Travel accounting: basic procedures

Participation of an employee on a business trip is a process that consists of the following basic procedures:

1. Issuance of advances and daily allowances to the employee.

The exact deadline for issuing advance funds, as well as the procedure for their calculation, is not established by law. But in any case, they are issued before a business trip. If the advance is not issued, the employee has the right to refuse the trip, and this will not be a violation of work duties.

2. Checking the advance report and establishing specific items of travel expenses.

This procedure is carried out after a business trip upon submission of an advance report by the employee. Depending on the results of the audit, amounts of money are classified into certain categories (we will study how exactly later).

3. Reimbursement of overexpenditures made at the expense of the employee’s personal funds, or, conversely, deduction of the shortfall from him (if there is an overexpenditure or shortage).

Unconfirmed expenses, as well as expenses exceeding the daily allowance limit, are subject to return to the company. In turn, if an employee makes any expenses on a business trip at his own expense, the company must reimburse them.

ConsultantPlus experts tell you in detail how to prepare and submit an advance report for a business trip. Get free demo access to K+ and go to the Ready Solution to find out all the details of this procedure.

4. Payment of wages to an employee on a business trip.

During a business trip, the employee continues to be on the company’s staff and receives a salary. But it is accrued according to a special scheme (we will consider its features below).

Now let’s study in more detail the specifics of these accounting transactions, as well as what accounting entries are used to reflect these transactions in the accounting registers.

Accounting for business trips: issuing advances and daily allowances

Before leaving on a business trip, an employee receives:

1. Advance.

The traveler uses this amount to cover planned, most probable (and most often well-calculated) expenses, for example: travel, accommodation. Calculation of advance amounts to be issued is carried out on the basis of the manager’s order to send him on a business trip.

2. Daily allowance.

An employee receives a daily allowance to cover everyday, not always planned and calculated expenses. One way or another, the employee spends the daily allowance in any case at his own discretion, and he is not obliged to report on it.

The minimum and maximum daily allowance (the limit of expenses that the traveler makes at the expense of the enterprise) are established by the employer in local regulations. A daily allowance of 700 rubles per day for business trips in Russia and 2,500 rubles per day for trips abroad is not subject to personal income tax and social contributions.

Despite the fact that advance payment and daily allowance are essentially different payments from the point of view of tax accounting, in the accounting registers their issuance is recorded using the same entry:

- Dt 71 Kt 50 - if the advance and daily allowance are issued from the cash register;

- Dt 71 Kt 51 - if payments are transferred to the employee’s card.

The employee thus receives in his hands or in his bank account the amount for which he is obliged to report with documents attached. The accounting department, having studied the report and documents, will make a decision on whether to reimburse the employee for certain amounts or, conversely, to claim the shortfall from him.

Solving the problem of calculating travel expenses and mutual settlements with accountable persons

Payment of daily allowances

For each day of a business trip (including the time spent on the road), the employee is paid a daily allowance. The start day of a business trip is considered a full calendar day (up to 24 hours inclusive), during which a train, plane, bus or other transport departs from the place of permanent work of the business traveler, and the day of arrival is a calendar day (also from 0 to 24 hours inclusive), during which the vehicle arrives back. If a business trip lasts one day, per diem is not paid. The same procedure applies if the business traveler has the opportunity to return daily to his place of permanent residence.

Payment of daily allowances is also exempt from personal income tax - personal income tax within the limits of standards: 700 rubles for each day of a business trip within the country and 2,500 rubles - outside the country. If the organization has established the amount of daily allowance in excess of these amounts, then the employee must pay personal income tax on the excess.

Thus, the daily allowance for a business trip will be 5 x 700 = 3,500 rubles.

Accommodation expenses for a business trip

Expenses for renting residential premises are paid to the employee in full if supporting documents are available. The amounts of living expenses do not relate to the employee’s income, therefore personal income tax is not charged on them. Insurance contributions (to the Pension Fund, Social Insurance Fund, Compulsory Medical Insurance Fund) are not charged from these payments.

If for some reason the employee was unable to document his living expenses, then they are reimbursed to him according to the standards. In this case, the standard values are also not subject to tax.

The cost of staying in a hotel according to the conditions of the problem will be 5 x 3,540 = 17,700 rubles. Including VAT RUB 2,700.

Fare

Travel expenses to and from the business trip are reimbursed to the employee in the amount of the cost of travel by air, rail, water, and general road transport (except taxis), including insurance payments for state compulsory passenger insurance, pre-booking services, and payment for bedding.

In case of loss of travel documents, expenses are reimbursed to the employee at a minimum cost.

Transport costs according to the problem are 5,900 rubles, including VAT 900 rubles.

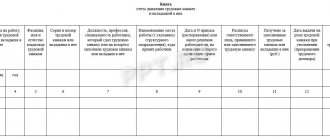

Advance report

Using an advance report, accountable persons confirm for the accounting department the spent amounts previously given to them in advance.

The advance report form is a two-sided unified form No. AO-1 and must be filled out in one copy, both by the accountable person and by the accounting employee. The advance report completed by the employee along with supporting documents (tickets, checks, documents from the hotel, etc.) is submitted to the accounting department. The accountant, after checking the correctness of the documents, fills in on the reverse side the amounts of expenses accepted for accounting, indicating the accounting accounts that are debited for the amount of expenses.

After approval of the document, the accounting department generates entries for writing off accountable funds and makes the final settlement with the accountable person. If the advance received by the employee is not fully used, then the remainder is handed over to the company's cash desk. Conversely, the overdrawn amount must be paid to the employee by the accounting department.

The final calculation of travel expenses is shown in the table below.

| Type of consumption | Expenses, rub. per day | 24 hours | Expenses, rub. |

| Daily allowance | 700 | 5 | 3 500 |

| Hotel accommodation | 3 540 | 5 | 17,700 incl. VAT 2,700 |

| Directions | 5,900 including VAT 900 | ||

| TOTAL | 27 100 |

Postings for travel expenses: return of unspent amounts and reimbursement of overexpenses

Within 3 working days after the end of the business trip, the employee sends the employer an advance report and supporting documents, against which the expenses issued to the employee as part of the advance will be verified (clause 26 of the Regulations on Business Travel, approved by Decree of the Government of Russia dated October 13, 2008 No. 749).

Based on the results of studying the report and the documents submitted with it, the accounting department will determine 3 types of monetary amounts:

1. Spent by the employee and confirmed by the advance report and supporting documents.

2. Amounts corresponding to daily allowance limits.

3. The amount initially given to the employee before the business trip.

Next, the sum of the indicators for points 1 and 2 is subtracted from the indicator for point 3.

If the result is positive, then the employee will have to return the corresponding amount to the company’s cash desk.

The following entries are recorded in the accounting registers:

- Dt 50 Kt 71 - when returning funds to the cash desk; or

- Dt 51 Kt 71 - when returning funds to the company’s bank account.

If the result is negative, the company must reimburse this amount, since the employee will be considered to have spent his money.

In this case, the transaction will be classified as travel expenses - the entries for it are the same as in the case of payment of advances and daily allowances: Dt 71 Kt 50.

Accounting for settlements with accountable persons for amounts issued for travel expenses

Travel expenses can be attributed to any of the production cost accounts (20, 23, 25, 26, 28, 29, 44, 91), as well as to the accounting accounts on which the actual cost or initial cost of the acquired property is formed. If a posted employee (accountable person) submits an advance report for an amount less than the advance was issued, the balance of the accountable amount must be deposited into the organization's cash desk or deducted from the employee's accrued wages. In this case, organizations should be guided by Art. 137 of the Labor Code of the Russian Federation, which provides for cases of deduction from an employee’s salary to repay his debt to the employer.

Read more: To whom does the Ministry of Internal Affairs report to the government or the president?

In particular, deductions from an employee’s salary to pay off his debt to the employer can be made to repay an unspent and not returned timely advance payment issued in connection with a business trip.

At the same time, as follows from Rostrud’s letter No. 3044-6-0 dated 08/09/2007, the employer has the right to decide to deduct from the employee’s salary no later than one month from the date of expiration of the period established for the return of the advance, and provided that the employee does not disputes the grounds and amounts of the withholding.

Decisions are made and formalized by the employer, as a rule, in the form of an order or instruction, although a unified form of such an order is not provided for by regulatory legal acts.

As for the employee’s consent to withhold amounts from wages, it must be received in writing.

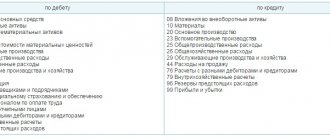

Thus, the complete scheme of accounting entries for accounting for transactions with funds issued for reporting to seconded employees is as follows:

Dt 71 “Settlements with accountable persons”

Kt 50 “Cash” - for the amount of cash transferred to the posted worker for reporting;

Dt71 “Settlements with accountable persons”

Kt51 “Current accounts” - for the amount of money issued to a posted employee directly from a current account or transferred for receipt by an accountable person at the place of business trip. In the first case, we mean a situation (not prohibited by civil and banking legislation) in which a check for cash is issued not to the cashier of the organization, but to a posted employee. A similar situation may occur, for example, if the business trip is unplanned and the required amount of cash is not available in the cash register. The second situation may arise when a business trip is extended or when additional expenses become necessary;

