The transfer of ownership as a result of the donation of a dacha, in accordance with Article 572 of the Civil Code of the Russian Federation, involves the conclusion of an appropriate agreement, in which the object of the donation is this real estate. At the same time, the main feature of the deed of gift related to civil transactions is its complete gratuitousness, which implies the absence of payment when transferring property from one owner to another.

Let us immediately note that the current legislation of the Russian Federation does not contain a clear definition of the term “dacha” and this object, as a rule, is understood as a non-residential, but suitable for habitation (not necessarily) premises located outside a large populated area, the main purpose of which is the opportunity its owner to spend some time during the warm season.

Most often, a dacha consists of 2 completely independent real estate objects:

- land plot;

- residential and non-residential buildings located on a summer cottage.

And, therefore, transferring, for example, a country house and buildings by deed of gift without transferring ownership of the land plot is impossible and contradicts the letter of the law (according to Article 35 of the Land Code of the Russian Federation)!

To legally conclude a transaction, the gift agreement must also necessarily reflect the will of the recipient and the giving party. That is, the donor must express in writing his desire to transfer the property, and the recipient must confirm his desire to accept the gift by signing.

As a result of the execution of the transaction, any obligations related to the procedure for transferring the dacha can only arise from the owner (donor), since the deed of gift refers to unilaterally binding transactions.

Expert opinion

Oleg Ustinov

Practicing lawyer, author of the website “Legal Ambulance”, one of the co-founders of the “Our Future” foundation.

During the preparation and signing of the contract, both parties must strictly follow the rules and regulations of the current legislation of Russia, which relate to the subjective composition of the transaction (Article 575 of the Civil Code of the Russian Federation), as well as the rights of owners (only in cases where the object being donated is part of the general property, as specified in Article 576 of the Civil Code of the Russian Federation)!

Since a dacha is defined as real estate, the transfer of ownership from the donor to the donee must be officially registered, in accordance with Article 131 of the Civil Code of the Russian Federation. In addition, according to the rules for its implementation, described in Article 13 of Federal Law No. 122, which was adopted on July 21, 1997, this agreement must be drawn up in writing.

Also, it is worth noting the fact that a deed of gift as a method of alienation of real estate significantly expands the rights of the parties. For example, a transaction can be canceled at the request of both the donor and the donee before signing the agreement (in accordance with Articles 573 and 577 of the Civil Code of the Russian Federation). In addition, the donor has the opportunity to cancel it after signing the deed of gift, but only on the basis of the list specified in Article 578 of the Civil Code of the Russian Federation.

Remember that when receiving a dacha as a gift, the new owner actually receives income that is equal to the market value of the gift. At the same time, he does not spend his own funds on the acquisition of property, which is the basis for taxation, the amount of which in 2021 is 13% of personal income tax.

ARTICLE RECOMMENDED FOR YOU:

Tax on gift of real estate to non-relatives

Legislative regulation

The natural consequence of drawing up a gift agreement will be the transfer of property to the recipient free of charge.

A desire to make a gift to a third party, expressed orally, has no legal force. The contract must be drawn up in writing, this is the requirement of Art. 574 of the Civil Code of the Russian Federation. What requirements must the contract meet:

- Free transaction. Absence of conditions and reservations on the part of the donor and recipient.

- Consent of the recipient to receive the subject of the transaction.

- Delayed transfer of a gift is allowed after certain conditions have been met. Such a condition cannot be the death of the donor, since in this case it is necessary to draw up a will.

In this way, you can donate both the entire dacha plot and part of it. If the donor owns the plot jointly with his spouse under the terms of community property, the written consent of the husband or wife will be required.

The procedure for drawing up a contract for the donation of a dacha in 2021

As we have repeatedly noted in previous articles on the Legal Ambulance website, since an agreement of this type requires mandatory state registration - the agreement must be drawn up in writing! At the same time, the legislator allows the donor and the recipient to notarize the document drawn up by the parties, recommending that transactions be notarized due to their high cost.

Expert opinion

Oleg Ustinov

Practicing lawyer, author of the website “Legal Ambulance”, one of the co-founders of the “Our Future” foundation.

Since the deed of gift regulates the conditions and procedure for the actual transfer of a country house and land, the success of the transaction, in general, will depend on the correctness of the agreement. Therefore, the parties must specifically, clearly and unambiguously state each point of the document!

