Russian legislation on single mothers

Until recently, in domestic legislation there was no such thing as a “single mother” and no clear definition of who could be classified in this category.

In 2014, a resolution was adopted by the Supreme Court of the Russian Federation, according to which a single mother should be understood as a woman who independently fulfills parental responsibilities for the upbringing and development of one or more children without the help of their father or stepfather.

State support for such women is provided at different levels and in different areas. Some benefits are prescribed, for example, in the Labor and Tax Codes of the Russian Federation.

In addition to federal payments, regional regulations may provide for the availability of additional monetary assistance in a certain territory.

How to properly fill out papers to obtain single mother status

The documents should be completed at the place of registration in the social protection department. The processing time for documents is usually 30 days. If a woman works, then she submits papers to the accounting department at her enterprise. The package of documents includes:

- statement;

- a certificate from the registry office (form 25) and a birth certificate (if it was issued at the time of submitting documents);

- mother's work record;

- passport;

- income certificate (for the last 3 months).

This is what sample form No. 25 looks like

It should be remembered that in the event of the death of a spouse or divorce, a woman does not fall under the category of a single mother. And she cannot qualify for increased payments and additional regional benefits for a mother raising a child alone.

We recommend reading in detail about obtaining single mother status here (very detailed material).

What is required by law for a single mother?

In general, we can say that the law requires single mothers to receive the same payments as women in a two-parent family:

- payment at the birth of a child;

- benefits related to pregnancy and childbirth;

- child care allowance until the child reaches 1.5 years of age.

Federal payments are not all that a single woman who gives birth to a child is entitled to. For example, the Moscow Government has determined compensation payments for this category of the population:

- related to the rising cost of living for children under 16 years of age;

- tied to rising food prices for children under 3 years of age;

- in the case of a single mother caring for a disabled child.

In addition, if a woman’s income is below the subsistence level, state assistance for child care is not the only thing she is entitled to by law. She is also entitled to other payments, the amount of which depends on the age of the child.

What benefits are available to single mothers?

All child benefits for single mothers in 2021 can be divided into two large groups:

- those that are paid in a lump sum;

- those that are accrued monthly until the child reaches a certain age.

In addition, the amount of payments depends on the number of children in the family and the order of birth of a particular child, as well as on whether the woman works or not.

There are federal and regional benefits. The former are due to all citizens of Russia, and the latter – only to residents of a certain region.

As practice shows, payments at different levels differ significantly from each other. But in any case, single mothers should be under special protection of the state.

One-time payments

Already from the name it is clear that lump sum payments do not have a regular basis, but are transferred only once. Thus, a single mother, along with other women giving birth, is entitled to financial assistance from the state after childbirth.

Each child is entitled to a separate payment. From February 1, 2021, its size is 18,143.96 rubles. This amount is the same for everyone and does not depend on the woman’s employment, her income level and other factors.

You must contact your employer (for workers) or social security authorities (for non-working citizens) to request payment within six months after the birth of the baby.

In the regions, an additional one-time payment is often provided: for example, in Moscow it is currently 5,500 rubles. at the birth of the first child and 14,500 rubles. for the second and all subsequent ones.

Monthly benefits

Monthly payments are assigned to a young mother and are paid every month until the child reaches 1.5 years of age. The amount of benefit for a working mother is 40% of the average earnings for the previous 2 years of pregnancy, but not more than 27,984.66 rubles. and not less than 5036 rubles. for the first child (after indexation from 1.02.20). The amount of benefit for the second and subsequent ones is no more than 27,984.66 rubles. and not less than 6803.9 rubles.

The minimum amount of child support up to one and a half years for a mother who did not work before his birth is 5,036 rubles for the first child and 6,803.9 rubles for the second.

As we can see, benefits are paid to both officially employed women and those who did not work. Employees need to contact their employer to apply for one. In this case, the payment is made by the Social Insurance Fund.

For unemployed citizens, this payment is issued and paid monthly after contacting the social protection authorities at the place of residence.

From the beginning of 2021, young families with a monthly income of less than 1.5 subsistence minimums have the opportunity to receive new payments for children under 3 years of age. These are targeted benefits in the amount of the subsistence minimum established in a certain region.

