How is it different from an internship?

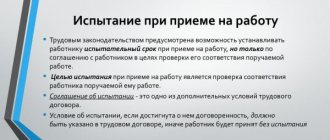

The time during which the head of the enterprise must check the professional qualities of a candidate for a position may be provided for in any employment contract . At this time, it is important for the employee to show potential and experience in the position for which he is applying. The period during which the employer tests the professional suitability of a new specialist must be paid.

If the test period has not been passed, the administration may terminate the employment relationship.

The main difference between an internship and testing a candidate’s professional qualities is the impossibility of allowing an employee to work independently. When the internship period comes to an end, the employee must undergo testing of acquired knowledge and skills. In case of unsatisfactory results, the duration of the internship may be extended.

If, after repeating the activity to gain work experience, the candidate cannot confirm his professional suitability, he will be dismissed from his position.

Attention! During the internship, the company enters into a fixed-term contract with the intern, which defines his functions, powers and amount of payment. This allows you to avoid orders for violation of the law.

Deadline for transferring personal income tax upon final payment

The amounts of the final calculation are subject to taxation - the employer is obliged to transfer personal income tax from them, guided by the following algorithm:

- Calculation of tax due.

- Withholding tax from accrued income.

- Transfer of personal income tax on the day following the termination of the employment relationship.

- Filing a tax return in form 2-NDFL at the end of the calendar year.

According to Art. 225 of the Tax Code of the Russian Federation, personal income tax is 13% of the tax base, which is calculated as the monetary expression of income minus tax deductions. Monthly tax deductions are presented in the table.

| Basis of deduction | Amount of deduction, rub. |

| Disabled person status during WWII | 3000 |

| Title of Hero of the Russian Federation | 500 |

| Parents of one or two children | 1400 each |

| Parents of three or more children | 3000 each |

How long does it last according to the Labor Code of the Russian Federation?

The head of the enterprise may initiate early termination of the inspection period if the employee has proven his professional suitability. In this case, the subject will be hired for a permanent job ahead of schedule. Below you can find the minimum, maximum and optimal duration of the test period.

Minimum

The minimum permissible probationary period at work according to the Labor Code lasts 14 days. A minimum professionalism test, during which the employer checks the professional suitability of an employee, is assigned to persons with whom a fixed-term employment contract of 2 to 6 months has been signed.

Maximum

The maximum duration of IP should not exceed 3 months. However, there is a category of professions that may be subject to a six-month review period. The maximum probationary period according to the Labor Code of the Russian Federation is assigned to candidates for the position of chief accountant and his deputy, as well as the head of the enterprise and his deputy

The specific nature of the work of the listed categories of employees does not allow checking their professional qualities in a short period of time.

Optimal period

The most preferred period for passing the test is 3 months . During this period of time, the candidate will be able to demonstrate his abilities. The manager, in turn, will be able to assess the professionalism of the new specialist and answer the question of how easily he can fit into the team.

Is it possible to extend

If a candidate for a position was on sick leave during the professional test According to the Labor Code, the employer has the right to add the amount of time that the employee did not appear at the enterprise.

Important! To extend the probation period, you will need to create a special order that will reflect the reasons for adding time.

Nuances of drawing up an employment contract regarding the probationary period

When a new employee is hired, an employment contract is signed with him and a special order is issued to accept him for work. These documents contain information about the conditions under which the employee will work for the company. If an employer wants to check the professional suitability of a new employee, then he must stipulate that the employee undergo a probationary period. This fact must be reflected both in the order and in the employment contract. The testing period is regulated by Article 70 of the Labor Code (LC) of the Russian Federation.

How to calculate

The professional review period should be calculated taking into account the agreement that was drawn up with the candidate and the position that he plans to occupy. If an agreement was drawn up for a period of 2 to 6 months, then the duration cannot exceed 14 days. When hiring managers, chief accountants and their deputies, the employer can calculate for them the maximum period for testing their professional skills, which will be up to 6 months.

If an employee leaves during the test on sick leave, the days that he did not attend work will not be counted.

Dismissal immediately after completion of the inspection

In the absence of notice of dismissal from the employer, the first day following the end of the probationary period is considered the first day of work on a permanent basis. The manager or human resources department is not required to notify the subject employee of the end of his or her inspection period.

If the employer decides to dismiss the candidate, he is obliged to notify him of this 3 calendar days in advance. Dismissal with the wording that the candidate has not passed the test can occur no later than the date following the day the probationary period ends. Thus, the last day for an employee to receive a notice of legal dismissal with the wording described above is the date 2 working days before the check completion date specified in the order and contract.

Let us remind you that the employer must justify his decision. You can read specifically about what can become a reason for dismissal in the previous section.

Dismissal initiated by the employer, if more than 1 day has passed from the end of the probationary period, must be carried out on a general basis.

The wording that the employee did not pass the test during the probationary period is illegal in this case. Therefore, an employee in this situation should be dismissed only on a general basis, according to the Labor Code of the Russian Federation. A different development of events may become a reason to appeal the legality of the employer’s actions in court.

The standard dismissal procedure on a general basis provides for:

- working for a 2-week period after receiving notice of dismissal;

- receiving full cash payment, including severance pay.

Who should not install

According to the Labor Code of the Russian Federation, during the execution of an employment agreement, not every category of individual can be subject to an inspection. It is prohibited to install the test even for a minimum period:

- Persons who have passed a competition to fill a position and have been selected based on their results. The competitive recruitment must comply with the procedure of the Labor Code of the Russian Federation.

- Women who have children under one and a half years old.

- Minor citizens.

- Persons who graduated from an educational institution with state subsidies. If 12 months have not passed since the date of graduation from the educational institution, the employer cannot establish a check even for a minimum period.

- Individuals with whom an employment agreement was concluded for a short period.

- Women carrying a child.

- Persons who entered the position by agreement between the heads of organizations.

Attention! When signing an employment contract, the employer should make sure that the candidate does not belong to a category that does not allow the appointment of a check.

Grounds for dismissing an employee during probation

Common reasons for dismissal include:

- The employee fails to cope with the obligations assigned to him;

- Absenteeism;

- Failure by the employee to comply with established safety rules;

- Neglect of labor discipline rules;

- Unprofessional behavior/behavior discrediting the reputation of the enterprise;

- Disclosure of commercial/official secrets.

The reason will be legal if the employer has evidence supporting it. For example, an employee has signed job descriptions and safety regulations, but does not comply with their provisions.

Is work experience included?

For employees who are on the IP, not only health insurance is paid, but also pension contributions. The time for testing the professional suitability of an employee must be included in the length of service. Only the order number and date are entered in the work book entry. There is no need to register information about passing the test.

The time period during which a candidate for a position proves professionalism must be included in the length of service according to which the next vacation will be calculated. When a new specialist has worked at the enterprise for 6 months, he can count on being granted leave in the general manner.

If the employee’s dismissal occurred before the completion of the audit, the individual must receive compensation for vacation based on the time actually worked.

Documents required to justify dismissal during the probationary period

Evidence of unsatisfactory testing is:

- acts on marriage committed by the employee;

- reports on the candidate’s non-fulfillment or poor performance of his work duties;

- a negative reference from the employee responsible for supervising the candidate’s probationary period;

- if available, extracts from the test control log;

- complaints from team members;

- customer complaints in the book of complaints and suggestions (if available);

- orders, acts, notices of disciplinary sanctions (if any).

Dismissal during the probationary period and at its end

Both parties who entered into an employment agreement have the right to terminate the contract during the probationary period and at its end. According to Article 71 of the Labor Code, an employer can sign a dismissal order if an employee fails to cope with his professional duties. It is possible to terminate an employment contract by agreement of the parties or at the request of the employee.

There is a category of persons whose dismissal will be considered illegal. This category includes:

- pregnant women;

- single mothers who are raising disabled children (under 18 years old) and children under 14 years old;

- women who raise children under 3 years of age;

- other persons raising a small child without a mother;

- parents with many children who have more than 3 young children in their family.

The law does not provide for the payment of severance pay in this situation. If the manager did not take care in advance to inform the young specialist about his professional unsuitability before the deadline specified in the employment agreement, the reason for dismissal will be canceled.

