From January 1, 2021, tax authorities will begin to check payroll calculations. This will be done as part of the fight against gray wages and envelopes with cash. We thought about this topic for a long time, but could not develop a single algorithm. But from January 1, 2021, the situation changes - tax authorities will check the size of workers’ salaries and compare them with the minimum wage. But how will they do this? Let's talk about it.

Also see

- Minimum wage in 2021: table by region;

- How to increase your salary to the new minimum wage.

The average industry salary according to qualifiers in 2019

If your employees receive wages below the industry average, the tax authorities may require written explanations.

We have provided a sample of explanations to the tax office about the reasons for low wages (below the industry average) below. If explanations are not sent, tax authorities may charge additional personal income tax on the difference between real wages and the industry average. They will assume that you are giving out salaries in envelopes.

We received comprehensive explanations from the FSS Professional Risk Insurance Department. The Federal Tax Service has edited the control ratios of VAT declaration indicators. This is due to the entry into force of the order amending the VAT reporting form.

If your employees receive wages below the industry average, the tax authorities may require written explanations.

This is due to the entry into force of the order amending the VAT reporting form. Rosstat named the average salary in Russia in July 2021. Also in the report published on the Rosstat website, it is noted that real salaries of Russians in July increased by 4.6%, and real disposable income decreased by 0.9% (in annual terms, however, since the beginning of the year they have decreased by 1.4%).

Actions of the taxpayer at the salary commission

Based on the fact that tax authorities have repeatedly heard standard phrases in conversations with directors, it is important to convince them that making a profit is a fundamental aspect of the company’s activities, but not bypassing the payment of taxes. Below are the main arguments for a small salary:

- work on a flexible schedule. A good explanation for the tax authority is to pay small wages to part-time freelancers;

- employment of young personnel. It is considered quite normal to hire students and young people with no work experience for positions with a small salary. Rare employers provide this opportunity. You can also show the inspector the personnel documents of employees who worked previously to gain experience, but have now been transferred to a decent salary;

- part-time job. If the company employs an employee whose job responsibilities are not directly related to the company’s activities, he can work part-time and manage to perform the functions assigned to him;

- low salaries for managers and top employees. This can be justified by the payment of bonuses and increased earnings in the future.

It is best to attach all sorts of documents to management’s words: schedules, business plan, calculations and reporting, consultations and research from the HR department. These papers will help highlight that the company is working according to its business plan, and there is no goal of paying low salaries to the staff all the time. As soon as the revenue reaches the planned targets, the earnings of subordinates will be revised and increased. The inspector, according to the director, gives him a protocol for signing. The management’s task, before signing it, is to carefully study the specified information and the absence of phrases that contradict the taxpayer’s business data. The protocol should not contain the inspector’s conjectures or any untrue facts that are not related to the company’s activities, since after signing the protocol it can result in the accrual of considerable fines.

Salary by type of economic activity 2021

Industry average salary by type of OKVED for 2021 The selection of OKVED codes when filling out an application for registration of an individual entrepreneur or LLC may seem like a real stumbling block to the applicant.

Some professional registrars even list this service as a separate line in their price list. In fact, the selection of OKVED codes should be given a very modest place in the list of actions of a novice businessman. If difficulties with selecting codes still arise, then you can get a free consultation on OKVED, but for a complete picture, including familiarization with the risks associated with choosing codes, we recommend that you read this article to the end.

OKVED codes for 2021 with decoding and classifier (official website): detailed instructions for each code, how to find the desired OKVED code, new OKVED 2 classifier for 2019.

ipc-zvezda.ru Online magazine for land tax accountants.

As for personal income tax and insurance premiums, they are subject to quarterly monitoring by the commission for legalization of the base.

Real income of the population

It follows from the Rosstat report that, contrary to the government’s expectations, the past year was the 5th year in terms of continuous decline in the population’s true income. As social policy experts note, there is nothing unusual about this dynamic. Since GDP growth is moderate, there are no economic breakthroughs, and wage growth, according to experts, is no higher than 3 percent.

