Features of donating a land plot

A deed of land can be issued to any citizen. The donor must be the owner of the property and have all the necessary title documents.

Features of the deed of gift registration procedure:

- State registration of land. A plot of land, information about which is available in the Unified State Register of Real Estate, can be donated even if there was no land surveying. The extract from the Unified State Register of Real Estate about the property indicates the category of land and the type of permitted use.

- The site must be assigned a category of land and type of permitted use in accordance with the current norms and provisions of land legislation:

- Land category – legal regime for the use of land with a description of standard properties. Without it, the transfer of rights will not be registered (Article 8 of the Land Code of the Russian Federation). The category of land can be found on the public cadastral map. To search, you need to select the type of object and search by number, address or name. The cadastral map provides information about land plots, their boundaries and basic parameters.

- The type of permitted land use specifies the nature of the intended purpose. It may not be specified in the contract.

In cases where the recipient does not know or does not understand how to use the site, it is better to indicate the type of permitted use and explain what opportunities and limitations of use the donated site has.

Example: A young man received a plot of land as a gift and planned to build a house. After registering the right, he saw in the Unified State Register of Real Estate that the type of permitted use of the land plot was personal farming on field plots. According to the classifier of types of permitted use, it is impossible to build capital construction projects on these lands and it will not be possible to build a house. Was such a gift necessary?

A plot that is not registered must be registered before the next transaction is registered.

Features of donating a dacha with land in 2021

As we have already mentioned more than once in this section, the donor can only transfer to the recipient the real estate that is his property.

And, since the land plot and the country houses on it are, from the point of view of the law, independent objects, the donor must have the appropriate rights for each of them, formalized through state registration of the objects for this person.

Additional Information:

According to the provisions described in paragraph 4 of Article 35 of the Land Code of the Russian Federation, the land plot and the buildings on it are inextricably linked, which leads to the impossibility of severing property rights if they belong to the same owner.

Simply put, if the donating party has legal rights to both the plot and the buildings, he cannot donate only one of these two objects. Thus, when drawing up a deed of gift for a dacha, the compiler must reflect the fact that not only the plot/buildings, but also the buildings/plot are being transferred to the donee as a gift.

Lawyer's Note

If the donating party does not have ownership rights to the land, then before drawing up the deed of gift, the land plot must be acquired on the basis of the rules that are listed in paragraph 2 of Article 25 of Federal Law No. 122. Otherwise, according to paragraph 1 of Article 35 of the Land Code of Russia, the donee will receive the right of ownership only of the buildings, and in relation to the dacha plot he will have rights similar to the former owner of the buildings on it.

Also, it is worth noting that the donee, in accordance with paragraph 7 of Article 25.2 of Federal Law No. 122, has the full legal right to register rights to a land plot, but only after the transfer of ownership of buildings on the site to him.

For such registration, all he needs is to provide any of the documents confirming the rights of the former owner (for example, an extract from the household register or an act on the provision of a land plot).

For greater clarity, let’s look at an example situation similar to the case that the site’s lawyers dealt with.

Example

Ivanov and Petrov concluded a deal by signing a deed of gift, according to the content of which Ivanov accepted a dacha plot of land as a gift from Petrov with the obligatory condition that the donee would plow and improve the land. At the same time, the buildings themselves, namely the bathhouse extension and the country house, were not transferred to Ivanov, remaining the property of Petrov.

ARTICLE RECOMMENDED FOR YOU:

How to draw up a deed of gift by power of attorney - sample and norms

Since the transfer of land requires mandatory state registration, immediately after signing the donation agreement, Petrov delivered all the necessary documentation to Rosreestr, but 10 days later he was refused registration on the grounds that the deed of gift did not meet the standards established by the current legislation of the Russian Federation.

After this, the employees of the registrar organization explained to Ivanov that, according to the rules specified in paragraph 4 of Article 35 of the Land Code, he cannot receive a dacha plot as a gift without the dacha buildings associated with it.

The procedure for registering a deed of gift for a land plot

Registration of a donation agreement for a plot consists of several stages:

- Achieving mutual agreement on the terms of the gift agreement between the parties to the transaction.

- Drawing up a gift agreement.

- Collection of necessary documents.

- Draw up an act of acceptance of the transfer.

- Pay the state fee.

- Submit documents for registration of rights at the location of the real estate.

- Obtain title documents.

Drawing up a gift agreement

The agreement is drawn up in writing, with the mutual consent of the parties. You can draw it up yourself, contact a lawyer or notary.

