Alimony: what is it?

According to the Code of Laws on Marriage and Family of the Republic of Belarus, one of the property parental responsibilities is the obligation to support their children. This is not only about the maintenance of minors, the article also answers the question in what cases alimony is paid after 18 years of age in Belarus. Thus, children under 18 years of age have the right to maintenance, as well as later if they are recognized as needy disabled people. If such maintenance is not provided by either parent, funds for it may be recovered through the court. The collected funds will be called alimony.

Child support can be paid as a share of earnings or as a fixed amount, in kind or in the form of transfer of property, by court order or voluntarily if the parents have signed a child support agreement.

It is important to understand that parents' child support obligation may arise regardless of whether they are divorced or live together with their children; it occurs when they shirk their parental responsibilities, for which they can be held accountable.

Find out more about what alimony is.

Who can receive alimony

Persons entitled to receive alimony payments:

- minors and disabled children over 18 years of age - from their biological parents;

- women carrying babies if they became pregnant before the couple divorced - from ex-husbands;

- divorced parents who care for common children under 3 years of age, disabled minors, children over 18, recognized as disabled - from a former spouse;

- parents who need financial assistance from their working children;

- former spouses who have lost their legal capacity as a result of illness, by court decision - from the spouse with whom they were married.

Most often, courts deal with child support cases. Some unscrupulous parents try to hide the amount of their income in order to reduce their maintenance. In 2021, the law provides for a minimum amount of alimony in the Republic of Belarus, so the possibility of hiding the level of your salary and evading payments is excluded.

The minimum maintenance amount has a direct relationship with the budget included in the subsistence level. The minimum amount of child support in the Republic of Belarus is:

- for one child – half the subsistence level;

- for two children – three quarters of the minimum;

- for three or more children – the entire minimum amount.

The law does not provide for the maximum possible amount of child support.

Options for paying alimony in the Republic of Belarus

Belarusian legislation provides for two options for paying alimony.

- On a voluntary basis . Responsible parents, without external coercion, take part in the upbringing and financial support of their children. They enter into an agreement where they determine the amount, procedure and time of payments. To obtain it, you need the parents’ passports and children’s birth certificates. Funds are deducted from salary or pension benefits upon a written request by the person willing to pay voluntarily. If residential property is transferred as payment, then title papers for the property will be required. The agreement is concluded by a notary. It is subject to change and can be terminated by agreement of the parties.

- Forcibly . To ensure that the child is not left without a means of support, if the adults cannot agree, alimony for the father or mother can be ordered by the court. There is no state fee when filing a claim. If payments for a child have not been made for more than 3 months, then a criminal case may be opened against the debtor parent or sent to forced employment. If the debtor has real estate or other valuable property, it can be seized in favor of the child to pay off the debt.

Legislation of the Republic of Belarus on alimony

The only law on alimony in Belarus for 2021, which fully regulates the alimony obligation, is the current Code on Marriage and Family (CMF).

In particular, the Code of Social Security of the Republic of Belarus defines the general property responsibilities of parents, fixes their alimony obligation and the amount in which it must be fulfilled, determines the types of earnings from which alimony should be deducted, provides for the possibility of receiving additional maintenance in addition to alimony, and so on. The legislator has provided for the procedure and conditions for concluding an agreement on the payment of alimony, and the procedure for paying and collecting alimony payments.

We must not forget about the Law of the Republic of Belarus dated October 24, 2021 No. 439 “,” which does not directly relate to alimony payments, but regulates the activities of bailiffs who are engaged in forced collection if alimony arrears have arisen in Belarus. In addition, we must not forget about the Code of Administrative Offenses and the Criminal Code of the Republic of Belarus, which provide for administrative (Administrative Code of the Republic of Belarus) and criminal (Criminal Code of the Republic of Belarus) liability for non-payment of alimony.

Child support in Belarus in 2021

The Ministry of Justice of Belarus has explained the new procedure for collecting alimony debt in relation to certain categories of debtors. From July 1, 2021, the basis for calculating alimony arrears will be the average subsistence budget per capita. This principle will be applied by the bailiff only in cases where the debtor does not work or documents confirming his earnings and (or) other income have not been submitted.

Since the amount of alimony will be:

- 50% – the subsistence level budget for the maintenance of one child;

- 100% BPM – for two children;

- 150% BPM – for three or more children.

Amount of alimony for an unemployed person in 2020-2021:

| per child | for two children | for three children | |

| from 1.07.2020 | 123,39 | 246,78 | 370,17 |

| from 1.08.2020 | 128,05 | 256,1 | 384,15 |

| from 1.11.2020 | 129,06 | 258,11 | 387,17 |

| from 1.02.2021 | 131,44 | 262,87 | 394,31 |

| from 1.05.2021 | 136.64 | 273.27 | 409.91 |

In cases where it is difficult to accurately determine the amount of income of the alimony payer or the irregularity of his earnings, the court has the right to assign a fixed amount of payments in basic amounts.

These are the general rules, but the amount of alimony can be established by agreement. The parties to such an agreement are usually former spouses or non-custodial parents. The amount of alimony under the agreement cannot be less than that established by law.

Disabled adult children retain the right to receive alimony for life, or until their ability to work is restored.

In cases where, after a divorce, children remain living with each of the former spouses, alimony may be ordered by the court in favor of the less wealthy parent. The amount and other terms of payments are also established by the court, unless otherwise specified in the marriage contract or agreement.

There are special circumstances when the amount of alimony can still be reduced by court decision. This:

- the first or second disability group of the parent of the alimony;

- the payer has children who, after collecting alimony, find themselves in a worse financial situation than the children receiving it;

- other objective reasons which, in the opinion of the court, do not allow alimony to be paid in full.

The initiator of the reduction in the amount of payments must be the payer; it is his application that serves as the basis for starting legal proceedings.

The described reduction in the amount of alimony is a temporary measure and can be canceled if the payer’s situation improves.

Article 103-6 of the Code of the Republic of Belarus on Marriage and Family stipulates that when paying alimony voluntarily, by agreement of the parties, the amount of payments can be determined:

- as a percentage of the parent's earnings;

- in the amount of a regularly paid specific amount of money;

- in the form of a one-time payment of money sufficient to provide for the child until adulthood;

- by transferring property into the ownership of the child;

- as a combination of the above methods.

In any of the selected options, the total amount of alimony cannot be less than what would be assigned by the court in accordance with current legislation. This assessment is based on the payer’s income at the time the agreement is concluded. When agreeing on the regular payment of a specific amount of money, a decision is also made on its possible indexation, to protect against inflationary processes, for example, linking it to a base value or a stable foreign currency. When transferring property, it is assessed and compared with the approximate total amount of expected alimony before the end of the payment period. The sufficiency of a lump sum cash payment is determined in the same way.

It would not be amiss to recall that in the Republic of Belarus, evasion of alimony payments is subject to administrative, and in some cases, criminal liability. In addition, the punishment imposed by the court does not relieve the obligation to repay arrears of alimony payments. Sometimes the debts of negligent parents accumulate for years, which often ends in correctional labor with the withholding of part of the salary to pay off the amount of debt and pay child support for the current period.

Amounts of child support for two or more children

The amounts of alimony, if they are not agreed upon by the parents in a voluntary contractual manner, are determined in accordance with Art. 92 KoBS RB. According to it, the amount of alimony in Belarus for two children must be collected in the amount of no less than 33% of the monthly salary and other income of the parent obligated to pay alimony.

