Calculation of the thirteenth salary calculator online

Attention

To receive the full bonus, you need to work 227 days (minus 20 days of required rest). Topolev worked: 3 – 27 = 220 working days.

- Here's how to calculate the 13th salary for Topolev, taking into account the time he worked:

- Also see Bonuses and Income Tax: Taxation Rules. Average annual earnings The most labor-intensive process for calculating bonuses at the end of the year.

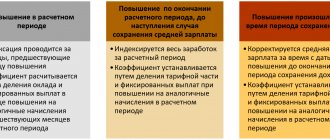

The accountant will need certain information: the amount of the employee’s income for the year, the number of employees in the department, length of service, etc. Now about how the 13th salary is calculated based on average annual earnings: Pzp.av.g. + Experience P salary average year – bonus from average annual income; Experience – cash payments provided for length of service.

Important

Now let's look at the mechanism for calculating bonus payments. The accounting department provides the immediate manager with reporting documentation on the availability of residual funds at the end of the year. After this, a decision is made on their use, for example, this could be the accrual of bonuses. The decision is made based on the size of the “free9raquo; funds.

Incentives can be given to all employees or to individual employees.

After this, in interaction with the chief accountant, the issue of the most acceptable method of calculation is resolved, and an order is issued with a list of employees to be awarded. The order is certified by management. Next, the accounting department transfers, according to this order, funds to bank cards or hands them out.

The rules for calculating bonus payments are practically no different in any organization.

How to calculate income tax from money to be issued

Sometimes employers cooperate with individuals semi-officially. That is, they pay extra salary “in an envelope”. The law does not approve of such actions, because many organizations avoid fulfilling legal obligations. Then two questions arise: how to calculate personal income tax from the amount in hand and the accrued salary?

To calculate, use one of two formulas:

Salary – salary from which income tax is calculated;

ZP – cash transferred in person.

Example 2 Sales manager Vishnevskaya, working in, is paid 21,500 rubles per month by agreement with the employer. How to calculate personal income tax and the amount on which tax is withheld?

Solution:

CJSC Edelweiss pays Vishnevskaya a salary of 24,712 rubles, from which 3,212 rubles. contributes to the budget.

An organization may employ employees who have financial obligations that do not reduce the NB. For example, when deducting alimony, personal income tax is withheld not from the amount handed out, but from the accrued salary. According to Art. 81 of the RF IC, their size is:

- 1/4 of earnings - for one child;

- 1/3 – for two children;

- 1/2 – for three or more children.

Example 3 An employee of Antey LLC Orlov received a salary for June - 35,977 rubles. He is divorced from his wife. By court decision, he is obliged to pay alimony for his minor daughter (25% of income). The tax base, taking into account the deduction for a child, will be:

| Period | Amount, rub. | Personal income tax, r. |

| January-May | 172 885 | 22 475 |

| January June | 207 462 | 26 970 |

How much money should be given to Orlov?

Solution:

The share of alimony will be: 35977 x 25% = 8994.25 rubles.

Calculation of the taxpayer’s personal income tax: 26970 – 22475 = 4,495 rubles.

Calculation of the thirteenth salary calculator online in KZ

Do not leave blank lines, otherwise the calculation result may be distorted.

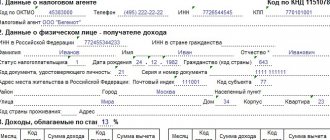

To calculate the required salary , fill out the following six lines :

- Click to enlarge

Salary is directly the amount from the employment contract.

- Bonuses - here you can include all incentives that supplement the salary part of the salary.

- Deductions are personal income tax benefits applied to wages to which the employee is entitled; only the required standard deductions must be entered in this field. The most common is a deduction for a child: 1,400 for the first and second, 3,000 for the next in order of birth, 12,000 (or 6,000) for disabled children.

This bonus is always stimulating and/or encouraging.

Accordingly, the calculation of 13 salaries and the attached formula depends solely on the policy of the company’s management. It is possible to 100% calculate the final “addition” only if it is specified in the contract or if you have access to the company’s internal documentation.

Most often, entrepreneurs pay money in the following order:

- Fixed fee;

- Through the calculated coefficient;

- As a percentage of the employee's salary;

- As a percentage of the employee's average annual earnings.

You can correctly calculate the money owed by knowing the calculation model chosen by the company’s managers.

With a fixed bonus payment it is easiest - that’s why it is one of the most popular incentives among entrepreneurs. It is expressed in a specific fixed amount.

For example, according to the wage regulations of Vostok LLC, it is established that bonuses at the end of the year are paid in the amount of 8% of the amount of wages for the year. Engineer Ivanov was paid 120,000 rubles for 2010.

Thus, the bonus amount was: 120,000 * 8% = 9,600 rubles. 5 You can also calculate the amount of the bonus at the end of the year based on your salary. For example, according to the administrative document, the annual bonus is paid in the amount of 1.5 monthly salary.

It is known that Ivanov’s salary is 10,000 rubles. Thus, he will receive the thirteenth salary in the amount of 10,000 * 1.5 = 15,000 rubles.

6 Perhaps you will stop at paying the thirteenth salary in the form of average earnings for the year. To do this, you will need timesheets and pay slips.

Among other things, the employer also has the right to determine the circle of employees who are able to qualify for this type of incentive.

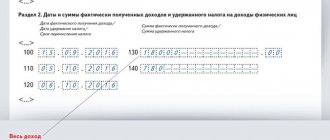

The procedure for calculating the amount of personal income tax

The rules by which personal income tax is calculated are the same for everyone. In the Russian Federation, this value does not have a floating coefficient, but is calculated based on the established percentage for all population groups.

(D – V) * 13%

13% is the established tax rate for individuals.

D - income received over a separate period of time.

B – tax deduction required by law.

The indicated 13 percent tax is unchanged for all amounts received from work, so you should not check the legislation every time to clarify this value. But the amount of deductions varies depending on the social category to which the taxable person belongs and other preferential parameters. Earned income also varies and not all of it is taxable.

An ordinary worker who works in a factory or any other enterprise does not know how much tax the enterprise’s accounting department transfers to the state budget from its income.

We will tell you how to calculate this amount below.

What do you need to know?

Knowing the amount in hand, you can calculate the amount of income tax if you know the personal income tax rate.

According to Article 224 of the Tax Code of the Russian Federation, the following personal income tax rates apply:

- 13% (basic tax rate);

- 9% (in case of receiving income as a founder of trust mortgage management; if a person receives dividends on enterprise income received before 2011);

- 30% (all types of profit of non-residents, except dividend income and income from labor activities at a rate of 13%);

- 35% (income from lotteries, competitions, etc. is subject to this tax).

As you can see, the base rate for withholding funds from taxpayers’ income in the Russian Federation is 13%.

Nuances for children

If there are children in the family, then their parents (mother or father) have the right to reduce the tax base of their income, from which personal income tax will be deducted to the state budget of the Russian Federation.

The legislation established the amounts of tax deductions in the following amounts:

- for the first son (daughter) - 1400 rubles;

- if there is a second child in the family - 1,400 rubles;

- if there is a 3rd, 4th and so on child - 3000 rubles.

The maximum amount of benefits (12 thousand rubles) is provided to parents of disabled children until they reach the age of majority, as well as when they continue their studies at institutes and other educational institutions (maximum up to 24 years).

The tax deduction amount is assumed to be for each month of the year.

Salary deductions

According to Article 218 of the Tax Code of the Russian Federation, standard tax deductions in the amount of 3,000 rubles are provided to the following categories of citizens:

- all persons who took part in the liquidation of the Chernobyl accident and the consequences of this accident in 1986-1987;

- employees of the Department of Internal Affairs and the State Fire Service who participated in the creation of the Shelter object in 1989-1990;

- participants in nuclear weapons tests;

- combatants;

- war invalids.

A deduction of 6,000 rubles per year is provided to:

- certain categories of military personnel (for example, Heroes of the USSR, Russian Federation, etc.), whose years of service were counted towards the period of length of service;

- disabled children;

- disabled people of groups 1 and 2;

- victims of radiation accidents;

- evacuees from their places of permanent residence after the Chernobyl accident;

- warriors are internationalists.

Article 219 of the Tax Code of the Russian Federation establishes the rules for providing social tax deductions.

According to the norms of this article, the tax base when calculating tax is reduced by:

- the amount of official charitable donations;

- the amount of payment for education at universities;

- the amount of money paid for medical services;

- for the amount of replenishment of pension accounts in non-state pension insurance funds.

The total amount of expenses should not be more than 25% of the total income received before taxes.

If there is alimony

Income tax in the presence of alimony may also not be taken from the full amount of the citizen’s income.

In this aspect, we note two very important points:

- alimony (if there is no established fixed amount) is calculated from the net amount of income, that is, when personal income tax has already been deducted;

- The father who pays child support is entitled to receive the standard social benefit for children.

Formula

Calculating the personal income tax amount knowing the amount in hand can be done using 2 steps:

- Amount in hand: (100% - Tax rate) = full amount of taxable income;

- Taxable income - Amount in hand = personal income tax.

Now you know how to find the personal income tax amount.

How to calculate income tax in 2021? The calculation scheme is in our article. Is personal income tax required for maternity benefits? Find out here.

What kind of treatment can I get a tax deduction for? Information in this material.

Calculation example

How to calculate 13 salary calculator online

The enterprise independently determines:

- How are 13 salaries calculated?

- What indicators does it depend on?

All nuances must be spelled out in internal documents: collective agreement, bonus regulations, labor regulations, charter. Some innovations from 2021 in this regard will only affect small businesses. For more information about this, see “Local regulations from 2021: changes to the Labor Code of the Russian Federation.” Management sets a budget for such payments, and the accountant distributes the funds. When the 13th salary is paid The year-end bonus is usually given before the New Year holidays.

Reasons for reducing payments may be violation of safety regulations, non-compliance with labor discipline, etc.

You can download the forms of these standard orders on our website using the link. The source of payment of 13 salaries may be a material fund created by management in order to reward good employees.

The corresponding decision can be reflected in the paragraphs of the following legal documents:

- collective and labor agreements;

- regulations on the procedure for calculating salaries or bonuses;

- charter;

- internal regulations regulating labor regulations.

According to the laws of Russia, in the above documents it is necessary not only to mention the fact of the existence of an annual bonus, but also to describe the order in which it will be accrued and which employees can count on it.

- At the same time, we should not forget that, just like a standard salary, such a bonus is subject to personal income tax, and therefore the employee receives 13% less than the amount indicated in the regulatory documentation.

Calculation and payment of the thirteenth salary in 2021

If you want to find out how to solve your particular problem, contact the online consultant on the right or call the free consultation numbers: What does this mean? The thirteenth salary is an accrual that an employee receives at the end of the year as a reward. The thirteenth salary is issued with the aim of increasing labor efficiency. The concept of the thirteenth salary comes from Soviet times, when employees received money equal to average earnings.

At the beginning of 2021 they will receive certain payments, which are:

- sixty thousand rubles to each of the managers;

- twenty-five thousand to each sales agent;

- thirty-two thousand to each accounting specialist.

The bonus order is usually drawn up in a single copy. It is prepared by an accountant or personnel officer.

The document must indicate the positions, names, surnames and patronymics of those workers who are entitled to the thirteenth salary. It is also necessary to indicate the structural unit in which they work and the amount of payment to the employee.

You can find a sample bonus order here.

Reward amounts vary based on specific criteria.

This could be the implementation of the plan, work experience, etc.

Let's look at how the 13th salary in Russia is calculated later in the article.

The thirteenth salary is an accrual that an employee receives at the end of the year as a reward.

The thirteenth salary is issued with the aim of increasing labor efficiency. The concept of the thirteenth salary comes from Soviet times, when employees received money equal to average earnings.

Currently, they are more similar to bonuses for conscientious work. For this reason, the thirteenth salary is also called a bonus based on the results of work for the year or the New Year.

The legislation does not provide information about such charges as the thirteenth salary.

They are paid during the New Year holidays and are an unregulated form of incentives and bonuses. How the 13th salary is calculated in Russia The concept of “thirteenth salary” is used mainly only by staff in everyday life. Labor legislation does not regulate such a payment, so the accounting department does not have the right to register it as the employee’s next salary based on the results of a month that does not exist.

Tax calculation example

Consider an example of how to calculate the tax rate in various cases.

Locksmith Ivanov earned his salary this month in the amount of 14,500 rubles. Plus, he was given a fixed bonus of 3,500 rubles. His total income for this month was 18,000 rubles.

It is necessary to calculate how much income he will pay from his salary to the state, and how much he will receive in his hands.

(18000 – 400) * 13% = 2288 rubles

400 rubles is the standard deduction that mechanic Ivanov is entitled to.

The received amount of 2288 rubles is the amount of personal income tax, which will be deducted from the money earned.

18000 – 2288 = 15712 rubles.

Ivanov will receive 15712 for the entire month worked.

Larger deductions may be made from the amount of calculated income if the person is included in special categories or is entitled to additional deductions. Like, for example, when buying an apartment.

If you use an online calculator to make personal income tax calculations, all the described actions are performed in one click.

Payroll calculator

According to the organization’s documents, it can go like this:

- Year-end bonus for all employees of the enterprise.

- Cash rewards for individual employees for achieving excellent results.

- Bonuses for specialists due to their high level of qualifications.

It is important to make a choice before calculating the 13th salary.

In these cases, the thirteenth salary can be calculated using the following formula:

bonus = (bonus max./days worked)*days neg.

Mask Prize - the greatest monetary remuneration a worker can hope for;

Working days – the sum of working days for the year;

Days negative – actual number of days worked.

Premium max. = salary*%

Please note that the amount may increase over the course of the year. This fact must be taken into account. Internal documents must state how the thirteenth salary is determined, and the employer must transfer payment from it in the form of a tax to the budget.

This calculation is considered the most labor-intensive.

This bonus is usually awarded to military personnel, doctors of public clinics, teachers, teachers in budgetary educational institutions, and employees of municipal transport enterprises.

In private organizations, as a rule, bonuses are given to those employees who directly generate income for managers. For example, these could be managers searching for potential clients, operators, if we are talking about the non-production sector. In the production sector, bonuses can be given to employees involved in the manufacture of products.

The Labor Code does not regulate the procedure for bonus payments.

Popular materials in this section

If the husband is a guarantor, does he have the right to an apartment?

Filling out 3 personal income tax when returning for a child’s education at the institute

Taxi Company Law

How to calculate length of service for the police

Plan procurement schedule for 2021 instructions

Can the investigative committee investigate fraud?