About the bonus regulations

The regulation on bonuses for employees is a standard put into effect by management order, which defines the main measures to stimulate and motivate people working at the enterprise in order to increase the efficiency of the enterprise.

This document allows you to adapt the existing rules provided for by law to certain operating conditions of the enterprise, as well as resolve conflict situations that arise regarding the appointment and payment of bonuses.

The importance of this act also lies in the fact that it allows us to confirm the economic justification of the company’s expenses incurred in this area.

Many competent authorities that come to inspect enterprises often ask for this document to verify the correctness of taxation and inclusion in the expense base.

The regulation on bonuses defines those situations and indicators, the achievement of which allows the employee to pay bonuses both for performance efficiency and compliance with labor discipline. And if a dispute arises regarding the legality of assigning or not assigning bonuses, then, guided by these Regulations, you can resolve the issue and protect the interests of the company.

Since the company employs a significant number of employees, it is quite labor-intensive to consider such conditions in their employment contracts. It is best to create a standard and refer to it when concluding contracts. This will also make it possible to streamline incentive measures.

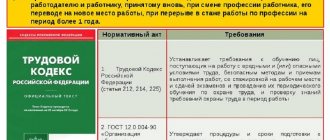

When creating a provision on bonuses for employees, we must remember the main thing. Its norms should not contradict labor legislation and impair the rights of employees.

Attention! At small enterprises, a separate similar local regulatory act may not exist; its norms may be regulated by another document, such as the Regulations on the remuneration of employees.

How to process bonus payments

Regular payments must be prescribed in internal regulations and provided for in the remuneration system. To accrue them, the manager does not need to make a separate decision on issuing bonuses. All conditions and criteria are specified in the regulations on financial incentives.

An unplanned or one-time cash payment is initiated by a memo from the immediate superior addressed to the general director, which indicates the reason or reason that served as the basis for paying the bonus to the employee.

Article 191 of the Labor Code of the Russian Federation gives the employer the right to monetary remuneration for the team, but the development of a bonus system at the enterprise is not mandatory.

What should a bonus clause contain?

The regulation on bonus payments to employees does not have a strictly defined form. Each subject develops it in accordance with existing needs, so it may include various issues regarding stimulation and motivation of work in the enterprise.

General information

This section should indicate the main goals and objectives of the document.

In a large company consisting of many divisions, regulations can be drawn up both for each division and for groups that have the same types of bonuses.

You also need to determine what types of employees the document applies to - full-time, part-time, all, etc. This will serve as justification for the expenses incurred.

You might be interested in:

Local regulations of the organization: what are they, list of basic documents

Types of bonuses and grounds for payment

In this section you need to list all types of bonuses that can be assigned at the enterprise, as well as the indicators for which they are paid. This section must be formatted in such a way that it is immediately clear what bonus will be awarded to the employee and for what.

It is allowed to include in the section bonuses that the company will pay from its own profits. They can be assigned, for example, when certain holidays occur.

The criteria for assigning a bonus can be set either single or multiple. In the latter case, a bonus can be awarded only if all of them are met.

Attention! If the organization pays only one type of bonus, then in this section you can also indicate the procedure for calculating it. However, a better step would be to put this in a separate section.

Calculation and approval of the bonus amount

Such a section must be included in the document for each type of bonus that is accrued at the enterprise.

First you need to identify the circle of people who can qualify for this type of award. It also outlines the process for paying this type of bonus to individuals who have either left the company or have just joined the workforce.

The next step is to define the conditions under which the employee will receive a bonus. All types of violations are listed separately, if detected, the size of the bonus may be reduced, or the employee may be deprived of payment altogether.

These include:

- Penalties or reprimands due to violation of discipline;

- Incomplete fulfillment or non-fulfillment of duties specified in the employee’s job description;

- Violations of established labor protection rules, safety regulations, fire safety, internal regulations, etc.

- Failure to show up for work, absence from work for more than 3 hours, appearing under the influence of alcohol or drugs;

- Loss or damage to property owned by the company.

The amount of the bonus paid can be set either in strict monetary terms (for example, 3,500 rubles) or as a percentage (for example, 25% of the salary). If the regulations establish a percentage of the bonus, then the employer has no right to pay it below the established percentage.

The law does not establish the possibility of depriving an employee of a bonus, either fully or partially. The amount of payment can be reduced only if the employee has committed any offense for which a reduction in the bonus is indicated. This means that when drawing up this document, it is necessary to clearly state by what amount the premium is reduced if a certain violation is committed.

The premium can only be reduced in the same period in which the corresponding violation was detected. It is prohibited to transfer punishment to subsequent periods.

If it is not possible to clearly determine the size of the premium based on a quantitative indicator, then you can specify its upper and lower limits. In this case, the head of the department will independently determine the amount of the bonus for the employee in this range, guided by the results shown by him.

In the description of the procedure for assigning a bonus, it is also necessary to indicate in detail the methodology by which it will be calculated. It is also necessary to determine which of the officials decides whether to assign a bonus or not, as well as how exactly the amount of the bonus for each employee is communicated to the payroll manager.

Attention! Another important point in this section is how often this type of bonus is paid. This could be an appointment every month, quarterly, once a year, etc. You also need to indicate the period within which the decision on paying bonuses to employees must be made.

Final provisions

This section must indicate the manner in which this document is to be implemented. The period during which it is valid is indicated next to it.

The date from which the provision comes into effect must be recorded in the provision or in the order by which it was put into effect. If the validity period of a provision is not specified, it is considered to be of unlimited duration.

What is deprivation of bonuses: grounds and conditions

There is an opposite function regarding the promotion of employees - this is the reduction of bonuses for employees. It is used, as a rule, in exceptional cases.