It should be clarified that, in addition to the share of the alimony recipient’s income, the legislator also determines the minimum amount that must be paid by him if he is not disabled. For two children it is 75% of the subsistence level budget (BMS), which is from 01.11.18 to 31.01. 2021 is 160.66 Belarusian rubles.

A similar approach is practiced when determining the amount of alimony for three children in the Republic of Belarus. The legislator established them in the amount of 50% of the monthly salary and other income of the alimony worker. But in the case of able-bodied parents of three children, a minimum limit has also been established - 100% of the BPM, which is until January 31. 2021 is 214.21 rubles.

By the way, the law does not provide for a maximum alimony limit, which, however, does not prohibit parents from stipulating it on their own.

Child support: procedure, amount and terms of payment

The law obliges parents to support their minor children and disabled adult children in need of financial assistance.

Questions from our readers regarding the collection of child support are answered by And. O. Head of the Compulsory Enforcement Department of the Lelchitsky District Natalya VORONOVICH.

— Natalya Andreevna, from what moment does alimony begin to accrue?

— Alimony begins to accrue from the moment the application is filed with the court. Please note: not from the moment of the court hearing at which the decision will be made, but from the day when the application was accepted in court. Child support for the past can be collected for no more than 3 previous years, and only if the court establishes that before going to court, measures were taken to obtain maintenance funds, which were unsuccessful due to the parent’s evasion from paying them, and also if At the new place of work, this parent did not file a new application for withholding child support.

— When does the payment of alimony stop?

— Child support is paid until the child reaches adulthood. In this case, it does not matter whether the child studies or works. Even if he is a student of a paid department of a university, a parent who does not live together can provide financial assistance for his maintenance only at his own request or if this point was stipulated in the previously concluded Agreement on Children. There is only one exception to this rule: when the child is disabled and at the same time in need.

— What is the amount of child support for minor children?

— In accordance with Article 92 of the Code of the Republic of Belarus on Marriage and Family, alimony for minor children from their parents in the absence of an Agreement on Children, an Agreement on the Payment of Alimony, and also if the amount of alimony is not determined by the Marriage Agreement, is recovered in the following amounts: per child – 25 percent, for two children – 33 percent, for three or more children – 50 percent of the parents’ earnings and (or) other income per month. At the same time, for able-bodied parents, the minimum amount of child support per month must be at least 50 percent for one child, 75 percent for two children, 100 percent for three or more children of the average per capita subsistence budget. These dimensions may be changed by the court.

— What is the procedure for collecting arrears of alimony?

— When calculating the debt, the bailiff is guided by Art. 110 of the Code of the Republic of Belarus on Marriage and Family, which states that in cases where, according to the writ of execution presented for collection, alimony was not withheld in connection with the search for the debtor, alimony should be collected for the entire past period, regardless of the established statute of limitations.

The amount of alimony debt is determined by the bailiff based on the amount of alimony determined by a court order, an Agreement on Children, an Agreement on the Payment of Alimony or a Marriage Agreement.

Alimony debt is determined based on earnings and (or) other income received by the debtor during the time during which collection was not made.

If the debtor did not work during this period or documents confirming his earnings and (or) other income are not submitted, the debt is determined based on the earnings and (or) other income received by him at the time the alimony debt is accrued.

In cases where the debtor is not working at the time of accrual of alimony debt, its amount is determined based on the debtor’s earnings at his last place of work, and in the absence of information about this or if more than three months have passed since the dismissal, based on the average salary of employees in republic.

— Does the law provide for a voluntary procedure for paying child support?

— Payment of alimony for the maintenance of minor children can be made voluntarily or judicially. Alimony can be paid voluntarily by the person obligated to pay alimony, or by deduction from wages at the place of work or at the place of receipt of a pension, allowance, scholarship, or other payments.

In accordance with paragraph 132 of the Instructions for Enforcement Proceedings, approved by Resolution of the Ministry of Justice of the Republic of Belarus dated December 20, 2004 No. 40 (as amended and supplemented), persons who have expressed a desire to pay alimony voluntarily (without having a writ of execution) have the right to contact the administration at the place of work or receiving a pension, benefits, etc. with a written application, withhold alimony and pay or transfer by mail the collected amounts to the person specified in the application.

A legal entity is obliged to withhold alimony upon a submitted application in the same manner as under a writ of execution.

The written application of a person who has expressed a desire to voluntarily pay alimony must indicate:

last name, first name, patronymic and date of birth of the child for whose maintenance alimony should be withheld;

last name, first name, patronymic and address of the person to whom alimony should be paid or transferred;

the amount of deduction as a percentage of monthly income received.

Applications for the withholding of alimony, as well as for changing their amount or for terminating the withholding of alimony, are stored by the administration of the enterprise, institution, or organization in the manner established for storing executive documents. For the loss of such a statement, an official of an enterprise or institution is liable, as well as for the loss of a writ of execution.

The voluntary procedure for paying alimony does not exclude the right of the claimant to apply to the court at any time to collect alimony.

— Natalya Andreevna, tell us about the judicial procedure for paying and collecting alimony?

— In the case of a judicial order for the payment of alimony, the bailiff sends a writ of execution to a legal entity or citizen for whom the debtor works or receives wages and other income equivalent to it, with a proposal indicating the amount and frequency of their deduction, as well as the debt on them in a fixed amount of money (if available). In an organization, this executive document must be registered no later than the day following the day of receipt and transferred to the responsible person in the accounting department against signature. The accounting department also registers this document in a special journal or file cabinet and within three days notifies the bailiff of its receipt by sending a return notification. It should be noted that the legislation provides for liability for the loss of executive documents, therefore the organization must establish a clear procedure for their storage.

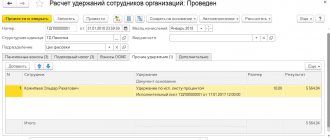

When you receive a writ of execution to the accounting department, we recommend that you carefully study these documents, since often the withholding of alimony begins from a certain date, which means that alimony from the employee must be collected not on the basis of monthly earnings, but from the specified date. For example, an employee of an organization received a salary for May 2014 for 20 working days in the amount of 2,500,000 rubles. (the amount of withheld income tax was RUB 215,400). The organization received a writ of execution with a proposal to withhold alimony from this employee from May 27, 2014 in the amount of 25%.

Thus, since in this situation, in accordance with the writ of execution, the withholding of alimony begins from a certain date, alimony must be collected from the employee not based on earnings for May, but from the specified date - from May 27.

To determine the amount of alimony for May, it is necessary to calculate the due amount of income for the part of the month after the date of occurrence of obligations to pay alimony, namely from May 27, 2014, and then calculate alimony from this amount based on the percentage established in the writ of execution. The base for calculating the amount of alimony is determined as follows: (2,500,000 − 215,400) / 20 × 5 = 571,150 rubles; the amount of alimony will be: 571,150 × 25% = 142,788 rubles.

— What is the procedure for withholding alimony?

— Withholding of alimony is carried out at the place of payment to the debtor of wages and income equivalent to it, simultaneously with their calculation once a month from the amount that is due to the debtor for payment. The withheld amounts are sent to the collector at the expense of the debtor. The accounting department at the place of main work, receipt of a pension, service (study) of a person obliged to pay alimony, upon receipt of information about the debtor’s other work (part-time work) and the income he receives, within three days, must notify the claimant and the enforcement department at the location of the legal entity in writing. persons about the debtor’s combined work and other additional income.

