Certificate of number of employees

To summarize, it should be noted that:

- The average number of employees is submitted to the tax authorities using a form with KND code 11100018.

- data on the payroll number is provided to the Social Insurance Fund and the Pension Fund of Russia;

- Information on the average number is provided to statistical authorities.

A form for a certificate of the number of employees can be found here: A form for a certificate of the average number of employees Average payroll for the period The calculation is made on the basis of information about the payroll number taken into account daily, using the arithmetic average formula taking into account the required period - month, quarter or year. First, the monthly indicator is calculated, from which the quarterly and annual indicators are calculated.

When making calculations, you should be guided by FSGS Resolution No. 56 of 10/09/2006, which regulates the rules for assigning categories of workers.

External part-time workers are not taken into account; persons taken under the GPA; transferred to other companies without retaining their earnings; military servants during the performance of official duties, etc.

The number of personnel obtained as a result of calculations is indicated with rounding, that is, in full units of number.

In this case, the accountant may need time sheets for recording work hours, orders for personnel movements, personal personnel cards, statements, etc. Suppose an accountant needs to create a certificate form for 2021.

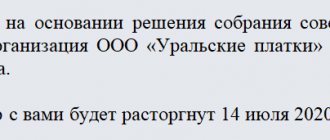

What types of certificates of employment exist? A certificate of employment is a document that may be useful: when applying for a visa; to apply for sick leave or maternity leave at a new job; for registration of state benefits for child care. The structure of a certificate of employment can vary significantly depending on the specific purpose of drawing up the document.

April 12, 2021 at 17:54 The number of employees is the actual number of personnel working at the enterprise under employment contracts. The number must be calculated for different purposes: both for the purpose of analyzing the activities of the enterprise, and for the purpose of reporting to regulatory authorities. Today we will figure out what the actual number of employees in an institution is, who to include in it, and what document it is displayed in.

Calculation method

When counting the number, specialists are usually guided by the following regulations and documents:

- Instructions for filling out statistical reporting forms. Their current version was approved by Rosstat Order No. 722 dated November 22, 2020.

- An instruction approved by the USSR State Statistics Committee back in 1987. Despite the considerable age of the document, there are no plans to cancel it; it is still in force, but only to the extent that does not contradict the current labor legislation of the Russian Federation.

- LNA of the organization: staffing table, staff book, etc.

- Orders on admission, transfer, dismissal, vacations, business trips and other similar orders.

- Personal cards of employees (unified form T-2 or its replacement at the enterprise).

We invite you to familiarize yourself with What is regulated by the Federal Law “On the Protection of Consumer Rights”? Structure and content of the normative act

The roster includes:

- those working (including part-time, reduced working hours) and those who are idle;

- on sick leave;

- on business trips;

- on vacation (regular, educational, without pay, child care) or time off;

- those performing state and public duties, for example, participating in the work of election commissions or serving on jurors;

- temporary workers hired under a fixed-term employment contract;

- those under investigation or arrest;

- those who committed truancy;

- suspended from work;

- taking part in strikes;

- those who improve their qualifications if they retain their salary;

- employees are foreign citizens.

Not included in the list:

- external part-time workers (internal part-time workers are included as 1 unit, at the main place of work);

- attracted on the basis of the GPA;

- owners of the company, if they do not receive wages;

- military personnel, persons serving sentences, and others involved under special agreements with government organizations.

The actual number includes all employees of the organization who performed their duties on a specific working day and is determined on the basis of time sheets. When calculating it, persons who did not go to work are excluded, regardless of the reasons for their absence.

Certificate about the total number of jobs in the enterprise

The tax office accepts reports with legible data entered in black ink. Important Forms filled out with other color variations will not be considered. Write information in cells and rows as legibly as possible. Tax professionals should not feel like graphologists.

If you are an advanced computer user, feel free to fill out the form using editing software.

Calculation nuances When calculating the number of employees, you should take into account some features of the procedure:

- If an organization/entrepreneur operates for less than a full month, the number of calendar days per month is taken when calculating the number.

This situation is possible for a new enterprise, or for an enterprise operating seasonally. Example: an enterprise was registered on September 18 with 20 employees. Headcount for September = (20 people x 13 days) / 30 days.

