The remuneration system characterizes its unit of account and the method by which the amount of labor remuneration is calculated. Different business circumstances dictate different ways of organizing the payment of wages.

The most common types of wages are piecework and time-based. In some cases, a special type of piecework system is used - piece-rate payment.

- What are its features,

- when is it more profitable to use it,

- how remuneration is calculated based on the criteria of this system,

- and how to introduce it in an enterprise

We'll tell you below.

What are the features of using the lump sum system of remuneration ?

The logic of lump sum remuneration for work

In practice, sometimes labor is organized in such a way that it is impossible to apply either the piecework or time-based wage systems in their full form. For example, a group of people works, completing a set amount of work within a given time frame, and the specialization and qualifications of the employees are different. The result of their work is complex.

It would be logical to use piecework payment, since there is a volume of work to be taken into account, but, unlike the usual use of the piecework system, it cannot be arbitrarily increased, nor can the set time be changed. The time-based payment system is also inapplicable here, since the product produced directly reflects the amount of labor invested, and the hour worked cannot act as an accounting unit.

How to calculate and pay wages in construction using the lump sum form of remuneration ?

For such types of activities, there is a lump sum system of remuneration - a subtype of piecework remuneration, when the money earned is planned to be paid in aggregate for the entire required amount of work completed within the agreed time.

REFERENCE! We can say that piece-rate payment is piecework, established for a heterogeneous group of employees, but can also be established for one employee. It is regulated by the Methodological Recommendations for accounting of labor costs and their payment in agricultural organizations, approved by the Ministry of Agriculture of the Russian Federation on October 22, 2008.

Procedure for attracting employees

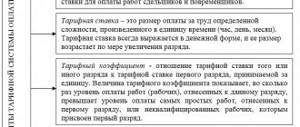

- What is the wage grade system?

If the technique is used for a limited period, then the establishment time should appear in internal local regulations. It is necessary to conclude a fixed-term individual employment contract with each employee. If the lump sum system of remuneration is characterized by the implementation of specific work for a specific period, then the period in the employment contract should not exceed the established time interval.

- How is overtime paid under the Labor Code?

Labor relations are formalized:

- a fixed-term employment contract for internal part-time work or an order to combine positions if the employee is on the staff of the enterprise;

- an additional labor agreement for external part-time work, if the hired citizen is not on the staff of the enterprise as the main employee.

The lump sum wage system provides for the possibility of paying remuneration in an amount not lower than the minimum wage established at the regional level throughout the entire period until the completion of the production cycle or set of works. This information must be specified in internal local documents.

Piecework wages are an analogue of attracting a citizen to perform work of a civil nature. However, unlike a one-time contract, the employee is not removed from activities based on the results of performance, but receives a bonus payment and “extra points” in the eyes of management.

When is it appropriate to use

The chord payment system should be chosen in cases where you need to perform a number of actions within a limited time frame, these could be the following situations:

- rush;

- the need for urgent implementation under threat of sanctions;

- extraordinary circumstances that may cause problems with the further functioning of production;

- one-time amounts of work;

- introduction of new equipment or technological process, etc.

IMPORTANT! The chord system is stimulating in nature, therefore it is mainly used only temporarily and in special situations.

Most often, the chord system is used in enterprises where it is possible to accurately take into account the amount of work performed according to the developed labor cost standards. These could be communications enterprises, industrial organizations, construction companies, work in some branches of agriculture, where manual labor is used, etc.

Features of design in the organization

Basically, chord is used for production needs, when urgent types of work are required.

Article 59 of the Labor Code of the Russian Federation states that in such cases it is necessary to conclude fixed-term employment contracts.

Labor Code of the Russian Federation

The fixed-term contract must indicate:

- the types of work that an individual employee or team of workers must perform;

- deadline for completing the work;

- salary amount, bonus procedure and other nuances.

Composition of lump sum payment

Wages intended for a group (team) of workers for a given volume of labor operations within a specified period consist of the following components:

- salary, tariff or established rate for labor;

- certain additional payments;

- premium.

Earnings depend to a greater extent on the first component, that is, on the prices for certain types of work.