Withholding of alimony for the maintenance of minor children is made from all types of earnings (monetary remuneration, maintenance, monetary allowance) and additional remuneration, both at the main place of work and for part-time work, which are received by parents working in organizations of any organizational and legal forms, as well as on the basis of labor contracts in peasant (farm) households and individual entrepreneurs, in cash and in kind. For example, an employee of an organization received a salary for May 2014 in the amount of RUB 1,850,000. (the amount of withheld income tax was RUB 137,400). The organization received a writ of execution with a proposal to withhold alimony from this employee in the amount of 25%.

The base for calculating the amount of alimony is determined as follows: 1,850,000 − 137,400 = 1,712,600 rubles. The amount of alimony will be: 1,712,600 × 25% = 428,150 rubles. Next, we compare the amount of alimony with 50% of the average subsistence level budget per capita. In May 2014, the amount of BPM amounted to 1,212,470 rubles, and 50% - 606,235 rubles. Taking into account the fact that the amount of alimony withheld is less than 50% of the BPM, it is necessary to withhold and transfer the amount of 606,235 rubles to the alimony recipient.

— From what income is alimony not withheld?

— In the Republic of Belarus, the legislation clearly defines the income from which alimony is not withheld. This:

severance pay paid upon dismissal (with the exception of severance pay, the amount of which exceeds the average monthly earnings of the alimony payer);

compensation for unused vacation paid upon dismissal (with the exception of compensation for several unused vacations if they are combined over several years);

compensation payments in connection with a business trip, transfer, hiring or assignment to work in another location, with depreciation of tools belonging to the employee, and other compensation provided for by labor legislation;

one-time bonuses issued not from the wage fund;

state benefits for families raising children, except for cases established by law;

funeral benefits;

benefits and payments to citizens affected by the accident at the Chernobyl nuclear power plant;

care supplements to pensions established by law.

financial assistance provided in connection with a natural disaster, fire, theft of property, injury, birth of a child, marriage registration, illness or death of the alimony payer or his close relatives;

the amount of therapeutic and preventive nutrition issued in accordance with labor legislation.

The most common mistake made by accountants is that they withhold alimony from earnings minus income tax and mandatory contribution (pension insurance) to the Social Protection Fund of the Ministry of Labor and Social Protection of the Republic of Belarus.

We clarify that the payment of a mandatory contribution to the Social Security Fund is not regulated by tax legislation, therefore, it is not a tax (clause 3 of Article 6 of the Tax Code). Thus, if the specified contribution is deducted from earnings before alimony is withheld, there is an underpayment of the amount of alimony due to the recipient.

Let me also remind you that if, when calculating income tax, the alimony payer is not provided with standard tax deductions for dependents (minor children) (subclause 1.2 of Article 164 of the Tax Code), the base for withholding alimony and its amount are reduced.

— Our reader A. Butkovets contacted the editor. She said: “I am divorced from my husband. He works in . Its director, Yuri Petrovich Sologub, did not pay me my husband’s alimony from January 2014 to September, despite the fact that it was accrued. On September 5, alimony was paid for 4 months without interest on the debt. Is this a violation of the law?

— The employer paying wages is obliged, on the basis of a written application or writ of execution:

withhold monthly alimony in the established amount from wages and other income of the payer;

no later than three days from the date of payment of wages and other income, pay the withheld alimony to their recipient by issuing from the organization’s cash desk, transferring to his account or transfer by mail (Part 1 of Article 105 of the Code of Laws of Ukraine).

In practice, a situation may arise when the alimony payer, on the basis of an application, is granted leave without pay (Article 190 of the Labor Code). No wages are accrued for this period and, therefore, alimony is not withheld. During such leave, the employee incurs arrears in alimony, since in the proposal attached to the writ of execution, the bailiff is ordered to withhold and pay them monthly and regularly. This debt can be identified by a bailiff during an inspection carried out to monitor the correct and timely deduction of alimony. The bailiff will determine the amount of debt, which the accountant will still have to withhold from the payer’s earnings in the future. It should be noted that the accountant has the right (but is not obligated, since this is not provided for by law) to independently inform the bailiff in writing about the period when the alimony payer was on leave without pay.

Due to downtime or other circumstances that occurred for reasons beyond the control of the employees, underpayment of alimony may occur. In such cases, alimony is withheld in the established amounts from actual earnings for the period worked under the specified circumstances. The amount of underpayment due to downtime or other circumstances beyond the payer’s control must be determined by bailiffs when the employer contacts them. For example, an employee of an organization who pays alimony for one child (25% of earnings) due to the fault of the employer, worked for less than a full month (16 days out of 20 workers). The base for withholding alimony for time actually worked is 2,000,000 rubles, alimony for 16 working days is 500,000 rubles. (2,000,000 x 25%), alimony for one working day - 31,250 rubles. (500,000 : 16).

The shortfall in alimony, based on the earnings that would have been due to the employee with a normal working month, will be 125,000 rubles: 31,250 x (20 – 16). The total amount of alimony that the claimant must receive is 625,000 rubles. (500,000 + 125,000). In this case, 500,000 rubles. will be withheld from the alimony payer’s earnings, and 125,000 rubles. – compensated by the FSZN authorities with subsequent reimbursement of this amount by the employer.

The shortfall in alimony payments to the claimant is compensated by the Social Protection Fund of the Ministry of Labor and Social Protection of the Republic of Belarus. In the future, the employer reimburses the Fund the amount of compensation from his own funds during the next transfer of insurance premiums.

To receive compensation to alimony claimants, organizations submit an application to the Federal Social Security Fund authorities at the place of registration, attaching a certificate from the judicial authorities confirming the debt for the amounts not received by the claimants. Within five working days, the FSZN bodies check the accuracy of the submitted applications, fill them out and send them to the regional and Minsk city departments of the Fund, which, within three working days after receiving the specified documents, transfer the organization’s funds to the current (settlement) account or an open account for accounting of funds of the Federal Social Security Fund.

— What if the alimony payer quits?

— When dismissing an alimony payer, the organization’s accounting department:

makes notes on the writ of execution about all alimony deductions made and the amount of remaining debt, and certifies them with a seal;

indicates information about the new place of work or residence, if known;

sends, within three days, by valuable or registered mail, the enforcement document to the compulsory enforcement department that sent it, with mandatory notification of this to the compulsory enforcement department in whose area of activity the organization is located.

It should be remembered that the bailiff at the location of the organization in which the alimony payer works monitors the correctness and timeliness of withholding funds. Inspections are carried out according to the schedule, as well as upon receipt of a complaint from the alimony collector. Based on the results, accounting audit reports are drawn up indicating the identified deficiencies and the deadlines for their elimination.

Officials, within the period established by the bailiff, but not more than 10 days, are obliged to take measures to correct the shortcomings and violations identified during the inspection and notify the enforcement department in writing.

Officials of the organization who are guilty of failure to comply with the requirements of the bailiff to foreclose on the debtor's funds held by other persons and specified in the proposal of the bailiff, as well as failure to comply without good reason with the requirements for the provision of information about the debtor's wages, as well as the loss of the bailiff document, spending the withheld amounts for other purposes, failure to report (or untimely reporting) information about a change in the place of work of the alimony payer, delay in returning the writ of execution upon dismissal of the payer, may be held liable in the form of a fine in the amount of 10 to 30 basic units (Art. 24.9 of the Code of Administrative Offenses).

