The birth of a child is a very important moment in the life of a couple. Now you can not only rejoice at the first victories of your son or daughter and raise them, but also bear responsibility before the law. This includes paying alimony for a child, or even two, if family life turns at this angle.

Ensuring a happy and carefree life for a child is the responsibility of every parent. And if it happens that the spouses divorce, you need to make sure that these events will not affect or affect the child in any way. Regardless of who the children stay with, their mother or father, the amount of child support for two children does not change.

Minimum amount of child support for two children

If the union between the parents is dissolved and the father and children live separately, the obligation to support minors remains in full. The optimal option is to deposit funds voluntarily.

The law provides for cases when a document on the collection of funds from the second parent is mandatory. For example, when determining the level of wealth of a family for registration as those in need of improved living conditions. In addition, a document confirming the payment of allowance for children is required when applying for benefits and gubernatorial maternity capital.

Thus, a support document may be required regardless of whether the father voluntarily pays for the child's needs or not.

It is possible to document the procedure and amount of payments as follows:

- voluntarily (notarial agreement);

- without the consent of the payer (in court).

In most cases, documentation of financial support is required in connection with the father’s refusal to contribute funds on his own.

Payment of financial assistance for children is possible in the following types:

- percentage of the income of the alimony payer;

- offset of large property;

- fixed amount;

- lump sum payment;

- mixed type of payments.

Amount of child support for 2 children

The amount of alimony can be established from the rates specified in Art. 81 IC RF. As we said above, for two children a 1/3 share or 33% of the parent’s total income can be recovered.

This amount is paid if an agreement on the payment of alimony has not been concluded between the children’s parents. When making a decision, the court takes the rate of 33% as a basis.

Alas, in practice this does not mean that the payer will pay exactly this amount. The court may take into account a number of other circumstances, as a result of which alimony may be increased or decreased. For example, an increase in the amount of payments can be achieved if the parent with whom the children live:

- income has decreased significantly (wage reduction, job loss);

- your health has deteriorated (requires funds for treatment);

- another child was born;

- does not have its own living space.

In turn, the alimony payer may file a counterclaim demanding a reduction in the amount of payments. The reasons for this may be:

- onset of disability;

- presence of other dependent persons (disabled parents, appearance of other children);

- payment of child support for other children born from other mothers;

- sharp decline in income;

- the child’s employment or entrepreneurial activity upon reaching 16 years of age.

The court considers all the circumstances together and may come to a conclusion about changing the amount of alimony to a larger or smaller extent than specified in family law.

There are situations when a parent does not have a permanent source of income, he does not work anywhere, and accordingly it is impossible to determine the amount of alimony as a percentage. In such a situation, payment of alimony will be made in a fixed amount of money, independent of income. If alimony has already been collected as a share of the types of earnings, the bailiffs will make the calculation based on the average salary in the region.

Alimony in a fixed amount is a multiple of the minimum subsistence level established by government agencies in each region for the current year. If such a value was not recorded by local authorities, then the amount for calculation is taken on the basis of Government Decree No. 730. As of January 1, 2021, this amount amounted to 9,756 rubles.

What is the maximum size

There is no upper limit, but the court most often focuses on regional wages and the cost of living. Until May 1, 2021, the minimum wage also played a role in Russia, but from May 1 it is equal to the subsistence level and can now be neglected.

Example : The minimum wage or subsistence minimum (subsistence minimum) is now 11,163.00 rubles. In theory, this is exactly what one person needs for 1 month. However, it is assumed that two people will support the child. As a result, the amount is divided into 2 parts. This means that alimony must be paid in the amount of 11163/2 = 5581.50 rubles. This is an example of a calculation linked to PM for 1 child. For two people there will be exactly the same PM: 11163.00 rubles.

If we consider the option of deducting a third of the profit received, then in this case we need to rely on wages.

Example : An alimony payer receives 60 thousand rubles a month for his work. A third of this amount is 20 thousand rubles. This is exactly how much he will pay for the maintenance of two children. As you can easily see, the amount is greater than if you use the previous calculation method.

