Why draw up a regulation on sending employees on business trips?

The regulation on business trips refers to the internal local acts of the employer, used along with other similar documents (regulations on remuneration, internal labor regulations, regulations on bonuses, wage indexation, etc.).

Read more about internal local acts on our website:

- “Internal labor regulations - sample 2020”;

- “Regulations on labor protection of workers - sample 2020.”

The form of this document is not approved by law and its content is not regulated. Each employer draws up such a provision taking into account its “travel” subtleties and features.

The regulations on business trips are intended to establish and consolidate many different factors: types of business trips (within Russia or outside its borders), the nature and amount of reimbursed travel expenses (only for travel and accommodation or another list), the transport used for trips and other features.

The development of such an internal document for tax accounting purposes allows you to fearlessly recognize various expenses as travel expenses and justify their amount in expenses when calculating income tax or simplified tax system.

There is no need to draw up a regulation on business trips if the employer does not send its employees on business trips and does not plan to do so.

ConsultantPlus experts explained how to develop and approve regulations on business trips. If you don't already have access to the system, get a free trial online.

How to approve a position

The approval procedure is simple:

- the developed text is agreed upon by the interested structural units of the organization;

- the text is analyzed by the accounting department in terms of compliance with the areas of activity;

- the text can also be studied by the institution’s lawyers;

- after receiving approval, the document should be sent to the manager for signature;

- approve the text agreed by the employer by order;

- familiarize all employees of the organization with the local act in writing.

What is considered a business trip and when the travel regulations do not apply

The 2021 regulation on business trips is based on the definition that is familiar to everyone and the basic conditions for recognizing an employee’s trip as a business trip.

IMPORTANT! Based on the definition given in Art. 166 of the Labor Code of the Russian Federation, a business trip is considered to be a trip by an employee to carry out an official assignment outside his workplace for a period established by the employer.

Since a person’s departure from the place of his permanent location is associated with additional expenses (for travel, accommodation, etc.), requiring special documentation and justification, and the recognition of travel expenses when calculating the tax base for profit or the simplified tax system depends on many factors (service focus, duration trips, etc.), the importance of the provisions on business trips can hardly be overestimated.

This document substantiates the amount of various expenses associated with the trip (from daily allowance to airfield taxes and baggage fees), and also describes the procedure for the actions of seconded employees (the scheme for obtaining funds for the trip, the composition of the required documents, working hours when traveling, etc.).

This provision may not be used in all cases. This document does not regulate the actions of company employees if their work is of a traveling nature, as well as when employees travel for their personal purposes.

Of particular importance when applying the travel regulations is the correct classification of the trip. You can recognize a departure as a business trip and legally use the position in the following cases:

- the trip is carried out for official purposes and by decision of management;

- the employee works for a certain period of time away from the locality in which his main workplace is located;

- An employment contract or a GPC agreement has been concluded with the traveling employee.

Is it possible to take into account travel expenses for income tax purposes for an employee with whom a GPC agreement has been concluded? Find out here.

What is a business trip

Let's figure out how this term is defined in the Labor Code of the Russian Federation. A business trip is a trip by a company employee to carry out an official assignment outside the permanent place of work (Part 1 of Article 166 of the Labor Code of the Russian Federation). Sending is carried out on the basis of an order from the employer with the issuance of a work assignment. If an employee holds a position that involves constantly performing work duties while away, this is not a business trip (it is traveling work). During the business trip, the employee retains his position, workplace, and salary.

An important condition of the provision is to secure the employee’s right to refuse a business trip

In the regulations on business trips, it would not be amiss to list all the cases when an employee has the right to refuse a business trip, and the situations when a ban on sending an employee on a business trip is imposed by law. This will allow employees to assert their legal rights and eliminate labor conflicts.