“Unfortunately, there are often situations when parents try in every possible way to evade paying child support.

— In such cases, our responsibilities include checking the debtor’s income, and in the absence of the debtor’s earnings, we foreclose on the debtor’s property, which can be foreclosed on in accordance with the law. One of the interim measures in accordance with current legislation may be a judicial restriction on travel outside the country for the debtor. Sometimes alimony payers agree with the employer to understate their legal earnings. However, it is important to know that such fraud is fraught with consequences.

Parents obligated to pay child support should also be aware that if they evade paying child support for more than 3 months during the year, criminal liability may arise.

Interviewed by Nina PODOLSKAYA.

If you find an error, please select a piece of text and press Ctrl+Enter.

Like Like Love Haha Wow Sad Angry

Amount of payments per child

As for payments per child, Art. 92 CoBS RB defines them in the amount of 25% of the labor and other income of the payer’s parent. At the same time, the minimum amount of child support in Belarus in 2021 is 50% of the BPM, which until February 2021 corresponds to the amount of 107.11 rubles. Further, by a resolution of the Ministry of Labor, the BPM may be changed, which will entail a change in the amount of minimum alimony payments.

However, this procedure applies only to general cases: if the amount of income cannot be determined or it is irregular, the judge has the right to determine the amount of payments that is a multiple of the basic values (the abstract nominal purchasing power of Belarusian rubles), which since the beginning of last year has been 24.5 rubles.

Please note that the above alimony minimum of 50% of the BPM is the minimum alimony in Belarus in 2021 for working or able-bodied (except for exceptions) citizens. Disabled people of groups I and II and parents with other children, under certain circumstances, can count on a reduction and sometimes even the abolition of child support obligations, which we will discuss below.

Amount of alimony payments by agreement and without

How much financial assistance a parent who does not live with the child will depend on whether the former spouses came to a common decision or not. If the settlement agreement is not signed, the court determines the payment. In accordance with Belarusian legislation, in 2021 the state cannot assign deductions from the official income of the alimony worker to more than 70%.

In most cases, the judge focuses on the number of common children:

- if the first parent is raising one child, the obligation of the second is to pay 25% of the monthly official earnings;

- if there are two children, the amount of alimony can reach 33%;

- three children or more have the right to claim payment of 50% of the father’s (mother’s) earnings.

When drawing up an agreement, the spouses independently indicate in what amount and when the alimony provider will transfer money to the second parent’s bank card to support the child. Cash payments may exceed the legal limits if the spouse can afford it.

It is not necessary to pay money every month. You can agree on contributions once every 3 months or six months, depending on the wishes of the spouses. It is better to reflect the agreement on paper. Otherwise, if the alimony provider suddenly refuses to pay the money, which often happens, it will be almost impossible to prove his case in court.

Income from which alimony is paid

The CoBS does not directly answer the question of what income is used to pay alimony in the Republic of Belarus, mentioning only that such income must be determined by the government. This was approved by Resolution of the Council of Ministers of the Republic of Belarus dated August 12, 2002 No. 1092. It also included such income as:

- any salary, bonuses, salaries and compensation, additional payments, maintenance, allowances and compensation received from the employer;

- income from authorship, teaching, expert, curatorial, advisory, excursion and other activities that generate income;

- pensions, scholarships, benefits, compensation, additional payments and other forms of social assistance;

- income received from entrepreneurial, investment, financial, economic, managerial and other activities;

- income from leasing and subleasing property, income from loan agreements, shares, bonds and other securities, and so on.

Please note that this is not all the income from which alimony payments can be withheld. You can find out the full list.

From what types of income is alimony withheld?

Every person, even the unemployed, has an income from which he eats, dresses, and pays utility bills. Different types of profit can act as sources of income:

- unofficial cash payments;

- wages issued at a permanent place of work with official employment;

- working as a freelancer;

- profit received from business activities;

- scholarship;

- pension, except for disability assistance;

- payment for renting an apartment by a tenant;

- benefits accrued to a bank card related to unemployment;

- bonus, one-time remuneration.

In any case, in order for the court to take another source of income into account, it must be documented. That is, if the parent with whom the child lives claims that the second, in addition to salary, has an unofficial additional payment at his official job, it is necessary to provide comprehensive evidence. Without evidence, alimony is calculated based on the official salary.

How to apply for alimony in Belarus

The behavior strategy of a parent who wants to arrange child support payments should first of all depend on the relationship with the second parent. For example, before applying for alimony in Belarus to a single mother, you first need to confirm the origin of the child from a specific father.

In general, the family legislation of the Republic of Belarus provides for two options for assigning payments - a contractual and a judicial procedure. The contractual agreement involves the signing of an alimony or other agreement, which will determine, among other things, the specific amount of monthly payments. However, its conclusion does not deprive the parties of the right to go to court for a similar purpose. Let's consider both options in more detail.

Signing a child support agreement

In the classical definition, a child support agreement is usually understood as an agreement between parents, signed in accordance with the Code of Laws of the Republic of Belarus. It is concluded in accordance with the rules provided for by the Civil Code of the Republic of Belarus for registration of civil transactions, in writing and is subject to notarial registration (and in the case of transfer of real estate under it, also state registration), without which it is considered invalid. The parties can determine the amount of payments, in what ways alimony can be paid, in Belarus, it is also permissible to determine the procedure and conditions for transferring money, and so on.

Please note that, according to the Code of Laws of the Republic of Belarus, when determining the amount of alimony in the agreement, it cannot be lower than the minimum established by Art. 92 codes. In this case, acceptable methods of payment are considered to be a percentage of earnings, a periodic or lump sum fixed amount, or the transfer of property.

With the consent of the parents, they can independently change or cancel individual terms or the entire agreement. Moreover, this is also permissible in court, for example, if there is a significant change in financial or family circumstances.

With all this, an alimony agreement is not the only form of agreement in which alimony payments and the procedure for their transfer can be stipulated. In particular, this is permissible in an agreement on children (KoBS RB) or a marriage contract (KoBS RB). In addition, the KoBS RB does not rule out that a parent can voluntarily transfer funds, without signing any agreements or legal proceedings.

Awarding alimony in the Republic of Belarus

If an agreement could not be reached, and the parent has not started paying child support voluntarily, the only option is to seek the transfer of money through the court. At the same time, it does not matter how to apply for alimony: without a divorce in Belarus in 2021 or after having divorced.

In essence, the responsibility to support your child is a parental one and has nothing to do with marriage. Thus, the right to file for alimony can be exercised even if the parents were never married and never lived together.

The KoBS RB allows you to apply for alimony without observing any statute of limitations - throughout the entire period while they can be collected, that is, until the child’s eighteenth birthday, regardless of how much time has passed since the right to alimony arose.

The plaintiff has the right to recover money for maintenance for the past period, but no more than 3 years preceding the filing of the claim. Debt incurred subsequently will be collected in a different manner.

Next, we will figure out what the applicant needs to do.

Where to file a claim

The first thing that is necessary is to file a claim for alimony in court. According to the Code of Civil Procedure of the Republic of Belarus, this should be a district or city court that will hear the case as the first instance. Code, in this case, allows the plaintiff to apply to the court both at the place of residence of the alimony provider and to the court in the area of his place of residence. Please note that the legislator allows both writ and lawsuit proceedings in alimony cases.

