Author: Ivan Ivanov

An employee's stay on a trip by order of the head of the organization and for carrying out official assignments is paid taking into account the average salary and daily allowance for all calendar days spent on a business trip.

In the current year 2021, the government has not changed the procedure for paying business trips abroad.

What is the daily allowance abroad in 2021?

Let’s say right away that the amounts of daily allowance issued for business trips abroad in 2021 are important for:

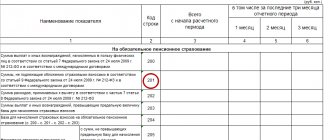

- calculation of income tax (tax accounting of expenses);

- calculations and payments of personal income tax (not subject to personal income tax, contributions for temporary disability and maternity, compulsory health insurance and compulsory medical insurance - 700 rubles for business trips in Russia and 2500 rubles for business trips abroad).

As a general rule, the employer sets the amount of daily allowance in 2021 independently , fixing any specific amounts in a collective agreement or local regulation (Article 168 of the Labor Code of the Russian Federation).

Please note that some companies set different daily allowances for business trips abroad, depending on which country the employee is sent to to perform a work assignment.

However, for budgetary organizations, the amount of daily allowance for business trips abroad in 2021 is set by the Government of the Russian Federation. At the same time, commercial organizations, if desired, can focus on these daily allowance amounts (see below).

Daily allowances in 2021 in Russia

At the beginning of 2021, no changes to the daily allowance ratio have been adopted.

In August 2015, legislators started talking about amending the current regulations regarding daily expenses, which would eliminate the very concept of “per diem” in relation to business trips in Russia.

The bill proposed expanding the list of expenses related to the performance of work duties on a business trip, which the enterprise had the right to compensate in accordance with the Labor Code of the Russian Federation. It would seem that this is just a change of wording. It's not that simple.

How to calculate daily allowance

Calculation of daily allowances for business trips abroad in 2021 depends on the number of days spent by the employee outside Russia.

But there are 3 rules that must be followed (clause 17, paragraph 1 and 3 of clause 18 of the Regulations on Business Travel, approved by Decree of the Government of the Russian Federation of October 13, 2008 No. 749):

- when leaving the Russian Federation, daily allowances are paid in foreign currency for the day of crossing the state border as for days spent abroad;

- when entering Russia, per day of crossing the border is paid in rubles as for days spent on the territory of the Russian Federation;

- if an employee is sent on a business trip to the territory of 2 or more foreign states, daily allowances for the day of crossing the border between states are paid in foreign currency in the amount established for the state to which the employee is sent.

However, the company has the right to establish its own procedure for calculating daily allowances paid for 2021.

Main changes in 2018-2019

This year, no innovations in the field of regulation of business trips, including business trips abroad, were adopted.

It is important not to forget that in order to include travel expenses, including daily allowances, it is necessary to correctly draw up all the necessary documents.

Currently, all administration of these amounts, both for calculating personal income tax and insurance contributions, is carried out by tax authorities on the basis of the provisions of the Tax Code of the Russian Federation.

Attention: in 2018-2019, when calculating travel expenses, you also need to take into account existing standards for business trips abroad.

The company has the right to develop its own daily allowance rates for foreign business trips. However, if they are greater than the amounts approved at the legislative level, then for the purposes of calculating personal income tax and social contributions, the amounts exceeding the standards must be taken into account in the base of these mandatory payments.

They are not taxed only in relation to contributions to the Social Insurance Fund for injuries, since their calculation is regulated by social insurance, and not by the tax authorities.

Attention: during the periods under review, the same rules continue to apply to reimbursement of expenses for one-day business trips.