During the probationary period and upon its completion, the employer has grounds to dismiss the employee if the following were noticed on his part:

- unprofessional behavior;

- absenteeism;

- committing offenses at the place of work;

- ignoring the rules of labor discipline.

Before issuing a dismissal order, the head of the company is obliged to warn the employee in writing 3 days in advance.

Reference! If an employee needs to be dismissed after the completion of the probationary period, then professional unsuitability cannot be the reason for termination of the employment agreement.

Is a probationary period paid at work?

The terms of salary payment are reflected in the main employment contract with the employee. Despite the stereotype that during the probationary period, wages are assigned in a smaller amount, according to the law, the level of wages and the method of calculating it must be the same. The calculation of wages for employees during the trial period is reflected in detail in Section 6 of the Labor Code.

In addition to salary, the probationary period includes:

- bonuses, allowances, various types of additional payments;

- compensation payments covering employee expenses on business trips, studies, etc.;

- necessary contributions for the employee to the Social Insurance Fund and the Pension Fund;

- vacation pay if an employee has worked for the company for more than 15 days and decides to quit.

Thus, when determining the amount of payment, you should focus on what is stated in the contract. It’s good if the document contains specific numbers and conditions for calculating wages. It is worse if the employer, when drawing up a document, limits himself to a general phrase about the official salary or staffing table.

A reduced amount of payment for work cannot be stipulated in the contract for the test period, as this violates the law. Therefore, payment must be made in full. Otherwise, using Article 135 of the Labor Code, the employee can appeal to the court.

Article 135. Setting wages

Having proven that the salary has been deteriorated, the employee will receive the underpaid amount, and the employer will be required to pay legal costs and a fine for violating labor laws.

Rights of employee and employer

The attitude towards the company's employees who are on the IP must be identical to the rest of the institution's personnel. An individual applying to occupy a certain position is officially registered, and a record of employment is entered into the work book. A new specialist may qualify for:

- sick leave;

- business trips;

- additional payment for processing.

The only drawback of the test is the employer’s right to early dismiss a new specialist who has not demonstrated professionalism.

Pay for new staff may be slightly lower. Managers promise an increased rate only after successfully passing the test. However, it is important to remember that even at the time of adaptation, wages should not be lower than the minimum wage .

The employer has the right to adjust the work of a new employee. If a candidate for a position did not live up to expectations, was unable to cope with professional responsibilities, or ignored the rules of labor discipline, the manager may fire him without waiting for the completion of the assessment of the candidate's abilities for the position.

It is important to notify the employee in writing of the upcoming dismissal 3 days in advance. If this is not done before the completion of the test, then it will be illegal to indicate professional unsuitability as a reason for terminating the employment agreement. In this case, the candidate for the position will be able to apply to the court for reinstatement at work.

Important! It is unacceptable to prescribe the passage of IP unilaterally.

Bonuses

With regard to bonuses for probationary applicants, everything depends on the standards established in the organization. Referring to the equality of employees, the Labor Code includes bonuses and incentive payments in the total amount of remuneration.

However, local company regulations may deprive newcomers of the opportunity to receive additional money. To achieve this, regulatory documents stipulate conditions that exclude employees who have worked for less than three months from candidates for bonuses. At the same time, there will be no indication anywhere that the reason for the lack of payment was the probationary period.

Is it possible to take sick leave or vacation on IP?

An employee may take sick leave while undergoing a professional competency test. However, the period of time during which the individual was absent from the workplace will not be counted. The test will continue from the day the employee began his duties.

Dismissal of a subject due to sick leave is unlawful. In this situation, the dismissed employee can go to court to challenge the decision of the head of the enterprise. The court will make a decision on reinstatement and continuation of the probationary period.

Persons undergoing the aptitude test have the opportunity to enjoy the same rights as other employees of the company. Therefore, during the probationary period, annual leave may be granted with the consent of the employer.

Peculiarities of dismissal of a part-time employee who has not completed the probationary period

Establishing a test for part-time workers is not prohibited by law. Dismissal of a part-time worker during the probationary period is possible both at the initiative of the employee and the employer. If a part-time contract is terminated, the employee can continue to work in his main function (if the contract is terminated based on the results of a trial or at the request of the employee, that is, not as a result of a violation of the established terms of interaction by the employee). All other rules remain the same: 3 days notice is required, the manager must justify his decision, but the employee may not do this. Additionally, in accordance with Art. 288 of the Labor Code of the Russian Federation, a part-time employee may be dismissed if an employee is hired for whom it will become the main one.

How is it paid?

According to the Labor Code of the Russian Federation, during the test, the employee is subject to the provisions of legislation, as well as regulatory legal acts regarding labor law.

Any enterprise has a staffing table that reflects salaries for any of the positions existing in the organization. During the test, wages cannot be lower than the salary indicated in the staffing table.

Situations involving underpayment of wages are considered unlawful. Managers often transfer subjects to another position on the staffing table with a lower salary so that unnecessary questions do not arise. Low wages can only be challenged if they are white.

How to minimize payment

Options by which an employer can legally reduce costs when paying an applicant during a probationary period are known and are often used in practice:

| Low salary | In this option, an agreement is initially concluded with the applicant for a low salary, which is paid to him during the probationary period. After the expiration of time, an additional agreement is issued to the contract. They fix a new salary amount, which is used when working on a permanent basis. |

| Split payments |

|

| Indexing | The contract in this version will also contain a reduced salary, but at the same time it specifies the conditions for its indexation. |

It is important to remember that in any case, the applicant’s salary specified in the contract should not be lower than the minimum wage.

Useful video

A properly drawn up agreement between employer and employee will help avoid problems that often arise during work. It is illegal to dismiss a specialist who has passed the IP for professional unsuitability. A candidate can only be fired during probation. We should not forget about the category of persons who are not supposed to be tested, much less fire them.

May be useful:

- Features of the probationary period when hiring: procedure for registration and conditions for its appointment

What to do if compensation for vacation is not paid

If the employer is in no hurry to pay the employee the compensation due to him by law after dismissal during the probationary period, the employee has the right to appeal the non-payment to the labor dispute commission. The statute of limitations in this case is three months - the period is counted from the day the employee learned of the violation of his rights (in most cases this is the day of dismissal). If you miss the deadline, you will no longer be able to receive payment. If the result is negative, the decision made by the commission can be appealed to higher authorities within 10 days.

Hello! How many days of compensation are due upon dismissal during a probationary period if the employee worked for two weeks?

Good afternoon If an employee has worked for a probationary period for less than half a month, he is not entitled to compensation. In all other cases, compensation is paid on general terms. Surpluses amounting to less than half a month are excluded from the calculation, and surpluses amounting to at least half a month are rounded up to the full month. Payment of compensation for unused vacation does not depend on the grounds for dismissal.

Hello, I am leaving my job on probation, should I be paid for all the time I worked?

The employer must make a full settlement with the employee and give him his work book.

I went on sick leave during a probationary period and I was fired. What to do?

They definitely cannot fire you, since there are no grounds for dismissal. This is a direct violation of labor laws.

Hello, if I was fired during a probationary period, the period is 3 months, and I only worked 15 days. Will they be included in the labor office?

Dismissal during a probationary period is regulated by Art. 70 Labor Code of the Russian Federation and Art. 71 of the Labor Code of the Russian Federation.r An employer may dismiss an employee during a probationary period for violation of discipline, as well as:

— When staffing is reduced; — Upon liquidation of an enterprise; — When transferring this employee to another employer by agreement between these employers; — When the owner of the enterprise changes and the employee refuses to work with this owner; — If the employee refuses to move to another area with the employer; — The employee’s refusal to continue his work activity if the employer changed the terms of the employment contract unilaterally in accordance with the Labor Code of the Russian Federation; — Other grounds listed in Art. 81 Labor Code of the Russian Federation.

This is important to know: Why you can fire a teacher

Hello! Is compensation for unused vacation during the probationary period (1 month and 23 days) based on piecework wages? And how many days, if possible?

An employee who has worked for less than 6 months, upon dismissal, has the right to compensation for unused vacation (Part 1 of Article 127 of the Labor Code of the Russian Federation). It does not matter that the employee has not yet acquired the right to annual paid leave.

Hello! Please tell me what is the responsibility of the personnel officer for the gray scheme of calculating salaries for employees?

Managers of companies that pay wages lower than the industry or regional average may be called to a “salary” commission, which includes tax officials and municipal officials. Many heads of organizations, after being called to a commission, usually increase wages. If the commission’s convictions do not work, the company may face an on-site inspection.

The following consequences of using “gray” wages are possible for the organization:

1) full on-site inspections of departments such as the tax inspectorate, internal affairs department, prosecutor’s office, Social Insurance Fund and others, during which numerous errors will be identified that relate not only to wages;

Expert opinion

Lebedev Sergey Fedorovich

Practitioner lawyer with 7 years of experience. Specialization: civil law. Extensive experience in defense in court.

2) accrual of taxes payable, which the organization will be obliged to pay (calculation is made on the basis of information about the taxpayer available at the tax office);

3) accrual of penalties and fines for intentional non-payment of taxes.

The consequences of paying wages “in an envelope”, in addition to the organization, affect the manager, chief accountant, as well as other employees who were involved in the preparation of primary documents. In this case, they are recognized as accomplices and Art. 199 “Evasion of taxes and (or) fees from an organization” of the Criminal Code of the Russian Federation.

In accordance with Art. 199 of the Criminal Code of the Russian Federation, evasion of taxes and (or) fees from an organization by failure to submit a tax return or other documents, the submission of which in accordance with the legislation of the Russian Federation on taxes and fees is mandatory, or by including in a tax return or such documents knowingly false information, committed on a large scale, is punishable by a fine of 100 thousand rubles. up to 300 thousand rubles. or in the amount of wages or other income of the convicted person for a period of one to two years, or forced labor for a term of up to two years with deprivation of the right to hold certain positions or engage in certain activities for a period of up to three years or without it, or arrest for a term of up to six months, or imprisonment for a term of up to two years with or without deprivation of the right to hold certain positions or engage in certain activities for a term of up to three years.

The same act, committed by a group of persons by prior conspiracy or on an especially large scale, is punishable by a fine of 200 thousand rubles. up to 500 thousand rubles. or in the amount of wages or other income of the convicted person for a period of one to three years, or forced labor for a term of up to five years with deprivation of the right to hold certain positions or engage in certain activities for a term of up to three years or without it, or imprisonment for a term up to six years with or without deprivation of the right to hold certain positions or engage in certain activities for a period of up to three years.

At the same time, I note that an employee who received income from which tax was not withheld by the employer (tax agent) is obliged to independently declare such income at his place of residence before April 30 of the next year and pay it independently by July 15. Otherwise, he bears responsibility under the legislation of the Russian Federation.

Benefits of probation for employer and employee

According to labor legislation, dismissal during the probationary period is simplified, which greatly facilitates the procedure for an organization to part with a person it does not like. But there are some positive aspects for the employee.

For clarity, the positive aspects of providing time to complete the test for both parties are reflected in the table below.

| Advantage | For whom is it an advantage: employer - P employee – C |

| all rights provided for by labor law are provided | WITH |

| the provisions of internal regulatory documents of the enterprise, including the collective agreement, apply | WITH |

| there is no need to seek the opinion of the trade union elected body on the issue of dismissal of the subject | R |

| If you are dismissed during probation, no severance pay will be paid. | R |

How is compensation calculated upon dismissal?

An applicant for a position who is fired during the probationary period receives a certain compensation: the period of his income, the number of unused vacation days, and the amount of the average salary are taken into account.

Calculation of compensation for vacation days is as follows - you should multiply the amount of the employee’s average daily income by the number of days of unused vacation for which the employer is obliged to make payments.

Keep in mind! The payment of amounts due to the employee, including compensation, is made on the day he resigns (Article 140 of the Code).

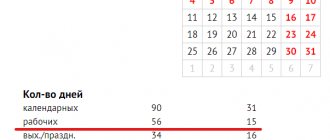

The duration of the calculation period for the most part covers one year. During the calculations, the concept of a calendar month is used - the period from 1 to 30 (31) days of the corresponding month (inclusive).

Those dismissed are entitled to the following types of payments: wages, bonuses, remunerations, additional payments that are related to working conditions and working conditions. Social payments are not taken into account.

When a person is fired after completing his probationary period, the time he worked is calculated as standard. The same applies to vacation days that the employee did not have time to use.

For the month actually worked, the dismissed employee is entitled to an amount equal to compensation for 2.33 days of employer-paid leave.

If an employee worked only 15 days in a month, then when calculating compensation, the full period is considered - that is, a month. When two weeks or less are worked per month, no compensation is made for that month.

For your information! If the employee has the right to provide him with additional vacation, the number of compensated days is subject to a corresponding increase.

For vacation pay, the average employee income received per day is calculated on a general basis, while the last month of work will be included in the calculation only if dismissed on the last day. (Letter of the Ministry of Labor dated July 22, 2010, N 2184-6-1).

Example

For greater clarity, let's look at how payments are calculated during the dismissal of an employee using an example.

- the salary is 32 thousand rubles;

- The dismissal of an employee occurs during the probationary period. He got a job on March 1, his dismissal date was April 20. For the month of March, salaries were paid in full;

- in April, the employee worked 16 days, while according to the organization’s calendar, workers were only 20 days;

- VP will not be paid by the employer (not required).

Worked - get it

Remuneration for work during the probationary period should not differ in any way from the remuneration of other employees in the organization.

The tested employee is fully subject to such basic principles of labor legislation as the prohibition of forced labor; ensuring the right of each employee to timely and full payment of fair wages, and not lower than the minimum wage established by federal law (Article 2 of the Labor Code of the Russian Federation).

The main rights of employees listed in Article 21 of the Labor Code of the Russian Federation, and in particular, the right to timely and full payment of wages in accordance with their qualifications, complexity of work, quantity and quality of work performed, also directly apply to employees on a probationary period.

Therefore, the work of such workers:

- It must be paid in full accordance with the terms of the employment contract and not lower than the established minimum wage (regional or federal).

- Remuneration for work must be full and timely.

It is illegal to establish in an employment contract with employees employed on a probationary period a salary less than that approved in the organization’s staffing table. This is a violation of Article 135 of the Labor Code of the Russian Federation, which regulates that the terms of remuneration determined by the employment contract cannot be worsened in comparison with current legislation.

In addition, underestimation of wages to employees during the probationary period may be regarded by inspectors or judicial authorities as discrimination against them.

Naturally, the answer to the question: “is the probationary period paid?” definitely positive.

Dismissal during the probationary period

During the test, the employment agreement can be terminated at the initiative of the employer or employee.

In this case, both one and the other party must notify 3 days in advance.

In the application to terminate the contract at his own request, the employee is not required to indicate the exact reasons for his decision. also no need for preliminary two-week training .

In this case it is 3 days. Otherwise, the procedure for dismissing an employee and filing an application is the same as for permanent employees of the enterprise. Within three days from the date of notification, the enterprise must pay the quitter the money earned and compensation for unused vacation.

In cases where termination of an agreement occurs at the initiative of management, the employer must have evidence on the basis of which such a decision was made.

That is, the notification must indicate clear reasons for the conclusion that the employee does not meet the requirements of the enterprise.

The document is given to the employee for signature. If necessary, it includes annexes that justify such a decision.

These may be copies of reports, acts, orders, explanatory notes, protocols of test or exam results. Read more here about the types of disciplinary sanctions.

In case of refusal to receive notification, an act is drawn up in the presence of witnesses. If an employee does not agree with the announced results, he can petition the court or the labor inspectorate.

In general, the Labor Code quite precisely regulates all aspects relating to documentation and completion of the probationary period. And in order to avoid conflict situations, the employer and employee only need to know the relevant regulations.

