Why is it needed?

Question: why issue a separate certificate for sick leave? After all, all the figures are already given in the sick leave itself - in the second part, which is filled out by the employer. In fact, such an application provides more information about the calculations made by the company's accountant.

In fact, such a certificate is needed for Social Insurance Fund employees, who with its help will be able to verify the correctness of the calculations made by the company’s accountant. This cannot always be done using only the data indicated on the sick leave. Also see “How to fill out sick leave for an employer: sample.”

The reason lies in the fact that there is a limit on making contributions for social insurance purposes. This is recorded in parts 1 and 3.2 of Art. 14 of the Law on Compulsory Social Insurance No. 255-FZ. Accordingly, the amount of sickness benefit payments is limited.

Thus, the maximum amount of an employee’s average salary for sick leave purposes is 1,294,000 rubles (current in 2016). This is enshrined in Part 4 of Article 8 of the Law on Insurance Contributions No. 212-FZ and Decree of the Government of the Russian Federation dated November 30, 2013 No. 1101, dated December 4, 2014 No. 1316.

The average amount of daily earnings should not be more than 1,772 rubles and 60 kopecks. This value was obtained by dividing 1,294,000 rubles by 730 days making up the billing period. This situation is fixed in part 3 of article 14 of Law No. 255-FZ and paragraph 15(1) of government regulation No. 375 dated June 15, 2007.

Purpose of the certificate

Any employee pays insurance premiums to the Social Insurance Fund through the enterprise’s accounting department. The longer he works at the enterprise, the longer his insurance period, which affects the amount of benefits in the event of a sick leave. In accordance with the law, the amount of benefits paid in connection with loss of ability to work depends on the length of time in which insurance premiums have been paid, depending on the duration of work at the enterprise, as well as on the amount of salary:

| Less than 6 months | from 3 to 5 years | from 5 to 8 years | from 8 years |

| Calculation is based on the minimum wage | 60% | 80% | 100% |

Expert commentary

Kamensky Yuri

Lawyer

When changing places of employment, seniority is not lost; it must be included in the calculation of benefit payments if the employee becomes ill and this leads to incapacity for work.

The law establishes that when paying for a sick leave document, the employer and the Social Insurance Fund must take into account the insurance experience for the previous two years of work, regardless of the place of work. Therefore, the accounting department of the new employer must be aware of the previous insurance record and the amount of earnings indicated in the certificate from the previous place of work. For this purpose, a document in Form 182 should be presented to the accounting department so that it can correctly determine the amount of benefits due to the employee in the event of loss of temporary ability to work. In the absence of such a document, the insurance period at the previous job will not be taken into account, and the accounting department will be forced to base the calculation of the amount of benefits on the minimum established amount of the minimum wage.

The certificate may also reflect the amount of salary received for the period of time worked elsewhere in the current year. This information will be needed if the employee becomes unable to work in the year following the year in which he or she started working.

Important! In addition to determining the amount of benefits in connection with the illness of the employee himself, information from certificate 182-can also be used to calculate payments for maternity leave and benefits for caring for a newborn child up to 1.5 years old.

"Super income"

A certificate for the Social Insurance Fund for calculating sick leave becomes especially important if the income of a specialist in his position in the billing period is greater than the specified amounts.

Example of calculation in 2021: Let’s assume that for 2016 – 2021. the person actually received 1.8 million rubles. Then his daily earnings will be 2,465 rubles. 75 kop.:

RUB 1,800,000 \ 730 days

This means that the sickness certificate itself must reflect indicators that do not exceed the maximum. Namely:

- RUB 1,473,000 (718,000 + 755,000) – as the average salary for calculating benefits;

- 2017.81 rub. – as the average daily salary.

From the sick leave certificate, it will be clear to representatives of the social insurance fund that the employee’s actual earnings are higher. But they will not be able to verify the correctness of the calculations made at the enterprise. Also see “100% sick leave: when paid in full.”

What should be included in the certificate?

The information that must be present in the document assumes the following main points:

| Contents of information about the employing organization |

|

| Information about the personal data of the employee himself |

|

| The amount of wages received by him for each specified year | Information for each specified year must be entered on a separate line. If the report includes two years, then there should be two lines. If the report additionally includes the worked period of the third year, then there should be three lines. You should first indicate the year for which the income is presented, and then show the amount of income received during that period. |

| Periods when the employee was incapacitated for two selected years | When preparing this information, you must also observe the breakdown of information for each year, indicating the year and the total number of days of incapacity in it, which are subject to exclusion in the calculation. |

At the end of the certificate, the date of its issuance and registration number are indicated. Then the signature of the official responsible for the information reflected in the document, the seal of the enterprise or documents confirming the authority of the employee who signed is affixed.

Important clarifications:

- In the paragraph reflecting the amount of earnings from which contributions to the Social Insurance Fund were collected, it should not go beyond the maximum established by law (in 2021 it is 865,000 rubles).

- The total amount of income received over a two-year period may also include wages received while on maternity leave if the employee was working part-time during that time.

- Even if, during the period of caring for a child under 3 years old, the employee did not start working in full, the period of her caring for the child must still be indicated in the certificate as the period of time of her incapacity for work.

