What federal payments and benefits can you get for your third child?

At the birth of a third child in the family, parents have the right to the same payments and benefits as for previous children. In particular, these include:

- maternity benefits;

- one-time payment for early pregnancy registration;

- lump sum payment at birth;

- child care allowance up to 1.5 years;

- maternity capital (if the parents did not register it for their second child);

- Putin's payments from 3 to 7 years inclusive - for low-income people.

In addition, at the federal level, the following benefits are also provided for families with three children:

- repayment of part of the mortgage debt in the amount of 450,000 rubles from the federal budget;

- perpetual preferential mortgage rate 6%;

- benefits for paying property and land taxes;

- increased standard tax deductions for the third and subsequent children (summed with deductions for previous children);

- accounting for parental leave in the pension period;

- early retirement at age 57.

Later in the article we will look at them in more detail.

Who is entitled to it and how much: the Public Chamber explained the idea of introducing paternal capital

The Public Chamber of Russia proposed introducing paternal capital. How it will differ from the maternal one and what its size is, “Evening Moscow” learned from the author of the initiative, chairman of the OP commission on demography, protection of the family, children and traditional family values, Sergei Rybalchenko.

What is the difference from maternity capital

First of all, Rybalchenko emphasized in a conversation with VM, in the chamber this form of support is called multi-child capital. According to the publication’s interlocutor, paternal capital will be provided at the birth of the third and subsequent children. Like maternity capital, the new payment is a one-time payment, the social activist specified.

— Paternal capital is more family-oriented than maternal capital, since the latter can be provided to a mother without a father, while paternal capital is provided for a third child when three children were born in the same family . Father's capital carries not only material, but also family value. “It will encourage fathers to continue family traditions,” says Rybalchenko.

He drew attention to the fact that the Public Chamber proposed introducing this support measure in 2021. Even then, surveys of families were conducted and during the survey it turned out that many respondents would like to expand the scope of application of their father’s capital, said the author of the initiative.

- After all, this is not money “in hand”, but funds that can be used for implementation in various directions. For father's capital, we want to expand these areas . The families we interviewed suggested, for example, allowing these funds to be used to purchase a family car, renovating a house, developing their own farm and other purposes,” he clarified.

The main goal of the new initiative, according to the expert, is to celebrate the role of the father and draw attention to families with strong traditional ties.

— It’s called paternal because, according to statistics, 40 percent of mothers with many children do not work, but raise children. In such cases, providing for the family falls on the shoulders of the father, Rybalchenko added.

Photo: pexels.com / Andreas Wohlfahrt

What will be the amount of paternal capital?

According to the social activist, the amount of paternal capital will be comparable to maternal capital . At the same time, the expert recalls, in 2021, at the birth of the first child, the family receives 483.8 thousand rubles. For the second child - another 155.5 thousand. In total, Rybalchenko says, the amount of maternity capital funds as a federal support measure reaches 639.4 thousand rubles for the second child. A similar amount is due for the third and subsequent child born or adopted from 2021, if previously the family did not have the right to maternity capital.

Among other things, adds VM’s interlocutor, at the birth of a third child, the state provides 450 thousand rubles to repay the mortgage loan.

Some experts in the OP, according to Rybalchenko, believe that paternal capital should be twice as much as maternal capital, but so far this proposal has not been approved. According to surveys conducted by the chamber, about half of families would like the father's capital to be equal to the amount of maternity capital for the second child (639.4 thousand rubles). In turn, approximately 30 percent of families said that capital for many children should be twice as much as maternal capital, the social activist noted.

Is it possible to receive both paternal and maternal capital?

In theory, this is possible, said the chairman of the OP commission on demography, protection of family, children and traditional family values. According to him, this is feasible in the context of the following analogy: large families can receive maternity capital as a federal payment and maternity capital as a regional support measure.

— In theory, you can have two payments from the state, but from different entities. For example, in the Sakhalin region, after the birth of a second child, families are simultaneously provided with federal and regional maternity capital. That is, there are two capitals for one family - federal and regional. And here there will be one father’s and one mother’s,” the social activist explained.

Photo: Andrey Nikerichev / AGN Moscow

Where does the state get the money for the new support measure?

Answering this question, Rybalchenko pointed to the authorities’ intention to support demographics, which will not happen without providing assistance to large families.