Thus, the Labor Code of the Russian Federation prohibits sending pregnant employees on business trips (Article 259), employees during the period of validity of the apprenticeship contract, if business trips are not related to apprenticeship (paragraph 3, Article 203), as well as minor employees of the company (Article 268). With regard to the last category of workers, the specified article of the Labor Code of the Russian Federation provides for nuances: business trips for minor creative workers are not prohibited according to the list approved by the Government of the Russian Federation (Resolution No. 252 dated April 28, 2007).

Another group of employees is allowed to refuse or agree to go on a work trip. In this case, they can express their will in writing. Among such employees (Article 259 of the Labor Code of the Russian Federation):

- women with children under 3 years of age;

- mothers and fathers raising children under 5 years of age alone;

- workers with disabled children;

- employees caring for sick members of their families in accordance with a medical report (Article 259 of the Labor Code of the Russian Federation).

The same choice is given to guardians and trustees of minors (Article 264 of the Labor Code of the Russian Federation).

For workers who do not fall into the above categories, refusal to go on a business trip means a high probability of receiving disciplinary punishment.

IMPORTANT! In accordance with Art. 192 of the Labor Code of the Russian Federation, an employee will commit a disciplinary act if he does not fulfill or performs his job duties poorly.

Thus, an employee’s refusal to go on a business trip is regarded as a violation of labor discipline, entailing disciplinary liability up to and including dismissal (Articles 192, 193 of the Labor Code of the Russian Federation). A clause in the employment contract stating that the employee cannot be sent on a business trip will help avoid this responsibility.

Read more about disciplinary offenses and their consequences in the material “Disciplinary offense under the Labor Code of the Russian Federation - concept and signs” .

Description in the position of the process of sending on a business trip

The Regulations on Business Travel for 2021 are based on the current version of the Regulation “On the Peculiarities of Sending Employees on Business Travel,” approved by Government Resolution No. 749 dated October 13, 2008.

According to this document, the fact of being sent on a business trip is determined by issuing an order from the employer. The basis for issuing an order is most often a memo from the head of the department. A sample business trip memo may look like this:

If a memo is used to send an employee on a business trip, the procedure for its creation and movement should also be reflected in the regulations on business trips.

The rules for drawing up a memo for a business trip, sample 2020, are not regulated in any way. It is mandatory for her to have a resolution from the employer.

For information on how to draw up the main document for sending an employee on a business trip, read the article “Unified Form No. T-9 - business trip order .

The requirement to obtain a travel certificate has been abolished since 2015. However, the presence of this document to a certain extent disciplines the posted employee, and in the absence of travel documents, it allows you to confirm the dates of your stay on a business trip. For this reason, most employers did not abandon the use of a travel certificate and left it among the mandatory internal documents.

For information on how it is drawn up, read the material “Unified Form No. T-10 - Form and Sample” .

Returning from a trip. Business trip memo: sample 2020

Since 2015, one more document has ceased to be used - a business trip report. Although this does not mean that an employee returning from a business trip will not have to report for the work done on the business trip. You will still have to issue the document at the end of your business trip, just in a different form and under a different name.

IMPORTANT! In accordance with clause 7 of Regulation No. 749, confirmation of the length of stay on a business trip and other nuances of the business trip can be a memo issued by the employee about the business trip. The 2020 sample is not normatively established for it, and the employer can develop it independently. At the same time, he has the right either to provide for all seconded employees, without exception, the obligation to draw up such a memo, or to reflect in the regulations on business trips certain cases of its execution (for example, a business trip on personal transport or the absence of travel cards and other documents confirming the duration of the business trip).

In addition to the memo, the employee returning from a trip will have to draw up a document that is mandatory for everyone - an advance report. A company can develop its own form for such a report or use the unified form AO-1.

For rules for filling out Form AO-1, see here .

To prepare an advance report and final payment for the travel payment issued in advance, 3 working days are given after returning from a business trip (clause 26 of Regulation No. 749). The report is accompanied by documents confirming all expenses incurred during the trip (accommodation, travel and other travel expenses).

Where are the memos for business trips in 2021?

As noted above, in some cases, confirmation of the length of stay on a business trip is a memo drawn up by the employee.

