Personal income tax and advance: dates and deadlines

The employer must calculate personal income tax on the date of actual receipt of income (clause 3 of Article 226 of the Tax Code of the Russian Federation) and withhold tax from the employee’s wages upon actual payment (clause 4 of Article 226 of the Tax Code of the Russian Federation). For wages (including advance payments), the date of receipt of income is the last day of the month for which the wages were accrued (clause 2 of Article 223 of the Tax Code of the Russian Federation).

Therefore, at the time of payment of the advance, personal income tax is not calculated and not transferred to the budget (Letters of the Federal Tax Service of Russia dated January 15, 2016 No. BS-4-11/320, dated March 24, 2016 No. BS-4-11/4999).

- the last day of the month for which it was accrued;

- the last day of work of an employee in the organization if he is dismissed before the end of the month.

Personal income tax from “advance”

Salaries in the organization are paid as follows: on the 30th day - advance payment, on the 15th day - the rest of the salary. Will personal income tax be withheld from the advance in this case?

The date of actual receipt of wages is considered to be the last day of the month for which it was accrued. On the day of payment of the salary for the first half of the month (“advance”), income has not yet arisen. Therefore, in general, personal income tax is not withheld from advances.

In the example given, it turns out that the dates of payment of the advance and the actual receipt of income will coincide in those months in which there are 30 days . If there are such matches, the organization will have to calculate the amount of personal income tax for the past month. On the same day, personal income tax must be withheld (ruling of the Supreme Court of the Russian Federation dated May 11, 2016 No. 309-KG16-1804), and on the next working day it must be transferred to the budget.

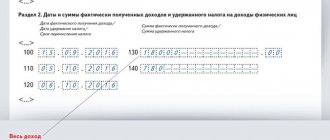

Therefore, in this case, 6-NDFL will be filled out depending on the number of days in the month . For example, September has 30 days in a month , so section 2 would look like this:

- on line 100 - 09/30/2019 (income received on the last day of the month);

- on line 110 - 09/30/2019 (personal income tax was withheld on the same day);

- on line 120 - 10/01/2019 (deadline for transferring tax to the budget).

there are 31 days in October , so the entry will be like this:

- on line 100 - 10/31/2019;

- on line 110 - November 15, 2019 (day of salary payment and personal income tax withholding);

- on line 120 - November 18, 2019 (next business day).

Example of filling out 6-NDFL: advances

The amount of the advance paid is not shown separately in Form 6-NDFL. The advance will be reflected in the salary for which it was issued.

The LLC has been operating since February 2021. Until the end of the first quarter of 2021, salary accruals amounted to RUB 738,000. (personal income tax - 95,940 rubles), including:

- On February 22, 2019, a salary advance was issued (RUB 300,000);

- On 03/05/2019 the final payment for February was made (RUB 438,000).

Example of filling out 6-NDFL:

- The date of actual receipt of income (line 100) is 02/28/2019;

- Tax withholding date (line 110) is 03/05/2019;

- The tax payment deadline (line 130) is 03/06/2019;

- The amount of income actually received (line 130) is 738,000 rubles;

- The amount of tax withheld (line 140) is RUB 95,940.

For May 2021, the employee was paid a salary of 63,218 rubles. Personal income tax at a rate of 13% is 8,218 rubles. On 05/20/2019, the employee was paid an advance in the amount of 25,000 rubles, the final payment was made on 06/03/2019 in the amount of 30,000 rubles. To simplify, let’s assume that the employee had no other income for the six months.

Then, as part of 6-NDFL:

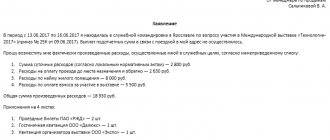

Let's say the company gave an advance to an employee on June 18, 2021 in the amount of 25,000 rubles. The accountant does not withhold personal income tax from this amount. The employee received the remaining second part on July 3.

