What is the daily allowance abroad in 2021?

Let’s say right away that the amounts of daily allowance issued for business trips abroad in 2021 are important for:

- calculation of income tax (tax accounting of expenses);

- calculations and payments of personal income tax (not subject to personal income tax, contributions for temporary disability and maternity, compulsory health insurance and compulsory medical insurance - 700 rubles for business trips in Russia and 2500 rubles for business trips abroad).

As a general rule, the employer sets the amount of daily allowance in 2021 independently , fixing any specific amounts in a collective agreement or local regulation (Article 168 of the Labor Code of the Russian Federation).

Please note that some companies set different daily allowances for business trips abroad, depending on which country the employee is sent to to perform a work assignment.

However, for budgetary organizations, the amount of daily allowance for business trips abroad in 2021 is set by the Government of the Russian Federation. At the same time, commercial organizations, if desired, can focus on these daily allowance amounts (see below).

In what currency should daily allowances be issued for business trips abroad?

Daily allowances, according to clause 10 of Regulation No. 749, must be paid to the employee before the start of his business trip. In addition, he must be paid a cash advance to cover travel expenses, rental housing and other expenses related to the implementation of his official tasks. The required funds can be issued in rubles or foreign currency.

The procedure for issuing funds to pay off expenses on a business trip abroad and repay the unused part of the advance is established by Federal Law No. 173-FZ “On Currency Regulation and Currency Control” dated December 10, 2003. This regulatory act contains a ban on conducting currency transactions between residents.

However, there are exceptions, the list of which is enshrined in Article 9 of this Federal Law. These include compensation for expenses associated with foreign business trips and the return of part of the funds that were not used.

Regulation No. 812 establishes daily allowance standards for foreign business trips in 2021 in US dollars. Advance payments and daily allowances in foreign currency can only be issued if the company has a foreign currency account. In the absence of such, the necessary funds are transferred in ruble equivalent.

After receiving the money, the employee independently purchases the necessary currency at an exchange office or bank branch. At the same time, he is obliged to obtain from the cashier a receipt or other document confirming the conduct of the relevant currency transactions. Subsequent calculations and compensation of expenses will be made based on the payment documents that the worker will receive upon purchase.

In this situation, currency conversion should be regarded exclusively as a transaction between individuals. This is due to the fact that when it is carried out, a specific citizen (travelling employee) purchases cash foreign currency on his own behalf, and not on behalf of the enterprise.

While performing the tasks assigned to the employee during a business trip abroad, he will spend these funds on renting housing, paying telephone expenses and other expenses made in the interests of the company. All of them must have mandatory documentary evidence.

How to calculate daily allowance

Calculation of daily allowances for business trips abroad in 2021 depends on the number of days spent by the employee outside Russia.

But there are 3 rules that must be followed (clause 17, paragraph 1 and 3 of clause 18 of the Regulations on Business Travel, approved by Decree of the Government of the Russian Federation of October 13, 2008 No. 749):

- when leaving the Russian Federation, daily allowances are paid in foreign currency for the day of crossing the state border as for days spent abroad;

- when entering Russia, per day of crossing the border is paid in rubles as for days spent on the territory of the Russian Federation;

- if an employee is sent on a business trip to the territory of 2 or more foreign states, daily allowances for the day of crossing the border between states are paid in foreign currency in the amount established for the state to which the employee is sent.

However, the company has the right to establish its own procedure for calculating daily allowances paid for 2021.

The procedure for calculating daily allowances for business trips abroad

The calculation of daily allowances for business trips abroad in 2021 is carried out in the manner prescribed in paragraphs 16 - 18, 20 of Regulation No. 749. According to these standards, compensation for travel costs is made:

- On the territory of our country - while traveling abroad, payments are made in foreign currency, and when returning back (after crossing the border) - in rubles.

- Abroad - in the manner prescribed by Regulation No. 812 or otherwise established by local regulations of the enterprise,

The date of crossing the state border is determined based on the marks of the border service, which are affixed to the employee’s international passport. If in the state where the posted employee is sent, such marks are not made, then the date of crossing the border will be determined based on travel documents.