A larger amount may be assigned by court or agreement, but, again, it is not limited in size in any way, except by common sense. It is logical that the judicial authorities do not assess alimony in the amount of 100 thousand rubles if the payer receives only 30 thousand rubles, but the amount of payment may be slightly increased to the level of the subsistence level if a third of the salary is less than this amount.

Example : The payer receives 30 thousand rubles. The third part = 10 thousand rubles. This is less than the amount received under the first calculation and the court can raise the level of payment to the specified level of 11,163.00 rubles. However, this is an optional rule and does not necessarily mean that it will be used.

What is the minimum size

More often the problem arises not with the maximum, but with the minimum amount of payments. Some irresponsible payers are trying their best to reduce the amount of payments as much as possible. The court, based on the financial condition of the payer, serious illnesses and many other factors that are individual in each individual case, may even award a payment of 10% of the minimum wage. However, this requires providing strong evidence. In practice, the court is extremely reluctant to reduce the amount of alimony.

If children are from different marriages

If one father-payer of alimony has two children from different marriages, then in such a situation alimony is paid in the same amount as in the case of two children from one marriage, but the amount will be divided into two parts and distributed among the children’s mothers, recipients of alimony . In such a situation, the same 33.33% of the salary is additionally divided by two.

Example : Father receives 60 thousand rubles. A third of this amount is 20 thousand rubles. This is the total amount of child support for two children. However, since they are from different mothers, each of the children will receive 10 thousand rubles - half of the third part of the salary.

Conditions for paying alimony

The alimony payer receives such obligations only if his relationship is confirmed. This problem does not arise with mothers, since they are always indicated on the birth certificate, but with fathers, controversial situations sometimes arise, especially if the parents are not married or the parties have serious doubts about paternity. In such a situation, it is necessary to conduct an analysis and appoint the biological father as the payer of alimony in court. Separately, it should be noted that the court usually takes the entry in the birth certificate as a basis. If it is not there, then there is no one to collect alimony from. In such a situation, you need to look for the biological father, enter him into the certificate and only then demand child support.

The presence of an entry on the birth certificate is also not a guarantee of payments. The potential father can do an analysis, and if he confirms that he is not the biological father, then, if he wishes, the record will be deleted.

It should also be taken into account that, according to general rules, alimony is paid for 18 years of the child’s life. Once the child reaches adulthood, payments stop automatically. However, there is an exception to this rule: if the child is disabled for health reasons, he will have to pay child support in the future, even after he reaches adulthood.

Forms for collecting alimony for 2 children

To determine the form of payments, one should be guided by Art. 81 and 83 of the RF IC. It is influenced by the presence or absence of an official source of income and the current financial situation of the payer.

As a percentage of income

If the person liable for alimony has official earnings, receives state benefits or pensions, the amount of payments will be 33% of the salary.

If children are from different marriages, 16.6% are transferred. This is due to the fact that, according to the law, large sums cannot be recovered from the father. He can transfer increased payments only voluntarily.

In a fixed amount of money

If it is not possible to establish the exact level of the payer’s earnings, he receives a salary in foreign currency or does not work, alimony is assigned in a fixed amount. For the calculation, the cost of living indicators in the region of residence of the child are used, and in the absence of such, in the country. The financial situation of both parties is also taken into account.

The average salary in the country can also be taken into account if it is not possible to calculate the amount of the payer’s income.

Mixed alimony

If the payer, in addition to official earnings, has other confirmed sources of income, the recipient can collect alimony from him in a flat amount and in shares at the same time.

This is also important to know: Alimony and the cost of living for a child

To recover, it is enough to file a statement of claim, where the requirement will indicate the withholding of mixed amounts.

The amount of the fixed payment is established by the parties by mutual agreement. The law does not limit the maximum amount, however, it establishes the need to link the amount of payment to the minimum wage. The monthly payment must be a multiple of the minimum wage. In addition, the amount is subject to annual indexation. The fixed amount of child support for 2 children must be no less than 33% of all types of father’s income. In the absence of official income, no less than 1/3 of the average salary in the Russian Federation established for the period of conclusion of the document.

