An employee may be declared incompetent after the termination of the employment contract, which raises the question of whether the employer pays sick leave after dismissal by agreement of the parties. Looking ahead, it is worth noting that the employer still has such an obligation, but what to do when, for example, the relationship with an employee had to be terminated after the liquidation of a branch or even an entire organization? These and other questions will be discussed in detail below.

Dear readers! The articles contain solutions to common problems. Our lawyers will help you find the answer to your personal question

free of charge To solve your problem, call: You can also get a free consultation online.

Is payment required by law?

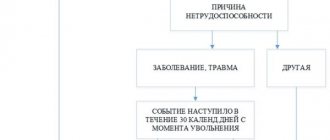

Legal provisions provide additional guarantees to employees dismissed as a result of an agreement with the employer. The legislation on social insurance (Part 2 of Article 5 of Federal Law No. 255-FZ of December 29, 2006) gives this category of citizens the right to payment for the period of incapacity for work, provided that it was temporary and occurred within 30 days after termination of the contract .

It does not matter what circumstances caused the breakdown of the employment relationship. The main thing is that the above conditions are met.

A similar procedure applies when terminating a contract with an employer at the initiative of an employee. Payment for the period of illness is carried out from the funds of the Federal Social Insurance Fund of the Russian Federation, since the citizen received a salary during the period of work, from which contributions were made to the fund.

The period of time between dismissal and further employment is considered a period of social insecurity, therefore the legislator ensures that dismissed employees have the right to sick pay.

Watch the video. 5 questions about sick leave:

Sick leave after dismissal by agreement of the parties in 2021

// Therefore, when terminating a contract with an employee during a period of temporary disability, the main thing is to determine who exactly is the initiator of the dismissal. In a situation where a letter of resignation is written of one’s own free will, the initiative to terminate the contract comes not from the employer, but from the employee himself. Therefore, his dismissal during sick leave is possible, and it must be formalized in accordance with the established deadlines. This also includes such developments as dismissal during sick leave by agreement of the parties.

Payment of sick leave after dismissal by agreement of the parties in 2021

The Labor Code covers the entire range of relations that arise between the company and employees. In Part 3 of Art. 84.1 of the Labor Code of the Russian Federation states that the existing business relationship between them will cease on the day when the employee goes to work for the last time. The severance of relations does not mean that the dismissed person has lost the right to provide compulsory social insurance due to the illness that was given to him by clause.

Monetary compensation will not be paid only if the certificate of incapacity for work is submitted after the expiration of the period specified in the contract. Author: Express your opinion about the article or ask a question to the experts to get an answer Subscribe to the HR Club news Once a week we will send the most important articles to your email.

The period of temporary disability is paid to the employee depending on the level of his salary and length of service. The first three days of illness of the general period are paid from the funds of the employer (enterprise), and the remaining days - from the Social Insurance Fund.

Payment of sick leave after dismissal by agreement of the parties in 2021

Video (click to play). A “closed” sheet with the doctor’s signature and the seal of the medical institution is provided by the employee to the manager or employee of the human resources (accounting) department no later than 6 months after the date of recovery (discharge from the hospital). Payments are usually made within a month.

When a person works under an open-ended contract, it is impossible to dismiss him during sick leave at the initiative of the employer. The exception is the liquidation of an organization. If a contract is concluded with an employee for a certain period, which ends during sick leave, the employer has every right to calculate it.

Terms of payment

A citizen who is ill or injured can exercise the right to receive benefits only if there is documentary evidence of incapacity for work. The legislator considers this type of certificate of incapacity for work – sick leave – as the main document.

It simultaneously confirms the fact of illness or injury and gives the right to receive a monetary payment - benefits.

Note! Payment for sick leave in connection with the dismissal occurs under the following conditions:

- If the parties to the employment relationship made a general decision to terminate it, but before the dismissal was formalized, the employee fell ill, terminating the contract is permitted. But this can be done only 14 days after notifying the employee. Benefits for temporary disability will be paid only if the sick leave certificate is correctly completed;

- if the contract with the employee was terminated, and within 30 days after that the citizen fell ill, a certificate of incapacity for work issued by a medical institution gives him the right to receive benefits;

- women who have issued sick leave in connection with pregnancy and upcoming childbirth will be able to receive benefits only if timely deductions have been made from their wages;

- Payment of sick leave for illness occurring within 30 days after dismissal is possible only if the employee has not yet been employed. Otherwise, such payment is no longer the responsibility of the former employer;

- Disability benefits can be paid to a dismissed employee if it is only his own illness. Sick leave issued in connection with the need to care for a sick child is not subject to payment in this case. The same applies to other cases of issuing sick leave when caring for a relative in need;

- issuing a certificate of incapacity for work does not have to be associated with a hospital stay. If a citizen was sick, but was at home, that is, was on an outpatient treatment basis, the benefit should be accrued in full. As in other cases, it is necessary that the sick leave certificate be drawn up correctly, indicating the period of illness and the diagnosis made by the doctor.

In case of disputes, you should be guided by the provisions of Article 5 of Federal Law No. 255-FZ. It provides a list of grounds for receiving benefits for temporary disability. The procedure for calculating payments in these cases is regulated in more detail by Article 13 of the same legislative act.

Step-by-step procedure for receiving compensation

Few ordinary citizens know how to behave correctly so that their former employer pays for sick leave issued within thirty days after dismissal.

Procedure to successfully resolve the problem:

- At the first signs of illness, you should go to the clinic to see a therapist or go to the hospital if your health condition requires it. Based on the examination, a diagnosis will be made and, subsequently, a certificate of incapacity will be issued. The paper must be prepared in accordance with the decree of the Ministry of Health No. 624 of June 29, 2011.

- Prepare a package of documentation , which usually includes a work book confirming the fact of lack of employment, a sick leave certificate and a certificate of average earnings.

- Write an application addressed to your former employer requesting payment for sick leave . It must contain the name of the company, personal data of the employee, date of writing, signature.

- Wait for the accrual and subsequent payment of benefits.

Who pays?

The following may pay monetary compensation to a dismissed citizen on sick leave:

- a former employer who terminated the employment relationship with the employee;

- social insurance fund , if the previous employer is not financially able to pay for the certificate of incapacity for work. At the same time, it is the former manager who should contact this organization for help;

- employment service , according to paragraph 1 of Art. 28 of the Federal Law “On guarantees of support for the unemployed”, if the dismissed citizen managed to register for unemployment and received the appropriate status.

ATTENTION. If the illness lasts more than six months, issues of payment for such sick leave are resolved with the involvement of the Federal Tax Service.

Amount of charges

The procedure for assigning financial payments due to a sick employee is prescribed in Article 13 of Federal Law No. 255 of December 29, 2006.

Within a month after the employee’s dismissal, the company continues to make transfers to the Social Insurance Fund for him, which is why such a period of time is allocated for reimbursement of payments for sick leave issued during this period.

According to Article 2 and Article 7 of Federal Law No. 255, the amount of sick leave for a dismissed employee does not depend on his length of service , reason for dismissal, duration of illness and is 60% of the average earnings of this citizen.

With an average salary of 30 thousand rubles. 1% will be equal to 300 rubles, respectively, 60% will be 18 thousand rubles. This will be the amount to be paid. If a citizen is registered with the Employment Center, his sick leave will be paid there.

The amount is the same for everyone - unemployment benefits . For women who have been on maternity leave for a certain period of time, this period can be changed to another, more paid one. This will have a positive impact on the benefit amount.

All sick leaves issued within one month after dismissal are necessarily subject to monetary compensation from the enterprise.

Where should I send my ballot?

Obtaining a sick leave certificate is not difficult, but not everyone knows where it should be entered subsequently. A document on temporary disability of a citizen is submitted to:

- organization to the former manager , in which a citizen dismissed by agreement of the parties previously worked;

- employment center , if, after breaking employment relations with a previous employer, a person registered for unemployment and then went on sick leave;

- social insurance fund , if the former employer is unable to pay for the certificate of incapacity for work and turns to them for help.

When will the payment be made?

The former employer must pay for sick leave within a month after it was provided. Deadlines can be postponed only if the document is not completed correctly and correction of inaccuracies is required.

After adjustment and submission of a new certificate of incapacity for work, a new countdown of the period of one month will begin. If the employer needs to contact the Social Insurance Fund, payment will be made 14 days after his request. At the Employment Center, the procedure for paying sick leave lasts about a month.

By complying with current legislation, the employer will be able to avoid many problems associated with complaints from dismissed employees to the judicial authorities or the Labor Inspectorate. A citizen, knowing his labor rights, can easily receive the monetary payments due to him.

Payment terms

An employee whose employment contract has been terminated by mutual agreement of the parties has the right to present a certificate of incapacity for work for payment within 6 months from the date of recovery. It is only important that the date of onset of the disease falls within the 30-day time interval from the date of dismissal.

The benefit must be paid within a month from the date of submission of documents confirming the incapacity for work.

The regulations of the Social Insurance Fund oblige the transfer of benefits within 14 days from the date of submission of documents. An employer submitting documents for direct payments changes this period downwards.

Having received the documents for calculating benefits, the employer sends them to the Social Insurance Fund no later than 5 days later. The fund makes the payment itself no more than 14 days later. Funds are transferred to the recipient's account; the use of a postal transfer is also allowed. It follows from this procedure that the benefit must be received by the citizen no later than 21 days after contacting the employer with documents.

Pensioners dismissed by agreement of the parties enjoy the same rights to sick pay as all other employees.

Is sick leave paid?

The rules that sick leave in some cases can be paid even after dismissal are provided for by Law No. 255-FZ. However, this requires a number of conditions:

- The employee previously had to work under an official employment contract, and the employer had to transfer funds for him to the Social Insurance Fund (SIF).

- A certain period must not pass from the moment of termination of the employment relationship.

- By the time the sick leave opens, the former employee should not be re-employed (in which case all payments are made through the new management) or be in the employment service as an unemployed person (in this case, instead of paying for sick leave, he receives unemployment benefits from the SZN funds).

Thus, if the above conditions are met, the employee has the right to contact his former employer with an application and sick leave and wait for payments.

Important! Payment at the expense of the employer is made only within 3 days, then funds from the Social Insurance Fund are paid. In some cases, the Social Insurance Fund pays from the first day.

Is it possible to submit the form later?

In some cases, the law allows you to pay benefits to a citizen, even if the sick leave is submitted in violation of the established deadlines.

Please note! Such cases include:

- manifestations of the elements that do not provide the opportunity to act properly, for example, a hurricane, earthquake, flood, etc.;

- long-term disability due to illness or injury, the duration of which is more than six months;

- change of place of residence associated with moving to another locality;

- an officially established fact of forced absenteeism due to illegal dismissal or suspension from service;

- difficult family circumstances associated with illness or death of family members;

- other reasons that the court deems worthy of attention.

Procedure

A citizen who needs to receive benefits for disability arising after dismissal must act as follows:

- If you feel a deterioration in your health, immediately contact a medical facility. Only in this case will the diagnosis be documented, and the start date of the illness period will be recorded. After the citizen recovers, the same medical institution must indicate the end date of the period of incapacity for work. The sick leave must fully comply with the requirements of the Ministry of Health of Russia established on June 29, 2011 in Order No. 624;

- contact your employer. The benefit will be accrued after the administration of the enterprise submits an application for payment of the benefit. You should apply at your previous place of work. In the document, the applicant indicates the name of the organization, his own full name and position, and the full name and position of the manager. The application must include the date of preparation and the signature of the applicant. Advice! When composing the text of the document, you should use a special form developed for these cases by the FSS of the Russian Federation (approved by Order No. 578 of November 24, 2017);

- wait for benefits to be paid. If a citizen is registered with the Employment Center, the payment is made by the Employment Service.

Sick leave after dismissal by agreement of the parties 2021

A company cannot terminate a working relationship with a sick employee on its own initiative under Art. An exception is made only for the situation when the employing organization is liquidated - no organization - no workplace. Therefore, when terminating a contract with an employee during a period of temporary disability, the main thing is to determine who exactly is the initiator of the dismissal. In a situation where a letter of resignation is written of one’s own free will, the initiative to terminate the contract comes not from the employer, but from the employee himself. Therefore, his dismissal during sick leave is possible, and it must be formalized in accordance with the established deadlines.

This is interesting: How long is the sale of alcohol allowed in Krasnoyarsk

Sick leave pay after dismissal

If we talk about the liquidation of an enterprise, whether it is possible to fire a person on sick leave depends on the availability of prior notice to the employee. The employer has an obligation to notify people of layoffs two months in advance.

In the event that an employee wishes to leave work of his own free will in connection with retirement, but on the day of dismissal he falls ill and goes on sick leave, he is also entitled to disability payments.

What documents are needed

From all that has been said, it follows that in order to receive benefits, a citizen must submit the following documents to his former employer:

- application for payment of benefits;

- properly completed sick leave. The current procedure allows for sick leave to be issued on paper with the appropriate signatures and seals. It is also allowed to issue a certificate of incapacity for work in the form of an electronic document with a digital signature on it. The second option is possible if the organization works with similar documents;

- a copy of the work record book received upon dismissal. This is necessary to prove the citizen’s lack of employment;

- a copy of an identity document - passport.

You can contact your employer in the following ways:

- personally appear at the organization and hand over the papers with an acceptance mark;

- send the package by mail. Documents are not sent by regular mail. It is necessary to issue a registered shipment with notification. It’s even better if the letter contains a list of attachments. When the notice is returned to the sender, the letter will be considered delivered to the address. The notice must be kept;

- use the services of delivery services, courier services and other persons. If a representative submits documents in person, he must have a power of attorney to do so.

Attention! Our qualified lawyers will assist you free of charge and around the clock on any issues. Find out more here.

Sick leave pay after dismissal

- Wages for actual hours worked, including the day of dismissal

- Cash compensation for the next vacation if it was not used (or part of it)

- Severance pay, provided that the dismissal clause provides for such a payment or it is specified in the collective agreement

Documents required for payment

Extension of a certificate of incapacity for work is the prerogative of the Social Insurance Fund. It is the employees of the insurance fund who can consider a written request from a citizen, in which he will outline the reasons for the omission. To confirm the written grounds, it is necessary to collect supporting documents that will explain why the person had to delay submitting the sick leave form. If you have several ballots, you should also contact the FSS directly, bypassing the employing organization.

Payment for this sheet occurs only if the employee prepares all the necessary documents for the organization within thirty days from the moment he was officially dismissed from his main place of work. It is important to remember that every employed employee has the right to receive money for sick leave, since all necessary insurance contributions in the required amount are paid to the Social Insurance Fund for him. However, it is important to remember that many factors influence the benefit amount. These include the employee’s insurance length, and it must be calculated in accordance with work in official places. The employee’s average daily earnings are also taken into account, and the calculation takes into account the earnings that the person received over the last two years.

Those who are interested in whether it is possible to dismiss by agreement of the parties during sick leave should remember that the boss must have documentation confirming the sending of the notice. This will help avoid liability in case of delay in issuing a work book.

What is paid sick leave after dismissal?

Within a week, the manager must transfer the documentation to the FSS employees. Next, this organization must pay the benefit to a bank account within two weeks. So the benefit must be paid within a month from the date of submission of documents. If the dismissed person is not registered with the employment authorities, he must present a sick leave certificate to his boss. When liquidating an organization, you should contact the Central Bank.

This is interesting: Redemption price of emergency housing in 2021

After which the organization will perform the calculation on the sheet. It should be remembered that only a document confirming that the former employee himself is sick will be accepted; care for a relative or child will not be paid, even if applied within the allotted period.

The list of documentation for receiving assistance is small - it only includes an application, a photocopy of an identity document and a work record book. The latter document allows you to verify that the employee was not re-employed.

Rules and procedures for applying for sick leave after dismissal

As a rule, an employee informs his employer in writing about leaving work within the period established by law - two weeks in advance. And if it so happens that the doctor later wrote him out on sick leave, then after recovery the employee should not work off the days he was on sick leave at the enterprise. He has the right to be treated for these 14 days or to go to work.

// Therefore, when terminating a contract with an employee during a period of temporary disability, the main thing is to determine who exactly is the initiator of the dismissal. In a situation where a letter of resignation is written of one’s own free will, the initiative to terminate the contract comes not from the employer, but from the employee himself. Therefore, his dismissal during sick leave is possible, and it must be formalized in accordance with the established deadlines. This also includes such developments as dismissal during sick leave by agreement of the parties.

Sick leave after dismissal is paid if it is open within 30 calendar days from the date of dismissal. Any employee of a company that pays insurance premiums to the Federal Social Insurance Fund of the Russian Federation (and from 2021 - the Federal Tax Service) in case of temporary disability and in connection with maternity can count on payment of their sick leave.

How is sick leave paid after voluntary dismissal?

Free consultation by phone All Russia » » » Contents An employee may be declared incompetent after the termination of the employment contract, which raises the question of whether the employer pays sick leave after dismissal by agreement of the parties. Looking ahead, it is worth noting that the employer still has such an obligation, but what to do when, for example, the relationship with an employee had to be terminated after the liquidation of a branch or even an entire organization? These and other questions will be discussed in detail below.

Personnel records management Disease codes on sick leave certificates. Vacation Illness during vacation. Dismissal Dismissal by transfer: pros and cons. Dismissal Pay slip upon dismissal. Sick leave Certificate of incapacity for work. Sick leave How many days a year is sick leave paid? Dismissal When should you hand over your work book upon dismissal? Dismissal Dismissal to care for a child under 14 years of age.

Dismissal of an employee on sick leave at his own request and by agreement of the parties is, in principle, carried out identically. The difference lies in the grounds for dismissal. Therefore, when the question arises whether it is possible to fire a person who is on sick leave on personal initiative or by agreement of the parties, the answer is unequivocal - yes.

How to pay sick leave after dismissal

Disease codes on sick leave certificates. Maximum duration of sick leave per year. Illness while on vacation. An example of calculating sick leave per year. Dismissal upon expiration of the employment contract. Often, people who are forced to stay in the hospital for a long period of time wonder whether it is possible to be fired on sick leave. There are many circumstances that have a significant impact on the possibility of carrying out such a procedure.

Find out more All your questions will be happy to be answered by phone 8 Articles on the topic: How chief accountants can solve problems due to electronic sick leave Dismissal during sick leave What mistakes of companies in sick leave judges forgive, but the Social Insurance Fund does not Lose sick leave by an employer does not deprive employees of the right to receive benefits A sample certificate, without which the employee will not be given a duplicate sick leave.

This is interesting: General house needs in a direct agreement with RSO

The amount of benefits for a former employee does not depend on the length of insurance coverage. In any case, it is 60 percent of his average earnings. Otherwise, the calculation procedure is the same as for existing employees. In what order to calculate sick leave benefits, see the instructions. As with sick pay for current employees, the first three days of illness for those who quit will be paid at the expense of the company. And do not forget that the amount of temporary disability benefits is subject to personal income tax. Transfer the tax to the budget on time, otherwise penalties will be added to the amount of arrears.

How long is sick leave paid after dismissal?

He can claim payment for all sick leave after voluntary dismissal in the year. The main thing is that the certificate of incapacity for work is opened within 30 calendar days from the date of dismissal. Let's say an employee got sick on the last, thirtieth day. And in this case, he is entitled to pay for the entire sick leave, even if it lasts for several months.

It should be noted that the amount of money upon dismissal, which is paid as a benefit due to disability, is not affected by such a factor as length of service. After issuing a sick leave certificate, the question almost immediately arises as to where it should be taken.