In the case where the official assignment requires the posted worker to be in several foreign countries, the day on which the border between them was crossed is paid according to the norms of the country to which he is now sent.

It may also happen that an employee went on a business trip abroad, but returned on the same day, after completing the assigned tasks. In this case, the daily allowance will be paid in foreign currency, but in the amount of 50% of the norm.

Daily allowances for business trips in 2021 on weekends are paid according to the same rules as work at the main workplace, that is, at double the rate. In this case, it does not matter whether the employee was at his business trip or on the road, since he is wasting his personal time. In the second case, not only the daily allowance is subject to double payment, but also the fare.

If a situation arises when an employee is delayed on the way, payment of daily allowance for this time is made at the decision of the employer. The worker, for his part, must provide evidence confirming that the delay was caused by production necessity and was necessary to solve the tasks assigned to him.

Local acts of the organization may establish the procedure for calculating daily allowances for business trips abroad, an example of its implementation, the amount of daily payments and the rules for calculating the necessary amounts for business travelers. The ability of an enterprise to independently determine these points gives the right to establish its own rules, but they should not contradict the norms of current legislation.

Daily allowance for business trips abroad in 2021: table

Here are some daily allowances for business trips abroad in 2021, established by the Government of the Russian Federation for federal public sector employees (Resolution No. 812 dated December 26, 2005). If desired, they can be used as a guide for any legal entities and individual entrepreneurs.

| A country | Daily allowance in US dollars | |

| When traveling from Russia to the territory of another country | When employees travel abroad. institutions of the Russian Federation within the territory of the country where the foreign office is located. institution | |