Daily allowance for business trips abroad in 2021: table

Here are some daily allowances for business trips abroad in 2021, established by the Government of the Russian Federation for federal public sector employees (Resolution No. 812 dated December 26, 2005). If desired, they can be used as a guide for any legal entities and individual entrepreneurs.

| A country | Daily allowance in US dollars | |

| When traveling from Russia to the territory of another country | When employees travel abroad. institutions of the Russian Federation within the territory of the country where the foreign office is located. institution | |

| Abkhazia | 54 | 38 |

| Australia | 60 | 42 |

| Austria | 66 | 46 |

| Azerbaijan | 57 | 40 |

| Albania | 67 | 47 |

| Algeria | 65 | 46 |

| Angola | 80 | 56 |

| Andorra | 62 | 43 |

| Antigua and Barbuda | 69 | 48 |

| Argentina | 64 | 45 |

| Armenia | 57 | 40 |

| Afghanistan | 80 | 56 |

| Bahamas | 64 | 45 |

| Bangladesh | 67 | 47 |

| Barbados | 68 | 48 |

| Bahrain | 66 | 47 |

| Belize | 59 | 41 |

| Belarus | 57 | 40 |

| Belgium | 64 | 45 |

| Benin | 66 | 46 |

| Bermuda | 69 | 48 |

| Bulgaria | 55 | 39 |

| Bolivia | 63 | 44 |

| Bosnia and Herzegovina | 60 | 42 |

| Botswana | 64 | 45 |

| Brazil | 58 | 41 |

| Brunei | 57 | 40 |

| Burkina Faso | 72 | 50 |

| Burundi | 74 | 52 |

| Vanuatu | 68 | 48 |

| Great Britain | 69 | 48 |

| Hungary | 61 | 43 |

| Venezuela | 64 | 45 |

| Vietnam | 63 | 44 |

| Gabon | 70 | 49 |

| Haiti | 61 | 43 |

| Guyana | 67 | 47 |

| Gambia | 62 | 43 |

| Ghana | 66 | 46 |

| Guatemala | 68 | 48 |

| Guinea | 66 | 46 |

| Republic of Guinea-Bissau | 91 | 64 |

| Germany | 65 | 46 |

| Gibraltar | 69 | 48 |

| Honduras | 75 | 53 |

| Grenada | 92 | 64 |

| Greece | 58 | 41 |

| Georgia | 54 | 38 |

| Denmark | 70 | 49 |

| Djibouti | 75 | 53 |

| Commonwealth of Dominica | 69 | 48 |

| Dominican Republic | 59 | 41 |

| Egypt | 60 | 42 |

| Zambia | 68 | 48 |

| French overseas territories | 65 | 46 |

| Zimbabwe | 57 | 40 |

| Israel | 70 | 49 |

| India | 62 | 43 |

| Indonesia | 69 | 48 |

| Jordan | 62 | 43 |

| Iraq | 81 | 57 |

| Iran | 62 | 43 |

| Ireland | 65 | 46 |

| Iceland | 70 | 49 |

| Spain | 62 | 43 |

| Italy | 65 | 46 |

| Yemen | 66 | 46 |

| Cape Verde | 64 | 45 |

| Kazakhstan | 55 | 39 |

| Cayman islands | 69 | 48 |

| Cambodia | 68 | 48 |

| Cameroon | 69 | 48 |

| Canada | 62 | 43 |

| Qatar | 58 | 41 |

| Kenya | 66 | 46 |

| Cyprus | 59 | 41 |

| Kyrgyzstan | 56 | 39 |

| Republic of Kiribati | 75 | 52 |

| China | 67 | 47 |

| China (Hong Kong) | 67 | 47 |

| China (Taiwan) | 67 | 47 |

| Colombia | 65 | 46 |

| Comoros | 86 | 60 |

| Congo | 85 | 60 |

| Democratic Republic of the Congo | 76 | 53 |

| Democratic People's Republic of Korea | 65 | 46 |

| The Republic of Korea | 66 | 46 |

| Costa Rica | 63 | 44 |

| Ivory Coast | 74 | 52 |

| Cuba | 65 | 46 |

| Kuwait | 59 | 41 |

| Laos | 64 | 45 |