— Our birth rate has decreased recently. Taking this into account, certain reserves have appeared that we can rely on (from the point of view of financing the project - note “VM”). At the same time, fewer third children are born in families than the first two, so the father’s capital in terms of implementation will not be a very expensive step, the social activist believes.

He also drew attention to the fact that 90 percent of maternal capital is usually spent on improving the living conditions of a particular family. According to Rybalchenko, every ruble spent on construction is returned in the form of 30–40 kopecks, which go as part of taxes to budgets at all levels.

“Taking into account the attraction of additional funds, the measure we propose is a returnable investment, and not expenses that we will have to look for in the budget,” the expert concluded.

Maternity benefit for the third child

Maternity benefits are paid exclusively to the mother of the baby . It was specially designed to compensate women for lost earnings, because in the late stages of pregnancy it is already difficult, and sometimes impossible, to work.

In addition, after giving birth, the mother needs time to recover and care for the newborn.

Payments are due to women:

- officially employed;

- full-time students (both on a budgetary and commercial basis);

- serving in law enforcement agencies or in military service under a contract.

As for unemployed women, this benefit is given only to those who were fired due to the liquidation of the organization. But only on the condition that they managed to register as unemployed at the employment center within 1 year after their dismissal.

Maternity benefits are paid to these categories and when adopting a child under three months old. Maternity benefits are paid immediately for the prenatal and postnatal periods in full .

The amount of benefit for each woman is calculated individually.

For workers, the benefit is assigned in the amount of 100% of the average daily earnings for the 2 years preceding the sick leave.

The duration of leave depends on the duration of sick leave for pregnancy and childbirth. In a normal situation, the doctor will issue it for 140 days . If the birth takes place with complications or ahead of schedule, then by 156 days . And if a woman gives birth to twins (triplets, etc.), then paid sick leave will last 194 days .

To calculate the average daily earnings, you need to add up the entire official salary of the maternity leaver for the 2 years preceding the year of maternity leave. Divide the resulting amount by the number of days in past years - usually by 730 or 731 if there was a leap year. However, sick days and previous maternity leave days are not taken into account.

If the current maternity benefit is insignificant due to earlier maternity leave, the earlier years can be used to calculate the new benefit. But only on the condition that the amount of benefits increases from this.

When a woman works part-time for two or more employers for two years, she can receive maternity benefits for all places of work.

If a woman’s work experience is less than 6 months or her average earnings for the billing period are less than the minimum wage (minimum wage) established on the date of maternity leave, benefits are calculated based on the minimum wage.

From January 1, 2021, the minimum wage is 12,130 rubles. Accordingly, the minimum amount of maternity benefits in 2021:

- for workers - 55,830.60 rubles. ;

- for persons who voluntarily insure themselves with the Social Insurance Fund (individual entrepreneurs, lawyers, notaries, etc.) - RUB 54,780.60.

The amount of the minimum benefit may further decrease. For example, if a woman does not fully use maternity leave or has adopted a newborn.

In addition, the law establishes the maximum amount of maternity benefits. In 2021 it is:

- for standard maternity leave - 322,191.80 rubles ;

- for complicated childbirth - 359,013.72 rubles ;

- for multiple pregnancy - 446,465.78 rubles .

Maternity benefits for students, employees and the unemployed are calculated differently.

Students will receive the full amount of the scholarship, and employees will receive the full amount of money in proportion to the length of maternity leave.

The unemployed are paid benefits in a specific amount, which is indexed annually on February 1. In 2021, it amounted to 675.15 rubles per month.

To assign benefits, a woman applies for a sick leave certificate to a doctor. It will indicate the date of maternity leave and its planned duration. This sick leave must be taken to the accounting department for work/study/service, and for the unemployed - to social security, where they fill out the appropriate application.

Benefits for women registered in the early stages of pregnancy

To ensure that pregnant women begin seeing doctors on time, the state has approved a special one-time payment - a benefit for women who register with a medical organization in the early stages of pregnancy.

The following are entitled to it:

- women working under an employment contract;

- unemployed women laid off due to liquidation;

- those who have ceased to operate as individual entrepreneurs;

- full-time students;

- employees in law enforcement agencies or in the army under contract.

To receive benefits, you must register for pregnancy before 12 obstetric weeks .

The lump sum benefit is assigned and paid at the place of assignment and payment of maternity benefits. Accordingly, you must apply for benefits at your place of work, study, service or social protection authorities.

The basis for the appointment is a certificate from the antenatal clinic or other medical organization that registered the woman for pregnancy in the early stages.

This benefit is assigned and paid simultaneously with maternity benefits. That is, this certificate is issued together with sick leave for pregnancy and childbirth.

If the certificate is submitted later, the benefit will be assigned and paid no later than 10 days from the date of registration of this certificate.

Unemployed women are granted benefits no later than 10 days from the date of registration of the application with all the necessary documents. Social security authorities pay benefits by mail or to the woman’s personal account (personal card) no later than the 26th day of the month following the month of registration of the application with all the necessary documents.

The amount of the benefit for registration in the early stages of pregnancy in 2021 is 675.15 rubles.

The benefit is indexed annually along with other social payments.

Allowance for caring for a third child up to 1.5 years old

A benefit for a third child can be applied for by either the mother or another relative (father, grandmother, aunt, etc.) who is actually caring for him.

Benefits for working citizens are paid only when taking parental leave.

At the same time, the person caring for the child can continue to work only part- time or at home (i.e., remotely).

For workers, this benefit is provided monthly in the amount of 40% of the employee’s average salary for the 2 previous calendar years of work .

At the same time, there is a legal minimum that will be assigned to the employee if his salary was below the established minimum value. Also, the minimum amount of benefits will be received by:

- unemployed persons;

- IP;

- those engaged in private practice (lawyers, notaries, etc.).

From June 1, 2021, the minimum allowance for caring for a third child under 1.5 years old is 6,752 rubles. It is the same for all of the above categories of citizens.

If a person takes care of two or more children under the age of 1.5 years, then the benefits for each of them are summed up . But in the end, the benefit should not exceed 100% of average earnings (for officially employed people).

The maximum amount of benefits for caring for the 3rd child in 2021 for officially employed people who are on parental leave is RUB 27,984.66 . For other recipients, the maximum payment amount is RUB 13,504.00.

Let us help you figure it out: annual payment from regional maternity capital

In June 2021, an additional opportunity to manage funds from regional maternal (family) capital was introduced in the Moscow region. Now families with children have the right to receive two annual payments - 50 thousand rubles each in 2021 and 2021. How to issue them and what will happen if part of the funds from an earlier issued certificate has been spent, mosreg.ru explains in the “We’ll help you figure it out” section.

How to take part in the Family Mortgage program in the Moscow region>>

Isn’t maternity capital strictly intended for use? Why was the payment introduced?

Source: Photobank of the Moscow region

The right to regional maternity capital arose for families in which at least a second child was born or adopted from January 1, 2011 to December 31, 2021. From 2014 to 2021, certificate funds could be used to improve the family’s living conditions or to obtain a child’s education. More than 200 thousand families received certificates, but less than a third used them. At the same time, 22 thousand of these families had third or subsequent children. The authorities of the Moscow region decided to introduce a new opportunity to manage maternal capital so that parents could use the funds allocated to them for any purpose.

How to get a housing subsidy for the birth of triplets in the Moscow region>>

It’s not clear, so how many children do you need to have to get money - two or three?

Source: Photobank of the Moscow region, Alexander Kozhokhin

It is necessary that a third or subsequent child be born or adopted in a family that has a certificate for regional maternity capital before December 31, 2021.

Benefits for the first and second child in the Moscow region: new rules from 2020>>

Is it possible to make payments if we have already spent part of the funds under the certificate?

Source: Photobank of the Moscow region, Anastasia Osipova

Families who have received a certificate and have not yet used it are entitled to full payments.

If part of the funds has been spent, then in 2021 the family will be paid up to 50 thousand rubles, and in 2021 - the rest of the amount, taking into account the deduction of funds spent on targeted needs and payments for 2020.

Support for families with children in the Moscow region: federal and regional measures>>

Where to contact?

Source: Serebryano-Prudsk news agency, Oksana Kalmykova

To receive an annual payment, you must submit an application on the regional government services portal.

How to conclude a social contract in the Moscow region and receive targeted assistance>>

What documents are needed?

Source: RIAMO, Anastasia Osipova

Applications for payments are accepted upon provision of a package of documents:

- passports with a mark of registration in the Moscow region;

- certificate for regional maternity (family) capital;

- birth or adoption certificates of the third or subsequent children.

How can a foreigner get married in the Moscow region>>

Can I contact you at any time?

Source: RIAMO, Nikolay Koreshkov

To receive payment for 2021, you must submit your application before April 1, 2021. For payments for 2021, documents will be accepted from January 1 to December 1 of the same year.

How the national project “Demography” is being implemented in the Moscow region>>

One-time payment upon birth of a child

The baby who is the third born in the family has the right to receive a one-time birth benefit. This benefit is paid in Russia for each child , excluding :

- family income;

- birth order of children;

- social status of the family.

When two or more children are born in a family, a woman becomes entitled to this payment. Payment is also due if the baby was born alive but died immediately after birth.

From February 1, 2021, the lump sum benefit for the birth of a child is RUB 18,004.12. This amount is the same for all categories of citizens, regardless of the fact of employment.

Like other benefits, the lump sum payment is indexed annually in accordance with the actual level of inflation.

One of the child’s parents (guardian/adoptive parent/adoptive parent) can apply for benefits at their place of work (service - for military personnel) or to the social security authority (if both parents do not work and do not pay contributions to the Social Insurance Fund).

Federal maternity capital for the third child

In general, maternity capital under the federal program is not provided for the third child. It is issued only for the first and second child.

However, if the applicant applying for maternity capital has not applied for it before for some reason, he can receive capital for a third child.

Let us remind you: maternity capital for a child can be obtained only if the applicant and the child are citizens of the Russian Federation.

You can receive federal maternity capital at the birth of your third child if:

- 1. The two older children were born before 2007 (before the adoption of the Law on Maternal Capital).

- 2. The family could not take part in the program.

In this case, the amount of maternity capital will be 466,617 rubles , and 616,617 rubles after 01/01/2020.

If the second child appeared after 01/01/2007, and the third child after 01/01/2020, but the applicant did not apply for maternity capital, he is entitled to it for the second child in the amount of 466,617 rubles . There will be no additional payment of 150,000 rubles for a third child .

How to apply for maternity capital for a third child and to whom it is given

Regional maternity capital is material support from the state that is provided to families with three children. This payment is formed at the regional level and can vary from 30,000 to 300,000 rubles. In addition, regional-type maternity capital can be indexed, which cannot be said about the federal subsidy for a second child. Unfortunately, today many families do not know about this type of material support, and therefore are deprived of the opportunity to improve the lives of their children. Today, this article will talk specifically about this regional support.

Regional maternity capital is material support from the state that is provided to families with three children

Do they provide capital for a third child?

At the moment, a huge number of families with one and two children live on the territory of the Russian Federation, but there are also families that are classified as having many children. They can have three or more children. It goes without saying that the birth of a child is a great happiness, not only for parents, but also for brothers and sisters. But in order to maintain a favorable atmosphere in the family, parents of children have to work hard.

It is for this reason that a decision was made at the state level on the need to provide maternity capital to families with three children. At the same time, the size of this type of payment depends on local governments.

Who is entitled to it?

In accordance with the legislation of the Russian Federation, regional-type maternity capital for a third child can be provided to those who:

- A third child naturally appeared in the family.

- To those families who have adopted a child.

- Capital is provided only to those who have citizenship of the Russian Federation.

- A person who applies to receive maternity capital of this type at the time of the birth of the third child must have citizenship of the Russian Federation.

All other provisions regarding the receipt of regional-type maternity capital are regulated by local government authorities.

Terms and requirements

To receive regional-type maternity capital, parents will need to write an application and collect a certain package of documents. Of course, a child must appear in the family, and he can be either natural or adopted.

There are certain conditions regarding the use of material capital of a regional nature:

- Firstly, this type of subsidy can be used as funds intended to improve housing conditions.

- Secondly, it can be used as funds to pay for the education of a child or children.

- Thirdly, regional maternity capital can be used as funds for the purchase of land.

- Fourthly, it is allowed to be spent on the purchase of a vehicle.

- Fifthly, this money can be used as payment for medications or as payment for treatment of varying degrees of complexity. We are talking only about the treatment of children.

- Sixth, unlike federal-type material capital, funds provided by regional authorities can be spent on renovating an apartment or country house.

Details and individual points should be clarified with representatives of the local pension fund.

Amount amount

Today, on the territory of the Russian Federation there are a huge number of government programs that are designed to motivate married couples to give birth to two or more children. This is also the case with regional maternity capital. Its size is not fixed and varies depending on the region. for example, in the Rostov region, the amount of regional family capital for a third child is 150,000 rubles in 2021, but in some regions of the country this amount reaches only 50,000 rubles.

