Financial assistance is considered to be cash or in-kind payments made by an employer to its employees who find themselves in a difficult financial or emergency situation. Although the employer has no obligation to pay financial assistance. He helps his employees of his own free will if funds are available. To establish a unified procedure for receiving financial assistance, the employer can approve the provision on the payment of financial assistance or prescribe the rules and conditions for receiving it in another local act. In this article we talk about the provision on financial assistance to employees and provide a sample of 2021 for ordinary organizations (IP) .

Contents of the Regulations on financial assistance

The employer, represented by the manager or members of a specially created commission, in each specific case decides to pay the employee financial assistance.

What is financial assistance and in what cases it can be issued, read the article “Material assistance”.

Due to the fact that is not established there is no mandatory completion of the Regulations on financial assistance (hereinafter referred to as the Regulations) . Each employer independently develops the structure and content of the Regulations.

If at the moment you don’t have such a document yet and you’re just wondering where to start, then let’s figure it out together. If you have already developed a Regulation on financial assistance, then it would be a good idea to check whether all the nuances have been taken into account.

So, the Regulations should indicate a list of cases in which an employee will be able to receive financial support:

- firstly, this will get rid of unnecessary statements from the series “I took out a mortgage, I ask you to provide financial assistance”;

- secondly, social guarantees will be created for workers who will be able to seek help from the employer in a certain situation.

It so happens that many companies provide financial assistance for the funeral of a close relative or employee, or to pay off damage due to a natural disaster or other emergency situation. There are also positive aspects in which the employer tries to support his employee during a joyful period for him. This is the birth of a child, marriage, anniversary. Also, financial assistance can be provided for treatment, in connection with retirement, and for improving living conditions. It all depends on:

- financial capacity of the company;

- its social orientation.

Some employers provide financial assistance for vacations, for health improvement in a sanatorium, for parents of first-graders and school graduates, for children's gifts for the New Year, and so on. All available to you must be thought through and indicated in the Regulations.

We also recommend that you indicate in the Regulations a list of documents that are needed to receive assistance. This list will save time on explaining to employees what documents they need to attach to the application for financial assistance. These may be copies of the following documents:

- birth (adoption) certificate of children;

- certificate of death or declaration of death;

- extracts from the medical history;

- certificate from the Ministry of Emergency Situations about the emergency situation;

- registry office marriage certificate, etc.

When required and what is provided

Financial assistance is a one-time payment of funds that is not related to the employee’s performance of official duties and does not depend on the quality or quantity of work performed by him. It does not apply to incentive payments and does not compensate the employee for difficult working conditions or overtime, night work, etc.

It is important to remember that payment of financial assistance is the right of a budgetary organization, and not its obligation. And the size of the amount depends on financial capabilities.

The procedure and conditions for financial support can be established in a local regulatory act: regulations on wages or regulations on financial assistance to employees.

It is also possible to additionally prescribe provisions for financial assistance to the trade union organization, if necessary. The requirements for it do not differ from the case described in the article.

Basic provisions

In addition to the sections listed above, the Regulations should include a clause on limitation of payments. This is necessary if the employer wishes to limit the frequency of payments. For example, you can indicate that financial assistance is provided no more than once a year for each reason.

Also, no one forbids to indicate in the Regulations that financial support is provided only to employees who have worked for more than 1 year in the company. That is, it is possible to provide for a minimum length of service to qualify for assistance.

We also consider it important to indicate in the Regulations the amount of financial assistance for each basis or for all reasons in general. This may be a specific payment size or a so-called “fork” - for example, “from 5,000 to 10,000 rubles.”

The actual amount of financial assistance to a specific employee in a specific life situation is indicated in the order of the manager.

For transparency of financial assistance payments, we recommend that the Regulations indicate a fixed amount of financial assistance. Or do this at least for basic types of assistance. For example, at the birth of a child - 5,000 rubles, for a wedding - 8,000 rubles, for a funeral - 10,000 rubles, etc. This will reduce the influence of the human factor when deciding on the payment of financial support.

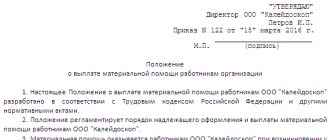

The regulations are approved by order of the head. The manager can also put the visa in the upper right corner of the Regulations in the “I approve” column.

Financial assistance in the regulations on wages at the enterprise

It is possible not to create a separate document, but to register such a section in the regulations on remuneration.

This document must be presented to all employees of the organization under the personal signature.

Supporting a person who finds himself in a difficult situation is a noble act, regardless of who provides it - an ordinary person or an organization. Organizations carry out such an action in the form of material assistance. But unfortunately, providing assistance from an enterprise, if not properly executed, can bring losses to the benefactor and even penalties from the Federal Tax Service.

What is financial assistance, who is entitled to it, what conditions are required, the amount of assistance, is it subject to taxes? How to get financial assistance at work? The information below will help answer these questions.

Material assistance, by definition, is support in material or monetary form that is provided by various enterprises and organizations to employees in need and their close relatives. This is one of the types of social guarantees that an employer provides to an employee.

The law regulating the standards for payments of material assistance is the Labor Code of the Russian Federation. Funds for its provision may have different sources of origin.

If funding is allocated from the budget of the country (region), then it is federal, regional assistance; if it is provided by an enterprise, it is production assistance.

The assignment of financial assistance is carried out both to one employee and to different employees. This happens at different intervals:

- at one time;

- repeatedly throughout the calendar year.

Financial assistance is paid to support an employee in financially difficult, unforeseen circumstances. It is not the result of work, a reward for conscientious work or professional excellence.

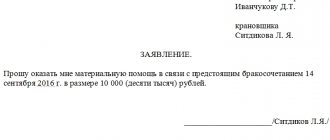

A prerequisite for assigning financial support is justification - an order approved by the company's management in accordance with the accepted procedure. To determine such a procedure, a special act is created - the Regulations on Financial Assistance to Employees - a sample of it is given below. Official name: Regulations on the provision of financial assistance to employees. It sets out clear reasons and conditions underlying such support with a designated amount in certain circumstances: payment of financial assistance in connection with the death of a close relative, the birth of a child, additional payment for the next vacation, for training, treatment and other situations.

There is no strict procedure regulated by law in the development of this Regulation, however, the requirements of the Labor Code of the Russian Federation must be observed, in particular, Article 8. And also Article 372, which provides for the coordination of the contents of this document with the body representing the interests of the employees of the enterprise (trade union).

The algorithm for developing the Regulations looks like this:

- Issuing an order from the manager to create a draft Regulation.

- Development of this project.

- Coordination of the draft Regulations with the trade union (other representative body).

- Approval of the agreed act and its entry into force.

- Written familiarization of employees with the approved Regulations.

There is an option to regulate the provision of material support, not necessarily by a similar adopted act, but also by the Regulations on the remuneration of workers, to which the corresponding clauses are added. Thus, the employer can allocate funds to finance assistance from the wage fund . Also, for such payments, management uses the profits of the enterprise.

Sample provision on financial assistance

Our specialists have prepared for you an example of the Regulations on the payment of financial assistance (sample), which you can read at the link.

This Regulation is given as an example. It can be easily modified and used in your situation. We tried to take into account all the main points.

Do not forget that financial assistance can be given not only in money, but also in property .

Some companies introduce a separate section describing the conditions for receiving financial assistance in the Regulations on Remuneration . It is not prohibited . The most important thing is that the document reflects the main points and conditions for receiving assistance, as well as the amount or maximum payments.

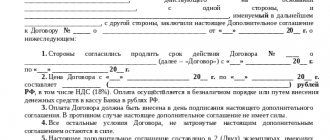

How to draw up an order for financial assistance

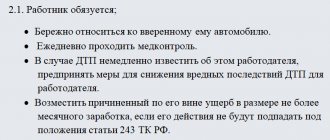

The provision of material support to the employee is implemented after the issuance of the order. The order, of course, must be drawn up legally competently, taking into account the legal framework, adhering to the legislation of the Russian Federation. Directly, the norms of the Labor Code of the Russian Federation do not provide for requirements for the execution of this order; the right to draw it up remains with the management of the enterprise.

When issuing an order, the personnel service must rely on the Regulations approved by the management of the enterprise, since it clearly defines the procedure for its appointment and payments. To prepare an order, you do not need to resort to a single form. It is drawn up in any form indicating the list of documentation that formed the basis for the decision:

- Regulations on the provision of financial assistance to employees of the enterprise;

- written request from the employee;

- a document to confirm the fact of the event;

- decision of the commission (agreed with the head) on the relevant issue.

This documentation is not mandatory, but its presence is desirable, since the payment of taxes and contributions depends on the calculation of financial assistance. Therefore, adherence to order and the availability of documentation will ensure the correct approach to the payment of financial assistance to an employee.

Each enterprise issues orders based on its own practice. The template for issuing orders is usually standard, so it makes sense to create this order similarly to similar ones.

In certain situations, payment of financial assistance may not take place immediately, but in several stages. Then the order should indicate its total amount, as well as the size and timing of each payment.

If assistance will be provided in material form, for example, in the form of food, medicine, household goods and other things, their list and quantity must be displayed in the order indicating their valuation, which is confirmed by documents.

Financial assistance for vacation

There is no such type of payment established by law for private businesses . However, an employer can in this way encourage an employee who takes a vacation of 14 days or more . They do this once a year.

If the company provides additional financial assistance for vacation, be sure to specify the conditions for receiving it in the Regulations. For example, the condition for receipt is a signed order for the next annual leave for a period of 14 calendar days or more. This type of payment is considered an element of remuneration with the accrual of appropriate taxes.

You can find out what taxes are imposed on financial assistance in the article “How and by what is financial assistance taxed.”

Financial assistance in kind

When a person has a misfortune, he will be glad to receive any help, including provided clothing and basic necessities.

In accordance with the letter of the Ministry of Finance of Russia dated August 24, 2012 No. 03-03-06/4/87, the transfer of essential items (clothing, etc.) to employees and members of their families in connection with an emergency or natural disaster is recognized as material assistance issued in kind.

Also, financial assistance can be provided with expensive medications that the employee cannot buy himself. This is also a natural form of help.

In some companies, it is customary to provide financial assistance in kind. Let's give examples.

EXAMPLES

Parents of a future first-grader are given stationery (notebooks, albums, pencils, paints, colored paper, etc.) packed in a briefcase. On the one hand, the company has the opportunity to purchase school stationery at wholesale prices, and on the other hand, the parents of a first-grader are relieved of the headache of getting him ready for first grade. For sponsored war and combat veterans, the company can provide targeted financial assistance in the form of food packages. This type of support eliminates the need for the veteran or his family members to purchase food.

Also, some companies provide financial assistance in the form of issuing certificates and cards for the purchase of goods or services in stores. For example, newlyweds are given a certificate for purchasing a photo shoot or ordering another service.

When creating the Regulations, you can specify the following assistance options.