Offsetting large property towards the financial support of minor children is an exclusively voluntary option. The court cannot oblige a citizen to give up property in favor of children.

The market value of the property should approximately correspond to the amount of money that the father will pay until the children reach adulthood. Under the terms of the agreement, the man transfers large property to the minors as shared ownership. If the age difference between children is significant, then the ratio of shares in property may differ.

For example, if there are 2 children - 8 and 15 years old, the youngest receives ¾, and the eldest - ¼ share. The calculation is approximate. A more accurate calculation depends on the value of the property, the age of the children and the opinion of the parents.

A one-time payment is a transfer of a large amount of money for all years of payments. Funds must be transferred to the nominal account of the second parent. By court decision, ½ part can be credited to the minor’s personal account.

Amount of alimony: how is it calculated?

The law allows you to negotiate the amount yourself or go to court if disputes arise. In the first case, you can draw up an agreement, write down all the important nuances in it and confirm it. This money is paid monthly, but a different procedure can be specified in the agreement. The calculation is carried out using the following methods:

- As a share of income. Personal income tax is not taken into account, therefore only net earnings are taken into account. It is divided into a percentage, depending on the number of heirs in need of help. The deduction can be carried out directly in the accounting department of the company where the alimony payer works.

- Fixed amount. It is calculated depending on the child’s subsistence level in the region and is half of it. The calculation method under consideration is used if the payer’s earnings are inconsistent, the amounts differ, or there is no earnings at all (confirmed). As the VPM changes, the amounts need to be recalculated.

You can also calculate help for the baby using a mixed form of the two listed options.

Registration of child support for two children

The process of obtaining financial support differs depending on the method of collection. Procedure if the parties decide to enter into a notarial agreement:

- determining the minimum amount of payments;

- establishing a fixed amount greater than or equal to the minimum amount;

- drawing up an agreement;

- signature of the parties;

- notarization of the document.

From the moment the document is notarized, the agreement acquires the force of a writ of execution. If the father refuses to fulfill his obligations or contributes less money, the mother is obliged to submit the document for forced collection.

Let's consider how many documents need to be provided to collect alimony for two children:

- personal documents of the mother and father (adoptive parents);

- certificate of dissolution of the union (if available);

- personal documents of children (passports, birth certificates);

- adoption certificate (if available);

- certificates of income of mother and father.

If funds are recovered in court, the following procedure is provided:

- collection of documents;

- drawing up an application to the magistrate's court;

- filing an application with the court;

- obtaining a court order;

- sending the document for forced execution to the FSSP.

If the parents have an additional dispute regarding family law (divorce, establishment of paternity, determination of the child’s place of residence), the applicant draws up a claim and submits it to the district or city court. In this case, the parties are required to be present at the trial.

To collect child support for 2 children, how many documents must be provided? The list of documentation is similar to that provided for drawing up a notarial agreement.

Who pays child support?

According to the law, alimony is paid by the party that left the children with the ex-spouse. Statistics show that most children stay with their mother, so the father pays child support. In practice, there are also cases when alimony for two children is received not by the mother, but by:

- Guardian;

- Adoptive parents;

- Single father;

- An orphanage in which a child left without parental care and support is raised.

One thing remains unchanged, if a parent abandoned a minor child, he will not escape responsibility and will have to pay a certain percentage of his own income.

We recommend reading

Child support upon reaching 18 years of age: rules for collecting tuition fees

The procedure for collecting alimony for two children

First of all, you need to try to come to an agreement with the potential alimony payer, discuss the alimony agreement, the amount, payment procedure and other conditions that are important for the parties. Some do not want alimony to be collected by the court and a writ of execution to be sent to them at work. But if a peaceful agreement cannot be reached, then you should go to court.

If the debtor has a regular official income and does not have other alimony obligations, he should apply to the court for a court order to collect alimony, which will be considered by the court as soon as possible, but the debtor, having not agreed with it, has the right to cancel it.

If there is no reliable information about the debtor’s income and whether he has other alimony obligations, if the court order was previously canceled by him, we file a statement of claim in court, which will be considered by summoning the parties to court hearings and, at the end, with a court decision and the issuance of an executive order. leaf.

The next stage is the execution of a court decision (court order), the claimant has an alternative action, to apply with a writ of execution to the debtor’s place of work or to the bailiff service, which will initiate enforcement proceedings and begin forced collection. Depending on the specific case, the appropriate solution is selected.

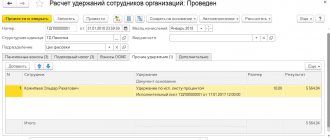

Amount of alimony: how to pay through bailiffs?

Bailiffs can contact the employer to withhold part of his earnings to pay alimony. The money will be sent to the claimant. When initiating enforcement proceedings, the bailiffs will monitor how correctly the instructions are followed.

When the defendant is not officially employed, he may not wait for the bailiffs to arrive, but immediately transfer the money to the claimant’s account without using the bailiffs’ details. Then the money will appear in the account much faster - in 1 day, instead of 3-5 with the participation of bailiffs.

Sometimes there is already a debt, but there is no official work; the exact amount can be determined by the average salary level in Russia. This happens because without official employment it will not be possible to confirm income.

Court order for the collection of alimony

If the debtor has no other alimony obligations, is officially employed, and has a regular income, he should apply to the court with an application for a court order, which will be considered in a simplified manner within 5 days and without calling the parties.

If in this case you immediately file a claim for the recovery of alimony in proportion to earnings, it will be returned by the court, since nothing prevents the case from being considered in a simplified manner. From June 1, 2021, all demands for the collection of alimony for minor children, not related to establishing paternity, challenging paternity (maternity) or the need to involve other interested parties, are formalized only in the form of an application for the issuance of a court order for the collection of alimony (Federal Law dated 02.03. 2016 N 45-FZ). But the debtor in this case has the right, within 10 days from the date of receipt of the court order, to cancel it, then the next stage will be filing a statement of claim.

Indexation and current amount of alimony

Bailiffs can carry out indexation if enforcement proceedings have been opened against the payer. This can also be done in the administration of the institution that is involved in withholding funds.

Indexation is carried out taking into account the cost of living, since it is a share of it. This approach is used when it comes to payment in a lump sum. The amount of child support for minor children is indexed according to the following scheme:

- The current cost of living is found out at the time when the court decided to collect funds;

- Select the number of PM, which will be a multiple of the amount of deductions;

- Multiply the multiple by the size of the PM.

As a result of these simple calculations, you will get an indexed indicator. Indexation should be carried out only if the cost of living increases.

Reducing the amount of alimony

According to Art. 119 of the RF IC, those obligated for alimony can file a claim to reduce the amount of alimony due to a difficult financial situation, if there are grounds:

- Receiving disability of 1 or 2 groups. Most often, such citizens are disabled, cannot provide for themselves and need financial assistance themselves.

- The child is 16 years old, engaged in entrepreneurial activity or has other confirmed income.

- The birth of a third child, for whom child support must also be paid. Here, the total amount of deductions cannot exceed 50% of income.

- Losing a job due to layoffs.

Any of the reasons must be supported by documents. If there is no evidence, the claims will not be satisfied.

To reduce the amount of payments, it is necessary to file a claim with the court that previously made a decision on alimony. It states the following:

- name of the judicial authority;

- Full name, registration address of the plaintiff and defendant;

- passport details and telephone number of the plaintiff;

- information from a past court decision;

- on what basis should alimony be reduced;

- in what amount of payments were previously assigned;

- claims for reduction;

- a list of attached documents.

At the end there is a date of compilation and a signature. The application is considered within two months, then a decision is made on it to be satisfied in part or in full, or to refuse satisfaction.

Alimony at the birth of a second child

If a parent previously paid child support for one child, then upon the birth of a second child in a new marriage, the amount of payments paid for the maintenance of the first may decrease. This can be formalized either by changing the alimony agreement in agreement with the legal representative of the first child, or by applying to the court to change the court decision. It is important to keep in mind that the birth of a child support provider into a new family does not mean that the amount of payments for a child from the first marriage will automatically be reduced. The interests of minor children are a priority for the court, so the payer must provide compelling reasons to reduce the amount of alimony.

It also happens that a parent who pays child support for one child finds himself in a situation where he is forced to also pay it for the second child in the new marriage. Since according to the law, 1/3 (about 33%) of income must be paid for the maintenance of two children, this amount will be divided in half between two children from different marriages. That is, each child will receive 1/6 (or approximately 16.5%) of the parent’s income. In this case, the court has the right to revise the amount of payments, reduce or increase shares depending on the circumstances.

Alimony for the past period

It is interesting that the legislation provides for the right of the recipient of alimony to recover payments for the past period within three years. A person receives this opportunity if he has previously repeatedly approached the alimony debtor with a request for financial assistance, but all attempts have been unsuccessful. The complexity of such cases lies in the fact that it is extremely difficult to prove to the court that such attempts were actually made and that the person evaded payments.

Alimony is collected by the court from the date of application to the court.

If a person initially applied for a court order, the debtor canceled the court order, and then the claimant files a claim for alimony, he has every right to demand alimony from the date of the initial application to the court for the issuance of a court order.

Changing the amount of alimony

A change in the amount of alimony may be required for various reasons, one of them is the emergence of new alimony obligations. Thus, if a person is already paying alimony and is approached with demands to collect alimony for other children, the court will establish alimony for their maintenance, taking into account existing alimony obligations, and to change the amount of alimony that was collected earlier, the person will need to go to court independently , In most cases.

Here's an example:

Vasily pays alimony to two minor children from his marriage with his ex-wife Svetlana in the amount of ⅓ of his income; Vasily’s current wife, Natalya, is filing a lawsuit to collect alimony also for the two children they share with Vasily. The court will set the amount of alimony for Natalya for the maintenance of two minor children in the amount of ¼, each child ⅛. In such a situation, Vasily has the right to file a lawsuit against Svetlana to change the amount of alimony from ⅓ to ¼. Thus, each of Vasily’s four children will receive ⅛. Next, the situation will change when Svetlana’s eldest child reaches adulthood, Svetalana will receive ⅙, and Natalya will receive ⅓, after Svetlana’s next child comes of age, the amount of alimony for Natalya will not change, since for two children the law requires ⅓, after one of Natalya’s children comes of age, the amount of alimony for the only minor child will be ¼ until he reaches adulthood.

The Family Code also establishes the possibility of changing the amount of alimony in the event of a significant change in the financial and marital status of one of the parties. So, if the debtor’s income has decreased significantly, and he does not have the financial capacity to provide the same level of maintenance for the children, the amount of alimony can be changed in court.

Depending on changes in the nature of income, the amount of alimony can be changed from a share ratio to a fixed sum of money and vice versa.

The amount of alimony in 2021 and its voluntary payment

It is most convenient to pay money voluntarily, since both parties will be able to minimally avoid troubles from a showdown and the children will not suffer. The amount of child support for one child allows you to pay in cash. But the fact of transfer of finance must be confirmed. For example, a receipt. In addition, you can transfer money using the following methods:

Via bank transfer or online banking

You can quickly and conveniently send documents through a banking service by sending them to a card or bank account. Today, everyone has either one or the other, and even if they don’t, it takes a few hours to register them. But in order for the amount to be counted, the purpose of the payment must be correctly indicated and the payer must be the sender of the money. All information about the completed transaction should be stored in your personal banking account

By postal transfer

This option is preferable if the recipient for some reason does not want to provide details. In addition, you need to pay a rather large commission for a postal transfer.

Through accounting at work

The payer can leave a statement to the employer, according to which an amount that is a multiple of child support will be withheld from his salary.

If there is no court decision or agreement, all transferred amounts will be considered financial assistance, but they cannot be called alimony.