| Latvia | 55 | 39 |

| Lesotho | 61 | 43 |

| Liberia | 78 | 55 |

| Lebanon | 73 | 51 |

| Libya | 70 | 49 |

| Lithuania | 57 | 40 |

| Liechtenstein | 71 | 50 |

| Luxembourg | 61 | 43 |

| Mauritius | 63 | 44 |

| Mauritania | 67 | 47 |

| Madagascar | 64 | 45 |

| Macau | 67 | 47 |

| Macedonia | 60 | 42 |

| Malawi | 66 | 46 |

| Malaysia | 60 | 42 |

| Mali | 70 | 49 |

| Maldives | 67 | 47 |

| Malta | 61 | 43 |

| Morocco | 58 | 41 |

| Mexico | 64 | 45 |

| Mozambique | 68 | 48 |

| Moldova | 53 | 37 |

| Monaco | 65 | 46 |

| Mongolia | 59 | 41 |

| Myanmar | 65 | 46 |

| Namibia | 61 | 43 |

| Nauru | 60 | 42 |

| Nepal | 65 | 46 |

| Niger | 78 | 55 |

| Nigeria | 72 | 50 |

| Netherlands | 65 | 46 |

| Nicaragua | 68 | 48 |

| New Zealand | 65 | 46 |

| New Caledonia | 60 | 42 |

| Norway | 79 | 55 |

| United Arab Emirates | 60 | 42 |

| Oman | 62 | 43 |

| Pakistan | 69 | 48 |

| Palau island | 63 | 44 |

| Palestine | 70 | 49 |

| Panama | 64 | 45 |

| Papua New Guinea | 68 | 48 |

| Paraguay | 57 | 40 |

| Peru | 63 | 44 |

| Poland | 56 | 39 |

| Portugal | 61 | 43 |

| Puerto Rico | 72 | 50 |

| Rwanda | 72 | 50 |

| Romania | 56 | 39 |

| Salvador | 68 | 48 |

| Samoa | 64 | 45 |

| San Marino | 65 | 46 |

| Sao Tome and Principe | 74 | 52 |

| Saudi Arabia | 64 | 45 |

| Swaziland | 65 | 46 |

| Seychelles | 71 | 50 |

| Senegal | 70 | 49 |

| Saint Lucia | 69 | 48 |

| Serbia and Montenegro | 60 | 42 |

| Singapore | 61 | 43 |

| Syria | 62 | 43 |

| Slovakia | 59 | 41 |

| Slovenia | 57 | 40 |

| Solomon islands | 56 | 39 |

| Somalia | 70 | 49 |

| Sudan | 78 | 55 |

| Suriname | 69 | 48 |

| USA | 72 | 50 |

| Sierra Leone | 69 | 48 |

| Tajikistan | 60 | 42 |

| Thailand | 58 | 41 |

| Tanzania | 66 | 46 |

| Togo | 65 | 46 |

| Tonga | 54 | 38 |

| Trinidad and Tobago | 68 | 48 |

| Tunisia | 60 | 42 |

| Turkmenistan | 65 | 46 |

| Türkiye | 64 | 45 |

| Uganda | 65 | 46 |

| Uzbekistan | 59 | 41 |

| Ukraine | 53 | 37 |

| Uruguay | 60 | 42 |

| Fiji | 61 | 43 |

| Philippines | 63 | 44 |

| Finland | 62 | 43 |

| France | 65 | 46 |

| Croatia | 63 | 44 |

| Central African Republic | 90 | 63 |

| Chad | 95 | 67 |

| Czech | 60 | 42 |

| Chile | 63 | 44 |

| Switzerland | 71 | 50 |

| Sweden | 65 | 46 |

| Sri Lanka | 62 | 43 |

| Ecuador | 67 | 47 |

| Equatorial Guinea | 79 | 55 |

| Eritrea | 68 | 48 |

| Estonia | 55 | 39 |

| Ethiopia | 70 | 49 |

| South Ossetia | 54 | 38 |

| South Africa | 58 | 41 |

| Jamaica | 69 | 48 |

| Japan | 83 | 58 |

Read also

20.05.2020

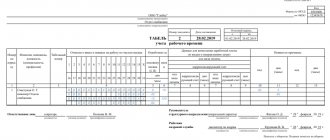

Filling out the advance report

It will be more convenient for the accountant if the expenses in the advance report are indicated both in foreign currency and in rubles. In order for an accountant to be able to check the accuracy of the calculation, the conversion rate must be indicated somewhere. To do this, you can enter a separate column on the back of the expense report.