Women often go on maternity leave not for one and a half years, but for three. It is logical that during this time they must somehow provide for themselves and the child. But, according to the law, the above amounts are paid only for the first 1.5 years, and the amount of benefits for up to 3 years in the Russian Federation will be only 50 rubles for the remaining period. per month.

Targeted payments are available only to those whose child was born or adopted since January 1, 2021.

Payments to employed women

Maternity benefits (so-called maternity benefits) are paid exclusively to women. After 30 weeks of pregnancy, the antenatal clinic issues them a certificate of incapacity for work, after which the working expectant mother receives payments in the amount of her average monthly earnings.

In 2021, the maximum benefit amount is 322,190 rubles, the minimum benefit is 55,830 rubles.

In addition, she should receive:

- allowance for registration in the early stages of pregnancy – 680 rubles;

- one-time benefit for the birth of a child – 18,143.96 rubles;

- monthly child care allowance – minimum 5036 rubles. and a maximum of 27,984.66 rubles.

- monthly allowance for child care up to 3 years old - the amount depends on the region;

- maternity capital – 466,617 rubles. (+ 150 thousand if the child is the second or subsequent).

Payments for unemployed people

It happens that a woman does not work either before or during pregnancy. In this case, all payments to her are:

- are charged in a minimum or clearly established amount;

- are paid through the social protection authorities.

Payments due at the birth of a second child

We have figured out what payments are due at the birth of the first child. However, many families have more children. According to Russian legislation, upon the birth of a second child, the same payments and benefits are provided as during pregnancy and the birth of the first child. Only the payment amounts differ. For example, the minimum amount of benefits for caring for a second child until he reaches the age of 1.5 years is already 6803.9 rubles, which is more than the minimum for the first.

Under any circumstances, raising and raising two children is much more difficult than one, especially if you do it alone. Therefore, the state guarantees additional assistance to single mothers - monthly payments for the second child are much higher than for the first.

In addition, from 2020, when issuing a certificate for maternity capital at the birth of a second or subsequent child, its amount will be increased by 150 thousand rubles.

Many regions of the country encourage the birth of two or more children, also increasing the amount of benefits.

Payments to mothers of many children

If a woman has three or more children, she is considered a mother of many children. In addition to the payments provided for other children, a mother with many children will receive:

- a monthly payment for the third child until he reaches the age of three in the amount of the child’s subsistence minimum established by law;

- regional maternity capital.

Having received the status of a woman with many children, she will be able to count on additional benefits and benefits, which differ in each region.

The subsidy for the third child is paid together with the maternity capital provided under the program for the second child. To find out about the required benefits and benefits, you should contact the social protection authority.

Benefits for low-income single mothers

Families in which the income per person is less than the minimum subsistence level established by law are considered low-income.

This happens to single mothers because, due to raising a child on their own, they do not work or are forced to limit themselves to part-time work. This phenomenon is especially common if there are several children in the family.

To ensure that their lives meet the minimum standard, low-income families are paid a monthly additional child benefit.

Although this payment is considered federal, its amount is set at the local level and differs in different regions. In many territories, such assistance for single mothers is provided at an increased rate.

What payments are due in 2021

At birth, in addition to maternity capital at the federal level, local lump sums can also be paid. For example, in Moscow, the first child receives 5.8 thousand rubles, and the second child receives 15.3 thousand rubles. You can check availability and size at your place of residence.

Social benefits and compensation

Each child under one and a half years old is entitled to a monthly allowance. A woman employed before the birth of her child can count on 40% of her average monthly earnings for the last 2 years of work. This value may increase by the regional coefficient, if the territorial entity has one. It has a minimum and maximum value, which may change in the coming year.

A divorced woman or widow is not considered a single mother. If the child’s father is no longer alive, then you can apply for a survivor’s pension. And divorced people cannot be considered single mothers, since the father bears responsibility for the maintenance and upbringing of the child in any case, no matter whether there is a stamp in the passport or not.

- You can't give her night shifts.

- You can go on a business trip only with her consent.

- She can work on a weekend or holiday only at her own request.