Accord-premium system

Payment of bonuses under such a system is carried out for the fulfillment of pre-agreed bonus conditions. What these conditions will be is determined individually. Naturally, there must be mandatory accounting of established indicators. If the group failed to achieve these indicators or meet the conditions (for example, meet the allotted deadline), then the money will be paid without a bonus component.

How to calculate employee salaries

If an urgent job consisting of n separate components is assigned to one employee, then his remuneration is calculated using the formula:

C = S1 * A1 + S2 * A2 + … + S(n) * A(n),

where C is the total payment amount, A(n) is the quantity of the nth work, and S(n) is the cost of the nth component of the work.

Example 1.

The worker is tasked with turning 100 parts in 10 days (job A1) and assembling 5 structures from them (job A2). The cost of manufacturing one part is 100 rubles (S1), and the cost of one assembly is 1000 rubles (S2). The salary will be:

C = (100 * 100) + (5 * 1000) = 15,000 rubles.

Piece system

If the work is entrusted to a team, and the result of the work directly depends on the time it takes to complete it (for example, guarding a warehouse or performing similar actions), then the piecework type of the chord system is used, and the contribution of each employee is proportional to the duration of his work.

Formula for calculating payment to the nth team member:

C(n) = S * T(n) / T,

where S is the total payment for the entire facility, T(n) is the time spent by the nth employee on work, and T is the time spent by all employees, with T1 + T2 + ... T(n) = T.

Example 2.

A team of 5 workers was assigned to guard the warehouse for 10 days in turn. The declared total cost of the work is 40,000 rubles. During the entire period, two workers guarded the warehouse for 72 hours each, the other three – for 32 hours each. The total operating time is 240 hours.

The payment to each of the first two workers is 40,000 * 72 / 240 = 12,000 rubles, and the payment to each of the remaining three is 40,000 * 32 / 240 = 5,333.33 rubles.

Premium and mixed systems

If the work consists of several components, each of which is valued in a different way, then the final payment for each employee of the team consists of the price of work of each type, multiplied by the contribution of this employee to this component (in hours or another unit of measurement) and, if necessary, multiplied by the KTU. The formula in this case will be individual for each case.

Example 3.

A team of 6 workers was tasked with renovating the premises in 10 days. The total cost of the work is 100,000 rubles. The list of works included:

- dismantling the old floor - 30,000 rubles;

- installation of a new floor – 60,000 rubles;

- security of the premises at night (ten nights for 12 hours) – 10,000 rubles.

The dismantling fee depends on the labor contribution, therefore it is calculated using the formula:

C = 30000 * (A(n) / A),

where A(n) is the area of the floor broken by the nth member of the team, A is the total area of the floor.

Installation is more complex, therefore, in addition to the volume completed, KTU is taken into account for quality. 0.9 – low quality, 1.1 – high.

The fee for installing the floor of the nth employee is 60000 * (A(n) / A) * KTU .

The security fee depends on time and is calculated for the nth employee as:

10000 * T(n) / T,

where T(n) is the number of hours worked by the nth employee, and T is the total number of hours (120).

In total, the salary of the nth employee will be:

C(n) = 30000 * (A(n) / A) + 60000 * (A(n) / A) * KTU + 10000 * T(n) / T.

When calculating, it is important to take into account that the total KTU of all employees should be equal to 6 (the number of team workers).

How to distribute lump sum earnings within a team

The amount paid upon completion of the work is intended for all participants in the process. It can be distributed depending on different criteria:

- by the time during which each participant was employed (distribution of wages);

- according to the labor participation coefficient (LCR), which takes into account various labor characteristics (this is how bonuses and additional payments are usually distributed).

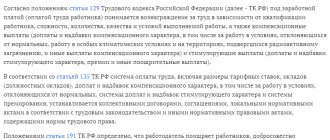

What payments does it involve?

The accord method of calculating earnings involves taking into account certain indicators:

- Limited period of time.

- Including a certain exact scope in the task.

- Payment is determined exactly before the action is completed.

The entire amount is paid if the project deadlines were met as accurately as possible. It is permissible to introduce additional rewards.

If a lump sum salary has been established for a team of employees, it includes the following components:

- Awards.

- Various additional payments.

- Salaries or tariffs, established prices.

Counting methods are divided into two options:

- Piecework.

- Premium.

For work performed in the second option, an additional amount specified in advance is awarded.

If the manager has set a specific task, it is easy to provide bonuses for meeting the following requirements:

- Saving.

- Quality.

- The task was completed before the deadline.

- The plan has been exceeded.

At the request of the customer, the list can be easily expanded; the list is not exhaustive. Payments are increased for various reasons.

Compliance with existing indicators and conditions for bonuses are the most important factors that require consideration.

If the scheme is piece-rate, only a specific salary is paid if the other party has fulfilled all the conditions.

How to introduce the chord system

Since the application of this system is temporary (one-time or emergency) in nature, the accounting documents must reflect that for a group of employees, wages will be calculated according to this scheme for a specified time.

This kind of work can be performed under fixed-term employment contracts (Article 95 of the Labor Code of the Russian Federation), which will stipulate:

- types of actions;

- deadline (there must be a work schedule, even if it does not affect the amount of remuneration);

- prices for work.

IMPORTANT INFORMATION! If an employee who wants to be involved in working under such a system has already concluded an agreement with the company, that is, is part of the staff, an internal transfer will be needed. You cannot do without it: since the remuneration system is an indispensable element of the employment agreement, it must be reflected in the employment contract.

Example of use in practice

Most often, lump sum wages are used to calculate wages for teams of two or more people. Therefore, as an example, let’s take a situation in which a team of 3 people was repairing a crane. They were given 3 working days to complete the work - that is, 24 hours of working time. The predetermined total salary amount is 6,000 rubles. Let's calculate how much each specialist will receive, according to the number of hours worked:

- Two team members worked 18 hours. The amount they must be paid will be 6000/24 x 18 = 4500 rubles. Accordingly, each of them will receive 2,250 rubles (4,000 rubles / 2 (number of employees) = 2,250 rubles).

- The remaining 6 hours were worked by the third team member. The salary calculated for him is 6000/24 x 6 = 1500 rubles. Also, his salary can be calculated differently: 6000 – 4500 = 1500 rubles.

If it is necessary to calculate wages per person according to a similar scheme, then it will be necessary to set a rate per unit of work performed. For example, for each meter of cable installed, the installer will receive 100 rubles. Accordingly, for 100 meters of cable installed, he will receive 10,000 rubles. In addition, the employer can set a period of time during which the cable must be installed and provide a bonus if the employee meets the recommended deadline. Accordingly, if the installer spends more time on installation, then he loses the bonus.

Documenting

One of the internal documents of the organization must specify the procedure for remuneration according to the lump-sum system if it is planned to be used. When a fixed-term employment contract is concluded with a worker or group of employees, it must contain a reference to this act.

To calculate wages using the lump-sum system, there must be the following documentary grounds - paper reflecting the essence of the lump-sum task and the progress of work on its implementation. Such a document must contain:

- a list of all types of work performed;

- their quantitative and qualitative indicators;

- prices for each type of activity;

- total amount to be paid.

In most cases, such documents are work orders and reports of completed tasks.

ATTENTION! An organization may adopt its own design standards, but in some industries, unified forms of documentation have been developed for this purpose, for example, a waybill for the transport sector, a work order for piecework in agriculture, a report on the operation of mechanisms in construction, etc.

Calculation formula

To calculate possible time and labor costs when the lump-sum method of remuneration is used, projects, drawings, time standards, waybills, and work orders on a piece-rate basis are used. The money to be paid is issued to the entire team, after which a calculation is made for each employee based on individual contribution in proportion to the time spent or the volume of the task.

To calculate the individual contribution, the formula is used:

Piece rate = prices for the type of work (RVR) No. 1 × quantity of work (KR) No. 1 + RVR No. 2 × KR No. 2 + … + RVR No. n × KR No. n.

If the form of labor is collective, the resulting calculation result is divided by the total amount of work for the final result.

The payment is calculated according to the labor participation rate (LCR):

Wages = cost of work / KTU of workers × KTU of an individual worker.

Advantages of the lump sum payment system

Since the original meaning of any labor remuneration is payment for achieving a certain result, lump sum payment is the best way to promote the effective application of this principle.

If the organization has a well-established record of labor results, rationing is well planned, and quality control is constant, then the chord system guarantees:

- reducing the workload of standardizers;

- simplifying the distribution of work volumes;

- facilitating the process of accepting work results;

- saving working time, material and energy costs;

- reduction in production costs;

- a more cohesive workforce;

- a significant reduction in business risk, since personnel costs are always proportional to the volume of labor.

Advantages and disadvantages

The advantages of the chord system include:

- increasing the team’s motivation for quality work>;

- time saving>;

- reduction of labor standardization costs>;

- independent distribution of work volumes and working hours within the team;

- reducing business risk.

If, when concluding ordinary employment contracts, the employer is forced to continuously monitor the speed and quality of work, then with the chord system, the team itself is interested in the quick and high-quality completion of the work.

For private customers, this system is convenient because there is no need to delve into the essence of each component of the scope of work in detail - it is enough to agree on the final price for the entire volume and set deadlines.

The disadvantages include the likelihood of an incorrect (inflated) initial estimate of the cost of the total scope of work , especially for an inexperienced customer, since after signing the contract, the cost of the work cannot be changed if there are no violations. For the brigade, the disadvantage is the difficulty of assessing the contribution of each individual employee under the piecework-bonus system.

Payment methods

The amount due to employees as remuneration for work performed can be calculated in several ways. Some enterprises consider time-based payment beneficial when employees perform work within the time regulated by internal documentation. In this case, production volumes are not important, the main thing is the presence of a person at the workplace. This method does not stimulate employees to achieve any production results.

When wages are calculated for completing a task within a strictly specified time frame and in a certain volume, the activities of workers who strive to show the best work results are stimulated. This ensures increased competitiveness among employees, each of whom strives to show the best results. The consequences of such a remuneration calculation scheme is an increase in the profitability of the enterprise. Each business entity has the right to independently choose a remuneration system. This takes into account production parameters, the need to implement the plan in accordance with customer requests, as well as improve labor efficiency.

Types of remuneration

Lump-sum payment is one of the types of application of a piecework remuneration scheme for workers.

Having decided to put it into practice, the employer sets prices for each type of product or service in the form of a fixed payment that regulates the performance of work in a specific volume. The tariff is established by signing administrative documentation before the start of work. In an internal order or instruction, it is necessary to take into account the parameters of production activities that limit its conduct to a time frame and a certain number of employees. Their work is paid only after fulfilling all regulated conditions and achieving the required indicators.

The chord remuneration system is characterized by collective production results of a specific volume in a time strictly established by the plan. Its use is relevant when work is performed by a team, when each member is busy at his own production site. The remuneration calculation method is popular because employees strive to increase productivity with the required quality of products due to the transparency of relations with the employer. This is due to the preliminary familiarization of employees with the methodology for carrying out settlement measures relating to remuneration for work, as a result of which the amount of earnings to employees is known in advance, even before the start of activity.

An example of calculating wages for employees using the lump-sum system

When is it relevant to use?

The use of a lump-sum payroll system is not always acceptable, since it is relevant only in situations where a business entity is provided with orders that require compliance with certain production volumes.

Otherwise, productivity growth can lead to the release of a huge amount of products, which will gradually become unclaimed, since the sales markets of a business entity are not designed for such volumes. This is due to insufficiently established relationships with counterparties who are consumers. In such a situation, the use of lump sum wages can lead to a reduction in the cost of the final result of labor, a decrease in the profit of the enterprise, and, as a consequence of this, a fall in prices that determine the amount of remuneration.

The lump sum form of remuneration is recommended in situations where the company cannot cope with the speed of production and delivery of products in the volume required by consumers within a specific time frame. Such remuneration is relevant in cases where the terms of contractual relations with counterparties imply the accrual of penalties for delays in product delivery. The launch of new equipment at the enterprise, as well as force majeure production circumstances, such as emergencies or breakdown of equipment or production line, contribute to a decrease in production volumes and failure to meet the plan on time. A strictly bonus wage system in such a situation will stimulate workers to increase productivity while complying with the regulated parameters of the quality of work results. However, its use does not allow highlighting the achievements of a particular employee.

Accord-bonus system, calculation example