Even if the cost of products and services grows, this should not happen at such a rapid pace when household incomes do not keep up with expenses. At this stage this is not observed, the economy is also not trending upward. Therefore, there is no point in talking about stable growth in real incomes of the population yet.

Industry average salary in 2021 according to Okved in Tula

What arguments can the company make in its defense? 10/07/2009 “Economy and Life” Anna Eganova, lawyer at First House of Consulting “What to do Consult” SITUATION We received on September 2, 2009

a letter from the Federal Tax Service notifying that by type of activity our organization (LLC) is obliged to pay wages to employees of at least 22,934 rubles. In addition, the letter contained an invitation to a meeting of the commission for monitoring the activities of enterprises and organizations regarding the remuneration of workers. Average salaries in Moscow The minimum wage is the minimum wage.

In Russia there is a general minimum wage, as well as regional and Moscow-specific minimum wages. Minimum wage in Moscow But it is worth remembering that if the employer has submitted a reasoned refusal to apply the minimum wage to the Labor Inspectorate, then he has the right to pay his employees such salary as he sees fit.

The accountant must take into account that the replacement must necessarily lead to an increase in the amount of the benefit. This code will be entered into the Unified State Register of Legal Entities or Unified State Register of Individual Entrepreneurs. Using it, all interested government services will determine what kind of activity you are conducting.

Namely, the amount of remuneration of an individual employee actually depends on these specific conditions and factors.

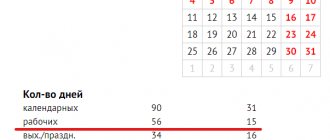

The calculation of the average monthly wage is based on data provided by organizations: the wage fund is divided by the average number of employees, as well as by the number of calendar months.

Average salary level by type of economic activity in Moscow in 2021

Clarifications on planning issues December 12, 2021 21:45 44-FZ

- “Methodology for calculating the NMCC for the supply of certain types of medical devices” Approval of the Methodology for calculating the initial (maximum) contract price for the supply of certain types of medical products October 31, 2021 21:28 44-FZ

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10

- 11

Information on the conduct of routine maintenance From 22-00 on December 22 to 10-00 on December 23, 2021

Conclusions This type of business, such as organizing children's entertainment complexes, is seasonal. A noticeable decline occurs during the summer holidays.

Almost all revenue in these months will go to rent payments and wages of employees.

It should be taken into account that such data is given in “pure” form without deduction of taxes. That is, the amount received by the employee in hand will be slightly lower.

After all deductions, it will be 57,900 rubles without taxes.

The average salary in the capital of our state is 85% higher than the average salary in all other regions of the country.

Salary in 2021: changes, calculation, indexation and increase in the minimum wage Salary in 2019: changes, calculation, indexation and increase + minimum wage February 9 12126 0 Kakzarabativat 12126 0 Hello!

Average salary in Moscow according to Rosstat by industry in 2019

- teachers and teaching staff of universities - from thirty-five thousand to one hundred and eighty thousand;

- police officers - from forty to eighty thousand.

- doctors and medical personnel - from fifty to eighty thousand;

Rosstat conducts a study on wage differentiation once every 24 months, in April.

For starters, here is the average salary for the entire country. We studied the latest Rosstat data as of June 2019. The average monthly salary in Russia in nominal terms in January 2021 was 35,369 rubles.

Or 30.8 thousand rubles after deducting income tax of 13%. What is the average salary in Russia by region and specialty?

One of the main indicators of the standard of living of any citizen is wages.

In the Russian Federation, its size for different specialties and in different cities can vary greatly, differing by several times, or even tens of times. Below IQReview has collected in one place the most current data on the average salary in Russia.

Review of labor market statistics in the Rostov region The histogram shows the change in the level of average wages in the Rostov region.

Lowest paid professions

How much do specialists earn?

