16

After the death of citizens, various property remains. One of the objects of inheritance is a car. The procedure for registering an inheritance is determined by law. The legal successors will have to obtain a certificate from a notary. The time it takes to complete documents at a notary office depends on the method of inheritance and/or the order of successors. The vehicle is registered with the state within 10 days. Let's look at how to re-register a car by inheritance in the traffic police after the death of the owner.

What to do with the car after the death of the owner

Expert opinion

Stanislav Evseev

Lawyer. Experience 12 years. Specialization: civil, family, inheritance law.

The law prohibits third parties, including heirs, from using the vehicle for its intended purpose from the date of the owner’s death. From the moment of the death of the owner, all possible powers of attorney that he issued cease to be valid. Therefore, using a car can lead to a number of problems.

Initially, you need to take ownership and register the car in your name with the traffic police. Otherwise, problems may arise on the road. For example, State Traffic Inspectorate officers will issue a fine and confiscate the car. A daily fee will be charged for being in the impound lot.

If such a situation arises, it is advisable to involve a qualified lawyer.

Therefore, the heir needs, in general order:

- Submit an application to a notary to accept the inheritance.

- Then, after 6 months, receive a certificate of inheritance.

- And based on this document, register the car in your name.

How long does it take to register an inheritance?

By law, the heir has 6 months. If the period has expired, the car will become the property of the state.

But there are situations when the period is increased:

- serious health problems of the heir, long-term treatment;

- the heir did not know that the owner had died;

- a new heir should be born soon (the conceived child also has the right to a car);

- protracted legal proceedings.

There may be other reasons, but they must be serious. They must be reported in advance.

How to inherit a car

Registration of inheritance documents takes place at the notary. The basis for accepting the inheritance is the application of the interested parties.

Priority in inheritance is given to citizens for whom the will is executed and relatives of the 1st stage.

However, even if there is an administrative document, the law protects the interests of citizens who are entitled to a mandatory share in the property of a deceased person. In other words, the obligatory claimants accept the inheritance along with the primary assignees.

Sample application for acceptance of inheritance

Procedure and procedure

Procedure

| No. | Actions of legal successors |

| 1 | First of all, the heirs need to ensure the safety of the deceased’s car. You need to park it in a paid parking lot or garage (if available). The registration procedure will take a long time, third parties may damage the inherited property. |

| 2 | Legal successors must contact the notary office at the place of residence of the deceased relative |

| 3 | The applicant must have a package of documents with him. Among them is a vehicle assessment report. |

| 4 | Based on the report, the assignee must calculate the fee and pay it |

| 5 | The notary is contacted twice. The first time - an application for acceptance of the inheritance is submitted. The second time - the heirs are issued a corresponding certificate. |

| 6 | After receiving this document, you can contact the territorial traffic police department to register ownership of the car. |

Deadlines

The general period for accepting an inheritance is 6 months . The countdown of time begins from the day of death of the testator or from the moment the judicial act enters into legal force. For example, if a person was declared dead in court.

Cases of extension of time limits by force of law

| No. | Cases | Comments |

| 1 | Transfer of rights upon inheritance by law | If the heirs of the 1st degree refused to accept the property or were removed, then the next-degree relatives can assume their rights after them. For this, an additional period of 3 to 6 months is given (Article 1154 of the Civil Code of the Russian Federation). |

| 2 | Having a child conceived but not born | If the notary establishes this fact, then the issuance of the inheritance certificate is postponed until the birth of the baby. Since he is a potential heir of a deceased person. |

| 3 | Hereditary transmission | If one of the legal recipients died before entering into the inheritance. In such a situation, the rights to the property pass to his heirs. If the death occurs 3 months after the death of the testator, then the period for registering the inherited property is extended for another 3 months. |

Is it possible to enter into an inheritance before the expiration of the six-month period? Theoretically yes. However, in reality everything is not so simple.

The heirs must provide indisputable evidence of the absence of other claimants to the property. This is usually not possible. It is one thing to confirm the fact of death of other family members, and another to justify the absence of hypothetical successors. For example, children from a previous marriage

If the heir missed the deadlines for good reasons, then their extension is allowed only through a judicial procedure. To do this, the interested person will need to apply to the court.

The hearing of the case takes place as a special proceeding. For filing an application, a state fee of 300 rubles is withheld. The application must be accompanied by written evidence that confirms the facts stated in it (certificate from a medical institution or place of detention, travel documents).