Attention: The company was created back in 2015, therefore data is submitted to the tax authorities as of January 1st until January 22, 2018.

The company's roster for this period:

- From January to February – 20 people.

- From March to August – 22 people.

- From September to December – 30 people.

Annual average = (20 x 2 + 22 x 6 + 30 x 4) / 12 = 24.3 rounded to 23 people.

Note! For failure to submit a certificate on time, the taxpayer will be fined 200 rubles. according to the norms of clause 1 stat. 126.

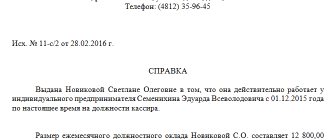

Attention Certificate of number of employees sample

- persons located abroad;

- employees sent to other enterprises and not receiving payment for their work;

- employees who submitted a letter of resignation and stopped working earlier than the appointed date or without warning the administration;

- employees working under contracts with state-owned enterprises;

- external part-time workers.

A certificate of the average number of employees looks like this: Sample certificate of the average number of employees Included in the payroll:

- regular employees;

- seconded employees while maintaining wages, including employees sent abroad for a short period of time;

- sick employees;

- employees with government powers;

- truants;

- employees registered for part-time or part-time work. The operating time is taken proportionally.

Drawing up a certificate in any form is not allowed.

The frequency of information submission is annual. Deadline - until January 20 for the previous year (calendar) based on the requirements of clause 3 of the statute. 80.

Each company has its own accounting features. When filling out the tax payer identification number field (abbreviated as TIN), which is assigned to legal entities and individuals, start entering the code numbers from the leftmost square cell. The “Checkpoint” column is intended only for organizations. Individual entrepreneurs do not need to fill out this field.

Please note! If your code has fewer numbers than cells, you must first enter zeros and then the digital values of the TIN. The tax office code for your area always consists of four digits.

Why do inspectors need information about the average number of employees?

Submitting information on the average number of employees to the Federal Tax Service is required by clause 3 of Art. 80 Tax Code of the Russian Federation. Why is this information necessary for tax authorities?

First of all, this indicator directly determines how you will submit your tax reports.

If last year's number of employees exceeds 100 people, the only acceptable way to submit declarations is electronically, according to TKS through an EDI (electronic document management) operator. For failure to comply with this requirement of Art. 119.1 of the Tax Code of the Russian Federation provides for a fine of 200 rubles.

Taxpayers with 100 employees or fewer can choose between electronic and paper filing.

In addition, the number affects the right to apply special tax regimes. For example, for simplification, the average number cannot exceed 100 people, and for PSN - 15 people.

Sample certificate of number of employees

- All fields of the certificate of number of employees are filled out by the taxpayer, except for the lower right section, which will be filled out by a tax authority employee.

- The completed form on the number of workers can be submitted to the Federal Tax Service either in person or sent by mail, describing the attachment. You can also submit data electronically.

- The document is submitted to the tax office at the place of registration of the enterprise or at the place of residence of the individual entrepreneur.

In the case where the company is going through a reorganization process, the report is submitted by the twentieth day of the next month after completion of all processes.

For example, if your company was reorganized in March, the headcount report must be submitted by April 20.

We fill out only our fields . The taxpayer should not go into the blocks intended for the inspection representative.

Moscow trust Mosotdelstroy No. 1 has the following strength, including under civil contracts:

- Full-time employees – 56 people

Of these: Management staff – 4 people Engineering and technical staff – 3 people Maintenance personnel – 17 people Support staff – 13 people Production personnel – 22 people

- Involved – 53 people.

Head of HR Department B.A.

The average indicator of employees on the payroll, including persons on vacation, sick leave and absent from the workplace for other reasons. The calculation also takes into account citizens who have entered into any civil law contracts and external part-time workers.

- Payroll. The value of the composition of employees on a specific date and date. When calculating, all workers on a permanent or temporary basis with official employment are taken into account. Owners receiving wages are also taken into account. Persons who have entered into a contract or other agreements are not taken into account. When determining the indicator, both citizens who report to the workplace and employees who are absent for a number of reasons are taken into account.

- Average pay. Number of employees for a particular period.

Employees with part-time work at their discretion are taken into account when calculating:

- in proportion to working time - when calculating average list information;

- as a unit per day – when calculating list information.

When calculating the average number of employees per month for people with part-time work, you should be guided by the following formula: the total working time of such employees in hours per month / duration in hours of a day of work / the established number of days of work in a month.

For example, at 0.5 employee rate (with 20 working days in a month): 80/8/20 = 0.5 Temporary workers Counted only at one enterprise to avoid double counting.

If these are persons sent on a temporary basis, their salaries are usually paid by the enterprise where the work is carried out.

How is the number calculated?

Rules for counting list data:

- All persons registered under employment contracts are included.

- Owners are hired and paid for their labor.

- Both present and absent persons are taken into account.

- The data must match the data in the timesheets.

Average Average number is used in calculating various activity coefficients: labor productivity, average pay level.

The average number also includes:

- Persons entered into under civil contracts. They are considered as ordinary employees hired into the organization for full time. The exception is entrepreneurs.

- External part-time workers. They are considered as part-time employees.

Sample certificate of number of employees to the tax office

Representative" "Signature" "Date" "MP" "Name of document..." If the form is filled out by a representative, then in this section you need to indicate information about him. If the representative is an individual, indicate his data: first name, last name and patronymic according to the passport.

If the taxpayer's representative is an organization, the signature of the head of this organization, certified by a seal, indicating the date of signing must be affixed here. At the end of the form, you must enter the name of the document that confirms the authority of the representative.

A copy of this document must be attached to the form. All fields of the certificate on the average number of employees are filled in by the taxpayer. The only section that does not need to be filled out is the bottom right one. It is filled out by a tax official.

The number of employees of each enterprise is determined by the number of employees on the staff of this organization, or is recorded in the staffing table. Those. employees with whom an employment contract has been concluded. These may be employees working on permanent, temporary or seasonal jobs.

The number of full-time employees in an organization can be recorded in the charter of this enterprise. In most cases, the number indicator is calculated in government organizations. It is rarely determined in various structural departments of commercial companies.

The composition of workers in an organization influences the accrual or deduction of certain fees. The indicator plays an important role when choosing a taxation system. Moreover, the provision of this data affects the provision of tax benefits.

The number of employees in an organization is of the following types:

- General . The average indicator of employees on the payroll, including persons on vacation, sick leave and absent from the workplace for other reasons. The calculation also takes into account citizens who have entered into any civil law contracts and external part-time workers.

- Payroll . The value of the composition of employees on a specific date and date. When calculating, all workers on a permanent or temporary basis with official employment are taken into account. Owners receiving wages are also taken into account. Persons who have entered into a contract or other agreements are not taken into account. When determining the indicator, both citizens who report to the workplace and employees who are absent for a number of reasons are taken into account.

- Average pay . Number of employees for a particular period. The calculation is made by adding the number of employees on the payroll for each day of the month. If the employee is employed part-time, then the actual time worked is taken into account when calculating.

- Safe house . A certain number of employees who must attend work every day. This number shows how many people are needed to implement the planned work processes that contribute to the start of production and the passage of all stages to its logical end.

- Regulatory . The maximum permissible value of workers, calculated according to the labor cost standards of a specific category of employees.

- Planned . Calculates the composition of personnel in accordance with labor standards with adjustments to certain working conditions of the enterprise.

- Regular . The number of personnel included in the company's staff, with the exception of citizens hired temporarily or seasonally. According to statistics, the value of this type is lower than planned, because It is more interesting for management to recruit staff for a specific period and not keep such a number of employees on their staff.

- Actual . It is established on a certain date, and also includes all actually working personnel at the enterprise, regardless of the duration of work.

- Average . It is formed from the average number of employees, and is also taken for calculation the average value of working people under external part-time jobs and civil service agreements.

At some enterprises, in order to obtain the necessary certificate from an employee, no documents are required - it is enough to contact the immediate supervisor or a representative of another structural unit with an oral request. But this is not always the case: in most, especially large companies, the employee is required to provide a written request or application for a certificate, in which he must indicate the purpose of obtaining the document and also what information needs confirmation.

But it should be noted that the law gives the employee the right not to inform the employer about where exactly the certificate is required and for what reason.

Average headcount: 2019-2020 form

The form of information on the average number of employees is approved by the tax service.

To submit information on the average headcount in 2019, the form was used in accordance with order dated March 29, 2007 No. MM-3-25 / [email protected] The average headcount on the form in 2021 for the past year 2021 is submitted using the same form. Recommendations for filling out the form are given in the letter of the Federal Tax Service of the Russian Federation dated April 26, 2007 No. CHD-6-25/ [email protected]

The form is the same for organizations and individual entrepreneurs. for the average payroll, submitted in 2021, can be found on our website:

The form is quite easy to fill out. It consists of only 1 page, which looks somewhat similar to the title page of the declaration.

The certificate must provide information about the organization or individual entrepreneur (TIN, KPP, name or full name), indicate the name and inspection code. Then you need to indicate the date on which the average headcount was calculated. It will be:

- January 1 of the current year - if this is the number of last year; or

- 1st day of the month following the month of creation or reorganization.

The following is the actual average number. It is indicated in whole units.

The rules for calculating the number from 2021 are established by Rosstat order No. 772 dated November 22, 2017.

Read more about the changes introduced by Rosstat Order No. 772 dated November 22, 2017 here .

In general, the calculation formula looks like this:

Average year = (Average 1 + Average 2 + . + Average 12) / 12,

where: Average year is the average headcount for the year;

Average number 1, 2, etc. - average number for the corresponding months of the year (January, February, December).

For more information about the calculation procedure, read the article “How to calculate the average number of employees?” .

The information is certified by the signature of the entrepreneur or the head of the company, but can also be signed by a representative of the taxpayer. In the latter case, you must indicate a document confirming the authority of the representative (for example, it could be a power of attorney), and submit a copy of it along with the information.

NOTE! The power of attorney of the representative of the individual entrepreneur must be notarized (Article 29 of the Tax Code of the Russian Federation).

Certificate from the place of work at the place of requirement. Current sample and form

Typically, the certificate is issued by the head of the department whose jurisdiction includes the requested information. If an employee needs a certificate about his profession or position, then he must contact the personnel department, if about wages - accordingly, to the accounting department, etc. But if the head of a structural unit can directly prepare the certificate, then it must be certified by the director of the company or a person authorized to sign such documents.

Each certificate of employment has its own expiration date, which is determined by the institution or organization requesting the document individually, and which most often does not exceed a two-week period - during this time the employee must have time to request the document from the organization and present it where needed.

Does a resigned employee have the right to request a certificate?

According to the law, an employee who quit can also demand the certificate he needs from his former employer. True, only one type of such document is legally established, the issuance of which is prohibited from being refused: this is a salary certificate (for example, for receiving subsidies, pensions, benefits and other social benefits). Information for such documents is stored in the archives of the enterprise.

There is no single, unified, mandatory sample of a certificate of employment. Enterprises and organizations have the right to write it in free form or use a template developed within the company (however, such templates must be registered in its accounting policies). Regardless of which option the company chooses, the certificate must contain a number of necessary data :

- Name of the organization,

- date of compilation,

- information that needs to be confirmed

- signature of the company director.

It is not necessary to put a stamp on the document, since since 2016 legal entities have been exempted from the obligation to certify their papers with seals and stamps (however, in this case it is advisable to include the organization’s details (address and telephone number) in the document, otherwise the certificate may simply not be issued accept where it is provided).

The certificate must contain only relevant and reliable information; entering into it knowingly false or unreliable information can lead to administrative punishment for organizations and officials in the form of a large fine.

If any documents or copies thereof are attached to the certificate, then information about this should also be recorded in the certificate itself in the form of a separate paragraph about the attached documentation.

- First, indicate the full name of the company, just below its actual address and telephone number.

- Next, put the date the document was compiled, then in the middle the word “Certificate” and its number according to the organization’s internal document flow.

- Then comes the actual necessary information: here you must completely enter the last name, first name, and patronymic of the employee for whom the certificate is intended, as well as certify the necessary facts.

- After this, if the employee has named the recipient of receipt, you can indicate to whom the certificate will be presented.

- At the bottom, the document must be signed by either the director of the company or his authorized representative (indicating the position and a transcript of the signature).

Certificate of employment is a document that may be useful:

- when applying for a visa;

- for presentation to court;

- to apply for sick leave or maternity leave at a new job;

- for registration of state benefits for child care.

The structure of a certificate of employment can vary significantly depending on the specific purpose of drawing up the document.

Documentation confirming the number of personnel

- At the top of the form, the taxpayer fills out the TIN and KPP fields, guided by the Tax Registration Certificate.

- Further, after the words “Submitted to,” the full name of the tax accounting authority where the information must be submitted is indicated, and its code is indicated in the cells of the corresponding field.

- The next line contains the name of the person conducting business activities, or the full name of the organization submitting the information, in accordance with the constituent documentation.

- In the field below, the reporting date for submitting information is indicated - January 1 of this year in the order “day-month-year”.

The TIN and KPP at the location of the branch (branch, representative office) of a foreign organization operating on the territory of the Russian Federation are indicated on the basis of a Certificate of registration with the tax authority in Form N 2401 IMD and (or) an information letter on registration with the tax authority of the branch foreign organization in form N 2201I, approved by Order of the Ministry of Taxes of Russia dated 04/07/2000 N AP-3-06/124 “On approval of the regulations on the peculiarities of accounting by tax authorities of foreign organizations” (registered with the Ministry of Justice of Russia on June 2, 2000, registration number 2258 ; “Bulletin of normative acts of federal executive bodies”, June 19, 2000, No. 25).

Blanker.ru

- The next field contains the average number of employees.

- The lower left section confirms the accuracy of filling out the form. An individual entrepreneur puts his signature and the day the document was drawn up. If the taxpayer is an organization, its head enters his personal information, the day the form was drawn up, and the signature and seal of the organization in the appropriate field.

- If the certificate is certified by a legal representative who is an individual, he signs the form, indicating his name and the day the form is filled out.

- If the organization is also represented by an organization, its head confirms the completed form with his signature, indicating the full name of the organization, the day of compilation and affixing the organization’s seal.

- The name of the document giving the representative the corresponding authority is indicated below.

Certificate of employment - form and sample filling

During court hearings, the presentation of a certificate of employment is usually required to confirm the employment and income of the plaintiff or defendant, for example, to assign alimony. In this case, the defendant may be required to submit a certificate indicating:

- his full name, position;

- salary or average earnings;

- work experience in the company.

The document must be certified by the seal of the employing company (if any), as well as the signature of the head of the company.

Such a certificate is needed in order to show the social protection authorities that the father or mother of the child is not on leave to care for him, in order to receive state benefits assigned by order of the Ministry of Health and Social Development dated December 23, 2009 No. 1012n.

The form of this certificate is not approved by law. For such purposes, a document presented in a general structure is suitable, but it must be supplemented with wording that corresponds to the specific situation (for example, that the employee does not use parental leave).

A certificate of employment may be required in a variety of types of institutions - private, public and even international. The main thing when drawing them up is to take into account the requirements for the relevant documents established by the organizations that request them.

You can familiarize yourself with the specifics of other types of certificates issued by employers for employees in the articles:

- “Why and where do you need a 2-NDFL certificate?”;

- “The procedure for issuing a 2-NDFL certificate to an employee”.

Sources:

- Order of the Ministry of Labor of Russia dated April 30, 2013 N 182n

- Order of the Ministry of Health and Social Development of Russia dated December 23, 2009 N 1012n

It is important to know where a certificate of employment is required. Knowing who needs to provide it determines the order of compilation and the form in which the document will be printed. The form of the document being drawn up is determined by whether it will be sent, for example, to the Pension Fund or whether it is needed for housing and communal services.

When confirming the employment of an employee who has applied for a Schengen visa, the text is usually written in English. By providing the migration service with data on the length of service and the amount of wages, they supplement them with a guarantee that upon return the employee will continue to work at his previous place of employment, and he is provided with paid leave during the voyage abroad.

It is also advisable to provide form 2-NDFL, possibly in place of the main document.

A citizen who decides to:

- adopt children;

- establish guardianship or guardianship over the child.

The guardianship authorities check whether the adoptive parent (guardian, trustee) can support the child. The document provided must convince them of financial solvency.

Sample certificate confirming work in the organization

A worker who is several months away from reaching the age that gives him the right to grant a retirement pension must take information about his work activity from his main place of work. It should be submitted to the Pension Fund of the Russian Federation, to the branch at the place of registration, so that the necessary calculations can be made there.

Among the materials of interest to Pension Fund employees is a certificate of employment from the employer for the period before 2002. The Pension Fund does not have a single database confirming contributions to the fund over these years. Therefore, when assigning a pension, they request documents confirming the employee’s employment for two consecutive years during this period.

There are several cases where it is mandatory to provide a certificate of employment for the court. This happens when you need:

- recover from wrongful dismissal;

- assign alimony;

- to pay damages;

- make a decision on an administrative violation.

Based on the specified samples, the court will receive data regarding the average monthly salary. They will allow you to determine how much alimony should be paid monthly or compensation for damage caused.

For a bank or other financial institution providing loans, you need to fill out form 2-NDFL. Although many banks prefer to assess the level of financial solvency of a potential borrower using reporting forms independently developed for him.

A document issued by an individual entrepreneur for a driver or other employee will not show the amount of average monthly earnings broken down for each individual month. It will have one general indicator.

The part-time student will be required to provide a certificate of employment to the university to confirm the fact of employment. Please note that such a document may be required by any educational institution, not just the university.

A certificate is needed in order to have a basis for attracting a student to study for a certain period, i.e. take you away from work.

Essence of the question

The number of employees is: payroll, average and average. For different purposes, different numbers need to be determined. The general indicator is the average number - it most fully covers all categories of workers. Next comes the payroll number, and from it the average payroll is calculated.

Reason for compilation

There may be several reasons for drawing up a certificate. The main one is the requirements of tax legislation.

Employees of the Federal Tax Service determine which organizations/entrepreneurs must submit reports on paper and which electronically based on the average indicator.

If the number does not exceed 100 people per year, you can report on paper declarations. Therefore, all legal entities and entrepreneurs must report from 2008 on the average number of employees for the previous calendar year. The certificate is also drawn up when creating, reorganizing, liquidating, or closing an enterprise.

The average number is used to confirm the right to the simplified tax system, the calculation of UTII for certain services, such as repairs, car washing, veterinary, and household services. Also for preferential confirmation for organizations that have disabled employees.

Information on the average headcount does not apply to declarations, therefore failure to submit may result in fines for the organization and its management:

- in the amount of 200 rubles – for a legal entity or entrepreneur;

- in the amount of 300 - 500 rubles - per official.

In addition, certificates of headcount in any form may be needed by banks, credit institutions, company owners and other users.

Feeding organs

The average headcount in the form of a certificate is submitted by all taxpayers, regardless of the registration form:

- To the Federal Tax Service by January 20 for the previous year. When a new legal entity is created or an old legal entity is reorganized, the certificate must be submitted by the 20th day of the month following the month of creation or reorganization. For example, a company was registered on May 18, a certificate must be submitted by June 20 reflecting information as of June 1.

Who submits:

- enterprises of any tax regime and type of activity;

- individual entrepreneurs with employees.

Who does not submit:

- individual entrepreneurs without employees - from 01/01/2014 (Article 80 of the Tax Code of the Russian Federation). There is no longer any need to report for 2013.

The certificate is submitted at the place of registration of the entrepreneur or at the place of registration of the organization’s head office.

- Information on payroll numbers is also submitted to the Social Insurance Fund and the Pension Fund as part of the 4-FSS and RSV-1 calculations.

- Information on the average number is submitted to the statistical authorities using forms P-4, PM, MP-micro as necessary.

A large staff is difficult to control.

Find out how to request an explanation from an employee. An application for an appointment with the General Director is not required. See why.

Sample certificate of the number of employees of the organization

About a month is given to prepare the information: it is submitted by the 20th day of the second month of work to the Federal Tax Service at the place of registration. In addition, the number of employees must be reported annually: based on the results of the previous year - before January 20 of the following year. Violation of deadlines will result in a fine of 200 rubles.

This is what a correctly compiled sample of filling out a certificate of average number of employees looks like. The picture shows an example for an LLC, which employed 15 people at the end of last year. But a certificate of the number of employees of less than 15 people is prepared according to the same rules.

Let's look in detail at how to fill out a report for tax authorities:

- Indicate the name of the Federal Tax Service inspection where you are sending the form. Please note that separate divisions do not have to report such information separately.

A copy of this document must be attached to the form. All fields of the certificate on the average number of employees are filled in by the taxpayer.

The only section that does not need to be filled out is the bottom right one. It is filled out by a tax official.

The average number of employees of the company is calculated in accordance with the Guidelines approved by Rosstat Order No. 498 dated October 26, 2015.

A certificate of average headcount is submitted:

- for all organizations - no later than January 20;

- if the company has just been created (reorganized), then the management must submit such information no later than the 20th day after the month in which this company was created.

The number of employees reflected in the information on the form described affects the collection or waiver of certain fees. This indicator is also important when choosing a taxation system.

Important

NKT USSR 04/30/1930 No. 169). But sometimes these 11 months are not so spent.

But be careful: the procedure for paying for “children’s” sick leave remains the same!

To the head of the State Unitary Enterprise of Moscow Trest Mosotdelstroy No. 1 Sorokin Yu.P. from the head of the HR department B.A. Prigozhin

S P R A V K A about the number of employees and persons involved, including under civil contracts as of October 12, 2009 As of October 12, 2009 in the State Unitary Enterprise of the city.

Moscow trust Mosotdelstroy No. 1 has the following strength, including under civil contracts:

- Full-time employees – 56 people

Of these: Management staff – 4 people Engineering and technical staff – 3 people Maintenance personnel – 17 people Support staff – 13 people Production personnel – 22 people

- Involved – 53 people.

Head of HR Department B.A.

Representative" "Signature" "Date" "MP" "Name of document..." If the form is filled out by a representative, then in this section you need to indicate information about him. If the representative is an individual, indicate his data: first name, last name and patronymic according to the passport.

If the taxpayer's representative is an organization, the signature of the head of this organization, certified by a seal, indicating the date of signing must be affixed here. At the end of the form, you must enter the name of the document that confirms the authority of the representative.

A copy of this document must be attached to the form. All fields of the certificate on the average number of employees are filled in by the taxpayer. The only section that does not need to be filled out is the bottom right one. It is filled out by a tax official.

Deadlines for submission and responsibility for non-submission

Long-established private businessmen must submit a certificate before the twentieth of January of the year following the reporting year. Newly registered companies and entrepreneurs are required to submit a certificate by the twentieth day of the month following the month of registration.

Responsibility for failure to provide a certificate of the number of employees is a fine of 200 rubles. Also, persons responsible for the generation and submission of this report may receive a fine. The fine for them will be from 300 to 500 rubles.

Video on the topic:

Letter about the number of employees of the organization sample

| No. | Last name, first name, patronymic of the specialist | Education (which educational institution you graduated from, year of graduation, specialty obtained) | Job title | Work experience in this or similar position, years |

| Management level (manager and his deputies, chief accountant, chief economist, chief lawyer) | ||||

| 1 | ||||

| 2 | ||||

| … | ||||

| Specialists (including product specialists, purchasing managers, sales managers, warranty service managers) | ||||

| 1 | ||||

| 2 | ||||

| … | ||||

| Other personnel (including forwarders, drivers, loaders, security guards, etc.) | ||||

| 1 | ||||

| 2 | ||||

| … |

A table with other personnel is also possible. This includes employees working in the organization, but not directly related to the implementation of the contract for this competition. The table looks similar.

| Group of specialists | Staffing, people |

| Management personnel | |

| Engineering and technical personnel | |

| Workers and support staff |

At the bottom of the certificate, the position, full name and signature of the authorized person with the seal of the organization (blue) must be indicated.

So, for such persons you need to take both SZV-M and SZV-STAZH!

But be careful: the procedure for paying for “children’s” sick leave remains the same!

In fact, they are listed as employees of one organization, but may perform some work in others. At the same time, their working hours at other companies will be incomplete (about four hours a day).

Their participation in the calculation of the MSS is calculated using the formula (it is given in the next paragraph). Internal part-time workers are employees of a specific company who perform not only their direct duties, but also additional work.

It is impossible to give a resigning employee a copy of SZV-M. According to the law on personal accounting, when dismissing an employee, the employer is obliged to give him copies of personalized reports (in particular, SZV-M and SZV-STAZH). However, these reporting forms are list-based, i.e. contain information about all employees.

This means transferring a copy of such a report to one employee means disclosing the personal data of other employees.