Dt 71 “Settlements with accountable persons”

Kt 55 “Special accounts in banks” - reflects the transfer to an accountable person of a letter of credit or a check from a checkbook for settlements with counterparties. When traveling on business, a similar situation, in our opinion, is possible only in relation to letters of credit, since settlements with checks from checkbooks are most often limited to the borders of the locality in which the branch of the bank that opened the special account is located. In addition, funds accumulated in special bank accounts (for example, to finance capital construction or finance targeted activities) can be used in the same way as funds in a current account. In other words, this posting can be made when a posted worker receives cash from a special account or when transferring accountable amounts from the relevant accounts;

Dt 07 “Equipment for installation”

Kt71 “Settlements with accountable persons” - for the amount of the cost of purchased equipment, as well as for the amount of travel expenses to be included in the actual cost of purchased equipment for installation. Of course, such posting can be formalized in organizations that are customers of construction under a construction contract, as well as organizations that carry out construction using an economic method;

Dt 10 “Materials”

Kt 71 “Settlements with accountable persons” - for the amount of travel expenses to be included in the actual cost of purchased materials, including the cost of purchased materials;

Dt 11 “Animals in cultivation and fattening”

Kt71 “Settlements with accountable persons” - for the amount of the cost of animals purchased for raising or fattening, as well as for the amount of travel expenses associated with the purchase of animals;

Dt 15 “Procurement and acquisition of valuables”

Kt 71 “Settlements with accountable persons” - for the amount of travel expenses to be included in the actual cost of purchased equipment, materials, goods, purchased products, animals for growing and fattening if the accounting policy of the organization establishes an accounting scheme, in accordance with which the actual cost of inventories is formed on account 15;

Dt 20 “Main production”

Kt 71 “Settlements with accountable persons” - for the amount of the cost of work and services of third-party organizations paid by the posted employee, as well as for the amount of travel expenses to be included in the actual cost of products (works, services) of the main production. The cost of work and services of third-party organizations can be paid by an employee of any department. As for the direct amounts of travel expenses, then, in our opinion, the most legitimate is such a write-off of costs in the event that a worker of the main production is sent to perform an official task;

Dt 23 “Auxiliary production”

Kt 71 “Settlements with accountable persons” – for the amount of expenses incurred. Such a write-off of the amounts of expenses incurred can take place in the same cases as the write-off of expenses in correspondence with account 20, with the only difference being that the expenses relate to products, works or services of auxiliary production;

Dt 25 “General production expenses”

Kt 71 “Settlements with accountable persons” - for the amount of travel expenses to be attributed to the increase in general production expenses. These may be expenses in the form of payment for the work and services of third-party organizations for the maintenance of fixed assets for workshop purposes, as well as travel expenses for workshop personnel (for example, a foreman or shop manager);

Dt 26 “General expenses”

Kt 71 “Settlements with accountable persons” - for the amount of payment for work and services of third-party organizations included in general business expenses (for example, utility bills, legal, consulting services, etc.);

Dt 28 “Defects in production”

Kt71 “Settlements with accountable persons” - for the amount of travel expenses. The formation of the cost of production defects is carried out on the same principles as the formation of the cost of products (works, services) of the main or auxiliary production. Consequently, attributing business travel expenses to the increase in the cost of manufacturing defects is legitimate. Travel expenses associated with warranty repairs or warranty service can be written off in a similar manner;

Dt 29 “Servicing industries and farms”

Kt 71 “Settlements with accountable persons” - for the amount of the cost of work and services of third-party organizations paid by the posted employee. The cost of work and services of third-party organizations can be paid by an employee of any department, including employees of the management apparatus.

Checking the expense report: expense entries

The procedure discussed above (when an accountant determines whether an employee should return something to the company or, conversely, whether the company is obliged to pay him compensation) is closely related to determining the amounts corresponding to specific types of expenses of the traveler. For these purposes, the same expense report and supporting documents are used.

Main types of travel expenses:

1. Daily allowance.

To write them off as travel expenses, the following entry is used:

- Dt 26 Kt 71.

In this case, depending on the purpose of the trip, the operation can be carried out by debiting such accounts as:

- 20 (23, 25, 28) - if the employee is sent on a business trip for operational reasons;

- 08 - if the trip is related to the acquisition of fixed assets;

- 44 - if the business trip was carried out in connection with the purchase/sale of goods.

Moreover, if the daily allowance limit approved by the employer exceeds the norms established in the Tax Code, then the excess amounts are subject to personal income tax and contributions. The fact of their accrual is reflected by the following entries:

- Dt 70 Kt 68;

- Dt (08, 20, 23, etc.) Kt 69.

2. Travel, accommodation, etc.

For relevant travel expenses, postings are applied according to the same principle as in the case of per diem expenses:

- Dt 26 Kt 71 (in general) or correspondence on the debit of accounts 08, 20, 23, etc.

If expenses are confirmed by primary documents and an invoice, then input VAT is accepted for deduction, which is recorded by the following entries:

- Dt 19 Kt 71 - incoming VAT is recorded;

- Dt 68 Kt 19 - input VAT is accepted for deduction.

Find out what is included in travel expenses with the help of explanations from ConsultantPlus experts. If you do not have access to the K+ system, get a trial online access for free.

Let's study the procedure for accounting the salary of a posted employee.

Travel expenses - postings

To account for travel expenses, account 71 is used. Debit account 71 takes into account all the money issued to the employee for reporting, and the Credit accounts for all expenses incurred by him.

The employee should not spend his own money on travel arrangements. Therefore, he is given a pre-calculated amount in advance in the form of an advance from the cash register in cash or the money is transferred to his personal plastic card account:

issued from the cash register for travel expenses - posting D71-K50;

issued non-cash for travel expenses - posting D71-K51.

If, after returning from a trip and presenting an advance report, the traveler has excess money in his hands, the unused balance is deposited into the cash desk:

unspent money for travel expenses was received at the cash desk - posting D50-K71.

Sometimes the opposite happens: an employee spends more than the amount planned and received on a business trip. In this case, the overexpenditure is issued in cash or by non-cash transfer:

money was issued for travel expenses - wiring D71-K50 or D71-K51. This operation is similar to the original posting (“a report was issued for travel expenses”), but the wording of the purpose of payment adds that it is: “overspending on the advance report.”

Salary on a business trip: postings

While on a business trip, the employee also receives a salary. True, it is calculated not as usual, but according to average earnings (clause 9 of the Regulations). In addition, weekends while a person is on a business trip are paid double or single when subsequent time off is granted, provided that the accounting documents are correctly filled out (clause 5 of the Regulations, Article 153 of the Labor Code of the Russian Federation).

Find out about the nuances of paying for a business trip on weekends here.

Payroll for a posted employee is calculated using the following entries:

- Dt (08, 20, 23, etc.) Kt 70 - calculation of wages calculated based on average earnings;

- Dt 70 Kt 68 - personal income tax withholding;

- Dt (08, 20, 23, etc.) Kt 69 - calculation of insurance premiums.

The transfer of wages to the employee is made using correspondence accounts:

- Dt 70 Kt 50 - if the employee receives his salary at the cash desk;

- Dt 70 Kt 51 - if the salary is transferred to the card.

Read more about the nuances of accounting for travel expenses in the article “Procedure for accounting for travel expenses.”

Results

Accounting for transactions that characterize sending an employee on a business trip is carried out in several stages. First, the employee is given an advance amount and daily allowance, and after his return from a business trip, the mutual financial obligations of the employee and the employer are determined - based on the report and supporting documents. Any cash movements between the cash desk (current account) of the enterprise and the employee (his bank account) are recorded in transactions, the content of which is determined by the purpose of the business trip.

You can learn more about the procedure for maintaining accounting and tax records when traveling on business trips in the following articles:

- “A business trip ticket includes meals - should an employee be paid daily allowance for days on the road?”;

- “We pay personal income tax on travel expenses in 2020”.

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Write-off of travel expenses: postings

Based on the supporting documents received from the employee and attached to his advance report, travel expenses are written off by posting:

D26,20,44-K71 - travel tickets, daily allowance, accommodation without VAT;

D19-K71 – posting is done if VAT is included in their cost.

If an employee on a business trip purchased goods for sale, materials for the company, an entry is made:

the employee incurred expenses, posting: D41.10-K60;

VAT is reflected on the basis of received invoices (or UPD): D19-K60;

travel expenses are reflected, posting: D60-K71.

When purchasing fixed assets, the postings will be as follows:

D08-K60 - OS purchased,

D19-K60 — VAT included,

D71-K60 - employee expenses are reflected.

It often happens that companies pay for travel to and from their business trip from their current account, booking air and train tickets in advance: for many this is cheaper and more convenient. In this case, the wiring is as follows:

D60.76-K51 – the ticket price has been paid including the fee,

D19-K60.76 – VAT reflected,

D20,26,44-K60,76 – the fee for issuing a ticket is reflected,

D50.3-K60.76 – the ticket was received by the company’s cash desk,

D71-K50.3 – ticket issued to a posted worker.

After submitting the advance report with attached electronic tickets and boarding passes, the following entry is made:

D 20,26,44-K71 – the cost of the ticket has been written off.