Legislation 2021 - changes and regulations

The basic conditions for obtaining family capital were enshrined in Federal Law No. 256. But the procedure and conditions for registering maternity capital in 2021 have undergone some changes. Let us remind you that on the initiative of the president, maternity capital is now issued for the first descendant. The amount will be 466,617 rubles. Parents with two children will be offered 616,617 rubles. Families with three offspring will be able to receive both targeted cash assistance and the opportunity to repay parts of the mortgage in the amount of 450,000 rubles. It has already been proposed to extend the program of maternal support for young families until 2026, so citizens who are lucky enough to give birth to twins have the right to count on maternity capital.

Here are the payments you are entitled to in Russia if twins are born:

- maternity benefits;

- payment at the birth of a baby;

- care payments up to 1.5 years of age;

- payments for child care from 1.5 to 3 years.

Payments for the birth of twins in 2021

Each woman’s body, as well as her lifestyle, are individual - and therefore pregnancy proceeds differently for everyone. Maternity leave is considered sick leave because its essence is to give the woman time to recover from the difficult process of childbirth. Some women give birth normally, others experience complications, some give birth on their own, others undergo a Caesarean section - which means the recovery period will be different for everyone.

In this regard, the Government has approved various standards designed to select the duration of maternity leave, which will be affected not only by the presence of postpartum complications, but also by the number of babies born.

In case of multiple pregnancy, the leave is extended. If the birth proceeded normally naturally and no complications arose, the woman is given 194 days of rest, of which 84 days are provided before childbirth, and 110 days after.

Many people know that after a Caesarean section, a young mother has the right to extend her leave by 16 days, so before giving birth she is given not 70 days, but 86 days. After such births, a woman takes longer to recover, so postpartum leave is also extended to 110 days. But you should know that the operation does not in any way affect the duration of the vacation when twins are born - the very fact of having two children already significantly extends it.

During a singleton pregnancy, a woman must leave the workplace at 30 obstetric weeks of pregnancy, but twins, as a rule, are born earlier, and it is more difficult for a woman to bear them, so pregnant women with twins go on vacation earlier - at 28 obstetric weeks.

After maternity leave, a woman has the right to submit an application to her employer for maternity leave to care for a newborn. At this point, her child care allowance will be calculated. If a woman is not employed, she registers the benefit with the social protection authorities - then it is paid to her in the minimum amount.

According to the provisions of federal laws, there is a special procedure for calculating benefits for mothers who gave birth to twins - baby care benefits are summed up, but do not exceed the mother’s salary. Payments continue until the child reaches one and a half years old.

At the birth of one child, the amount of childcare benefit is 40% of the mother’s average income; when a second child is born, she receives an additional benefit in the amount of 80% of earnings, but for the birth of twins, one cannot count on a benefit of more than 100% of the average salary.

Until 2007, the situation was worse - the benefit for the birth of twins was equal to the benefit for one baby.

Since officially employed women make regular insurance payments through their employer, they are entitled to all of the following lump sum payments, generated from insurance contributions:

- Sick leave benefits in connection with maternity leave. It is paid along with the issuance of a management order assigning leave to the employee (the basis for issuing a local act is a sick leave issued at the clinic at the place where the pregnant woman is registered). It is calculated based on the salary for the 24 months preceding maternity leave and in the case of the birth of twins it is at least 50,000 rubles.

- An additional payment to the Birth and Birth benefit payable to those women who registered with the antenatal clinic in the early stages of pregnancy (up to 12 obstetric weeks). To confirm the right to this benefit, it is necessary to provide the employer, along with the sick leave certificate, with a certificate from the gynecologist about the time of the first visit to the clinic by the pregnant woman. The size of the payment varies depending on the region, usually it does not exceed 580 rubles.

- One-time benefit on the occasion of the birth of a child. Paid to the mother or father of the child, but only to one of the parents. The amount of benefit for one baby is 16,360 rubles, but when twins are born, the two benefits are summed up, that is, the parents will receive 33,000 rubles.

Legislative norms for supporting maternity can be divided into two types:

- federal level;

- regional level.

Federal regulations apply to all families living in Russia. The amount of payments is determined in a single amount for all citizens of the Russian Federation, regardless of how many children were born at the same time. Regional payments in some areas provide for an increase in benefits depending on the number of children born, which is relevant for the so-called gubernatorial payments.

Even before the babies are born, the mother of twins has the right to count on federal support.

Thus, by virtue of Article 9 of Federal Law No. 81, she can receive benefits for early registration for a period of up to 12 weeks.

The purpose of this type of payment does not depend on the woman’s social status and is paid to her regardless of whether she is in an employment relationship or not.

The benefit amount as of 2021 was 655.49 rubles. From February 1, 2020, the payment is indexed by 3% and amounts to 675.15 rubles, paid simultaneously with maternity benefits when going on maternity leave.

As a special support measure, a one-time benefit is also paid to pregnant wives of conscripted military personnel, provided that the pregnancy period is at least 180 days in accordance with the norms of Article 12.3 of Federal Law No. 81.

At the same time, the payment amount from February 1, 2021 is 28,539.08 rubles.

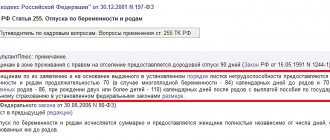

Also, in pursuance of the norms of Article 255 of the Labor Code of the Russian Federation, women are granted leave for childbirth, the length of which increases specifically for mothers with multiple pregnancies.

Thus, expectant mothers of twins have the right to take maternity leave not at the standard 30 weeks, but at 28 weeks, that is, 84 days before the birth of the newborns. The law also extended postpartum leave for women from the standard 70 days to 110 days.

Thus, benefits for multiple pregnancies are assigned for 194 days in the form of a one-time payment when taking leave under the BiR. Moreover, by virtue of Article 6 of Federal Law No. 81, benefits are paid not to all women, but only to certain categories.

The following may qualify for this type of payment:

- working and military personnel on a contract basis; mothers;

- women who were laid off due to layoffs within a year before applying for employment and employment benefits, subject to registration with the Employment Center;

- full-time female students;

- mothers who adopted children under 3 months of age.

Considering that the sources of financing for these categories vary greatly, the amount of the B&R benefit also differs:

- For working mothers, benefits are paid based on their average earnings, and for military personnel - taking into account their monetary allowance.

- For students, the allowance is determined in proportion to the stipend paid, and for dismissed mothers - in the amount of 675.15 rubles.

The amount of payment for dismissed women is determined by the norms of Federal Law No. 81; in 2021 it was indexed, albeit by a very modest percentage. It is also possible that from 01.02.2020 there will be a slight increase in the allowance for B&R and students if at the beginning of the academic year a decision was made to increase the scholarship.

It is planned to increase the monetary allowance for military personnel in 2020, as a result of which this category of women giving birth will receive a larger B&R benefit, taking into account the innovations.

Which ones are assigned at birth?

From the first day of children’s lives, at the state level, their parents have the right to benefits under a two-tier system.

Families can receive a one-time payment:

- on the basis of Federal Law No. 81, that is, for the birth of each child;

- within the framework of regional legislation, but only in certain areas.

Thus, if twins are born, father and mother have the right to a federal payment for each child, regardless of place of residence, region or region. In the case of the birth of twins, the right to a regional payment may depend on the average per capita income of the family, as well as conditions determined by local legislation.

For example, in the Khanty-Mansiysk Okrug, benefits are provided specifically for the birth of twins, and in the Kostroma Region only for the birth of a second and third child.

Will maternity capital be paid for twins?

When two newborns are born at once, parents retain the opportunity to receive maternity capital for twins, but only if the children were the first for the parents, or if they previously had only 1 minor born no later than 2007. The main thing is that before the birth the family does not have the right to payment or does not have time to use the maternity capital.

ConsultantPlus experts looked at how to get maternity capital and how it can be used legally. Use these instructions for free.

Typical mistakes on the topic

When you give birth to twins, several common mistakes can be made during the registration of MSK.

Error 1.

Smirnova A.A. in January 2021 she gave birth to her first children - twins. The woman applied for a certificate for MSK. She was given a document indicating the amount of 466,617.

Solution 1.

If a woman gave birth to twins after January 2021, then she has the right to receive MSC in the maximum amount, or more precisely in the amount of 616,617 rubles.

Error 2.

Maksimova L.Yu. in 2007 she gave birth to her first child, and her second in 2021. Having applied for the MSK, she learned that its amount would be 466,000 rubles.

Solution 2.

Since Maksimova did not apply for MSK for her first child, in 2021 she has the right to receive a certificate for the maximum amount of 616,617 rubles.

Maternity capital for twins during the first birth

The family has the right to dispose of capital only when the children reach three years of age, and not earlier. But there are exceptions to this rule: the family has the right to dispose of MK immediately after the birth of children if:

- the money is used to pay off the mortgage;

- the funds are used to repay a loan taken to purchase means of social adaptation for a disabled minor;

- the family intends to receive a monthly payment from these funds.

You should apply for a certificate for MK at the nearest offices of the Pension Fund and MFC or fill out documents on the portal of the State Services or the Pension Fund.

Target direction of Maternity capital in 2021

MSC funds cannot be received in cash and cannot be spent on any needs. It has a purpose, and in order to dispose of the certificate it is necessary to comply with the law.

According to the introduced changes, in 2021 MSC can be spent on:

- Improving living conditions. The right to dispose of MSC arises after the child turns 3 years old. To send funds, you must contact the Pension Fund of the Russian Federation, MFC.

- Mortgage repayment. You can send MSK without waiting for the child to turn three years old, but immediately after his birth.

- Home construction. It will not be possible to build a house on your own, since the Pension Fund of the Russian Federation requires documents confirming the intended use of MSC funds. And for this you will need to hire a specialized team of builders.

- Down payment on a mortgage. To receive MSC funds, the Pension Fund of the Russian Federation provides a certificate from the bank confirming the approval of a mortgage or loan.

- Compensation of costs for the construction of individual housing. In this case, you can build a house yourself. The Pension Fund of Russia will reimburse the family for the cost of materials from MSC funds.

- Children's education. It is possible to pay for the education of any child. In addition, MSK funds can now be used to pay for a private kindergarten.

- Rehabilitation and treatment of a disabled child. Only the costs of activities specified in the individual rehabilitation program for a disabled child (hereinafter referred to as IPR) will be reimbursed.

- Monthly cash payment (hereinafter referred to as EDV) from MSC. Accrued from the moment the child is born until he reaches 3 years of age. They are paid in the amount of the minimum wage to families whose income is less than two times the minimum wage.

- Mom's pension. The rarest type of channeling MSC funds. To receive such support, no additional documents are needed. You just need to write a statement.

Basically, MSC funds can be used after the child reaches three years of age. This also applies to those families where twins were born.

Disposal of Maternity capital up to 3 years in 2021

The Government of the Russian Federation makes it possible to dispose of MSC before the child’s third birthday. In this case, parents can direct funds to:

- repayment of a mortgage loan;

- down payment on mortgage;

- monthly payment.

In the first and second cases, the certificate holder must contact the bank and write an application to deposit MSC funds to pay off the mortgage. Previously, it was necessary to agree on the possibility of covering the debt with capital with the bank, and then contact the Pension Fund of the Russian Federation with a request to dispose of the certificate.

Monthly payment from Maternity capital in 2021

Parents applying for MSC are given the opportunity to arrange a monthly payment from the capital. However, not everyone can take advantage of the support, but only families whose income is below two times the subsistence minimum (hereinafter referred to as the subsistence minimum) in the region for each member.

When twins are born during the first birth, the mother can apply for two payments at once, which are popularly called “Putin’s”:

- EDV for 1st child. Social protection of the population pays in the amount of monthly minimum wage.

- EDV for the 2nd newborn. Paid from MSC funds in the amount of monthly subsistence in the region. To receive it, you must contact the territorial division of the Pension Fund of the Russian Federation, the MFC, or use your personal account on the State Services service, the website of the Pension Fund of the Russian Federation.

To receive additional support, you must prepare the following documents:

- statement from the certificate holder;

- parents' passports;

- birth certificates of all children;

- certificate of family composition;

- papers confirming family income;

- certificate for MK.

Important!

Monthly benefits are provided for up to 3 years. However, you must confirm your eligibility every year.

It should be noted that such a payment is the only way to legally receive MSC funds in cash and spend them on any needs.

What documents are needed

In addition to a written application with a request to register maternity capital, the applicant provides:

- passport and SNILS of the applicant;

- birth certificates of children;

- a certificate of death of one of the parents, if such a fact occurred;

- a court decision on adoption if the children are not biological descendants;

- a document on the citizenship of the children, if it does not appear from the birth certificate;

- certificate of registration or divorce;

- a document confirming the loss of rights to children by one of the parents.

When directly disposing of MK funds, documents will be required for the chosen area of spending. For example:

- contract of sale;

- certificate of enrollment in an educational institution;

- mortgage agreement, etc.

Papers can be submitted in paper or electronic form.

The request for the issuance of MK must be considered and approved within 15, not 30 days, as was previously the case.

Instead of parents, official guardians who have registered the rights to children have the right to request financial assistance.

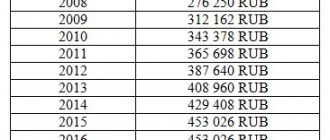

Maternity (family) capital in 2021

Since January 2021, changes have been made to Federal Law No. 256 that change the procedure for obtaining MSC. It is indexed for the first time in 4 years. In addition, now young mothers with newborn children do not need to apply for a document. The registration of the MK occurs automatically, that is, there is no need to submit an application.

Maternity capital: who has the opportunity to receive a certificate

In 2021, the right to MSC arises in families where the firstborn and subsequent children were born. Previously, only families with two or more children could receive support.

When the first child appears in a family from January 2021, a certificate for 466,617 rubles is required. Parents of second babies born before December 31, 2021 can count on the same amount.

At the birth of the second baby after January 1, 2021, the MSK increases to 616,617 rubles. The opportunity to receive its second part arises for families who acquired children after January 1, 2021. That is, if a woman gave birth to her first child in 2021, she will receive a certificate in the amount of 466,617 rubles, and when a second child appears in the family, the MSC already issued and received increases by 150,000 rubles.

Support is provided:

- natural or adoptive mother;

- to the natural or adoptive father, in the event that the mother has lost the right to receive MSC (death of a woman, missing person, deprivation of parental rights);

- children, if the parents do not have the right to MSC.

The certificate holder loses the right to capital if he is deprived of parental rights to children.

Obtaining a certificate

Until March 2021, to obtain a certificate, citizens applied with a small package of documents to the Pension Fund of the Russian Federation (hereinafter referred to as the PF of the Russian Federation). Required:

- completed application form;

- applicant's passport;

- children's birth certificates;

- certificate of paternity.

Starting from March 2021, MSC is issued automatically, without the need for employees of the Pension Fund of the Russian Federation to submit an application. Information about the birth of a child is transmitted by the Unified State Register of Civil Status Records (hereinafter referred to as the Unified State Register of Civil Status Records).

To find out whether the MSC and its amount have been issued, you need to log in to your personal account (hereinafter referred to as LC) of the State Services service or on the website of the Pension Fund of the Russian Federation and order an extract on the MSC.

Where to spend funds

Federal Law No. 256 regulates all purposes of using funds:

- purchasing housing (using funds to purchase or pay the first mortgage payment);

- payment for repairs, reconstruction or construction of a residential property;

- contributing funds to the funded part of the mother’s pension;

- payment for education for children (both university and preschool) in accredited institutions;

- receiving regular monthly payments as financial assistance.

There are no legal schemes to legally “cash out” maternity capital. Funds are always transferred in cashless form and only after the purpose of its use has been approved and confirmed.

Registration procedure

It's never too late to get a certificate for financial assistance. If a family in which a second or subsequent child was born after January 1, 2007 has not yet received the required state support, then it can apply for it until the end of 2021. This is the validity period determined today. But it is better not to delay in exercising your rights and to resort to obtaining a certificate as early as possible.

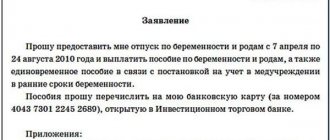

According to the law, to obtain a certificate you must follow the following path:

- Collect the necessary package of documents.

- Go to the desired department of the Russian Pension Fund.

- Write an application for maternal capital.

- Submit the entire package for registration.

When receiving documents, a Pension Fund employee checks their completeness and announces the deadline for consideration of the application. After this, the applicant can only wait for a positive decision. A refusal to issue a certificate can only be given if the family does not meet the mandatory conditions set out in Federal Law No. 256.

Collection of documents

The entire registration procedure for the birth of twins is identical to that provided for families whose second child was born as a result of repeated births. Parents of the child must understand that each application to the Pension Fund will be accompanied by the collection of necessary documents and the initial submission of the application is only the beginning of the procedure.

When issuing a certificate, you will need to collect and provide the following set of papers:

- Identity card of the parent who is applying for financial assistance in their name. Usually this is the mother, but it can be different.

- Birth certificates for all children. In fact, an adult must prove that he has two or even more children, so a certificate is submitted not only for the one who became the reason for receiving state support, but also for the others.

- SNILS of the applicant.

- Marriage certificate. Lack of marital relationship or divorce is not a reason for refusing to issue a certificate.

If we are talking about the situation with the adoption of twins, then you will additionally have to submit documents that will confirm that the procedure was carried out officially and all rights to the children were transferred to the specified person.

When adopting stepsons and stepdaughters, you cannot count on receiving maternity capital. The state program stimulates the birth rate, and does not simply distribute budget funds.

Contacting the Pension Fund

To apply for a maternity capital certificate, you must go to the branch of the Pension Fund, the service area of which includes the family. To apply to the Pension Fund, you do not need to take your children with you or prepare in any other way. If you have all the specified documents and free time, this can be done any day.

The most important moment for a parent is filling out the application. Its blank form can be taken directly from the Pension Fund of Russia branch, where a sample of filling out this document will be displayed at the stand. It is recommended to approach entering information carefully and responsibly. If there are errors, the application will have to be rewritten, and providing false information will even contribute to the refusal to satisfy the request.

After the fund employee accepts the application and all specified copies of documents, the applicant will have to wait for a response. The law allows 30 calendar days for consideration of applications of this kind. In some cases, the answer is given earlier than the specified period, but more often you have to wait exactly a month.

Additional Information

The response is given in writing to the applicant’s address, which was indicated in the application.

Grounds for refusal of extradition

When checking submitted papers, employees will look at the following points:

- whether citizens have previously applied to the Pension Fund to receive MK;

- whether the mother and/or father were deprived of rights to the newborns;

- whether the parents committed crimes against their children.

Another, less common reason for refusing to transfer funds concerns cases where parents have already spent all the funds provided. Let us remind you that citizens have the right to spend maternity capital not on one of the purposes, but on several of them at once, but only if the required amount has not been spent previously.

Conditions for receiving money

Federal Law No. 256 establishes three mandatory conditions, the observance of which is mandatory in order to receive state material support:

- The family or only one of the parents has Russian citizenship. And the born child is also a citizen of Russia.

- The baby was born after the law was passed, namely later than January 1, 2007.

- Parents have not previously exercised their right to receive maternity capital.

If these three conditions are met, you can apply to the Pension Fund for a certificate.

The following can receive financial assistance from the state:

- Mother of babies. This is the most common option, but not the only one.

- The father of newborns, if the mother has died or for some reason is deprived of this opportunity.

In some cases, for example, when parents are deprived of parental rights or their death, a certificate can be issued for children, but with the right to use only after reaching adulthood. Maternity capital is issued not only to natural children, but also to adopted ones.

Is maternity capital paid for twins during the second and subsequent births?

If children have already been born in the family, maternity capital for twins and the possibility of receiving it depends on the number of children:

- if a couple has only one descendant and the family did not receive MK, with the birth of twins the condition of having two children in the family is fulfilled - citizens have the right to receive MK;

- If a family already has two or more children and the couple received MK earlier, MK is no longer required for twins born in 2021. The exception is cases when parents did not have time to register MK at the first birth.

The legislative framework

Russian legislation sets out all the rules regarding the current program of financial support for families.

The requirements for receiving capital are set out, including for the birth of twins.

Federal Law of December 29, 2006 N 256-FZ

The conditions that must be met are described:

- The payment is provided even if two children were born at the same time, during the woman’s first birth;

- The right to submit an application also arises if the family already had one or more children under the age of majority;

- Capital is accrued provided that the parents have not previously applied for it to the Pension Fund.

Contains instructions on how to apply for the disposal of maternity capital funds.

Order of the Ministry of Labor of the Russian Federation dated August 2, 2017 N 606N

If spouses who have become parents believe that their legal rights have been violated, they can challenge the refusal given by the Pension Fund in court.

We invite you to read: At what point can you apply for alimony?

Regional payments for twins

In a number of regions there are additional surcharges aimed at supporting young families. In the case of parents with twins, they also receive a package of assistance for families with two babies. Registration of a regional payment does not deprive the right to receive federal maternity capital; what maternity capital is due in 2020 if twins are born depends on the region. Amounts of local support range from 30,000 to 300,000 rubles, depending on the subject of residence. Eg:

- in the Tula region - 150,000 rubles;

- in the Murmansk region - 121,612.92 rubles for the third child;

- in the Nizhny Novgorod region - 100,000 rubles, etc.

In addition to the fact of the birth of twins, it is also necessary to confirm the period of residence in the territory of the subject. The period ranges from 3 to 10 years. Usually it is also necessary to confirm the purpose of using the allocated funds and meet age restrictions (for example, one of the parents to receive assistance is not older than 35 years). You should find out about benefits and family assistance programs at your local Pension Fund offices.

Peculiarities of registration and disposal of MK funds

The Government of the Russian Federation has developed a program for registering and disposing of MSCs in such a way that the support cannot be used for personal gain. In this regard, when using capital, a number of nuances must be taken into account.

- A parent who has not previously received such support can apply for a certificate. If he is deprived of his rights to a child, then his right to receive money is lost.

- MSC funds cannot be obtained in cash. An exception is the EDV for the second child.

- You can direct MSK to repay a mortgage or loan only if a target agreement has been drawn up with a bank or credit cooperative.

- MSK can reimburse the costs of building a house only if there is an agreement for the supply of materials. Simple checks will not work in this case.

- When buying a house under the MSK, it is necessary to allocate shares to all family members. If real estate is purchased with borrowed funds, then the allocation of shares occurs six months after the restrictions are lifted.

- A family cannot buy real estate under the MSK if it is worse than the house or apartment owned by the parents. An exception is if parents purchase an additional residential building or apartment.

Is maternity capital due if twins appear at once?

This is the first thing they ask. Yes, it is assumed that if a family had no children before, now both the first and the second appeared in it at once. Since maternity capital is received for the birth of a second child, then twins fall under these rules. In case of adoption of two children at once, maternity capital is also required.

After the first birth of twins has occurred, paperwork is completed in exactly the same way as usual; there are no differences; maternity capital is issued under the appropriate federal program.

But if twins were born during the second birth, there is a difference. In this case, the mother can receive two certificates - not only federal, but also regional. If under the federal program a certificate is issued for the birth of a second child, then under the regional program a certificate is issued for the birth of children starting from the third.

The regional certificate, its amount and design features may vary from region to region. Not everywhere it is available at all - for example, in Moscow a regional certificate is not issued.