The monthly salary amounted to 50,000 rubles. The accountant withheld personal income tax from the entire amount at once - 6,500 rubles. I transferred the tax on July 4th. In the second section of the 6-NDFL calculation it will be like this:

If you find an error, please select a piece of text and press Ctrl+Enter.

The legislation of the Russian Federation guarantees the regular provision of wages to the employed population. Thus, the Labor Code of the Russian Federation provides for a provision according to which salaries must be paid every half month. As a result, the first payment, intended as remuneration for one half-monthly part of the work, is called an advance. In this regard, accountants have a logical question: how to reflect the advance in 6-NDFL?

Reflection of advance data in the tax report

In order to officially record the moment of payment of the advance, it is necessary to allocate funds for the advance payment from the amount of wages for the month. To issue an advance, an enterprise can draw up some act of transferring part of the funds, however, this payment will not appear separately in the tax reporting document 6-NDFL. As part of the total income for the month, the advance will be entered in line 020 “Amount of accrued income” of Section 1 and line 130 “Amount of actually received income” of Section 2 of the same 6-NDFL declaration.

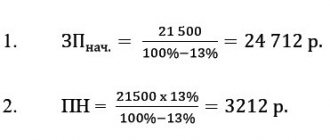

To understand the algorithm for entering data into the report a little more clearly, we will give a specific example:

For April 2021, the employee was paid a salary of 48,500 rubles. At a tax rate of 13%, the amount of personal income tax calculated from this income was 6,305 rubles. On April 14, the employee was paid an advance in the amount of 16,700 rubles, and the main part of the salary was transferred to the employee on May 3, 2021, and amounted to 31,800 rubles. For the convenience of entering data, we assume that the employee did not receive any additional income during the reporting period, and also did not have the right to tax deductions.

In the 6-NDFL report for the half-year, this payment will be reflected as follows:

| Line number | Content |

| 100 “Date of actual receipt of income” | 30.04.2018 |

| 110 “Tax withholding date” | 03.05.2018 |

| 120 “Tax payment deadline” | 04.05.2018 |

| 130 “Amount of income actually received” | 48 500 |

| 140 “Amount of tax withheld” | 6 305 |

In a word, the advance payment, although its issuance is provided for by labor legislation, is not reflected in the 6-NDFL declaration separately from the total amount of income.

Features of reflecting an advance in 6-NDFL

An advance is understood as a mandatory amount that each employer must provide to staff in accordance with Art. 136 of the Labor Code of the Russian Federation, which sets out the requirement to divide employee salaries into two parts, each of which is provided to subjects no less than every half month.

In turn, form 6-NDFL provides two parts, the first of which reflects information on an accrual basis from the beginning of the year, and the second contains information for the last quarter.

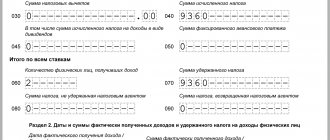

Thus, the first section of 6-NDFL assumes the following lines, which include the advance amount:

- 020 – this column reflects accrued income, which will include all earnings from the beginning of the year until the end of the current quarter, including the last advance paid to staff;

- 040 – calculated amount of income tax, which is also levied on advance payments for the entire designated period;

- 070 – withheld amount of the tax in question. At the same time, the tax on the advance payment for the last month of the quarter will not be reflected here, which is determined by the provision in accordance with which the deduction is carried out in the month that follows the reporting month.

In the second section of the reporting form under consideration, the advance is reflected in the following columns:

- 100 – this line reflects the day the income was actually issued; in the case of an advance, this is the last date of the month when it was accrued;

- 110 – date of personal income tax withholding, that is, the day of payment of wages for the second part of the month;

- 120 – the date of tax payment is fixed, the actual day of deduction of the amount is assumed, or the next day;

- 130 – this column reflects the amount that includes the advance payment from which personal income tax has already been withheld for the last three months;

- 140 – the amount of tax withheld is specified, while income tax on the advance payment for the last month of the quarter should not be reflected.

