Home » Useful » How can a military pensioner receive a civil pension? Is it possible to receive two pensions at the same time?

Author of the article

Agata Kozhukhova

Reading time: 5 minutes

AA

The law on the second pension provision came into force in 2001. What new opportunities did military specialists receive after their retirement?

Is it possible to receive two pensions at the same time - civil and military?

Military specialists retire based on length of service. But they remain full of strength people. Most continue to work as civilian specialists. Accordingly, military personnel are subject to the law on old-age labor benefits. They have the right to count on the second type of pension provision.

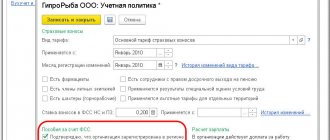

The legislative act regulating the receipt of an old-age pension is called “On Insurance Pensions”. Having served the required number of years after demobilization, a retired military personnel must collect a package of certain documents and submit an application to the pension fund at the place of residence. The rules for obtaining labor pensions are the same for former military personnel and ordinary workers and employees. There are also minor differences.

Second pension for military personnel after 60 years

Having settled in a civilian profession, a military pensioner has the right to receive an insurance pension only upon reaching the age limit specified by law. Funds allocated for payments are allocated through the Pension Fund from the federal budget. The main condition for assigning an insurance pension is official employment. This is the only way to guarantee that the employer makes contributions for insurance premiums, which are mandatory to receive a labor pension.

In addition to this, a citizen must register in the compulsory social insurance system. This is confirmed by a special certificate - SNILS. The document is issued upon employment in the HR department. In addition, it can be obtained by submitting an application to the Pension Fund or the Multifunctional Center. Information about length of service in civilian professions, transferred insurance premiums, and the amount of salary are displayed on a personal personal account, which is opened in the Pension Fund of the Russian Federation. These data determine the right to receive a second pension for military pensioners.

- 10 easy ways to get rid of forehead wrinkles at home

- Types of taxation in Russia - general and simplified regime, single tax and patent system

- What complications from coronavirus can there be besides pneumonia?

Registration in the OPS system and obtaining SNILS

The compulsory pension insurance system (MPI) began operating in Russia in 2002. In order to become a member, you must register in the personalized accounting system. Directly here, throughout the citizen’s entire working life, information is displayed that is subsequently needed to assign and pay him a pension benefit: places and length of work, contributions, periods of work, number of pension points. This information is confidential and not subject to disclosure.

All Russians, including children and adolescents, are subject to mandatory registration in the OPS system. The Pension Fund also enters here data on foreigners and stateless persons. After opening a special account, a person is given a unique insurance number - SNILS. The document is a green plastic card with information about its owner:

- individual personal account insurance number (SNILS);

- personal data of the owner (last name, first name, patronymic);

- place and date of birth of the insured person;

- floor;

- date of registration in the system.

There are several ways to obtain plastic. The first option is when applying for a job. You need to fill out the appropriate application at the HR department and pick up the document after some time. Self-registration of SNILS is also allowed. To do this, you need to come to the Pension Fund or MFC office with your passport and fill out an application. The card will be ready in five days.

Conditions of appointment

The second pension for military pensioners is assigned on an application basis and with the simultaneous fulfillment of several conditions:

- Retirement age. The insurance pension is assigned upon reaching the age of 60 for men and 55 for women. Early retirement is allowed for certain categories of persons. Thus, military personnel living in areas with difficult climatic conditions and regions of the Far North have the right to retire five years earlier - 55 for men and 50 for women. Persons who suffered as a result of the disaster at the Chernobyl nuclear power plant and other man-made disasters - for 10 years (50 - men, 45 - women).

- Insurance experience. When calculating, the period during which the employer paid insurance contributions from the citizen’s salary to the Pension Fund is taken into account. In 2021, the minimum indicator is 9 years with an annual increase of 1 year until it reaches 15 by 2024.

- Minimum number of IPCs. The individual pension coefficient is one of the main values when calculating the amount of pension payment. IPC is the number of points that a person has earned for his work activity (insurance contributions transferred to the Pension Fund of the Russian Federation are transformed into pension points). Every year the government reviews the value of the IPC. For 2021, its value is 81.49 rubles.

- Monthly contributions to the Pension Fund by the employer. Every month, based on the citizen’s salary, the employer transfers a certain amount to the pension fund. Subsequently, this will affect the size of the former military man’s pension. This means that the higher a citizen’s “white” salary, the higher his insurance pension payment will be.

When a military man is awarded a civil pension - conditions

To assign an old-age pension, the former defender of the Motherland must have a personal registration number in the SNILS system. It makes payments from civilian employers. The reason for granting old-age benefits is when a man reaches the age of 60, and when working in difficult climatic conditions, this age is reduced to 55.

The main condition is the presence of a minimum work experience. Now it is nine years. It is planned to increase it; 24 months will be added per year. The minimum number of points must be ten. Afterwards, one will be added until the indicator reaches thirty points. The assignment of an old-age benefit is possible when deductions are made by the Ministry of War.

Documents, sample application for receipt

When registering with a fund branch, a pensioner must present documents identifying him, including a pensioner card. The address and telephone numbers of the district department of the pension fund will be announced when you contact the hotline.

Former military personnel who retired due to length of service, by the time they receive their second labor compensation, have very little work experience compared to other citizens. Therefore, receiving contributions from the Ministry of Defense is a prerequisite. The decision to assign a pension is made within 2-3 weeks.

In order for future payments to be accrued, the employee must have a certain salary level, which is measured in points. The minimum salary level corresponds to nine points. If a former security officer is engaged in business, then deductions go when paying taxes. And in this case, the citizen has the right to a second pension.

As for contributions from the employer, they are all automatic. 22% is calculated from the salary.

When accepting documents for the second payment, in addition to your passport, you will be required to provide a work book or a certificate indicating the place and length of work. The certificate must also indicate the position of the person applying for the pension. Papers confirming military experience must also be presented. They must indicate the place of service and rank, the beginning and end of the career.

Are you going to a sanatorium for treatment? Read this first! Indications and contraindications for radon baths: treatment, beneficial properties, reviews.

6 facts about climatotherapy: read more.

Harm of hydrogen sulfide baths, side effects:

Can a military pensioner receive a civil pension?

According to the law, military personnel have the right to retire regardless of their age if one of the following conditions is met:

- presence of the necessary length of service - the so-called military experience;

- presence of disability caused by injuries or illnesses received during military service.

When leaving, former military personnel often think about finding a civilian job. According to statistics, today there are more than 3 million military pensioners in Russia and many of them have an official place of work. When the employer pays insurance premiums for these workers and upon reaching the generally established retirement age (60 years for men and 55 for women), they have the right to claim additional pension benefits.

A second pension is accrued for military pensioners even if they were engaged in entrepreneurial activity after leaving service or were self-employed citizens (artisans, tutors, etc.). In this case, a prerequisite is also the presence of insurance contributions during the period of doing business, reaching the age limit, and the required number of pension points.

Methods for submitting documents

Correct submission of documents completely excludes the use of the Internet. Papers sent by post will not be taken into account. When submitting a package of documents, you must present only originals, which cannot be transmitted via the World Wide Web or sent in an envelope. Only the initial application is sent by mail.

When filling out the second provision, the pensioner is obliged to appear in person at the pension fund branch. After the two to three weeks allotted by law for making a decision, the pensioner will be informed of the results of his appeal. After this, the money will begin to flow.

The application form to begin processing pension payments can be freely downloaded from the pension fund website and printed for later completion.

Procedure for applying for a mixed pension

In order to begin the procedure of obtaining consent from the state to issue mixed pension insurance payments, a citizen should familiarize himself with the necessary documents, as well as the list of municipal bodies dealing with such issues.

Required documents

The main paper required to apply for a mixed pension is a corresponding written application, to which the following set of documents should be attached:

- certificate of pension insurance;

- passport of a citizen of the Russian Federation;

- employment history;

- certificate of average income;

- certificate of service in the Armed Forces;

Additional papers may also be required: a certificate of completion of training during military service, documents from the registry office on a change of surname, forms confirming the presence of one or another degree of disability, etc.

Where to contact

According to the law, all questions regarding the preparation of applications for double payments must be addressed to the branch of the Pension Fund located at the applicant’s place of registration.

Persons who are citizens of Russia, but do not have a permanent place of registration, can try to contact:

- to the Pension Fund bodies located at the place of territorial residence;

- to the main branch of the Pension Fund, located in Moscow, at st. Shabolovka, house 3;

You can find out detailed up-to-date information on where you can apply for mixed pension payments on the official website of the Pension Fund of the Russian Federation.

How to calculate a civil pension for a military pensioner, features of calculation

The calculation of the second - already civil pension - is carried out according to a formula created for calculating any civil pension benefits. The calculation is based on the principle of calculating salary points.

First, the Annual Pension Ratio is calculated. It is formed by the ratio of the total insurance premiums of the applicant for payment, and insurance premiums forming 16% of the maximum salary subject to contributions. The last indicator is determined every year and multiplied by ten.

According to the second formula, the SPK is determined from the ratio of the insurance without taking into account the base one and the monetary equivalent of one pension point, which in January 2021 amounted to 87.24 rubles. This indicator is determined by the government. It is possible to calculate a pension on your own, but it is difficult, since when calculating, experts take into account many nuances, such as the inflation rate in a certain period. Therefore, only specialists can make the correct calculation.

Anyone who decides to do it themselves must:

- calculate your work experience after demobilization;

- find out how many contributions went to the pension fund (22% of the exact salary);

- calculate the amount of contributions to the state, which also affect the size of the pension benefit.

ATTENTION! The calculations do not take into account periods when a person took vacation at his own expense and his salary was not accrued.