Package of documents

Next, we will figure out what documents are needed to apply for alimony in Belarus in 2021. First of all, the applicant needs to prepare an application to initiate writ proceedings that meets the contents of the Civil Procedure Code of the Republic of Belarus. It is submitted if there is no need to involve third parties and there is no dispute about recognition of paternity.

In other cases, as well as when the alimony provider provides his objections, the applicant will need a statement of claim, which in its content must meet the requirements of the Code of Civil Procedure of the Republic of Belarus. Any such statement must contain:

- name of the court;

- personal data and contacts of the parties;

- the essence of the circumstances that preceded the violated right;

- exact designation of the requirement for collection of alimony and its amount;

- the facts with which the plaintiff substantiates his claims;

- evidence confirming each of these facts;

- indication of other significant circumstances;

- list of applications.

The statement of claim is submitted in triplicate. Now let’s look at what certificates are needed to submit for alimony in Belarus along with the application. These include:

- copy of the passport;

- a copy of the common child’s birth certificate;

- a copy of the marriage and divorce certificate (if available);

- certificate from place of residence about family composition;

- a certificate of the debtor’s salary (they can independently request it in court);

- other documents to support the circumstances described in the application.

Please note that when collecting documents to apply for alimony without divorce in Belarus, parents must adhere to the same list. There is no additional list of documents for married people.

Trial

As we have already said, consideration of an alimony case is possible through writ or lawsuit proceedings. Thus, by order, consideration is carried out without calling the parties, solely on the basis of the documents provided by the applicant.

If all applications and documents are prepared properly and the judge has no grounds for refusing the request, he issues a ruling to issue a court order, which he sends to the alimony provider. He has 10 days to submit objections to it. If they are not received within 10 days, then, according to the Code of Civil Procedure of the Republic of Belarus, the judge certifies the ruling and issues a court order to the claimant for execution. If objections are nevertheless received, the judge must cancel the previously issued ruling, and also explain to the applicant that he has the right to apply for the award of alimony through a claim proceeding. Next, the plaintiff will have to file a statement of claim, wait for a court hearing to be scheduled, take part in it and support the claims.

Based on the results of the consideration, the court will make a decision that will most likely satisfy the plaintiff’s demands. Next, he will have to obtain a writ of execution from the court office, which must be sent for execution to the territorial enforcement agency at the place of residence of the alimony holder. Then enforcement officers will deal with enforcement.

How to get alimony?

In general, we can say that the right to alimony occurs when three main conditions are met. First, the recipient of alimony and the payer are family or related. Secondly, those who receive alimony cannot provide for themselves. Third is the lack of a common family household.

Why do they apply for alimony?

Child support is an obligation enshrined in the Code of Marriage and Family. If one parent does not participate financially in the upbringing, the other parent may request child support. It does not matter whether the spouses are married or divorced.

Another responsibility is financial assistance to disabled parents.

Who has the right to receive alimony?

- minor children (payments from parents);

- adult children if they are disabled (payments from parents);

- disabled parents (payments from able-bodied children);

- one of the spouses who became disabled (payments from the other spouse);

- a spouse who is on parental leave for a child under 3 years of age or is raising a disabled child.

Until what age is child support paid?

If the child is healthy, then payments continue until adulthood - up to 18 years. However, child support after 18 years of age must be paid in the following situation:

- disability of a child after 18 years of age - for life or until the disability is lifted.

In what situations can a mother on maternity leave for up to 3 years count on child support for herself, and not just for the child?

A parent on maternity leave can count on financial assistance from the other parent if the latter has the means to make such payments. It does not matter whether the parents are married or divorced. If a parent enters into a new marriage, then in this case he is no longer entitled to alimony.

By the way, a pregnant woman has the right to financial assistance from her spouse if the pregnancy occurred before the divorce process.

Child support for parents

Payments to parents are not the most popular type of alimony in Belarus, however, they are also provided for by law.

In what cases can a parent collect child support from children?

According to the Code of the Republic of Belarus on Marriage and Family, children are obliged to take care of their disabled parents. Disabled parents are:

- pensioners;

- disabled people of groups 1 and 2.

In this case, the court will examine in detail whether the parents have enough to live on. It is necessary to prove that the money is not actually enough to meet basic needs.

Parental support must be paid by every able-bodied adult child. Even if the parents went to court to recover from only one child.

How much can parents get?

Unlike child support, parental support is not limited by law to a minimum value. The court assigns the amount that the parents need for a normal life, and which is feasible for the child.

This can be a fixed amount or an amount that is a multiple of several basic amounts.

Is a child obligated to support his parents if they are deprived of parental rights?

No, in this case, the legislation of the Republic of Belarus exempts the child from the need for payments. The court may also deny child support to parents if evasion of parental responsibilities is proven.

Ways to receive alimony

Is it necessary to go to court?

No, there are two ways to assign payments - judicial and voluntary. If there is a voluntary agreement between the two parties, it must be secured by a notary. You need to take two passports and the child’s birth certificate to the notary. In addition, you must first agree on the form of payment of money - cash or non-cash, and the timing of payments.

Another option is to enter into an agreement regarding children during the divorce process.

How can you pay child support with a voluntary agreement?

If the case goes to court, then the parent has only two options. You can pay:

- a fixed amount monthly (it must be a multiple of the base amount);

- percentage of wages.

A voluntary agreement involves more options:

- a regular fixed amount (it is not necessary to pay monthly, it could be, for example, quarterly payments);

- the amount paid in one lump sum without subsequent alimony;

- percentage of income;

- transfer of expensive property.

Even with a voluntary agreement, the amount of alimony cannot be lower than the amount established by law.

Is it possible to go to court if the conditions of voluntary appointment are no longer satisfactory?

Yes. A mutual agreement does not cancel the right to go to court.

How to transfer money with a voluntary agreement?

It is better to do this by postal order or transfer to an account. In this case, the transfer of money can be proven. As a last resort, when handing over money, you need to write a receipt.

Going to court when applying for alimony

If a voluntary agreement cannot be reached, you can go to court.

Where to write an application for alimony?

It is advisable to submit the application to the court at the defendant’s place of residence. But you can declare your desire to request alimony in the court at the plaintiff’s place of residence. Sample application for collection of alimony .

What types of statements are there?

You can submit a statement of claim and an application to the court in the order of writ proceedings.

If the parents have agreed, they do not have other children for whom alimony is paid, and there is no need to establish paternity, then it is better to file an application for the collection of alimony for the child (children) in the order of writ proceedings. Why is it more convenient?

An application for writ proceedings does not require a court hearing or summoning the participants to court. Everything happens quickly and easily.

If the parents do not agree, then you need to write a statement of claim to the court. .

How long does it take to process a claim?

The application must be reviewed within a month. During this period, all parties to the dispute must come to court.

What documents are needed to establish alimony?

List of required papers:

- copies of passports;

- a copy of the marriage or divorce certificate;

- a copy of the child's birth certificate;

- a document from the housing authorities confirming that the child lives with the plaintiff;

- certificate of the defendant's salary.

The court may also request other documents.

Is it necessary to pay a state fee for someone who files an application to court for alimony?

No. According to the Tax Code, the applicant is exempt from such obligation. But after the trial, the defendant will have to pay the fee.

Can alimony be collected for periods before going to court?

As a general rule, no. Deductions are made after the trial. But in rare cases, the amount for the past period may be established. This is what the court does if the plaintiff has already made attempts to obtain money for maintenance, but the defendant has avoided his duties in every possible way.