Documentation

The following documents must be submitted to the notary office:

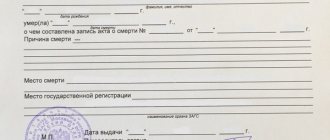

- death certificate of the testator;

- applicant's passport;

- papers confirming the degree of relationship;

- car registration certificate;

- registration certificate for the car;

- assessment report;

- receipt of payment of the fee;

- will (if any).

To order an assessment, heirs must prepare:

- death certificate;

- car documents;

- heir's passport.

How much does it cost, expenses

A state fee is charged for registering an inheritance.

Its size is:

- 0.3% - for mother, father, adoptive parent, son, daughter, brother and sister. The maximum collection amount is RUB 100,000.

- 0.6% for all other recipients. The maximum collection amount is RUB 1,000,000.

To calculate the amount of tax, the estimated value of the property is taken. It is calculated as of the day of death of the owner.

Minor heirs are exempt from paying state duty. Disabled people of groups 1 and 2 are entitled to a 50% discount. To obtain it, you must submit supporting documents to the notary.

You will have to pay extra for issuing a certificate of inheritance rights. The amount depends on the region of circulation and the type of inherited property. When inheriting a car, the recipient in Moscow will pay 500 - 3000 rubles.

You can check the maximum tariffs for your region on the website of the Federal Notary Chamber.

Additional expenses:

- conducting an assessment;

- registration of a car;

- change of numbers;

- car maintenance;

- annual payment of transport tax;

- registration of a compulsory motor liability insurance policy.

Car valuation

An appraisal of the vehicle is required to calculate the state duty when registering an inheritance. You can order it from a specialized organization by concluding an agreement.

The cost of services largely depends on the region and the condition of the car. The average price is 3000 rubles. If a truck is assessed, then the cost of services may increase by another 2000–1500 rubles.

Material costs

First of all, the applicant will have to pay for the services of an appraiser. Depending on the circumstances, the amount may be as follows:

- The average cost of an appraisal company's services is 1,500 rubles.

- If there are several heirs and the property is subject to shared division, then the amount increases to 2,000 rubles.

- A visit to inspect the car costs 1000 rubles.

An on-site inspection is necessary if the car does not start, has been in an accident, and cannot be delivered to the appraiser’s office. The additional payment for assessing the value of trucks is about 1,000 rubles.

These are only approximate amounts - the specific cost of services depends on the prices of the company, region and other circumstances.

State duty

The heir is required to pay the state fee before submitting documents to obtain a certificate. The amount of the mandatory contribution depends on the value of the car at the time of the death of the testator.

The final amount is also affected by the degree of relationship between the successor and the testator. The following options are possible here:

- a rate of 0.3% applies to the testator’s immediate family (maximum amount – 100 thousand rubles);

- other successors pay a contribution of 0.6% of the cost of the car (not more than a million rubles).

Civil liability insurance

A prerequisite for re-registration of a car is the purchase of an insurance policy. You will have to purchase compulsory motor liability insurance even if the car belonged to a close relative, and the heir was included in the previous insurance. You cannot reissue an insurance policy - you need to buy a new one.

The average cost of compulsory motor insurance is 3500-4000 rubles. The final amount depends on a number of variables, so for an accurate calculation it is better to use the calculator presented on the website of the specific insurance company src=»https://runasledstvo.ru/wp-content/uploads/2019/05/140161560917391.jpg» class=»aligncenter» width=”3752″ height=”2644″[/img]

Traffic police payments

Prices for traffic police services are determined at the legislative level and legalized by the Tax Code of the Russian Federation. When registering a car, the new owner will have to pay for the following:

- issuance of a new STS – 500 rubles;

- state duty for issuing PTS – 800 rubles;

- new numbers (you can keep the old ones) – 2000 rubles;

- entering data into an existing PTS – 350 rubles.

In most cases, the service of re-registration of a car with the traffic police costs 850 rubles. The driver pays 350 rubles for entering data into the PTS and another 500 for a new certificate.

Thus, the average cost of re-registration of a car (including notary services) is about 10 thousand rubles.

We contact the traffic police to register the car

After the notary has issued all the necessary papers, the heirs need to contact the State Inspectorate for Security Affairs. Registration of a car is usually carried out at the place of residence of the new owner. The vehicle will need to be presented to traffic police officers for inspection.

Registration period

Re-registration of a car to an heir takes from several hours to 5 working days. However, the necessary documents must be submitted within 10 days from the date of receipt of the certificate from the notary.