Contents of the deed of gift. The contract must contain the following information:

- document's name,

- place and date of compilation;

- information about the parties to the transaction:

- who is the donor and the recipient;

- surnames, first names, patronymics;

- dates of birth;

- passport details;

- registration addresses of the parties;

- information about the object of donation:

- address;

- square;

- cadastral number of the plot;

- category of land;

- type of permitted use;

- title documents for the land plot;

- information about the estimated value;

- indications of the presence of restrictions or encumbrances on the site;

- provisions on the rights, obligations, responsibilities of the parties, conditions for canceling the transaction;

- procedure for resolving disputes;

- signatures of the donor and recipient.

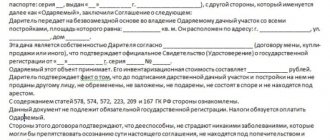

Sample land donation agreement

Donation agreement for a plot of land with a garden house

| Donation agreement for a plot of land with a garden house |

What documents are needed to donate a dacha?

To carry out all the above-described stages of drawing up a contract for the donation of a dacha from one person to another, the parties (for the most part, the donor of the property) must have these 5 types of documents on hand:

- original passports of the parties involved in the registration of the deed of gift;

- papers confirming state registration of the land plot and buildings on it;

- all title documents for the land plot and buildings on it, confirming the donor’s right to dispose of this object;

- technical and cadastral passports and plans (for the site and buildings);

- other available land and legal documentation.

ARTICLE RECOMMENDED FOR YOU:

Donation agreement between legal entities

And, in order to register the ownership of the new owner of the property, you need to add to the existing papers:

- original deed of gift;

- transfer deed (if it was concluded);

- a receipt confirming successful payment of the state duty established by current legislation.

Collection of necessary documents for the transaction

To transfer the right to the registration authority, the parties provide a full package of documents:

- gift agreement – 3 copies;

- application for state registration;

- identification documents of the parties to the transaction - original, copy; power of attorney, with the participation of a representative;

- title documents for land (including cadastral documents);

- act of acceptance and transfer of land;

- a document confirming the value of the object;

- documents confirming the relationship of the parties;

- permission from other owners, executed with notarization (in the case of shared ownership or if the donor has a marital relationship);

- written consent of legal representatives if the transaction involves persons from 14 to 18 years of age. receipt of payment of state duty. For more information on how to correctly draw up a deed of gift for a minor child, read the article.

How to register a donation of a dacha

The procedure for registering a deed of gift for a dacha is not much different from registering deeds of gift for other real estate properties. However, due to the fact that violation of the registration procedure or making errors can become a reason for challenging the transaction and declaring the donation invalid, it is advisable to consider this process in more detail.

As already mentioned, the donation of a dacha must be formalized in a written agreement. Violation of the written form of the transaction will entail the impossibility of passing state registration, which will not allow the donee to become the full owner of the real estate donated to him (clause 2 of Article 223 of the Civil Code).

Registration procedure

A fairly common contractual practice allows us to identify a number of stages that the parties will need to go through when drawing up a deed of gift for a summer cottage:

- Preparation of documents . Please note that donating a dacha plot and the buildings located on it is only possible if they are owned by the donor. Therefore, to formalize a deed of gift, it is necessary to have a set of title documents, otherwise the procedure will not be successful.

- Drawing up and signing a gift agreement . The draft agreement can be drawn up by a notary (recommended) or independently. When making your own, it is important to take into account the requirements of the law regarding the content - the need to specify the gift, its description, an indication of the donor’s intentions, recording the data of title documents, etc. It is important to remember that the contract, along with the transfer of buildings, must transfer certain rights to the land plot . After drawing up the project, the parties sign an agreement.

- Gift transfer . This stage is implemented in the manner prescribed by the provisions of the contract (conditions, method and timing of transfer). In order to avoid mutual subsequent claims, it is advisable to document the procedure for transferring a gift with a deed of transfer, which reflects the main characteristics of the transferred property.

- State registration of rights to real estate . The procedure for its implementation is determined by Federal Law No. 122 of July 21, 1997. The parties must submit an application for registration and a number of documents to the local authorities of Rosreestr. At this stage, the state registrar checks compliance with the requirements of the law of all previous stages, only after which the information is entered into the register of rights (USRE).

- The emergence of property rights in the donee . The donee becomes the full owner of the dacha from the moment the state registrar issues the applicants with title documents with appropriate identification inscriptions, as well as a certificate of state registration.

This is important to know: What is the difference between a donation and a deed of gift for an apartment?