However, lawyers note that an agreement can be challenged in 95% of cases if its content does not contain the following information:

- The intention expressed by the donor to transfer the dacha free of charge into the ownership of the donee or group of persons;

- the expressed consent of the recipient to accept the gift and assume all responsibilities associated with it;

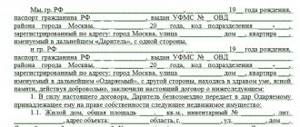

- information about the parties to the transaction, including their passport details and actual residential addresses at the time of drawing up the dacha donation agreement;

- a detailed description of the properties and characteristics of the object of the donation, including data on the land plot, the address of the dacha, cadastral numbers of the house and plot, as well as the technical characteristics of all premises that distinguish the gift from among similar objects;

- list of grounds for termination of the deed of gift;

- instructions on the current legal capacity of the donee and the donor;

- indicating the period for transferring the object into ownership of the new owner;

- a list of obligations and rights of the parties, as well as their responsibility for violating the terms of the agreement;

- information about the absence of encumbrances or similar restrictions on the use of real estate;

- signatures of the parties.

ARTICLE RECOMMENDED FOR YOU:

Parties to the gift agreement: rights, obligations, prohibitions

The next step in concluding a dacha donation agreement after drawing up and proofreading the main agreement is its mandatory state registration, or more precisely, the re-registration of ownership from the donor to the donee. All the parties need to do is go together to the registration authority, where they will have to write a corresponding application (from both the donor and the donee), hand over a package of necessary documents and receive a receipt from the organization’s employees with an approximate completion date of the procedure.

Registration at the MFC

To register a deed of gift for a dacha through the MFC, the donor must prepare in advance a list of documents confirming ownership of the object.

The procedure is as follows:

- Drawing up a draft gift agreement in 3 copies, a standard sample will do.

- Preparation and collection of documentation.

- Personal appearance of the parties to the transaction at the nearest MFC (at the place of registration of one of the parties to the transaction, or at the location of the property). Submitting documents to the center employee, signing the application for registration of the gift, receiving a receipt for the submission of documentation. The applicant is informed of the expected date of document readiness.

- Waiting for the deadline for registering the right (no more than 10 days from the date of receipt of the documentation at Rosreestr).

- Repeated appearance at the center. Receive an extract from the Unified State Register of Registered Rights to the property.

What documents are required

By the time you appear at the MFC, the following documents must be prepared:

- confirmation of the donor's ownership of the dacha plot;

- passports of the parties to the transaction;

- receipt for payment of state duty;

- consent of the donor’s marriage partner, notarized (if the dacha was acquired during marriage);

- certificate of inventory value;

- a certificate of family ties between the parties to the transaction, if any;

- consent of the recipient's representative if he is a minor.

Reference! In the MFC, when drawing up a deed of gift, the presence of both the giver and the recipient of the gift is required. When concluding a gift transaction, you should check the availability of all necessary documents and their relevance. Since any inaccuracies may lead to its recognition as invalid. This can happen if other relatives are interested in the property.

What documents are needed to donate a dacha?

To carry out all the above-described stages of drawing up a contract for the donation of a dacha from one person to another, the parties (for the most part, the donor of the property) must have these 5 types of documents on hand:

- original passports of the parties involved in the registration of the deed of gift;

- papers confirming state registration of the land plot and buildings on it;

- all title documents for the land plot and buildings on it, confirming the donor’s right to dispose of this object;

- technical and cadastral passports and plans (for the site and buildings);

- other available land and legal documentation.

ARTICLE RECOMMENDED FOR YOU:

Giving ordinary gifts of small value

And, in order to register the ownership of the new owner of the property, you need to add to the existing papers:

- original deed of gift;

- transfer deed (if it was concluded);

- a receipt confirming successful payment of the state duty established by current legislation.

Gift deed between close relatives

Close relatives are:

- brothers and sisters;

- relatives in ascending and descending lines.

If the donor and the recipient are related (as confirmed by a document), the transaction is exempt from tax, in accordance with Art. 217 Tax Code of the Russian Federation.

At the same time, participants in the transaction who are relatives do not pay only the 13% tax, but are not exempt from paying state duty, as well as other related payments.