Therefore, the correct calculation and reflection of the advance in form 6-NDFL is of great importance when filing a declaration. If the advance amount is entered incorrectly in any of the lines, this may lead to claims from employees of the regulatory authority.

When to fill out

An employer, be it an individual entrepreneur or a legal entity, has the right to employ both citizens of Russia and citizens of other states if foreigners reside in Russia legally and work legally.

Line by line filling out 6 personal income tax: title page and calculation

Arriving in Russia, a foreigner undergoes temporary registration and issues a “patent” for work. This is what is called an official work permit.

Having such an employee, the employer is obliged to pay remuneration for work. A foreigner, observing the tax legislation of the Russian Federation, is obliged to pay income tax on the remuneration received.

Just as in relation to Russian individuals, the employer acts as a tax agent for a foreign employee. Responsibilities include calculation, withholding and payment of personal income tax to the budget. In addition, the employer reports to the state on these amounts.

However, foreign workers are required to pay their own income tax, which must be taken into account by the employer. This amount is called a “patent” - the foreigner pays in advance the amount of tax that he will receive in the current reporting period. And the employer reflects this amount in the report.

The tax agent is obliged to calculate the income tax from the foreigner, and then reduce this tax by the amount of the advance payment already paid.

On a note! The employer keeps checks and receipts confirming that the foreigner has paid for the patent. These payment receipts are the basis for reducing the tax amount.

The following list is provided to the accounting department:

- An application by an employee who is a national of another country with a request to reduce the amount of income tax by the amount that he has already paid when “purchasing” the patent;

- certificates confirming payment for the patent;

- notification from the tax office where the employer is “attached”, and confirmation of the foreign employee’s right to reduce personal income tax is also given there.

Lines 010 - 030 6 Personal income tax: what is included there, nuances of filling out the report

As soon as the employer receives the notification, the tax calculated from the foreigner is reduced by the amount of the patent already paid. This amount will be reflected in 6NDLF.

The procedure for reflecting an advance in 6-NDFL

The legislation provides employers with the opportunity to independently determine specific dates for the actual payment of wages, in particular:

- provision of an advance is appropriate in the period from the 15th to the 30th or 31st of the reporting month;

- Employees must receive the rest of their income from the 1st to the 15th of the month following the reporting month.

Column 020 of the first section of 6-NDFL should reflect the amount of the advance that was accrued for the full reporting period, also taking into account the last month of the quarter.

Line 040 records the amount of income tax that has been calculated. The calculation date coincides with the day of actual disbursement of funds. To calculate wages for the first and second parts of the month, the date is identical - the last calendar day of the period.

In turn, line 070 reflects only the personal income tax indicator that was withheld. Deductions are made from income for the first part of the month in parallel with the actual payment of the rest of the salary - the date in question refers to the month following the reporting one. Due to this, tax for the last month of the quarter is not reflected.

However, column 070 will take into account the amount of personal income tax withheld from the advance payment issued for December of the previous year, since the actual deduction will be made only in January of the current year, which will be taken into account as part of the first quarter of the reporting period.

In the second section, column 100, it is recorded that the day of payment of funds as an advance is the last day of the month within which it was accrued.

Line 110 marks the day of personal income tax withholding, that is, the day indicating the deadline for payment of the balance of staff income.

Column 120 indicates the date of tax transfer. In this case, this information may either coincide with the data from line 110 or differ by one day.

Fields 130 and 140 of Form 6-NDFL should not reflect the advance amount, as well as the personal income tax withheld from it for the last month of the quarter.

It is assumed that when completing the second section of the form in question, the advance amount (as part of the total income) for the month leading up to the last quarter, as well as for the first two months of the quarter in question, is first recorded. Consequently, for the third month of the current quarter, the advance will be reflected as part of the next period.

