Why do you need a report on the DSV-3 form?

Each insured citizen has the right to independently increase the amount of his pension contributions by making additional contributions. The correct interpretation of DSV is additional insurance contributions for the funded part of the pension; they are paid by the employer. The basis for these payments are (Articles 7, 8 56-FZ of April 30, 2008):

- employee's own funds;

- funds of the policyholder, but only in the case when the possibility of such deductions is indicated in the collective agreement and employment contracts and the insured employee simultaneously transfers an additional contribution at his own expense.

To reflect the amount of additional insurance payments paid, Pension Fund specialists have developed a unified form and instructions for filling it out. In simple words, what is DSV-3 and where to submit it: this is a report on the listed additional contributions, and it is submitted to the Pension Fund.

To correctly calculate and pay additional insurance premiums for your pension, use free instructions from ConsultantPlus experts.

to read.

Filling rules

We figured out what DSV-3 is and where to submit the report, we’ll explain how to fill it out. The form is a small introductory part for indicating information about the employer and a table where you write down:

- the amount of funds that should go to the funded part;

- numbers of payment orders for payment of funds;

- SNILS and full name the insured person.

All data is taken from documents. If necessary, it is permitted to submit corrected information.

An important rule: with regard to contributions to funded pensions at the request of employees and with regard to amounts paid by the employer, separate DSV-3 registers are submitted.

IMPORTANT!

One register contains information for only 1 month. But since the reporting is quarterly, 3 registers are submitted simultaneously if the employer paid for all 3 months. If contributions have only been paid for 2 months, 2 forms are submitted.

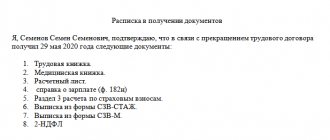

Now let’s figure out what an extract from DSV-3 is and how to prepare it. The document is generated simply: the tabular part includes only data per employee. Since the legislation does not specify for what period such a document should be issued, experts recommend providing information for the entire payment period. But we must warn you: each form is filled out only for one payment, and if, for example, employee Ivanov worked for 5 years, and additional contributions were paid for him for all 5 years, this is 60 sheets. It makes more sense to agree to provide an extract for the quarter in which the employee quits, and explain that information about earlier payments can easily be obtained online in the Pension Fund’s personal account ().

Sample extract from DSV-3 upon dismissal

Report submission deadlines

This is a quarterly reporting form for additional insurance premiums. It is submitted to the territorial branch of the Pension Fund of Russia by the 20th day of the month following the reporting quarter.

IMPORTANT!

Report for the 4th quarter of 2021 by 01/20/2021.

All deadlines for submitting DSV-3 reports in 2021 and based on the results of the reporting period:

- 01/20/2021 - for October, November and December 2021;

- 04/20/2021 - for January, February and March 2021;

- 07/20/2021 - for April, May and June 2021;

- 10/20/2021 - for July, August and September 2021;

- 01/20/2022 - for October, November and December 2021

The deadline for paying additional insurance payments is until the 15th day of the month following the reporting month, that is, the same as for paying the main insurance payments.

Is it required to submit zero certificates?

The legislation does not contain the concept of a “zero” form of DSV-3, so if an employer does not have employees who make a voluntary decision to increase their future pension, then he does not submit such a report to the Pension Fund.

Reporting begins on the first day of the month following the date when the employee submits an application to transfer funds to a fund.

As soon as a citizen resigns or completely refuses voluntary contributions, submitting a corresponding application to the head of the enterprise, then from the next month not only the transfer of funds, but also the submission of reports stops. However, there is no need to warn Pension Fund specialists about such changes.

Important! If an individual entrepreneur does not have employees, then he does not need to submit any reports to PF representatives for hired employees.

Who submits the DSV-3 report and where?

56-FZ specifies who submits the DSV-3 form: a report on additional insurance contributions is required to be submitted by every employer paying additional contributions. Moreover, regardless of the funds used to make the transfer.

The policyholder has the opportunity to report to the MFC (Part 6, Article 9 56-FZ). A reporting form is generated for each payment order document. The report is submitted in the context of data on contributions paid by employers at their own expense and through payments from employees (two separate forms are filled out). When an employee resigns, the policyholder gives him a copy of a certificate of additional insurance premiums paid.