A sample memo for a business trip in 2021 can be downloaded here:

Please note that even with a memo in some cases (in the absence of travel documents, documents for the rental of residential premises or other documents confirming the conclusion of an agreement for the provision of hotel services at the place of business trip), it is impossible to confirm the duration of the business trip (paragraph 3, paragraph 7 of Resolution No. 749 ). Additionally, you need to put on a memo or other document confirmation from the receiving party about the actual length of the employee’s stay on the business trip. In this regard, the execution of a travel certificate becomes important and it is still advisable to provide for the execution of such a document in the regulations on business trips.

Decree of the Government of the Russian Federation of October 13, 2008 No. 749 “On the specifics of sending employees on business trips”

With changes and additions from:

March 25, May 14, 2013, October 16, December 29, 2014, July 29, 2015

In accordance with Article 166 of the Labor Code of the Russian Federation, the Government of the Russian Federation decides:

1. Approve the attached Regulations on the specifics of sending employees on business trips.

2. The Ministry of Labor and Social Protection of the Russian Federation must provide clarifications on issues related to the application of the Regulations approved by this resolution.

| Chairman of the Government of the Russian Federation | V. Putin |

Moscow

October 13, 2008

N 749

Regulations on the specifics of sending employees on business trips

1. These Regulations determine the specifics of the procedure for sending employees on business trips (hereinafter referred to as business trips) both on the territory of the Russian Federation and on the territory of foreign states.

2. Employees who have an employment relationship with the employer are sent on business trips.

3. For the purposes of these Regulations, the place of permanent work should be considered the location of the organization (a separate structural unit of the organization), the work in which is stipulated by the employment contract (hereinafter referred to as the sending organization).

Employees are sent on business trips based on a written decision of the employer for a certain period of time to fulfill an official assignment outside their place of permanent work. A trip by an employee sent on a business trip based on a written decision of the employer to a separate unit of the sending organization (representative office, branch) located outside the place of permanent work is also recognized as a business trip.

Business trips of employees whose permanent work is carried out on the road or has a traveling nature are not recognized as business trips.

4. The duration of the business trip is determined by the employer, taking into account the volume, complexity and other features of the official assignment.

The day of departure on a business trip is the date of departure of a train, plane, bus or other vehicle from the place of permanent work of the business traveler, and the day of arrival from a business trip is the date of arrival of the specified vehicle at the place of permanent work. When a vehicle is sent before 24 hours inclusive, the day of departure for a business trip is considered the current day, and from 00 hours and later - the next day.

If a station, pier or airport is located outside a populated area, the time required to travel to the station, pier or airport is taken into account.

The day the employee arrives at his place of permanent work is determined similarly.

The issue of an employee’s attendance at work on the day of departure on a business trip and on the day of arrival from a business trip is resolved by agreement with the employer.

5. Payment for an employee if he is involved in work on weekends or non-working holidays is made in accordance with the labor legislation of the Russian Federation.

6. Lost power.

7. The actual length of stay of an employee on a business trip is determined by travel documents presented by the employee upon returning from a business trip.

If an employee travels on the basis of a written decision of the employer to the place of business trip and (or) back to the place of work on official transport, on transport owned by the employee or owned by third parties (by power of attorney), the actual period of stay at the place of business trip is indicated in the official document. a note that is submitted by the employee upon returning from a business trip to the employer with the attachment of documents confirming the use of the specified transport for travel to the place of business and back (waybill, route sheet, invoices, receipts, cash receipts and other documents confirming the transport route).

In the absence of travel documents, the employee confirms the actual length of stay of the employee on a business trip with documents for renting residential premises at the place of business trip. When staying in a hotel, the specified period of stay is confirmed by a receipt (coupon) or other document confirming the conclusion of an agreement for the provision of hotel services at the place of business trip, containing information provided for by the Rules for the provision of hotel services in the Russian Federation, approved by the Decree of the Government of the Russian Federation of April 25, 1997. N 490 “On approval of the Rules for the provision of hotel services in the Russian Federation.”