What are the risks of providing false data and being late when submitting the calculation?

Current legislation provides for financial liability for violations of the deadlines, form of payment, as well as for the provision of false information by the declarant. These include fines:

- they have the right to fine an agent by 1,000 ₽ for each full and incomplete calendar month if he submits a payment late or simply does not provide it (see paragraph 1.2 of Article 126 of the Tax Code of the Russian Federation);

- does not cancel the first fine and the already widespread sanction in the form of blocking the current account of an enterprise if the declaration is not submitted for more than 10 days (specified in paragraph 3.2 of Article 76 of the Tax Code of the Russian Federation);

- 500 ₽ for each document provided at the request of the Federal Tax Service will be imposed by the fiscal authorities on the declarant if false information is found in it (regulated specifically for the calculation of 6-NDFL in paragraph 1 of Article 126.1 of the Code);

- 200 ₽ - if the payment is submitted in the wrong form or in an inappropriate way (Article 119.1 of the Tax Code of the Russian Federation);

- 5,000 ₽ — when the agent ignores the controllers’ questions, if this happens for the first time;

- 20,000 ₽ - if the declarant refuses to make contact on subsequent occasions.

Therefore, we emphasize once again: check and double-check all calculations in 6-NDFL. There are already statistics that in 90% of incorrectly completed declarations, errors are made due to inattention or illiteracy of the components

So, reflecting advance payments in the calculation, the advance payment figure is summed up with the final payment figure and only the specific date of its payment is indicated. There is no separate column for this physical indicator. The argument for this decision is quite simple: salary advances when calculating personal income tax are not included in the income of individuals. person, respectively, and the tax collection from him is recorded only in the final calculation. At the same time, there may be special cases when the advance payment can be made according to separate lines and amounts of section No. 2 of the declaration. Therefore, when registering such amounts, you must rely on the deadlines for calculating and withholding personal income tax established by current legislation.

An example of reflecting an advance in 6-NDFL

When answering the question of how to reflect a salary advance in 6-NDFL, it is appropriate to consider an example for greater clarity.

Let's consider the procedure for reflecting an advance as part of filing 6-NDFL reports for 9 months, that is, the period from January to September. Thus, the first part of the salary for September was accrued in the nominal amount of 30,000 rubles, and the rest - in the amount of 25,000 rubles. At the same time, the date of actual issuance of the second part of the income to the staff is October 5th.

The procedure for entering the information provided in the first section of the form:

- in line 020 it is necessary to take into account 30,000 rubles;

- in column 040 you should indicate personal income tax from 30,000 rubles, since it will be calculated on September 30, and should be taken into account within the line under consideration;

- the amount of personal income tax should not be recorded in field 070 of the form, since it will be calculated only at the beginning of October, and, therefore, does not fall within the reporting period.

The peculiarities of entering information into the second section of the reporting presuppose that there is no indication of the amount of the advance for September, since this amount will subsequently be included in the annual reporting. That is, within the framework of the example under consideration, 30,000 rubles. will be reflected in the annual form 6-NDFL as follows:

- in column 100 the date 09/30/2019 will be indicated;

- in line 110 – 10/05/2019;

- at 120 – 10/06/2019;

- in 130 - the indicated amount will be taken into account as part of the total income;

- at 140 - the tax withheld from the total amount of staff wages will be reflected.

Thus, the procedure for reflecting an advance in form 6-NDFL requires care and awareness regarding the rules for preparing such reporting. An accountant must not only know the algorithm for calculating the advance payment and the procedure for accounting for it, but also monitor legislative innovations.

