Published: 01/01/2019

Updated May 2021

The lack of housing conditions or the need to improve them is a problem faced by a huge number of Russian families. To help resolve this issue, the state has adopted a number of programs aimed at increasing the affordability of real estate for families with children. How to get a mortgage for maternity capital, where to start and where to go - answers to these and other questions can be found in this article.

How to get a mortgage loan using maternity capital?

One of the most popular options for investing a certificate is the purchase of real estate, which means:

- new flat;

- secondary housing market;

- ready-made private cottage;

- construction of a house with maternity capital;

- share housing cooperative.

Regardless of the option chosen, the conditions and principle of concluding a mortgage have standard requirements and form. It is advisable to consider them in more detail.

Conditions of receipt

Current legislation defines the right to use maternity capital to obtain a mortgage loan to purchase housing. However, in practice, not every owner is able to obtain a loan.

A financial institution has the right to refuse applicants if they do not meet these requirements:

- the presence of a stable material income - this must be documented;

- the work experience in one place must be at least six months (at the same time, a number of banks, making concessions to families with children, have reduced this period by half);

- credit history - of course, it must look impeccable, otherwise the chance of getting a loan is zero.

The level of material income should be understood as its legal share, and we are talking about all employed family members, since everyone will become the owner of the living space in equal shares.

Note! If part of the family capital was previously spent on other purposes provided for by law, then it will not be possible to take out a loan from scratch - the certificate can only pay off an existing debt.

Documents for a mortgage with maternity capital

To obtain the bank's consent, the following documents will be required (submitted by the applicant in person):

- passport of the person for whom the loan will be issued, confirming the fact of Russian citizenship, since persons who do not have citizenship of the country cannot take part in this program;

- certificate of maternity capital for a mortgage;

- pension insurance certificate;

- certificates proving the financial solvency of the borrower - both statements of the amount of basic income and all additional sources of income are submitted;

- a document in the established form confirming the absence of debts to public utilities.

In addition, you will need documents on the property purchase and sale transaction, extracts from the BTI, and other technical papers, the list of which is approved by the bank on a personal basis.

Registration procedure

The applicant’s procedure for concluding a credit mortgage using maternity capital is standard, practically no different from any other methods of purchasing a home in installments and is as follows:

- An apartment or other residential premises is documented as property.

- The banking organization transfers the money to the seller’s bank account.

- The apartment, being collateral, retains this status and is owned by the bank until the entire amount, taking into account interest rates, is repaid in full by the borrower.

Step-by-step algorithm for parents' actions:

- Collect the necessary package of documents, certificates and approvals.

- Contact the Russian Pension Fund. It is this organization, having considered the applicant’s application, that will make the final decision - to refuse or allow the borrower to take advantage of the mortgage investment opportunity. The review period is about 2 months. This period is necessary to verify all submitted documents. If any of them does not correspond to the established standards, the application may be refused.

- Signing an agreement with a banking institution - the document is confirmation of parental consent to a shared or full transfer of family capital to the bank account as an initial contribution or payment of a current payment.

Upon transfer from the pension fund, the credit institution will recalculate the monthly payment schedule and reduce the amount of one-time contributions.

There are two parties to the agreement – the bank and the spouses. Legally, they receive the status of co-borrowers. From the moment the agreement is signed, they are controlled by two structures - the pension department and the institution that issued the loan.

Registration procedure

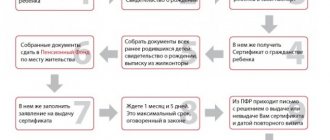

For people who have not previously dealt with a maternity certificate, it is not clear how to get a mortgage using a subsidy. Here it is better to adhere to a clear algorithm in order to avoid mistakes and save your time and nerves. The procedure is as follows:

- Obtaining a certificate of funds balance;

- Contacting the bank;

- Obtaining documentary approval;

- Registration of an obligation with a notary;

- Contacting the Pension Fund to transfer funds.

Obtaining a certificate of funds balance

When purchasing real estate with borrowed funds, the purchase and sale agreement is concluded together with the signing of the mortgage agreement. If the borrower wants to additionally use the mother’s certificate to repay part or the full amount of the down payment, then the bank will have to confirm the availability of funds.

Pension Fund employees are responsible for issuing the certificate, tracking expenses and transferring funds. If necessary, they issue capital owners with a certificate of cash balance. First, a person draws up an application and attaches a package of documents to it:

- Russian passport;

- SNILS;

- birth certificate for the child for whom maternity capital was received;

- the certificate itself.

It is better to prepare copies of all papers and hand them over to the Pension Fund employee (otherwise they will do it themselves). After submitting the application, the certificate will be issued within 3 working days.

Contacting the bank

When the certificate is in hand, you can contact the bank with a loan application. It is better if the property has already been selected and its cost is known. Then all that remains is to indicate the size of the mortgage, the down payment and the loan term.

Many banks offer their clients to submit an online application for a mortgage. In this case, it is enough to fill out the form and wait for a preliminary decision.

After some time (sometimes on the same day, sometimes later), a bank employee contacts the potential borrower and clarifies the details of the transaction. It is important to warn that part of the first payment will be made by maternity capital.

It is important to understand that the transfer of money from the Pension Fund does not occur immediately - this procedure takes 1 - 2 months. Only after their transfer will the debt to the bank in this amount of funds be repaid. How does this affect the borrower? Before the installment is repaid, the monthly payment may be higher than originally expected.

Get documentary approval

Each bank has its own processing time for a mortgage application. Therefore, it is better to clarify the information with a specialist. If, after analyzing the borrower, the decision is made in his favor, then the loan is approved.

Next, a loan agreement is drawn up between the bank and the borrower. At the same time, a purchase and sale agreement for real estate is drawn up. Afterwards, you need to get a certificate from the bank indicating that the mortgage has been issued. Without it, it will not be possible to receive money from maternity capital - the application will simply be rejected.

You can order the appropriate certificate at the stage of signing the documents, so as not to wait for it later. If you apply for it at a later time, then you need to take with you a Russian passport and the original of the mortgage agreement itself.

The certificate does not have a single form - banks usually use their own form. The document contains the number of the concluded agreement, the loan amount and information about all borrowers (for example, spouses). It is important that the certificate indicates that it was compiled for presentation to the Pension Fund.

Registration of an obligation with a notary

In order to use maternity capital to purchase real estate, the owner of the certificate must give a written undertaking that all family members (spouse, children) will also become owners. In the case of a mortgage, it is impossible to include them in the list of owners, since the bank requires first to fulfill its financial obligations, and only then to carry out actions with the real estate. Therefore, it is necessary to contact a notary for drawing up and certification of the obligation.

The document must indicate that all family members will be included as owners no later than 6 months from the date of full repayment of the debt. This allows the Pension Fund to make sure that the borrower will fulfill his obligations and will not sell the property after returning the money to the bank.

Before going to a notary, you must register the purchase and sale agreement with Rosreestr and obtain the corresponding extract on the registration of property rights. Other documents will be required:

- mortgage agreement;

- contract of sale;

- borrower’s passport (if there are several of them, then each);

- birth certificates for children;

- maternal certificate;

- marriage certificate (if available).

Personal presence is required from all owners. They will express their consent to the drafting of the obligation. The document itself is issued within 2 days.

It is better to immediately make and certify several copies of the obligation, since the original will be transferred to the Pension Fund. At least one copy will be required when registering housing as the property of the remaining family members. If the document is suddenly lost, you will have to pay an additional several thousand rubles for its restoration.

The application to the notary is paid by the borrower. All services will cost approximately 2–3 thousand rubles.

Maternity capital as a down payment on a mortgage

The presidential law adopted in May 2015 (Federal Law of the Russian Federation No. 131, in particular its articles 7 and 10) regulates the right to dispose of the certificate as an initial mortgage payment. This amendment freed families with children from having to wait until the child reaches three years of age.

Before going to a bank branch to conclude an agreement on a certificate, parents need to take into account the following nuances:

- you can apply for a program operating within a financial organization with repayment of the down payment with maternity capital only when the document is in hand;

- meet the basic requirements for income share amounts, which should be sufficient to service the loan (if this is not enough, you can attract additional co-borrowers);

- the family cannot be the owner of any other housing;

- already upon making the down payment, the right of ownership of the acquired real estate is distributed among the entire family in equal shares;

- The main payment under the certificate cannot be made if the land plot on which the housing is located does not have the status of individual housing construction.

After signing the agreement, the bank will make all the calculations, determine the amount of the loan and the size of the first payment, which will be closed with capital. After the contribution is made, the total loan amount will be reduced by the amount of the payment made. A bank employee will calculate a new plan for repaying the remaining debt.

Top 5 profitable banking offers

Sberbank - “Mortgage plus maternity capital”

Sberbank occupies a leading position among all Russian banks working with maternity capital.

Advantages:

- the borrower can receive 100% of the amount required to purchase the property;

- low minimum commission;

- the opportunity to purchase both finished and under construction housing under the program.

- Sberbank offers both the use of maternity capital to repay an existing housing loan, and as a down payment when applying for a new mortgage.

Conditions:

| Interest rate | From 11 to 13.5%. |

| Credit term | Up to 30 years old. |

| Down payment amount | 10-15% of the cost of housing. |

| Possibility of attracting co-borrowers | Up to three co-borrowers. |

| Hidden fees and penalties for early repayment | None. |

Despite all the advantages of Sberbank, it has its own characteristics. First of all, these are strict requirements for clients, and especially for confirmation of income level. In addition to a certificate of employment (form 2-NDFL), work record book and tax return, the borrower will have to confirm that his total work experience is more than a year, and the person being borrowed worked at his last job for more than six months.

VTB 24 - “Mortgage plus maternity capital”

The mortgage lending program using maternity capital from VTB 24 is designed both for the purchase of finished housing and for the purchase of real estate under construction. At the same time, the terms for lending to young families are quite favorable, and the requirements for borrowers are relatively flexible:

- interest rate – from 11%;

- loan term – the maximum mortgage repayment period has been reduced in comparison with the standard program from 50 years to 30;

- the amount of the down payment is from 20% of the cost of the purchased housing.

If 20% of the cost of the purchased property is fully covered by the amount of maternity capital, the certificate can be used as a down payment when applying for a new mortgage loan.

Rosselkhozbank - “Mortgage + maternity capital”

The bank is ready to lend to borrowers both for the purchase of finished housing and for participation in shared construction and for the construction of private houses. Conditions:

| Interest rate | 11,9-14,5%. |

| Credit term | Up to 25 years old. |

| Maximum and minimum mortgage amount | From 100 thousand rubles to 20 million rubles. |

| Down payment amount | From 15% of the cost of purchased housing. |

The bank is ready to offer the most favorable conditions to borrowers who are willing to make a down payment of 50% of the purchase price. It is also important to note that Rosselkhozbank offers to involve up to three co-borrowers in mortgage lending. However, this bank lends only to citizens of the Russian Federation who are in the age group of 21-65 years.

DeltaCredit – “Mortgage for maternity capital”

In addition to relatively loyal requirements for the borrower, this credit institution offers the following mortgage program conditions that are unique for the Russian market:

| Interest rate | From 10.25%. |

| Credit term | Up to 25 years old. |

| Down payment amount | From 5% of the total cost of the property (unique offer). |

DeltaCredit Bank lends to both employees and private entrepreneurs. However, this credit institution sets age restrictions and does not issue mortgage loans against maternity capital to persons under 21 years of age.

UniCredit Bank - “Mortgage for maternity capital”

This bank offers two separate mortgage programs using maternity capital - “Loan for the purchase of an apartment” and “Loan for the purchase of a cottage.” A special feature of banking programs is the absence of commissions and penalties for early repayment of a loan. The conditions for both programs boil down to the following proposals:

| Interest rate | From 9.75% to 13.25%. |

| Credit term | From 1 year to 30 years. |

| Down payment amount | 20-30% of the total cost of the apartment. |

| Maximum mortgage loan amount | Up to 30 million rubles. |

Another advantage of this bank is that there is no need to register at the location of the purchased property.

Using maternity capital to pay off the mortgage

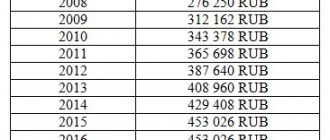

On average across regions, the size of the certificate ranges from 20 to 40% of the total cost of the apartment. To use it for its intended purpose, parents will have to perform the following algorithm of actions:

- find funds from other sources of income to pay the entry fee - this is at least a fifth of the total cost of the loan;

- go through the registration procedure, sign an agreement with a banking institution;

- after all formalities have been completed, you will need to draw up a statement proving the fact of ownership of the real estate object (the document has legal force only after it is certified by a notary);

- registration of the loan in the unified state register, which can be confirmed by an official extract from the Unified State Register of Real Estate - it is handed over to the owner;

- the intended use of the certificate to repay debt obligations to the bank (for this, the credit institution must issue the borrower a certificate indicating the total amount of debt under the agreement);

- after this, the owner of the certificate signs a document where he undertakes to register the second parent and children as shareholders with equal rights (this must be done six months before repaying the debt to the organization and canceling the encumbrance on the purchased housing - the document must also be notarized);

- filing an application for the right to use family capital at the address of the district department of the pension fund (after the borrower is issued a certificate confirming the assignment of loan obligations to him, all prepared documents are also submitted to the Pension Fund of the Russian Federation).

Features of obtaining family capital with a mortgage

Today, a lot of special loan packages have been offered for the use of family capital. In addition to the country's leading banking institutions, a similar solution was presented by the Housing Mortgage Lending Agency (Dom.rf), which implements programs with the support of banks. To receive maternity capital, you must carefully study all the established conditions. First of all, the borrower’s family must fully meet the requirements put forward by the bank. In general, they are standard:

- the borrower must have a stable average income with at least six months of work experience at the last place of employment;

- age restrictions: from 20 to 65 years at the time of loan repayment;

- the borrower’s total work experience over the past five years is at least 12 months;

- availability of documents that confirm work experience (at least half a year at the last job) and;

- solvency: when applying for a mortgage loan, only “white” income is taken into account. “Gray” parts of wages and third-party income can only be taken into account as additional or unstable;

- Loan approval can only be obtained with a clean credit history.

- provision of a state certificate of participation in the program “Lending taking into account the maternal certificate”, as well as a certificate from the Pension Fund of the Russian Federation on the amount of the required amount.

In addition to the certificate and certificate from the Pension Fund of the Russian Federation, the standard package of documents consists of:

- Photocopies of each page of the country’s citizen’s passport;

- A certified copy of the work book with the employer's seal on all pages;

- Certificates confirming the borrower's solvency.

Recommended article: Maternity capital for the first child in 2020

Additionally, the bank may need to provide a photocopy of an employment contract, education documents, other lending agreements (if any), bank statements and photocopies of documents that confirm the borrower has real estate or expensive property. The requirements for documents for a mortgage are detailed in another article.

How to calculate a mortgage with maternity capital?

A mortgage calculator will help you quickly calculate a mortgage with maternity capital. This program is easy to use and is available in every financial institution that has state accreditation and participates in the maternity capital lending program.

There are two ways to use the calculator:

- do it yourself on the bank’s official page;

- personally contact the organization, where an employee of the institution will explain everything on the spot.

The program is purposefully designed so that the borrower can, without leaving home, control the overall picture of the status of debt obligations, and also ensure that all payments are repaid according to the schedule, which can be printed on the website.

Step-by-step instructions for calculating a loan:

- go to the online banking website;

- go to the “calculator” section;

- fill in the apartment cost field;

- indicate the amount in rubles that you are willing to pay as an entrance fee;

- mortgage term – the number of months is indicated;

- indicate interest payments;

- choose the type of repayment - it can be annuity (when the monthly repayment amount is a fixed amount, it does not change depending on the debt already paid) and differentiated. In the second case, the amount of regular payments decreases as the main debt obligation is repaid.

After all the fields are filled in, if everything is done correctly, after pressing the “calculate” key, a graph will appear on the desktop.

It will contain the following information:

- total loan amount;

- the period during which it must be paid in full and interest at the rate;

- repayment method;

- the total amount to be paid, taking into account the overpayment.

Let's look at an example.

The loan amount will be 8 million rubles. Entry fee – 1 million. The term of the mortgage is 18 years. The interest rate offered by the credit institution is 12% per annum.

Calculation:

- If you pay in a differentiated way, the amount of the overpayment will be 7,595,000 rubles, and the total amount will be 14,595,000, respectively;

- With a fixed repayment - 1011488.32 rubles, and the total loan amount - 17115088.32 rubles.