In the absence of travel documents, documents for the rental of residential premises or other documents confirming the conclusion of an agreement for the provision of hotel services at the place of business trip, in order to confirm the actual period of stay at the place of business trip, the employee must submit a memo and (or) another document about the actual period of stay of the employee in business trip, containing confirmation of the party receiving the employee (organization or official) about the date of arrival (departure) of the employee to the place of business trip (from the place of business trip).

8. Lost power.

9. Average earnings for the period the employee is on a business trip, as well as for days on the road, including during a forced stopover, are retained for all days of work according to the schedule established by the sending organization.

During a business trip, an employee working part-time retains the average salary from the employer who sent him on a business trip. If such an employee is sent on a business trip simultaneously for his main job and work performed on a part-time basis, the average earnings are retained by both employers, and reimbursable expenses for the business trip are distributed between the sending employers by agreement between them.

10. When an employee is sent on a business trip, he is given a cash advance to pay for travel expenses and rental of living quarters and additional expenses associated with living outside his place of permanent residence (daily allowance).

11. Employees are reimbursed for travel and rental expenses, additional expenses associated with living outside their permanent place of residence (daily allowance), as well as other expenses incurred by the employee with the permission of the head of the organization.

The procedure and amount of reimbursement of expenses related to business trips are determined in accordance with the provisions of Article 168 of the Labor Code of the Russian Federation.

Additional expenses associated with living outside the place of residence (per diems) are reimbursed to the employee for each day of a business trip, including weekends and non-working holidays, as well as for days en route, including during a forced stopover, taking into account the provisions provided for in paragraph 18 of these Regulations.

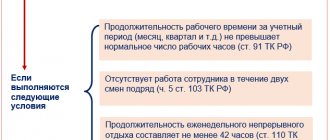

When traveling on business to an area from where the employee, based on transport conditions and the nature of the work performed on a business trip, has the opportunity to return daily to his place of permanent residence, daily allowances are not paid.

The question of the advisability of the daily return of an employee from a business trip to a place of permanent residence in each specific case is decided by the head of the organization, taking into account the distance, transport conditions, the nature of the task being performed, as well as the need to create conditions for the employee to rest.

If the employee, at the end of the working day, in agreement with the head of the organization, remains at the place of business trip, then the costs of renting accommodation, upon provision of the relevant documents, are reimbursed to the employee in the manner and amount provided for in paragraph two of this paragraph.

In the case of sending wages to an employee on a business trip, at his request, the costs of sending them are borne by the employer.

12. Expenses for travel to the place of business trip on the territory of the Russian Federation and back to the place of permanent work and for travel from one locality to another, if the employee is sent to several organizations located in different localities, include expenses for travel by public transport, respectively. station, pier, airport and from the station, pier, airport, if they are located outside the populated area, in the presence of documents (tickets) confirming these expenses, as well as payment for services for issuing travel documents and providing bedding on trains.

13. In the event of a forced stop along the way, the employee is reimbursed for the costs of renting living quarters, confirmed by relevant documents, in the manner and amount provided for in paragraph two of clause 11 of these Regulations.

14. Expenses for booking and hiring residential premises on the territory of the Russian Federation are reimbursed to employees (except for those cases when they are provided with free residential premises) in the manner and in the amounts provided for in paragraph two of clause 11 of these Regulations.

15. Lost power.

16. Payment and (or) reimbursement of employee expenses in foreign currency associated with a business trip outside the territory of the Russian Federation, including payment of an advance in foreign currency, as well as repayment of unspent advance in foreign currency issued to an employee in connection with a business trip, are carried out in accordance with Federal Law “On Currency Regulation and Currency Control”.

Payment of daily allowances to an employee in foreign currency when the employee is sent on a business trip outside the territory of the Russian Federation is carried out in the manner and amount provided for in paragraph two of clause 11 of these Regulations, taking into account the features provided for in clause 19 of these Regulations.