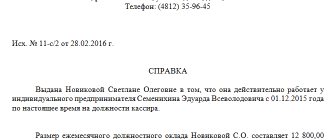

Document form

Please note that the 2021 sick leave certificate, approved by regulatory documents, is not available. That is, you can fill it out arbitrarily. But at the same time, the main condition must be met: FSS employees will understand all the manipulations made with the numbers. An approximate design of such an explanatory document is presented below.

Also see “How sick leave is paid in 2021.”

Reduced amount or denial of benefits

Payments can be made by the policyholder based on the minimum wage for the following reasons:

- failure to comply with doctor’s instructions, including failure to show up for an appointment, will result in the calculation of a reduced benefit from the date of the violation,

- illness or injury resulting from any type of intoxication during the entire period of incapacity.

Refusal to accrue due to the following reasons:

- intentional infliction of harm to health (including attempted suicide). The fact must be proven in court,

- the onset of illness in connection with the commission of a crime intentionally by a person.

For some periods social guarantees are not provided:

- releasing an employee from performing duties (except for vacation),

- suspension from work with no accrual of insurance premiums,

- arrest, forensic examination,

- downtime that began before going on sick leave.

Dismissal

There is one more case when you cannot do without an attachment to the certificate of incapacity for work - a certificate for calculating sick leave upon dismissal. The employer issues it to his employee when he expresses a desire to terminate a previously concluded employment contract. It must reflect the income of this person for a billing period of two years. This certificate is issued by the accounting department. In another way, it can be called a certificate of income.

Among accountants, such a document is still known as a certificate for calculating sick leave, form 4n. Although since mid-2013 its mandatory template has not been in effect, and Order No. 182n of the Ministry of Labor contains a somewhat similar document. See “Two Year Salary Certificate Form.”

It first indicates the details of the policyholder - the organization that acts as the person’s employer. This is the name, registration number, subordination code, TIN, address and contact telephone number.

Next, fill out information about the employee: his full name, passport details, residential address, SNILS. The period during which he was officially employed in the organization is also indicated.

Then they give the amounts paid to the Social Insurance Fund for each year and the number of days when the employee received confirmation of his temporary disability.

The certificate must be signed by the head of the company and the chief accountant.

Filling out this form falls on the shoulders of the organization's chief accountant. It should be designed using a ballpoint pen with a black refill. It is permissible to use the capabilities of computer technology for these purposes.

Also see “In what cases is sick leave not paid?”

Remember: a sick leave certificate upon dismissal must be issued in 100 percent of cases! And what the name of the certificate for calculating sick leave is not of fundamental importance.

Read also

03.12.2019

When is the certificate issued?

The need for a salary certificate may arise for an employee when applying for a new job, so it should be issued by the accounting department of the enterprise from which he resigned immediately upon dismissal, along with the work book and other necessary documents. He can also apply for it at his previous enterprise at any time subsequent to his dismissal.

According to the insurance rules established by law, the employer is required to issue certificate 182-at the request of a former employee, if it was not issued upon his dismissal. It is better to request the issuance of a certificate by submitting an application to the previous employer for the provision of this document. By law, he is required to issue the requested certificate within three days after the application. The request can be submitted personally, through a trusted person, or sent by mail.

Important! When combining work in several organizations for less than two years, the employee has the opportunity to receive benefits under a sick leave document only in one company, taking into account part-time work. To calculate the payment, he should provide the accounting department of this company with certificates about the amount of earnings in other organizations where he worked.

Application for issuance of certificate 182n (sample)

Procedure for completing the form

The legislator has not introduced a standard form of calculation. The policyholder has the right to develop it independently, reflecting this fact in the accounting policy. But it is recommended to indicate such basic details as:

- name of the employer, its registration number in the Social Insurance Fund,

- the name of the insured, his work experience,

- duration of sick leave,

- salary for 2 years,

- calculation order, total,

- signature of the person who prepared the certificate.

The form for calculating temporary disability benefits can be downloaded for free from the link. A sample form is also available.

Payment source

The first 3 days of illness are paid at the expense of the employer, the rest of the period is paid from the Social Insurance Fund.

The issuance of funds to a sick employee is reflected in settlements with the Social Insurance Fund: with an increase in benefits, the obligation to pay contributions to the Fund decreases, which is recorded in the reporting.

Since 2011, the Direct Payments project has been operating in test mode. In 2019, more than 50 regions of the Russian Federation will be involved in it. It consists of transferring funds from the Social Insurance Fund directly to the insured:

- the policyholder pays only for 3 days of illness, he does not have to withdraw the rest of the money from circulation,

- payment of insurance premiums is carried out as usual and is not reduced,

- the funds received by the patient from the Fund are not indicated in the reporting,

- the transfer is carried out on the basis of documents provided by the employee at the place of work, and from there to the Social Insurance Fund.

Calculation example

Let's look at the input data:

- the employee provided the accounting department with sick leave for 10 days,

- The length of service is 6 years; the payment standard is 80%,

- earnings for 2021 are 770,000 rubles, for 2021 805,000.

Calculation order:

- income limit for 2021 755000, used in the calculation,

- a similar limit for 2021 is 815,000, the employee received less, we take into account 805,000 rubles,

- P = (755000+805000) / 730 * 80% * 10 = 17095.89 rubles amount to be issued to the person.