Required documents

To carry out all stages of registration of a deed of gift for a dacha, you will need the following documents :

- Passports of the donation parties;

- Title documents for the dacha (for buildings, for land);

- Documents confirming state registration of the dacha (buildings and land under them);

- Cadastral and technical passports, as well as plans for the building, other buildings and land;

- Other land cadastral documentation.

To carry out state registration , in addition to the above documents, you will need:

- Donation agreement;

- Transfer deed;

- Receipt for payment of state duty.

Registration of a deed of gift for land from a notary

Notarization of transactions is mandatory if this is the desire of the parties or the requirement of the law.

In case of donation of a share in the right of common property, the deed of gift is certified by a notary. The participation of a notary insures both parties from possible unpleasant consequences. The notary organizes everything independently, advises, explains and ensures full compliance with legal grounds, but the service will require payment of a notary fee. The notary fee for certifying a land donation agreement depends on the degree of relationship and the value of the land.

Notary fee for certification of transactions the subject of which is the alienation of real estate, at the request of the parties.

| Presence of relationship with the donor | real estate value up to 10,000,000 rubles inclusive | real estate value over 10,000,000 rubles |

| Close relatives | 3,000 rubles plus 0.2 percent of the valuation of real estate (transaction amount) | 23,000 rubles plus 0.1 percent of the transaction amount exceeding 10,000,000 rubles, but not more than 50,000 rubles |

| Presence of relationship with the donor | up to 1,000,000 rubles inclusive | over 1,000,000 rubles up to 10,000,000 rubles inclusive | over 10,000,000 rubles |

| Persons who are not close relatives | 3,000 rubles plus 0.4 percent of the transaction amount | 7,000 rubles plus 0.2 percent of the transaction amount exceeding 1,000,000 rubles | 25,000 rubles plus 0.1 percent of the transaction amount exceeding 10,000,000 rubles, and in case of alienation of residential premises (apartments, rooms, residential buildings) and land plots occupied by residential buildings - no more than 100,000 rubles |

For certification of contracts, the subject of which is subject to assessment, if such certification is mandatory in accordance with the law, is

– 0.5 percent of the contract amount, but not less than 300 rubles and not more than 20,000 rubles;

If a legal examination of the applicant’s documents or consultation is required, you will need to pay for legal and technical services. Notaries determine the cost of their services based on the prices established by the notary chamber of a given subject of the Russian Federation.

Obtaining an extract from the Unified State Register of Real Estate

The timing of donation registration is up to 9 days and depends on the place and method of submitting documents:

- three working days from the date of receipt of the application for state registration of rights and the documents attached to it on the basis of a notarized transaction;

- in case of receipt of an application and documents based on a notarized transaction, in electronic form - within one business day;

- certified the contract by a notary and submitted it to the MFC independently – 5 working days;

- were not certified by a notary, they submitted it to the MFC independently - the registration period is 9 working days.

Taxes upon donation of land

Income received under a land donation agreement is subject to personal income tax and amounts to:

- 13% for recipients who are not close relatives of the donor (for residents of the Russian Federation);

- 30% for non-residents of the Russian Federation.

A 3-NDFL declaration is submitted to the tax authority by April 30, in the year following the year the gift was received, and the tax is paid by July 15.

Close relatives of the donor are exempt from paying tax:

- parents;

- children;

- husband wife;

- grandmothers, grandfathers;

- grandchildren;

- brothers, sisters.

A land tax is paid annually for a plot of land owned by a citizen. Tax notices regarding tax payment are sent to payers by tax authorities.

Features of taxation when donating

If land is donated, a tax will be required to be paid to the state treasury. If relatives are involved in the procedure, payment of the fee can be avoided. Privileges are granted only to persons who are close relatives.

In accordance with Article 14 of the Family Code of the Russian Federation, these are:

- brothers and sisters;

- husband and wife;

- parents and children;

- Grandmothers and grandfathers.

Single-parent or adopted children, as well as adoptive parents, are also recognized as close relatives. Persons entitled to donate land on preferential terms will only have to pay a state fee. Its size in 2021 is 2000 rubles. Additionally, you will have to pay money for the transfer of rights to the land. The amount is 350 rubles. The need for the above payments is regulated by the Tax Code of the Russian Federation.

If the state fee has not been paid, the documentation will be returned to the applicant within ten days. The deed of gift will not be considered.

If the parties to the transaction are not close relatives, you will need to pay tax. Its size is 13% of the value of the donated land. If a person does not know how to draw up a standard contract, it is recommended to use a ready-made template as an example of filling it out.

Video

Cancellation of a donation agreement for a land plot

It is very difficult to cancel a gift agreement. For this there must be grounds provided for by law:

- the donor may cancel the deed of gift upon the occurrence of circumstances provided for in Articles 577, 578 of the Civil Code of the Russian Federation:

- the donee deliberately tried to kill the donor or his close relatives;

- living conditions have changed, health has deteriorated;

- the donee creates a threat of irretrievable loss of a plot of land that is important to the donor;

- if the donee died earlier.

- the recipient may refuse the gift:

- the donee has the right to refuse it at any time before the gift is transferred to him (Article 573 of the Civil Code of the Russian Federation).

- according to the provisions of Art. 450 of the Civil Code of the Russian Federation, it is possible to change and terminate the contract by agreement of the parties. This can be done before registering the transfer of ownership.

Lawyer's answers to frequently asked questions

I want to donate a plot of land to children. How to apply correctly?

If the plot was acquired during marriage, the spouse's consent to the donation must be notarized. In the gift agreement, the recipients indicate their children and the size of the donated shares to each.

I did not have time to re-register ownership of the land under the gift agreement. The donor died in a car accident. What to do?

Contact Rosreestr and register ownership of the land if the gift agreement does not indicate cancellation in the event of the death of the donor.

I live alone. Can I give a plot of land to my 16 year old grandson?

Minors, aged 14 to 18 years, may enter into real estate transactions only with the consent of their legal representatives. In your case, the grandson will be present when submitting documents and sign the gift agreement, but with the consent of his parents.

How to donate a plot of land with a house?

If the house and land are owned, you need to draw up two donation agreements: for the house and for the land. Collect the necessary package of documents and submit for registration.

How to register a donation of a dacha

Any real estate transactions require appropriate registration. Giving a dacha is no exception.

A dacha is a plot of land with beds, trees and, of course, a country house built on the plot. The two named objects relate to real estate. This is confirmed by paragraph 1 of Article 130 of the Civil Code (hereinafter referred to as the Civil Code), from which it follows that plots of land and everything that is firmly connected with it - buildings, structures, including country houses, are immovable things .

Consequently, all the same requirements and rules apply to the execution of a dacha donation agreement as to the donation of any real estate. The main condition for this remains that the donor has documents confirming and establishing his ownership rights to the object of donation.

Registration procedure

As we have already noted, a deed of gift for a dacha is drawn up in writing. And although the provisions that previously required notarization of real estate donation transactions have been removed from the Civil Code, very often this becomes a necessity if the parties have even the slightest doubt about its consequences. And not everyone manages to draw up a document correctly, without errors, without missing some important factor in its content.

However, the deed of gift must contain as much of the following information as possible:

- information about the parties to the transaction, their passport details and addresses of residence;

- the donor’s intention to give and the recipient’s consent to accept the gift;

- detailed description of the object of donation (dacha) - address of the location, information about the land plot on which the country house is built, the area of each property separately, their cadastral numbers, technical characteristics of the building (what material it is made of, number of rooms and utility rooms, condition and so on.);

- an indication of title documents confirming ownership rights to real estate;

- information about the absence of an encumbrance on it or other restrictions on its use;

- an indication of the legal capacity of the parties to the transaction;

- information about other owners of the dacha (if available);

- determination of the rights and obligations of the donor and the donee, their responsibilities;

- indication of the period for transfer of ownership of the dacha;

- grounds for termination of the gift agreement;

- signatures of its parties.

The next stage of concluding a gift transaction after execution of the document itself is state registration of the transfer of ownership rights to the objects of donation from the donor to the donee. For this purpose, both parties are sent to the registration service, where each of them draws up a separate application . Together with the collected package of documents, signed applications are submitted to the registrar, receiving a receipt in return.

Required documents

Currently, if the title documents on the donor's ownership of real estate are properly registered, then many documents that were previously submitted for registration without fail are no longer necessary. But since the registration service has the right to request any of them in each specific case, it is better to have with you all the papers relating to the gift transaction and the subject of the agreement.

The package of necessary and additional documents includes:

- a receipt or check for payment of state duty (this is the first thing required);

- passports of the donor and recipient to verify their identities;

- three copies of the gift agreement (or four if the deed of gift was certified by a notary);

- title and title documents for property;

- cadastral passport for real estate;

- power of attorney confirming the authority of the representative of the party to the transaction;

- notarized consent to donate the joint property to the participant;

- permission from the guardianship and trusteeship authorities for the transaction if the property belongs to a minor under 14 years of age and the consent of parents or guardians if he is between 14 and 18 years old;

- and others.

This is important to know: What cannot be challenged: deed of gift or will