Articles, reviews, expert comments

In which line of 6-NDFL is the salary advance reflected? It makes no sense to look for a separate advance line in the report. There is no space allocated for information about the salary advance issued to employees and the personal income tax corresponding to this payment. This seemingly flaw in the report is actually based on tax legislation, since:

- the employer is obliged to calculate personal income tax on the date of actual receipt of income (this approach is dictated by clause 3 of Article 226 of the Tax Code of the Russian Federation);

- it is necessary to withhold tax from the employee’s salary upon its actual payment (clause 4 of article 226 of the Tax Code of the Russian Federation);

- the date of receipt of income in the form of wages (including advance payments) is the last day of the month for which salary accruals were made (clause 2 of Article 223 of the Tax Code of the Russian Federation, see

Algorithm for correcting errors and submitting updated calculations

There is no need to worry too much when, after submitting reports in Form 6-NDFD, errors were discovered by the declarant himself. Until the company receives a notification that specific inconsistencies have been found in the calculation, the situation can be corrected quite simply: an update is sent to the Federal Tax Service, where the initial calculation was submitted.

In terms of design, it is no different from the primary calculation, with the exception of the adjustment number:

- instead of “000”, which should appear in the primary report for a given period;

- in the first clarification “001” is put, in the second – “002”, etc.

When filling out the correction number, we start counting from code “000”, code “001” is considered an error

In the updated calculation, in addition to the new number, it will be necessary to correct all discrepancies in amounts and dates (where they were). The clarification is provided in the same way as the initial calculation. It is recommended to attach an explanatory note to the new calculation, which indicates the reason for the arithmetic or other errors.

According to the standards of the tax service: as soon as the updated declaration reaches the fiscal controller, the desk audit of the reports already submitted is stopped and a new desk audit is launched without any sanctions or fines.

But if the errors were discovered by the tax authorities themselves, the situation becomes more complicated. Let us remind you that the cameral for any of the declarations can last for three months. During this period, the tax inspector has the right:

- Require clarification from the declarant on any of the points in the report. And such comments must be given within five working days. In this case, the declarant has the right to defend his point of view, provide the primary report, personal income tax register, salary slips, and other documentation (see paragraph 4 of Article 88 of the Tax Code of the Russian Federation).

- Request documentation related to 6-NDFL reporting. Again, this must be done 5 days in advance, otherwise fines may follow.

- In addition, tax authorities can call the responsible person of the declarant and his counterparties, request information on the company’s bank accounts, check all data on payments to the budget, as well as control ratios.

- If the controller admits errors, a report will be drawn up in which all discrepancies will be indicated and sanctions or a warning will be assigned.

- If, after a desk audit, a fine is imposed on the company, it must be paid within 60 days.

Advance in the form of 6-NDFL

- On February 22, 2018, a salary advance was issued (RUB 300,000);

- On 03/05/2018 the final payment for February was made (RUB 438,000).

To simplify the example, we will assume that there are no other accruals and payments during this period. Filling out 6-NDFL:

- The date of actual receipt of income (line 100) is 02/28/2018;

- Tax withholding date (line 110) - 03/05/2018;

- The tax payment deadline (line 130) is 03/06/2018;

- The amount of income actually received (line 130) is 738,000 rubles;

- The amount of tax withheld (line 140) is RUB 95,940.

The amount of a fixed advance payment in 6-NDFL: how not to make a mistake in terms How to show an advance on salary in 6-NDFL, we figured it out.

The amount of a fixed advance payment in 6-NDFL: how not to make a mistake in terms

We’ve figured out how to show an advance on salary in 6-NDFL. But sometimes it also indicates an advance of a completely different nature, namely: a fixed advance payment (FAP), which is paid by foreigners working on the basis of a patent.

For him, the calculation has a separate line 050 and its own reflection rules, due to the offset between the personal income tax advance, which is transferred by the employee under the patent, and the tax that the employer has calculated and must transfer to the budget from the income paid to the employee.

Thus, the amount of the FAP in line 050 should not exceed the amount of tax from such employees included in line 040. When the personal income tax paid under a patent is less than the tax calculated on wages, the entire fixed advance is reflected in line 050. When more, only a part of it equal to the calculated personal income tax. If the foreigner continues to work and receive a salary, the difference is counted in subsequent periods.