If the parties are not related, they are required to pay 13% of the cost of the plot. In addition, they still have the obligation to pay state fees.

Deed of gift for a summer cottage

The donation agreement for a dacha must contain the following mandatory sections:

- Passport details, full name and addresses of the parties.

- The subject of the contract, its distinctive features and characteristics (address, type, area, cadastral number).

- Confirmation of the donor's property rights.

- Presence of encumbrance.

- Rights and obligations of the parties to the transaction.

- Signatures and date.

Attention! If the parties to the transaction are related, for example, a deed of gift for a dacha is being drawn up for a daughter, this must be indicated in the agreement. Since this circumstance entails exemption of the parties from paying personal income tax.

In order for property rights to be transferred to the daughter, it is necessary to register the transfer of rights in Rosreestr. To do this, you can contact the MFC at the place of registration of the donor or recipient, or the location of the site.

Registration by a notary

Registration by a notary is not a requirement.

This entails additional expenses. But this item is desirable for those who want to further secure the transaction. Completing a transaction in the presence of a notary is an additional guarantee of the legality and voluntariness of the donation. The contract will be stored in the archive, and if lost, it can be restored. In addition to the mandatory expenses associated with the registration of a deed of gift (state duty, tax, if necessary), you will have to additionally pay for the services of a notary. Depending on the region, the cost starts from 2000 rubles.

A state fee is also paid for notary services; their amount is tied to the estimated value of the dacha with land, as well as the degree of relationship.

For example, when issuing a deed of gift for a daughter who is a close relative, the rate will be 0.3% of the value of the gift.

For distant relatives, the rate is 1% if the value of the gift is no more than 1,000,000 rubles. If more, then the rate will be 0.75%, in addition to which you must pay another 10,000 rubles.

The parties can independently agree on who pays the obligatory payments.

Donation agreement for a dacha with a plot of land

It is worth remembering that, first of all, donating a dacha means alienating a plot of land and a house! Thus, in order to carry out a transaction, the donor must legally own this property and have the appropriate title documents, the absence of which leads to the nullity of the gift transaction.

Example of lawyers from the website “Legal Ambulance” No. 1

Citizen O. considers himself the legal owner of a dacha (a country house located on a small plot of land). At the same time, this person did not take care of the mandatory registration of ownership of the objects listed above - and, therefore, he does not have title documents to carry out any transactions with this property. However, he himself can continue to use the dacha.

ARTICLE RECOMMENDED FOR YOU:

Procedure for delivery of title documents

Example of lawyers from the website “Legal Ambulance” No. 2

No less rare are cases when the owner of a dacha registered only a plot of land, without legally registering the house built on it. In such cases, theoretically, the donor can formalize the donation of the land plot, and the registration of the building will fall on the shoulders of the party receiving the dacha in the future.

Not everyone will agree to accept a gift under such conditions, because there is a chance that when re-registering land ownership, Rosreestr employees will require a certificate stating that there are no buildings on the site!

Expert opinion

Lyudmila Kim

Invited expert: author of the “Child Support” blog, practicing family lawyer, 7 years of experience.

Remember that when drawing up an agreement, the donor is obliged, in addition to a detailed description of the house, to give the same detailed description of the site on which it is located with the obligatory indication of the boundaries of its land survey, the purpose of using the land and its category of purpose.

Today, the document of title for the land plot mentioned in the donation agreement can be an act of granting land for perpetual possession, as well as a lease agreement and a certificate of ownership of the plot.

After mandatory state registration of ownership of the new owner, the donee receives 2 separate certificates of ownership for:

- residential property;

- land plot.

Nuances

The following situations may lead to recognition of the invalidity of a transaction:

- Identification of facts of exerting pressure on the donor in order to force the transaction.

- Attempt on the donor's life.

- Incapacity of the donor, poor understanding of the consequences of his actions. Relatives who have claims to the disputed property may try to prove these facts in court. But they will have to provide significant evidence of incapacity: certificates, photos, videos.

- Errors and lack of specificity in the contract. For example, the inability to identify a gift based on the characteristics specified in the document.

- Bankruptcy of a legal entity within six months after the donation. In this case, creditors can go to court.

There are situations when the recipient dies as soon as he takes possession. In order for the donor to receive the donated property back, it is necessary to provide for such a situation and mention in the contract the possibility of return in exceptional cases.