A freelance employee of the organization is not listed among the staff, but a civil or employment contract has been concluded with him. In one of the companies where I worked, freelancers were specialists who were officially registered in the company, but worked not in the office, but from home. However, according to an honest Hamburg account, it is correct to call such workers remote - this is one of the convenient formats of cooperation beneficial for enterprises, but it differs from hiring freelancers.

Freelance employees are required by organizations to perform certain types of work. Most often we are talking about tasks that arise only from time to time, but sometimes out-of-staff employees perform regular tasks and remain on call full-time, so that they are distinguished from full-time specialists only by the contract format and tax payment scheme. How to hire a freelancer and not regret it?

Freelance status: rights and responsibilities

I’ll say right away: the Labor Code of the Russian Federation does not provide for such a form of hiring as an out-of-state specialist. Therefore, if you have entered into an employment contract with an employee, he is subject to the same rights and obligations as specialists who come to the office five days a week.

In practice, the difference comes down to the fact that his position is not included in the staffing table, or you are looking for a specialist to help full-time employees. For example, you have two locksmiths, but from time to time they cannot cope with the volume of tasks, so you attract a third specialist.

In such cases, the rights and responsibilities of a freelancer are no different from the rights and responsibilities of other employees in your company.

Who are the staff members?

Labor relations are relationships based on an agreement between the employee and the employer on the personal performance by the employee for payment of a labor function (work according to the position in accordance with the staffing table, profession, specialty indicating qualifications; a specific type of work entrusted to the employee) in the interests, under management and control the employer, the employee’s subordination to the internal labor regulations while the employer provides working conditions provided for by labor legislation and other regulatory legal acts containing labor law norms, a collective agreement, agreements, local regulations, and an employment contract. An employment contract is an agreement between an employer and an employee, according to which the employer undertakes to provide the employee with work for a specified labor function, to provide working conditions provided for by labor legislation and other regulatory legal acts containing labor law norms, a collective agreement, agreements, local regulations and by this agreement, to pay the employee wages on time and in full, and the employee undertakes to personally perform the labor function determined by this agreement in the interests, under the management and control of the employer, to comply with the internal labor regulations in force for this employer.

09 Feb 2021 marketur 546

Share this post

- Related Posts

- Prohibition of Repair Work on Weekends in the Tula Region

- What do incentive payments for educators consist of?

- Is a citizen of the Russian Federation required to have permanent registration?

- Do I need to pay for electricity bills from five years ago?

Pros and cons of out-of-state specialists

The advantages of hiring out-of-state workers include:

- Reducing the burden on accounting. However, this is only true if you outsource some functions - you enter into an agreement with the company, for example, on cleaning, eliminating the need to hire a permanent cleaner. Also, cooperation with individual entrepreneurs reduces the burden on accounting.

- Reducing the burden on the HR department. Again, this is not always true. In addition to cases of searching for specialists through outstaffing, the load on the HR department is reduced if the head of the department or a responsible specialist is looking for a freelancer to perform a certain task.

- Saving money. The work of freelancers is often paid on an actual basis; it is not necessary to accrue a monthly salary and advance payment. Another type of savings is the ability to rent a smaller office or purchase fewer tools (depending on the specifics of the business). A freelancer does not have to be allocated a permanent place, and he often has his own tools.

- Possibility to hire an unlimited number of freelancers. The customer’s hands are free: the law does not prohibit hiring as many out-of-state specialists as you want.

The disadvantages include higher risks associated with specialists performing their duties. For example, such employees often do not feel like full members of the team, so they do not strive to establish communication with other employees, and treat their duties negligently.

But even if the specialist is responsible, the lack of communication can make work difficult - it often creates an additional burden on the manager, because even small issues go through him, as through an intermediary. Non-staff specialists often do not have the bonuses and privileges of full-time employees, so they easily lose motivation. That is, you still need to be able to work with such employees.

Which temporary staff are most in demand?

Temporary personnel are required in various fields, including industry. Temporary staff are often required to formulate and promote new projects due to seasonal increases in workload. To get reliable and responsible staff, an organization needs to choose a good provider. The provider is usually selected based on the experience of other companies: management pays attention to the cost of services, reputation and agencies. There are some challenges that managers may encounter when working with a provider.

Agencies are different, some provide honest, conscientious workers, others may provide personnel that does not meet the requirements of the organization. Some companies complain that the provider does not provide employee services on time. Another problem that management may encounter is frequent changes of employees (in this case, it is necessary to spend additional time training new staff).

Agency clients sometimes complain that the provider provides “the wrong specialists.” However, it is worth remembering: the best specialists in their field do not sit idle, they have long found their place in one or another company and work as full-time employees.

As for the focus of the work of outsurfing agencies, as a rule, they provide temporary staff without qualifications (this includes cleaners, workshop workers, warehouse workers, call center operators, drivers, etc.). Providers are not involved in the selection of managers, IT specialists, and doctors.

Is it promising to work as a freelancer?

People often ask in what areas you can be a freelancer. In short: in all cases, you can even become a freelance employee of the FSB or Interpol.

Most often, freelancers are hired by companies related to information, marketing and IT: online publications actively cooperate with freelance authors, entrepreneurs are looking for freelance specialists for technical support of sites, freelance marketers are involved in individual promotions and events.

Another in-demand area is finance: companies are often looking for freelance accountants and auditors. However, you should not assume that you cannot get a job, for example, as a freelance electrician or plumber. More and more companies are entering into contracts with freelancers.

How promising is it to become a freelancer?

It’s difficult to give a definite answer: it depends on your specialization and the specifics of the industry. If you are looking for a way to arrange a shift work schedule in order to devote time to some important things other than work, this will be, if not promising, then profitable for you.

In the future, a freelancer can really turn into a permanent specialist and even take a leadership position. Because any company prefers an already verified person to a stranger who came through an advertisement. But it's not that simple.

You may come across companies that save money by hiring freelancers. They are looking for smart, qualified, but insufficiently experienced specialists, offering a low rate, but with the prospect of being hired as a staff member.

Since no one gives specific deadlines, such a specialist can work for several years for ridiculous money, counting on the future.

Just remember: if you don't get paid well out of state, you're unlikely to get paid well once you get your own desk and chair in the office.

The concepts of “Outstaffing” and “Outsurfing”

In the modern world, there is a term “Outstaffing”, which implies the removal of personnel from the company’s staff and the hiring of a provider who assumes obligations in relation to this personnel. As for employees, everything remains the same for them, except for the entry in the work book.

An organization that orders outstaffing pays the provider an agreed amount for the provision of such services, and it also pays all necessary expenses for the provider’s work related to the maintenance of employees. Outstaffing is widespread because it makes the business easier to manage and reduces the workload for the organization. Tax optimization occurs legally, outstaffing is a convenient method for management.

Outstaffing services are often provided by recruitment agencies involved in personnel selection. In frequent situations, they are faced with fired employees: the agency can easily employ them in any other organization that they have as a client. Outsurfing involves an agency searching for employees to temporarily work in a specific organization. In this case, workers provide their services for a specified period.

Many organizations need non-staff personnel. Temporary staff are often needed for seasonal work, for example, in the hotel business, trade, and construction. In the medical industry, employers are not confident that the provider will be able to provide employees whose quality of work will be at the highest level.

Freelance employee: how to apply correctly

And now the most slippery moment: how to guide a freelancer through accounting and legitimize your relationship with the employee? Concluding an employment contract is usually unprofitable for the employer, because then he will be required to pay a salary, advance payment, vacation, paid sick leave, etc. Therefore, a freelance contract is usually a civil law form, which implies that one party acts as a customer, and the other as a contractor.

Specifics of a civil contract:

- The work can be paid at any frequency, but the contractor is not subject to your work schedule.

- The contractor has no right to social guarantees, but personal income tax is withheld for each payment to him.

- Mandatory insurance contributions are only to the Pension Fund of the Russian Federation and the Federal Compulsory Compulsory Medical Insurance Fund, but if the contract provides for payments for injuries, then the contractor may be entitled to them too.

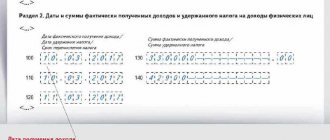

As you already understand, taxes must be paid for a freelance employee. The customer becomes a tax agent and is obliged to withhold personal income tax from all payments. Exception: if you have entered into an agreement with an individual entrepreneur, then he must pay taxes on his own.

I recommend that contractors themselves pay attention to the clause in the contract “compensation for damages for uncompleted work or damage to the company,” if there is one.

Because under this clause of the contract you may be given extra responsibility. Also carefully re-read the terms and amounts of payments, the possibility of receiving additional payment. If your work involves health risks, your contract should include a clause on compensation for medical expenses. From the site pravsiila.ru

Who is a freelancer?

A freelancer is a hired worker who is involved in the general work process to perform some specific work.

There can be a variety of qualifications in this area, from ordinary workers to professionals in the field of creating a website and assessing the development strategy of an organization. In other words, a freelancer has the name “freelancing”, which has become very popular and is being actively embraced by the market, both from employees and from organizations.

At first, freelancing was considered to be workers who come, do work and leave. Now a freelancer can be a permanent freelance worker whose activities are aimed at performing various company tasks and at the same time he has the opportunity to be at home.

Recruitment

In order to hire a non-staff employee, just follow a couple of steps:

- Ask the citizen to bring the necessary package of documents.

- Make an agreement with him.

It is worth making a few additions to this instruction for hiring a non-staff employee to make everything clear:

- The required package of documents includes: a passport or any other document confirming identity (TIN, SNILS and work book are not required). This item also includes a document indicating or confirming the registration address on the territory of Russia (as a rule, this document is required for foreign citizens).

- There is no need to conclude an employment contract with a citizen; in this case, it is enough to use a civil agreement. In addition, it has a division: a contract agreement (involving that a worker is hired to perform a certain amount of work) or a contract for services (in which case it is assumed that a non-staff representative will provide certain services).

As for the very content of the agreement on hiring a non-staff employee, it must necessarily contain the following points:

- Describe all the items and the scope of work performed or the type of services (this means a detailed description, taking into account all the specifics, features and important points; you should not try to shorten this item).

- The exact deadlines for completing the work must be indicated (the number of hours worked or even the work schedule can similarly be attributed to this).

- The responsibilities of the freelance worker must be indicated in terms of reporting on the work done (usually in this case the need to provide a certificate of work performed is indicated).

- The amount of remuneration that the employee will receive is indicated.

- It must be noted when payment will be received and in what way it will be made.

- The rights and main responsibilities of each of the parties who sign must be outlined.

- Special conditions are noted under which the agreement may be terminated.

- Data must be provided regarding the complete information of the organization (indicating the manager), as well as information about the employee himself (passport details, place of residence and full name).

A special condition of this agreement is that it can be terminated early, but only if a situation arises that must be specified in the document. In addition, other conditions may be included in the document, but only with the consent of both parties.

Freelance worker: dangerous moments for employer and employee

“Personnel officer. Labor law for personnel officers", 2009, N 3

Freelance worker: dangerous moments for employer and employee

In Soviet times, “freelance workers” meant citizens who performed work for an organization and were not on staff. With the development of Russian legislation, the concept and status of a “freelance worker” has changed. The thinking of some organizational leaders remained at the level of legal regulation of the labor of “freelance workers” in the USSR. The employer does not always think about the consequences of such relationships.

Currently, there is no definition of “freelance worker” in current legislation. In practice, the following citizens can be classified as “freelance workers”:

— persons who have entered into an agreement for the provision of services (performance of work) with the organization;

- persons who were on the staff of the organization (were employees), but for some reason, at the direction of the manager, were “removed from the staff.”

Let's take a closer look at the situations that arise in practice.

Citizens who have entered into an agreement for the provision of services

(work performance) with the organization

Relations between an organization and a citizen are regulated by a civil contract for the provision of paid services, contracts, etc. for the performance of certain types of work and provision of services. In accordance with the terms of a civil contract, the organization receives the result of the work (service), and the citizen receives remuneration. The organization is obliged to withhold personal income tax in the amount of 13% from the amount of the citizen’s remuneration for transfer to the appropriate budget (Articles 224, 226 of the Tax Code of the Russian Federation).

It is quite common that when concluding a civil contract, the parties do not take into account such a feature as the duration of the relationship. It happens that relationships under a civil contract are long-term in nature and systematic, monthly cash payments are made under it. The duration of the contract poses a danger for the parties, since the activities of a citizen providing services under such a contract may fall under the definition of entrepreneurial activity. The result of the provision of services under a civil contract is that an individual receives remuneration over a long period, that is, profit and, therefore, he is a business entity not registered in the manner established by the legislation of the Russian Federation (Part 3, Clause 1, Article 2, Article 23 of the Civil Code of the Russian Federation). As a result, a citizen may be brought to administrative responsibility for carrying out business activities without state registration (Article 14.1 of the Code of Administrative Offenses of the Russian Federation), and if it is established that this person systematically carried out activities aimed at making a profit at least 2 times, then to criminal liability for illegal entrepreneurship (Article 171 of the Criminal Code of the Russian Federation).

If a civil law contract is incorrectly formulated, adverse consequences may also arise for the organization.

Tax authorities, when conducting tax audits in organizations, closely study contracts concluded with citizens for the provision of services, trying to qualify the concluded contracts as employment contracts. If the civil contract includes conditions regulated by labor legislation, this will benefit the tax authorities. If the organization is classified in this way, the tax authorities will make a decision on an unjustified reduction in taxable profit, additional taxes, and penalties.

In addition, the State Labor Inspectorate, when conducting inspections of organizations, can issue an order to the manager to eliminate violations if it finds that, according to the terms of the concluded civil law contract, it follows that it actually regulates the labor relations between the employee and the employer. The State Labor Inspectorate will be guided by Part 4 of Art. 11 of the Labor Code of the Russian Federation, clause 8 of the Resolution of the Plenum of the Armed Forces of the Russian Federation dated March 17, 2004 N 2 “On the application by the courts of the Russian Federation of the Labor Code of the Russian Federation.”

In order to recognize the legal conclusion of a civil contract, citizens who have entered into a civil contract must not obey the local regulations of the organization, including the internal labor regulations in force in the organization. At the same time, the work performed or the provision of services should not coincide with the performance of similar work by a full-time employee of the organization; remuneration should be paid upon completion of the work performed or the provision of services. Otherwise, such a civil law contract may be recognized by the court as a labor contract (Decision of the Supreme Court of the Russian Federation dated March 21, 2008 N 25-B07-27).

It is also erroneous to include in a civil contract the obligation of the organization to provide compulsory social insurance against accidents at work and occupational diseases (Clause 1, Article 5 of the Federal Law of July 24, 1998 N 125-FZ “On compulsory social insurance against accidents at work” and occupational diseases" (as amended on July 23, 2008). Organizations that have included an insurance clause in the contract or pay insurance premiums under the contract, even without a reference in the contract, risk being held liable in the form of payment of monetary compensation for treatment, additional food, purchase of medicines and etc., if an accident occurs in an organization with such a citizen or he acquires a disease related to the work performed.Payment of insurance premiums can also be considered as confirmation of the conclusion of an employment contract, and not a civil law one.

In order to avoid adverse consequences, an organization, when concluding a civil contract with a citizen, must take into account that the relationship under the contract is not long-term, remuneration is paid upon completion of work, and the contract does not contain conditions regulated by labor legislation. It is advisable to provide clauses distinguishing a civil contract from an employment contract.

Example. “This agreement is governed by the norms of civil law; the norms of labor law do not apply in the relationship between the parties.”

A point reminding the citizen that he is independently responsible for his actions (inactions), the obligation to perform which is imposed on him by current legislation (for example: register as an individual entrepreneur, pay taxes, etc.). This clause is needed by the organization to ensure security in the event that, when concluding a contract, a citizen provided incomplete or unreliable information about himself.

Example. “The Contractor (Executor) is independently responsible for his actions (inactions), which he is obliged to perform in accordance with the requirements of the law.”

Workers “retired from the staff”

According to current legislation, the organization independently establishes its structure and, accordingly, staffing based on economic feasibility. With the introduction of modern automated equipment into organizations (new work methods, etc.), situations arise when there is no need for any structural unit. When downsizing a structural unit being liquidated, the organization is obliged to provide employees with guarantees and benefits provided for by labor legislation.

If with the majority of workers the reduction process is regulated by the norms of the Labor Code of the Russian Federation, then with pregnant women, women with children under the age of 3, as well as single mothers raising a child under the age of 14 or a disabled child under 18, etc. , a problem arises. In Art. 261 of the Labor Code of the Russian Federation provides guarantees that prohibit the termination of an employment contract with women who have children under three years of age at the initiative of the employer (with the exception of dismissal on the grounds provided for in paragraphs 1, 5 - 8, 10, 11 of Part 1 of Art. 81 and paragraph 2 of Article 336 of the Labor Code of the Russian Federation). The enterprise faces a dilemma about what to do with this category of workers. The unit is excluded from the staffing table, but there are employees who are guaranteed retention of their positions by law (Article 261 of the Labor Code of the Russian Federation). However, this position cannot be on the staff list due to the fact that there is no volume of work, there is no structural unit, and the employer is forced to “retire” this category of employees, which is a significant violation of Part 4 of Art. 256 Labor Code of the Russian Federation. In fact, based on the staffing table, it turns out that the employee has not retained his place of work (position).

Thus, the organization has an employee in a department that does not exist. This employee, for example, is paid a child care benefit through the organization.

There are also cases when, by decision of the manager, a department is liquidated and, when measures are taken to employ workers, in addition to transferring to vacant positions, they are transferred to positions in which employees are already registered, but it is assumed that these positions will soon become vacant (the end of a fixed-term employment contract, retirement and other reasons). The transfer is processed on the basis of the employer’s proposal and the employee’s statement, who often does not even assume that he is writing an application for transfer to a position held by another employee.

Thus, there are two employees in one position in the organization. One of them is overstaffed.

The organization does not advertise such situations (does not show “extra” workers in reporting to government agencies) and, not realizing the seriousness of the issue, may from time to time, if necessary, repeat transfers of workers to existing positions to solve its current problems.

Summarizing the above examples, it should be noted that the employer does not always assess the complexity of the situation when carrying out the “retirement” of employees.

The main mistakes made by employers

As a rule, the employer has no reason to attribute the amount of wages of an “extra-staff” employee to the cost price, since the amount of salary (tariff rate) for each position is directly indicated in the staffing table (unified form T-3, approved by Resolution of the State Statistics Committee of Russia dated January 5, 2004 N 1 “On approval of unified forms of primary accounting documentation for recording labor and its payment”), which is absent in the situation that has arisen.

By virtue of paragraphs. 2 p. 2 art. 253 of the Tax Code of the Russian Federation, the organization’s expenses for paying employees are included in the reduction of income received for profit tax purposes. According to Art. 252 of the Tax Code of the Russian Federation, in order to include in the cost of goods (works/services) produced, labor costs must be documented. Documented expenses mean only those expenses that are confirmed by documents drawn up in accordance with the legislation of the Russian Federation, in particular labor legislation regarding labor costs.

Therefore, in case of violation of the requirements of labor legislation, the organization does not have the right to attribute expenses for remuneration of “freelance workers” to the reduction of taxable income.

When inspecting an organization and identifying overstaffed employees, the tax authority may assess additional taxes and penalties on the amounts of payment attributed to the cost price due to an unjustified reduction in taxable profit, and impose penalties.

The employer violates the guarantees of certain categories of employees (women who have children under 3 years of age and are on parental leave before reaching the age of 3 years, persons temporarily disabled, etc.) - Part 6 of Art. 81, art. Art. 256, 261 Labor Code of the Russian Federation. In particular, their positions may not be included in the organization’s staffing table.

An employee who is registered in a position already occupied by another employee may have problems with preferential retirement due to harmfulness if this position is included in the list of positions giving the right to early retirement. To assign a pension in connection with work in hazardous conditions, Pension Fund employees require the provision of primary documents confirming the actual time the employee spent (working) in hazardous conditions.

Failure to comply with labor legislation leads to the fact that employees, in order to protect their interests, will file lawsuits, which will take a lot of time and entail additional costs if a court decision is not in favor of the organization.

Manager's responsibility for violating the law

For violation of labor legislation, the head of the organization may incur administrative or criminal liability.

Administrative liability for officials for violation of labor legislation is provided for in Art. 5.27 Code of Administrative Offenses of the Russian Federation. A first-time offense will entail the imposition of an administrative fine in the amount of 1,000 to 5,000 rubles. (Part 1 of Article 5.27 of the Code of Administrative Offenses of the Russian Federation). Cases of administrative offenses are considered by state labor inspectorates and judges (Article 23.12, paragraph 2 of Article 23.1 of the Code of Administrative Offenses of the Russian Federation). For repeated offenses, the penalties are toughened. If a similar administrative offense has already been committed previously, then the official may be subject to disqualification for a period of 1 to 3 years (Part 2 of Article 5.27 of the Code of Administrative Offenses of the Russian Federation). In such cases, officials of state labor inspectorates draw up protocols and send the collected documents to the court (clause 16, part 2, article 28.3 of the Code of Administrative Offenses of the Russian Federation), where these cases are directly considered (clause 1, article 23.1 of the Code of Administrative Offenses of the Russian Federation).

The organization as a legal entity also bears responsibility - in the form of a fine from 30,000 to 50,000 rubles. or administrative suspension of activities for up to 90 days (suspension of activities also applies to persons engaged in business activities without forming a legal entity).

In order to prevent adverse consequences for both the employee and the employer, human resources services of organizations need to know the above features and not violate the law.

Food for thought. Working from home and employer control

Svetlana Voskoboynik, lawyer:

It is no secret that widespread automation (computerization) of various types of work allows a significant number of people to work not in the office, but remotely, at home. This category includes programmers, journalists, editors, designers, translators, design engineers, etc. Such workers abroad are called freelancers.

Freelancer (English freelancer - “free spearman”, mercenary). In a figurative sense, this term means a free artist, that is, a person who performs work without concluding a long-term contract with an employer, hired only to perform a certain list of works. In English, “freelancer” was a noun for a long time, but in 1903 a derivative verb was formed from the noun, which was immediately included in the Oxford English Dictionary. Recently, the noun has been transformed and used in various verb and adverb forms. We are more familiar with the term “freelance worker”. An employee invited to perform work as part of outstaffing can also be called a freelancer (freelance worker). For the freelancer himself, such an organization of work is quite beneficial, since, without being included in the staff of a certain organization, such a person can simultaneously perform work for several unrelated customers. Despite the fact that the most common type of formalization of relations with remote access workers, both here and abroad, is, as a rule, a contract, there are a number of differences that lead to the need for employers to use methods for tracking the work of freelancers.

Articles about the American company oDesk published in the public domain have excited the Russian community of “free artists.” This company is engaged in finding professionals to solve various problems, acting as an intermediary between customers, most of whom are American, and telecommuting employees located primarily outside the United States. The oDesk company practices tracking the activities of freelancers using technical means. For example, productivity monitoring is established for working on the keyboard or using a mouse, the number of open windows, and traffic to sites not related to work. In addition, Monitor Activity - oDesk Team creates a slideshow of the freelancer’s online activity, so-called screenshots and webcam images. This information is not for internal use at all. Customers with whom oDesk works can make a request for a specific employee and use materials captured from cameras and other technical means. This is not the only company in America that uses tracking methods for homeworkers. Working Solutions provides telephone working services. During parallel listening, increased tone in a conversation, incorrect answers, the presence of background (for example, children's voices, a dog barking, the sound of a working receiver or TV, etc.) are very strictly monitored. The question of the legality of using such measures abroad in this case does not arise, since the use of these methods is carried out by agreement of the parties, that is, the employee is notified of the presence of wiretapping or video recording. According to studies conducted by American sociologists, the majority of freelancers working under conditions of constant control do not express any dissatisfaction, since their work is decently paid, and over time, some inconveniences simply develop the habit of not noticing them.

Let's return to the analysis of issues of formalizing relations with remote access employees. The main reason for using the methods demonstrated above for monitoring freelance workers is the notorious issue of compensation. Paying a freelancer hourly is an unacceptable option for an employer, since he naturally becomes very concerned about the question: what is he paying for? Which, in turn, leads to the use of such sophisticated methods. Russian employers act much more wisely. They prefer to pay not for the process, but for the result of the work. In addition, for creative professions, the process of thinking and planning can take from 60 to 80% of the time allotted for the implementation of the project, which cannot be ignored.

Literature

1. Isaycheva E.A. Encyclopedia of Labor Relations. 2nd ed. - M.: Alfa-Press, 2007.

2. Orlovsky Yu.P., Nurtdinova A.F., Chikanova L.A. 500 topical issues on the Labor Code of the Russian Federation: comments and clarifications (ed. by Yu.P. Orlovsky). - M.: Yurait-Izdat, 2006.

3. Egorova V.I., Kharitonova Yu.V. Employment contract: Textbook. allowance. - M.: Knorus, 2007.

4. Mironov V.I. Labor law of Russia. - M.: LLC “Personnel Management Magazine”, 2005.

5. Popova O.V. Practical application of the Labor Code. - M.: Alfa-Press, 2003.

6. Sotsuro L.V. Interpretation of the contract by the court. - M.: Prospekt. 2008.

I. Saifullina

Legal Advisor

Ufa

Signed for seal

12.02.2009

freelancerfreelance creative workerfreelance workerfreelance employees

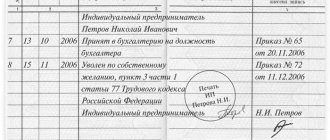

Hiring order

An interesting point is the situation regarding the need to issue an order to hire a freelance representative. If a civil contract is concluded with such an employee, then there is no need to create an order, since an employee of such a plan is not subject to the internal charter and rules.

And if a fixed-term employment contract is concluded with such an employee for a short period due to the absence of the main employee, then in this case the creation of an order is simply necessary.

It is published in the usual way, however, it indicates a shorter period of activity and the main reason why a freelance worker is hired.

Dismissal process

In addition to the fact that hiring a freelancer is not supported by a long and unpleasant bureaucracy, and also does not take much time, firing an employee occurs in a similar way. The contract is the only document that regulates the relations of the parties. In addition, the contract itself specifies the reasons and the possibility of early termination. This may be one of the reasons for the dismissal of a freelancer; it is enough to simply terminate the agreement.

For your information

If the employee does not violate any duties and performs his work conscientiously, then after he completes his duties, he can safely terminate the contract. Or it is terminated if the work period ends. There is no need to draw up any additional conclusions or orders; all processes are concentrated exclusively in the contract.

Sample documents for hiring

For a more clear example related to drawing up a contract and checking documents, we attach to the article a sample and a copy of documents that can become the basis for hiring an employee. This is purely visual information that will help you understand what the documents look like and what the main document contains. From the site citize.ru

In this article, you learned what a freelancer is. If you have any questions or problems that require the participation of lawyers, then you can seek help from the specialists of the Sherlock information and legal portal.

Editor: Igor Reshetov