Hello! In this article we will talk about piecework wages.

Today you will learn:

- What is piecework wages and where is it applied?

- What types of piecework wages exist;

- What are the prerequisites for transferring to piecework wages;

- Advantages and disadvantages of this type of payment.

What is it and why is it needed?

Piece wages

— rewarding employees for achieving set goals.

At the end of the month, the work completed is calculated and paid upon completion. This type increases efficiency and encourages subordinates to perform efficiently and on time. Compared to time-based, the amount of work done is taken into account, but this does not mean that time is not controlled. Despite the fact that the conditions are beneficial to both parties, it is not allowed to be applied everywhere.

There are several payments of this type:

- Individual, takes into account the results of each employee separately;

- Team, takes into account the results in the group;

- Direct, takes into account earnings based on the amount of work performed;

- Premium depends on the result obtained at the end of the billing period;

- Chord, when a product is taken as a product;

- Akkordno - premium, taking into account awards for production and processing.

Which one to choose depends on the production and its type of activity.

Piece-progressive form of cash payments

Piece-progressive form of remuneration

This method of obtaining increased production volumes is used by companies where all products are immediately sold out or transferred for sale. The essence of such a payment system is that certain steps are established in payment for work.

With the achievement of each specific level, you receive an increased level of prices for the manufacture of parts (provision of services).

For example, if the daily plan is set at 100 parts, they are paid at the rate of 5 rubles per part, then for each product over 100 units you can be paid, say, 6 rubles. In this case, there can be several steps at once. For example, in the ranges from 100 to 130 parts, from 130 to 150 and over 150 parts.

There are several key nuances to consider that distinguish this level of income:

- there should be no defective products;

- actual growth in labor productivity is taken into account;

- the actual cost reduction for each unit of output is calculated;

- the pricing scale is established based on the average performance results for previous periods (usually a period of 3 months to six months is taken);

- usually set for a fixed period (directly depends on seasonality, as well as the company receiving large orders and the need to complete them in a short time).

Remember, if you do your work “at speed” without taking into account the level of quality of the final result in pursuit of increased earnings, you may even end up with penalties from the employer.

Advantages and disadvantages

Like any type, piecework has pros and cons. An employer switching to it should definitely pay attention to this.

Advantages:

- Fast sales of manufactured products;

- Increased performance;

- Personal control of each subordinate;

- Increased output;

- With a team system, mutual assistance appears and efficiency increases.

We can conclude for the employer:

- The boss can easily track the process of each employee, thereby speeding up the process and productivity efficiency.

- Subordinates are interested in production, due to which production does not stand still, but works at an ever-increasing pace.

- Due to the fact that everyone’s performance can be tracked, the employer can protect the enterprise from lazy people.

For an employee:

Interest in the work process, since earnings depend on the efficiency and speed of completing a task.

Flaws:

- The quality of the product may deteriorate due to haste in production;

- Mandatory availability of all necessary materials needed for work;

- In a hurry, an employee may violate some safety rules.

For the boss:

Sometimes, due to increasing the speed of work, defects appear. It is not suitable for all types of activities.

For a subordinate:

There is no guarantee of stable earnings or full salary payment. The advantages are more justified and there are significantly more of them, so you can safely switch without hesitation.

Piece-rate payment options used in the labor sector

Highly developed foreign industries use a piece-rate payroll system in their practice. This is a measure by which they motivate their employees to reduce the time spent on producing a unit of product. The incentive scheme provides for an increase in the rate by a percentage premium. The level of surcharge depends on factors such as:

• long-term automated operation; • the share of additional labor activity in the work process; • total time spent on manual labor.

In this way, the wages of piecework employees are distributed. When employees perform work of the same degree of complexity, but spend different time periods on it, it is advisable to use such a scheme for calculating salary. This approach avoids conflicts between the employer and employees. There is no “unprofitable work”, there is work that requires more diligence and effort to increase labor efficiency.

Domestic companies have established the practice of applying labor tariffs. Foreign enterprises include the tariff in the rate of the employee who has the skills necessary to perform a specific labor process. This motivates personnel to improve their theoretical knowledge and practical work experience, master and implement new technological processes, and increase the competitiveness of the products produced or services provided.

Russian legislation also predetermines certain guarantees for piece workers. Employees who perform functions that do not relate to their qualification level have the right to apply for bonuses. The employer's obligation in this situation is to compensate for the difference in salary caused by this work situation. This point is regulated by the Labor Code of the Russian Federation in part of Article 50.

Another variation of the piecework form is additions in the form of a temporary payment system. Under this program, the rate remains the same regardless of the results of work activity. The basic income is 60-70% of the tariff - a fixed part. The calculation is made based on the number of working shifts and hours. The second part of the salary is directly affected by performance. The cost of one unit or operation is used in calculating the moving part.

The level of the moving part of the salary is determined by the following indicators:

• quality of work performed, parts manufactured; • efficiency of working time; • compliance with work rules and labor discipline; • normative indicators.

The mixed piecework form is calculated based on the points scored. According to the moving share program, you can accrue 15-30% of the main fixed part of your earnings.

Using a different approach, the bonus is determined taking into account quality labor indicators. Payments are made based on final monthly, quarterly, and annual results. In proportion to the improvement in quality indicators, the premium also increases.