What to do if the father does not recognize paternity?

It is necessary to write another statement of claim to establish paternity. If the father denies paternity at trial, a genetic examination will be ordered.

Amount of alimony in the Republic of Belarus

The court sets the amount of alimony and the terms of payment if the parents could not agree on their own.

What is the amount of child support for one child?

A court order most often orders one parent to pay a certain percentage of their salary. Child support for one child cannot be less than 25% of income.

The second option is to assign a fixed amount, a multiple of the minimum wage. The maximum amount is not limited by law.

What is the amount of child support for two children?

The minimum percentage of wages that must be deducted for two children is 33% of income.

How much child support should I pay for 3 children?

For three children, the law obliges the parent to pay at least 50% of the salary.

What is the minimum amount of child support in numbers?

A new procedure for collecting alimony debt in relation to certain categories of debtors will be introduced from July 1, 2021. The Ministry of Justice of Belarus has clarified the new procedure for paying alimony in the case when the debtor does not work or documents confirming his earnings and/or other income have not been submitted.

- for one child – 50% of the average cost of living budget per capita;

- for two children – 100% of the BPM;

- for three children – 150% BPM.

From May 1, 2021, the cost of living budget is 273.27 rubles. Accordingly, the minimum payments for children for unemployed parents will be:

- per child – 136.64;

- for two children – 273.27;

- for three children – 409.91.

Amount of alimony for an unemployed person:

| per child | for two children | for three children | |

| from 1.07.2020 | 123,39 | 246,78 | 370,17 |

| from 1.08.2020 | 128,05 | 256,1 | 384,15 |

| from 1.11.2020 | 129,06 | 258,11 | 387,17 |

| from 1.02.2021 | 131,44 | 262,87 | 394,31 |

| from 1.05.2021 | 136.64 | 273.27 | 409.91 |

The next increase in the cost of living budget will occur on August 1, 2021.

What to do if the parent obligated to pay child support is unemployed?

A parent's lack of work does not relieve him of responsibility for the child and the obligation to pay child support. His monthly transfers cannot be less than the minimum values established by law.

It is taken into account that the amount of alimony for an unemployed person cannot be at the level of an employed person. Therefore, the following rules have been developed:

- the first three months after dismissal, alimony is calculated based on the average salary at the last job;

- after three months, the calculation is based on the average salary in the country;

- if a parent is officially registered as unemployed (at the Employment Center), then deductions for child support are made from unemployment benefits.

What to do when your ex-spouse hides part of his income?

Sometimes problems arise if a parent works in another country. As for working in Russia, you can submit an application to a Russian court. Regarding other countries, each specific case must be analyzed based on international agreements between countries.

If a parent works in the Republic of Belarus but hides part of their income, you can apply for additional documents on income. This is not a very simple situation. The outcome of the case will depend on the qualifications of the lawyer.

For what reasons can alimony be reduced?

In some cases, the parent who pays child support may sue to review the amount of the payments. A decrease may occur if:

- the parent has been assigned disability group 1 or 2;

- if children living with their father receive less from him than the child who is entitled to alimony;

- if there are other circumstances that, for objective reasons, prevent the father from paying the previously established amount.

Is it necessary to pay child support to the father during periods when the child lives with him for a long time (for example, summer holidays)?

Parents can go to court and enter into a settlement agreement for such periods.

What to do if a child needs treatment and the amount of child support is not enough?

If a child has been diagnosed with a serious illness, or other force majeure circumstances have occurred, then you can go to court. In these cases, the former spouse is obliged to help financially with treatment or rehabilitation.

Evasion of alimony payments

If the court rules that the defendant is obliged to pay alimony, then administrative or criminal liability is assumed for evasion of payments.

Why didn't the alimony payments arrive on the card?

There may be technical reasons (delay in the bank’s work, incorrect card details for transfer, etc.). Another reason is that the person who was supposed to make the transfer simply did not do it.

Are there penalties if child support is always paid late?

Yes, the alimony payer, in addition to the basic amount, will have to pay another 0.3% of the debt amount for each day of delay.

When does administrative responsibility arise?

Punishment is possible if the person who must pay alimony did not inform the bailiff about:

- change of place of residence;

- changing jobs;

- about the appearance of additional income.

When does criminal liability arise for evading alimony payments?

According to Article 174 of the Criminal Code of the Republic of Belarus, if there is a debt for more than 3 months (not necessarily in a row, it can be a total of one year), then the defaulter faces one of the penalties:

- community service;

- correctional labor (up to 2 years);

- arrest (up to 3 months);

- restriction of freedom (up to 3 years);

- imprisonment (up to 1 year).

If the defendant has already been punished for evasion, then in case of repeated debts the penalties will be harsher. For example, imprisonment for up to 2 years.

Is there liability for late provision of data on the transfer of alimony?

No, such liability is not provided for by law.

What needs to be done for a criminal case to be initiated?

You must write an application to the police department at your place of residence.

The procedure for calculating and withholding alimony

Next, we will figure out how alimony is calculated in Belarus and in what order it is withheld. The calculation procedure, by and large, does not depend on the basis on which payments are collected. So, the first case is the voluntary payment of alimony. Without a court decision, the parent independently transfers funds to the mother’s account or writes an application for such a transfer and submits it to the place of work. In this case, the employer makes the deductions described in the application and transfers them to the specified account or sends them by postal order.

A similar procedure is provided if alimony is calculated in the Republic of Belarus according to an executive document (agreement, court order or writ of execution). Thus, for forced collection and calculation of alimony, any of the above documents must be sent to the territorial department of forced collection at the debtor’s place of residence. Based on it, the bailiff:

- will open enforcement proceedings;

- will accrue the amount of debt incurred over the past period of time;

- will search for the alimony holder and identify his place of employment or other permanent source of income;

- will send the writ of execution for execution at the place of work or other place of receipt of income.

In the future, the deduction and transfer of alimony to the claimant to the account or by postal transfer will be carried out by the accounting department of the enterprise.

The period for which alimony is transferred in the Republic of Belarus usually depends on the timing of salary receipt. As a rule, alimony is transferred to the mother’s account within 2-3 days after the date of payment of the salary. However, this is the case in the case of collection from wages: if the funds are paid not from it or from other regular payments, the terms of accrual must be stipulated by the executive document, in particular, by the agreement.

If the alimony worker does not work or works unofficially, and also does not have any other official income and does not independently transfer funds to the child, then the bailiff accrues the debt to him and also applies enforcement measures. In particular, he may be limited in his ability to travel abroad, as well as have his existing property seized and subsequently foreclosed upon. This could be funds in banks, deposits, vehicles registered to the debtor, real estate, and so on.

Option for collecting alimony

There are two options for withholding alimony :

1. voluntary (if the spouses were able to agree on the amount of deductions or another method of payment) - here the form of payment can be any - from payment of a certain% of earnings to the transfer of movable / immovable property to pay alimony or a combination of methods.

2. forced (if it was not possible to reach an agreement) - there are two payment options here: - in the form of a % deduction from wages; - in the form of a link to the volume of the base value (minimum wage) - usually if the parent does not work or has an unstable income.