Attention! You can find out the amount of family capital in your region directly from the local branch of the state pension fund.

Issue date

Every married couple living on the territory of the Russian Federation, in which a third child is born, must understand that funds will not be transferred to them immediately after the birth of the baby. The money will be received only after one month has passed, and then only if all documents and the application have been collected and completed correctly.

How to apply?

It goes without saying that in order to receive a regional subsidy of this type, parents will need to contact the regional branch of the pension fund and collect the following package of documents:

- Firstly, you need to provide an appropriate document identifying the potential owner of the certificate (an insurance pension certificate and a passport of a citizen of the Russian Federation);

- Secondly, you will need to bring a certificate of family composition;

- Thirdly, you will need to provide the specialist with birth certificates for all three children;

- Fourthly, a document confirming the presence of registration in the region.

- Fifthly, write a corresponding statement according to the sample.

- Fourthly, it will be necessary to submit a document that would indicate the purpose of using capital of this type.

You must apply for regional family capital to the pension fund.

First, one of the parents collects the relevant documents and writes a statement. Only after a certain period of time can the money be used to improve housing conditions, pay for children’s education, etc.

Video

Watch a video about family capital for a third child:

Every parent should understand that the fact of providing regional capital cannot be taken as a basis when deciding to give birth to a third child. Firstly, such a subsidy is provided at a time, and secondly, the child will need to be supported and helped throughout his life. Therefore, in order for children to grow up happy, it is necessary to proceed from their real capabilities. The state can only provide some assistance, but not provide full support.

Regional benefits and benefits for the third child

There are also regional benefits:

- regional maternity capital (issued in addition to federal);

- free plot of land (in some regions, instead of land, large families are entitled to monetary compensation );

- monthly benefit up to 3 years of age (recommended by Decree of the President of the Russian Federation dated May 7, 2012 No. 606);

- tax benefits;

- priority admission of children to kindergarten;

- free meals for schoolchildren and students of colleges, technical schools, schools;

- free clubs and sections;

- free school and sports uniforms for the entire period of study at school;

- free medicines for children under 6 years old according to doctor's prescriptions;

- free travel on public transport;

- the opportunity to receive a voucher for health improvement;

- free entry to museums, exhibitions, parks 1 day per month;

- discount on utility bills - no less 30%;

- preferential loans, subsidies, interest-free loans for housing construction and the purchase of building materials;

- priority allocation of garden plots;

- employment of parents with many children, taking into account their needs and capabilities.

If parents with many children want to organize a farm, they can count on:

- allocation of land for these purposes;

- land tax benefits;

- financial assistance or interest-free loans to reimburse the costs of running such a household.

If parents with many children want to implement another small business option, they are entitled to:

- rent benefits;

- full and partial exemption from paying registration fees for entrepreneurs.

Who has the right to claim the governor's hundred thousand for 3 children

In Kaliningrad, Kirov, Ulyanovsk and other regions, maternity capital is provided reusably. In most constituent entities of the Russian Federation, maternity capital for a third child is a one-time payment in the amount of 25 thousand rubles to one million rubles (in the Kaliningrad region, subject to the birth of triplets).

Legislative acts and changes for 2021

Regional maternity capital for a third child, its availability and size, is not covered as widely as a similar payment from the federal budget. This state support is paid in almost all constituent entities of the Russian Federation to families that meet the requirements.

- The man is the only adoptive parent of 3 children.

- The mother of the minor died suddenly, as a result of which the right to maternal capital will be transferred to the father.

- The woman lost the right to maternity capital and was limited or deprived of parental rights.

1.5 million for the third child

Many families in which a third child was born are interested: will the state pay 1,500,000 rubles for him? Answer: no , it won't. Russian legislation does not provide for .

This question arises due to the fact that earlier draft law No. 571638-6 “On Amendments to the Federal Law “On Additional Measures of State Support for Families with Children” was submitted to the State Duma. He proposed to issue maternity capital only for the third child, but in the amount of 1.5 million rubles.

However, this bill was rejected back in 2015, and the maternity capital program was first extended for second children, and then expanded not to third children, but to first children born in 2021.

How to receive and spend maternity (family) capital

Families that have had their first child since January 1, 2021 are also entitled to maternity capital. For families that have had a second child since 2021, maternity capital will additionally increase by 155,550 rubles. For families in which a third child or subsequent children were born after January 1, 2021, maternal (family) capital is set at 639,431 rubles. 83 kopecks in the event that previously the right to additional measures of state support for families with children did not arise.

- a woman with citizenship of the Russian Federation who gave birth to (adopted) a second, third child or subsequent children starting from January 1, 2007;

- a man who has citizenship of the Russian Federation and is the sole adoptive parent of the second or subsequent children, if the court decision on adoption entered into legal force starting from January 1, 2007;

- a woman with citizenship of the Russian Federation who gave birth (adopted) her first child starting from January 1, 2021;

- a man who has the citizenship of the Russian Federation and is the sole adoptive parent of the first child, if the court decision on adoption entered into legal force starting from January 1, 2020;

- the father (adoptive parent) of the child, regardless of citizenship of the Russian Federation, in the event of termination of the right to additional measures of state support for a woman who gave birth (adopted) children, due, for example, to her death, declaring her deceased, deprivation of parental rights in relation to a child, in connection with birth (adoption) of whom the right to receive maternity capital arose, committing an intentional crime against his child (children), related to crimes against the person and entailing deprivation of parental rights or restriction of parental rights in relation to the child (children), in the event of cancellation of the adoption of the child , in connection with whose adoption the right to additional measures of state support arose;

- a minor child (children in equal shares) or a full-time student child (children) until he (they) reaches 23 years of age, upon termination of the right to additional measures of state support for the father (adoptive parent) or a woman who is the only parent (adoptive parent) in cases established by Federal Law*.

You may be interested :: In Bashkiria, a single mother can count on benefits for up to 3 years from 2021

In different regions there may be differences in terms of permanent residence - from 1 to 10 years. If the child is stillborn, the parents lose the right to receive MK. When the previous one dies, the third one is taken into account for the total number of children. In the Sakhalin region, MK is paid if the mother’s age is from 19 to 25 years; in the Republic of Udmurtia, one of the parents must be no more than 35 years old.

Allowance for a third child under 3 years of age

In accordance with Decree of the President of the Russian Federation dated May 7, 2012 No. 606 “On measures to implement the demographic policy of the Russian Federation,” an allowance is provided for the third child until he reaches 3 years of age.

This payment is not federal, but is only recommended for establishment in the regions. However, in constituent entities of the Russian Federation with a low birth rate (where on average there are less than two children per woman of reproductive age), this payment is co-financed from the federal budget.

The size of the benefit and the frequency of its payment are established by regional legislation. For 2021, 75 regions can participate in this program .

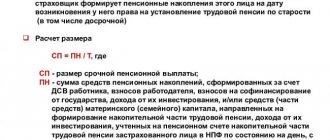

General provisions on maternity capital.

In 2006, the president signed a decree that families where a second child was born after January 1, 2007 are entitled to financial assistance in the amount of 250,000 rubles. Over the 12 years of the program’s existence, the amount has grown, and in 2021 it amounts to more than 450,000 rubles.

These funds cannot be obtained in cash. They can be used for various purposes, including the purchase of real estate, mother’s pension savings, education of children, purchase of adaptation equipment for disabled children, etc.

In 2021, the following changes were made to the program:

- Families whose income is below the subsistence level will be able to receive monthly payments from maternity capital.

- Payment for the services of a preschool educational institution is allowed until the child turns 3 years old.

- An application for financial support may be submitted to the Pension Fund office electronically.

- Civil servants should review documents for the issuance of a certificate for no more than 2 weeks.

- Possibility of restructuring debt on a mortgage taken out before the birth of the baby.

To receive maternity capital, the third child must be born after 2007. Financial support is provided to families after the addition of a second minor to the family.

But if he was born before 2007, then no payment is due. In this case, parents will be able to receive benefits when a third minor appears in the family.

Indexation of maternity capital in 2021.

In 2020, maternity capital will be indexed by 3.8%. It has not increased since 2014.

Maternity capital will be 466,617 rubles in 2021.

Regional lump sum benefit for the birth of a third child

In a number of regions, upon the birth of a third child, the family is entitled to a lump sum payment. The decision to assign such benefits to families is made based on financial capabilities and priority areas for the development of the region. Payment amounts vary in different regions of the Russian Federation.

The conditions for receiving this benefit are:

- financial well-being of the family;

- family composition;

- the age of the woman who gave birth (for example, up to 30 years).

- This benefit is aimed at stimulating the birth rate in certain regions, reducing the number of abortions and maximizing the reproductive potential of women of childbearing age.