It involves complete or partial non-payment of bonuses that were initially established by regulation. Deprivation of bonuses applies only to systematic payment of bonuses.

If the award is of a one-time nature, then it may simply not be paid and there is no need to develop special documents for this. In this case, the employee did not earn a one-time bonus and, accordingly, did not receive a sum of money.

Demotion of bonuses to employees is carried out on the basis of a document developed by the enterprise. That is, there is a provision on the payment of bonuses and the reduction of bonuses to employees. The accrual and deprivation of bonuses is made on the basis of documents. The procedure for depreciation is determined by the employer. For what reason can an employee be deprived of a bonus?

Several criteria for deprivation:

- disruption of planned events without reason;

- violation of work and rest regulations, for example, absenteeism, late return from lunch or breaks, as well as showing up to work in a state of intoxication;

- a fact for disciplinary action has been found, for example, violation of labor protection and safety requirements in the workplace; untimely notification to the manager about a detected violation, injury to an employee and other information;

- disclosure of classified information and confidential information;

- false information to the manager;

- other information determined by the regulations;

- if at least one of the listed cases occurs, this ultimately leads to a management decision to deprive bonus payments;

- If an employee fails to comply with labor regulations (it doesn’t matter whether it happened once or there were several violations), the manager has the right to punish the latter by depriving him of bonus payments.

Procedure for approval and amendment of regulations

The regulation on bonuses for employees does not apply to mandatory documents. However, when using it, the interests of all employees of the company are affected, and therefore it is necessary to follow the established procedure for its implementation.

Initially, the draft of the newly created normative act must be sent to the trade union body for its approval. The latter can accept it, or formalize an act of disagreement, and then the parties must come to a common opinion through negotiations.

If a trade union has not been formed, then this step is omitted.

You can put a document into effect in one of the following ways:

- By affixing the stamp “I approve” on the cover of the local act with a transcript of information about the person who performed this action;

- Issuing an order approving the regulations on bonus payments to employees. A separate order is issued for the enterprise approving the bonus regulations, which puts the regulation into effect. The details of this order must be indicated on the position.

How to correctly draw up an order to approve a position

Important! After the document is accepted, its contents must be communicated to the company’s employees. They must familiarize themselves with it, and then sign either in the journal intended for this purpose or on the familiarization sheet.

If there is a need to make changes to the regulation, the responsible employee must communicate this in a report or memo. Based on it, the manager must form a working group or appoint a responsible person who will draw up a new document.

Possible improvement of the scheme

- Eliminating possible subjectivism is where we need to start.

The solution to the problem is to form a working group that will reflect on improving the bonus system. - Most bonus systems require employee differentiation. The working group should first address this division.

- Each category is assigned an area of responsibility for a certain indicator - costs, profit or something else.

- Bonus criteria are prescribed for him using a point assessment of personnel achievements, percentages of fulfillment of standards, etc. At this stage, it is important to take into account the results of the previous analysis.

- Compare all options for sets of changes in the scheme, check the feasibility of their implementation and appropriateness within the specifics of the company.

- Record the chosen option in all necessary papers and inform the company staff about the innovations.

Due to the abundance of subtleties that have to be taken into account, it may seem that the bonus system is a difficult, restive horse to control, which, if you loosen control a little, turns into losses, but this is the case only on paper.

Of course, no one has canceled attentiveness and common sense, but a good leader has such qualities in themselves, which means that control over the bonus system is no more difficult than any other management.

More attention - and in the hands of the manager there is a means that can increase the efficiency of the enterprise so much that the costs of bonuses will be quite insignificant , but, due to stimulating additional payments and allowances, the interests of the employer and subordinate will be satisfied.

Procedure for making changes to the regulations

The law does not establish how an employer must make changes to existing regulations. If the company has a trade union body, then such actions must be coordinated with it. Otherwise, you can issue a separate document with a list of changes, or adopt the provision in a new version.

The process for accepting changes must be the same as the way the original document was implemented. If the provision on bonuses for employees was put into effect by order, then to introduce changes it is also necessary to draw up an order. If the acceptance was made by affixing the stamp “Approved”, then the changes must be done in the same way.

The law establishes that the employer is obliged to familiarize all employees with any internal act against signature. Exactly the same action must be performed when accepting changes - each employee must read it and sign it.

Development of a structure of material incentives in the organization

An example of a bonus system at an enterprise:

What problems does it solve?

The developed bonus system is primarily:

- employee motivation;

- reducing staff turnover;

- establishing labor discipline in the team.

As a result of these actions, the main purpose of bonuses is to improve the quantitative and qualitative indicators of work activity. But the strategic priority when organizing staff bonuses should ensure that the employee’s bonus depends on the benefits received by the employer.

Participants

For development, it is necessary to determine the personnel groups and who is included in them. The company's employees are divided into categories:

- top managers;

- middle management;

- departments;

- structural units;

- production sites;

- certain positions;

- all employees.

Criteria

Each organization must determine for itself what bonuses are and what criteria to choose for remunerating employees, departments and managers. The main indicators for calculating the bonus are as follows:

- Fulfillment or overfulfillment of a specific work plan.

- No violations of PVTR.

- No manufacturing defects.

- Proper performance of official duties.

- Reducing the organization's costs.

- Absence of disciplinary sanctions for a certain period of time.

- The efficiency of the entire department.

How often are bonuses paid?

The legislation does not approve the organization of bonuses at the enterprise and the frequency of payment of bonuses. Each company fixes by local internal act when and for what bonuses will be paid.

Amount of bonus payments

The amount of monetary remuneration is set as a percentage of the salary or a fixed amount of payments is indicated.

Performance check

Six months later, the results of work before and after the introduction of the reward system are compared. If a company's income from the activities of motivated personnel exceeds the amount of costs for bonuses, the bonus system for employees of the enterprise is effective.