17. During the travel time of an employee sent on a business trip outside the territory of the Russian Federation, daily allowances are paid:

a) when traveling through the territory of the Russian Federation - in the manner and amounts provided for in paragraph two of clause 11 of these Regulations for business trips within the territory of the Russian Federation;

b) when traveling through the territory of a foreign state - in the manner and amounts provided for in paragraph two of clause 11 of these Regulations for business trips on the territory of foreign states.

18. When an employee travels from the territory of the Russian Federation, the date of crossing the state border of the Russian Federation is included in the days for which daily allowances are paid in foreign currency, and when traveling to the territory of the Russian Federation, the date of crossing the state border of the Russian Federation is included in the days for which daily allowances are paid in rubles .

The dates of crossing the state border of the Russian Federation when traveling from the territory of the Russian Federation and to the territory of the Russian Federation are determined by the marks of the border authorities in the passport.

When an employee is sent on a business trip to the territory of 2 or more foreign states, daily allowances for the day of crossing the border between states are paid in foreign currency according to the standards established for the state to which the employee is sent.

19. When sending an employee on a business trip to the territory of member states of the Commonwealth of Independent States, with which intergovernmental agreements have been concluded, on the basis of which border authorities do not make notes on crossing the state border in entry and exit documents, the date of crossing the state border of the Russian Federation is determined by travel cards documents (tickets).

In case of a forced delay in transit, daily allowances for the delay are paid according to the decision of the head of the organization upon presentation of documents confirming the fact of the forced delay.

20. An employee who went on a business trip to the territory of a foreign state and returned to the territory of the Russian Federation on the same day is paid daily allowances in foreign currency in the amount of 50 percent of the rate of expenses for the payment of daily allowances, determined in the manner provided for in paragraph two of clause 11 of these Regulations, for business trips to foreign countries.

21. Expenses for renting living quarters when sending employees on business trips to foreign countries, confirmed by relevant documents, are reimbursed in the manner and amount provided for in paragraph two of clause 11 of these Regulations.

22. Travel expenses when sending an employee on a business trip to the territory of foreign states are reimbursed to him in the manner prescribed by paragraph 12 of these Regulations when sending on a business trip within the territory of the Russian Federation.

23. An employee who is sent on a business trip to the territory of a foreign state is additionally compensated for:

a) costs for obtaining a foreign passport, visa and other travel documents;

b) mandatory consular and airfield fees;

c) fees for the right of entry or transit of motor transport;

d) expenses for obtaining compulsory medical insurance;

e) other obligatory payments and fees.

24. Reimbursement of other expenses related to business trips is carried out upon presentation of documents confirming these expenses, in the manner and amount provided for in paragraph two of paragraph 11 of these Regulations.

25. An employee, in the event of his temporary incapacity for work, certified in the prescribed manner, is reimbursed for the costs of renting a living quarters (except for cases when the posted worker is undergoing hospital treatment) and is paid daily allowances for the entire time until he is unable to begin work due to health reasons. fulfill the official assignment assigned to him or return to his place of permanent residence.

During the period of temporary disability, the employee is paid temporary disability benefits in accordance with the legislation of the Russian Federation.

26. Upon returning from a business trip, the employee is obliged to submit to the employer within 3 working days:

an advance report on the amounts spent in connection with the business trip and make a final payment for the cash advance for travel expenses issued to him before leaving for the business trip. Attached to the advance report are documents on the rental of accommodation, actual travel expenses (including payment for services for issuing travel documents and providing bedding on trains) and other expenses associated with the business trip;

paragraph three is no longer valid.

- Back

- Forward

We list in the regulations documents confirming expenses

Fare

An employee's travel within the territory of our country or abroad, associated with the performance of official assignments, is always associated with additional costs. If you are planning a business trip around Russia, the initial costs of the employer when sending an employee on a business trip will be the cost of travel to the destination (for business trips abroad, costs begin with issuing visas, international passports, etc. - we’ll talk about this separately).

Modern methods of moving in space are quite diverse: trains, planes, buses, taxis. In addition, an employee’s personal car or a rented vehicle can serve as a business trip vehicle.

With the usual travel documents, everything is extremely simple: their originals are attached to the advance report, and the cost of travel is easily included in tax expenses. However, modern realities make adjustments to this understandable and familiar procedure for accounting for travel expenses.

The rapid introduction of electronic documents into our lives gives rise to disagreements between taxpayers and tax inspectors regarding the recognition on their basis of expenses for the movement of employees on business trips.

Explanations from officials can help with this. For example, the letter of the Ministry of Finance dated December 4, 2019 No. 03-03-07/94225 states that to document travel expenses when purchasing an air ticket in book-entry form (electronic ticket), a boarding pass and a printed baggage receipt (itinerary receipt) are sufficient. The coupon will confirm the travel of the business traveler on the route specified in the electronic ticket, and the cost of the flight will be justified by the route receipt. But a bank statement for the card that paid for the ticket is not required (see letter from the Ministry of Finance dated August 17, 2018 No. 03-03-07/58432).

In letters dated 09.24.2019 No. 03-03-07/73187, dated 09.23.2019 No. 03-03-06/1/72906, the Ministry of Finance notes that in the absence of a boarding pass with an inspection stamp, expenses can be confirmed by a carrier’s certificate or other documents , including indirectly confirming the fact of use of purchased air tickets.

See also: “Can the penalty for returning a ticket be taken into account?”

Living expenses

The algorithm for reimbursement of living expenses should also be reflected in the regulations on business trips (Article 168 of the Labor Code of the Russian Federation, paragraphs 11, 13, 14, 21 of Regulation No. 749). This is of no small importance for the recognition of tax expenses taken into account when calculating income tax or the simplified tax system: this possibility arises only if supporting documents are available (clause 1 of Article 252, subclause 12 of clause 1 of Article 264 of the Tax Code of the Russian Federation, letter from the Ministry of Finance Russia dated 03.03.2015 No. 03-03-07/11015).

For the employee himself, the issue of compensation for living expenses during a business trip is also not indifferent: the compensation he receives for unconfirmed expenses in amounts exceeding the established norms is subject to personal income tax (paragraph 10, paragraph 3, article 217, article 210 of the Tax Code of the Russian Federation).

Options for an employee’s accommodation at the place where work assignments are carried out are no less varied than the types of transport used for business trips. The easiest way to document expenses is to stay in a hotel.

In this case, it is enough to submit to the employer’s accounting department a strict reporting form from the hotel (it must comply with the requirements of the legislation on cash register systems) or a cash register receipt.

Are “unfortunate” contributions subject to compensation for paying a hotel for washing and ironing services for an employee’s personal belongings? The answer to this question is in ConsultantPlus. Study the material by getting free trial access to the system.

If an employer rents housing for a business trip employee and incurs expenses to pay the rent, such expenses can only be recognized for the days the employee actually resides there (letter of the Ministry of Finance of Russia dated March 25, 2010 No. 03-03-06/1/178, Federal Tax Service of Russia for the city of Moscow dated April 16, 2010 No. 16-15/ [email protected] ).

To learn about accounting for rental travel expenses, read the article “How to recognize apartment rental expenses for business travelers in tax accounting?” .

Reimbursement of travel expenses

5.1. The expenses that the employer reimburses to an employee sent on a business trip include:

- travel expenses;

- expenses for renting residential premises;

- additional expenses associated with living outside the place of permanent residence (per diem);

- other expenses incurred by the employee with the permission or knowledge of the employer.

5.2. Travel expenses to the place of business trip and back to the place of permanent work (including insurance payments for compulsory insurance of passengers in transport, payment for services for issuing travel documents, expenses for the use of bedding on trains, luggage transportation) are reimbursed in the amount of actual expenses confirmed by primary travel cards documents, but not more than the cost of travel: