Calculation of insurance premiums to extra-budgetary funds

Calculate insurance premiums on the last day of each month separately for each insured person and each type of contribution. In 2021, insurance premiums are paid for:

- compulsory pension insurance (OPI) at a rate of 22%;

- compulsory health insurance (CHI) at a rate of 5.1%;

- compulsory social insurance (OSI) for temporary disability and in connection with maternity (VNIM) – 2.9%.

Above are the basic contribution rates. For some policyholders, reduced and additional rates are provided. For details, see the material “Insurance premium rates in the table.”

From April 2021, the part of the salary that is above the minimum wage is subject to insurance contributions at reduced rates. These tariffs are available only to those taxpayers who belong to small and medium-sized businesses. ConsultantPlus experts spoke in more detail about the new tariffs for insurance premiums. Get trial access to the K+ system and upgrade to the Ready Solution for free.

The employer pays insurance premiums at his own expense to the tax office no later than the 15th day of the month following the month in which insurance premiums are calculated.

In addition to the above contributions, the employer pays insurance premiums against accidents at work to the Social Insurance Fund. The rate varies from 0.2% to 8.5% and depends on the main type of activity of the policyholder.

How to determine the tariff size, see here.

To calculate contributions, use the formula:

ATTENTION! When calculating the contribution base, take into account the approved limits. In 2021, the limits for VNIM are 966,000 rubles, for OPS – 1,465,000 rubles. Read more about applying limits here.

Employers must keep records of contributions for all funds separately.

To obtain information about contributions, account 69 “Social insurance payments” is divided into three sub-accounts, namely:

- 69.1 - information on contributions to OSS;

- 69.2 - information on contributions to compulsory pension insurance;

- 69.3 - information on contributions to compulsory medical insurance.

Subaccount 69.1 is further divided into second-order accounts (69.1.1 - social insurance for VNIM; 69.1.2 - injury insurance) or an additional subaccount of account 69 is used (for example, 69.11) to account for contributions for injuries.

This grouping by accounts allows you to track all movements of funds for each fund.

Features of insurance taxation of income

The basis for their taxation is the accrued wage fund, which, in addition to the basic salary, may consist of bonus payments, accrued vacation pay, compensation and additional payments. Also subject to taxation are travel payments, payments under GPC agreements, author's orders and licensing, vacation pay, accrued bonuses and compensation, and additional payments.

Completely exempt from insurance taxation:

- All social benefit payments;

- Providing financial assistance;

- Preferential payments;

- Unemployment benefits;

- Monetary allowances for military personnel and others.

Contributions listed: what kind of postings are made?

Insurance premiums are transferred monthly no later than the 15th day of the month following the month of accrual (clause 3 of Article 431 of the Tax Code of the Russian Federation and clause 4 of Article 22 of the Law “On Mandatory Social Insurance” dated July 24, 1998 No. 125-FZ). When transferring funds to pay contributions, indicate the subaccount number of the corresponding fund in debit, and account 51 in credit, which reflects the current accounts of the company. The posting for payment of contributions (using the example of a pension fund) is as follows: Dt 69.2 Kt 51. Postings are made similarly for other subaccounts of each fund.

The accountant of Smiley LLC transferred the contributions untimely.

How to make a payment for insurance premiums, see here.

She reflected the following entries in accounting:

Dt 69.2 Kt 51 - 19,340.16 rubles;

Dt 69.3 Kt 51 – 6,708.58 rub.;

Dt 69.1 Kt 51 – RUB 1,483.88;

Dt 69.11 Kt 51 – 264 rub.

Transfer of insurance premiums for each fund must be carried out in separate payment orders. When paying contributions to funds, you need to pay special attention to the timing of their payment. For late payment of insurance premiums, organizations are charged penalties. Penalties are calculated for each day of late payment from the day following the payment due date until the day of payment inclusive. The amount of the penalty interest is taken at the rate of 1/300 of the Central Bank refinancing rate, and for companies - 1/300 for the first 30 days of delay and 1/150 of the refinancing rate starting from 31 days.

Also, the accountant of Smiley LLC calculated the penalties using our calculator and transferred them to the budget. She reflected the following entries in accounting:

Dt 99 Kt 69 (for subaccounts) - penalties accrued.

Dt 69 (for subaccounts) Kt 51 – penalties are transferred to the budget.

See also “Accounting entries when calculating penalties for taxes.”

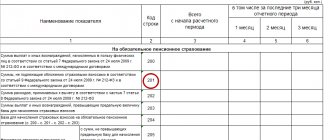

If the policyholder does not also provide a calculation of contributions to the relevant fund, an additional fine will be issued. It will be 5% for each month of delay. It is calculated from the amount of accrued contributions for the last 3 months. The maximum fine is 30% of this amount, the minimum is 1,000 rubles.

