Home / Alimony / Calculation of alimony from wages

If divorce allows a husband and wife to relieve themselves of their obligations towards each other, it does not allow this to be done towards a child. Paying child support is fulfilling your parental obligations. Ideally, the child’s parents themselves can calculate and determine the terms of payment of alimony. Otherwise, the procedure for forced calculation and deduction of alimony from wages provided for by law will be used.

Regulatory regulation of alimony obligations

Issues related to the calculation, methods and procedure for paying alimony have been resolved:

- Code of the Republic of Kazakhstan “On marriage (matrimony) and family” (section 5). There is no separate law of the Republic of Kazakhstan on alimony; the norms of the code are mainly applied.

- Civil Code of the Republic of Kazakhstan (regarding the execution of an agreement on the payment of alimony).

You can also name the laws of the Republic of Kazakhstan on alimony, or more precisely, the laws related to alimony legal relations:

- Law of the Republic of Kazakhstan dated November 30, 2021 No. 113-VI “On the republican budget for 2018-2020” (used to calculate the amount of alimony and arrears in payment);

- Law of the Republic of Kazakhstan dated April 2, 2010 No. 261-IV “On enforcement proceedings and the status of bailiffs” (regarding the execution of a court decision on the payment of alimony).

By-laws also apply:

- Order of the Minister of Justice of the Republic of Kazakhstan dated March 31, 2017 No. 345 “On approval of methodological recommendations for the execution of judicial acts on the collection of alimony.”

- Order of the Minister of Justice of the Republic of Kazakhstan dated December 24, 2014 No. 372 (List of types of wages and (or) other income that parents receive and from which alimony is withheld).

- to certify the agreement on the payment of alimony (approved by the decision of the Board of the Republican Notary Chamber dated August 20, 2021).

- Information letter of the Advisory Council on the development of a unified judicial practice in the administration of justice of the Karaganda Regional Court dated June 6, 2012 No. 10 “On the practice of considering civil cases for the collection of alimony for minors and adult children.”

Is it possible to apply for recalculation if new circumstances arise?

The law does not prohibit the recalculation of alimony. However, it does not directly establish such cases.

Based on current practice, there are three main cases in which recalculation of alimony is possible:

- indexation of alimony if it was not carried out in a timely manner;

- debt collection for the previous period;

- the emergence of disagreements regarding the amounts paid in the form of alimony debt.

Recalculation during indexation is possible only for those alimony workers from whom alimony is collected in a fixed amount. But this also includes cases of loss of work by the payer. Because in the absence of regular income, bailiffs will collect alimony not in shares, but in a fixed amount.

Let's look at the second case with an example. Let's say Ivanov lost his job in April. Before that, he regularly paid alimony in the amount of 25% of his salary. After losing his job, the bailiff will initiate enforcement proceedings, since the payment of alimony will stop, and Ivanov’s writ of execution from the organization will be returned to the bailiffs.

The bailiff will recalculate alimony starting from the day following the day of Ivanov’s dismissal. Now Ivanov will have to pay alimony in an amount equal to one subsistence minimum for children. And this will continue until he gets a job.

After getting a job, the bailiff will make a final settlement of the debt incurred for Ivanov’s unemployed period. And then he will send the amount to a new place of work for collection. Thus, already from Ivanov’s first salary, the current 25% plus arrears of alimony will be deducted.

But, however, they cannot deduct more than 70% in total from his salary. As a rule, total salary deductions do not exceed 50%. Otherwise, Ivanov will be left virtually without a livelihood.

In this situation, we see that the bailiff recalculated the amount of alimony due to the changed circumstances of the payer. The bailiff verified the accrued and paid amounts of alimony. And all this happened as part of debt collection for previous periods.

But if disagreements arise when paying alimony debt, the collector will have to go to court for recalculation. The same thing will most likely have to be done to prove that the alimony holder’s income has sharply increased.

Who can count on receiving alimony in 2021

The person who is obliged to pay alimony is called the alimony payer, and in case of debt, the debtor. The person who is entitled to receive alimony is called the recipient. Both payers and recipients can only be family members.

Family law provides that the following may receive alimony:

- children from their parents or from one of the parents (minors or disabled);

- disabled parents from their child(ren);

- spouse or ex-spouse.

Sometimes the question arises about how long alimony is paid in Kazakhstan. In Part 2 of Art. 138 of the Code of the Republic of Kazakhstan “On Marriage (Matrimony) and Family” there is a provision on the possibility of receiving alimony for an adult and able-bodied child. But subject to three conditions:

- he is studying in the system of general secondary, technical and vocational, higher education;

- he is a full-time student;

- his age is up to twenty-one years.

Alimony for able-bodied adult absentees is not provided for in the Republic of Kazakhstan. In such cases, he cannot count on receiving alimony, since he is able to work and, studying in absentia, can work.

Alimony paid for the maintenance of minor children

Collection can be carried out:

- in part from the wages and income of the alimony payer;

- in a fixed amount of money.

Sometimes both parents are deprived of parental rights. However, this does not mean that financial support cannot be recovered from them. Child support is paid to the guardian, foster carer or custodian and is credited to deposit accounts opened in the names of the children.

Parents also contribute to additional expenses for children.

Alimony for adult but disabled children

The procedure for collecting funds for the maintenance of adults is the same as for minor children. However, if we talk about the method of collection, then in this case alimony can only be received in a fixed amount of money. In practice, in addition to alimony, additional expenses are collected (for example, payment for treatment, rehabilitation, purchase of a wheelchair, etc.). When concluding an alimony agreement, a payment method can be chosen that will satisfy both parties.

Alimony paid to spouses and former spouses

Spouses are obliged to financially support each other. In the event of refusal of such support and the absence of an agreement between the spouses on the payment of alimony, the following have the right to demand the provision of alimony in court from the other spouse who has the necessary means for this:

- disabled needy spouse;

- spouse during pregnancy and for three years from the date of birth of a common child;

- a needy spouse caring for a common disabled child until he reaches the age of eighteen, as well as in the event that the common disabled child is assigned a disability group of I - II upon reaching eighteen years of age.

Alimony paid to disabled parents

Children have a responsibility to care for their disabled parents. If they do not do this voluntarily, the legislator has provided for the possibility of imposing an obligation to pay alimony for their maintenance. There is an exception to this rule: children are exempt from such responsibility if the parents were deprived of parental rights or evaded fulfilling their parental responsibilities towards them.

Examples of calculating alimony in different situations

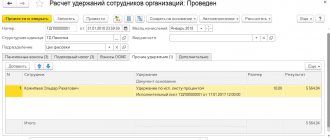

Example 1. The maximum allowable deduction for alimony payments

The employee pays child support for two children. The employee’s salary after withholding income tax and contributions to the Social Security Fund (1%) is 874.82 rubles. The organization received a writ of execution for the collection of alimony for two children in the amount of 33% and about the resulting alimony debt in the amount of 400 rubles.

The employee must retain earnings in the amount of 262.46 rubles. (RUB 874.82 × 30%). The employer has the right to withhold the amount of 612.36 rubles. (874.82 – 262.46), incl. alimony for the current month - 288.69 rubles. (RUB 874.82 × 33%); alimony debt – 323.67 rubles. (612.36 – 288.69). Outstanding alimony debt in the amount of 76.33 rubles. (400 – 323.67) is withheld the next time income is accrued to the employee

Example 2. When paying alimony in a fixed amount, the maximum amount of deductions must be observed

The employee pays child support for two children under 18 years of age in a fixed sum of 400 rubles. The employee was on leave at his own expense for 15 calendar days, for this month he was paid a salary for the days worked in the amount of 500 rubles.

The employee is due to pay an amount of 458.08 rubles. (500 – (500 – 102 – 114) × 13% – (500 × 1%)). The maximum possible deduction is RUB 320.66. (RUB 458.08 × 70%). The amount of alimony exceeds the maximum amount of deductions from the employee’s income by 79.34 rubles. (400 – 320.66), therefore, there is an underpayment of alimony for this month, which is a debt and is deducted from the employee’s income next month

Example 3. The procedure for determining the end date of alimony withholding for an incomplete month

The employee has a minor child who turns 18 on August 28.

From what day should the withholding of alimony stop?

The payment of alimony collected in court ceases when the child reaches the age of majority (Article 115 of the Code of Child Life).

Consequently, alimony does not need to be calculated on the day of coming of age. The amount of alimony for an incomplete month is determined in calendar days (hereinafter referred to as calendar days). The calculation is made as follows:

base for calculating alimony / 31 k.d. × 28 k.d.

Example 4. Termination of alimony withholding due to the marriage of a minor child

The employee, on the basis of a writ of execution, pays alimony for a minor child who is getting married.

What should the employer do in this situation when the employee presents the child’s marriage certificate?

In cases where the law allows emancipation or marriage before the age of 18, a citizen under 18 years of age acquires full legal capacity, respectively, from the moment the decision on emancipation is made or from the time of marriage (Article 20 of the Civil Code of the Republic Belarus).

The legal capacity acquired as a result of marriage is retained in full even in the event of divorce. Accordingly, on the basis of the child’s marriage certificate presented by the employee, the employer must stop withholding alimony collected in court (Article 115 of the Code of the Republic of Belarus on Marriage and Family).

From what income is alimony withheld?

When determining the amount of alimony, the sources of its receipt are taken into account. Their list was established by the Ministry of Justice of the Republic of Kazakhstan (Order of the Minister of Justice of the Republic of Kazakhstan dated December 24, 2014 No. 372).

The calculation of alimony in Kazakhstan in 2021 is based on the following types of income:

- wages, including additional payments, allowances, bonuses;

- scholarship;

- pension payments, state social benefits;

- royalties;

- commissions provided for insurance agents and brokers;

- income from engaging in entrepreneurial activity without forming a legal entity;

- income from rental property;

- income from securities.

How much alimony is paid?

The amount of alimony paid is determined by the parents by mutual consent. In cases of disagreement, it is determined by the court. In this case, mandatory state guarantees are taken into account.

The actual amount of child support depends on their number (their age is not taken into account). Thus, for one child, ¼ of the parent’s earnings or other income is recovered, for two children – 1/3, and for three or more children – ½. This provision is contained in Art. 139 of the Code of the Republic of Kazakhstan “On marriage (matrimony) and family”.

For example, the salary of the alimony payer amounted to 120 thousand tenge. The amount of alimony for 2 children is calculated in the amount of 1/3 of his income and is equal to 40 thousand tenge (120,000/3). If he has only one child, then the amount of alimony is 30 thousand tenge (120,000 / 4), and if there are three children - 60 thousand tenge (120,000 / 2).

When calculating, the financial situation of the payer and recipient of alimony is taken into account. If it changes, the amount of alimony may also be changed.

Not only children can count on receiving child support. Let's take a closer look at which family members can receive maintenance and how much alimony is in Kazakhstan in such cases.

For spouses, former spouses and other family members, this amount is determined by a voluntary agreement between them or in court. Secondly, it is determined as a multiple of the monthly calculation index (MCI) in force at the time of payment of alimony. In this case, the family and financial situation of the parties and other important factors are taken into account.

The size of the MCI is established in Art. 8 of the Law of the Republic of Kazakhstan dated November 30, 2021 No. 113-VI “On the republican budget for 2018-2020” and amounts to 2,405 tenge.