Collection of alimony from abroad

Belarusian legislation provides for the obligation of parents to allocate funds for the maintenance of their children, regardless of which country the parents are citizens of and where they live. However, if the collection of alimony in Belarus occurs transparently and clearly, then in cases where the debtor managed to leave the country, everything is not so simple. The collector’s behavior strategy in this case should depend on the situation that has developed, as well as the country in which the debtor is located:

- If the defaulter is located in the CIS, and the collector already has a writ of execution, then, in accordance with the Convention on Legal Assistance in Civil, Family and Criminal Matters of 1993, he can send it through the regional department of justice to the court of the country at the place of execution. If such a writ of execution goes through the procedure of recognition by a court of another CIS country, recovery will be carried out according to its legislation, but in the amounts provided for by the sheet.

- The Republic of Belarus also has bilateral agreements similar to the Convention on Legal Assistance with Iran, Vietnam, China, Latvia, Lithuania, Poland and a number of other countries. If such an agreement on legal assistance is concluded with the country in which the alimony recipient is located, the mechanism discussed above is in effect, requiring recognition of the court decision in another country through the Ministry of Justice of the Republic of Belarus.

- Please note that since the end of 2021, the State Emergency Committee Convention has been in force in the Republic of Belarus, which provides for the same recognition procedure, which applies to 27 European countries, Turkey, the USA, Brazil, Montenegro, Norway, Albania and some other states - all of them can recognize the decision of the Belarusian court decisions on the collection of alimony.

- If the debtor is located in the territory of a country with which the Republic of Belarus does not have an agreement on legal assistance, the claimant has the right to apply to the court of that state to assign payments.

In any other case, it will not be possible to collect alimony; you will have to wait for the debtor to return.

Alimony from the unemployed

The fact of unemployment and lack of income does not relieve the parent of his responsibility. How much alimony you need to pay if you don’t work in Belarus depends on several circumstances:

- the amount of alimony in the writ of execution (if there is a fixed amount, a multiple of the basic values, the fact of unemployment does not affect anything - the debtor will have to pay exactly as much as indicated);

- duration of being unemployed;

- the average salary in the region where the alimony worker lives;

- registration with the employment service.

It is clear that in most cases, alimony is awarded as a share of the salary. But since in its absence the application of this principle is impossible, other calculation options are provided:

- during the first three months after leaving work, the amount of child support for an unemployed person in Belarus in 2021 will be calculated from his previous salary;

- After a three-month period, alimony is calculated based on the average salary in the region of residence.

Please note that if, after dismissal, the alimony worker registers with the Belarusian employment service and begins to receive unemployment benefits, the amount of payments will no longer be calculated from the salary, but from such benefits. But regardless of how much child support a non-working person must pay, the amount of payments per child cannot be lower than 50% of the BPM, that is, no less than 107.11 rubles (until January 31, 2021). Minimums for two and three children are listed above.

According to what laws must an unemployed person pay child support?

The amount of alimony for an unemployed person in Belarus is determined according to the same legislative acts as for other payers. The first of these legislative acts is the Code on Marriage and Family. It explains the basic rights and responsibilities of spouses, children and parents. As well as material obligations in the event of family breakdown, incl. all determining aspects of the assignment and collection of alimony.

With regard to alimony for an unemployed person, the following are of particular importance:

- Articles 30, 31, 32 and 40 – regulate the maintenance of former spouses and determine the grounds for this;

- Article 33 – determines the termination of maintenance of former spouses;

- Article 91 – provides the grounds on which parents are obliged to support minors, and in certain cases, adult children;

- Article 92 – determines the amount of alimony as a percentage of earnings and the amount of alimony for an unemployed person as a percentage of the subsistence level;

- Article 102 is devoted to alimony collected from children to support disabled parents.

Maintenance obligations, incl. Child support from the unemployed is also covered by a number of articles of the Code on Marriage and Family. In them, the unemployed are not identified as a special group of payers, but act on a general basis.

Amount of alimony from an unemployed person in Belarus

It is not difficult to calculate how much alimony the unemployed, as well as people with irregular earnings, pay. Here, as with working people, a certain percentage is deducted, but not from income, but from the established amount of the subsistence level budget. From July 1, 2020, the procedure for paying alimony for a certain category of debtors is changing. In the event that the debtor does not work or documents confirming his earnings and/or other income have not been submitted. The calculation is based on the average BPM per capita and will be:

- for 1 child – 50% BMP;

- for 2 children – 100% BMP;

- for 3 or more children - 150% BMP.

In recent months, mandatory minimum payments were determined as follows (before changes were made on July 1, 2021):

| Period | Estimated size of BMP | for 1st child | for 2 children | for 3 or more children |

| 1.08.2018- 31.10.2018 | 213,67 | 106,84 | 160,25 | 213,67 |

| 1.11.2018- 31.01.2019 | 214,21 | 107,11 | 160,66 | 214,21 |

| 1.02.2019- 30.04.2019 | 216,90 | 108,45 | 162,68 | 216,90 |

| 1.05.2019- 31.07.2019 | 224,02 | 112,01 | 168,02 | 224,02 |

| 1.08.2019- 31.10.2019 | 230,91 | 115,46 | 173,18 | 230,91 |

| 1.11.2019- 31.01.2020 | 231,83 | 115,92 | 173,87 | 231,83 |

| 1.02.2020-30.04.2020 | 239,87 | 119,94 | 179,9 | 239,87 |

| 1.05.2020-30.06.2020 | 246,78 | 123,39 | 185,09 | 246,78 |

After July 1, 2021, the amount of alimony for an unemployed person will be:

| per child | for two children | for three children | |

| from 1.07.2020 | 123,39 | 246,78 | 370,17 |

| from 1.08.2020 | 128,05 | 256,1 | 384,15 |

| from 1.11.2020 | 129,06 | 258,11 | 387,17 |

| from 1.02.2021 | 131,44 | 262,87 | 394,31 |

| from 1.05.2021 | 136.64 | 273.27 | 409.91 |

Until the end of July 2021, the minimum amount of child support from the unemployed in Belarus has been determined. In the future, this amount will change in proportion to changes in the cost of living budget.

An important point is that the calculation of child support based on the BMP amount begins after 3 months of the payer being unemployed. Until this time, alimony is calculated based on the average earnings in the previous place.

Other types of alimony from the unemployed, in relation to former spouses, parents, are usually prescribed by the court, the amount to be paid is also determined in court based on the degree of need of the alimony recipient.

Alimony from individual entrepreneurs

The nature of entrepreneurial activity creates many problems and features when collecting alimony from individual entrepreneurs:

- Firstly, this is an entrepreneurial risk, which causes significant fluctuations in the income of individual entrepreneurs, which, accordingly, is reflected in the amount of alimony paid, if they are assigned as a share of earnings. In this case, it is advisable to use the capabilities of the CoBS of the Republic of Belarus, which allows you to establish alimony in the form of a fixed amount or an amount that is a multiple of the base amount. However, this is permissible only in the course of claim proceedings.

- Secondly, this is the determination of the basis for calculating payments. Alimony for individual entrepreneurs in Belarus in 2021 is calculated from the amount of net profit, that is, the amount of his income is reduced by the amount of expenses.

- Thirdly, individual entrepreneur is a form of sole proprietorship, which gives the creditor reason to doubt the correctness of the calculations made. To verify it, there are a number of legal mechanisms, including the obligation to verify the correctness of the calculation by the bailiff, for example, at the request of the claimant.

Otherwise, similar rules for collecting alimony apply to individual entrepreneurs, including the minimums provided for by law.

How to pay alimony to an unemployed person in Belarus?

