | ||||

| 68 | 77 | 1 890,00 | Deferred tax liability accrued9450 * 20% (income tax) = RUB 1890. | Accounting certificate-calculation |

| 77 | 68 | 1 890,00 | Reducing deferred tax liability (we uniformly reduce the amount of bank commission accrued in the current period on account 91-2) | Accounting certificate-calculation |

| Retention of bank proceeds credited through the POS terminal | ||||

| 60 (76) | 90-1 | 35 000,00 | Revenue deposited through the POS terminal is displayed | POS terminal control tape |

| 90-3 | 68-VAT | 5 338,98 | VAT is charged on the sales transaction | POS terminal control tape |

| 91-2 | 60 (76) | 630,00 | There is a fee charged for servicing the POS terminal. | POS terminal control tape, agreement |

| 51 | 60 (76) | 34 370,00 | The proceeds received through the POS terminal (minus bank commission) 35,000 – 630 = 34,370 rubles are credited to the company’s current account. | Electronic journal, bank statement |

Accounting for other expenses of non-profit organizations in 1C: Accounting ed. 3.0

Published 09/11/2020 20:16 Every non-profit organization, as well as commercial ones, in its activities is faced with other expenses, such as expenses for bank services, penalties, expenses for compensation of losses, etc. How to reflect such expenses in accounting We will talk about non-profit organizations today in our article.

Reflection in NPO accounting of expenses for bank services

Let's start with banking expenses that any organization faces every day.

The bank is a commercial organization and charges fees for its operations. Such operations include, for example, servicing a current account, processing a payment order, recalculating cash, providing certified copies of documents, etc. The credit institution, within the framework of a bank account agreement, will immediately write off the commission for the transaction from the current account. The organization will not have to do any additional actions for this, and the commission written off by the bank will be reflected in the bank statement.

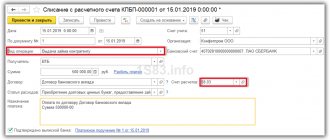

Today, almost all organizations receive bank statements electronically in the Client Bank system. Further in the 1C: Accounting program you can act in two ways:

1) Reflect manual transactions;

2) Download the statement using a file generated in the Client Bank system.

Most organizations operate in the second way.

So, in the Client Bank system you need to generate a statement for a certain date in the “1c” format - this is a text file format with the extension “.txt”, by default the file name is “kl_to_1c”.

Then in the program, in the “Bank and Cash Office” section, select the “Bank Statements” item:

In the window that opens, click the “Download” button:

The program will prompt you to select a file from the disk - the same one that we saved from Client Bank:

After selecting the download file and clicking on the “OK” button, the program will begin downloading the extract. Upon completion of the download, it will be indicated how many documents have been downloaded and for what amount, and the journal of bank statements itself will reflect all downloaded transactions:

Among the loaded operations we will see the operation to reflect the bank commission. In our case, it is a fee for writing off funds under a payment order to pay for goods and materials to the supplier.

By default, the program reflects fees for bank services as an operation with the type “Bank Commission”:

This involves generating a posting using account 91.02 “Other expenses”:

Typical 1C: Accounting ed. 3.0 provides for accounting in commercial organizations. And according to the Chart of Accounts (approved by Order of the Ministry of Finance of the Russian Federation dated October 31, 2000 No. 94n), expenses associated with payment for services provided by credit institutions are reflected in the debit of account 91 “Other income and expenses” in correspondence with the settlement accounts. Therefore, when selecting the “Bank Commission” transaction type, the program reflects accounting entries in commercial organizations.

In the case when non-profit organizations keep records not in an industry solution, but in standard 1C: Accounting ed. 3.0, then expenses associated with statutory (non-commercial) activities are reflected in accounts 20, 26 with their subsequent write-off to account 86 (and not to account 90, as in commercial organizations).

In the case of bank commissions, you can act in two ways:

1 way. Using accounts 20 and 26

Method 2. Using directly account 86

When choosing any of the methods to reflect the bank commission, you must select the “Other write-off” transaction type. That is, having automatically downloaded a bank statement, you need to enter the operation to reflect the commission and change the type of operation from “Bank Commission” to the type of operation “Other write-off”:

Then you need to choose account 26 or 86 instead of account 91 - depending on the chosen method:

1 way. Using accounts 20 and 26.

When choosing this method, at the end of the month, all costs collected on account 26 are closed to account 86 using the “Month Closing” operation (in manual adjustment mode):

Method 2. Using account 86 directly.

To simplify accounting, you can immediately reflect the bank commission on account 86 (by analogy with reflecting the commission on account 91 in commercial organizations). In this case, in the loaded operation to write off the bank commission, select account 86.02:

Reflection of fines and penalties on taxes and fees in NPO accounting

In the 1C program: Accounting ed. 3.0 does not provide for a special document to reflect penalties for late submission of reports and payment of taxes. Penalties and fines are calculated using the document “Operations entered manually” in the “Operations” section:

According to the Chart of Accounts (approved by Order of the Ministry of Finance of the Russian Federation dated October 31, 2000 No. 94n), to reflect the amounts of tax sanctions due, account 99 “Profits and losses” is provided in correspondence with the account for accounting settlements with the budget for taxes:

Dt 99.01 Kt 68.69

Here again we will make a reservation that such wiring is done in commercial organizations.

In non-profit organizations, instead of account 99, account 86 is used:

Another important point that raises questions: what is the date for accruing penalties?

When penalties and fines were assessed to the organization as a result of an inspection by regulatory authorities, the date will be the moment the corresponding decision of the Federal Tax Service came into force.

If the payer independently discovers, for example, an underpayment of tax, then he can pay additional tax, but he does not have to pay penalties himself, but wait for a request from the Federal Tax Service.

When an organization submits an updated declaration (calculation), which led to an increase in the amount of tax (contribution), then in order to avoid a fine, before submitting the update, it is necessary to pay the tax/contribution and penalties. In this case, the date of accrual of penalties will be the date of approval of the calculation (including the calculation of penalties) by the head of the company.

Reflection of penalties under contracts with counterparties in NPO accounting

Unlike tax penalties, for sanctions under contracts with counterparties, the program provides a special document “Accrual of penalties”, which is located in the “Sales” - “Settlements with counterparties” section.

For example, our non-profit organization, in addition to its statutory activities, is engaged in renting out its own building on the territory of the village. So on June 17, she entered into a lease agreement with Romashka LLC, according to which the payment period for renting the building was set at 5 days.

In order for the program to automatically calculate penalties under a contract, this period must be specified when creating a counterparty agreement (the “Counterparties” directory):

For June-August the rent was accrued:

However, as of September 10, no funds had been received from Romashka LLC.

In the 1C program: Accounting ed. 3.0 the accrual of penalties under agreements with counterparties is reflected in a special document: “Sales” – “Settlements with counterparties” – “Accrual of penalties”:

Let's create a new document:

Fill in the counterparty, agreement, penalty rate and click the “Fill” button to fill out the tabular part:

The program will calculate the penalties automatically, all that remains is to post the document:

After completion, the following transactions will be generated:

Please note that this document is used by non-profit organizations, as a rule, when conducting business activities. However, the issue of calculating penalties is also relevant when conducting statutory activities.

For example, according to the Regulations on the calculation of membership fees, as a rule, sanctions are always provided for failure to pay them within a certain period. In this case, penalties will have to be calculated similarly to tax penalties - through the “Operation” document manually:

The basis for the accrual of such penalties is a court decision, or the fact of their recognition by the payer (actual payment):

Important! Non-profit organizations using a simplified tax system may not take into account income under Article 251 of the Tax Code of the Russian Federation. The list of income not subject to taxation in accordance with Article 251 of the Code is closed. In this article, there is no income in the form of penalties for late payment of membership fees, therefore this income is subject to taxation with tax paid in connection with the application of the simplified taxation system.

Author of the article: Anna Kulikova

Did you like the article? Subscribe to the newsletter for new materials

Add a comment

JComments

Banking services for issuing loans and providing guarantees

These types of banking services have specific features of reflection in accounting. The bank's tariffs for the use of loan funds are called interest on the loan and are reflected depending on the purpose of obtaining the loan in correspondence with cost accounts or are taken into account in the value of the assets for the purchase of which the loan was received. Accounting for short-term loans is kept on account 66, long-term - on account 67. Interest and principal are accounted for separately.

A feature of reflecting bank commissions for providing guarantees is that these costs should be evenly distributed over the entire period of validity of the guarantee.

Dear readers, if you see an error or typo, help us fix it! To do this, highlight the error and press the “Ctrl” and “Enter” keys simultaneously. We will learn about the inaccuracy and correct it. You may be interested in: ACCOUNTANT: ARTICLES ACCOUNTANT: ARTICLES Subscribe to the daily newsletter Every weekday we will send you everything that was published yesterday You won’t miss anything! Subscribe

Bank services: transactions without VAT

Operations for opening and servicing a current account, cash transactions (except for collection), making payments, issuing a bank guarantee, servicing a bank client and others listed in clause 3 of Article 149 of the Tax Code of the Russian Federation are not subject to taxation.

Services of credit institutions without VAT should be reflected in correspondence with the cash account:

Dt 91.02 Kt 51, 52, 55, 57.

Bank transactions for services without VAT:

| Operation | Debit | Credit |

| Commission for execution of payment order | ||

| Commission for RKO in March | ||

| Fee for using a bank client | ||

| Commission for execution of payment in foreign currency | ||

| Acquiring fees | ||

| Refund of erroneously charged commission |

If an organization deposits funds in excess of the cash limit to a bank for crediting to a current account independently, without involving collectors, then the service for receiving and recounting cash is not subject to VAT.

Delivery of proceeds to the bank, postings:

| Operation | Debit | Credit |

| Cash deposit to current account (revenue) | ||

| Cash conversion fee | ||

| Cash acceptance fee |

A banking offer called “salary project” has become quite popular, which allows organizations to save accounting time on issuing wages, shortens and simplifies the procedure for paying wages.

Many credit organizations charge a commission within the framework of a salary project for transferring funds to employee cards; this type of commission is not subject to VAT. The accounting entry when paying for servicing a salary project:

Dt 91.02 Kt 51.