How to calculate salaries in April during the period of self-isolation

The President of Russia declared the entire month of April non-working due to the outbreak of the coronavirus epidemic. In this regard, accountants have a question about how to calculate wages for April. Vladimir Putin, in his address to the nation, clearly said that wages for April will remain the same.

Option #1. Time-based wage system

For everyone who works for a salary or for a tariff rate, wages will remain in full, regardless of whether the subordinate worked or observed self-isolation at home. The presence of non-working days in April 2021 is not a reason for reducing wages.

The Ministry of Labor recommended that employers introduce a new designation for non-working days due to self-isolation in the time sheet. The new value should be approved by a separate order.

Option #2. Piece wages

If piece-rate workers are sent into self-isolation, and the entire month of April is non-working for them, then wages will still have to be paid. Such specialists are entitled to remuneration, the amount and procedure for calculating it is determined by the local act of the employer.

Option #3. For those who continue to work

If the employer is one of the institutions that were allowed to work in April, then calculate the employees’ salaries in the standard manner. Non-working days do not include weekends or holidays, therefore increased payment is not due for work in April. Of course, if the employee is not brought in on his day off. For example, on Saturday, Sunday or another day - a scheduled day off.

Option number 4. What to do with vacation

If an employee has a vacation and a period of self-isolation at the same time, then do not count non-working days in the duration of the vacation. Vacations on non-working days are not extended. Such clarifications were given by the Ministry of Labor in Letter dated March 26, 2020 No. 14-4/10/P-2696.

Payment for working days according to the usual schedule

In January, with a five-day workday, Russians will have to work only 15 days. Therefore, the question often arises of how New Year holidays are paid with a salary, given that the number of working days has been reduced. Despite the fact that most work less, wages are paid in full. If a salaried employee has worked all the required days, then payment is made in full. This follows from the same article 112 of the Labor Code of the Russian Federation. It makes no sense to separately consider the question of whether New Year's holidays are paid in government agencies or municipal structures, since the law states: the presence of non-working holidays in a calendar month is not grounds for reducing wages for salaried employees.

As for the remaining employees (piece workers, hourly workers, etc.) who were not involved in work during the New Year holidays, for non-working holidays they are paid additional remuneration, the amount of which is determined by the internal LNA.

If an employee is on sick leave, he will be paid benefits after the certificate of incapacity for work is closed. If an employee is on vacation, he already receives money for the New Year holidays 3 days before it starts, plus the vacation is extended due to official holidays. But there are situations when they won’t pay anything.

The first is that the employment contract is valid, but the employee took unpaid leave at his own expense. The second is that the person is registered in the organization, but is not currently fulfilling his duties (applies to women on maternity leave, employees caring for a newborn).

New rules for paying for holidays

The Constitutional Court of Russia published Decision No. 17-P of 04/11/2019, which finally approved that irregular payments for work in non-standard conditions cannot be included in the minimum wage. What would that mean? Now calculate your salary in a new way. The changes affected workers receiving minimum wage.

When calculating wages to an employee, the accountant is obliged to compare the level of earnings for the period worked with the minimum wage. For fully worked time at full time, the employee will receive payment no less than the minimum amount. In 2021, the minimum wage is 12,130 rubles. If the accruals are below the established minimum, then the employee is given an additional payment up to the minimum wage.

How did the decision of the Constitutional Court of the Russian Federation affect the rules for calculating wages? Judicial representatives decided that additional payments for work in non-standard conditions cannot be taken into account when comparing earnings with the minimum wage. That is, when calculating the minimum wage, do not include:

- additional payment for work on holidays and weekends;

- allowances for night work;

- overtime work.

Now there will be no disputes over the issue of whether payment for holidays is included in the minimum wage. The decision of the Constitutional Court of Russia dated April 11, 2019 clearly established that payments for work on holidays and weekends, as well as night work and overtime, cannot be taken into account in the minimum wage. Consequently, such allowances must be calculated above the minimum wage.

Relevant: wages on weekends, holidays and non-working days in 2021.