There is no special regime for paying alimony for the unemployed in the Republic of Belarus. They pay the same as everyone else. Most often, an amount that is a multiple of the BPM minimum is transferred through a bank. Transfer from hand to hand is also allowed, but care should be taken to confirm the fact and amount of the transfer. There were too many complaints when the recipient of alimony later stated that the funds were not transferred, filed a lawsuit, and the payer became involved in a case of evasion of alimony.

In addition to monthly payments of established amounts, the unemployed can also pay alimony by agreement. Article 103-6 KoBS also allows alimony in the form of:

- one-time paid amount;

- transfer of ownership of property.

This can be either a very large amount, comparable to regular alimony until adulthood, or expensive property such as a house or apartment.

What does the law say?

- Article 64. Grounds for the emergence of the rights and responsibilities of the family

- Article 30. Preservation of the right of spouses to maintenance after divorce

- Article 91. Responsibilities of parents to support children

- Article 92. Amount of alimony collected from parents for minor children

- Article 102. Amount of alimony collected from parents

Brief conclusions

The assignment of alimony from an unemployed person to provide for children is a well-established and legally justified practice. Not paying or reducing payments yourself makes no sense and is fraught with criminal penalties. Only a court can reduce child support, only for objective reasons, and most likely, only for a certain time.

The amount of alimony from an unemployed person to parents and former spouses is not specified in the law, but is determined by the court based on many circumstances, incl. financial situation of both parties.

Popular questions

If I don't have a job, do I have to pay child support?

Definitely necessary. Lack of work and money does not exempt you from alimony.

What happens if you don't pay child support?

There will be an appeal to the court, which will almost certainly immediately side with the alimony recipients. There will be forced employment with the collection of alimony from the salary. However, salaries at the place of forced employment are usually low, and penalties can reach 70% of earnings.

How much child support do unemployed people pay?

For 1, 2 or 3 or more children, the unemployed pay 50%, 100% or 150% of the subsistence level budget, respectively.

What income is used to pay child support?

Alimony is paid from almost all regular income, incl. from salaries and pensions. The list of income for alimony is determined by the government. An exception may be travel allowances and other non-main income.

Changing the amount of payments

According to the Code of Laws of the Republic of Belarus, in the event of exceptional circumstances, the alimony holder may apply to the court with a request to reduce the amount of payments or even to be exempt from paying them. Part 2 of the CoBS states that alimony payments in Belarus in 2021 can be reduced if the alimony provider:

- has other children who, as a result of the recovery, will become less financially secure;

- is a disabled person of groups I and II (in exceptional cases he may also be exempt from payment);

- for objective reasons, can no longer pay child support even in the established minimum amount;

- is in life circumstances as a result of which his financial and marital status has changed, and at the same time alimony was assigned in a fixed amount or in basic amounts.

When these circumstances disappear, the claimant again has the right to petition for the restoration of the previous amounts of payments. Please note that, in addition to alimony, according to the Code of Social Security of the Republic of Belarus, a parent can also be required to participate in additional expenses for the child, which will increase the amount of payments.

Alimony is a payment of funds (one-time or periodically) to a person who is entitled to financial assistance from another person.

Alimony can be paid both voluntarily (transfer of funds or deduction from wages) and in court (collection of alimony in court).

Naturally, no one will simply pay alimony to a stranger, so there are a number of conditions under which these funds are paid to a person:

- fact of family or kinship connection (between the person who pays alimony and the person who claims to receive it)

- inability of the alimony recipient to provide for himself

- termination of common farming

Who is eligible to receive alimony?

The following have the right to receive alimony :

- minor children from parents

- disabled adult children from parents

- ex-wife from ex-husband during pregnancy, if pregnancy occurs before divorce

- ex-spouse caring for a common child under 3 years of age, or a disabled child under 18 years of age, or an adult disabled child

- disabled parents from able-bodied children in need of financial assistance

- by court decision - one of the former spouses who has become disabled and needs financial assistance from the other former spouse

Voluntary payment of alimony

Parents (parent) can meet each other and enter into an agreement on the payment of child support for children (child). This agreement determines the procedure and amount of payments, as well as the method of such payment. To conclude such an agreement you will need: passports of both parents, birth certificate of the child. Also, a document is provided confirming the parent’s ownership of the property, if the agreement concerns the rights to this property. Next, with this set of documents, you go to the notary and enter into an agreement.

However, the agreement cannot specify the amount of alimony payment, which is less than the amount established by law. Also, it is necessary to indicate the specific form and method of payment: cash payment or by bank transfer.

By the way!

The alimony payment agreement may provide for a combination of different payment methods (cash and non-cash payments). Read more about the agreement...

The agreement can be terminated or amended at any time by agreement of the parties, and it is made in the same form as the conclusion. Modification or termination of the agreement is not permitted unilaterally.

Types of alimony payments:

- a fixed sum of money paid periodically

- a fixed sum of money paid in one lump sum

- percentage of earnings

- transfer of ownership of property

Collection of alimony through court

Collection of alimony through the court is possible at any time, despite the fact that it is paid voluntarily.

To do this, you need to fill out a statement of claim, which looks like this:

Important!

When filing a claim for alimony recovery in court, you are exempt from paying the state fee for filing such a claim.

Alimony can be collected for no more than 3 previous years , provided that up to this point measures have been taken to obtain these funds.

In case of non-payment of alimony, arrears are accrued. The amount of debt is determined based on the income of the debtor parent received during the period of non-payment. If the parent who is obliged to pay child support did not work at this time, then the debt is calculated based on the income received at the moment. However, if the place of work is currently unknown, then the debt is determined from the income received from the last place of work. In a situation where this is also unknown, then the average salary in the country is taken into account.

Interesting!

The court, taking into account the financial and family situation, as well as due to illness or other valid reasons, has the right to partially or completely exempt from payment of arrears of alimony.

The payer of alimony, in case of delay in this obligation, pays a penalty in the amount of 0.3% of the amount of unpaid alimony for each day of delay. A parent who evades payment of child support for more than 3 months during the year may be subject to criminal prosecution.

It is worth noting that paying alimony does not relieve the parent from the responsibility to raise the child, as well as from the obligation to participate in unforeseen expenses for the child.

Amount of alimony

The amount of alimony is expressed as a percentage of wages, namely:

- 25% of income - for 1 child

- 33% of income - for 2 children

- 50% of income - for 3 children

At the same time, the legislation establishes an amount below which the amount of alimony cannot be. This amount is tied to the subsistence level budget, which is 231 rubles. Let's consider the minimum amounts for alimony:

- for 1 child - 50% of the subsistence level budget

- for 2 children - 75% of the subsistence level budget

- for 3 children - 100% of the subsistence level budget

A reduction in the amount of alimony is possible if the alimony-paying parent files a corresponding claim in court.

The court reduces the amount of alimony in the following cases:

- if the alimony parent has other minor children who, when collecting alimony, are less well off than children who receive alimony

- if the parent paying alimony is a disabled person of groups I and II

- if the child support parent cannot pay child support for objective reasons

Attention!

Alimony is calculated from the moment the application is submitted to the court, i.e. from the day when the statement of claim was accepted in court. The end of child support payments occurs when the child becomes an adult, i.e. until he reaches the age of 18 years.

Child support for adult children

There are exceptions to almost every rule - this also applies to alimony. Maintenance funds are paid for minor children, but there are cases when adult children also receive alimony.

Thus, a former spouse who has the necessary means is obliged to financially support: