Bankruptcy as a reason for dismissal of an employee

First, you need to figure out whether filing an application to file bankruptcy for an organization is always a legitimate reason for dismissing employees. The liquidation procedure of a company is carried out in several stages, and unilateral termination of employment contracts with employees is allowed only at the last two stages.

The stages of observation and financial recovery do not exclude the possibility of continuing the activities of a legal entity, therefore there are no legal grounds to dismiss employees during this period. At the stage of external management , dismissal due to bankruptcy is legal, but this does not apply to all employees - HR employees continue to work because the organization will need them.

The final stage of bankruptcy, bankruptcy proceedings, makes it possible to dissolve the staff under any conditions, since at this stage the legal entity ceases its activities, and the company’s property is sold at auction.

How and from whom to demand wages in bankruptcy

Depending on the stage of the insolvency procedure, it is necessary to differentiate the obligations of the paying party. At the stage of external supervision, the manager draws up the payment schedule, but the responsibility for calculating wages remains with the head of the LLC.

At the stage of bankruptcy proceedings, the bankruptcy trustee is obliged to notify employees of the planned dismissal within 1 month from the date of initiation of such a stage of proceedings. In the event of a lack of funds, the sale of the enterprise’s property at public auction is ordered, and the proceeds are used to pay off the debt to the team, so the fact of a shortage of funds is not a way to evade responsibility to the workers. It must be remembered that the result of such activities as fictitious or deliberate bankruptcy is criminal liability.

Exceptions to dismissal

When liquidating a legal entity, some categories of citizens have the right not to be legally dismissed until a decision is made to completely terminate the company's activities. Accordingly, dismissal of employees belonging to these categories is possible only at the last stage.

These categories include:

- employees raising a child under 3 years of age;

- disabled people;

- pregnant women who are not on maternity leave.

How to fire an employee due to bankruptcy

Given the complexity and length of insolvency proceedings, it is worth following the correct procedure for terminating an employment relationship. The process of severing an employment relationship is as follows:

- initiation of bankruptcy proceedings in court: a decision on this need is made at a general meeting of founders;

- notification of the state employment authority - the Employment Center about the upcoming reduction and the number of employees: this notification must be completed no later than 3 months before the dismissal;

- notification of all employees about dismissal due to liquidation: the entire team must sign these copies;

- dismissal of persons according to the order of the manager;

- settlement with the staff on the last working day, as well as the return of personnel, accounting and any other documents containing information about employees, in accordance with the law.

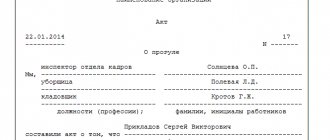

It is worth noting that if an employee refuses to sign a notice or order, this does not cancel the legal force of the document. However, it is necessary to make a note of such actions in the presence of witnesses and secure them with signatures.

Procedure for informing employees about upcoming dismissal

Look, I fired you, but that doesn't mean I don't love you with all my heart. Stu Banks.

If the organization's bankruptcy procedure has already been initiated, employees should be informed about upcoming layoffs in advance, in accordance with the terms of the employment contract. The notice period for employees depends on the type of dismissal - regular or mass. By massive we mean a staff reduction of 15 or more employees at a time. In such a situation, it is necessary to notify employees three months before termination of the contract (with a normal dismissal, the employee is notified 2 months before terminating the contract unilaterally). In addition, you will need to report the mass layoff to your local employment office.

To comply with the terms of the contract and to avoid litigation with the organization’s employees, it is necessary to give each person a written notice that due to the liquidation of the legal entity, the employees will be dismissed. Employees who receive such a notice must sign in the appropriate register indicating that they have read the document. In this case, dismissal during bankruptcy of an enterprise will be completely legal and will not be a reason to go to court.

It is possible to dismiss employees before the 2-month period has passed from the date they receive the notice, but you will need to pay the employee compensation in the amount of the average monthly salary for the period remaining before the expiration of the established period. Dismissal by mutual consent is also possible - the employer and employee come to a compromise solution.

Terms and payments

You can always clarify the terms of settlement (dismissal) of employees of an insolvent organization in legal reference books. The periods for excluding employees from the organization’s lists, established by the legislator, are calculated in such a way that both the employee and his personnel department have time to take measures and prepare for the upcoming separation within the framework of current legislation. Errors and miscalculations in this matter can harm both sides of the labor relationship. Thus, the most important point when dismissing due to bankruptcy is the formation and delivery of notices for signature:

- Two months in advance – for those working under general conditions;

- One week - for those working on a temporary (seasonal) basis;

- In three days - for those who cooperate with the organization under a two-month contract.

According to the general rule, all payments due on the day of dismissal must be closed no later than the day of dismissal. The legislator does not prohibit doing this earlier; this can be especially important, since the accountant will still have to calculate taxes and other deductions.

According to the general rule established in the Labor Code, employees receive payments in an amount not lower than average earnings upon dismissal from a liquidated company. At the same time, the maximum amount of payments is limited to three or even four such payments. Everything will depend on how quickly the former employee finds a new job.

Cash compensation upon dismissal of employees

The liquidation of a company is considered a legitimate reason for the termination of the employment contract between the employee and the employer, however, this factor obliges the latter to pay some monetary compensation, since the termination of the contract was due to the fault of the employer.

First of all, dismissal of employees during bankruptcy of a company implies payment of severance pay, which is equal to one average monthly salary. In addition, the employer undertakes to pay the employee the same amount for two months as a guarantee of security for the duration of the job search. Finding a job earlier than this period eliminates the need for the previous employer to pay compensation.

Bankruptcy of an enterprise and dismissal of workers in stages

During the liquidation of an enterprise, a large burden falls on the HR department, which is obliged to prepare all the necessary documentation within tight deadlines and carry out a series of sequential actions aimed at mass dismissal of personnel.

At the same time, it is extremely important that no existing legal norms are violated.

Algorithm for phased dismissal:

- Notification of the local employment service about the bankruptcy of the entity and dismissal of employees in the event of bankruptcy of the enterprise. The message must be in writing in compliance with the approved notification deadlines. In case of a partial wave of layoffs, the employment service is informed at least two months in advance, and in case of a full wave - three months in advance.

- Notification of each individual employee about dismissal. Such an action is considered completed when the employee confirms with his signature the information about the upcoming dismissal.

- Notifying staff about the possibility of early termination of employment. It is carried out in parallel with the notice of dismissal and also requires the employee’s signature. If the reaction is positive, the employee who agrees to this option receives compensation established by law. In case of refusal, the employment relationship is terminated on a general basis in compliance with legal deadlines.

- Creation and entry into force of an order to terminate labor relations with the personnel of a bankrupt enterprise. Each employee must personally familiarize himself with a document of this kind and then certify it with his signature.

- Preparation of all personnel documentation for personnel. During this period, the personnel service supplements the personal file of each employee with all the necessary data that indicates his work activity at the bankrupt enterprise.

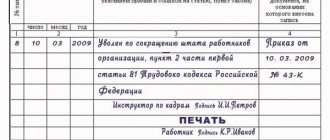

- Issuing each employee his personal work book. It is important that the formulation of the reasons for terminating labor relations with a bankrupt enterprise clearly corresponds to the plot provided for by labor legislation (even down to the reference to a specific paragraph of the article). All records indicating the employee’s work activity must be certified by his signatures.

This is also important to know:

Dismissal under an article: why they can be fired from work, procedure for registration

Making entries in the work book is possible in the following options:

Insolvency decision

When a company becomes insolvent and accounts payable continue to increase, this indicates the presence of significant signs of bankruptcy. If it is impossible to correct the situation, then the owner must make a decision on insolvency, which will simultaneously launch the processes of liquidation and dismissal of personnel.

The decision on insolvency and massive severance of labor relations with employees has the right to be made by the leading collegial management body of the enterprise (as a rule, a meeting of shareholders).

For this purpose, a joint meeting is held, where the strategy for the further development of the legal entity is determined by voting. The final result is drawn up in the form of a protocol, which is signed by all persons entitled to vote. If a positive decision is made on the voluntary bankruptcy of the enterprise and the release of personnel, the owner must immediately send a written notification to the local authorities.

After this, the staff is notified about the upcoming event, and the powers to manage the enterprises are transferred to the liquidation commission, under whose leadership the process of terminating labor relations with employees will be completed.

Problems with payments or non-compliance with the terms of the contract

In some cases, there are employers who do not adhere to the terms of the contract, carrying out dismissal due to bankruptcy earlier than the established 2-month period from the date of sending notices. In such a situation, the employee can go to court, but there are some pitfalls here.

If employees demand monetary compensation, then it is worth considering that bankruptcy is characterized by the termination of the company’s activities and the sale of its property. The funds received from sales at the auction will be used to pay off all the organization’s debts, and often some debts cannot be covered. Inclusion of employees upon dismissal in the register of creditors does not guarantee that they will receive compensation.

Going to court to file a claim against an employer is not always cost-effective. On the one hand, declaring him bankrupt and conducting bankruptcy proceedings will not satisfy the interests of employees upon dismissal, since debt of this nature is written off in most cases. On the other hand, if the liquidation of a legal entity has already taken place, then the company against which the claim is brought, accordingly, does not exist. If there is no defendant, the court will close the procedure.

Grounds for dismissal in bankruptcy

In relation to employees, bankruptcy is not a reason for dismissal:

- there is no such basis in the Labor Code of the Russian Federation;

- three out of four bankruptcy procedures are aimed at restoring the solvency of the enterprise (supervision, financial recovery, external management); during the period of their implementation, employees cannot be fired with reference to liquidation;

- employees are fired due to the liquidation of the organization (clause 1, part 1, article 81 of the Labor Code of the Russian Federation), which ends only the fourth procedure - bankruptcy proceedings.

An additional basis for the dismissal of a manager is his removal from office as part of bankruptcy procedures (clause 1, part 1, article 278 of the Labor Code of the Russian Federation, clause 2, article 126 of the Law of October 26, 2002 No. 127-FZ).

Liquidation of a company and its exclusion from the Unified State Register of Legal Entities occurs only after the court has issued a ruling on the completion of bankruptcy proceedings (clause 3 of article 149 of Law No. 127-FZ, clause 28 of the Resolution of the Plenum of the Armed Forces of the Russian Federation of March 17, 2004 No. 2, art. 61 of the Civil Code of the Russian Federation) .

In practice, bankruptcy trustees, in order to save money, fire staff before the end of bankruptcy proceedings, and judges’ opinions on this matter vary:

- some take the side of the employees: they are reinstated at work, the dismissal is carried out at a later date (Appeal ruling of the Moscow City Court dated January 18, 2016 No. 33-956/2016, Determination of the Supreme Court of the Russian Federation dated July 11, 2008 No. 10-B08-2);

- others believe that dismissal in connection with liquidation should not occur exclusively at the final stage of liquidation (Appeal ruling of the Rostov Regional Court dated November 16, 2015 No. 33-17725/2015, Appeal ruling of the Investigative Committee for civil cases of the St. Petersburg City Court dated July 31, 2018 to case No. 33-14493/2018).

As a result, bankruptcy makes it possible to dismiss employees on the following grounds:

- at your own request (clause 3, part 1, article 77 of the Labor Code of the Russian Federation);

- by agreement of the parties (clause 1, part 1, article 77 of the Labor Code of the Russian Federation);

- on reduction (clause 2, part 1, article 81 of the Labor Code of the Russian Federation, clause 3, article 129 of Law No. 127-FZ);

- in connection with liquidation (clause 1, part 1, article 81 of the Labor Code of the Russian Federation), if bankruptcy proceedings have begun.

Let’s take a closer look at the last two options, since they have nothing to do with the employees’ desire to quit.

Useful tips

Both employers and employees are advised to contact qualified lawyers who will help carry out this procedure in such a way that no one’s interests are harmed. The legislation has a lot of nuances that only competent specialists know about. Solving the issue on your own can lead to serious problems or a waste of your money.

The rights and obligations of employers and employees during the liquidation of a legal entity are regulated by the provisions of the Labor Code of the Russian Federation, therefore it will be useful to familiarize yourself with the main provisions of this regulatory framework.

Rating: 3.5.

Please wait…

Features of termination of contracts with employees in the legal field

The legislation of the Russian Federation provides for regulations that must be followed in order to correctly resolve the issue with the labor collective. The main documents that spell out the nuances of dismissal of employees are provided for by the Labor Code of the Russian Federation, the Civil Code, the Constitution, as well as Federal Law-127 of October 26, 2002. The legislation also provides for the order of receipt of funds, the amount of compensation and the procedure for terminating employment relationships.

The basis for dismissal of workers at an LLC is the liquidation of the company. Such a decision is made after the completion of the bankruptcy proceedings. Companies try to avoid employee downtime, since a bankrupt enterprise does not fulfill its functions, and the staff simply have nothing to do. The company's managers offer their workers to resign by agreement of the parties, and the bankruptcy trustee dismisses them within the scope of his powers - to reduce staff.

Special categories

During hiring, just as during dismissal, there is a separate category of employees who, for one reason or another, cannot fall under the general norms of labor legislation.

This is also important to know:

How to correctly write a letter of resignation at your own request

In case of bankruptcy of an enterprise, two groups of employees should be included here:

- Pregnant women, as well as women on maternity leave.

- CEO.

Let us consider the features of termination of employment relations with each of the above groups.

What to do with pregnant women and women on maternity leave?

Liquidation of an enterprise is the only basis that allows you to dismiss a pregnant woman or a woman on maternity leave at the initiative of the employer. Therefore, the process of dismissal for this category of employees will occur on a general basis. Payments and compensation in this case will also not be different (if you do not take into account a number of nuances that allow you to apply for child support in a manner strictly regulated by law).

Important! During mass layoffs, liquidation should not be confused with reorganization. The second option involves only reformatting the existing enterprise, and, therefore, gives the right to pregnant women and women on maternity leave to retain their jobs.

Dismissal of the CEO due to bankruptcy

The head of an enterprise can be dismissed, in addition to the general grounds provided for by labor legislation, also in connection with the recognition of the entity under his control as bankrupt (this is called an additional or special condition).

The algorithm for removing the general director from work occurs in accordance with the current law defining the bankruptcy procedure of an enterprise:

Free legal consultation We will answer your question in 5 minutes!

Call: 8 800 511-39-66

Free legal consultation

We will answer your question in 5 minutes!

Ask a Question

- A decision on insolvency is made, a liquidation commission and a temporary manager of the bankrupt entity are appointed.

- To remove the general director from performing his job duties, the temporary manager must submit a corresponding petition to the Arbitration Court.

- If the submitted petition is granted, then further actions related to the dismissal of the general director will take place on the general basis inherent in an ordinary employee of the enterprise.