The entry when calculating a fine or penalty will be Dt 91 Kt 69.1. Account 91 “Other income and expenses” is used here. True, there is another opinion that in this case you need to use account 99. The choice of account depends on the accounting procedure for such expenses adopted in accounting, which is enshrined in the accounting policy of the organization.

The material “Basic entries when paying penalties on insurance premiums” will help you figure out which account should be used to calculate penalties on insurance premiums.

Accrued penalties and fines do not reduce taxable profit (clause 2 of Article 270 of the Tax Code of the Russian Federation).

For information on what sanctions and fines are provided for non-payment of premiums, see the material “What is the responsibility for non-payment of insurance premiums?”

Find out about liability for late payment of taxes and contributions in the Ready-made solution from ConsultantPlus. If you don't have access to the system, get a free trial online.

When an accountant needs to accrue temporary disability benefits, they use the following entry: Dt 69.1 Kt 70 (for regular sick leave) or Dt 69.1.2 (69.11) Kt 70 (for benefits due to an industrial injury).

ATTENTION! Since 2021, all regions of the Russian Federation have joined the FSS pilot project “Direct Payments”. Our experts have prepared a guide for accountants. To avoid making mistakes in your calculations, study this material.

As for temporary disability benefits, the first 3 days are paid for by the organization, the rest - by the Social Insurance Fund. For the calculation, data on earnings for 2 years before the occurrence of the insured event is used. The benefit amount for a calendar month should not be less than calculated from the minimum wage (RUB 12,792 in 2021).

Calculation of penalties: postings

The penalty is an amount intended to be paid in special cases and calculated as a percentage of the overdue amount. As a rule, the amount is one three hundredth of the refinancing rate for each day.

But from October 2021, for legal entities, the calculation schemes for this payment have changed and, depending on the period of formation of the debt, its size can range from 1/150 to 1/300 SR for arrears. The total size will be determined by simply adding up.

Payment of such an accrual is possible by the company either voluntarily or upon receipt of a notification provided by the Federal Tax Service after verification. To reflect penalties in transactions, subaccounts are added to the main account 69.

Postings for account transactions look like this:

- Accrual/additional accrual – 99; 69

- Payment – 69; 51

If during the transfer it was established that in addition to penalties there is an arrear, the payer must pay it off. In the event of an initially incorrect calculation of the amount, the arrears are accrued according to the usual payment calculation algorithm: debit of the cost account - Kt 69.

There are special rules for recording the time of operations:

- In case of voluntary payment, the posting is dated in the same way as the prepared statement of payment

- When paying after verification, the date becomes the entry into force of the decision on it

To transfer the penalty accrued by the Social Insurance Fund, you must be guided by the explanations of the Ministry of Finance of the Russian Federation. The wiring itself looks like this:

- Accrual of penalties – Dt 26/44, Kt 69

- Payment from a current account – Dt 69, Kt 51

The period of delay for calculating the penalty payable to the Federal Tax Service, according to insurance. contributions are calculated starting from the day after the established payment date. The period ends on the date preceding the actual payment.

For traumatic contributions, the number of days of delay is counted from the day on which the payment deadline is set until the date of deposit of funds, inclusive.

Results

Attribute insurance premiums to cost accounting accounts 20,23,25,26,44, etc. To break down insurance premiums by type, use account 69 and various subaccounts. When transferring contributions to the budget, record the posting Dt 69 (for subaccounts) Kt 51. If during the reporting period there was sick leave paid for from the Social Insurance Fund, reflect it with the posting Dt 69 Kt 70.

Sources:

- tax code

- Law “On the Fund’s Budget...” dated December 2, 2019 No. 384-FZ

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Changes in entries for insurance premiums and penalties in 2020-2021

Penalties and fines on contributions must be reflected in the debit of the main general expenses account (26, 44) with correspondence on the credit of the subaccount of the corresponding type of insurance (section 2 of the appendix to the letter of the Ministry of Finance of the Russian Federation dated December 28, 2016 No. 07-04-09/78875). When calculating penalties, the analytics for the contribution administrator who assigned them must also be observed.

ConsultantPlus experts explained in detail how to reflect the accrual and payment of penalties for taxes and insurance premiums in accounting. To do everything correctly, get trial access to the system and go to the Ready solution. It's free.

