Can a resigning employee’s salary be withheld?

On the day of the official termination of the employment relationship, the employee is paid all amounts of money due to him. If the employee did not work on the day of dismissal, accruals are made no later than the next day after the citizen’s request to make a payment (Article 140 of the Labor Code of the Russian Federation).

The basis for payments to the accounting department is the order to terminate the employment relationship. If the dismissal is made at the employee’s own request, he is obliged to submit a corresponding application 2 weeks before the expected date of departure. On its basis, an order is prepared, then funds are transferred (what payments are due upon dismissal of one's own free will and should vacation pay be given?).

The following payments are included in the calculation upon dismissal:

- wages for the period worked;

- compensation for unused vacation (read about how to claim compensation for unused vacation upon dismissal and what to do if funds are not paid in separate materials);

- incentive payments in accordance with the collective agreement;

- compensation for sick leave;

- severance pay (in case of downsizing or liquidation of the company).

If on the last day of work the payment is not made while the employee is present at the workplace, this is considered a delay and entails liability for the enterprise.

If the employee was absent on the day of official dismissal, he can request payment on a day that does not coincide with the officially stated one. In this case, the payment is made no later than the next day after the request is sent to the employer. Accordingly, the period for which payments may be delayed is calculated from this date.

When a person goes on vacation and subsequently terminates the employment relationship, the employer can calculate it when issuing vacation pay, on the last day before the vacation. If a citizen is on sick leave, payment is made upon presentation of a sheet officially confirming the illness.

According to labor legislation, delaying payment terms at the end of an employment relationship is unacceptable. State bodies have the right to impose sanctions on the employer, which include:

- compensation to an employee for delayed payments;

- fine;

- administrative and criminal liability.

Legislative framework of the Russian Federation

In accordance with Art. 37 of the Constitution of the Russian Federation and Art. 21 of the Labor Code of the Russian Federation, everyone has the right to remuneration for work without any discrimination and not lower than the minimum wage established by federal law.

According to Art. 22 of the Labor Code of the Russian Federation, the employer is obliged to pay the full amount of wages due to employees within the time limits established in accordance with this Code, the collective agreement, internal labor regulations, and employment contracts.

We suggest you read: How to register a person in an apartment

General provisions on employers' liability are enshrined in Art.

What compensation is due for delay?

For late payments, the employer faces financial liability (Article 236 of the Labor Code of the Russian Federation). The company is obliged to provide the employee with compensation, the amount of which is at least 1/150 of the key rate of the Central Bank of the Russian Federation of the unpaid amount for each day of delay. If the salary was not transferred in full, compensation is calculated from the funds actually not provided.

The law allows for an increase in interest for late payments if this condition is established in the local regulations of the enterprise.

The obligation to provide compensation arises regardless of the organization's fault for the delay. This payment is not subject to personal income tax (Article 217 of the Tax Code). However, with an increased percentage, income tax is levied on the difference between the amount established by the employer and the amount established by the Labor Code of the Russian Federation.

It is recommended to make insurance contributions from compensation to employers, since it is not clearly indicated in the list of non-taxable income. However, in the practice of the Supreme Court, claims about the illegality of their collections are satisfied. If you do not want to bring the matter to litigation, it is advisable to make contributions.

It should be noted that the former employee has the right to additionally demand indexation of the unpaid amount due to inflation (clause 55 of the resolution of the Supreme Court of the Russian Federation dated March 17, 2004 No. 2). Accordingly, the amount of compensation will also increase.

Rules for collecting unpaid payments (severance pay) upon dismissal

The main reasons why commercial organizations delay payment of wages are problems with the sale of products, solving the financial problems of the organization with the help of funds intended to pay employees, investing these funds in various projects in order to obtain greater profits, and others.

It is important to understand that non-payment of wages is considered a violation of workers’ rights, regardless of the reasons that led to such a delay.

Who is responsible?

The company is responsible for late payments to a former employee. Compensation for delay is due even if the employer is not at fault.

For example, the Central Bank revoked the license of the bank servicing the enterprise. Because of this, the employer was unable to transfer payments to the dismissed employee on time. However, the enterprise is obliged to provide compensation for the delay to the citizen, despite the absence of its fault.

For late payments, the employer may be subject to administrative and criminal liability.

To do this, it is necessary to prove the direct guilt of the organization, the official, or the action for selfish purposes. Responsibility may be borne by both the director of the enterprise and another employee who committed illegal actions (deputy director, accountant).

What fines may be imposed?

If payment rules are violated, the organization is subject to not only financial liability in the form of compensation, but also administrative liability, which involves issuing a warning and imposing a fine. The amount of sanctions is indicated in parts 6, 7 of article 5.27 of the Code of Administrative Offenses of the Russian Federation.

The amount of the administrative fine is:

- 10-20 thousand rubles. - on officials;

- 1-5 thousand rubles. - on individual entrepreneurs;

- 30-50 thousand - for organizations.

In case of repeated violation, the amount of sanctions increases:

- 20-30 thousand or disqualification for 1-3 years - for officials;

- 10-30 thousand rubles. - on individual entrepreneurs;

- 50-100 thousand - for organizations.

The exact amount of the sanction depends on the degree of guilt of the employer, the scale of the damage caused, and the number of similar offenses within the company.

The withheld fine is transferred to the municipal fund or the state treasury.

Criminal liability for violation of payment terms is regulated by Art. 145.1 of the Criminal Code of the Russian Federation. In this case, the sanctions include:

- In case of partial non-payment for more than 3 months - a fine of up to 120 thousand rubles, forced labor for up to 2 years or imprisonment for up to 1 year.

- In case of complete absence of payments for more than 2 months - collection of 100-500 thousand rubles. or forced labor for up to 3 years or imprisonment for up to 3 years. If there are serious consequences from the offense, the period of loss of freedom can increase to 5 years.

It is also possible to introduce restrictions on entering into management positions or conducting specified activities.

How to calculate compensation correctly?

The standard method for calculating compensation is based on the provisions of Art. 236 Labor Code of the Russian Federation. Formula for calculation:

K=NZ*1/150*StR*P , where

- K is the amount of compensation;

- NZ - the amount of unpaid earnings;

- StR - key rate of the Central Bank;

- P - period of delay.

The case of delay

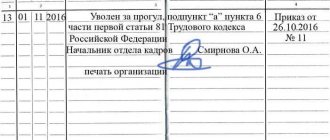

According to the order, citizen Smirnov’s last working day before dismissal is November 14, 2021. He was at the workplace, but the payment was 20 thousand rubles. not received. Payments to him were made in full on November 21, 2021.

The period of delay is calculated from the day following the designated payment date until the date of actual repayment of the debt to the employee, inclusive. Smirnov's delay was 7 days. The key rate of the Central Bank at this time is 6.5%.

Compensation calculation:

K = 20,000 * 1/150 * 6.5 / 100 * 7 = 60.67 rubles.

That is, 60.67 rubles must be added to the amount of earnings of the dismissed Smirnov.

If the percentage of compensation is indicated in the local acts of the enterprise, the calculation is carried out according to the formula:

K=NZ*D*P , where

- K is the amount of compensation;

- NZ - unpaid wages;

- D - percentage of compensation in accordance with the regulations on remuneration or other act;

- P - period of delay.

The percentage of compensation specified by local regulations of the employer cannot be lower than 1/150 of the rate of the Central Bank of the Russian Federation.

The case with the coefficient specified in the contract

The day of dismissal of citizen Smirnov is November 14, 2021, payment in the amount of 20 thousand rubles. he received it only on November 21, 2019. At the same time, the wage regulations stipulate a compensation percentage of 0.08%. The delay period is 7 days.

Compensation calculation:

K = 20,000 * 0.08 / 100 * 7 = 112 rubles.

That is, Smirnov, when calculating the amount of earnings, will receive an additional 112 rubles.

What should a fired person do if he is not paid?

If a citizen is not paid upon dismissal, he has the right to defend his violated rights by all means available to him. For these purposes he can:

- Contact your former employer with a written demand for repayment of the debt;

- Seek help from the labor inspectorate;

- Complain to the prosecutor's office;

- File a claim in court.

As a rule, a direct demand to the former employer for repayment of the debt is unsuccessful. In this regard, it is more advisable to immediately resort to subsequent options.

How to complain to the State Tax Inspectorate or the prosecutor's office?

A citizen whose labor rights have been violated can submit a written complaint to the labor inspectorate. It can be delivered in person, sent by mail with a notification, or sent by email. Each application is considered within 30 days from the date of its receipt; in exceptional, particularly difficult cases, this period can be extended by another 30 days.

During the specified period, the State Tax Inspectorate will verify the fact of the violation. If non-payment of wages upon dismissal is confirmed, the inspectorate takes the following actions:

- Issues an order to repay the debt within a certain period (Part 1 of Article 357 of the Labor Code of the Russian Federation, Article 12 of Law No. 59-FZ);

- If the employer does not fulfill it within the period specified in the document, then no later than a month from its end, the procedure for forced collection of the salary debt begins;

- A decision on forced collection that has not been appealed and not fulfilled on time is sent to bailiffs for execution.

In general, the procedure for contacting the prosecutor’s office is similar to filing a complaint with the State Tax Inspectorate and is considered within the same time frame. The prosecutor conducts an inspection and, if a fact of non-payment of wages is discovered, issues an order to eliminate the violation, which is mandatory for the employer.

- Sample application to the prosecutor's office, view and download here

- Sample application to the labor inspectorate, view and download here

How to go to court and do you need to seek the help of a lawyer?

Expert opinion

Mikhailov Vladislav Ivanovich

Lawyer with 6 years of experience. Specializes in family law. Knows everything about the law.

A citizen who has not been paid upon dismissal can go directly to court (see how to sue an employer for non-payment of wages) bypassing the above authorities.

In addition, writing a complaint to supervisory authorities also does not deprive a citizen of the right to subsequently initiate legal proceedings. It should be borne in mind that the final decision on labor disputes is made by judges and, if the dismissed person has a firm intention to file a claim, he needs to do this immediately, and in this case there is no point in writing complaints.

An exception to this rule is cases when, as a result of an inspection, a citizen hopes to obtain additional evidence of the employer’s guilt for the subsequent process, which is not possible to obtain in other ways. This is especially true for a citizen who did not work officially, since in this case it is quite difficult for him to obtain documentary evidence of the existence of an employment contract and the amount of debt.

Claims for recovery of wages can be filed within 1 year from the date of termination of the employment contract (Article 140, Part 2, Article 392 of the Labor Code of the Russian Federation, Clause 56 of the Resolution of the Plenum of the Armed Forces of the Russian Federation dated March 17, 2004 No. 2). Proceedings for the collection of wage arrears are possible in 2 options:

- If the amount of the claim is not disputed by the defendant, it is no more than 500 thousand rubles. – in the order of writ proceedings, through the magistrate;

- In the case of a debt amount exceeding 500 thousand rubles. or if there are disagreements with the employer regarding the amount of debt - through litigation through a district court.

You can go to court at the place of residence of the employee, the location of the employer or the territory where the dismissed person performs work, depending on the wishes of the plaintiff. The order of collection is much simpler, it includes:

- Filing an application for a court order;

- Consideration of the application by a magistrate and issuance of a court order within 5 days from the date of receipt of the application;

- Within 5 days, a copy of the order is sent to the employer, if he does not provide written objections to it within 10 days, the order acquires the force of an executive document and is transferred to the plaintiff or, at his request, immediately to the bailiffs.

Important! If a long time passes from the receipt of the order to the date of actual repayment of the debt, the citizen has the right to additionally demand indexation of the payments due to him (Article 208 of the Code of Civil Procedure of the Russian Federation, clause 3 of the Resolution of the Constitutional Court of the Russian Federation of July 23, 2018 N 35-P).

The process of full-fledged litigation is longer and without the help of a qualified lawyer it will be difficult for an unprepared person. It includes:

- Drawing up and filing a claim along with a package of evidence substantiating the stated requirements;

- After accepting the claim, the judge makes a decision to prepare the case for trial, and preliminary court hearings may be scheduled;

- After the preparatory procedures are completed, a decision is made to set a date for the court hearing;

- Meetings are held and a decision is made on the case.

The labor dispute must be considered within a period not exceeding 2 months from the date of acceptance of the claim. If the case turns out to be complex, this period may be extended, but not more than 1 month. After the decision in the case is made, the defendant has a month to appeal. After this period, the decision comes into force.

On the day the employee ceases to work, the company management undertakes to provide wages and compensation. However, not everyone strives to comply with the law.

Dear readers! The article talks about typical ways to resolve legal issues, but each case is individual. If you want to find out how to solve your particular problem , contact a consultant:

APPLICATIONS AND CALLS ARE ACCEPTED 24/7 and 7 days a week.

It's fast and FREE !

What should Russian citizens do in such a situation? How to achieve justice?