Filling out the calculation in such a situation is discussed line by line in the article “Nuances of filling out 6-NDFL for “patent” foreigners.”

Advance in 6-NDFL: filling out reports using an example

Info

Therefore, the advance amount will not be paid separately anywhere. And the tax itself will not be withheld from it. After all, the agent is obliged to withhold tax on the day on which the employee actually received the income due to him.

And for salaries, this date is the last day of the month. It turns out that the advance included in the salary is recognized as actually received income at the end of the month, and at the moment when it is actually paid, tax is not withheld and transferred.

It is also worth recalling that the date of transfer of tax to the treasury must be no later than the day following the payment of wages. For sick leave, this number shifts during the month in which it is paid.

Online magazine for accountants

Personal income tax on them. The absence of lines, as a rule, is based on tax legislation, since: Get 267 video lessons on 1C for free:

- Free video tutorial on 1C Accounting 8.3 and 8.2;

- Tutorial on the new version of 1C ZUP 3.0;

- Good course on 1C Trade Management 11.

- the employer should calculate personal income tax on the date of actual receipt of income by the employee, based on clause 3 of Article 226 of the Tax Code of the Russian Federation;

- tax is withheld from the employee’s salary upon actual payment, based on clause 4 of Article 226 of the Tax Code of the Russian Federation;

- The actual date of receipt of income in the form of salary and advance payments is considered to be the last day of the month for which income is accrued, based on clause 2 of Article 223 of the Tax Code of the Russian Federation.

Consequently, on the date of payment, the advance is not recognized as income, and therefore personal income tax is not withheld from the advance amount.

How to reflect an advance in 6-NDFL

Important

Confirmation that paid advances are not indicated in the calculation of 6-NDFL as a separate line are letters from tax authorities dated January 15, 2016 No. BS-4-11/320, dated March 24, 2016 No. BS-4-11/4999. Advance in 6-NDFL example of filling Let's look at an example of how an advance is reflected in the 6-NDFL form.

It specifies the personal income tax rate, the number of recipients of money, and the amount of accrued and withheld tax.

- Second section. Reflects information about the specific amounts of money paid and transferred to the treasury.

- without fail;

- the force of legal requirements;

- deadlines established by the company itself (taking into account the requirements of labor legislation).

The document is filled out based on the data in the tax registers.

How to reflect an advance in 6-NDFL The advance paid to an employee is not reflected in these reports, because according to the law, salary income is not yet recognized as received. Therefore, no income tax is withheld yet. This approach is followed by the Federal Tax Service.

Add to favoritesSend by mail Advance payment in 6-NDFL how to reflect correctly? This question is asked by many specialists responsible for personal income tax reporting. From our article you will learn about the nuances of reflecting an advance in 6-NDFL.

An advance is considered to be part of an employee’s earnings given to him by the employer:

NOTE! The need for advance payment arises from the requirements of labor legislation. Art. 136 of the Labor Code of the Russian Federation requires the employer to pay wages every half month, otherwise he faces fines (Art.

5.27 of the Code of Administrative Offenses of the Russian Federation) and material losses in the form of interest for delayed wages (Article 236 of the Labor Code of the Russian Federation). Study salary nuances using the materials posted on our website: Thus, an advance is an element of an employee’s income that is subject to personal income tax and, as a result, has every reason to be included in personal income tax reports, one of which is form 6-NDFL. You will find out whether the advance is reflected in 6-NDFL in the next section.

Legislation in order to regulate human labor rights obliges the employer to pay an advance to its employees every half month. If this does not happen, the employer may be held administratively liable for violating the labor rights of citizens.

Along with the salary, the advance is the income of employees, therefore it is subject to income tax, which means its place is in 6-personal income tax. We’ll figure out how to reflect an advance in 6-personal income tax in this article.