| Abkhazia | 54 | 38 |

| Australia | 60 | 42 |

| Austria | 66 | 46 |

| Azerbaijan | 57 | 40 |

| Albania | 67 | 47 |

| Algeria | 65 | 46 |

| Angola | 80 | 56 |

| Andorra | 62 | 43 |

| Antigua and Barbuda | 69 | 48 |

| Argentina | 64 | 45 |

| Armenia | 57 | 40 |

| Afghanistan | 80 | 56 |

| Bahamas | 64 | 45 |

| Bangladesh | 67 | 47 |

| Barbados | 68 | 48 |

| Bahrain | 66 | 47 |

| Belize | 59 | 41 |

| Belarus | 57 | 40 |

| Belgium | 64 | 45 |

| Benin | 66 | 46 |

| Bermuda | 69 | 48 |

| Bulgaria | 55 | 39 |

| Bolivia | 63 | 44 |

| Bosnia and Herzegovina | 60 | 42 |

| Botswana | 64 | 45 |

| Brazil | 58 | 41 |

| Brunei | 57 | 40 |

| Burkina Faso | 72 | 50 |

| Burundi | 74 | 52 |

| Vanuatu | 68 | 48 |

| Great Britain | 69 | 48 |

| Hungary | 61 | 43 |

| Venezuela | 64 | 45 |

| Vietnam | 63 | 44 |

| Gabon | 70 | 49 |

| Haiti | 61 | 43 |

| Guyana | 67 | 47 |

| Gambia | 62 | 43 |

| Ghana | 66 | 46 |

| Guatemala | 68 | 48 |

| Guinea | 66 | 46 |

| Republic of Guinea-Bissau | 91 | 64 |

| Germany | 65 | 46 |

| Gibraltar | 69 | 48 |

| Honduras | 75 | 53 |

| Grenada | 92 | 64 |

| Greece | 58 | 41 |

| Georgia | 54 | 38 |

| Denmark | 70 | 49 |

| Djibouti | 75 | 53 |

| Commonwealth of Dominica | 69 | 48 |

| Dominican Republic | 59 | 41 |

| Egypt | 60 | 42 |

| Zambia | 68 | 48 |

| French overseas territories | 65 | 46 |

| Zimbabwe | 57 | 40 |

| Israel | 70 | 49 |

| India | 62 | 43 |

| Indonesia | 69 | 48 |

| Jordan | 62 | 43 |

| Iraq | 81 | 57 |

| Iran | 62 | 43 |

| Ireland | 65 | 46 |

| Iceland | 70 | 49 |

| Spain | 62 | 43 |

| Italy | 65 | 46 |

| Yemen | 66 | 46 |

| Cape Verde | 64 | 45 |

| Kazakhstan | 55 | 39 |

| Cayman islands | 69 | 48 |

| Cambodia | 68 | 48 |

| Cameroon | 69 | 48 |

| Canada | 62 | 43 |

| Qatar | 58 | 41 |

| Kenya | 66 | 46 |

| Cyprus | 59 | 41 |

| Kyrgyzstan | 56 | 39 |

| Republic of Kiribati | 75 | 52 |

| China | 67 | 47 |

| China (Hong Kong) | 67 | 47 |

| China (Taiwan) | 67 | 47 |

| Colombia | 65 | 46 |

| Comoros | 86 | 60 |

| Congo | 85 | 60 |

| Democratic Republic of the Congo | 76 | 53 |

| Democratic People's Republic of Korea | 65 | 46 |

| The Republic of Korea | 66 | 46 |

| Costa Rica | 63 | 44 |

| Ivory Coast | 74 | 52 |

| Cuba | 65 | 46 |

| Kuwait | 59 | 41 |

| Laos | 64 | 45 |

| Latvia | 55 | 39 |

| Lesotho | 61 | 43 |

| Liberia | 78 | 55 |

| Lebanon | 73 | 51 |

| Libya | 70 | 49 |

| Lithuania | 57 | 40 |

| Liechtenstein | 71 | 50 |

| Luxembourg | 61 | 43 |

| Mauritius | 63 | 44 |

| Mauritania | 67 | 47 |

| Madagascar | 64 | 45 |

| Macau | 67 | 47 |

| Macedonia | 60 | 42 |

| Malawi | 66 | 46 |

| Malaysia | 60 | 42 |

| Mali | 70 | 49 |

| Maldives | 67 | 47 |

| Malta | 61 | 43 |

| Morocco | 58 | 41 |

| Mexico | 64 | 45 |

| Mozambique | 68 | 48 |

| Moldova | 53 | 37 |

| Monaco | 65 | 46 |

| Mongolia | 59 | 41 |

| Myanmar | 65 | 46 |

| Namibia | 61 | 43 |

| Nauru | 60 | 42 |

| Nepal | 65 | 46 |

| Niger | 78 | 55 |

| Nigeria | 72 | 50 |

| Netherlands | 65 | 46 |

| Nicaragua | 68 | 48 |

| New Zealand | 65 | 46 |

| New Caledonia | 60 | 42 |

| Norway | 79 | 55 |

| United Arab Emirates | 60 | 42 |

| Oman | 62 | 43 |

| Pakistan | 69 | 48 |

| Palau island | 63 | 44 |

| Palestine | 70 | 49 |

| Panama | 64 | 45 |

| Papua New Guinea | 68 | 48 |

| Paraguay | 57 | 40 |

| Peru | 63 | 44 |

| Poland | 56 | 39 |

| Portugal | 61 | 43 |

| Puerto Rico | 72 | 50 |

| Rwanda | 72 | 50 |

| Romania | 56 | 39 |

| Salvador | 68 | 48 |

| Samoa | 64 | 45 |

| San Marino | 65 | 46 |

| Sao Tome and Principe | 74 | 52 |

| Saudi Arabia | 64 | 45 |

| Swaziland | 65 | 46 |

| Seychelles | 71 | 50 |

| Senegal | 70 | 49 |

| Saint Lucia | 69 | 48 |

| Serbia and Montenegro | 60 | 42 |

| Singapore | 61 | 43 |

| Syria | 62 | 43 |

| Slovakia | 59 | 41 |

| Slovenia | 57 | 40 |

| Solomon islands | 56 | 39 |

| Somalia | 70 | 49 |

| Sudan | 78 | 55 |

| Suriname | 69 | 48 |

