To regulate various economic processes, such an indicator as the living wage was established.

It is the minimum limit that allows a person to provide all his basic needs. It is logical to assume that the salary cannot be lower than this indicator, otherwise the balance is upset and the employee’s right to decent wages is not respected. But, most often, when setting wages, employers are based on the minimum wage rather than on the minimum wage. And as you know, these two basic indicators are far from identical.

Labor legislation, meanwhile, has a number of articles that allow you to defend your rights as an employee if your salary is less than the subsistence minimum. We will figure out when the claims will be justified, and in what cases it will be unlawful to apply for the restoration of your rights.

Minimum wage - guaranteed minimum

First of all, let's look at what the minimum wage is and where it is used. In fact, this is the minimum amount of remuneration for work. Enshrined in Art. 133 Labor Code of the Russian Federation. Provides a minimum threshold of payments for fully worked hours. An employer, regardless of its form of ownership, has no right to pay less than this threshold.

The guarantee of payment of a full salary is provided by:

- Budgetary organizations - at the expense of the state or local budget. Financing from funds received from business activities is allowed.

- State enterprises – with their own funds received from economic activities. They can receive partial subsidies from budgets.

- For private companies - through the use of their own funds.

It is important to note that the guarantees established by the Labor Code of the Russian Federation are basic. In practice, individual constituent entities of the Russian Federation may change the amount of such payments upward. If such a right is exercised, it takes precedence over general legislation. In case of disputes, the increased amount of the guaranteed payment will be taken as the basis.

Remember, the essence of the “minimum wage” is that a person who has fully worked the norm of working hours or output established for the month does not receive an income less than the state guaranteed one. If this happens, the employer is obliged to pay the worker the remaining difference from his own funds.

Differences in indicators

The minimum wage is a fixed indicator that reflects the minimum wage for Russian citizens. It is approved by the government of the country. The minimum wage is the same for the entire state; wages cannot be paid below this figure. But the law also explains possible exceptions that may arise in certain situations. The subsistence minimum is the minimum amount of earnings that a citizen will need to meet the minimum level of needs.

The federal minimum wage is established for the entire territory of the Russian Federation. Employers are required to pay wages to employees in an amount not less than a fixed amount. Since the territory of Russia is large and located in different climatic conditions, the standard of living differs by region. Therefore, local authorities can set the minimum wage in a larger amount than the basic indicator for the country, but not less.

Regional levels are used for specific regions - the Far North and territories that are equivalent to it, including highlands and deserts. The minimum wage also differs for capital districts. The minimum wage in the Russian Federation is regulated by Law No. 82, adopted in 2000.

Many other payments to citizens depend on the monthly salary and the minimum wage:

- earnings;

- compensation for sick leave;

- pensions;

- payments to pregnant women;

- child care payments;

- compensation.

What the minimum wage and the living wage have in common is that both indicators are designed to guarantee citizens a normal existence and satisfaction of basic needs.

The main differences between the minimum wage and the PM:

- The minimum wage is a minimum fixed indicator of income for performing labor activities.

- With the help of PM, the standard of living in different cities and regions of Russia is assessed through the consumer basket. That is, how much food can you buy in a certain area for the same amount. Or how much the same set of products will cost in each region.

The living wage is based on the consumer basket - the monetary value of all goods and services that are needed for a normal life. It includes:

- food, utilities, non-food products;

- other mandatory payments to the government or essential service providers.

Therefore, the concepts of minimum wage and minimum wage rather complement each other.

What are the consequences of paying wages below the minimum wage?

The practical effectiveness of each legislative norm directly depends on the level and size of the punishment that will follow for violation of such a guarantee. The punishment is regulated by Art. 5.27 Code of Administrative Offenses of the Russian Federation. For certain violations liability is established under Art. 145.1 of the Criminal Code of the Russian Federation.

The following sanctions are provided:

- up to 5 thousand rubles if the violation was committed by an individual entrepreneur for the first time;

- up to 30 thousand rubles for repeated violation by an individual entrepreneur;

- up to 50 thousand rubles when the law was ignored by a legal entity;

- up to 100 thousand rubles, if the company committed a similar violation again;

- criminal liability for systematic gross disregard of the law. The sanctions include fines, long forced labor, and even imprisonment.

The initiator of opening such an administrative (criminal) case may be:

- Employee . Can file a complaint with the body authorized to consider such cases personally or through other organizations.

- Trade union . Usually initiates an investigation based on an oral or written complaint from one of its members. Can act on his own initiative, having received documents from the employer confirming the fact of the violation.

- Prosecutor's office . Here, preference is given to complaints about violations in budgetary or state-owned enterprises. But the violations of private owners do not go unnoticed.

- Labour Inspectorate . In fact, this is an organization authorized to consider such cases, which has this direct responsibility. All applications and requests (except anonymous ones) are subject to verification.

- Court . No one forbids a worker to draw up and file a claim in court. In this case, responsible government agencies will be involved and a decision will be made on the merits. In fact, by a court decision, you can receive compensation not only for a specific case, but also for the entire period of such violations. But all this will need to be documented.

Remember, paying a fine for a violation does not relieve the employer of the obligation to eliminate the violation and compensate the employee for losses. And if the case is considered by the court, the company may also receive an obligation to pay moral damages and legal costs.

Judicial practice on this issue

The court is the only body capable of making a decision on the recovery of funds from the employer. In this case, you can request not only the funds themselves, but also compensation for their underpayment.

To file a claim, you must write an application and attach supporting documents to it. Ideally, these should be pay slips that directly indicate the amounts of accruals and deductions.

Judicial practice on issues of additional calculation of wages up to the minimum wage is extensive, and almost always the trial ends in favor of the employee. It is impossible to attribute a low minimum wage to a lack of funds.

Disputes often arise over the procedure for calculating wages using northern allowances. Thus, employers often set the salary level so that after all calculations it is no less than the minimum wage.

Important! However, the court’s position in this case is that earnings must be no less than this level until all increasing factors are applied. As a result, firms have to recalculate wages and pay the difference to employees.

Salary may be less than minimum wage

The concepts of “official salary” and “minimum wage” should not be combined. The legislator clearly indicated that the total amount of payments cannot be lower than the minimum. In other words, the employee has no right to receive less than what is indicated by law. What this amount will consist of depends solely on the employer. Based on this, it is advisable to highlight the following nuances:

- the official salary (tariff rate) of a worker may be less than the minimum;

- the amount is taken into account from the amount of the total payment, and not from its individual components;

- if a situation arises that for a fully worked standard of time it is necessary to pay less than the minimum acceptable threshold, the employer will have to pay such an employee up to the guaranteed amount;

- payments due to the employee are calculated based on the standard time worked for the calendar month.

Can wages be below the subsistence level?

The Labor Code of the Russian Federation establishes that wages should not be less than the subsistence minimum. But this is a theory. Since this indicator is revised quarterly, the comparison is made with the minimum wage, which is determined for the current year on the basis of the subsistence minimum in force in the second quarter of the previous year. Therefore, when comparing, it is assumed that the salary will be less than the subsistence minimum for the selected period.

In addition, it must be taken into account that the salary for comparison should be summed up, and not for any part of it. Thus, in the presence of bonuses and additional payments, the answer to the question - can the salary be less than the subsistence minimum - becomes clear - yes.

You might be interested in:

How to fire an employee for showing up at work while intoxicated according to the Labor Code of the Russian Federation

It is also taken into account whether the salary was paid for the entire standard duration of the month, or whether it is due to the employee at a certain rate, for example, 50%. That is, when working part-time, it is allowed that the accruals made to the employee may be less than the subsistence level.

Attention! It is necessary to understand the difference between accrued and paid wages. Therefore, when determining whether an employer can legally pay its employee less than the cost of living, the answer is yes.

Where to go if your salary is below the minimum wage

To understand how the sanctions mechanism works in practice, it is necessary to understand who has the right to consider such violations and make binding decisions. Three organizations are currently vested with such powers:

| Organization | A comment |

| Rostrudinspektsiya and its regional divisions | Each of them is authorized to consider complaints about violations committed by employers. Who violated does not play a role here. Their powers extend to budgetary, public and private companies, as well as individual entrepreneurs. Typically, checks are carried out on each complaint. Issue orders to eliminate comments, draw up administrative protocols |

| Prosecutor's office | Their powers are much broader. They can conduct inspections and make decisions themselves, or involve authorized officials in this. Usually they “keep” cases with gross or repeated violations of the law. The rest is redirected according to the jurisdiction to the State Labor Inspectorate. And then they simply receive a report on the actions performed. |

| Trade union | In some collective agreements of large enterprises, the parties agree that trade unions can create special labor inspection bodies. The powers of such bodies are recognized by employers. They do not have the right to fine, but their instructions are mandatory. |

Remember, the main thing is not to remain silent. It is optimal to contact the State Labor Inspectorate. They will definitely thoroughly check your complaint and make a decision on it. The main thing is to initially provide evidence that you did not receive proper wages.

What do minimum wages and PM affect?

The minimum wage and the cost of living affect the following payments:

- Wage. In 2021, a citizen cannot receive an income per month below the established figure. If the salary is below the subsistence level, the employee has the right to file a complaint with the appropriate organization. After this, sanctions are applied to the company owner and fines are imposed. At the same time, real earnings may be lower than the minimum wage if a citizen works part-time, does not meet the time and labor standards, or works part-time.

- Benefits. Benefits for pregnancy, childbirth, child care up to 1.5 years old, and sick leave payments depend on the minimum income.

- Taxes. The amount of taxes also depends on the minimum wage. As the minimum wage increases, tax deductions increase.

- Regional coefficient . Additional payments are assigned to those citizens who work in special climatic zones.

Minimum wages can have a negative impact on small businesses. Entrepreneurs are not able to pay salaries in this amount. In addition, a number of citizens have reduced motivation to develop and improve professional skills.

If a Russian’s pension is less than the minimum subsistence level, then the payments reach the required level. The pensioner will need to contact the social protection fund at the place of residence or the Pension Fund and submit a written application.

about the author

Klavdiya Treskova - higher education with qualification “Economist”, with specializations “Economics and Management” and “Computer Technologies” at PSU. She worked in a bank in positions from operator to acting. Head of the Department for servicing private and corporate clients. Every year she successfully passed certifications, education and training in banking services. Total work experience in the bank is more than 15 years. [email protected]

Is this article useful? Not really

Help us find out how much this article helped you. If something is missing or the information is not accurate, please report it below in the comments or write to us by email

When can you pay less than the minimum wage?

And yet, in practice, there are cases when an employer can legally pay an employee a reduced remuneration based on the results of a month worked. This is allowed in the following cases:

- When taxes are deducted from salary . It is important to understand this point. The main thing is that the remuneration accrued to the worker exceeds the minimum. Further tax deductions that reduce the guaranteed minimum will not be taken into account.

- Part of the salary is withheld for reasons specified by law . This may be financial responsibility, alimony, compliance with the orders of the writ of execution, and other similar cases. The amount of the initial charge also plays a major role here.

- The employer refused to join regional agreements that increase the minimum income . Here you will not have to pay more than the minimum established by federal law only after refusal. But such a refusal must be properly formalized.

- Payments to part-time workers . An important nuance that must be taken into account in this case is that the employee cannot work part-time for more than 50% of the total hours. Therefore, the employer is obliged to pay him wages at a level not lower than the guaranteed minimum in proportion to the time worked.

- Employees performing their functions on reduced working hours . Here the rule is that wages must be paid in proportion to the time worked. It is necessary to ensure that when recalculating the income received for a full work schedule, it is not less than that specified by law.

- With a cumulative accounting of labor time . In this case, it all comes down to meeting the production quota, or working out the hours of actual work. If this standard is not met, the employer has every right to pay for the amount actually completed.

- After leaving sick leave . The time that the employee actually worked is paid. Compensation for sick days is carried out according to a different procedure and is calculated separately.

- When I was on vacation at my own expense . Equivalent to the absence of working the standard hours (workout) established for everyone. They will pay for the actual amount of work performed in a particular month.

- Simple . In such cases, the employer has the right to pay only 2/3 of their income. And if the salary was at the minimum level, then it can be proportionally reduced.

- Truancy . It is simply not paid legally. As a result, the total amount of time worked (output) is proportionally reduced. Pay for these hours is also reduced.

- Payment under civil contracts . The nature of such relationships requires payment for the end result, not the process. Therefore, all conditions here are regulated by contract.

Remember, if an employee does not work the required hours, the employer has the right to reduce his level of pay. Even if this amount is below the minimum wage.

Establishing a minimum wage

The minimum earnings are set based on the following basic criteria:

- An employee works five days a week during a calendar month.

- The working day of an employee is a mandatory eight hours.

If these conditions are met, the employer can charge the minimum wage. Typically, such small salaries are awarded to those specialists who do not have any qualifications.

The employer is not always required to pay the minimum established level. Here are a number of legal cases when an employer pays less than the minimum wage for a month and is right:

- An employee works part-time or on a special schedule, in which he performs his duties not to the extent that were established basicly.

- The employee is employed full-time, but for individual reasons did not work the entire month as required. For example, he took days off at his own expense, went on vacation or was sick.

- Taxes were deducted from the legal minimum, resulting in a reduction in the amount.

Some workers believe that the minimum wage should be equal to a salary or tariff rate. However, there are no such instructions in the Labor Code of the Russian Federation, therefore the minimum amount may include salary and other incentive payments and additional payments.

If the employee has not worked for a full month

The minimum wage calculation is always based on a fully worked month. It is in this case that the employer has an obligation to pay the guaranteed amount of remuneration. In other situations, payment is made in proportion to the result obtained.

For less than a month of work, the worker will be paid proportionally. The proportion will apply to all elements, salary, allowances, additional payments, compensation, unless other standards are provided for by the company’s Remuneration Regulations. In this case, the guaranteed minimum payment threshold will be calculated proportionally. It is prohibited to fall below this proportion.

Comments: 17

Your comment (question) If you have questions about this article, you can tell us. Our team consists of only experienced experts and specialists with specialized education. We will try to help you in this topic:

Author of the article: Klavdiya Treskova

Consultant, author Popovich Anna

Financial author Olga Pikhotskaya

- Alexander

01/20/2020 at 21:01 If for some reason the employee’s salary is less than the minimum wage, the employer must pay the missing amount through bonuses, allowances, or increase the salary by an additional agreement.©Don’t you think this is wrong. A bonus is an incentive BONUS, and “raising” the salary to the minimum wage due to bonuses means depriving the employee of INCREASED wages for high-quality and conscientious work. Instead of “reinventing the wheel” and deceiving the people by raising wages to the minimum wage with incentive bonuses, it is necessary to return to the Labor Code an article about equating the rate of the first grade to the minimum wage, which was in the previous Labor Code and which was removed from the new one, which is where the movement into poverty began...

Reply ↓ Anna Popovich

01/20/2020 at 23:19Dear author, in the commentary material we are only talking about legal literacy and the employer’s obligation to pay employees in accordance with the minimum wage. As for bonuses, they are also part of the salary in accordance with Article 129 of the Labor Code of the Russian Federation, which means that at their expense the legally established minimum wage level can be achieved and this is legal.

Reply ↓

03/30/2020 at 14:45

We need to lock up the deputies for a month, give them the minimum wage, and let them bring food according to their orders. Let's see how they howl. In another month they would have adopted a law on the minimum wage = 25,000 rubles.

Reply ↓

04/19/2020 at 00:13

I have been working in a hotel since November 1, 2019. Due to the pandemic, the hotel was not closed for quarantine. I work. There are 5 shifts of 12 hours a month, a shift costs 1300 with a tax deduction of 13%. There are no more payments. How correct is this on the part of the employer. When the cost of living is 11 thousand. How can you live for a month on 5655 rubles? Is the Organization doing the right thing by forcing you to work, and even for such pennies?

Reply ↓

- Anna Popovich

04/20/2020 at 20:37

Dear Lina, as a general rule, the employer is obliged to give the employee the opportunity to work out the norm of working hours established by law and enshrined in the contract for a specified period, and at the same time, for working out the norm for a month, the employee must be paid a salary of at least the minimum wage. Moreover, even when maintaining a time-based wage system and summarized recording of working time, payment cannot be lower than the minimum wage. But this issue can only be resolved with a detailed study of the conditions of your work and the employment contract.

Reply ↓

06/04/2020 at 12:07

Can a working pensioner receive a salary of 3 minimum wages, or should it be fixed?

Reply ↓

- Anna Popovich

06/04/2020 at 14:50

Dear Boris, the current Labor Code establishes time-based, piece-rate and commission wages, from which we can conclude that wages may not be fixed. But at the same time, the amount of remuneration cannot be expressed in variable quantities - that is, even non-fixed remuneration must have an established monetary equivalent in Russian rubles, and not in the size and quantity of the minimum wage.

Reply ↓

09.18.2020 at 18:48

Can a pension be lower than the subsistence level?

Reply ↓

- Anna Popovich

09.19.2020 at 19:19

Dear Irina, all non-working pensioners whose total amount of material support does not reach the pensioner’s subsistence level (PLS) in the region of his residence are provided with a federal or regional social supplement to their pension up to the PMS amount established in the region of residence of the pensioner.

Reply ↓

09.21.2020 at 11:55

Hello! Please tell me, I gave birth to a second child, we want to apply for additional one-time benefits, we need to collect documents, and it is written not to exceed one and a half subsistence minimum for three months, tell me how to calculate this?

Reply ↓

- Anna Popovich

09.21.2020 at 12:36

Dear Irina, each region has its own cost of living. We recommend that you use for calculations the Government Decree “On approval of Methodological recommendations for determining the consumer basket for the main socio-demographic groups of the population in the constituent entities of the Russian Federation” and the Federal Law “On the subsistence level in the Russian Federation” No. 134-FZ.

Reply ↓

09.21.2020 at 18:43

Hello! Please tell me why the minimum wage is equal to the federal minimum wage, and not the regional monthly wage? In Vorkuta the PM is larger than the federal PM. Why then is the regional subsistence level calculated if all calculations are made according to the federal one?

Reply ↓

- Anna Popovich

09.22.2020 at 09:26

Dear Elena, the procedure for calculating the minimum wage is established by law and is regulated by Federal Law No. 82-FZ “On the minimum wage.”

Reply ↓

10/08/2020 at 01:04

I wanted to know that we are a family of 4 people, husband, wife, daughter and son. My husband’s salary is a maximum of dirty 36 thousand. I’m on maternity leave. And I have two children. We were told that in the Krasnodar region the cost of living should not exceed 44 thousand. And as I read, they wrote that the amount is then divided by 3 and then the number of family members. Then it’s rude my husband says 35,000 + I was paid maternity leave this month 18,000 = 53,000 thousand. We do everything by 3 = 17.700 and divide by 4. It turns out 4.417. So, or am I wrong about something???

Reply ↓

- Anna Popovich

08.10.2020 at 17:03

Dear Daria, The cost of living is calculated as follows: SD (average per capita family income) = D (profit of all members): Km (Calculation period for 3 months): H (number of people).

Reply ↓

09.10.2020 at 00:50

Tell me, I’m a pensioner with a non-working pension 14915, this includes children’s benefits. I have a minor child. It turns out that my child’s living allowance is 1920 rubles. And I read that it should be 11200. Am I understanding correctly or am I confusing something. And where should I contact about this issue?

Reply ↓

- Anna Popovich

09.10.2020 at 10:12

Dear Natalya Pavlovna, for a full consultation, we recommend contacting the social protection department of your city.

Reply ↓

Is it possible to earn a salary below the regional minimum wage?

The legislator granted the right to regions to increase the minimum wage on their territory. For such a norm to come into force, it is necessary to sign a definition agreement. After the entry into force of such a document, the employer has no right to pay below the regional minimum. Even if at the federal level there is a different minimum amount.

At the same time, if the employer refuses in writing to apply the regional minimum, he is exempt from complying with this norm and takes advantage of federal legislation. Typically, this question is relevant for large transport or energy corporations that have centralized management and branches in various regions of the country.

Magnitude

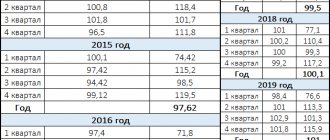

The cost of living indicator (income level) is calculated for each region of the Russian Federation individually on a quarterly basis, as well as in general for the Russian Federation (based on the cost of the consumer basket). Individual calculations are made for certain categories of citizens (children, disabled people, pensioners).

The lowest income level is set for people of retirement age. From time to time, the overall indicator, as well as the values for each individual group of people, changes upward or downward.

The calculation is carried out in accordance with Federal Law dated October 24, 1997 No. 134-FZ. In 2021, in Russia there is a living wage established for different categories of citizens for the 1st-3rd quarters of 2021.

So for the 1st quarter of 2021, its value was 10,038 rubles per capita, for able-bodied citizens - 10,842 rubles, for pensioners - 8,269 rubles. and for children - 9,959 rubles. In the 2nd quarter of 2018, these figures amounted to RUB 10,444. per capita, 11,280 rubles. — for able-bodied citizens, 8583 rubles. — for persons of retirement age and 10,390 rubles. - for children.

In the 3rd quarter of 2021, its value per capita was 10,451 rubles, for able-bodied citizens - 11,310 rubles, for people of retirement age - 8,615 rubles. and 10,302 rubles. - for children. All changes were made on the basis of Orders of the Ministry of Labor No. 410n dated 06.25.18, No. 550n dated 08.24.18 and No. 695n dated 11.12.18, respectively.

Employer's liability

After the employee has reported his problem to the executive authorities, the latter begin to carry out a whole series of verification activities: from studying the accounting records of the “suspected” organization, ending with appeals to the pension fund and tax service.

If the results reveal violations, the employer will be issued an order to eliminate the deficiencies and an administrative fine. The fine will have to be paid either by officials, which include the manager and chief accountant (depending on who is responsible for the improper fulfillment of their obligations to pay wages), or a legal entity.

In the first case, the amount of the fine ranges from 1,000 rubles to 50,000 rubles , in the second, 30,000 - 50,000 rubles . The amount of the fine is determined by the court, taking into account all the circumstances.

However, if it turns out that the employer pays wages below the established minimum wage on an ongoing basis, then sanctions of the criminal code may be applied to him, and this is much more serious: the punishment for such a crime includes arrest, correctional labor or a fine.

Receive the best articles by email every week