If your organization uses a unified form No. AO-1 or another form to which you cannot make changes (for example, because the accounting program does not allow this), calculate the employee’s travel expenses on a separate sheet.

We offer you a form for such a calculation. It makes little sense for the manager to approve it - after all, the employee will need to transfer the ruble amounts of all travel expenses to the advance report. The manager will approve it.

OPTION 1. For example, let’s take a situation where an organization located in Tver sends an employee on a business trip to Germany. The regulations on business trips of this organization establish that daily allowances for days spent on a business trip in Europe are paid in rubles in an amount equivalent to 60 euros/day, and daily allowances for days spent on a business trip in Russia - in the amount of 1000 rubles/day. At the same time, daily allowances for the day of crossing the border both there and back are calculated according to the standards for European business trips.

The regulations on business trips stipulate that daily allowances issued in rubles, the norms of which are established in foreign currency, are recalculated either at the exchange rate specified in the bank certificate, or at the Central Bank rate valid on the date of approval of the employee's advance report.

The employee was given an advance for travel expenses in the amount of RUB 60,000.

Calculation of travel expenses from “30” May 20 14

| End date of business trip |

| 05/20/2014The employee must attach a photocopy of the foreign passport with customs marks to the report |

| 05/27/2014The employee must attach a photocopy of the foreign passport with customs marks to the report |

1. The official exchange rate of the Central Bank on the date of approval of the advance report by the head of the organization (as of May 30, 2014) is 47.1145 rubles/euro.

2. On May 19, 2014, an advance was received for travel expenses - RUB 60,000.00.

3. Data on the purchase and sale of foreign currency:

4. Cost data:

5. Balance/overexpenditure in rubles: 9,750.93 rubles. Let us remind you that if an employee has a salary bank card, both an advance payment for a business trip and the amount of overexpenditure confirmed by an advance report can be transferred to it. This will not be a violation of cash discipline Letter of the Ministry of Finance No. 02-03-10/37209, Treasury No. 42-7.4-05/5.2-554 dated 09.10.2013 (69,750.93 rubles - 60,000.00 rubles).

All specified primary documents are attached to the calculation.

| Accountable person | signature | Verkhovensky L.G. full name |

After the employee has calculated his travel expenses, drawn up an advance report on them, and the accounting department has checked this report, the manager must approve it. Then the employee deposits the remaining cash into the cash register or, conversely, the organization must pay him the overexpenditure. In our example, the employee was paid an overexpenditure in the amount of 9,750.93 rubles on May 30.

| № | Index | Amount, rub. |

| 1 | Total amount of daily allowance in rubles (450 rub. 22,190.93 rub.) | 22 640,93 |

| 2 | Daily allowance, not subject to personal income tax, up to 2500 rubles/day - for 7 days on a business trip abroad (2500 rubles x 7 days) | 17 500,00 |

| 3 | Daily allowance, not subject to personal income tax, up to 700 rubles/day - for 1 day on a business trip in Russia (700 rubles x 1 day) | 700,00 |

| 4 | Amount of daily allowance not subject to personal income tax (line 2 line 3) | 18 200,00 |

| 5 | Amount of daily allowance subject to personal income tax (line 1 – line 4) | 4 440,93 |

The income of a posted worker in May must include 4,440.93 rubles.

OPTION 2. Let's slightly change the conditions of our example to illustrate the situation with exchanging excess currency for rubles. Let's assume that 85,000 rubles were issued for the report. At the same time, while in Russia, the employee bought 1230 euros at the exchange rate of 48 rubles. per euro.