TOP 10 lowest paid professions in Russia:

- Salesman. On average, a goods seller earns about 17 thousand rubles per month.

- Secretary. The salary of an office manager is 20 thousand rubles per month.

- Teacher. The average salary of a university teacher is 15 thousand rubles. But it is worth considering that famous professors and deans with a scientific degree receive an order of magnitude more. But even this amount cannot compare with the salary of a teacher in the USA, which is 87 thousand per year.

Salaries of teachers at public universities in different countries

- Locksmith. This specialty belongs to the middle class professions in Russia. A highly qualified specialist can receive up to 60 thousand rubles per month. And mechanics working in public utilities receive no more than 23 thousand rubles per month.

- Nanny or governess. In 2014, representatives of this profession received about 70 thousand rubles monthly. But due to the crisis and difficult economic situation in the country, their salaries have decreased significantly. Today, the average salary of a nanny in Moscow is 30 thousand - 35 thousand rubles.

Nanny for a child

- Sales Representative. The average monthly salary of a representative of this profession is 40 thousand rubles.

- Hairdresser. It is worth noting that a hairdresser’s salary directly depends on the number of clients. Therefore, on average, hairdressers earn from 13 thousand rubles per month.

- Doctor. The average salary of a doctor in Russia is 28 thousand rubles. Junior medical personnel receive from 13 thousand rubles. A nurse's salary starts from 15 thousand rubles in more developed regions.

- Teacher. The average salary in the specialty is 30 thousand rubles.

- Teacher in preschool children's institutions. The minimum salary for a teacher is 10 thousand rubles per month.

Industry average salary level 2019 according to qualifiers

Without the OKVED2 code in 2021, it will be impossible to register your enterprise or yourself as a private entrepreneur with the tax office.

This code will be entered into the Unified State Register of Legal Entities or Unified State Register of Individual Entrepreneurs.

Using it, all interested government services will determine what kind of activity you are conducting. The code according to the amended OKVED 2019 will need to be entered in many reporting documents reflecting your economic activity.

“Last week, the Verkhovna Rada voted for the conclusions and recommendations of people’s deputies on the 2019 budget. The Tax Service has changed its position regarding filling out field 101 “Payer Status” in payments for the transfer of insurance premiums. In the challenge letters there appeared specific amounts to which the salary must be raised.

Material remuneration must be of a permanent nature. In addition, the massive export of IT products to foreign markets and several other areas of economic activity make it possible to maintain a salary level throughout the country equal in size to developed European countries. The total amount includes actual amounts earned and material remuneration regulated by the internal regulations of the enterprise.

Material remuneration must be of a permanent nature.

for the transfer of insurance premiums. Also, the cost of living of the working-age population can be taken into account to determine the size of salary indexation. What was the industry average salary according to OKVED for retail trade in 2013 in Moscow?

Is the employer obliged to adhere to the industry average salary when setting wages for employees?

Reasons to pay less than the minimum wage

The basis for paying wages to an employee less than the established minimum wage is his failure to comply with established labor standards or he has worked for less than a full month. If an employee works part-time, such work is paid based on time worked, output, or according to the provisions of the employment contract. If there is a specific amount of work or task, payment can be made based on the results of their actual completion. Part-time employees may have accrued earnings less than the established minimum wage. In any case, the employer withholds personal income tax from the income of his subordinates and the amount to be paid will be the minimum wage minus taxes.

Salary by type of economic activity

This document states that if a taxpayer’s tax burden is below its average level for business entities in a particular industry (type of economic activity), he will be included in the plan of on-site tax audits.

In the capital, this commission operates on the basis of an order from the Federal Tax Service of Russia for the city.

Moscow dated February 22, 2008 No. 96. Let us emphasize that the task of the tax authority is not to increase wages for employees, but to bring unofficial wages out of the shadows in order to completely transfer salary taxes to the budget.

Rosstat industry average wages by type of economic activity 2019

How to find out what the industry average salary is in 2021 according to OKVED in your region. To obtain information about the industry average salary, the Federal Tax Service recommends contacting the following sources:

- websites of territorial bodies of Rosstat;

- websites of territorial departments of the Federal Tax Service;

- request of the company to the territorial bodies of Rosstat and the Federal Tax Service.

- collections of economic and statistical materials published by Rosstat;

The average salary according to OKVED for Russia as a whole is published on the website of the Federal State Statistics Service in the section “Labor Market, Employment and Wages.”

In similar sections of the territorial bodies of Rosstat you can find similar information on the subjects of the Federation. 2 tbsp. 41 Labor Code of the Russian Federation)

How do tax authorities find out the salary level at an enterprise?

The evaluation criteria do not say how tax inspectors determine the average salary paid in a company. But it is obvious that the information for assessment is received by the Federal Tax Service as part of the submitted reporting.

Thus, the number of employees of an organization is determined based on the report on the average number of employees as of January 1, which companies are required to provide annually.

Tax authorities receive information about income paid to employees from 2-NDFL certificates, based on insurance premiums. The regulatory authority will compare the data obtained from the company’s reporting with the average wage level by type of economic activity.

Thus, inspectors will determine the level of wages for the year. For internal analysis to determine whether the organization meets the criterion, information for the most recently closed reporting year should be considered.

Salary below the industry average: how to justify yourself to the Federal Tax Service

Tax accountants are increasingly receiving requests from the tax office that you don’t know how to answer. Directly and honestly - they may be “offended” and then “offend” you. Inventing fables is also fraught. What remains is something in between, an intermediate one - so that, as they say, one maintains innocence and does not run into sanctions. Here's how, for example, to explain to inspectors why the salary in the company is lower than the industry average? Now we'll tell you.

Recently, the number of requests from tax authorities has been steadily growing. They ask for all kinds of data - an explanation of the reasons for the loss, the amount of the tax burden, the presence of a system for assessing the integrity of counterparties, and much more. Along with this, quite often the tax authorities’ complaints relate to the amount of wages, which are “below the industry average.”

Very often this remark puzzles accountants. And no wonder. Firstly, it is often very difficult to understand what the industry average wage is. After all, probably only a beginner will think that there is only one such indicator. The average industry salary can be for a specific city (region), or it can be regional.

Secondly, it is not so easy to verify the level of wages for this indicator. After all, the requirement indicating the required value in any case already comes after the fact, that is, when it is almost impossible to correct past periods. At the same time, there are often cases of incorrect preparation of a request, in which the size of the industry average wage is simply not indicated at all, and even the performer is unknown.

And what to do in such a situation? Of course, the most important thing and the very first thing is not to panic, but to calmly figure it out.

Order of the Federal Tax Service of Russia dated May 30, 2007 No. MM-3-06/ [email protected] “On approval of the Concept of the planning system for on-site tax audits” defines the planning system for on-site tax audits, and at the same time establishes risk assessments for taxpayers used by tax authorities in the process of selecting objects for conducting on-site tax audits.

Thus, paragraph 5 of this order determines that one of the criteria for assessing risks for taxpayers is the payment of an average monthly salary per employee below the average level for the type of economic activity in a constituent entity of the Russian Federation.

It immediately becomes clearer what industry average value should be considered. In this case, the subject of the Russian Federation will not be the specific city in which the taxpayer is registered, but the subject of the Russian Federation. The list of subjects is given in Article 65 of the Constitution of the Russian Federation.

For example, an organization registered in Smolensk and belonging to the Federal Tax Service of Russia for the city of Smolensk will take the industry average for the Smolensk region.

But quickly obtaining these values will be problematic, despite the fact that the data in question is open - statistics summarize official results, which are made publicly available, with a certain objective delay.

For example, at the current time (August 2021) data for May 2021 is available on the statistics website (https://www.gks.ru/wps/wcm/connect/rosstat_main/rosstat/ru/statistics/wages/). And even without a breakdown by region of the country. Therefore, it will be possible to correct the discrepancy that has arisen only in the future.

Although, we emphasize, this is not at all necessary. After all, in fact, it turns out that the size of the industry average wage only affects whether the taxpayer will be included in the lists for tax audit. But the law does not establish fines or even an obligation to maintain wages equal to or higher than the industry average. After all, administrative liability is established only for the payment of wages below the minimum wage.

The letter of the Federal Tax Service of Russia for the Moscow Region dated July 23, 2007 No. 18-19/0372 states that additional accruals of “salary” taxes do not directly depend on the level of the average salary. Tax will be assessed additionally only if it is established that the taxpayer has paid “shadow” wages or if any errors are identified that resulted in incomplete payment of taxes.

Judges also say this (Resolution of the Federal Antimonopoly Service of the Moscow District dated July 30, 2007 No. KA-A41/7118-07 in case No. A41-K2-3115/07). By decision of the Supreme Arbitration Court of the Russian Federation dated December 5, 2007 No. 15995/07, the transfer of this resolution to the Presidium of the Supreme Arbitration Court of the Russian Federation for review in the order of supervision was refused.

A similar conclusion was made by the Federal Antimonopoly Service of the West Siberian District in the Resolution of October 30, 2008 No. F04-6627/2008 (15063-A45-25) in case No. A45-1955/2008, in the Resolution of May 21, 2009 No. F04-2979/2009 ( 6530-A81-37) in case No. A81-1884/2008, in the Resolution dated April 27, 2010 in case No. A81-3998/2009.

How the tax office detects violations

The average salary in the industry is not a legal norm, but only a guideline. The employer cannot be held liable for the very fact of paying wages below its level. Business conditions are not the same for everyone, and individual companies may have good reasons for saving on payroll.

The tax authorities are not interested in low salaries, but in the covered portions of payments. And if wages for a long time do not reach the average in their field, the following factors can indicate them:

- No staff turnover. If these are not temporary difficulties, but a common occurrence, workers would have long ago left for more profitable places. If they stay, it means they get paid extra for it.

- Discrepancy between real income and personnel costs. This is usually detected if the accountant is not very experienced in financial fraud. For example, with gray salaries, he settled the issue “in favor of the company”, and assessed income tax fairly. The Federal Tax Service compared the data and came to the conclusion that payroll accounts for too small a share of income or it is completely decreasing. And if this continues for several years, verification cannot be avoided.

- Equal salaries for positions of different qualifications. This happens if the employer officially shows rates in the amount of the minimum wage, and pays the rest “in an envelope.” In the eyes of the inspector, it is very strange if the archivist and the financial manager receive the same amount.

We must not forget that the Federal Tax Service has access to bank cards. She can check what amounts are coming into employee accounts at the same time.

Objective reasons

But, of course, you don’t want to get caught by the tax authorities either. Especially if there are objective reasons for paying wages below industry standards.

You need to calmly understand the situation and present objective arguments in your response to the tax authority.

For example, if accruals were less than the industry average due to the fact that employees were on sick leave, on unpaid leave, worked part-time under the terms of employment contracts, etc., then these explanations should be stated in the response.

If, nevertheless, it is established that the tax authority is correct regarding the correspondence of the actual level of wages to the industry average, you need to understand what the magnitude of the discrepancy is, how well the statistical indicator corresponds to the objective economic reality in your area.

After all, the “average temperature in the hospital” will not always reflect the condition of a particular patient. All these arguments must also be presented in a substantiated manner in the answer.

Naturally, the arguments may be different. There may be a comparison of real wages with the minimum wage, the presence of losses, and upcoming large investment projects that affect the solvency of the company. The main thing is that they are justified.

And, of course, another option is to increase payment to the recommended amount.

The accountant and the management of the enterprise must carefully evaluate all possible options for action, the pros, cons and consequences, and after that, be sure to draw up a written response to any option.

Sergey Danilov, PB correspondent

Electronic version of the magazine “PRACTICAL ACCOUNTING”

The best offer for those who need a minimum budget and practical information on accounting and taxes.

In what cases will the wages of your employees raise questions from the tax authorities?

- December 14, 2021 / Internet State, budgetary, autonomous institutions: Features and innovations in the formation of annual financial statements for 2021. Activities to mark the end of the financial year. Large-scale reform of the legislation of public sector organizations. Introduction of federal standards

- January 30, 2021 / Internet Certified chief accountant according to IFRS (IAB).

January set

- February 20, 2021 / Internet International Financial Practice (IAAP certification)

- November 09, 2021 / Moscow Construction: everything new in the Law on preschool education. Changes 2017-2018

If you would like to share your opinion with us, fill out the form below: select your city and indicate what salary you receive. I'm interested in the net salary with all deductions and taxes. Your salary will be taken into account when determining the average salary according to the opinion of visitors to our site.

Please, whenever possible, indicate the name of your place of work: names of LLC/OJSC, numbers of schools, medical institutions, etc., so that we and other visitors can see that the numbers and places of work are real and not taken out of thin air. We thank you for your opinion! Share information with friends: Visitor comments If you have thoughts and opinions, please express them in the comments.

What is the average salary in Moscow in 2019

- salary;

- salary supplements;

- various types of incentives;

- various types of compensation;

- buying groceries, paying utilities, etc.

Based on the average salary, pensions and other social benefits are calculated. Let us remind you that the minimum wage in Moscow in 2021 is 17,561 rubles, the same it was last year.

But even despite this, compared to last year, the level of average salaries in Russia, and in particular in the capital, has increased.

According to official statistics, in 2021 the average salary of Muscovites was 91,815 rubles.

When making average statistical calculations, one must also not forget about possible errors. The statistics service does not take into account the fact that part of the salaries of residents of the capital is given in envelopes, although this trend is decreasing every year, but, nevertheless, there are still structures in the commercial sphere, in the retail network and some others that continue to work in the shadows. Such enterprises employ tens of hundreds of workers.

This is where the amount of error comes from.

Based on this type of calculation, the Yandex service determined that the average salary in 2021 in Moscow is 49,000 rubles.

How is the average Moscow salary distributed by type of work activity and profession? The dispersion in wages among different categories of workers in the capital is large.

The next segment of those working in the capital are mid-level specialists.

These include the professions of manager, programmer, teacher, health worker and others. Salaries are an order of magnitude higher than those of the previous category of unskilled workers.

Poverty level

According to the results of Rosstat data analysis for 2021, this figure dropped to 13%. More than 17 million residents of the Russian Federation live below the poverty line. This figure is the lowest over the last five years.

If you look at how insolvent farms are distributed by category, you will notice the following: the most problematic “link” is citizens with children. In a modern state, according to experts, children are a very expensive pleasure. Despite various supporting measures from the government, raising the material level of families with children is still an impossible task.

Among other things, it is quite obvious that large families often experience financial problems. Thus, according to Rosstat, more than half of low-income families consist of 4-5 people or more. And if we talk about the localization (city or village) of the population below the poverty line, it is noted: in this case there is no noticeable difference and the distribution can be called relatively equal.

Among urban residents, poverty is often encountered by people living in small towns where the population does not exceed 50 thousand people. Usually these are small single-industry towns, where the problem of providing citizens with jobs is acute. Therefore, the population is forced to actively migrate in search of suitable work.

How to respond to a request from the Federal Tax Service to reduce risks

A lower salary level may be a consequence of objective reasons. The average salary by industry is determined for the region as a whole. It is obvious that incomes paid in the regional center will always be higher than those paid in rural administrative units.

It is also possible that your company is just starting to operate. And employees were recruited only by the end of the year. Or the company has many part-time workers. Your organization may experience temporary difficulties, as a result of which employees had to be placed on idle leave with payment of 2/3 of their average earnings. Or, as a result of low revenue, employee bonuses were cancelled.

For a competent response from the tax office, it is necessary to analyze all the reasons for paying wages and present them in the most detailed and reasoned manner.

Obviously, the payment of wages below the industry average alone will not be a reason for an audit. During the pre-audit analysis, tax inspectors consider all criteria in a comprehensive manner. But you should still monitor the level of this indicator. Moreover, a good salary level will increase the attractiveness of the company from the point of view of potential employees.

10/07/2009 “Economy and Life” Anna Eganova, lawyer at the First House of Consulting “What to do Consult”

SITUATION

On September 2, 2009, we received a letter from the Federal Tax Service informing us that, due to the type of activity, our organization (LLC) is obliged to pay wages to employees of at least 22,934 rubles.

In addition, the letter contained an invitation to a meeting of the commission for monitoring the activities of enterprises and organizations regarding the remuneration of workers. But, unfortunately, the letter was delivered by mail a week later than the date of the invitation.

Our organization operates with Federal Law No. 82-FZ dated June 19, 2000 “On the minimum wage”, the legislation of Moscow (tripartite agreement dated December 24, 2008, resolutions of the Moscow government) and Art. 133.1 of the Labor Code of the Russian Federation.

Are there laws that stipulate that employee wages (literally, the level of average monthly wages per employee) are determined by type of economic activity? Our OKVED is 60.21.11.

In 2008, we joined the Moscow Transport Union (MTS). Does this mean that the average salary in our organization should correspond to the average salary of organizations participating in MTS? Is this what the Federal Tax Service of Russia meant in the notification?

Minimum wage or OKVED

To date, there is not a single regulatory legal act that would establish an obligation for an employer, when determining the amount of wages, to be guided by the average monthly wage per employee by type of economic activity.

Order of the Federal Tax Service of Russia dated May 30, 2007 No. MM-3-06/ [email protected] established publicly available criteria for independent risk assessment for taxpayers. This document states that if a taxpayer’s tax burden is below its average level for business entities in a particular industry (type of economic activity), he will be included in the plan of on-site tax audits. That is, this document does not oblige one to be guided by the average monthly salary of an employee by type of economic activity, but only warns the taxpayer about including him in the plan of on-site tax audits according to the named criterion.

One of the methods of combating shadow wages is to call the head of the organization to the so-called salary commission. In the capital, this commission operates on the basis of the order of the Federal Tax Service of Russia for Moscow dated February 22, 2008 No. 96.

We emphasize that the task of the tax authority is not to increase wages for employees, but to bring unofficial wages out of the shadows in order to fully transfer salary taxes to the budget.

The relationship between employee and employer, in particular wages, is regulated by the Labor Code of the Russian Federation. The salary amount is established for the employee by an employment contract in accordance with the employer’s current remuneration systems (Article 135 of the Labor Code of the Russian Federation), as well as taking into account the federal minimum wage and the minimum wage for the subject.

According to Art. 37 of the Constitution of the Russian Federation, everyone has the right to work in conditions that meet safety and hygiene requirements, to remuneration for work without any discrimination and not lower than the minimum wage established by federal law, and the right to protection from unemployment.

Article 133 of the Labor Code of the Russian Federation establishes that the monthly salary of an employee who has fully worked the standard working hours during this period and fulfilled labor standards (labor duties) cannot be lower than the minimum wage. This value is established by Federal Law No. 82-FZ of June 19, 2000 “On the minimum wage.” From January 1, 2009, the minimum wage is 4,330 rubles.

Article 133.1 of the Labor Code of the Russian Federation stipulates that a regional agreement may establish the minimum wage in a constituent entity of the Russian Federation for those who work in the territory of the corresponding constituent entity of the Russian Federation, with the exception of employees of organizations financed from the federal budget.

The size of the minimum wage in a subject of the Federation is determined taking into account socio-economic conditions and the cost of living of the working population in the corresponding subject of the Russian Federation. It cannot be lower than the minimum wage established by federal law.

