The concept of materials and raw materials in accounting

These nomenclature groups include assets that can be used as semi-finished products, raw materials, components and other types of inventory assets for the production of products and services, or used for the own needs of an organization or enterprise.

Purposes of materials accounting

- Control of their safety

- Reflection in accounting of all business transactions involving the movement of inventory items (for cost planning and management and financial accounting)

- Formation of cost (materials, services, products).

- Control of standard stocks (to ensure a continuous cycle of work)

- Identification of shortages, losses, damage to materials

- Analysis of the effectiveness of the use of mineral reserves.

Cheat sheet on IKBFU

The main production costs are displayed here, providing:

- Transport support;

- Providing production facilities (electricity, water supply, etc.);

- Production of spare parts for equipment, additional parts;

- Carrying out repair work on fixed assets;

- Preparation of agricultural products for sale.

Account 23 in accounting is active, that is, the debit shows the money spent both directly to support the process of auxiliary activities (for example, the cost of purchased inventory items) and for indirect needs (for example, the salary of the administrative department), and the credit shows the actual cost of production works

Attention! Final account balance 23 “Auxiliary production” at the end of the month displays the value of the unfinished production process.

Costs associated with auxiliary production are directly reflected in the debit of the account. 23 in the amounts of the corresponding indicators used in the enterprise to display depreciation charges, materials, employee wages, etc. Indirect costs incurred are reflected in the debit of the account. 23 in the calculated shares attributable to the auxiliary production process, from the credit account. 25 and 26, which accumulate all production and business expenses for the organization as a whole.

Subaccounts 10 accounts

PBUs establish a list of certain accounting accounts in the Chart of Accounts that should be used to account for materials in accordance with their classification and item groups.

Depending on the specifics of the activity (budgetary organization, manufacturing enterprise, trade, etc.) and accounting policies, accounts may be different.

The main account is account 10, to which the following sub-accounts can be opened:

| Subaccounts to the 10th account | Name of material assets | A comment |

| 10.01 | Raw materials | |

| 10.02 | Semi-finished products, components, parts and structures (purchased) | For the production of products, services and own needs |

| 10.03 | Fuel, fuel and lubricants | |

| 10.04 | Container materials, packaging | |

| 10.05 | Spare parts | |

| 10.06 | Other materials (for example: stationery) | For production purposes |

| 10.07, 10.08, 10.09, 10.10 | Materials for processing (outside), Construction materials, Household supplies, equipment, Working clothes, equipment (in warehouse) |

The chart of accounts classifies materials according to product groups and the method of inclusion in a certain cost group (construction, production of own products, maintenance of auxiliary production and others, the table shows the most used ones).

Subaccounts to the account 10

- 10.1 “Raw materials and materials” - to reflect main and auxiliary production materials, raw materials of the mining industry, agricultural products.

- 10.2 “Semi-finished products, components, parts, structures” - to reflect the inventories directly involved in the production of products.

- 10.3 “Fuel” – to reflect all types of fuel and fuels and lubricants.

- 10.4 “Container and packaging materials” - to reflect items and materials involved in the process of packaging, storage and subsequent transportation of products. This type of inventory is divided into returnable and non-refundable.

- 10.5 “Spare parts” - to reflect the inventories involved in the repair of equipment, machinery and other fixed assets.

- 10.6 “Other materials and materials” - to reflect the generated returnable waste - remnants of goods and materials that still have a certain value and can be sold or reused.

- 10.7 “Inventory for external processing” – to reflect inventive materials sent for external processing.

- 10.8 “Building materials” – to reflect building materials from developers.

- 10.9 “Inventory and household supplies” - to reflect items of technical or general economic use.

Note! Full transcript of the account. 10, including accounts 10.10 and 10.11 for accounting for special equipment and clothing, is given in order No. 94n.

Correspondence on account 10

The debit of 10 accounts in the postings corresponds with production and auxiliary accounts (on credit):

- 20.01 (main production)

- 23 (auxiliary)

- 25 (general production)

- 26 (general economic, management)

Besides them:

- 44 (sales expenses)

- 45 (shipped goods)

- 76 (settlements with debtors and creditors)

- 94 (shortages and losses)

- 99 (profit and loss)

- And others - according to the chart of accounts and accounting policies.

Features of inventory accounting

Account 10 belongs to the active group of accounts. Consequently, debit 10 of the accounting account (for dummies) reflects the receipt (increase) of material assets, and credit turnover reflects the disposal of assets from the corresponding accounting accounts. The ending balance can only be in debit. A credit balance indicates that there is an error in recording accounting transactions.

Inventory accounting needs to be detailed. To do this, provide for maintaining detailed analytical records in the context of items, batches, storage locations, materially responsible persons and departments.

The actual presence of MC must be periodically monitored. Accountants are required to conduct inventory checks to identify deviations from accounting indicators and actual availability. The reconciliation procedure and frequency should be established in the accounting policy.

Accounting for inventory items in accounting: postings and documents

Accounting for inventory items in accounting is reflected on the basis of primary documentation and can be as follows:

- The purchase of materials is made in cash or by bank transfer, confirmed by a purchase agreement, payment and settlement documents or the transfer of a power of attorney to receive goods and materials with subsequent settlement with the supplier. It is received at the warehouse on the basis of a bill of lading or a receipt order. When purchasing materials, additional transportation and procurement costs (for example, delivery) may be reflected.

- Sale of materials - transfer of raw materials to third parties.

- Transfer - from the founders, contractors or sponsors, is accounted for at the estimated value or on the basis of available documents: contracts, payment documents, appraisal reports, etc.

- Write-off of materials - reflects the expenditure of inventory and materials into production. It may imply both the write-off of materials for actual production and the write-off for general business needs. Depends on corr. accounts (20, 23, 25, 26). Disposal may be reflected due to damage or loss of inventory items.

- Shortage of materials or surplus of materials are recorded as a result of inventory. They may be reflected within the normal limits or as a result of loss/damage.

- Operations with customer-supplied raw materials - features of accounting for materials received from another organization.

For production and for own needs, materials are released from the warehouse upon request - invoice or other documents (based on accounting policies); are written off to the production site, which then includes them in the cost of products or services.

Carrying out inventories

Every year, according to PBU, owners are required to conduct scheduled inventories on the basis of an issued order with designated responsible persons. In addition to them, there may be unscheduled (sudden) audits and inventories. Their goal: control over the safety and correct use and write-off of inventory items .

Current accounting and control over the presence and movement of accounting objects

⇐ PreviousPage 2 of 3Next ⇒15. Accounting, includes the following parts

Debit and credit

16. The main elements of the accounting balance at the beginning and end of the month: turnover by Dt and turnover by Kt for the month

17. Active accounts are used to record property

18. Passive accounts are used to record the sources of property formation

19. An increase in the organization’s property is reflected in the debit of the active account

20. A decrease in the organization’s property is reflected in the credit of the active account

21. An increase in the liabilities and capital of the organization is reflected in the credit of the passive account

A decrease in the organization's liabilities and capital is reflected in the debit of the passive account

23. Double entry is the reflection of one business transaction on two interconnected accounts: in the debit of one account and in the credit of another account in the same amount

24. Primary accounting documents are drawn up at the time of a business transaction

Receipt of funds to the cash desk is reflected in the debit of the Cash Account account.

The issuance of funds from the cash register is reflected in the credit of the Cash Account account.

The primary documents for accounting for cash in the cash register are: incoming cash order, outgoing cash order

The balance of the "Cash" account is reflected

On the balance sheet as part of current assets

29. Receipt of funds from the current account to the cash desk is reflected in D 50 “Cash” K 51 “Settlement accounts”

30. Crediting of funds to the current account is reflected in the debit of the “Settlement accounts” account

31. Write-off of funds from the current account is reflected in the credit of the “Current accounts” account

32. The balance on the “Current account” account shows the availability of funds in the organization’s current account

33. Primary documents for recording transactions on a current account: payment order, payment request.

34. Crediting of payment from the buyer for finished products to the current account is reflected in D 51 “Settlement accounts” K 62 “Settlements with buyers and customers”

35. Transfer from a current account to pay off debt D 60 “Settlements with suppliers and contractors” K 51 “Settlement accounts”