The standards indicate how to submit DSV-3 if there are 25 people - in electronic form after signing with an enhanced qualified electronic signature.

If the employer provides a report on paper, then he is obliged to prepare the submitted package of documents properly: all pages are bound, numbered and secured on a piece of paper with the signature of the manager (chief accountant) and the seal of the organization (if it is used in the institution).

DSV-3: procedure and features of filling out the new form

Many accountants are interested in how to correctly fill out DSV-3 for specific employees. There are the following filling rules:

- The “header” must contain all the necessary details of the employer: company name, INN, KPP, bank details, company registration number in the Pension Fund of the Russian Federation.

- The tabular part should include the following data: full names of employees, SNILS, information about the amounts of contributions that have already been transferred, including mandatory and additional payments.

The procedure for filling out the DSV-3 form is quite simple. To do this, you can use a special sample and software from PFR PU-5. The program can be downloaded from the official website of the Pension Fund of the Russian Federation or obtained upon a personal visit to the territorial office:

To submit data to the Pension Fund of Russia branch, it is necessary to prepare an XML file on electronic media in advance and draw up a register in 2 samples, which already has the company’s seal and the signature of the manager. Additionally, copies of payment documents must be provided:

If the prepared register has more than one sheet, then the documents will need to be stitched and numbered. After this, seal the ends of the thread that was used with a sheet of paper, and put a stamp on top. A signature indicating the number of laced and numbered sheets is required.

The form must be filled out without errors or inaccuracies, otherwise it will result in serious fines. It is extremely important, in addition to the data described above, to include in the report information about mandatory payments - 4 columns, and additional contributions - 5 columns.

The register must be filled out and submitted to the PFR office only by those policyholders who are responsible for transferring additional contributions and transfer funds according to the following BCC:

| Type of contribution | KBK |

| Additional employee contributions | 392 1 0200 160 |

| Employer contributions | 392 1 0200 160 |

Who transfers contributions and submits DSV-3?

Employers must pay health insurance premiums for their employees. In addition, they have the right to transfer additional contributions in favor of these persons to form a funded pension.

For such transfers, companies and individual entrepreneurs report in the DSV-3 form, which was approved by Government Decree No. 482p dated 06/09/2016. The document form has the title “Register of insured persons on whom additional contributions to the funded pension are listed and employer contributions are paid.”

The source of contributions to the funded pension is the employee’s own funds, which can be sent to the Pension Fund by both himself and the employer upon the employee’s application (application form DSV-1). In addition, the employer has the right to send additional insurance contributions at his own expense.

Thus, the DSV-3 report should be submitted by those employers who:

- pay additional insurance premiums exclusively at the expense of their employees;

- pay funds both at the expense of employees and at their own expense.

It should be noted that the DSV-3 register is formed for each payment order for the transfer of additional insurance premiums. In this case, registers are filled out separately for payments from employee funds and for payments from employer funds.

Is it mandatory to issue certificates to employees upon dismissal?

DSV-3 contains information about all insured persons in the company, and also provides the amount of the transferred contributions. Since the funds are transferred by the head of the organization, he has to report not only to the Pension Fund, but also to the direct insured persons.

Upon dismissal, the director is obliged to hand over to the employee a large package of documents, which includes an extract from DSV-3. It is issued exclusively to specialists for whom the employer paid insurance contributions for a funded pension. The basic rules for transferring this document are given in the provisions of Federal Law No. 56.

The statement contains information about all transferred funds for the entire period of work in the company. The head of the company must issue this documentation to the employee on the last day of employment. For this purpose, you cannot require any statement from a specialist. If an employer does not provide a citizen with the required documents, he may be subject to disciplinary or administrative liability.

What documents need to be attached to the report on the use of contributions for injuries?

| N p/p | Name of preventive measures | Documents attached to the report on the use of contributions for injuries |

| Conducting a special assessment of working conditions | Check; payment order with bank mark; certificate of completion; title page of the report on the special assessment of working conditions (SOUT); summary statement of the results of the special assessment; list of recommended measures to improve working conditions | |

| Implementation of measures to bring the levels of exposure to harmful and (or) hazardous production factors in the workplace in accordance with state regulatory requirements for labor protection | Check; invoice; packing list; payment order with bank mark; certificate of completion; protocol of the results of repeated measurements of dust and air pollution at workplaces carried out by accredited laboratories; special assessment card for working conditions | |

| Occupational safety training | Check; payment order with bank mark; certificate of completion; a list of certain categories of workers who have undergone occupational safety training; copies of training certificates | |

| Purchase of special clothing, special shoes and other personal protective equipment, flushing and (or) neutralizing agents for employees | Check; payment order with bank mark; invoice; packing list; certificates (declarations) of conformity; certificate for purchased personal protective equipment | |

| Sanatorium-resort treatment for employees | Check; payment order with bank mark; invoice for travel vouchers; tear-off coupon for a sanatorium-resort voucher; a list of employees who underwent treatment in sanatorium-resort institutions; a copy of the final report on periodic medical examinations; a copy of the license of the organization providing health resort treatment for employees | |

| Conducting mandatory periodic medical examinations (examinations) of employees | Register of insured persons who have undergone mandatory periodic examinations; check; payment order with bank mark; the act of providing services; a copy of the final report on the periodic medical examination | |

| Providing workers with therapeutic and preventive nutrition | ||

| Purchase of devices for determining the presence and level of alcohol content (breathalyzers) | Check; payment order with bank mark; invoice; packing list; certificate (declaration) of conformity | |

| Purchase of devices for monitoring the work and rest schedule of drivers (tachographs) | Check; payment order with bank mark; invoice; packing list; certificate (declaration) of conformity | |

| Purchasing first aid kits | Check; payment order with bank mark; invoice; packing list; certificate (declaration) of conformity |

All copies of documents confirming expenses must be certified (each sheet) with the company’s seal in the prescribed manner.

Let's look at how to fill out a report on the use of contributions in case of injury using the example of financing the costs of mandatory periodic medical examinations.

Reporting to the Pension Fund in 2021

Legal entities and individual entrepreneurs, in accordance with the law, must send reports on hired employees to the Pension Fund. From 2021, certain changes have been made to this procedure. Additional reporting forms were introduced for the transition to electronic work books.

Changes in the procedure for submitting reports to the Pension Fund in 2021

In the second quarter of 2021, a new form SZV-M was introduced into reporting for the Pension Fund. Its completion has become mandatory in 2021. This document must be submitted to the Pension Fund every month before the 15th.

The new report aims to make it easier to report on hires. Individual entrepreneurs who do not employ hired workers are exempt from filing it.

Also, starting from 2021, employers will need to submit reports on information about their work activities. This paper takes into account job responsibilities, transfers to new places, and dismissals. The need for this form is due to the transition to electronic work books.

What reports must be submitted to the Pension Fund?

In 2021, legal entities and individual entrepreneurs must send the following reports to the Pension Fund:

- SZV-M - information about the insured persons is filled in;

- SZV-STAGE - information about the length of service of employees is taken into account;

- Information about work activity - data from the work book is displayed;

- DSV-3 - information on additional insurance premiums.

In the process of filling out and submitting documents, it is necessary to take into account the order of registration and deadlines. Often, it is filling errors that cause fines.

SZV-STAZH

SZV-STAZH was introduced in 2021 and replaced the RSV-1 form. The document contains information about the period of work of each employee. Filled out once a year by organizations, individual entrepreneurs, as well as private detectives, lawyers and notaries.

Reporting is submitted regardless of whether the enterprise was operating or not. All employed employees must have information indicating their length of service. In case of reorganization or liquidation of an enterprise, the report is submitted ahead of schedule.

Deadlines for submitting reports to the Pension Fund

In 2021, the following deadlines have been established for submitting reports to the Pension Fund:

- the deadline for submitting the SZV-M report is until the 15th day following the reporting period of the month, if the date falls on a weekend, the deadline for submission is the first working day after the weekend;

- information about work activity is also submitted before the 15th according to the same principles as SZV-M;

- DSV-3 is submitted once a quarter, four times a year, before the 20th day of the month following the reporting period;

- SZV-STAZH is issued before March 1 following the reporting period of the year.

The last document is issued once a year. Such reporting to the Pension Fund for 2021 must be submitted before March 1, 2021. Accordingly, for 2019 the report must be submitted before March 1, 2021.

Fine for violating reporting deadlines

The fine for violating reporting deadlines is 500 rubles for each employee. Accordingly, if the company has 12 employees for whom reports were not submitted on time, the payment amount will be 6 thousand rubles.

Notification of the fine is sent to the employer by the Pension Fund. 10 days are given to pay the collection, but in some cases a different period is indicated. If payment is not made, the required amount is written off by collection from the account of the company or individual entrepreneur.

A fine of 500 rubles is also provided for providing incorrect information. The specified amount is paid for each inaccuracy or error. Filling out reports incorrectly can result in significant financial costs.

Deadlines for submitting the DSV-3 register and possible liability for violations

The registers are sent to the Pension Fund once a quarter no later than 20 days after its end (Clause 6, Article 9 of Law No. 56-FZ). The deadlines for submitting the report in 2021 are reflected in the table:

| Reporting period | Submission deadline, no later than |

| IV quarter 2021 | |

| I quarter | |

| II quarter | |

| III quarter | |

| IV quarter |

Note! Law No. 56-FZ does not define the rules for rescheduling if the 20th day after the end of the quarter falls on a weekend or holiday. According to the Pension Fund of Russia, for personalized reporting it is possible to apply an analogy with the no longer valid Law “On Insurance Premiums...” dated July 24, 2009 No. 212-FZ, according to which the deadline for submitting reports is moved to the next working day after the day off (letter of the Pension Fund of the Russian Federation dated April 7, 2016 No. 09 -19/4844). However, until there are clarifications regarding the DSV-3 form specifically, it will be safer to submit it exactly before the 20th (without postponements).

Subscribe to the newsletter More complete information on the topic can be found in ConsultantPlus. Full and free access to the system for 2 days.

Regardless of when PFR employees received the register, the date of the policyholder’s application will be considered:

- when applying directly to the Pension Fund in person - the date of receipt of the register by an authorized employee;

- sending the register through the MFC - the date of submission of the document to the MFC;

- in case of sending by mail - the date indicated on the stamp of the post office at the place of departure;

- when using the Internet, including the Government Services Portal, the date the register was sent.

You can find a sample of filling out DSV-3 in our other article.

The register can be submitted in the form of an electronic document certified by a qualified electronic signature, or in paper form. At the same time, those policyholders whose average number of employees in the previous calendar year (or in the current year for newly created companies) exceeded 25 people are required to submit the register only in the form of an electronic document. Other employers can choose the paper version.

For failure to comply with the deadlines for submitting the DSV-3 report or for providing incomplete or unreliable information, a fine of 500 rubles may be imposed on the employer. for each insured person. For failure to comply with the procedure for submitting the register electronically, a penalty of 1,000 rubles is provided. (Article 17 of Law No. 27-FZ).

***

The deadlines for submitting the DSV-3 register of insured persons to the territorial body of the Pension Fund of Russia in 2019-2020 do not change. Violation of the reporting procedure may result in fines.

***

Even more information on the topic can be found in the “Insurance Premiums” section.

Some employers are required to submit a report in form DSV-3 to the Pension Fund of Russia. It reflects information on individuals in whose favor the organization transferred additional insurance premiums.

What are additional insurance premiums?

Additional insurance contributions (ADI) are funds accrued to the funded part of the pension fund. According to paragraphs 3 and 5 of Article 2 of the Federal Law “On Additional Insurance Contributions” dated April 30, 2008 N 56-FZ, additional contributions may be paid:

- by the insured person at his own expense or by his employer at the request of the employee. In the latter case, the funds are calculated from the employee’s salary;

- by the employer for the benefit of the employee.

If additional contributions are paid directly by the employee, then he must apply to the territorial branch of the Pension Fund for voluntary payment of additional contributions to the funded pension fund. The corresponding application is submitted in form DBS-1; it can be sent through the official website of the Pension Fund of Russia, through the MFC, as well as through your employer. In this case, the application must indicate how much the employee will transfer to the Pension Fund each month. If the employer has received a corresponding application from the employee, then he is obliged to send it to the Pension Fund no later than 3 days later.

The procedure for payment of DSA by the employer in favor of the employee is regulated by Part 1 of Article 8 of the above-mentioned normative act. Employees of certain categories engaged in hazardous or heavy work have the right to such contributions.

Terms for calculating additional insurance premiums

According to Part 1 of Article 9 of Federal Law No. 56-FZ, additional contributions, regardless of who pays them, are transferred to the Pension Fund within the same time frame as contributions to pension insurance, i.e. for each month until the 15th of the following month. Contributions from employees and employers are transferred to different BCCs (budget classification code)

Each time DSV is accrued to the Pension Fund of the Russian Federation, the employer is obliged to create a register of insured persons to whose account the contributions were transferred. The registration of the register is carried out every month according to DSV-3 (the new form came into force on September 10, 2016).

The register must indicate:

- information about the policyholder - registration number in the Pension Fund of Russia, checkpoint, tax identification number, name of the organization;

- date, number of the payment order on the basis of which contributions are transferred, execution date;

- contribution period;

- information about the employee - full name, SNILS;

- the amount of accrued additional contributions.

The deadline for submitting DSV-3 is set no later than the 20th day of the month following the quarter in which the DSV was translated. For example, if an employer paid contributions for March, April and May 2021, then he must send three DSV-3 registers to the territorial department of the Pension Fund no later than June 20, 2021.

It is worth considering that for those employees who work in conditions of high danger and harmfulness, when determining the right to early retirement, periods of work taken into account to determine preferential length of service are counted only if during this period additional insurance contributions were transferred in their favor.

Insured persons whose work activities are carried out in dangerous and harmful working conditions are entitled to additional insurance premiums. The rate of such contributions is determined after a commission checks working conditions at least once every 5 years and varies from 2% to 8%. If the employer does not carry out such checks, he is obliged to pay 9% of the DSA to the Pension Fund for employees from List No. 1 and 6% for employees from List No. 2.

We recommend reading: Funded pension in the Russian Federation in 2021 5/5 (1 votes)

How to fill out DSV-3 in the 1C program?

When filling out the DSV-3 register, you must provide the following information:

- employer details - Pension Fund registration number, INN, KPP, short name;

- number and date of the payment order;

- date of execution of the payment order;

- period for paying additional insurance premiums;

- list of insured individuals - full name, SNILS, amount of funds transferred at the expense of the employee, amount of funds transferred at the expense of the employer;

- the total amount of funds transferred;

- signatures of the chief accountant and manager;

- date of formation of the register.

To generate the DSV-3 report in the 1C:ZUP program, you should use the document of the same name. You need to go to the section containing reporting forms and certificates and select a subsection for processing voluntary pension insurance transactions. After clicking on the “Create” button, a form will appear in which you need to fill in the following fields:

- name of the organization (if there are several of them, select the one for which the report is generated);

- date of compilation of the register (by default, the settings are set to the current date);

- month in which the deduction and transfer of additional insurance premiums was made;

- The program assigns the pack number automatically (it can be adjusted if necessary);

- number and date of the payment order by which additional contributions were transferred;

- date of execution of the payment order;

- It is recommended to fill out the tabular part for employees by manual selection. If you use automatic filling, an error may occur, because the register will only contain information for those employees whose applications are entered into 1C and reflected in the employee card. The register can also be filled out using a document on the calculation of salaries and contributions, on the basis of which voluntary contributions are directly deducted from the salary of the insured person;

- SNILS for each employee (if necessary, double-check their correctness so that the transferred contributions are correctly posted to the personal accounts of the insured persons);

- the amount of additional contributions transferred, deducted from the employee’s salary (data is generated on the basis of registers on deductions from employees’ salaries). If the company transfers additional contributions from its own funds, the information must be entered manually.

After checking the report, you can print it, sign it and submit it to the Pension Fund on paper. In addition, it can be downloaded in electronic format or sent directly to the Pension Fund of Russia via 1C: Reporting without prior downloading.

After the report is accepted by the Pension Fund, you need to check the box next to the corresponding document, which will exclude the possibility of making any edits or adjustments to it. If this needs to be done, then simply uncheck the box next to the document - the editing function will be available to the user again.