Can compensation for unused vacation be paid before the date of dismissal?

Article 84.1. General procedure for formalizing the termination of an employment contract [Labor Code of the Russian Federation] [Chapter 13] [Article 84.1] Termination of an employment contract is formalized by order (instruction) of the employer. The employee must be familiarized with the order (instruction) of the employer to terminate the employment contract against signature. At the request of the employee, the employer is obliged to provide him with a duly certified copy of the specified order (instruction). In the event that an order (instruction) to terminate an employment contract cannot be brought to the attention of the employee or the employee refuses to familiarize himself with it against signature, a corresponding entry is made on the order (instruction). The day of termination of the employment contract in all cases is the last day of work of the employee, with the exception of cases where the employee did not actually work, but in accordance with this Code or other federal law, he retained his place of work (position). On the day of termination of the employment contract, the employer is obliged to issue the employee a work book and make payments to him in accordance with Article 140 of this Code.

Upon written application by the employee, the employer is also obliged to provide him with duly certified copies of documents related to work. An entry in the work book about the basis and reason for termination of the employment contract must be made in strict accordance with the wording of this Code or other federal law and with reference to the relevant article, part of the article, paragraph of the article of this Code or other federal law.

Article 140. Terms of calculation upon dismissal [Labor Code of the Russian Federation] [Chapter 21] [Article 140] Upon termination of the employment contract, payment of all amounts due to the employee from the employer is made on the DAY OF TERMINATION of the employee.

If the employee did not work on the day of dismissal, then the corresponding amounts must be paid no later than the next day after the dismissed employee submits a request for payment. In the event of a dispute about the amount of amounts due to the employee upon dismissal, the employer is obliged to pay the amount not disputed by him within the period specified in this article.

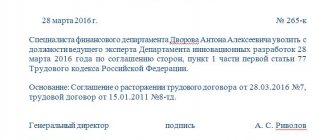

How to formalize early dismissal due to redundancy?

The procedure for notification of termination of employment due to the need to reduce personnel costs is strictly regulated by Art. 180 TK. Management responsibilities include:

- advance notice (at least 2 months) of impending dismissal - the employer must provide a written personalized notice;

- full promotion of new employment - the employee must be offered all available vacancies or planned positions in the future if the production is undergoing a reorganization process;

- payment of wages, compensation and severance pay no later than the last working day.

The situation with early separation is spelled out in such a way that it can only be implemented by agreement of the parties:

- if the offer came from the employer and the employee agreed to it;

- if the initiative came from an employee, and management supported it.

The step-by-step algorithm for such dismissal looks something like this:

- Delivery of a written notice of layoff (the employer can immediately include in its text a proposal for early payment and its financial conditions).

- Offering available vacancies up to the moment of signing the order to terminate the employment contract.

- A counter-offer from the employee, if one is not immediately received from his employer, or written consent to the conditions that were set out in the notice from management.

- Agreeing on a new separation date.

- Preparation of an updated version of the dismissal order and payment.

- Filling out the labor report and paying out the payroll.

To receive all additional compensation for early departure, the employee must correctly write a statement of consent to the employer’s message.

View a sample wording of an entry in a labor document

The employee must clearly understand that Art. 180 of the Labor Code contains a legislative guarantee that he will not be dismissed ahead of schedule at the will of the employer, but it is not the company’s obligation to hire a specialist at any time suitable for him.

How to offer an employee early dismissal?

You can contact an employee with a proposal to terminate cooperation without waiting for the agreed deadlines at any time. The law does not require this to be done in writing, so there are several options:

- describe the terms of termination of the contract in the notice of layoff;

- formally contact the employee on any other day after delivery of the notice;

- agree verbally, but receive a written statement from the employee.

In order to establish unambiguity in the relationship between the hired specialist and his employer, it is better to use the wording from Art. 180 TK. It is possible and necessary to supplement the notice if the company’s local regulations provide for additional compensation for former employees in case of staff reduction.

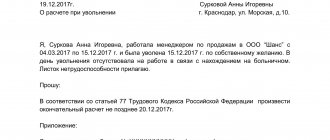

How to write a statement from an employee?

If the employer has not offered an early separation option, this does not mean that he is categorically against releasing specialists ahead of schedule. The law does not stipulate, but does not prohibit the employee from writing such a statement first.