| USA | 72 | 50 |

| Sierra Leone | 69 | 48 |

| Tajikistan | 60 | 42 |

| Thailand | 58 | 41 |

| Tanzania | 66 | 46 |

| Togo | 65 | 46 |

| Tonga | 54 | 38 |

| Trinidad and Tobago | 68 | 48 |

| Tunisia | 60 | 42 |

| Turkmenistan | 65 | 46 |

| Türkiye | 64 | 45 |

| Uganda | 65 | 46 |

| Uzbekistan | 59 | 41 |

| Ukraine | 53 | 37 |

| Uruguay | 60 | 42 |

| Fiji | 61 | 43 |

| Philippines | 63 | 44 |

| Finland | 62 | 43 |

| France | 65 | 46 |

| Croatia | 63 | 44 |

| Central African Republic | 90 | 63 |

| Chad | 95 | 67 |

| Czech | 60 | 42 |

| Chile | 63 | 44 |

| Switzerland | 71 | 50 |

| Sweden | 65 | 46 |

| Sri Lanka | 62 | 43 |

| Ecuador | 67 | 47 |

| Equatorial Guinea | 79 | 55 |

| Eritrea | 68 | 48 |

| Estonia | 55 | 39 |

| Ethiopia | 70 | 49 |

| South Ossetia | 54 | 38 |

| South Africa | 58 | 41 |

| Jamaica | 69 | 48 |

| Japan | 83 | 58 |

Read also

20.05.2020

Calculation of insurance premiums from daily allowances for business trips abroad

According to Article 168 of the Labor Code of the Russian Federation and Clause 11 of Regulation No. 749, daily allowances are paid to an employee sent on a business trip lasting two or more days. At the same time, in accordance with Part 2 of Article 9 of Law No. 212-FZ of July 24, 2009. daily allowances refer to payments from which insurance contributions are not paid to extra-budgetary funds.

In this case there is also a certain limitation. Their amount should not exceed the norm established for seconded employees in the local regulations of this enterprise. If there is a need to accrue more daily allowances, then the employer just needs to indicate the required amount in the order for the business trip.

Features of trips to the CIS countries

When traveling to countries that are part of the CIS, a stamp is not placed in the passport. Therefore, the date of border crossing in this case is determined by travel tickets, based on the date and time of arrival in the destination country.

Thus, the day on which the vehicle (train, bus, plane, etc.) arrived at its destination in a foreign country is considered the day of entry.

Attention! Daily allowances for a business trip in the CIS are paid according to the norm for a foreign trip. The days on which the vehicle arrived at its destination in Russia are considered the days of return, and daily allowances for them are paid according to the norms for trips within the country.

Daily allowance for a one-day business trip

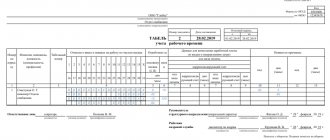

Russian legislation does not establish a minimum period of business travel. In particular, completing an assignment from your employer can be a one-day task. At the enterprise, such a business trip is formalized as a multi-day trip. You need to issue an order, and put o or “K” on the time sheet.

After returning from a trip, the employee must account for the amount used.

The employer reimburses money spent on travel and food. What about daily allowances? Despite the fact that, according to the law, one-day trips within the territory of the Russian Federation are not paid, many companies practice paying appropriate compensation to their employees. And this is definitely correct, because leaving your employee without money on a trip is far from a good idea. For example, compensation for trips abroad can be half the amount of daily allowance specified in the company’s local documents.

Changes in business trips from 01/01/2017 New daily allowance standards

The daily allowance rates for insurance premiums will change from 01/01/2017.

(Federal Law No. 243 dated July 3, 2017). This change occurs due to the fact that daily allowances are subject to insurance contributions . 08/30/2016

700 rubles in the Russian Federation and 2500 rubles abroad - this is the amount of daily allowance in 2021 that is not subject to contributions. If the daily allowance significantly exceeds these amounts, then they are subject to insurance contributions.

Let’s assume that an organization pays for a day of business trip to the Russian Federation at the rate of 900 rubles/day. The duration of the business trip was 5 days. Contributions from daily allowance are calculated in 2021. as follows: 5 days of business travel are multiplied by 900 rubles per day. The daily allowance is 4,500 rubles.

Next, the non-taxable amount of money is calculated from the total amount: 700 rubles multiplied by 5 days. It turns out 3500 rubles.

From the total daily allowance of 4,500 rubles, a non-taxable amount of 3,500 rubles is deducted. The difference of 1000 rubles is subject to insurance premiums.

To find out the amount of daily allowance contributions, you need to multiply 1000 rubles by the contribution rate in 2021. For example, the rate will be 20%, which means the amount of contributions is 200 rubles. In 2021 There were no restrictions on per diem, and any amounts were not subject to insurance premiums.

The amount of daily allowance in Russia, established in 2017.

An organization/firm has the right to set any amount of payments per day when traveling on a business trip in the Russian Federation or abroad; this amount is not limited by law. That is, the standardization of daily allowances for business trips, as well as similar trips for employees in 2021. does not apply (Article No. 346.16, paragraph 1, subparagraph 13 of the Tax Code of the Russian Federation).

This suggests that the organization itself has the right to choose the amount of travel allowances per day, both when traveling in Russia and abroad. The entire amount due for a business trip is taken into account in expenses under the simplified tax system. The amount of daily allowance must be specified in the local regulations of the organization. It is worth remembering that, despite the fact that the amount of travel allowance paid per day for the purpose of calculating the Unified National Tax under the simplified tax system is not standardized, paragraph 3 of Article No. 217 of the Tax Code of the Russian Federation establishes daily allowance standards that are used for the purpose of calculating personal income tax (for trips within the Russian Federation - 700 rubles /day, for foreign business trips - 2500 rubles /day).

If the daily allowance is paid by the organization in excess of that indicated above, then the excess amount is subject to personal income tax. Daily allowance for business trips in 2021 abroad - 2500 rubles/day are not subject to personal income tax, amounts in excess are subject to tax. As for insurance premiums, as we said above, in 2021. The contribution limit is the same as for personal income tax - 700 rubles (business trip within the Russian Federation) and 2,500 rubles (foreign business trip).

Daily allowance for business trips in 2021 by region

In 2021 Across the Russian Federation and regions, the amount of travel allowances per day does not differ. At the same time, travel expenses for daily allowance in 2021. are not standardized, based on the rules of the Tax Code. However, there are certain rules for collecting insurance premiums, as well as personal income tax on daily allowances.

Accounting for daily allowances in 2021

Under the simplified tax system in 2021 expenses for payments per day on a business trip are fully taken into account in the amount in which they are indicated in the local act. Therefore, if the organization indicated in the acts the amount of daily allowance, for example, 3,000 rubles, then it can be paid to the employee and fully taken into account in expenses under the simplified tax system (if the object is “income minus expenses”).

Calculation of travel allowances in 2021

Calculation of travel allowances in 2021 is very simple: the established amount of travel allowance per day must be multiplied by the number of days of the business trip.

After this, it is necessary to deduct personal income tax according to the limits from the amount received. The employee receives in his hands or the resulting amount of travel allowance is transferred to his card.

Daily accounting entries in 2021:

- As of the date of issue to the employee, a statement of funds: D 71 K 50-1 - Cash was issued to the employee for expenses due to being sent on a business trip (in terms of daily allowances).

- As of the date of approval of the advance report: D 20 (44, 91-2, 08 and others) K 71 - Thus, business trip expenses were reflected (in terms of daily allowance).

- If the daily allowance is issued in a larger amount than the established norm, non-taxable with personal income tax: D 70 K 68 - Personal income tax is withheld directly from the amount of daily allowance paid to the employee.

Post:

Comments

Catherine

April 13, 2021 at 3:21 pm

The daily allowance rates for insurance premiums will change from 01/01/2017. (Federal Law No. 243 dated July 3, 2017).