Conditions

Until 2015, according to the law, it was possible to use maternity capital to purchase housing only three years after the birth or adoption of a child. The same rule applied to applying for a new loan using maternity capital as a down payment on a mortgage. Today, you can use maternity capital to repay and apply for a mortgage at any time from the moment you receive it. This possibility is determined by Decree of the Government of the Russian Federation No. 862 of December 12, 2007 “On the Rules for allocating funds (part of the funds) of maternity (family) capital to improve housing conditions.”

According to statistics, more than 70% of families with this right decide to use maternity capital to pay off or apply for a mortgage. The conditions for a mortgage with maternity capital differ little from standard mortgage programs:

- interest rate from 9% to 14%;

- loan repayment period up to 30 years;

- the maximum mortgage loan amount reaches 100% of the cost of housing;

- the minimum mortgage loan amount is 100 thousand rubles;

- down payment amount from 15% to 30% of the market price of the property;

- the obligatory presence of a confirmed stable income of the borrower;

- positive credit history.

The family has the opportunity to use the mat. capital for the purpose of repaying or obtaining a mortgage loan using the following two mechanisms:

- payment of a down payment on a mortgage;

- payment of interest and interest on the mortgage.

Let's consider both options in more detail.

Which banks provide mortgages against maternity capital?

A mortgage using maternity capital is an excellent way to improve the quality of your living conditions or purchase a new apartment. Almost all large banking institutions licensed to operate in the Russian Federation will accept the certificate as an initial contribution to mortgage lending.

Sberbank

The largest banking structure in Russia is quite loyal to processing loans for maternity capital. It is especially popular and offers the following conditions:

- funds can only be received in national ruble currency;

- the financial rate for this loan item starts from 8.9%;

- the maximum permissible period for repaying debt to the bank is 30 years;

- the amount of the down payment cannot be less than 25% of the total loan amount;

- The maximum allowable loan amount is 30 million rubles.

A distinctive feature of Sberbank’s financial policy is that it does not take into account the category of real estate purchased by a family with children. This could be the secondary market, which according to statistics is the most attractive niche of the real estate market for this category of citizens, a private building or a new apartment.

The main condition of the organization is that the entire amount of money from the certificate must be transferred to the bank within a period of no later than 6 months from the date of signing the agreement and the official conclusion of the purchase and sale transaction.

VTB 24

VTB 24 is a commercial structure that has held an honorable second place in popularity among our compatriots for more than 10 years. Both borrowers and investors work with him. The bank enters into contracts for maternity capital for any type of housing. Although this factor is considered significant, it is not decisive.

Operations for signing an agreement under this article take place on the following credit terms:

- the loan is issued only in Russian rubles;

- The minimum repayment rate is 9.5%. At the same time, in the process of debt recovery, under the influence of a number of factors, its value may be revised downward. For example, when making payments early or with the help of government support, which assumes part of the obligations;

- maximum mortgage duration – 30 years;

- minimum initial deposit – 20% of the total amount specified in the agreement;

- the maximum value of real estate is 30 million rubles.

RaiffeisenBank

The bank offers two programs within the scope of the certificate:

- purchase of secondary housing using its collateral value;

- purchasing new real estate on the market.

For these programs, the minimum interest rate is 9.25%, the loan term is up to 30 years, and the maximum amount is 26 million rubles.

Conditions:

- presence of Russian citizenship;

- parents must be legally married;

- The parents of a married couple have the right to act as co-borrowers;

- type of family income – official and documented;

- none of the family members should have their own business;

- At the time of concluding the contract, the parents should not have other loans related to housing purchases.

Bank opening

Three programs have been launched:

- New building – interest rate is at least 9.7%. Loan term: minimum – 5 years, maximum – 30. Start-up fee – at least 10% of the total amount. Designed for the purchase of a new home.

- An apartment is the best solution for those who want to buy real estate on the secondary market. The starting rate is 9.7%. The maximum repayment period is 30 years. Initial payment – at least 10%.

- Free meters - individual construction. Rate – from 10.7%, term – up to 30 years. The first payment is 20%.

For all programs, the maximum loan amount is 30 million rubles. The package of documents is standard.

Important nuances

A number of nuances provided for by current legislation should be taken into account:

- You will have to notify the Pension Fund in advance . At the moment when you have agreed with the bank on the possibility of contributing maternity capital to repay or make a down payment on a mortgage loan, you should understand that the amounts and dates of payments are planned once every six months. This means that the process of reviewing and transferring maternity capital funds to the creditor bank account can take up to six months. That is, if you plan to apply for a mortgage in the fall, you should submit documents to the Pension Fund in the spring.

- If part of the maternity capital was previously used, it will not be possible to obtain a new mortgage . According to current legislation, maternity capital can be used to make a down payment only if not a penny of this amount has been spent. If you have previously used part of government funds. assistance, for example, to pay for a child’s education, it will not be possible to make the remaining funds as a down payment on a mortgage. However, the law does not provide restrictions on the use of the remaining amount to pay off the mortgage.

- A mortgage can be taken out both for the purchase of finished housing and for participation in shared construction . Today, many banks are ready to provide a mortgage loan against maternity capital not only for the purchase of finished housing, but also for the purchase of an apartment in a property under construction, or for the construction of a house. If a family chooses shared construction, risks should be taken into account, which are compensated by the low cost per square meter of real estate.

- The scheme for calculating the maximum mortgage loan is changing . The market price of housing today is quite high even for regional centers, not to mention megacities like Moscow and St. Petersburg. Accordingly, a young family is often faced with an insufficient level of official income to purchase even a small apartment. To increase the maximum mortgage loan amount, experts recommend involving co-borrowers. Co-borrowers can be both spouses and other working family members. If the family has the right to maternity capital, the amount of the mortgage loan = the sum of the income levels of all co-borrowers + the amount of family capital.

- You can sell or exchange real estate before paying off the mortgage only with the permission of the bank . When registering purchased real estate with government agencies, an encumbrance is placed on it. This means that if the new owner wants to sell or exchange such housing, he will be able to do this either after the mortgage has been fully repaid, or with the appropriate permission from the credit institution (bank).

- In addition to monthly mortgage payments, you will have to pay insurance premiums . Today, the vast majority of banks are not ready to work with mortgage loans without insurance of collateral. This means that when applying for a mortgage using maternity capital, you will additionally have to enter into an agreement with an insurance company. Banks usually require an apartment or house to be insured in case of accidents, catastrophes and intentional criminal acts of third parties. Some banks also insist that the borrower insure his life and health, and also have insurance in case of disability. A mortgage insurance contract is concluded as a tripartite contract and its parties are not only the insurance company and the borrower, but also the bank. That is why the choice of an insurance company must be coordinated with the credit institution that issues the mortgage.

How to avoid fraud when applying for a mortgage under mat capital

The first rule that will help you avoid fraud: work only with official organizations - large banks and the Pension Fund directly.

Scammers may introduce themselves to you as employees of well-known companies: it is worth checking their documents or asking banks and the Pension Fund whether such employees work for them.

MSC fraud schemes are quite numerous:

- concluding fictitious loan agreements and withdrawing commissions for intermediation from certificate holders;

- obtaining consent to cash the certificate and withdraw it from the owners;

- purchase of housing under construction using maternal capital with subsequent resale of rights.

We will not mention the options when the holders of the certificates themselves turn out to be scammers who purchase housing for the purpose of its further sale.

And a few more important points:

- If you plan to use maternity capital in a mortgage, you must notify the Pension Fund about this 6 months or earlier , since all payments in this organization are planned once every six months.

- Decide in advance what kind of housing you want to purchase - ready-made or under construction . In the second case, you will benefit in price, but the timing of obtaining housing will be more uncertain.

- The apartment is registered to all members of the family in equal shares.

- The right to dispose of an apartment (sale, exchange, donation) appears only after fulfillment of payment obligations.

A mandatory condition for executing an agreement with a bank is insurance. Some lending financial institutions provide sufficient insurance in case of disability or dismissal of the borrower.

Other firms require the client to provide life insurance and insurance against damage to real estate. In case of early repayment of the debt, it will not be possible to return the paid part of the insurance.

Requirements for borrowers

Before taking out a mortgage using maternity capital, the borrower needs to make sure that he meets all the bank’s criteria. Banking institutions carefully check clients before issuing a loan because they have certain risks.

They are more loyal to such categories of borrowers as:

- Persons who have a salary card from the bank where the mortgage is issued.

- Regular customers.

- Citizens working in partner firms of a banking institution that issues housing loans.

Each bank independently sets a list of criteria for borrowers, so it may differ slightly.

The standard requirements are as follows:

- Must be at least 21 years old and not older than 65 years old.

- Work experience in general is from a year, and in the current place from six months.

- Official employment.

- Stable salary.

- Registration in the region where the bank branch operates.

Loans for the purchase of housing using maternity capital are issued exclusively to Russian citizens.

Requirements for obtaining a mortgage loan with capital

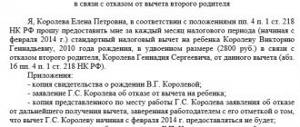

Even if a mortgage for the amount of maternity capital is impossible, nevertheless, getting a mortgage simply with the participation of maternity capital is more than realistic. There are very few conditions from the state and the bank:

- Excellent credit history. All payments on previous loans will be examined without fail, both at the bank where citizens applied, and at other financial institutions (even MFOs). Poor credit history is the most common reason for loan refusal;

- The applicant must have a constant and sufficient income to pay the loan. This will have to be documented. Suitable not only official, so-called. “white” income, but also part-time jobs, unregistered profits, etc.;

- Work experience at the last place of work must be at least 6 months. It should be noted that some banks may reduce or increase this value - from three months to three years;

- Real estate acquired with the participation of maternal capital must be registered in the name of all family members, incl. for children;

- Some banks additionally require a down payment in hard money, i.e. in cash or non-cash form. In this case, Matkapital acts only as a partial early repayment of debt.

Is it possible to take out a mortgage against capital?

Maternity capital is a cash benefit that is issued by the state after the birth of the second baby. However, there are several nuances to using such financial assistance.

These include the following:

- Only a certificate for receiving maternity capital is issued to the mother who gave birth to her second baby. Based on it, the Pension Fund of the Russian Federation itself transfers money for certain purposes, but does not transfer it to the recipient. It is impossible to withdraw funds legally.

- You can use the benefit after 3 years from the date of birth of the child.

- The use of state assistance is permitted for purposes strictly established by law.

- The state does not charge taxes for receiving funds.

- The law does not establish how long maternity capital must be used.

- You can only receive one certificate per MK.

- When indexing the amount of capital, you do not need to change the certificate; everything will happen automatically.

- If a certificate is lost, there is always the possibility of obtaining a duplicate.

Maternity capital is allowed to be spent on the following tasks:

- Improving living conditions.

- Getting an education.

- Accumulation of parents' pension.

- Social adaptation of children recognized as disabled.

You can spend state benefits to improve living conditions by purchasing or building housing. This includes the purchase of residential premises on credit, that is, by taking out a mortgage. Therefore, the law allows you to use maternal capital to obtain a mortgage loan.

Instructions for applying for a mortgage with capital

We have already written about what the procedure for transferring funds from the state to a bank looks like in the first paragraph of this article. Now let’s look at the algorithm of actions of the borrower himself: how to take out a mortgage with maternity capital as quickly as possible and without unnecessary delays.

The stages of the procedure for obtaining a loan look like this:

- First you need to collect the required package of documents. You can find the list of papers above;

- Next, the citizen must personally appear at the Pension Fund of the Russian Federation to submit documents to the Fund employee along with an application (application for the use of maternal capital funds). Over the course of several months, all submitted documents are verified. If something is missing or an error is found somewhere in the papers, the citizen is notified by mail or by telephone;

- If the decision is positive, the citizen is issued a certificate of family capital. It, along with other documents, should be submitted to the bank where the borrower wishes to obtain a mortgage;

- The bank requests money from the Pension Fund - the Pension Fund must transfer it within 10 days from the date of application. These funds are used either for the down payment or for partial repayment of the debt. A real estate purchase and sale agreement is signed, the seller receives money, and the buyer registers rights and encumbrances in Rosreestr. This completes the procedure.

The loan agreement is drawn up not only for the applicant: his spouse automatically becomes a co-borrower.

It is possible to attract several more guarantors or one co-borrower.