Pay for work on holidays in 2021 is a guarantee for workers to receive double payments. But this rule does not apply to non-working days introduced by Presidential Decree. Let's figure out how work on weekends, holidays and non-working days is paid.

How to calculate salaries in April during the period of self-isolation

The President of Russia declared the entire month of April non-working due to the outbreak of the coronavirus epidemic. In this regard, accountants have a question about how to calculate wages for April. Vladimir Putin, in his address to the nation, clearly said that wages for April will remain the same.

Option #1. Time-based wage system

For everyone who works for a salary or for a tariff rate, wages will remain in full, regardless of whether the subordinate worked or observed self-isolation at home. The presence of non-working days in April 2021 is not a reason for reducing wages.

The Ministry of Labor recommended that employers introduce a new designation for non-working days due to self-isolation in the time sheet. The new value should be approved by a separate order.

Option #2. Piece wages

If piece-rate workers are sent into self-isolation, and the entire month of April is non-working for them, then wages will still have to be paid. Such specialists are entitled to remuneration, the amount and procedure for calculating it is determined by the local act of the employer.

Option #3. For those who continue to work

If the employer is one of the institutions that were allowed to work in April, then calculate the employees’ salaries in the standard manner. Non-working days do not include weekends or holidays, therefore increased payment is not due for work in April. Of course, if the employee is not brought in on his day off. For example, on Saturday, Sunday or another day - a scheduled day off.

Option number 4. What to do with vacation

If an employee has a vacation and a period of self-isolation at the same time, then do not count non-working days in the duration of the vacation. Vacations on non-working days are not extended. Such clarifications were given by the Ministry of Labor in Letter dated March 26, 2020 No. 14-4/10/P-2696.

New rules for paying for holidays

The Constitutional Court of Russia published Decision No. 17-P of 04/11/2019, which finally approved that irregular payments for work in non-standard conditions cannot be included in the minimum wage. What would that mean? Now calculate your salary in a new way. The changes affected workers receiving minimum wage.

When calculating wages to an employee, the accountant is obliged to compare the level of earnings for the period worked with the minimum wage. For fully worked time at full time, the employee will receive payment no less than the minimum amount. In 2021, the minimum wage is 12,130 rubles. If the accruals are below the established minimum, then the employee is given an additional payment up to the minimum wage.

How did the decision of the Constitutional Court of the Russian Federation affect the rules for calculating wages? Judicial representatives decided that additional payments for work in non-standard conditions cannot be taken into account when comparing earnings with the minimum wage. That is, when calculating the minimum wage, do not include:

additional payment for work on holidays and weekends;

allowances for night work;

overtime work.

Now there will be no disputes over the issue of whether payment for holidays is included in the minimum wage. The decision of the Constitutional Court of Russia dated April 11, 2019 clearly established that payments for work on holidays and weekends, as well as night work and overtime, cannot be taken into account in the minimum wage. Consequently, such allowances must be calculated above the minimum wage.

Calendar for 2021

Let's determine on which days all workers are entitled to double pay in 2021. These are official holidays, which are named in Art. 112 Labor Code of the Russian Federation:

January 1,2,3,4,5,6,7,8

February 23

March 8

May 1.9

12 June

November 4

If an employee is hired to work on these days, then an increased bonus is guaranteed by the Labor Code.

There is also increased pay for work on weekends. Weekends are considered to be those days on which the employee is required to rest according to the work schedule. For example, for those working on a five-day shift, Saturday and Sunday are considered days off. For a six-day work week, the only day off is Sunday. For a shift schedule, days off are set on an individual basis.

But in any case, if an employee is hired to work outside of working hours, he is entitled to increased pay or single pay and additional rest time.

How to apply for holiday supplements

It is possible to attract an employee to work at non-standard hours, but only with his consent. The employer is obliged to comply with this requirement of the Labor Code of the Russian Federation. Otherwise, punishment from the State Tax Inspectorate cannot be avoided.

IMPORTANT!

Underage workers and pregnant women must not be assigned to additional work under any circumstances.

Consent can be obtained in different ways. For example:

send a notice offering to work on a weekend or holiday;

request a free-form statement from a subordinate stating that he agrees to work on a day off;

In the structure of the order, provide separate columns for the employee to review and sign.

IMPORTANT!

Employees have the right to replace increased pay with additional rest time. For example, request time off for holiday work. Then double payment will not be charged. Work on a weekend or holiday will be paid as standard and will be provided with paid time off.

Note to the employer. Receive an application for time off no later than the last working day of the month in which the employee was involved in “non-standard” work. If the application is submitted later, the inspectors from the State Tax Inspectorate will have questions.

How to calculate bonuses

Let's figure out how to correctly calculate payment on a day off. Each remuneration system has special rules. But there is one rule, the same for everyone. This is a guarantee of additional rest. Check with your subordinate whether he wants to receive time off or a double bonus. If you need a vacation, then accrue a holiday payment in a single amount. If time off is not needed, then consider the following recommendations:

for piece workers - no less than double the piece rate;

at an hourly rate - no less than double the hourly rate;

on a daily tariff - no less than double daily tariff;

wages on holidays with a salary are calculated at no less than double the employee’s daily or hourly salary.

IMPORTANT!

When calculating bonuses, take into account not only the official salary or tariff rate, but also all types of incentive and compensatory additional payments. For example, if an employee receives additional payment for length of service, then also include this payment in the calculation.

Example of salary calculation

Morkovkin I.P.’s salary is 20,000 rubles. Additional payment for length of service - 20% of salary. Stimulants - 40% of the DO. In January, he was involved in work from the 1st to the 5th. The region has a regional increasing coefficient of 15%.

Let's do the calculation:

We calculate the cost of one day of work in January: (20,000 + 4,000 (20% experience) + 8,000 (40% incentive)) / 17 working days = 1,882.35 rubles.

We calculate the additional payment for holidays: RUB 1,882.35. × 2 times the size × 5 days = 18,823.50 rubles.

We calculate the regional coefficient: 18,823.50 × 115% = 21,647.03 rubles.

IMPORTANT!

Withhold personal income tax from the amount paid for work on a holiday and calculate insurance premiums.

Night and holiday: how to pay

What to do if a subordinate had to work on a holiday or day off, and even at night. Payment for night hours on holidays is carried out in the following order:

add extra pay for holiday work;

calculate the premium for night hours;

add up the payments received.

Consequently, workers are entitled to two types of allowances at once. If the employer does not pay one of these additional payments, then he violates the provisions of the Labor Code of the Russian Federation. For this, administrative liability is provided under Art. 5.27 Code of Administrative Offenses of the Russian Federation.

Calendar for 2021

Let's determine on which days all workers are entitled to double pay in 2021. These are official holidays, which are named in Art. 112 Labor Code of the Russian Federation:

If an employee is hired to work on these days, then an increased bonus is guaranteed by the Labor Code.

There is also increased pay for work on weekends. Weekends are considered to be those days on which the employee is required to rest according to the work schedule. For example, for those working on a five-day shift, Saturday and Sunday are considered days off. For a six-day work week, the only day off is Sunday. For a shift schedule, days off are set on an individual basis.

But in any case, if an employee is hired to work outside of working hours, he is entitled to increased pay or single pay and additional rest time.

Amendments to regulatory documents

How the organization pays for work on a holiday is established in the labor or collective agreement, or in the regulations on remuneration. If it is necessary to make changes to regulatory documents, companies proceed as follows: after negotiations with employee representatives, an additional agreement to the collective agreement is drawn up, after which the additional agreement is sent to the labor inspectorate for registration, and then the additional agreement is presented to the organization’s employees under the signature.

If payment for work on a holiday is established in the wage regulations, then an order is issued to change it. There is no special form for such an order; the main thing is that an acquaintance sheet is attached to it, on which all employees put their signature confirming familiarization.

If the conditions for payment for a working holiday are provided for in the employment contract, then when changes are made, an additional agreement to it is drawn up.

Wording on remuneration on a holiday or day off in regulatory documents.

How to apply for holiday supplements

It is possible to attract an employee to work at non-standard hours, but only with his consent. The employer is obliged to comply with this requirement of the Labor Code of the Russian Federation. Otherwise, punishment from the State Tax Inspectorate cannot be avoided.

IMPORTANT!

Underage workers and pregnant women must not be assigned to additional work under any circumstances.

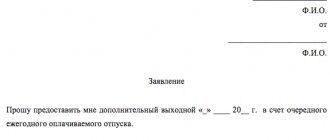

Consent can be obtained in different ways. For example:

- send a notice offering to work on a weekend or holiday;

- request a free-form statement from a subordinate stating that he agrees to work on a day off;

- In the structure of the order, provide separate columns for the employee to review and sign.

IMPORTANT!

Employees have the right to replace increased pay with additional rest time. For example, request time off for holiday work. Then double payment will not be charged. Work on a weekend or holiday will be paid as standard and will be provided with paid time off.

Note to the employer. Receive an application for time off no later than the last working day of the month in which the employee was involved in “non-standard” work. If the application is submitted later, the inspectors from the State Tax Inspectorate will have questions.

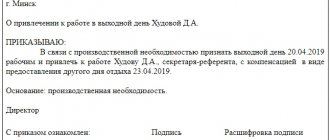

Sample order

Documents required to call an employee. Sample documents download

In order to attract an employee to work on weekends and non-working days, the manager must issue an order (Part 8 of Article 113 of the Labor Code of the Russian Federation). This document is drawn up in any form, but it must indicate the last name, first name, patronymic of the employee, specific days for going to work, as well as the structural unit in which he will work.

READ ON THE TOPIC:

How to calculate vacation pay if rest days coincide with holidays?

Calculation examples and answers to questions To avoid disagreements later, it is advisable to draw up an order in two copies and give one to the employee against signature.

In this case, both parties will have documentary evidence of being called to work on a day off, and the employer can easily prove that the employee was notified of the call. In addition, it is a good idea if the employee gives written consent in a separate document, drawn up in any form. Or you can provide the manager with two lines for the employee’s signature - “Agree” and “Disagree.” In this case, in the text of the order, use a quote from Part 2 of Art. 113 of the Labor Code of the Russian Federation, which states the employee’s right to refuse to work on a day off or a non-working holiday. An employee’s going to work on weekends or holidays must be noted in the work time sheet: in the column under the corresponding date, enter the letter code “РВ” or the digital code “03”, which indicates the duration of work on weekends and non-working holidays, and also indicate the exact number of hours worked by the employee that day.

Sample documents

Sample order from the head of an organization to call an employee to work on a weekend or holiday

Sample written consent of an employee to work on a weekend or holiday

How to calculate bonuses

Let's figure out how to correctly calculate payment on a day off. Each remuneration system has special rules. But there is one rule, the same for everyone. This is a guarantee of additional rest. Check with your subordinate whether he wants to receive time off or a double bonus. If you need a vacation, then accrue a holiday payment in a single amount. If time off is not needed, then consider the following recommendations:

- for piece workers - no less than double the piece rate;

- at an hourly rate - no less than double the hourly rate;

- on a daily tariff - no less than double daily tariff;

- wages on holidays with a salary are calculated at no less than double the employee’s daily or hourly salary.

IMPORTANT!

When calculating bonuses, take into account not only the official salary or tariff rate, but also all types of incentive and compensatory additional payments. For example, if an employee receives additional payment for length of service, then also include this payment in the calculation.

Example of salary calculation

Morkovkin I.P.’s salary is 20,000 rubles. Additional payment for length of service - 20% of salary. Stimulants - 40% of the DO. In January, he was involved in work from the 1st to the 5th. The region has a regional increasing coefficient of 15%.

Let's do the calculation:

- We calculate the cost of one day of work in January: (20,000 + 4,000 (20% experience) + 8,000 (40% incentive)) / 17 working days = 1,882.35 rubles.

- We calculate the additional payment for holidays: RUB 1,882.35. × 2 times the size × 5 days = 18,823.50 rubles.

- We calculate the regional coefficient: 18,823.50 × 115% = 21,647.03 rubles.

IMPORTANT!

Withhold personal income tax from the amount paid for work on a holiday and calculate insurance premiums.