Typo in the link to document Federal Law No. 243 dated 07/03/17, you need Federal Law No. 243 dated 07/03/16

Tatiana

October 6, 2021 at 9:53 pm

What are you writing about here!!! What an unrealistic daily allowance. State employees are paid 100 per day! This means that with these pennies you have to somehow eat a piece of black bread and water. This is how they fed only in CONCENTRATION CAMPS. This means our state is a concentration camp, because they are treated like cattle!

Calculation of daily allowances

There is no specific limit on the payment of daily allowances in Russia; the company independently determines the required amount of payments to employees.

Today, in most cases, payment per day is within 700 rubles. This phenomenon is due to the fact that the company in this case does not pay personal income tax.

For example, if an employee stayed on a business trip for 3 days, the daily allowance was paid 1000 rubles per day, respectively 3x1000 = 3000 rubles, while personal income tax is paid on 900 rubles.

Starting from 2021, an insurance premium is also required to be paid as part of the daily allowance.

Please note: the insurance premium has become mandatory in 2021. This has long been practiced in European countries and provides maximum protection in health emergencies.

How are travel payments made?

The manager, before sending a staff member on a business trip, undertakes to give cash or credit a certain amount of advance funds to the salary card.

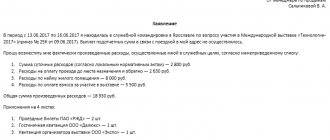

The amount to be credited includes the following calculations:

- transportation costs;

- Renting housing;

- Additional expenses related to accommodation;

- Other unforeseen expenses carried out with the permission or notification of the manager.

Travel expenses abroad are subject to reimbursement for the 2021 annual period. If the amount spent exceeded the advance amount, reimbursement for the listed items is made upon return to the main place of work. After the expiration of the business trip, 3 working days are given to provide a reporting document on financial expenses with a travel sheet, where tickets and checks are pasted, to the accounting department. https://casino-bonusik.site Even a beginner can receive a no deposit bonus at the casino for registration. The project administration tried to simplify all procedures as much as possible in order to take advantage of the functions of the top casino internet casino poker online play casino Sochi poker online play for free licensed casinos top 10 casino casino Sochi RF casino Sochi https://casino-bonusik.site To qualify for no deposit, the user must register an account. Only customers with an account are allowed to use promotions and enter promotional codes if required. However, the maximum daily amount of travel expenses for 2021 is not regulated by law. If any employee does not have confirmation of any of the sections of payments, the calculation is made according to the following generally accepted tariffs:

- Daily allowance is 12 rubles per day;

- Housing for state employees – 550 rubles/day.

If you take into account the days on which the business trip falls, then you need to include in the total number and also pay for those days when the employee is seconded, but a specific date falls on a day off or holiday. As long as the business trip lasts, the average salary must be calculated. Even if an employee is on sick leave, and also spends time on the road, with forced stops (for example, due to a temporary cessation of crossings or flights in stormy weather), then he is entitled to receive travel allowances. Anyone who cannot document any part of the expenses can only count on the minimum amount of travel expenses in Russia in 2017. By the standards of this year, in addition to the previously listed daily allowances and accommodation for state employees, it is worth noting the minimum rate for transportation costs. There is an individual payment system depending on the type of transport.

Payment of travel expenses to public sector employees

Today, there are two options for paying expenses to public sector employees:

- Paid before departure of the trip. In this case, the preliminary amount that is given to the employee is determined. Thus, the employee is already provided with funds. This is exactly how everything should be done according to the law. The main problem is that you need to report on the first day, sometimes this is not very convenient.

- Payment is made based on the documents provided regarding the costs incurred. An employee goes on a business trip with his own money. If this is a long business trip, then this option is not entirely suitable for the employee, since you need to have a good budget with you.

Travel expenses are the costs of an employee while on a business trip on behalf of the employer far from his place of residence. In turn, there are several types of travel expenses.

At the end of the business trip, it is important to provide supporting documents on the basis of which the payment of daily allowance and other expenses incurred is made. Daily allowance payment rates are regulated within the company based on existing regulations.

Watch the video in which a specialist explains how to calculate travel allowances: