Since 2007, our country has had a maternity capital program, which implies that families with a second child have the right to receive material support from the state.

At the same time, the funds that make up the maternity capital are not issued in cash to the certificate holders. The program is targeted, and families can exercise their right to state support only within the framework established by law.

Thus, among other things, the most popular area for spending MK funds is improving housing conditions. It should be noted that transactions aimed at purchasing real estate using public money have some features. In particular, the law obliges the allocation of mandatory shares to children. The features of this procedure will be discussed further.

Allocation of shares in an apartment after purchasing real estate using maternity capital

Maternity capital is a form of state support for families with children. According to statistics, the majority of holders of the relevant certificates decide to use maternal capital to purchase real estate.

Reference! In 2021, the amount of maternity capital is 466,617 rubles.

From the point of view of legislation, MK funds belong not only to its owner, but also to all family members. In this regard, the housing rights of each of them must be ensured when making a transaction using state support funds.

In other words, we are talking about the allocation of shares in the right to real estate. This is required by law.

The simplest way to allocate shares to children is to directly indicate this in the purchase and sale agreement . However, this is only possible in cases where housing is purchased using maternal capital using one’s own funds and savings.

In cases where a family takes out a loan to purchase real estate, it is not always possible to immediately allocate shares to children and this must be done after repaying the mortgage. The same applies to the purchase of housing in an apartment building under construction.

In this case, a written obligation must be drawn up, according to which the owner of the capital undertakes to allocate shares after the removal of the encumbrance or upon acquisition of ownership rights.

The presence of documents confirming the allocation of shares to children, or a corresponding obligation, is necessary for a positive decision by the Pension Fund in terms of satisfying the application for the disposal of MK funds.

It is also useful to read: Indexation of maternity capital by year

Obligation for the Pension Fund for maternity capital

According to the law, private houses and apartments purchased and built with state family subsidies must be re-registered as the common property of all family members. Strict deadlines for carrying out this procedure in Art. 10 of Law No. 256-FZ are not provided for, so in practice this requirement is not always met.

A residential building can be re-registered as shared ownership of parents and children a long time after the transaction for the purchase of real estate is concluded. The Pension Fund of Russia takes from the certificate holder a written obligation to provide each family member with a share. The procedure for its submission is determined by the Rules approved by the RF Government No. 862 dated December 12, 2007.

In what cases is it necessary to prepare an obligation for the Pension Fund?

- The house (apartment) has not yet been registered as a common family property, as it has not been put into operation.

- The property is collateral, encumbered, and as long as the parents pay the mortgage, the bank will not allow the children to become owners.

- There is currently only one owner of the property, for example, a spouse.

- The certificate holder plans to invest the subsidized money in the purchase of residential premises.

- The recipient of the subsidy is a member of a housing or other cooperative.

- The family plans to compensate for the reconstruction or construction of residential real estate using maternal capital funds (the house was put into operation after 01/01/2007).

The obligation is prepared and certified by a notary office. The document is written on behalf of the home owner (certificate holder). The owner prepares a package of papers for the notary to familiarize himself with the circumstances of the transaction. In the obligation, the notary states the moment from which the 6-month period for transferring the house into common family ownership begins.

Both borrowers are present when preparing the document: husband and wife. They will become equal owners of a residential property free of encumbrances. The presence of the second spouse is not required if only one of them became the borrower and owner.

Only an obligation certified by a notary has legal force. If the requirement is not met, it will be rejected by the Pension Fund. The original commitment must be submitted along with the application.

Who should allocate shares

As a general rule, the allocation of shares in real estate that was purchased with maternity capital should be handled by the owner of the certificate. In the vast majority of cases, this is a woman who has given birth to a second child.

In addition to children, the spouse also has the right to housing under the MK. However, it should be noted that he loses the corresponding right in the event of divorce before the disposal of the maternity capital.

In addition, if a woman gets married after receiving the use of MK funds, then her husband also cannot claim a share in the real estate.

In practice, the situation with the distribution of shares is more complex. So, if an MK pays for a mortgage that was issued to a spouse, then it is he who makes the allocation.