- Exempt from paying taxes on real estate.

- Has the right to extraordinary leave at his own expense for 14 days.

- A double tax deduction is provided for each child.

- If desired, you can get a mortgage with the lowest interest rate.

Who is given the status of a single mother?

The coronavirus pandemic has adversely affected the financial situation of all Russians. It’s easier for two-parent families, but not for mothers who raise children alone, without support from the state. Payments to single mothers in 2021 will be paid regularly. In addition, single mothers can count on benefits and preferences. What payments are they entitled to? Should we expect new payments in 2021? Read on for the latest news.

In the Moscow region, single mothers who have given birth to three or more children at the same time can count on a subsidy of 300 thousand rubles. Assistance is provided only to low-income families where the average per capita income does not exceed the subsistence level.

- Annual additional leave without pay for up to 14 days.

- Shortened working hours - a woman can work a part-time shift if she has a child (children) under 14 years of age. In this case, the employee must confirm her intentions with a written statement.

- Additional days off (up to 4 days) with preservation of earnings if there is a disabled child in the care. Provided monthly, at any time chosen by the employee.

Tax relief

Previously, it was assumed that for this group of recipients an additional payment in the amount of 2 living wages would be established. But so far the initiative of representatives of the NRC (the interregional public movement “National Parents Committee”) remains unanswered.

The social security authorities will inform you in detail about what payments a single mother is entitled to and how to apply for them. It would be useful to clarify the list of documents - changes are constantly being made to the current legal norms.

A single mother can apply for benefits directly or a person representing her, in which case a notarized power of attorney confirming the right to act on behalf of the sole guardian will be required. Document processing is carried out by social protection authorities located in close proximity to the residential address. It is also possible to submit an application at centers that carry out multifunctional activities. The benefit is issued within 10 days, after which money transfers are made.

You may like => Is it possible to travel to Moscow using a St. Petersburg pension card?

Can I obtain single mother status if my husband leaves me?

- for children under 1.5 years old – 4,591 rubles ;

- from 1.5 to 3 years – 6,672 rubles ;

- from 3 to 7 years – 2,296 rubles ;

- from 7 and older – 1,147 rubles .

Mothers who are raising a child without the participation of a father, recognized as a single parent, often experience difficulties in providing the baby with everything necessary and devoting the proper amount of time to him. To solve possible difficulties, the state has provided a number of real assistance measures: various benefits, subsidies and payments are designed to help improve the living conditions of single-parent families.

Other payments to single mothers

The state also provides other assistance for single mothers, for example, compensation for baby food. It is paid until the child reaches three years of age. In Moscow, there are compensations for renting housing if a woman is registered as in need of improved housing conditions.

Single mothers who register with a medical organization before the 12th week of pregnancy are entitled to an additional payment of 680 rubles. monthly.

A woman can not only give birth, but also adopt a child. To do this, all necessary conditions must be met. Those who decide to take such a responsible step are entitled to cash payments in the same way as those who give birth to a baby.

A special case is considered if a single mother is raising a disabled child. Then certain allowances are provided for her under various regional programs. And if a single mother is also disabled herself, she is paid an increased pension.

Other life circumstances also force women to think about whether or not they have the right to government assistance.

For example, pregnancy occurred in a girl who is still studying or is in military service. Formally, she is not employed, but will still receive maternity benefits in a fixed amount.

For example, when determining what a student is entitled to, the calculation will take the amount of her scholarship, and for a military woman - state care.

Benefits in the labor sphere

In tax legislation

the term “single parent” is used. It is understood as a person who raises a child independently from a financial point of view, without the participation of others. That is, if a woman gave birth to a child “for herself,” the spouse died or was deprived of parental rights.

You may like => You have to pay taxes when renting out an apartment

Who is the only parent

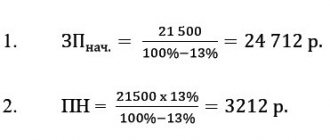

For example

: the woman has two children, in whose certificate there is a dash in the “Father” column, and she is not married. Her salary is 40,000 rubles per month. How much personal income tax must an employer withhold from an employee’s salary?

If a single mother in her region of residence falls into these categories, she must not only confirm her right to special food (for example, document the status of a low-income family), but also regularly update her prescription at the medical institution where the baby is registered.

Benefits for single mothers

Taking care of single mothers, the state provides various benefits.

First of all, a large number of benefits are prescribed in labor legislation. They relate to the daily routine, dismissal and hiring, sick leave and many other aspects.

The Tax Code of the Russian Federation specifies some tax deductions, including for this category of mothers:

- for the first two children – 2,800 rubles each (double deduction);

- for the third and subsequent ones – 6,000 rubles;

- for a disabled child – 24,000 rubles.

Thus, single mothers are not subject to personal income tax on one-time targeted payments.

Other benefits are provided for single mothers:

- free meals in educational institutions;

- priority right to place children in preschool institutions;

- free medicines and medical services, trips to a sanatorium;

- free travel by public transport and others.

These types of benefits are usually established at the regional level.

All types of benefits for single mothers in 2021 in Russia. Last news

- for the 1st, who was born in the period from January 1, 2021, as well as the 2nd or more from 2007 to 2021, it will be 483,882 rubles;

- 2nd and subsequent baby born after January 1, 2021 – RUB 639,431;

- Both babies were born after January 1, 2021: here, for the 1st, a family certificate is given, and for the 2nd, they pay an additional 155,550 rubles.

Maternity capital, amount

For a single mother, regions often assign various additional assistance: for the birth of a new resident, payment of most expenses associated with childbirth, and many others. They also help with medications, preparing for school, and paying for some clothes.

- less than 300 days have passed since the divorce, and the ex-husband has not challenged paternity in court, within the framework of which his status is automatically confirmed;

- the man acknowledged paternity and expressed a desire to be indicated on the birth certificate;

- children were born in marriage (even if the father subsequently evades participation in upbringing and payment of alimony);

- a court decision has established who the father of the child is;

- less than 300 days have passed since the death of the spouse (in this case, the woman is entitled to survivor benefits, and not as a single mother).

A subsidy can also be requested for the development of a mother’s business while on maternity leave, if she completed her studies no more than 3 years ago. You can use the funds six months after receiving your diploma or a year after the birth of your child.

Will there be any new benefit in 2021 for single mothers and one-time regional payments?

Raising children requires significant financial investments. It is especially difficult in this regard for women who cope with their parental responsibilities alone. To support such families, there are various social programs from the state, both regular and one-time.

You may like => Minimum number of hours for category b

When registering a child at the state registration department, a special certificate is issued. With a package of documents - birth certificate, passport, work book and salary certificate - apply to the multifunctional center to apply for benefits.

Local authorities in different regions also provide lump sum payments upon the birth of a child. For example, in the capital, the amount of payment for the first-born is 5.5 (five and a half), for the second and the next 14.5 (fourteen and a half) thousand rubles.

Benefits and preferences for single parents

Most benefits are prescribed in labor legislation. Concerns the daily routine, payment of sick leave, conditions of employment and dismissal. Tax deductions for children are provided. Social benefits are indexed every year. In 2021, the amounts paid will increase by 3%.

- Benefit during pregnancy. The opportunity to receive a monthly payment in the amount of the average salary in the region of residence. Specific amounts vary; the exact amounts of cash payments can be found in the social protection authorities at your place of residence.

- One-time payment for the birth of a child. After indexation it should be about 18 thousand rubles.

- Compensation for the purchase of baby food. You can return the costs until the baby turns 3 years old.

- Monthly discount when paying for housing and communal services.

- No waiting list for kindergarten. You need to obtain the necessary certificate from social protection confirming your status and write a corresponding application. If a child is not enrolled in kindergarten upon reaching 2 years of age, the state will pay monetary compensation.

- The birth of a child in marriage. Even if the father does not live with his family and does not support him financially. In such cases, you should apply for alimony; the husband bears full financial responsibility for the maintenance of the minor.

- The father's name is entered in the column. Then it is impossible to obtain the status of a single mother.

- Death of husband. In this situation, you can submit an application to the pension fund and receive a pension upon the loss of a breadwinner.

- The most important thing is the absence of the father on the birth certificate. In this case, there should be a dash in the column.

- The birth of a child outside of marriage. If a woman is in a marital union, then the husband is automatically recorded as the father, even if he is not actually one.

- Deprivation of parental rights. When a mother challenges paternity in court and achieves a positive result.

A single mother has the right to receive leave at her own expense at any convenient time for up to 14 days. Single mothers with a child under 5 years old cannot be required to work overtime, work at night, on holidays or weekends. The mother of a child under 14 years of age (including single mothers) has the right to part-time work , established at her own request.

Assistance to single mothers from the state is expressed as follows: additional child benefits and payments, benefits in labor and tax legislation, preferential waiting lists when enrolling in kindergarten, and much more. You will learn more about all the rights, benefits and benefits in 2021 for single mothers in this article.

Single mother status 2021

A single mother has the right to receive a double tax deduction for the costs of maintaining each of her children up to the age of 18. If a child who has reached the age of 18 is a university student, the double tax deduction will continue until the age of 24.

May 12, 2021 vektorurist 108

Share this post

- Related Posts

- Tax on the sale of an apartment via transfer

- Car tax for pensioners in the Kemerovo region

- What are the rights of a young family with 1 child in Belarus in 2021?

- Moscow region ate I don’t use free travel

How to apply for benefits

If she has a registered status as a single mother, a woman can apply for appropriate benefits.

The answer to the question of how to receive a particular payment may differ depending on the organization that assigns it.

Where to contact

As noted earlier, depending on the type of benefit, you need to collect a certain package of documents for the employer or social protection authorities at the place of residence.

Required documents

The complete list of documents depends on the organization you apply to to receive benefits. You will need:

- passport;

- child's birth certificate;

- certificate of family composition;

- work book (if available);

- certificate No. 25 (issued at the registry office).

To receive any payment, you must submit an application.

Refund for kindergarten for a single mother

Benefit for paying for kindergarten as a single mother, where to apply in Moscow for the mother of a child.

- Certificate in form No. 25 (issued at the civil registry office upon receipt of a child’s birth certificate without recording information about his biological father or entering data from the mother’s words).

- Certificate of birth of a baby (issued by the civil registry office).

- Certificate of recognition of a single mother as a parent with many children (if available).

- The child’s medical card (from the district clinic where the baby is being observed).

- Certificate of family composition (to confirm cohabitation with children - issued at the housing department, settlement administration, passport office).

- Medical policy (issued by the insurance company).

- Deadlines for receiving benefits The order for the admission of children to kindergartens is published at the beginning of each month, so the waiting period for the authorities’ decision depends on what day of the previous month the single mother submitted the application and documents.

What benefits are available to single mothers for kindergarten?

- in the event of complete liquidation of an organization in which a single mother works, the employer is obliged to provide her with a job no worse than her previous one in another institution (enshrined in Decree of the President of the Russian Federation of June 5, 1992 No. 554 “On compulsory employment of certain categories of workers during liquidation enterprises, institutions, organizations");

- if the child is under 14 years old, then his mother can apply for part-time work;

- sending a woman on a business trip to raise a child without the help of his father is possible only after obtaining her consent in writing;

- Women raising a child under five years old cannot be recruited alone to work at night, on weekends and on holidays;

- If a single mother is dependent on a disabled child, she is entitled to 4 additional paid days off monthly according to a convenient schedule.

What are the benefits for single mothers when entering kindergarten?

They will also refuse her if the mother chose a commercial kindergarten, or if the state institution does not have an entry in the Charter about providing benefits to a single mother. There may not be enough places in the preferential queue, since in addition to children of single mothers, other categories of parents also have the right to priority enrollment.

Legislative acts on the topic It is recommended to study in advance: Federal Law No. 273-FZ dated December 29, 2012 “On education in the Russian Federation On preferential conditions for enrolling children in kindergarten Typical errors when registering Error No. 1.

A single mother has queued up to enroll her child in a private kindergarten and is demanding priority enrollment and a discount on payment.

Commercial kindergartens do not take into account the right of special categories of citizens to benefits; the right to benefits can be exercised by contacting a state preschool educational institution. Mistake #2.

Benefits and privileges for single mothers in 2021

- at school, children raised by one parent have the right to have two meals in the canteen (for this you will need to submit a corresponding application to the educational institution addressed to the director);

- providing children with free massage sessions by medical specialists;

- the state provides free trips to camps and sanatoriums for children;

- children are placed on a preferential queue for admission to kindergartens;

- 50% discount on kindergarten fees;

- provision from the state of a 30% discount on a child’s education in additional education organizations (sports clubs, drawing schools, etc.).

If, for some reason, the administration of the educational organization where the child is studying refuses to provide benefits, you can file a complaint with a higher authority.

Benefits for single mothers

Who can and cannot claim benefits It is logical that only mothers who have received the appropriate status can hope for the privileges intended for single mothers. A single person is considered to be one who did not indicate information about the father on the birth certificate of her son or daughter, or whose full name was entered from her words.

This happens when a woman lived with a man in a civil marriage, or her husband renounced paternity at a court hearing. Single mothers are also those mothers whose baby was born within three hundred days after the end of the marriage, if the father abandoned him, or as a result of the adoption of a child by an unmarried woman.

If a mother remarries and her husband adopts her child, she ceases to be considered a single mother and loses her right to preferences.

Benefits for single mothers when paying for kindergarten

For 2 and 3 children the amount ranges from 100 to 150 thousand rubles.

- The monthly allowance for each child under the age of majority - up to one and a half years - 2,500 rubles, up to three years - 4,500 rubles, up to 18 years - 2,500 rubles.

- Monthly reimbursement for food – 675 rubles.

- If a child has health problems, an additional disability benefit may be issued. The state provides financial assistance, as well as benefits and benefits in order to give the mother the opportunity to provide the child with everything necessary and give him upbringing/education.

Additional benefits can be issued if there are several children raised without a father. Where to apply Before applying to a government agency for benefits, a woman must take care of registering her status as a single mother.

Up to what age are benefits paid?

Many single mothers are interested in the age up to which money is paid in Russia. Let us remind you that all women are required to receive benefits until the child reaches one and a half years of age.

Officially employed women have more rights, since they are forced to take maternity leave and take a break from work. In this regard, they are paid benefits until the child reaches the age of three.

After 3 years, payments are provided mainly to the poor, as well as to those raising a disabled child.

If the family's monthly income is below the minimum subsistence level established by the state, then, in accordance with regional laws, benefits may be awarded that are paid until the child reaches 18 years of age.

Prospects for increasing payments

Every year the state predicts an increase in payments and an increase in guarantees in the social sphere. This is done in order to ensure a decent standard of living for those categories of the population that need social assistance and protection.

At the end of last year, the government indexed many payments in connection with inflation. This determines whether certain benefits will increase. Compared to the previous year, all social payments, including those for single mothers, should increase by 3%.

Grounds for termination of payments

Benefits cease to be paid when the grounds for their assignment are eliminated. Local authorities may set reasons why benefits will be denied. For example, the Moscow Government decided that the legal basis for termination of monthly child benefits is:

- the child reaches a certain age;

- deregistration at his place of residence in Moscow;

- exceeding the average monthly family income;

- death of a child.

When determining how much money a single woman with a child should now receive per month, the capital authorities also decided that payments could be suspended if:

- benefits have not been received for 6 consecutive months;

- a legal court decision by which the child is declared missing comes into force;

- a minor works under an employment contract or is engaged in entrepreneurial activity, as a result of which he becomes fully capable.

Other regions may have different termination rules.

Payments to single mothers in 2021 in Moscow

In the capital, unlike other regions of the Russian Federation, single mothers can receive payments intended only for them:

- monthly allowance in the amount of 15 thousand rubles for a child under 3 years old and 6 thousand rubles. — for a child from 3 to 6 years old or 12 thousand rubles. — for a disabled child under 18 or 23 years old;

- monthly payments to compensate for inflation for food for a child under 3 years old - 675 rubles and for other expenses for children under 16 or 18 years old - 750 rubles.

To receive these payments, a single mother must have permanent registration in Moscow.