36. The balance of the “Current account” account is reflected in the balance sheet asset as part of current assets

37. Materials are objects of labor that are entirely consumed in each production cycle and transfer their entire value to the finished product

38. The balance on the “Materials” account shows the availability of materials in the organization’s warehouse

39. Receipt of materials to the warehouse from suppliers is reflected

D 10 “Materials” K 60 “Settlements with suppliers and contractors”

40. The release of materials from the warehouse to the main production for the manufacture of products is reflected

D 20 “Main production” K 10 “Materials”

41. Primary documents for recording the movement of materials:

Receipt order, invoice, demand, limit-fence card, invoice for release to the side

42. Primary documents for recording the receipt of materials at the warehouse: receipt order, invoice, invoice, payment order

43. Primary documents for accounting for the release of materials from the warehouse: requirement, limit card, invoice for release to third parties

44. The balance of the “Materials” account is reflected in the balance sheet asset as part of current assets

45. Calculation of wages (increase in accounts payable to the organization’s personnel) is reflected in the credit of the account “Settlements with personnel for wages”

46. Payment of wages and deduction from wages (reduction of accounts payable to the organization’s personnel) is reflected in the debit of the account “Settlements with personnel for wages”

47. The credit balance on the account “Settlements with personnel for wages” shows the organization’s debt to personnel for wages

48. Primary documents for calculating wages include: orders for piece work, time sheets

49. The calculation of wages for workers in the main production is reflected in 20 “Main production” K 70 “Settlements with personnel for wages”

Withholding of personal income tax from wages is reflected

Dt70 Kt 68

The issuance of wages to employees from the cash register is reflected in D 70 “Settlements with personnel for wages” K 50 “Cash desk”

Debt to employees for wages is reflected in the liability side of the balance sheet as part of short-term liabilities

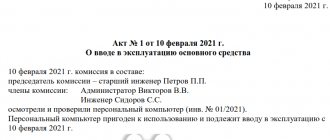

Fixed assets are means of labor that are consumed in several cycles and transfer their value to finished products in parts

The debit balance of the Fixed Assets account shows the presence of fixed assets in the organization

The residual value of fixed assets is the original cost minus depreciation

Acceptance of fixed assets for accounting is reflected in D 01 “Fixed assets” K 08 “Investments in non-current assets”

57. The disposal of fixed assets from the organization is reflected in the credit of account 01 “Fixed assets”

Primary documents for the acquisition of fixed assets include: invoices, delivery notes, receipt orders

58. Accrual of depreciation of fixed assets in accounting: increases production costs and increases the amount of depreciation of fixed assets

59. Depreciation of fixed assets is the transfer of the cost of fixed assets to finished products

60. Accrual of depreciation of fixed assets is reflected in the credit of account 02 “Depreciation of fixed assets”

61. Accounting entry for depreciation of fixed assets for general production purposes

D 25 “General production expenses” K 02 “Depreciation of fixed assets”

62. Depreciation of fixed assets in accounting is calculated in the following ways:

Linear method, method of writing off value by the sum of the numbers of years of useful use, reducing balance method, method of writing off value in proportion to the volume of production (work)

63. Write-off of depreciation of fixed assets for general business purposes upon their disposal is reflected as follows

D 02 “Depreciation of fixed assets” K 01 “Fixed assets”

64. Fixed assets in the balance sheet are reflected in the balance sheet asset as part of non-current assets

65. Fixed assets are reflected in the balance sheet at their residual value

66. To identify the financial result from the disposal of fixed assets, account 91 “Other income and expenses”

67. Production costs include materials costs, labor costs, depreciation of fixed assets

68. In relation to production volume, costs are grouped into: items and cost elements, variable and semi-fixed

69. Production costs are collected according to

On the debit of account 20 “Main production”

70. Grouping costs by item shows: what is spent in the organization

71. Grouping costs by elements: purpose of costs, their intended purpose

72. The debit of accounts 20, 23, 25, 26 leads to: an increase in production costs

73. Crediting accounts 20, 23, 25, 26 leads to: a reduction or write-off of production costs

74. Account balance 20 “Main production” means the cost of work in progress

75. Debit turnover on account 20 “Main production” means the amount of production costs for the month

76. Credit turnover on account 20 “Main production” means

⇐ Previous2Next ⇒

Didn't find what you were looking for? Use Google search on the site:

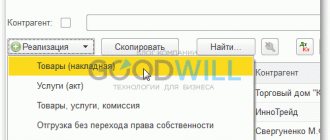

Postings to inventory items

Materials are accounted for in account 10, which has subaccounts depending on their type (materials, semi-finished products, fuels and lubricants, inventory, others, etc.). In its accounting policy, the organization must establish how it will reflect accounting: simply at actual cost or at accounting prices (in this case, it is necessary to use accounts 15 and).

In order to write off materials, they also choose their own method in the accounting policy. There are three of them:

- at average cost;

- at cost of inventories;

- FIFO.

Materials are released into production or for general business needs. Situations are also possible when surpluses are sold, and defects, losses or shortages are written off.

Subaccounts

Count 10 has a number of second order counts. Let us briefly describe what each of them takes into account:

- 1—property that forms the basis of the product produced by the organization (unprocessed raw materials, auxiliary materials, etc.);

- 2 - purchased components. Moreover, they must become an integral part of the product;

- 3 — fuel (including technological, household and lubricants);

- 4 - containers used for storing, packaging and transporting products. These can be various boxes, bags, containers, storage boxes, etc.;

- 5 - spare materials. These include spare parts for cars, machine tools and other technological equipment;

- 6 - returnable production waste. Everything that during the manufacturing process of a product was not included in its final composition, but retained its material value;

- 7 - materials for processing. Industrial waste that can only gain value if recycled;

- 8 - building materials (if construction is not the main activity of the organization);

- 9 - household equipment. Any devices that are not directly part of the organization’s technological turnover;

- 10 - tools and workwear in storage;

- 11 — tools and clothing in use.

Example of postings on account 10

The Alpha organization bought 270 sheets of iron from Omega. The cost of materials was 255,690 rubles. (VAT 18% - 39,004 rubles). Subsequently, 125 sheets were released into production at average cost, another 3 were damaged and written off as scrap (write-off at actual cost within the limits of natural loss norms).

Cost formula:

Average cost = ((Cost of remaining materials at the beginning of the month + Cost of materials received for the month) / (Number of materials at the beginning of the month + Number of materials received)) x number of units released into production

Average cost in our example = (216686/270) x 125 = 100318

Let's reflect this cost in our example:

| Account Dt | Kt account | Wiring Description | Transaction amount | A document base |

| 60.01 | 51 | Paid for materials | 255 690 | Bank statement |

| 10.01 | 60.01 | Receipt of materials to the warehouse from the supplier | 216 686 | Request-invoice |

| 19.03 | 60.01 | VAT included | 39 004 | Packing list |

| 68.02 | 19.03 | VAT is accepted for deduction | 39 004 | Invoice |

| 20.01 | 10.01 | Posting: materials released from warehouse to production | 100 318 | Request-invoice |

| 94 | 10.01 | Writing off the cost of damaged sheets | 2408 | Write-off act |

| 20.01 | 94 | The cost of damaged sheets is written off as production costs | 2408 | Accounting information |

Account 20: postings

The accounting records that form the amount of costs for the 20th account combine information about the cost of manufactured products/services for the reporting period. For example, posting Dt 20 Kt 26 reflects general business expenses, incl. to the administrative apparatus of the company; Dt 20 Kt 25 – posting for general production expenses; Dt 20 Kt 10 - posting reflecting the costs of production materials. Expenses for personnel involved in production are taken into account by correspondence Dt 20 Kt 70, entry for mandatory insurance contributions from their salaries - Dt 20 Kt 69. Posting for costs of services of other organizations: Dt 20 - Kt 60, etc.

We present the main correspondence on the account. 20:

| Operations | Wiring | |

| Dt | CT | |

| Accounted for as part of production costs: | ||

| – depreciation of machines and equipment | 20 | 02 |

| – raw materials and goods and materials | 20 | 10 |

| – purchased goods | 20 | 41 |

| – production staff salaries | 20 | 70 |

| – deductions of insurance premiums from salaries | 20 | 69 |

| – services, work of third-party enterprises (for main production) | 20 | 60 |

| – costs of auxiliary sector farms | 20 | 23 |

| – general business expenses (including AUP) | 20 | 26 |

| – general production expenses | 20 | 25 |

| – defect identified before sale and submitted for processing | 20 | 28 |

| – shortages for which the perpetrators have not been identified | 20 | 94 |

| - accountable amount spent on production needs | 20 | 71 |

The listed operations are quite understandable - their totality generates the cost of the product. But the entry found in accounting, D/t 20 K/t 20, often confuses the accountant. Let's figure out what it means.

What are the subaccounts in account 10

Materials are classified depending on their purpose and use in production. This information applies to subaccounts to account 10:

- 10.1 “Raw materials and materials”. Serves to record the availability and movement of materials and raw materials that are part of the finished product and are its important ingredient. This subaccount also includes materials involved in the performance of work and simply participating in production and used for economic needs, as well as for technical purposes;

- 10.2 “Fertilizers, plant and animal protection products.” The subaccount takes into account various fertilizers. medicines, chemicals. Mineral fertilizers are applied indicating the physical mass and the required content of the active substance. In storage areas in warehouses, veterinary sites, veterinary clinics and others, materials are taken into account by quantity and name. The accounting department keeps records for each type in monetary terms;

- 10.3 “Purchased semi-finished products and components, structures and parts.” Account 10 of subaccount 10.3 contains the availability and movement of semi-finished products purchased from third parties. These include components, building structures, parts;

- 10.4 "Fuel". The presence and movement of various fuels, lubricants, stored or purchased for economic and production needs, operation of vehicles, heating of buildings and structures is reflected in this subaccount. Lubricants are counted by weight, and petroleum products by volume. Gasoline and diesel fuel received by drivers are accounted for in kind or using coupons;

- 10.5 “Containers and packaging materials.” Any container used in production and transportation is accounted for in this subaccount. It can be made of bags, cardboard, wood and others;

- 10.6 "Spare parts". This sub-account reflects the movement and availability of spare parts, components, assemblies, tires purchased and manufactured in-house, intended for the timely replacement of used equipment and vehicles used in the production and economy of the enterprise. Accounting is carried out by item, with the obligatory indication of quantity and cost;

- 10.7 "Food". Any feed, both self-produced and purchased, is accounted for in this subaccount. Accounting is carried out by type, grade, group, cost and quantity. In storage areas only by quantity;

- 10.8 “Seeds and planting material.” Records are kept of last year's harvest, the current harvest and those purchased from third-party companies. The costs of drying, cleaning, and sorting are included in their final cost;

- 10.9 “Materials and raw materials transferred for processing to third parties.” This subaccount takes into account the movement of materials and raw materials transferred for processing to third parties. The cost of processing is included in the cost of producing products from them;

- 10.10 “Building materials”. All types of building materials used in installation, repair and construction work are taken into account in this subaccount. Accounting is carried out by their name, quantity, storage location and cost;

- 10.11 “Inventory and household supplies with a useful life of up to one year.” All equipment used in the economic and production activities of the enterprise must be accounted for in this subaccount, except for that which can be used for more than one year. The decision on the service life is made by the management of the company, with the obligatory reflection of groups of household accessories in the accounting policies of the organization;

- 10.12 “Other materials”. Waste from production activities, such as shavings, scraps, scrap, worn tires, etc., are taken into account in this subaccount.

Fertilizers and chemicals

Explanation for accounting for workwear and equipment of balance sheet account 10 and subaccounts 10.10 and 10.11 is specified in order No. 94n

We capitalize the receipt

Before recording funds received into the account. 10, you need to recalculate everything and compare it with the quantity and name indicated in the seller’s document, usually TORG-12 or TTN, and inspect for defects.

If the inspection reveals no problems, everything is in place and in excellent condition, they are transferred for reporting to the storekeeper without registration at the warehouse. Documentary posting is executed by an invoice in the unified form M-4 or in free form with the mandatory details established by law 402-FZ. Another option is to put a “posted” stamp on the seller’s document with the name of your company, date of posting, full name. and the position of the responsible person and his signature.

If, however, the check shows that not everything is as expected, you need to draw up a report on the defects of the goods in terms of quantity or quality. In this case, the actual quantity of received materials with quality that satisfies you is subject to capitalization.