Payroll

Wage expenses are written off against the cost of production or goods, therefore the following accounts correspond to account 70:

- for a manufacturing enterprise - 20 account “Main production” or 23 account “Auxiliary production”, 25 “General production expenses”, 26 “General (administrative) expenses”, 29 “Servicing production and facilities”;

- for a trading enterprise - account 44 “Sales expenses”.

Read more: Restoring a title card if lost 2021 through government services

The wiring looks like this:

D20 (44.26,…) K70

This posting is made for the total amount of accrued salary for the month, or for each employee, if accounting on account 70 is organized with analytics for employees.

Transfer of personal income tax and contributions

No later than the day following the day of salary payment, the organization is obliged to pay personal income tax. Insurance premiums, including insurance premiums, are paid by the 15th of the following month. Payment is made from the current account (account 51), the debt to the Federal Tax Service and funds is closed (accounts 68 and 69). Postings:

D68 K51 - personal income tax paid

D69 K51 – fees paid

Example of payroll with postings

Employees were paid salaries for March 2021, personal income tax was withheld, and insurance premiums were calculated. Accounting for account 70 is carried out without analytics for employees, for account 69 - with subaccounts for each contribution. Expenses for salaries and contributions are included in account 20.

04/10/2019 – salary paid, personal income tax paid,

04/15/2019 – insurance contributions to the Pension Fund, Federal Migration Service, and Social Insurance Fund were paid.

| Full name | Accrued | Personal income tax | Paid |

| Ivanov I.I. | 25 000 | 3 250 | 21 750 |

| Petrov P.P. | 20 000 | 2 600 | 17 400 |

| Sidorov S.S. | 30 000 | 3 900 | 26 100 |

| Total | 75 000 | 9 750 | 65 250 |

- in the Pension Fund of Russia (22%) - 16,500 rubles

- to the Federal Migration Service (5.1%) - 3,825 rubles

- FSS (2.9%) - 2,175 rubles

- FSS injuries (0.9%) - 675 rubles

Postings for all operations:

| date | Wiring | Sum | Contents of operation |

| 31.03.2019 | D20 K70 | 75 000 | Salary accrued |

| D70 K68.NDFL | 9 750 | Personal income tax withheld | |

| Insurance premiums charged: | |||

| D20 K69.pfr | 16 500 | - to the Pension Fund of Russia | |

| D20 K69.fms | 3 825 | - to the FMS | |

| D20 K69.fss1 | 2 175 | - in the Social Insurance Fund (temporary disability) | |

| D20 K69.fss2 | 675 | — in the Social Insurance Fund (injuries) | |

| 10.04.2019 | D68.NDFL K51 | 9 750 | Personal income tax listed |

| D70 K50 | 65 250 | Employees' salaries were paid from the cash register | |

| 15.04.2019 | Insurance premiums listed: | ||

| D69.pfr K51 | 16 500 | - to the Pension Fund of Russia | |

| D69.fms K51 | 3 825 | - to the FMS | |

| D69.fss1 K51 | 2 175 | — FSS (temporary disability) | |

| D69.fss2 K51 | 675 | — FSS (injuries) | |

Keeping accounting records in the online service Kontur.Accounting is convenient. Quick establishment of a primary account, automatic payroll calculation, collaboration with the director.

Before moving directly to the rules for compiling accounting records and reflecting deductions for social needs in accounting entries, let’s look at the key aspects regarding insurance coverage for employed citizens.

Read more: Power of attorney for representation of interests in SNT sample

Insurance for individual entrepreneurs

Insurance coverage for individual entrepreneurs (in relation to themselves) differs significantly from the norms provided for employers. Thus, for the reporting year, a businessman is obliged to transfer fixed payments to the budget:

- 29,354 rubles in 2021 - for OPS;

- 6884 rubles - for compulsory medical insurance.

However, if his income exceeds 300,000 rubles per year, then from the excess amount he will have to additionally transfer 1% to the Federal Tax Service for compulsory pension insurance. For more information about mandatory payments of individual entrepreneurs for themselves, read the article > “What contributions should individual entrepreneurs pay for themselves in 2021.”

How to make postings? If the individual entrepreneur does not resort to hiring employees, then there is no need to reflect the calculation of insurance premiums of the individual entrepreneur for himself with postings. Why? Small businessmen are exempt from the obligation to maintain accounting records according to general rules. They have the right to keep simplified accounting, complete accounting, or completely abandon accounting. Therefore, it is not necessary to reflect the SV with postings.

However, if the individual entrepreneur decided to conduct accounting according to generally accepted standards and enshrined such a decision in his accounting policy, then the accrual of fixed payments to the individual entrepreneur (postings) is drawn up in a similar way, using accounting account 69 and the corresponding subaccount to it.

>