According to Art. 133.1 of the Labor Code of the Russian Federation, the monthly salary of an employee working in the territory of the corresponding constituent entity of the Russian Federation and who is in an employment relationship with an employer in respect of whom the regional agreement on the minimum wage is valid in accordance with Parts 3 and 4 of Art. 48 of the Labor Code of the Russian Federation or to which the said agreement is extended in the manner established by Parts 6-8 of Art. 133.1 of the Labor Code of the Russian Federation, cannot be lower than the minimum wage in a given subject of the Russian Federation. Mandatory condition: the specified employee has fully worked the standard working hours during this period and fulfilled the labor standards (job duties).

In the capital, the minimum wage was established from January 1, 2009 - 8300 rubles, from May 1 - 8500 rubles, from September 1 - 8700 rubles. (Agreement on the minimum wage in the city of Moscow for 2009 between the Moscow Government, Moscow trade union associations and Moscow employer associations dated December 24, 2008). Salaries in Moscow cannot be lower than this level.

In confirmation of what has been said, we note that Art. 129 of the Labor Code of the Russian Federation reveals the concept of wages (wages). This is remuneration for work depending on the qualifications of the employee, complexity, quantity, quality and conditions of the work performed, as well as compensation payments (additional payments and allowances of a compensatory nature, including for work in conditions deviating from normal, work in special climatic conditions and in territories exposed to radioactive contamination, and other compensation payments) and incentive payments (additional payments and incentive allowances, bonuses and other incentive payments).

Article 132 of the Labor Code of the Russian Federation establishes that the salary of each employee depends on his qualifications, the complexity of the work performed, the quantity and quality of labor expended and is not limited to the maximum amount.

Conclusion: the approach to determining the salary of a particular employee depends on his professional qualities, such as qualifications, as well as on the complexity of the work, the quantity and quality of labor expended. Therefore, it is incorrect to generalize wages by industry (by type of economic activity), since there are no identical workers and they all differ to a greater or lesser extent in their level of professional knowledge.

What do tax authorities mean?

In the case under consideration, the Federal Tax Service of Russia did not mean the level of wages of employees of organizations participating in the Moscow Transport Union, but the average salary by type of economic activity in a subject of the Federation, that is, in Moscow.

As follows from the order of the Federal Tax Service of Russia dated May 30, 2007 No. MM-3-06/ [email protected] , information on statistical indicators of the average salary level by type of economic activity in a city, region or in general for a subject of the Federation can be obtained from the following sources:

1) official websites of territorial bodies of the Federal State Statistics Service (Rosstat).

Information about the addresses of Internet sites of territorial bodies of Rosstat is posted on its official Internet site www.gks.ru.;

2) collections of economic and statistical materials published by territorial bodies of Rosstat (statistical collection, bulletin, etc.);

3) upon request to the territorial body of Rosstat or the tax authority in the corresponding subject of the Federation (inspectorate, department of the Federal Tax Service of Russia for the subject of the Federation);

4) official Internet sites of the departments of the Federal Tax Service of Russia for the constituent entities of the Federation after posting the relevant statistical indicators on them.

Information about the addresses of Internet sites of the departments of the Federal Tax Service of Russia for the constituent entities of the Russian Federation is posted on the official website of the Federal Tax Service www.nalog.ru.

Subscribe Post:

Living wage

The dynamics of changes when calculating this indicator depend on certain factors, the main one of which is the consumer basket. The population is divided into categories with the highest and lowest cost of living. The 1st stage includes the working population, the next “steps” include children and pensioners.

It must be taken into account that when calculating the cost of living, there are no specific criteria by which one can judge its increase. The calculation is carried out in accordance with the rate of depreciation of money, as well as the increase in the cost of the food basket.

It is not possible to make forecasts on how the cost of living indicators will change, since prices can rise at any time. They can recalculate it only after several quarters. However, it happens that the cost of living is modified almost instantly and by several hundred rubles at once.