Probation period under the labor code: duration and registration

In this case, a reference to Article 71 of the Labor Code of the Russian Federation must be indicated. On the last working day, the employee is given his work and pay slips. Severance pay is not paid (Article 71, Part 2). If the candidate categorically refuses to accept the decision to dismiss, an act “on compliance with the terms of the Regulations” is drawn up. The second copy is sent to the citizen’s home address. Legally, the listed actions are sufficient to remove all claims from the enterprise and prevent litigation. How to avoid an unpleasant entry in the labor record The main advantage of a probationary period for an organization is the ability to quickly eliminate a careless employee if the production process suffers because of him. After all, it is not always possible to understand in advance whether a person is sufficiently qualified for a particular position, even after a long and thorough interview.

Dismissal procedure after probationary period. Design nuances

Before making a final decision on the employee’s competence and his ability to properly perform his duties, the head of the enterprise has the right to hire him by setting a probationary period.

After the test period comes to an end, the employer may come to the conclusion that the subordinate cannot cope with the duties assigned to him and dismiss him on the appropriate grounds - due to an unsatisfactory test result. We will talk about the features of such termination of legal relations between the parties in this article.

Aspects of calculating the duration of the probationary period

What else is recommended to pay attention to when establishing a trial period:

- In this matter, oral agreements are not valid.

- The condition for passing the test is signed by both parties before the start of work in the company of a new colleague.

- Any absence from work for valid reasons is a direct basis for its extension by the number of such absences.

- If during the probationary period it turns out that the employee is pregnant, the condition of her passing the test ceases to apply.

- The trial period is calculated in calendar days without excluding official non-working days.

- The initially agreed and documented test period cannot be extended.

Example #1. Reception of a pregnant employee

The employee started work on March 5 with a probationary period of 3 months. On March 30, she provided a certificate of pregnancy with a period of 5 weeks.

Is it necessary to conclude an additional agreement to the employment contract that cancels the condition of establishing a trial?

No no need. This condition simply will not apply to a pregnant colleague.

Example #2. Calculation of the duration of the probationary period

The employee accepted on April 2 with a probationary period of 3 months was called up for military reservist training for 1 month from May 11 to June 10.

When should his probation end?

The end of the trial period will be automatically postponed by the number of days of absence for objective reasons according to the report card, i.e. for 23 days. The trial period will end on July 11.

Pay during the probationary period

During the entire period when a new employee is being tested, he has the same rights and responsibilities as other employees of the enterprise.

That is, he must comply with internal regulations and adhere to the rules of labor discipline. See more about types of disciplinary action in this article.

It is also subject to labor law norms, local acts, coll. agreement.

That is, in relation to such an employee, all guarantees must be observed, including social benefits. plastic bag. Therefore, the employer is obliged to pay sick leave in full.

Passing a test at the beginning of work at an enterprise cannot serve as a basis for establishing lower wages.

If this norm is violated and in the event of a conflict, the employee can claim the amount of underpayment through the court. See here for more details on the procedure for filing a claim in court.

Is there any reason not to pay a bonus during the probationary period?

Briefly: I was on a probationary period for 3 months, passed it, and continue to work.

The employment contract states that there is a bonus in the amount of 20% of the salary for the bonus period (fixed, does not depend on work results). I didn’t receive it and I want to understand what legal grounds the employer has for not paying it.

Details. The contract was concluded as a fixed-term contract for remote work. The trial period is 3 months. The salary article contains the following wording: An employee’s salary consists of: official salary in the amount of X rubles per month.

bonus, which is 20% of the official salary for the bonus period. The condition for paying the bonus is the non-termination of the employment contract during the bonus period at the employee’s own request.

The duration of the bonus period is established in the Additional Agreement to the contract.

The bonus system is established in accordance with the Regulations on Remuneration. The bonus period is set at 3 months. At the moment, I do not have this Regulation on remuneration in my hands (for now I want to understand my position without attracting attention).

The question is whether there is a clause about non-awarding bonuses during the probationary period.

If so, does this not contradict the text of the agreement itself or the Labor Code of the Russian Federation? What interpretations can there be for this situation? February 02, 2021, 16:50, question No. 1523450 Dmitry,

Moscow Collapse Online legal consultation Response on the website within 15 minutes Answers from lawyers (2) 5041 responses 1595 reviews Chat Free assessment of your situation Lawyer, Moscow