Documentation

The following documents must be submitted to the State Traffic Inspectorate:

- statement;

- applicant's passport;

- PTS;

- vehicle registration documents;

- notarial certificate;

- OSAGO policy;

- receipt of payment of the fee.

State duty

Expenses of the heir:

- The mandatory fee for registering a car with the traffic police is 5,000 rubles.

- If you need new license plates for your car, you will have to pay an additional 2,000 rubles.

- Car owners pay 350 rubles for making changes to the PTS.

- The basic insurance rate for a passenger car is RUB 3,432. (minimum TB value). However, taking into account other indicators (driving experience, presence of violations, region of residence, insurance conditions, engine power, number of drivers), the cost of insurance will cost from 3,000 to 12,000 rubles.

You can reduce costs by registering a car through the State Services portal. The discount amount is 30% of the payment amount. To take advantage of the preferences, you need to register on the website, fill out an application, make an appointment with the traffic police, pay the state fee and send the application. Then you will need to visit the State Traffic Inspectorate at the appointed time and obtain documents.

conclusions

You can re-register a car after the death of your father or another close relative within a month. To do this, you need to go through all the stages and pay the state fee.

There may be other expenses in the process, such as paying for notary services, paying for a car appraisal (for a passenger car this is approximately 2,000 rubles, for a truck - 3,500 rubles), paying state duty to the traffic police (500 rubles) and purchasing compulsory motor insurance (3,000 rubles).

This is the only way to legally re-register a car in your name.

How the car is divided, who will get the car if there are several heirs

It often happens that several people lay claim to the property of a deceased person. For example, upon the death of a husband, his assets may pass to the spouse and their children or the decedent's parents.

If everything is more or less clear with an apartment, then with a car the situation is somewhat different. Property is distributed in equal shares.

However, it is almost impossible to use such property. Therefore, the parties can refuse the inheritance by receiving appropriate compensation from the beneficiary or draw up an agreement between themselves. The agreement will determine the procedure for using the inheritance.

Such agreements are impractical for passenger cars, however, they are quite suitable for trucks. Heirs can also accept the property and subsequently sell it. The proceeds are divided equally between the co-owners of the vehicle.

Example. After the death of my father, the car remained. The estimated cost of the car is 285,000 rubles. Among the heirs of the 1st stage are a wife and 2 children (son and daughter). The property is not the joint property of the spouses, therefore it is divided equally between three relatives. However, the wife renounced her property rights in favor of her son. The distribution of shares is as follows: 1/3 for the daughter and 2/3 for the son. But, since they live separately, it is almost impossible to use a shared car. Therefore, the heir paid the cost of part of the inheritance to his sister. After which she also renounced her rights. As a result, the only claimant to the property was the testator's son.

If the heirs cannot agree among themselves on the right to use the property or the amount of compensation for a share in the inheritance, then any disputes are resolved in court.

Reasons

In order to become the legal recipient of an inheritance, it is necessary that three important grounds arise around the situation . Let's take a closer look at them.

- The most important reason for receiving a car as an inheritance is the death of the testator.

- The fact is that the car is not limited in its turnover. This means that the car must be able to participate in transactions, and cannot be limited in them.

- Entry into inheritance not by will, but by law - a person, in accordance with the law, is a first-line relative, and therefore has a claim to the property of the deceased.

Fines from the previous owner

Fines are an administrative type of obligation that is inextricably linked to a specific person. Consequently, the heirs should not be held responsible for the misdeeds of the testator.

If administrative proceedings have been opened against him, then they are subject to closure due to the death of the person (Article 31.7 of the Code of Administrative Offenses of the Russian Federation).

However, if fines and penalties are associated with car loans, then this type of debt passes to the heirs. The loan is repaid using the inheritance.

Taxation when selling a car

If the new owner does not plan to use the car, he can sell it. The only drawback is the need to pay a tax of 13%.

The purchase and sale agreement is concluded in the usual written form. The parties to the transaction do not have to contact a notary.

Sample car purchase and sale agreement

Heirs who are tax residents of the Russian Federation who have been using the property for more than 3 years are exempt from paying personal income tax. Otherwise, you can reduce the amount of income tax only through a property deduction or, if the car costs less than 250,000 rubles. Personal income tax is paid until July 15 of the following year. Tax return 3-NDFL is submitted no later than April 30.

Important! Non-resident heirs are not entitled to tax exemption.

If the new owner is in no hurry to register the car, then you will need to write an application to terminate the registration of the vehicle.