Calculation of compensation amount

Please note! To calculate the amounts to be accrued due to the employee’s incapacity for work, the following information is required:

- the period during which the person was incapacitated;

- average employee income over the past 2 years;

- average earnings per day. It is calculated by finding the quotient of dividing the summed payments to the employee by the total number of calendar days in two years - 730;

- a limited amount of the base for calculating social insurance contributions, approved every year;

- the maximum amount of payments in accordance with Law No. 255-FZ. The law does not connect it with the length of service and considers it equal to 60% of average earnings per day.

So, to calculate sick leave payments, the summed up payments under an employment contract for 2 years are divided by 730. 60% is calculated from the result obtained. The resulting number is multiplied by the number of days of incapacity.

The formula is:

SP = DN × (SD / 730) × 60%, where:

- SP – benefit amount;

- DN – days of incapacity for work;

- SD – total income.

It should be taken into account that this formula is only suitable in cases where the total income is less than the maximum established size of the base. If this is not the case, the calculation is made based on the base one.

Responsibility for failure to provide funds

If the employer does not pay sick leave after dismissal, the measures provided for in Article 5.27 of the Code of Administrative Offenses of the Russian Federation are applied to him. It provides for a fine in the amount of:

- for officials – from 10 to 20 thousand rubles;

- for individual entrepreneurs – from 1 to 5 thousand;

- for organizations – from 30 to 50 thousand.

In addition, the question may be raised of bringing the perpetrator to criminal liability under Art. 145.1 of the Criminal Code of the Russian Federation, where the perpetrator can face imprisonment for a maximum of 5 years .

Although dismissal implies that the employment relationship between the employee and the employer is terminated, the obligation to pay sick leave for a certain period remains after dismissal by agreement of the parties. In those cases when the employer refuses to fulfill his duty, he will be held accountable under the law.

If you find an error, please select a piece of text and press Ctrl+Enter.

Maternity leaflet

Disability benefits after dismissal can only be paid on the basis of illness or injury occurring within 30 days.

Pregnancy or childbirth are not included in this list. They do not equate to illness.

In some situations, the law allows such payments to women dismissed on the basis of an agreement with the employer:

- if a woman is forced to move on the recommendation of doctors who consider the area unhealthy;

- if the dismissal is caused by the transfer to another location of the spouse;

- if a woman quits her job due to the need to care for sick or group I disabled family members.

What to do if your employer refuses to pay sick leave

The employer is obliged to pay sick leave to a dismissed employee if the incapacity for work occurs within 30 days. Waiver of this obligation is not permitted.

If the employer still evades payment, the employee has the right:

- file a complaint with the authorities authorized to monitor compliance with the law. These are the State Labor Inspectorate and the Prosecutor's Office;

- file a claim in court. By going to court, a citizen can recover not only the amount of the benefit, but also interest in the form of compensation for late payment. Such requirements are based on the provisions of the Civil Code of the Russian Federation and Art. 236 Labor Code of the Russian Federation. It is also possible that the employer may be brought to administrative liability.

You can DOWNLOAD samples of relevant appeals from the links below:

- Complaint to the Labor Inspectorate

- Statement of claim for recovery of payment for sick leave after dismissal

Amount of benefit provided due to temporary disability

For all employees who leave the workplace by joint agreement of the parties, the amount of sick leave benefits is established according to a single calculation rule.

This rule states that the calculation of monetary compensation is carried out by calculating the average salary of the dismissed individual, and then calculating 60% of this amount.

Thus, if the average salary of a certain employee is 15,000 rubles, then one percent of it is 150 rubles (15,000 rubles divided by 100%), and 60% is 9,000 rubles (150 rubles multiplied by 60%).

This means that the amount of monetary compensation will be equal to 9,000 rubles for this specific example.

It should be noted that the amount of money upon dismissal, which is paid as a benefit due to disability, is not affected by such a factor as length of service.

IMPORTANT! If additional questions arise regarding the amount of benefits, be guided by the seventh article of Federal Law No. 255, which entered into force on July 3, 2016.