After paying for hotel accommodation, the employee had 509 euros left (1230 euros – 30 euros for a public transport ticket – 166 euros for an air ticket – 525 euros for a hotel). Considering that he has the right to keep 480 euros of daily allowance (60 euros for each day of a business trip), after returning from a business trip on May 29, the employee sells 29 euros (rate - 47 rubles/euro). Received 1363 rubles, which is confirmed by a bank certificate (no bank commission).

When selling foreign currency previously purchased for business travel purposes, the report must indicate the resulting “exchange” differences between the rate of purchase of the currency and its sale. Otherwise, the employee will actually pay for such differences out of his own pocket, and the Labor Code tells us that the organization must reimburse the employee for all reasonable travel expenses (Articles 167, 168 of the Labor Code of the Russian Federation).

Calculating travel expenses will look slightly different.

2. On May 19, 2014, an advance was received for travel expenses - RUB 85,000.00.

5. Balance/overexpenditure in rubles: 15,203.88 rubles. (RUB 85,000.00 – RUB 69,796.12).

The total ruble amount of daily allowance in the second option will be equal to 23,039.12 rubles. (22,992 rub. 47.12 rub.). The personal income tax base will need to include 4839.12 rubles. (RUB 23,039.12 – RUB 18,200).

Sometimes employees who are not satisfied with the advance payment received pay on business trips with their bank cards. In this case, electronic terminal receipts, among other things, can serve as documents confirming expenses.

If the employee has a card in the same currency in which he pays, then there may not be any additional fees.

But if the card is in rubles, and, for example, an amount in euros is debited from the card, then the employee’s bank will carry out the conversion operation at its own internal rate (which will differ from the Central Bank rate).

In order for the employee to be reimbursed for all his expenses, he must provide the accounting department with an extract from his card account. Then his foreign exchange expenses can be reflected in the advance report at the real exchange rate. Consequently, the ruble amount of expenses will coincide with the one debited from the card. Otherwise, you will have to recalculate foreign exchange expenses at the official exchange rate of the Central Bank as of the date of approval of the advance report.

Accounting entries

When calculating an advance before going on a business trip, an entry is made to accounts Dt 71 Kt 50 or 51. It is noted that the funds are paid specifically for travel expenses.

Table 1. What transactions are made after receiving the advance report.

| Operation | Dt | CT |

| Payment of daily allowances, travel and housing expenses | 20, 23, 44 | 71 |

| VAT for housing and travel | 19 | 71 |

| Refund of advance balance | 50 | 71 |

| Compensation to an employee for overspending | 71 | 50 |

If the daily allowance limit has been exceeded, make a posting Dt 70 - Kt 68 with the appropriate mark. This operation is carried out when writing off income tax.

Daily allowances are included in the list of mandatory payments to an employee when going on a business trip. This amount is calculated taking into account the duration and country of stay. Travel allowances are provided in the form of an advance. Upon return, the employee draws up a report and provides documents confirming the fact of forced expenses.

Top

Write your question in the form below

Features of reflection

When sending an employee abroad, in addition to the main costs, the following expenses must also be reimbursed:

- arising during the preparation of travel documents;

- for mandatory airport and consular fees;

- related to fees for the right to exit and, if necessary, transit a vehicle;

- for compulsory medical insurance.

Other mandatory fees and charges must also be reimbursed. All this, based on paragraphs 12 and 1 of Article No. 168, must be taken into account in calculating the income tax base. Travel expenses and the procedure for their reimbursement in commercial organizations should be determined by local regulations or collective agreements.

If the employee traveled to the place of business trip by personal transport, the actual length of stay must be indicated in the memo. The latter must be handed over after arrival along with documents justifying the use of a personal vehicle.

In addition to travel documents or a note, within three days after the business trip, the employee must additionally provide an advance report indicating the amounts associated with the costs of the business trip. At the same time, he makes the final payment for the advance payment given to him before the trip.