To ensure that the employee’s initiative is understood correctly and is not mistaken for a desire to leave of his own free will, the following points should be included in the appeal to management:

- the employee means precisely early dismissal due to reduction, and not any other type of termination of relations listed in Art. 77 TK;

- a person claims to receive all the financial guarantees provided upon separation due to staff reduction, Art. 178 TK;

- in addition, consent to dismissal is given subject to payment of the average salary for the remainder of the warning period, Art. 180 TK.

You can submit a corresponding application any day after the announcement of the upcoming reduction. However, this does not automatically mean reaching an agreement with the employer. The employer may respond in writing with a refusal to an appeal officially registered in the office, or may not respond at all. Lack of management response does not mean tacit consent.

You need to pay special attention to the situation in which the management proposes not to mention the words about reduction in the document, but to enter a phrase about your own desire. In this case, the employee may lose all financial guarantees.

Payment terms upon dismissal

If an employee, for example, was on vacation or sick, that is, absent on the last day of work, and the organization’s salary is paid in cash, then the employer must make a payment upon dismissal no later than the day following the day when the employee applied for payment (Article 140 Tax Code of the Russian Federation).

When dismissing an employee (regardless of the reason for dismissal), the employer is obliged to make a final settlement with this employee, that is, he must pay all amounts due to the employee (unreceived salary, compensation for unused vacation.).

Unified dismissal procedure

Federal Service for Labor and Employment

LEGAL DEPARTMENT OF THE FEDERAL SERVICE FOR LABOR AND EMPLOYMENT LETTER dated June 18, 2012 No. 863-6-1 [On the day of final settlement with an employee who has a shift work schedule, upon termination of the employment contract in the event that his last worker day falls on a weekend or non-working holiday]

Is it possible to issue a paycheck upon dismissal before the day of dismissal?

Before dismissal, the employee writes a statement. This document or a copy of it is transferred to the accounting department. After all, the employee must receive payment: salary for days worked, bonus, compensation for unused vacation, etc.

This rule always applies in all cases. In other words, it does not matter whether the employer was at fault for the delays or not. You will still have to pay for the delay in accordance with the rules established in the Russian Federation.

Calculation and payments upon dismissal, payment terms in 2021

- reduction of staff or number of employees;

- liquidation of the enterprise;

- the employee’s refusal to move with the employer or transfer to another position;

- conscription of an employee into the army;

- recognition of an employee as unfit to perform this work due to a medical report.

The final payment deadlines for dismissal are strictly regulated by labor legislation. They are mentioned in Art. 140 Labor Code of the Russian Federation. This article states that the timing of payment of settlement upon dismissal is limited to the day of dismissal of the dismissing employee.

Payment of settlement pay before the day of dismissal violation

Regardless of the grounds on which the employment contract was terminated, the employer undertakes to settle accounts with the employee on the last working day and pay the amounts due to him. The types of payments and their size may differ depending on the reason for which the employee was dismissed.

The exception is dismissal during the probationary period and during temporary work. In this case, the deadline for submitting an application is three days before dismissal. If there are disagreements between the parties, funds are paid on the day of dismissal that are not the subject of a dispute between the employee and the employer.

Is it possible to fire an employee during illness?

Question: The organization is interested in the question of dismissing workers on weekends. Let's say a company works on a five-day schedule: official days off are Saturday and Sunday. An employee wants to quit and writes a letter, but the last day of work falls on Saturday. The next day you need to hire a new employee, and this is Sunday. Unfortunately, it is not possible to rewrite statements. What to do in this situation? Is it possible to issue an order in advance to dismiss one employee and hire another? Or will it be postponed to the next working days?

Please note => Will there be an amnesty after the 2020 summit for citizens of Tajikistan

The procedure and terms for payment of wages upon dismissal according to the Labor Code

In this case, it is necessary to take into account the grounds for termination of the contract. After all, a citizen’s salary and other necessary payments will depend on this basis. In such a situation, the manager should not forget that full settlement with the resigning person must be made on the day when the employee last carries out his activities in this organization. Otherwise, the boss simply cannot avoid problems with the law.

In accordance with Art. 236 of the Labor Code of the Russian Federation for a delay in the payment of wages, as well as payments upon dismissal and (or) other payments due to the employee, the employer is obliged to pay them with interest (monetary compensation) in the amount of not less than one three hundredth of the refinancing rate of the Central Bank of the Russian Federation in force at that time from unpaid amounts on time for each day of delay starting from the next day after the due date for payment up to and including the day of actual settlement.

Severance pay, its amount and payment period

Some situations require a special approach. For example, when should payment be paid upon dismissal if its date falls on a person’s day off? The answer is simple: on the next working day. There is no delay in this case, and if, for example, the application indicates December 24 (Sunday), the employee must go to work on December 25, Monday, and receive his money and documents.

