A detailed analysis of the situation in which the future borrower finds himself will help you understand what documents are needed for a mortgage at Sberbank. What matters is the type of object and the social status of the bank client. They also pay attention to the availability of collateral (including transport, etc.). The availability of rights to receive loans under special programs also has an impact. The documentation package differs depending on the specific situation. Therefore, before applying for a loan, you need to check the list.

What is required for the bank to consider your application?

Before contacting the bank’s office, you will have to collect information not only about the borrower, but also about the future purchase. The general package of documents for a mortgage at Sberbank is impressive, but you don’t need to collect all of them to send an application to the company. To start the process of issuing funds, all you need to do is:

- Identity cards.

- Questionnaires ().

- Confirmation of income (including the amount of the down payment).

- Papers from the place of work.

The last point includes documentation showing that the potential borrower has a permanent position with a specific company. These include:

- a copy of the work document (must be certified by a notary);

- an extract from the same document;

- a copy of the employment contract, if any;

- entrepreneur certificate;

- certificate of position in the company and length of service;

- business license (if the borrower is an individual entrepreneur);

- help in the format ;

- confirmation of the presence and size of a pension (if any);

- document on other types of income.

Although this is not the final package that every applicant will have to collect. The list of documents required for a mortgage at Sberbank varies depending on the person applying. This way, the entrepreneur will not need to receive statements about the amount of his pension if the loan is issued for him. The extract from the employment record, as well as its copy, must be certified.

If the future borrower receives a salary into an account in Sberbank, or an old-age or disability pension is transferred here, or other regular payments are made, the list of papers is reduced to a questionnaire and a passport. When collecting documents for applying for a mortgage at Sberbank, if you want to confirm other income (for example, renting out living space) - attach a declaration in the format to the list. You will also need a copy of the lease agreement or other paper stating that the potential borrower has a regular income. A separate package is collected when registering housing under special programs.

Tariffs and program conditions

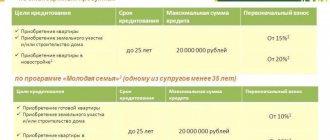

The difference between the program and related offers is that, under its terms, clients can buy ready-made apartments on the secondary market. The seller can be either a legal entity or an individual. All Sberbank housing projects are implemented through the DomClick.ru service. The terms of the mortgage loan are as follows:

- Amount - 300,000 rubles - 60,000,000 rubles.

- Loan terms are 1-30 years.

- Interest rate - from 7.7% per annum.

- Down payment - from 10% of the estimated value of the property.

- Apartment insurance is a must.

When registering a transaction electronically, the bank will make a discount on the interest rate in the amount of 0.3%. Also, discounts and other privileges are available to those clients who take out life and health insurance and use additional services of Sberbank.

Papers from the borrower and joint borrower for special purposes. programs

This financial institution offers many different programs that allow you to receive funds for housing on preferential terms. Each of them requires its own documents to obtain a mortgage from Sberbank.

For young married couples

To apply for a loan in this area, you will need a standard list of papers. Although there are some differences.

- In addition to the application form, copies of the borrowers’ identity cards are required. Copies of the guarantors' passports will be required. And the spouses will definitely be solidary borrowers for each other.

- Certificates indicating the level of earnings, documentation of children, if any, as well as information about the marriage.

The only new papers include a certificate for the child and registration of the relationship.

Mortgage for large families in Sberbank - conditions and benefits

When you only need a couple of documents

The applicant really does not need to collect a whole list of various extracts and certificates. In this case, the list of documents for a mortgage at Sberbank consists of an application, an identity card and one of the following items:

- military ID;

- papers for a military personnel;

- driver license;

- SNILS;

- foreign passport, etc.

If the loan is secured by real estate or other property, you will also need papers for it.

After approval of the preliminary request, they are often asked to confirm that there is a suitable amount in the account (it will be used to pay the advance fee).

Mortgage according to two documents: registration procedure, documents, list of banks

State program support

In addition to the identity cards of the title and joint borrower, an additional package of documents will be required for a mortgage at Sberbank. It includes:

- agreement with the second spouse;

- confirmation of salary;

- information about registration at the address of stay;

- certified copy of employment records;

- papers for purchased square meters;

- confirmation that you have money for the first payment ();

- documents for children (certificates).

However, the credit committee of a financial organization has the right to expand or adjust this list.

Military mortgage

The main thing in this case will be a certificate of entitlement to receive a targeted loan. It should be used to decorate the living space. The following documents are attached to such a certificate for approval of a mortgage at Sberbank:

- copy of ID;

- bank application form;

- confirmation of NIS membership;

- paper for the area to be decorated.

Sometimes other certificates and information about the living space are requested. After receiving a satisfactory response to the application, you need to submit the result of an expert assessment of the apartment, a purchase agreement, a certificate that there are no encumbrances, etc.

Recommended article: How to apply for a social mortgage for state employees, low-income people, and families with many children: procedure

Military mortgage in Sberbank: conditions and procedure for registration

Use of maternity capital

You will need a certificate itself proving the right to use these funds. The rest of the list is standard. An application for the transfer of maternity capital funds is considered up to 30 days. The order is indicated in.

How to calculate a mortgage with maternity capital in Sberbank using an online calculator

Regional maternity capital: how to apply for it and what to spend it on

Loan to pensioners

Money is issued to persons under seventy-five years of age. The procedure is standard, it includes filing an application and all kinds of certificates. The following documents will be required for a mortgage for pensioners at Sberbank:

- passport for the applicant and his husband or wife, if any;

- if the registration is temporary, the bank will ask for more paperwork;

- information about the amount of the pension (a certificate is received from the Pension Fund);

- employed pensioners submit a salary certificate;

- documentation for collateral housing.

However, it is worth checking with the company’s office what else should be prepared before submitting your application. Other documents may be required for a mortgage for pensioners at Sberbank. Often, employees request certificates proving the solvency of the title and joint borrower (second spouse).

Mortgage conditions for pensioners at Sberbank in 2021

Additional documentation on special mortgage programs

Sberbank operates about 15 collateral housing lending programs aimed at solving citizens’ housing problems and refinancing other loans. You can buy popular types of real estate with a mortgage: a property under construction or a finished property, a country cottage with a plot of land or an apartment in an apartment building, a private house within the city, in the countryside, a garage or a parking space.

At the same time, the lender offers profitable lending programs, including loans with a reduced or refundable rate using maternal capital. Special conditions are provided by the state by subsidizing banking costs. The client’s compliance with the requirements is confirmed by additional documents on social mortgage.

Papers for mortgages with maternity capital

In addition to the standard papers discussed above, the borrower must submit:

- a certificate from the regional branch of the Pension Fund about the balance of maternity capital;

- state certificate for MSK (original and copy).

A notification from the Pension Fund may be submitted to Sberbank during the entire period of approval of the mortgage loan. But you shouldn’t delay: the certificate is valid for 30 days from the date of issue.

With a Sberbank mortgage using MSK, parents will be able to buy a finished home or an apartment in a building under construction from a developer. Within 6 months after the loan is issued, the borrower applies to the Pension Fund branch at the place of residence to submit an application for debt repayment using MSK funds.

Secured lending for the purchase of housing

The program is called “Loan for any purpose secured by real estate.”

It is not the apartment being purchased that is registered as an encumbrance, but any real estate owned by the borrower. Since the loan is non-targeted, documents on the purchased object are not needed.

The following can serve as collateral:

- housing in apartment buildings, block sections of town houses, rooms in apartments;

- private houses of the individual housing construction category together with a plot;

- garages and garage premises with land allotment.

In addition to identity documents, confirmation of employment and solvency, the client additionally prepares papers on the collateral object.

The list is extensive:

- certificate of ownership on paper (if issued);

- documents providing the basis for the emergence of the right to real estate;

- extended extract from the Unified State Register of Real Estate;

- cadastral and technical passports, floor plan and explication;

- report on assessing the value of the object;

- notarized consent of the spouse for the pledge;

- marriage contract (if any);

- certificate from the housing department, extract from the house register about registered persons;

- consent of the guardianship authorities, if children and incapacitated persons are registered in the residential premises;

- boundary plan and other documents for the land plot (if the encumbrance is placed on a house or private plot).

The program is available to citizens with temporary registration in the Russian Federation (Russian citizenship is required). From such persons, Sberbank will require a document confirming registration at the place of residence.

Young Family Program

It would be more correct to call the program a promotion, since special conditions for citizens apply “within” the limited list of Sberbank mortgage programs. For a family to be included in the preferential category, at least one of the spouses must be under 35 years of age. Both full and single-parent families will be able to take advantage of the offer.

Under the terms of the program, a mortgage can be issued for housing under construction or a finished secondary market apartment.

In addition to standard documents, you will need:

- marriage certificate (not required for borrowers from single-parent families);

- child's birth certificate;

- confirmation of relationship with the parents of the borrower/co-borrower, if the income of these persons is taken into account in the calculation of solvency.

Family ties will be confirmed by the borrower’s birth certificate (parents are indicated there), registry office certificates about the change of surname, name, patronymic, and the borrower’s marriage certificate.

Military mortgage

The program is designed for military personnel participating in the military savings and mortgage system (NIS). Providing military housing is carried out by the department at the place of service, the procedure is regulated by a separate law (No. 117-FZ).

The essence of a military mortgage is as follows:

- credit debt is repaid by the state for the borrower throughout his service;

- it is the military department that determines whether the candidate is eligible for preferential conditions;

- The bank’s task is to verify the applicant’s right to a military loan and carry out all standard procedures for obtaining a mortgage.

The list of documents provided is not very different from other mortgage programs. Additionally, you will need a certificate of the right of a participant in the NIS of housing provision for military personnel to receive a targeted housing loan. Standard papers include a passport, a certificate from the place of service, documents on the loaned object and confirmation of the seller’s identity.

Mortgage with government support

The list of objects acceptable for purchase is limited to new buildings under construction and finished ones. To approve the application, it is enough to meet the standard requirements for the borrower discussed above, but the seller must be a legal entity (developer).

The package of documents includes confirmation of the borrower’s identity, employment, solvency, availability of a down payment, paperwork on the loaned property and the collateral.

Payments between the parties can be made through the secure transactions service of the DomClick portal.

The algorithm is as follows:

- The borrower transfers money for the property to a special account of the Sberbank Real Estate Center.

- The lender makes a request to Rosreestr to register the purchase and sale transaction.

- After receiving confirmation, funds are transferred to the seller's account.

Package of documents for registration of the service:

- passport, TIN of the buyer;

- passport and details for crediting the seller’s funds (legal entities provide only bank account information);

- purchase and sale agreement for the property.

Buying a home in a building under construction

The seller of such an object is the developer, so all registration falls on the borrower. Documents for mortgage approval and transaction are provided according to the usual list of Sberbank.

The additional kit required by the buyer depends on the situation:

- maternity capital is used - a state certificate and a certificate from the Pension Fund of the Russian Federation on the balance of funds in the MSK account;

- the loan is issued under the “Young Family” program - documents for children, marriage;

- if guarantors are brought in to secure the borrower's obligations or other real estate is pledged - papers on the object, confirmation of the solvency of the guarantors.

As an interim measure, it is more convenient to formalize a pledge of the right of claim under an equity participation agreement (PAA) between the buyer and the developer.

What package of papers does an individual entrepreneur need to get a loan?

To receive funds to purchase housing, an entrepreneur will need to collect a more impressive package of certificates and statements. They are designed to confirm the borrower’s reliability and financial stability. However, the procedure is simplified if the entrepreneur conducts monetary transactions through this bank.

Together with an identification document and an application, a sample of which will be issued by the managers of the financial institution, the following individual entrepreneur documents will be required for a mortgage at Sberbank:

- extract on availability of registration in the state. register of entrepreneurs;

- a license or certificate giving the right to entrepreneurial activity;

- report on taxes paid for a year or 24 months;

- certificate of income/expenses received ();

- certificate of property status and current obligations ()

- papers for a mortgaged house or apartment.

Tax reports for simplified taxation are provided for 12 months. A two-year report will be required for the general method of paying taxes.

Other certificates may be required (). They are mainly related to confirmation of income level (long-term commitment agreement, office rental agreement, etc.). Sometimes it is necessary to confirm marital status, salary of the second spouse, etc.

What is important to know when applying for a mortgage

To apply for a mortgage loan at Sberbank, you need to take into account several points:

- Becoming a spouse a co-borrower . Regardless of whether the spouse has an officially confirmed (or other) income, he/she must become a co-borrower when applying for a loan. To do this, you will need official confirmation of the second spouse agreeing to transfer the property being purchased to the bank as collateral until the debt is fully repaid. Exceptions are those cases when other conditions are provided for in the marriage contract (in such a situation, the loan application is considered separately).

- Multiple nuances . Applying for a loan can be a rather painstaking process. The number of documents depends on the specific situation: the type of residential property being purchased (its construction), the marital status of the borrower and his co-borrowers, their total income and credit history, the method of receiving income, as well as many other criteria that require supporting documents for each individual case are taken into account. You can get confused in this entire list (especially if you have no experience in the process of applying for the use of such a banking product and participation in real estate purchase and sale transactions). It is best to consult with an expert (as a rule, he is assigned to each client and carries out the transaction until the end) of the mortgage insurance department, who specializes specifically in the topic of home lending and will give good recommendations throughout the entire loan application process.

- Bilateral preparation of documents . An important point when applying for a home loan is that the required packages of documents are prepared by both the buyer of the property and its seller. It is necessary that the papers on both sides are drawn up correctly, and in the event of force majeure and controversial situations, all problems are resolved (if necessary, documented).

What papers are needed when registering a secondary apartment?

When the initial application is approved, you will need to collect various certificates and extracts for the area being processed. At this stage, a list of documents for a secondary mortgage in Sberbank is formed:

- agreement to purchase the property;

- information from the register of rights and the Unified State Register of Real Estate;

- title papers;

- extract with information about registered persons.

This is a minimum list, without which it will not be possible to conduct a transaction. Additionally they may request:

- consent of the second spouse to perform certain actions;

- consent from the guardianship department, if there are persons under 18 years of age in the family;

- consent of the mortgagee and the annuity recipient;

- confirmation that the co-owners of the living space have been notified, etc.

Sberbank does not always require such documents for an apartment for a mortgage. But you need to be prepared that they will be asked to submit for consideration.

Sberbank mortgage conditions for the secondary housing market

How to independently find out the required list of documentation for the purchased apartment

To independently obtain a list of required documentation for an apartment purchased with a mortgage from Sberbank, you should follow these steps:

- The main page of the financial organization Sberbank first opens.

- Find and click on the tab called “Mortgage”. In the menu that opens, click on the sub-item titled “Documents for mortgage approval.”

- At the next stage, a mortgage lending program is selected for the purchase of an apartment - in a new building or on the secondary market.

- At the next stage, you will need to clarify that you will be the buyer.

- Next, you will need to answer several questions automatically, following which the required package of documentation will be presented.

- You can later print the list or download it.

What is required as collateral when applying for a loan for an apartment?

When you collect the documents necessary to obtain a mortgage at Sberbank, the papers to secure it are lined up in a separate list. If purchased square meters serve as collateral, the list is standard (). In this case, the applicant for a loan brings to the bank the results of the assessment, consent from family members or the trusteeship department and other papers. But when using different software, the documentation changes.

What documents an individual needs to collect to obtain a mortgage from Sberbank depends on the item being pledged. These are:

- Drag. metals.

- Automotive technology.

- Shares, bonds and other securities.

- The right to demand fulfillment of obligations.

For all these points you will have to prepare a separate package. If you have chosen a vehicle (car, motorcycle, etc.) as collateral, you will have to submit to the bank:

- PTS and OSAGO policy;

- STS and transport assessment results;

- permission from the legal spouse;

- purchase agreement.

The last document is needed if the car is not yet registered. If precious metals are used as collateral, the documents required to obtain a mortgage from Sberbank are as follows:

- a letter from the husband or wife, where they agree to pledge them;

- data from the manufacturer of such products;

- may ask for assessment results.

When it comes to the right of claim, assurance (in writing) of its existence, as well as permission from the spouse to complete this transaction, is sufficient. as collateral - prepare evidence of ownership of these assets, as well as the consent of your husband or wife. However, the bank has the right to request additional confirmations, certificates or statements at its own discretion.

Mortgage for an apartment on the secondary market

When choosing an apartment to purchase with a mortgage on the secondary market, the borrower will need to prepare the following package of documentation:

- Basis for the transaction - in this case, as a rule, a preliminary purchase and sale agreement is drawn up. Subsequently, on its basis, the main agreement is drawn up;

- A document certifying the ownership of the property seller - a proof of heritage, a contract of sale or a gift can be used;

- A report on the cost of an apartment made by a specialized appraisal company;

- Information about the residents registered in the residential premises - you can provide an extract from the house register or order a certificate from specialized structures;

- Extract from the Unified State Register of Real Estate;

- When purchasing residential premises that are in shared ownership, you must provide notarized consent to the transaction from the other owners. Moreover, if one of the owners is a minor, the consent of the guardianship and trusteeship authorities is additionally provided;

- If the seller is a person who is married or was married at the time of registration of ownership, then consent from the spouse will be required. If at the time of registering the property the seller was not married, then a corresponding application is submitted;

- Technical passport of the apartment;

- A photocopy of the marriage contract, if available.

What documentation package to collect for registration of a new building

The standard list includes evidence of rights to a specific apartment or residential building, information from the register and the consent of the second spouse to the transaction. You will also need:

- results of expert cost assessment;

- cadastral passport of living space;

- technical documentation;

- certificate of registered persons;

- marriage contract, if any.

If you have dependents registered in the mortgaged living space, you need to obtain paperwork from the guardianship department. This list must be collected before 90 days have passed after the money is issued.

Buying a new building with a mortgage: instructions

What to do after accepting an apartment with a mortgage in a new building

What to look for when getting a mortgage from Sberbank

Filling out the questionnaire greatly influences the outcome of consideration of the submitted application. Everything recorded here is carefully checked by the Sberbank security service. If inconsistencies or outright lies are found, the loan will not be given. The bank may take more drastic measures and blacklist the applicant. After this, it is impossible to take out a loan from Sberbank of Russia.

When the cost of an apartment purchased by a client differs from the opinion of the lender or the amount of funds requested is very impressive, the bank may request a certificate of an expert assessment of the mortgage housing. This is rarely done. Usually such questions do not arise, and Sberbank does not ask for documents for housing.

Once your application is approved, it takes no more than 30 minutes to apply for a mortgage. The client is briefly introduced to the conditions. However, to fully understand the step taken, you need to read all the clauses of the loan agreement yourself and only then sign. The loan is issued for a period of up to 30 years, so you need to pay close attention to every letter written.

What papers should be prepared for a garage loan?

This type of building is also often purchased through a loan. There is a separate list of documents for obtaining a mortgage from Sberbank for a permanent garage and a portable building. In the first case you will need:

- confirmation of the absence of encumbrances;

- information about the owner of the land under the garage;

- object assessment results;

- registration certificate and consent of co-owners, if any;

- certificate from the cooperative for the owner of the garage;

- a certificate proving that the object will not be demolished.

Some certificates are requested from the municipality. The cooperative needs to clarify that the seller is the sole owner of the garage. If the building is located on the territory of an apartment building, additional clarification will be required from the management company.

When purchasing a portable structure, you will also need documents to take out a mortgage from Sberbank. This list includes:

- land lease agreement for a garage;

- or a certificate for the site;

- conditions for transporting the structure;

- confirmation of rights to the design.

These papers are collected specifically for the loan object. Additionally, you will need a package for applying to a financial institution.

Additional documents

All of the above is true for almost any situation, since the bank assumes that the person definitely has these documents. If something is missing (for example, a second identity document), this issue will also be considered separately. In addition to what has already been listed, if the bank believes that the client is obliged to confirm his income, a certificate of 2 or 3 personal income tax will be needed. In some cases, when the employer for some reason cannot issue such a certificate, it is allowed to provide another similar document, which will indicate all the information as in the 2-NDFL certificate.

If a potential borrower already has a salary card issued by Sberbank, the situation with income confirmation becomes even simpler. The bank independently takes the statement and makes a certificate based on its data. It is important here that the client does not receive his salary anywhere else in another way, since the bank will not be able to use this information without additional documents.

Pensioners will have to provide a certificate from government authorities about how much they receive monthly. In addition, if there are official additional sources of income, you will need to provide documents for them separately.

For example, if the client already has real estate that he rents out, then a lease agreement will be needed.

What papers are needed for real estate if the loan is issued to purchase a residential building?

The applicant will have to collect certificates and certificates not only for himself or a co-borrower, but also for the square meters being purchased. The list of documents for obtaining a mortgage at Sberbank is as follows:

- confirmation that the territory where the house will be built or is already located is registered in the name of the applicant;

- title papers for unfinished construction (if unfinished construction is purchased);

- permission to build a country house and agreements with builders;

- construction estimate, housing assessment report and information from the register of rights.

Additionally, they may request cadastral documentation for the purchased cottage or house.

Sberbank mortgage on a house: requirements and design features

Interest rates for secondary housing

Depending on the chosen mortgage lending program, bank interest in 2021 on secondary housing will be as follows:

| Program | Base rate, % |

| "Ready housing" | 7.7 (8.3 – for citizens participating in state federal and regional programs aimed at developing the housing stock within the framework of Sberbank’s partnership with constituent entities of the Russian Federation and municipal structures) |

| “Mortgage with state support for families with children” | First year – 0.1, then – 4.7 |

| "Young family" | 7,3 |

| "Country estate" | 8 |

| "Mortgage plus maternity capital" | 4,1 |

| "Military mortgage" | 7,9 |

These rates are relevant for potential borrowers who are salary clients of Sberbank, and subject to taking out life/health insurance, as well as using electronic registration on the DomClick service.

Existing allowances:

- +0.3% – in case of refusal of the “Electronic Registration Service”;

- +0.3% – when an apartment is purchased that was not selected on Domclick.ru;

- +0.4% – with an initial contribution of less than 20%;

- +0.5% – when the client does not receive wages from Sberbank;

- +0.8% – if a certificate of income is not provided;

- +1% – if you do not want to take out a life and health insurance policy.

Mortgage calculator

An online interest rate calculator will help you calculate your mortgage and find out the upcoming overpayment. The tool is available on the Sberbank website and on the DomClick platform (Mortgage tab), so the client does not need to visit the branch in person.

Thanks to the calculator, you can clarify the monthly payment in advance for different loan amounts and a certain payment period. It is enough to enter the initial indicators (program, amount, size of the down payment, installment period, additional conditions) for housing loans so that the system will automatically make the calculation.

What needs to be prepared for non-residential premises

In order to issue a loan for non-residential premises, for such real estate you need to submit the following documents to the bank for a Sberbank mortgage:

- if a land plot is rented - a lease agreement;

- technical passport or description of the floor where the premises are located;

- evidence that there are rights to the premises;

- a plan of the entire building, where the area being purchased is indicated;

- project and estimate, if the object has not yet been put into use;

- confirmation of the profitability of the premises.

The last point applies to commercial real estate, when the non-residential premises are planned to be used as a gas station, warehouse, store, etc.

What is valuation

To purchase residential premises on the secondary market under the mortgage program, an assessment is required. This operation is carried out by specialized appraisal companies. Based on the specified document, the financial institution, as well as the buyer and seller, will see the real market value of the residential premises.

Important! If the price of real estate is deliberately inflated, the banking company will refuse to provide a loan.

To order a real estate appraisal, you can use the following methods:

- Directly through a banking company specialist - in this case, the borrower will need to notify the bank specialist about the use of the assessment service. Financial institution specialists will independently prepare the required package of documentation for the assessment. They will then pass it on to a company that will carry out the assessment. The seller of the residential premises will be required to provide access to the inspection of the apartment on the appointed date. In the future, the appraisal company will prepare and submit a report to Sberbank. The borrower will need to make payment for the service provided;

- Independently find an appraisal company willing to provide a report. It is necessary to take into account that the list of appraisers with whom the financial organization Sberbank is ready to cooperate is located on the official website.

What papers should be collected to apply for a land loan?

A mortgage can be issued for land plots in accordance with. The exception is lands that are in state or municipal ownership (except for those leased), as well as those that have a size less than the minimum established (base -). There is a general list of documentation that allows you to get a response to your loan application. This package includes:

- cadastral passport of the territory;

- confirmation of the absence of encumbrances;

- information from the register;

- title papers.

They also often request documents for a mortgage transaction at Sberbank, such as confirmation of the presence of only one owner or equipment on access roads, if this is not clear from the papers already submitted. Although the list of certificates and statements is somewhat different for the buyer and the seller.

Mortgage under two documents

Another available service that the bank provides to its clients is obtaining a loan for the purchase of a home using just two documents. According to the bank’s program, you can apply for a loan if you only have a passport of a citizen of the Russian Federation, which is a mandatory document. But the additional borrower can independently choose the best option for him:

- SNILS;

- driver's license;

- international passport;

- military ID.

This program allows people who are unable to officially confirm their income to purchase housing. But it is necessary to take into account that in this case the amount of the down payment increases significantly - when submitting an application using two documents, you must pay a down payment in the amount of half the value of the purchased property according to the appraisal report. Also, for such clients, the age limits have been changed - you can get a housing loan at the age of 21 to 65 years. It is important to note that repayment of obligations to the bank must occur before the borrower’s 65th birthday.

Despite the special conditions that apply when applying for a mortgage loan using two documents, the client’s credit history is additionally taken into account, and you will also need the employer’s contact phone number so that in the future bank employees can verify the accuracy of information about monthly income. You can purchase a property that is already ready or just under construction. Also, promotions from developers and the Young Family preferential program apply to this category of clients. In this case, documents are provided in accordance with current requirements.

The loan period remains the same as for the regular application form – from 1 year to 30 years. The maximum amounts remain unchanged: 15 million for Moscow and St. Petersburg, 8 million for other regions of Russia. It is worth noting that interest rates will be slightly higher than those that clients who provide documentary evidence of official income can expect (for participants in the salary project, the rate is reduced by another 0.5%). If you refuse insurance, then the rate will increase by another 1%.

The advantage of applying for a mortgage loan using two documents is to save time and simplify the application process, because there is no need to collect income certificates and other papers (for example, a copy of a work record book). Among the disadvantages, one can highlight the high level of down payment, which corresponds to half the cost of the purchased housing, which in the conditions of the modern economy is quite a big problem. It will take a person a long time to collect such a sum of money.

List of papers from the buyer

The second party to the transaction must prepare its own list of documents for obtaining a mortgage at Sberbank, in addition to papers confirming the financial solvency of the borrower.

- Property valuation results. The procedure is ordered from an expert company that has accreditation from the bank. The report is prepared within 3 days, which means you need to contact the appraisers first. Real estate valuation for mortgage in Sberbank - list of accredited appraisers, price, terms, procedure

- Bank account statement or other documents proving that the applicant has money for the first payment. Confirmation will be a receipt from the seller of the apartment that the advance payment has been transferred to him, etc.

- Permission from the husband or wife to transfer square meters as collateral to a financial organization. Or a marriage agreement, where such points are indicated.

- If the applicant is not in a registered relationship, the package of documents for obtaining a mortgage at Sberbank must be supplemented with a document certified by a notary confirming this fact. Spouse's consent to mortgage

- When there are children under 18 years of age, you will need to contact the guardianship department for special approvals. They will allow you to conclude a deal. Mortgage guardianship.

There is also a separate list, which is compiled depending on the items that will be transferred as collateral to the financial institution. This could include transport, securities, or precious metals. metals, other or acquired area. When the collateral is selected, the package of documents for obtaining a mortgage from Sberbank will be supplemented with a new item. When restructuring or refinancing a loan, a separate set of papers is collected.

Features of collecting documents and submitting an application form

Depending on the individual capabilities of the client, it may take a different amount of time to prepare all the necessary documents. But there are certain advantages to applying for a mortgage this way compared to applying online. For example, with the help of a complete package of documents, you can officially confirm additional income, while online applications do not have this opportunity. As a rule, income is indicated “according to” clients and is not supported by documents.

In addition, having collected all the necessary documents, the client provides maximum information, which has a positive effect on the transparency of the submitted application and, possibly, will play into the hands of the borrower. Purchasing real estate is a responsible and scrupulous step, so the preparation of documents should be approached with all responsibility. Also of great importance is the fact how quickly the client is able to submit all the necessary documents to the bank - participation in various promotions may depend on this.

What is needed for loan restructuring

By preparing everything you need, you will eliminate delays during this procedure, reducing the risk of failure. To apply you will need:

- ID and application;

- questionnaire and extract from the house register;

- confirmation of rights to real estate;

- evidence of financial difficulties;

- already concluded mortgage agreement;

- receipts confirming loan payment;

- other papers (depending on the situation).

When collecting documents for mortgage restructuring at Sberbank, prepare:

- a certificate stating a serious illness that prevents you from receiving income;

- order of dismissal or liquidation of the company;

- certificate of the birth of another child, etc.

If a dependent person with a disability appears in the family, this is also evidence of a deterioration in the financial situation. The main thing is to have relevant evidence (that income has decreased or expenses have increased at the same salary) . What decision the bank representatives make depends on the situation. In addition to restructuring, managers can suggest other ways to solve the problem. In case of refusal, no explanations are given.

Mortgage in a new building

When purchasing residential premises in a new building using mortgage funds from Sberbank, you should look for a developer or housing for commissioning. At the same time, a period of 90 days is given for the preparation of documentation for the purchased real estate.

The borrower will be required to provide the following documentation:

- documents confirming an advance payment in an amount not lower than the established minimum;

- for the residential premises being financed;

- registration of a pledge on property rights for the purchased real estate;

- insurance.

What you need to refinance

This procedure is required when financial difficulties arise. Collect documents for refinancing your mortgage at Sberbank, fill out an application and contact the company’s office. The list includes:

- questionnaire in the form of a financial organization;

- document in 2NDFL format;

- employment records;

- confirmation of lack of money;

- mortgage agreement and payment schedule.

Sometimes a statement is required, which indicates the balance of the loan funds, or states that the borrower has no debt on the loan.

When refinancing is approved, three months are given to provide a certificate of living space, a report from housing assessment experts, a technical passport and data from the Unified State Register of Real Estate. If there is a co-borrower, his written assurance will be required that he is not against the transfer of property as collateral. They may also be required to submit a similar list of papers.

If the documents for the co-borrower on the mortgage at Sberbank are in order, but the loan itself was transferred to another organization (Dom.rf, etc.), an extract with new account details will be required. Sometimes they ask you to submit papers for bail. When swearing was used to get money. capital, you need to make sure that the trusteeship department is not against collateral under the refinancing program.

How to refinance a mortgage after the birth of a second child

How to buy collateral

If you intend to purchase collateralized living space through Sberbank, you should go to the official trading website (RAD or Sber-A) and register.

The auction goes like this:

- Sberbank offers its lots at a starting price. Typically it does not exceed 75% of the average cost of housing on the market.

- The buyer names his price, but it must be higher than the minimum. The participant who offers the largest amount becomes the owner of the property.

- After a successful purchase at the auction, all that remains is to draw up a mortgage agreement with the bank.

If the collateral apartment was not sold within 14 days, the bank reduces the price by 10-15%. This continues until a buyer is found for the exhibited object.

To participate in the auction, you must obtain a personal electronic digital signature and undergo accreditation on the virtual trading platform. After approval, you need to pay the bill - add a certain amount as a deposit to the balance in your online account. The amount is determined directly by the bank for each lot individually (approximately the contribution will be from 5 to 10% of the price of the selected object).

When the borrower does not have the funds to make a payment, Sberbank can offer a mortgage for a secondary home without a down payment.

You can count on such an offer:

- clients with Russian citizenship who have received government support (those who are entitled to subsidies);

- holders of a maternity certificate (present the document before signing the mortgage agreement);

- participants in the mortgage loan refinancing program of third-party banks;

- citizens performing military service and participating in the “Military Mortgage” program;

- regular clients of Sberbank who receive salaries there;

- spouses participating in the Young Family program;

- low-income borrowers who do not have their own living space;

- beneficiaries who have been waiting in line for a long time to improve their living conditions.

To register real estate, you will need the following documents:

- bank agreement on a mortgage for secondary housing and applications (originals and photocopies);

- a statement from all parties involved in the transaction;

- appraiser's report on the appraisal of the apartment;

- receipt for payment of state duty.

The procedure for transferring ownership takes about 2 weeks.

What is needed to close a paid loan?

In the process, you should contact the nearest office with an application. The following documents are attached to it to close a mortgage at Sberbank:

- identification;

- loan agreement;

- payment receipts.

Receipts are needed to confirm that all payments have been made in case of doubt, late payment or data failure.

The process involves removing the encumbrance from the property. This will take approximately 30 days. The procedure is stated in . Within a month, additional certificates or papers may be requested from the bank. To remove the encumbrance, you must submit:

- a mortgage note, which states that the borrower has no debt;

- documentary data on the rights to an apartment or other object;

- confirmation of payment of state duty;

- mortgage agreement and borrower's passport.

If a joint borrower participated in the transaction, you need to prepare the same list for him. All this is sent to the Rosreestr authorities. The list of documents for a mortgage in Sberbank for an apartment is much longer. But even in the case of closing a loan, it is important to collect all the required papers.

You can check whether the encumbrance has been lifted yourself by using the Rosreestr reference service, on the State Services portal, or by ordering an extract from the real estate register. In the latter case, you will have to pay extra for issuing information. If you decide to take out insurance along with the loan, or the bank insists on obtaining it, you will have to draw up a separate list of documentation.

Also, Sberbank itself can remove the encumbrance and the borrower will not have to go anywhere. Check with employees for information.

Providing information about income

Most often, the client’s solvency is confirmed by a 2-NDFL certificate about the applicant’s income for the last year. If it is not possible to obtain it, the following will help confirm solvency:

- certificates of pensions, compensation, lifelong benefits;

- for individual entrepreneurs and representatives of large businesses - a tax return accepted by the tax authorities (such a mark must be present).

Only official income is taken into account. If their size is small, you should find a guarantor, whose presence will not only increase the likelihood of a positive decision, but in some cases will also allow you to reduce the loan rate by about half a percent. The documents listed in this section also allow you to confirm the client’s work activity. All of the listed certificates/statements are valid for 30 days, so you must receive them immediately before filling out the application form.

What papers are needed to insure a mortgage loan?

The policy is provided to the client only after the documents for mortgage insurance at Sberbank have been collected and properly executed. The insurer will provide a complete list. Sample package includes:

- original and copy of ID;

- application (a sample will be provided in the office);

- a questionnaire with information about the borrower and the loan;

- documents for living space;

- results of collateral assessment;

- a copy of the technical passport of the object.

Sometimes a mortgage agreement or additional documentation is requested. If you have already collected documents to apply for a mortgage at Sberbank, then you know where to find it. The list is almost completely repeating.

Sberbank mortgage insurance

List of mortgage insurance companies accredited by Sberbank

The process of obtaining a policy will take no more than a few hours. When contacting a specialized branch of Sberbank, the service is issued on the day of application. When the contract for issuing insurance is signed, all that remains is to make the first payment by submitting a copy of the policy to the financial institution. After making all payments on the loan, it is possible to return part of the insurance premiums, but this will require a new package of papers.

The policy must be renewed every year. In order not to collect documentation again each time, it is worth taking out insurance from one company. In this case, information about the borrower will be in the electronic database. Now you know what documents are required for a mortgage at Sberbank and for issuing a policy, which means you can easily arrange both services.

Dear reader, if you have any questions, ask them in the comments. Our mortgage specialist and lawyer will answer them in detail.

Rate the author

Share on social networks

Author:

Mortgage specialist Maria Yurievna Sokhan

Date of publication September 27, 2019 September 30, 2019

Current samples of applications and certificates for obtaining a mortgage

Today, many mortgage transactions are concluded electronically. The DomClick portal, associated with Sberbank, helps with this. The site contains a huge database of real estate for purchase/sale, checked for legal purity by Sberbank specialists. The portal offers many useful services.

In fact, the platform allows you to conduct real estate transactions from filing an application to registering the right to an object.

Step-by-step algorithm for submitting a mortgage application to Sberbank through the DomClick portal:

- Log in to your “Personal Account” using your mobile phone number, Sberbank-Online service ID or login/password from the “Personal Account” of the “State Services” portal.

- Select the "Mortgage" tab.

- Go to the “Mortgage Calculator” section and in the “Loan Purpose” menu, select the appropriate program and set the necessary conditions.

- Click “Submit an application” (“Update calculation” if you need to change the lending parameters) and go to the page with the application form. Filling out begins with entering information about the identity and income level of the borrower.

- In the data verification section you will need to enter your passport details, registration and actual residence information.

- Indicate information about your spouse (upon official registration of marriage); if co-borrowers are involved, the information about these persons.

- At the final stage, the candidate selects a Sberbank office where it is convenient for him to conclude a deal and sends the application form for verification.

Expert opinion

Irina Bogdanova

Expert in the field of mortgage lending.

When purchasing real estate remotely, the buyer and seller will have to visit the Sberbank office to sign an apartment purchase and sale agreement (in 3 copies: for the bank and the parties to the transaction). If the owner is from another region, all 3 draft agreements are sent by mail or special mail. by courier to the branch at the person’s place of residence for signing.

Like most lenders, Sberbank has retained the ability to submit a paper mortgage application in the office. The borrower's questionnaire looks like this:

Requirements for the property

In addition to preparing the basic package of documentation for the apartment being purchased, you should also take into account the requirements directly for the property. This is due to the fact that the residential premises will act as collateral.

The financial institution Sberbank has the following requirements for an apartment:

- mandatory stay within the Russian Federation;

- the building should not be listed for demolition or resettlement;

- supply to the apartment of all required communications;

- if there are any changes to the layout, everything must be recorded in documents;

- If the legal review reveals risks of loss of property rights, the mortgage loan will be refused.