Such modern payment and incentive systems are most often used when paying for contractual labor in municipal and government institutions.

How is it different from time-based wages?

Time-based and piece-rate wages are completely different. Their conditions are opposite.

Time-based - involves payment for the time the worker spent performing duties.

With piecework, in turn, it is not the time that is paid, but the amount of work performed.

Types can be compared according to several criteria to understand their differences.

Piece-work payment:

- Earnings depend on the number of products made or sold;

- Although the employee is required to be on site full time, it does not play an important role;

- Additional work is paid;

- The work is mostly monotonous.

Time-based:

- Paid based on time worked;

- The number of duties completed does not affect the pay, which cannot be said about time;

- The payment is the same and the amount of production does not affect;

- Various types of work can be performed. As a rule, these systems are not accepted in their pure form, only in mixed form.

In what documents is it reflected?

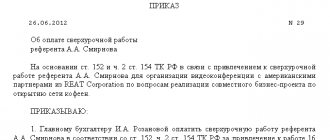

The state does not provide a universal document for piecework wages. The enterprise must draw up all the necessary samples independently, using experience in this activity.

How the document will look depends on several factors:

- Kind of activity;

- Production technology;

- Product control and quality;

- Providing production with the necessary measuring instruments.

When developing a document, the company must comply with all the conditions specified in the Federal Law “On Accounting”.

All primary documents are filled out based on:

- Technological maps;

- Working standards;

- Material pricing.

All primary documents are filled out based on time and production standards.

IMPORTANT! A special role in the documents is played by the type of piecework

How to calculate piecework wages. Formula for calculation

Piecework is calculated based on the quantity of products produced or sold. That is, 1 unit of material * fixed rate = salary of a subordinate.

EXAMPLE: When applying for a job, Anatoly entered into an agreement, which indicated that 1 m3 of material costs 500 rubles. At the end of the month, in fact, 100 m3 were processed.

100*500=5000

Total: at the end of the month, Anatoly will receive 5,000 rubles.

An example of calculating piece-rate progressive wages (SPOT).

With piecework - progressive, the employer takes into account the salary based on the goal. If the norm is fulfilled, the employee receives the agreed rate; if there is overtime, then they are paid more.

As a rule, the system is used in large enterprises engaged in mass production of elements.

SPOT conditions:

- The qualitative and quantitative qualities of the work are indicated;

- Increase in production volume;

- Clear control over the labor intensity of manufacturing products.

The meaning of SPOT is this: The more you do, the higher your salary will be.

Based on this information, you can extract the calculation formula:

Salary = Volume of output* Payment for 1 unit of output;

If the norm is exceeded:

Salary = Output volume * payment + exceeding volume * payment for exceeding.

Remuneration in case of non-production of a worker:

1. If the employer is at fault, the minimum wage is paid; 2. If an event occurred that no one could influence, 2/3 of the salary; 3. The worker himself is to blame, then he will receive a salary for the work actually performed.

In case of marriage:

1. If in good condition, the full amount; 2. The worker’s fault is not paid; 3.At a reduced price.

Direct piecework system

Direct piecework incentive system for workers

It is considered the simplest, most understandable and accessible employee incentive system. Here, wages are paid in proportion to the amount of work performed.

In other words, for each action (detail) certain prices are initially set. And if the worker did everything correctly, this amount is counted towards him as earnings.

The calculation of the wages due to the employee will be made taking into account two components. In large-scale or mass production, when it is very difficult to determine the contribution of each individual worker to the final results of labor, prices for labor are obtained by dividing the worker’s tariff rate for the job by the established production rate.

If wages are applied in a single production, then in order to obtain a price, the tariff rate is multiplied by the production rate.

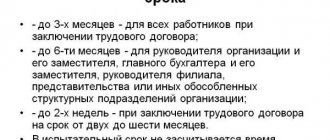

Vacation pay calculation

There is no special calculation procedure. Vacation pay is calculated in the same way as for other payments.

By law, the employer is obliged to provide annual leave while maintaining average earnings. Typically, it is determined by dividing wages by the number of days worked. It is customary to take 3 months for the billing period.

Salary includes:

- rewards for completing a transaction;

- bonuses provided for in special regulations;

- compensation (depending on the type of activity and conditions);

- year-end remuneration;

- material support provided by the enterprise.

ATTENTION: The calculation does not take into account holidays and weekends.

Piece-bonus form of remuneration

A fairly common way of stimulating employees to voluntarily increase the volume of work performed (services provided). Two types of stimulation are used at once - the employee receives a reward for the work performed, and on top of this he is also paid an additional bonus.

It is worth highlighting several key points here:

- the employee is obliged to fully complete the amount of work assigned to him for the period (usually these are monthly production standards);

- out of the total number of parts produced (services provided), there should be no defects (some employers, even if the established norm is exceeded, but with defective products, do not pay a bonus);

- the size of the bonus directly depends on exceeding the original plan (the more work completed above the plan, the higher the bonus due);

- in some cases, the bonus may be calculated over several periods (it is often practiced to pay wages monthly and the bonus once a quarter).

Remember, in order to receive additional remuneration, it is necessary not only to carry out the original plan efficiently, but also to significantly increase the amount of work beyond the norm.