The benefit amount becomes equal to the employee’s average earnings for one month. A person’s salary may be retained for the second month after leaving work if he was unable to find another job during this time.

When a collective agreement or agreement is terminated, the employee often finds himself in a more advantageous situation. Since such agreements are concluded directly between the employee and the employer, certain clauses can be included in it to improve the employee’s position compared to the situation prescribed in the Labor Code.

Specialists from the Federal Service for Labor and Employment answered this question in a commentary letter.

The manager has the right to severance pay upon dismissal, in connection with a change in the owner of the enterprise, or for other reasons that do not depend on him. Sometimes a contract with a manager may contain provisions that if the contract is terminated early at the initiative of the employee himself, he does not have the right to claim all types of compensation.

After the dismissal of an employee, the average monthly salary retained for the period of employment is paid on the days the employer issues wages. In this case, the dismissed employee presents his work book.

If you try to get information on this issue from your accounting department, you will most likely receive a sharp and categorical answer. Already at the stage of receiving such an application, personnel officers quickly calculate everything and tell the manager the day on which the resolution needs to be put forward. Of course, this date will fall on Friday or Monday.

So it turns out that, without written consent from the accounting or personnel department employees to work on a day off, the employer simply will not be able to pay off the employee fired on Saturday on a completely legal basis. In this case, the calculation on Monday becomes completely reasonable and does not contradict labor legislation.

The Labor Code of the Russian Federation obliges the employer, right up to the moment of dismissal, to offer those being laid off vacant positions in which they can work, taking into account qualifications and health indicators (Part 1 of Article 180). A situation is possible when an employee has given written consent to early dismissal, but in the period before dismissal, suitable vacancies appeared. Is the employer required to offer them?

To understand where work on a day off can come from, you need to look at the procedure for calculating wages. The legislator allows enterprises to choose a payment system, for example, if production conditions require assigning shifts or working on weekends or holidays.

And the situation described above, when the employee’s last working day falls on Saturday or Sunday, occurs quite often. Let's figure it out. Unified dismissal procedure The dismissal procedure is established at the legislative level (Article 84.1 of the Labor Code of the Russian Federation) and is mandatory for all employers upon termination of a contract for any reason.

Labor Code, it is impossible to fire an employee on a day off. The date of termination of employment should be postponed to the next working day (next).

Payment upon dismissal, payment terms established by law

Accordingly, funds can be recovered for all of the above periods. And every employee can demand them. Typically, employers independently pay their subordinates. The main thing is to check the accuracy of the accruals.

In Russia, an employer may be subject to more serious liability for failure to pay employees. The point is that the boss must pay the required funds with all interest to the subordinate no later than 3 months. This is exactly the period given for payment without additional large fines (only with a penalty, which is 1/300 of the refinancing rate for each overdue day).

Determining the calculation period for payments upon dismissal

As a general rule, the period of time for determining the amount of compensation payments upon dismissal is one year before the date of termination of the employment relationship. If an employee has worked for a company for less than a year, then the billing period will be equal to the duration of his employment relationship with the company.

Labor legislation also provides a calculation algorithm in case a person does not have a period of actual work for the employer before the date of dismissal. In this situation, average earnings are determined based on the current official salary or tariff rate.

What amounts are due at the final settlement?

Mandatory payments during settlement are received only by those citizens whose work activity is officially registered.

If an employee works unofficially, he may not count on payments.

Regardless of the reason for dismissal, certain amounts are credited to the employee’s account.

What must an employer pay an employee at work after dismissal under the Labor Code:

- wages for time worked but not yet paid;

- compensation for the remaining days of annual paid leave.

This is a standard list of charges. Under certain circumstances, it may be different, but if the business relationship is terminated at the initiative of the employee, it remains exactly that way.

Other payments in such a situation are paid only if they are provided for in an employment contract, collective agreement or other internal documentation. This may be severance pay, bonuses and other payments.

According to the information reflected in Article 77 of the Labor Code of the Russian Federation, in case of dismissal by agreement of the parties, the employee, as in the case of dismissal at his own request, receives a standard set of payments.

If the termination of the contract is associated with a layoff, in addition to wages and vacation pay, specialists are entitled to severance pay, which is also commonly called compensation.

The maximum duration for its accrual to the account of a dismissed employee is 3 months. In the case of seasonal specialists, this period is reduced to 2 weeks.

An employee who works for an individual entrepreneur receives money upon dismissal, information about the transfer of which is included in the employment contract. This rule is enshrined in Article 307 of the Labor Code of the Russian Federation.

Payment of settlement pay before the day of dismissal violation

The rules for calculating the days that the employer will have to pay can be divided into several steps. The first is to divide the total number of vacation days by 12. The second is to multiply the resulting amount by the number of months worked in a year.

The obligation to pay the specified monetary compensation arises regardless of the employer’s fault. Let's watch a video on this topic: If a former employee encountered a problem upon dismissal, when the money was never received into the account, he has the right to complain to the labor inspectorate or immediately to the courts. When contacting the labor inspectorate, you must have with you all the documents that can confirm that the employee actually worked in this institution.

Is it possible to pay compensation upon dismissal before the date of dismissal?

It has already been said that a lot depends on the situation. Usually, employees themselves come after vacation to get money. But if this does not happen, you will have to wait until the employee writes a corresponding application for payment. The employer’s responsibility for non-payment of payment upon dismissal

In this case, the wording of the reason for leaving can be as in the wording of clause. This type of dismissal requires compliance with a certain procedure, namely: The process of terminating the contract on the specified basis is regulated by Article 181 of the Labor Code.

Is it possible to pay a resigning employee a salary before the dismissal date?

How to calculate compensation for unused vacation?

Let’s assume that a person quits on his own after working for 8 months from the date of employment. In this case, the days for which compensation is due will be equal to: 28*8/12=18.67 days. Next, the resulting figure is multiplied by the employee’s average salary per day. And this money must be paid upon the dismissal of a subordinate. By the way, in Russia there is no provision for the absence of paid leave. Employees cannot work without it for more than 2 years.

If a subordinate intends to do this, it is necessary to force him to retire. And if a person quits after 24 months of work, then he will receive payment for 56 days of paid leave.

In fact, understanding how many days to pay is not as difficult as it seems.

Is it possible to make a payment before dismissal?

Payment of wages upon dismissal The question of payment of wages upon dismissal worries many workers. The Labor Code of the Russian Federation establishes that in case of dismissal on the grounds provided for by it, the period of payment should be limited to the last day of work. On the same day, other payments are issued, which are specified by the law and the employment contract.

Important In case of absence from the workplace on the last working day, the calculation must be made no later than the day following the day of submission of the relevant application. If a dispute arises with the employer regarding the payment of wages, he is still obliged to do so on time (Art.

140 of the Labor Code of the Russian Federation) pay an amount that is not disputed. Delay in payment is classified as an administrative violation and is punishable by a fine for each day of delay.

The topic of our article is the rules for settlement with an employee in case of dismissal, the timing of payment of wages and other mandatory payments upon dismissal.

Payment terms upon dismissal

Attention But in practice, everything is done much simpler: the employee is given all the documents and money either on the next working day after the weekend, or earlier, on Friday.

This is a violation, of course, but if you do this, then at least make sure that the dates in the documents on which the employee signs are Saturdays (for our example).

During inspections, inspectors rarely check on what day of the week the employment contract was terminated, and usually do not even notice that work on a day off was not properly documented. But in controversial situations, when a specific dismissal is being examined, this will certainly be revealed. So don't be lazy to do everything right.

Payment upon dismissal, payment terms established by law

Situation: the employee wrote a statement asking to be fired on Saturday, August 15 (the day of his last work shift). The director is not against it, but the accountant does not work that day.

Is it possible to issue an employee a work book and pay slips on Friday? The question is, in fact, very interesting, since the work schedule of the administration does not always coincide with the work schedule of other employees. And the situation described above, when the employee’s last working day falls on Saturday or Sunday, occurs quite often. Let's figure it out.

Unified dismissal procedure The dismissal procedure is established at the legislative level (Article 84.1 of the Labor Code of the Russian Federation) and is mandatory for all employers upon termination of a contract for any reason.

Dismissal of an employee

Plus, days worked by agreement with the employer that are holidays are added here (in order to receive an additional day off upon request).

If the vacation has been used to one degree or another, then the calculation will be made in direct proportion to the time worked. How to calculate compensation for unused vacation? First, you need to find out the employee's average salary per day.

And then correctly calculate how many days of vacation you need to pay. If an employee has worked for the company for at least a year, but never went on vacation, as already mentioned, he is required to pay for all 28 days.

Otherwise, you will have to make calculations using the following system (it is better to consider it with an example). The subordinate has 28 days of paid legal rest.

Is it possible to pay the salary in advance when dismissing an employee?

Usually, employees themselves come after vacation to get money. But if this does not happen, you will have to wait until the employee writes the appropriate application for payment. Disputes It is not always the case that the employer and subordinate resolve all issues without any problems.

It happens that some disputes arise about what calculation is due upon dismissal. The payment period (the Labor Code of the Russian Federation establishes a clear framework for this) of funds is one day. This means that either at the time of the application the employer must pay the subordinate, or the next day after writing the application for payment of the settlement.

What if disputes arise? Everything is very simple. The amount that is not in dispute is paid on the day of dismissal. That is, the one with which the boss agrees.

Online magazine for accountants

Tax Code of the Russian Federation). Calculation of an employee upon dismissal: payment deadlines violated by the employer An employer who has violated the payment deadline upon dismissal of an employee must pay the latter compensation for delayed payments in the amount of no less than 1/150 of the Central Bank key rate in effect during the period of delay (Article 236 of the Labor Code of the Russian Federation).

Compensation is calculated for each day of delay, starting from the day following the day when the employer was supposed to make payment upon dismissal, up to and including the day of actual payment. You can calculate the amount of compensation using our Calculator.

What else does the employer face if he has not made a payment on the day of dismissal? If the employer violated the deadline for issuing the calculation upon dismissal, and the employee complains about him to the labor inspectorate, then the employer faces a fine in the amount of (Part 6 of Article 5.27 of the Code of Administrative Offenses of the Russian Federation):

- from 30,000 to 50,000 rub. for organization;

- from 10,000 to 20,000 rub.

Calculation and payment of wages upon dismissal

Source: https://agnbotulinum.com/mozhno-li-uvolnyayushhemusya-sotrudniku-vyplatit-zarplatu-ranshe-sroka-uvolneniya/

Calculation of severance

There are situations when an employee wants to quit before the dismissal date. For such cases, the amount is calculated according to a separate scenario. If leaving before the dismissal date on the initiative of an employee, he must receive a signed application from the manager with a request to resign without working off.

The final payment to an employee upon dismissal begins with the calculation of wages. To do this, the employer determines the number of workers to be dismissed and calculates how many days worked per month. It is necessary to calculate all payments, including payment for weekends worked and holidays (if any were observed during the billing month) (Articles 152, 153 of the Labor Code of the Russian Federation).

Payments for early dismissal in case of staff reduction

Upon termination of an employment contract for any of the reasons set out in Art. 77 of the Labor Code, the employee is required to pay wages for all time worked and the cash equivalent of unused days of paid rest (of any type in accordance with the Labor Code of the Russian Federation and the collective agreement). In the event of a layoff, severance pay is paid in addition, aimed at supporting an employee who unplannedly loses his job.

If an agreement is reached between the employee and the employer to part ways ahead of schedule, then the list of payments will be somewhat wider. The final list will be formed as follows:

- salary for part of the month worked - calculated according to salary or actual output;

- compensation for vacation - determined according to the rules of Art. 139 TK;

- salary for the unworked balance of the notice period is calculated at the average daily rate, the accounting rules should be found in Resolution No. 922 of 2007;

- payment for the period of incapacity for work (if there was one in the calculation period) - the calculation mechanism is set out in Art. 14 of Law 255-FZ;

- severance pay for the first month of job search (unconditionally) and financial support for the next 2 months of unsuccessful attempts to find a job - calculations are carried out according to the norms of Resolution No. 922 of 2007.

Early dismissal can occur for various reasons. In the case where an employee leaves because he immediately found a new employer, he is entitled to only one month's severance pay.

If a person decides simply not to complete the agreed period and start looking for another job, then during the first 3 months he is entitled to financial support from his former employer. The full amount of all benefits will be available to those who managed to register with the state employment promotion service within 14 days after delivery of the order.

Payment terms and calculation rules upon dismissal in various situations

Embezzlement or theft of property. The rules of application are described in paragraph 6 of Article 181 of the Labor Code. Dismissal for such a reason requires an order from the court or an authorized person entitled to do so by virtue of his or her position. Thus, there is a need for an investigation. Typically, the culprit is often asked to leave voluntarily by writing a statement. After all, such a fact can adversely affect the reputation of both the enterprise and the culprit. The final decision rests with the employee.

The reverse side of the form must be filled out by an accounting employee with detailed notes on accruals and an indication of the total amount. Signed by the head of the personnel department and the chief accountant of the enterprise.