Most often, shares are allocated by spouses jointly under a distribution agreement. This applies to cases of purchasing housing with a mortgage, where they act as a borrower and co-borrower, as well as purchasing real estate with their own funds using maternity capital.

Allocation of shares in the construction and reconstruction of a residential building for subsidies under a certificate

Preparation of an obligation to distribute family shared property is mandatory if the certificate holder intends to receive subsidies for the construction and reconstruction of housing. It is not possible to register rights and shares when submitting an application for disposal of money, because:

- the residential property has not yet been built, has not entered into operation (the certificate holder has yet asked for funds for construction)

- the housing will be reconstructed, that is, its characteristics will change (it is more advisable to register rights and shares for the property that has undergone changes)

The obligation is written in the notary's office by the holder of the certificate or the owner of the house or cottage that will be reconstructed. Shares for family members will be allocated six months after completion of construction. First, an agreement on the distribution of shares between the parents is prepared. Afterwards, the spouses form children's shares when concluding an agreement, a gift deed.

The allocation of children's shares to a land plot for individual housing construction is mandatory. Since the Land Code establishes a joint alienation procedure for the building and the land. From a legal point of view, the transfer of shares is considered an alienation of property, since a construction permit (along with the right to a permanent residential property) is received by one spouse.

What share is allocated to children?

Today, the current legislation does not establish the size of the minimum share that must be allocated in the right to real estate when purchasing it with capital. Accordingly, it is set by the parents themselves.

However, it should be understood that maternity capital belongs to each family member. Accordingly, 466,617/4 = 116,654.25.

Thus, if the cost of an apartment or house is 1 million 116 rubles, then each child can claim a 1/10 share in the ownership. This calculation was given as an example in order to develop an understanding of the distribution principle.

Undoubtedly, family members have the right to independently determine its order and size of shares. However, experts do not recommend allocating too large portions to children. This is due, first of all, to the fact that in the future certain difficulties may arise when selling such real estate.

It has been determined that in transactions involving the alienation of housing owned by minors, the consent of the guardianship authorities is required. An important condition for this is to provide children with a volume of rights that is equal to or greater than those available in the real estate being sold.

In addition, a small share in the future cannot be allocated in kind, which significantly reduces the property risks of the remaining family members.

The role of guardianship authorities

Many are interested in the need to coordinate the allocation of apartment shares to children with the board of trustees. However, when it comes to using maternity capital, such actions and approvals are not necessary. On the one hand, state assistance is issued for the birth and adoption of a child, but on the other hand, referring to the Civil Code of the Russian Federation, the board of trustees is involved only when it comes to transactions with the property of minors. That is, only with the permission of the guardianship authorities can you sell, donate, exchange, or rent out housing, the share of which belongs to a minor.

However, it should be understood that neither the parents nor other relatives of the child can enter into transactions with housing without the consent of the guardianship authorities, with the exception of its donation or gratuitous transfer in another way. At the state level, children's rights are carefully protected, and even in cases where, when selling a home, a family buys another living space, it is important that it meets all the requirements and is of equal or greater value.

As for funds, the board of trustees is involved in their distribution only in cases where parents are deprived of parental rights or died and minors were transferred to the state for maintenance.

Registration of a notarial obligation

The undertaking is a written document according to which the owner of the certificate and his spouse undertake the responsibility to allocate shares in the acquired property to their minor children.

The obligation must be certified by a notary. At the same time, it can be issued both at the place of residence and at the location of the property.

Important! A written document must be sent to the pension fund when submitting an application for disposal of maternity capital funds.

It is also useful to read: Is tax paid for receiving maternity capital?

If not distributed

Allocation of the due shares to children is a mandatory condition, failure to comply with which is punishable by law. And although there is not yet a clear system for monitoring the fulfillment of such an obligation, there are already known cases when parents were prosecuted for fraud, and this is how manipulation with a certificate is interpreted.

It is also worth keeping in mind that some regions of Russia have launched special responsible commissions, whose activities are aimed at monitoring the fulfillment of obligations (whether maternity capital funds were actually spent on residential real estate).

Is commitment always required?

The obligation is drawn up in cases where the allocation of shares is impossible at the time of conclusion of the transaction, and serves as confirmation and guarantee of the parents’ compliance with the requirements of the current legislation.

In particular, this applies to situations:

- Payment of a mortgage loan due to the presence of encumbrances (if the mortgage was issued to one spouse or jointly);

- participation in shared construction;

- reconstruction of a residential building.

In those cases where the shares of children are determined initially in the purchase and sale agreement, there is no need to prepare additional documents.

Deadlines for the obligation

The main period for fulfilling the obligation is 6 months. It is important to take into account the specifics of purchasing real estate, namely:

- When constructing a house, the period is calculated from the day the facility is put into operation.

- Mortgage – after the encumbrance is removed.

- Purchase of secondary real estate - after transferring funds to the seller (without a mortgage).

- Buying real estate in installments - after making the last payment.

- Shared construction – after signing the transfer deed.

- Participation in a housing construction cooperative - after payment of the last share.

Terms of allocation of shares

The law determines that the obligation must be fulfilled within 6 months after the restrictions related to the impossibility of allocating shares are lifted. Let's look at these nuances in more detail.

- Mortgage. For the entire period of its validity, real estate purchased using maternal capital is under an encumbrance, that is, pledged to the bank. After fulfillment of obligations under the contract, upon application, the encumbrance is also removed. Accordingly, six months after the date of its withdrawal the shares should be allocated.

- According to DDU. The six-month period begins to run from the moment the house is handed over and ownership rights arise.

- In case of reconstruction of a residential building. Reconstruction can be considered completed from the moment a new cadastral passport is received. The same applies to the construction of a new individual residential building.

If the housing was purchased without borrowing funds under the DCT, then the allocation of the share must be carried out within six months after the funds are transferred to the seller and the corresponding encumbrance is removed.

Allocation of shares to children after repaying the mortgage with maternal capital

Subsidized family capital can be used to pay off part of the mortgage debt. A big advantage for families is that it is possible to pay off a mortgage taken out before the birth of the 2nd (3rd and next) child or after childbirth. Either spouse or both have the right to act as a borrower. The only condition is that the loan must be targeted, intended to solve housing needs.

In this case, how is the procedure for allocating shares carried out?

- The shares must be re-registered to all family members without exception within six months after the transfer of funds from the Pension Fund for loan repayment, but not before the debt burden is removed from the residential property.

- The mortgage encumbrance is removed when the owner fully fulfills all loan obligations, that is, repays the debt. This could happen in 10-20 years.

- If the mortgage has already been paid off, for example, ahead of schedule, the owner of the house obtains a certificate of absence of debt from a financial institution and sends an application to Rosreestr.

- The property owner receives a new certificate of registration of ownership rights to a residential property. The new paper must not contain the mortgage note. From 2021 you can order an extract from the Unified State Register, from 2021 from the Unified State Register.

- When the lien is removed, the owner has the right to redistribute the shares. To do this, parents enter into an agreement and prepare a gift deed. If the spouses are unable to agree, the procedure is carried out in court.

Both methods of redistribution of family property are considered legal: donation and agreement. The two options have a common legal basis, but are implemented in different ways. The standard form for them is established in 2021. Both documents are prepared in a notary's office. Some lawyers believe that the donation procedure is the most preferable, since it is described in more detail in the legislation and raises fewer questions.

It is recommended to arrange a consultation with the local branch of Rosreestr (Registration Chamber). This will help to avoid pitfalls when preparing documentation and registration. It is advisable to consult with a specialist in your region, since the requirements of registrars may differ.

In the process of creating a gift agreement in favor of minor children, ambiguities arise regarding redistribution:

- residential properties in common ownership of spouses, since the size of shares is not specified

- mortgage housing in shared ownership, usually set at ½ share for each parent

There are features associated with the shared re-registration of rights to land and property from mutual funds. The procedure for re-registration of a residential property is implemented according to the following scheme:

- firstly, legal spouses enter into an agreement on the division of joint property

- secondly, parents prepare deeds of gift or agreements for children

When concluding standard agreements and contracts for minor family members, the second parent signs. If both parents have the right to the house, they move on to the second stage of transferring rights to the children. Documents are prepared in quantities equal to the number of parties to the transaction. One copy is submitted to the registration authority. Let’s say that when forming shares for two legal spouses and three children, 6 copies will be required.

They write an application to the registration chamber or MFC, submit an agreement on shares and an agreement on donation of children's shares, passports, marriage certificates and birth certificates. In addition, you will need an agreement on the registration of rights to real estate, the purchase and sale of housing, and a receipt for payment of state duties.

How to select shares - methods

After the circumstances preventing the allocation of shares have ceased to apply, parents need to attend to this procedure directly. It can be done either by drawing up an appropriate agreement or in the form of concluding gift agreements.

Drawing up an agreement to determine shares

The agreement is a written document according to which the spouses determine the amount of allocated shares for their children. It is submitted to the registration authority and is the basis for making changes to the Unified State Register. There is no strictly established, unified form of such an agreement.

Sample agreement:

Donation agreement

A donation is a transaction as a result of which the property or property rights of one person are transferred to another person free of charge. In relation to the situation discussed in the article, the execution of a deed of gift is the optimal option for fulfilling obligations.

It should be noted that a separate agreement must be drawn up for each child, sent to the registration authority for making the appropriate entries in the Unified State Register of Real Estate.

Registration cost

Of course, you will have to pay a certain amount to determine children's shares in residential premises. In many ways, registration costs will depend on the cadastral value of the apartment or house. This is due to the fact that the residential premises for which the agreement is drawn up can be assessed, and transactions with such objects, in accordance with paragraphs. 5 tbsp. 333.24 of the Tax Code of the Russian Federation, are subject to a duty of 0.5% of the cadastral value of housing. But, in accordance with the same tax code, the amount of state duty cannot be lower than 300 and higher than 20,000 rubles.

For example, if children's shares are allocated in a residential building with a cadastral value of 2 million rubles, then the amount of the state duty will be 2,000,000 * 0.5% = 10,000 rubles. In this case, we did not go beyond the minimum and maximum limits of the state duty.

If the cost of the apartment is, for example, 5 million rubles, then the estimated amount of the state duty will be 5,000,000 * 0.5% = 25,000 rubles, but the law specifies the maximum upper limit of the state duty, above which its size cannot rise (20,000 rubles), so the payment will be reduced to exactly this amount.

If the parents decide to resort to the help of a notary when drawing up the text of the agreement, then they will also have to pay at the notary office for the work of the employee in drawing up the document. Depending on the region, the cost of this service will vary from 1 to 5 thousand rubles.

Some costs will also have to be incurred when registering the agreement with Rosreestr. In the Russian Federation, there is a single tariff for determining shares in residential premises; it is 2,000 rubles.

Drawing up any legal document requires at least minimal knowledge of the basics of jurisprudence and the rules for drawing up such papers. Any wrong word or definition, and the text of the document takes on a completely different meaning, in some cases the exact opposite of what was originally required.

Therefore, in order to avoid mistakes and not to rewrite the document several times, it is advisable to seek help from an experienced lawyer. He will not only help you draw up a competent document, but will also undertake legal support of the entire transaction, collect the necessary documents, and, if necessary, represent your interests in any government agency.

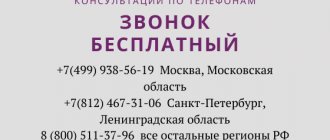

You can also seek help from the lawyers of our website, who will advise you on the issue of interest, tell you where to start, what documents will be needed in your particular case, and help in resolving other important issues. You can contact our employees by calling the indicated numbers or by contacting the duty lawyer online.

FREE CONSULTATIONS are available for you! If you want to solve exactly your problem, then

:

- describe your situation to a lawyer in an online chat;

- write a question in the form below;

- call Moscow and Moscow region

- call St. Petersburg and region

Save or share the link on social networks

(

1 ratings, average: 5.00 out of 5)

Author of the article

Natalya Fomicheva

Website expert lawyer. 10 years of experience. Inheritance matters. Family disputes. Housing and land law.

Ask a question Author's rating

Articles written

513

- FREE for a lawyer!

Write your question, our lawyer will prepare an answer for FREE and call you back in 5 minutes.

By submitting data you agree to the Consent to PD processing, PD Processing Policy and User Agreement

Useful information on the topic

1

What does a document on privatization of an apartment look like?

As of [current_date format='Y'], as the main document...

1

How to evict your ex-wife from an apartment

Not all families live happily ever after; many get divorced. Behind…

Privatization of an apartment through the MFC

Privatization of an apartment is a complex and lengthy process, but for many...

Privatization of a garden plot

A garden plot of land, provided that a house is located on it, can...

2

Certificate of non-participation in privatization

The certificate of non-participation in privatization has now been replaced by an extract...

What does a privatized apartment mean?

Almost immediately after the collapse of the USSR, the era of privatization of state and...

What consequences could there be if shares are not allocated to children?

If parents have not fulfilled their obligation within the required period, then certain sanctions may be applied to them. They are expressed in the fact that, at the initiative of the authorities, the amount of maternity capital can be recovered from citizens in court back to the pension fund.

Criminal prosecution under Art. 159 of the Criminal Code of the Russian Federation, which is written about on many thematic websites, is unlikely in this case unless there are signs of another crime. In particular, these include actions aimed at cashing out maternity capital funds.

Current legislation determines that when purchasing housing using MK funds, it is necessary to allocate shares to children. This can be done both at the moment of concluding the transaction, and after a certain time. In the latter case, a notarial obligation is drawn up.

How much to allocate to children: size of shares

The law does not establish what share of maternity capital to allocate to children; parents must decide for themselves. Please note that when signing the obligation, it is not necessary to indicate the specific shares that will be transferred into ownership. And when registering housing, citizens usually proceed as follows:

- divide the property equally among all family members;

- They calculate each person’s share depending on how much their share in the family capital is from the cost of the entire apartment, and what other funds were spent on the purchase of real estate.

According to the Supreme Court of the Russian Federation, in the absence of an agreement between the parties, the determination of shares for children when using maternity capital should also be made based on the equality of shares of parents and children in maternity capital funds spent on the purchase of housing, and not on all the funds from which it was purchased .

Example.

A family with two children purchased a two-room apartment for 1,800,000 rubles, of which 453,000 rubles were paid using maternal capital. In percentage terms, this amounted to approximately 1/4 of the purchase price. Accordingly, at least ¼ of the share must be divided among 4 family members, and the share of each child must be at least 1/16.

Real estate distribution agreement

In most cases, citizens prepare an agreement on the division of shares between the entire family to implement the obligation. The main reason is that this document will be accepted by Rosreestr without any problems. But many citizens are not satisfied with the price of the agreement - from 1500-3000 rubles.

Only the owner of the MK has the right to formalize the agreement.

When contacting a notary, a citizen must have with him the following documents:

- passports of spouses;

- children's birth certificate;

- notarial obligation;

- MK certificate;

- title documentation for acquired real estate;

- certificate of ownership of real estate or an extract from the Unified State Register (USRE);

- marriage (or divorce) certificate.

After preparing this document, all parties to the transaction must visit the Multifunctional Center (MFC for short) with the prepared agreement and documents such as:

- Agreement – the number of copies must match the number of participants in the transaction. Plus, one more copy should be prepared for the MFC.

- Passports and birth certificates of the entire family.

- Marriage certificate.

- Extract from the Unified State Register.

- State duty receipt (to be paid at the MFC).

It is important to know! Alternative to maternity capital

The agreement is drawn up at the MFC within no more than 2 weeks. In the absence of any documents, MFC employees have the right to refuse the applicant to register the agreement.