All payments to an employee in case of staff reduction

The financial compensation that an enterprise pays when laying off workers is listed in the Labor Code (Articles 81, 178–180). Part of the payments is mandatory and does not depend on any additional conditions. And some are available to laid-off employees only if they comply with the rules established by law.

Mandatory payments

The organization is unconditionally obliged to pay to personnel dismissed due to staff reduction, funds attributed by the legislator to:

- severance pay;

- funds earned during the time actually worked until the moment of dismissal;

- compensation payments for vacation not used in the current year, which are calculated based on the number of working hours of a given year.

In addition, if an employee decides to vacate his position before the expiration of the established period of two months, he also receives a cash payment equal to his average monthly earnings.

The elusive 13th salary: is there a chance to get it?

At many enterprises, the collective agreement or other regulations establish this type of incentive payment to staff as the 13th salary, which is calculated at the end of the year. In the event that the payment provision is officially approved, the laid-off employee is also given it. The only obligatory condition is the presence of work experience in this place for at least one year. It does not matter what month the dismissal occurred. If management does not want to pay this type of bonus to an employee, he has the right to go to court, since by law he is entitled to all the dividends that would have been paid to him if he had not been laid off.

Dismissal by agreement of the parties - how much salary does the employee receive?

There are a huge number of ways to terminate an employment contract between an employee and an employer. And, as a rule, the termination of the agreement occurs at the request of one of the parties - the employer in case of violations or layoffs, or the employee himself, at his request. However, sometimes it happens that the termination of an employment contract takes place by mutual consent.

Dismissal by agreement of the parties is not a very common, but at the same time very convenient procedure. And because of its low frequency. In this article we will talk about what dismissal by agreement of the parties is, how to formalize it correctly and, most importantly, what bonuses, payments and compensations an employee must receive if the employment contract is no longer in force by mutual agreement.

articles:

- When is it used?

- Issuance of compensation

When is it used?

Dismissal by agreement of the parties is a rare procedure. After all, it is rare that the employee’s desire completely coincides with the employer’s desire in terms of termination of employment. Therefore, dismissal by mutual consent occurs most often in three cases:

- The employee faces standard dismissal at the initiative of the employer for any misconduct, but he still has the opportunity to leave the employer at his own request;

- There are layoffs at the enterprise, and the employee has the opportunity to prepare all the documents in advance and sign an application to terminate the employment contract by mutual consent - this way he can quickly get a new job;

- The employee was hired to perform some work, which he successfully completed and nothing more is required from him, and there is no need to wait for the end of the employment contract.

Thus, dismissal by agreement of the parties is most often a simplified and much more convenient option for dismissal at the initiative of the employer; it is almost never used as an option for an employee to resign at his own request.

How is it going?

Let's move on to the procedure for terminating an employment contract, because it is this that raises the most questions. In fact, dismissal by mutual agreement of the parties is quite simple. It takes place in 4 stages:

- Writing a document - grounds;

- Editing a document - basics;

- Creation of a dismissal order based on it;

- Carrying out the procedure for terminating an employment contract.

Let's start with the first step. In order to legally confirm the fact that the employee has expressed his will to terminate the employment contract, you will need to draw up a special document.

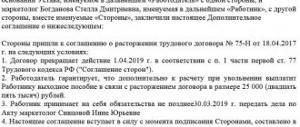

This can be either a statement with a proposal to terminate employment by mutual consent, or an agreement drawn up by mutual agreement to terminate the employment relationship.

In any case, the agreement will need to indicate all the conditions for terminating the contract - from the reason to the procedure for issuing compensation and the work record book.

The second step is to edit the existing agreement. If the agreement does not suit one of the parties, then it has the right to make its own adjustments. Only this can be done by mutual agreement, and each edit must be made in writing. However, if the parties agreed on everything in advance, then this step can be skipped.

The third step is preparing a dismissal order. In general, until the order is issued, nothing will be required from the employee. According to the terms of the previously drawn up contract, he can either continue working until the day of actual dismissal, or immediately stop working.

The last step is the dismissal procedure itself. The process itself takes place in a standard manner - the employee is returned the documents stored by the employer and his work record book.

By that time there should be Fr.

Next comes the calculation of compensation, which needs to be discussed in more detail.

The most difficult issue, and at the same time practically not regulated by current legislation, is the payment of benefits, compensation and salaries. And if everything is more or less clear with the first two, then the issue of paying salaries upon dismissal by agreement of the parties is a topic in which experienced lawyers and HR departments get confused.

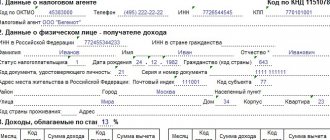

So, let's look at what the employee receives in general:

- Wages for all the time he worked from the date of issuance of his last salary. Calculating the amount of this compensation is simple - the number of working days is multiplied by the average daily earnings, which, in turn, is the quotient of dividing the employee’s monthly earnings by the number of working days in the month. This is a mandatory payment, and the employee has no right to refuse it;

- All bonuses that the employee could receive for the time he worked. Most often, these are bonuses for some individual services, and they are not considered together with the main income - it is indicated separately; If you have not been paid a bonus, you can read here what to do correctly.

- Compensation. Most often, this is only compensation for unused vacation, but if the employment contract also provides for other amounts of money to be paid, then they must be paid in full.

The last thing an employee receives is salary. Their issuance is an extremely controversial issue. Some people receive nothing, some are given two salaries, and some follow the example of Western corporations and give four at once. In this regard, a dispute may arise - how much salary is required by law?

The Labor Code itself does not answer this question, however, based on general provisions, the answer is simple - none. But at the same time, there is not only a labor code, but also other norms, as well as banal work ethics.

In this regard, upon dismissal, by agreement of the parties, the employee still receives a salary, although this payment is not required by law. To the question itself, “How much salary does an employee receive upon dismissal by agreement of the parties?” must comply with the agreement drawn up by this employee or by agreement of the parties .

And practice in Russia shows that such salaries are issued from two to four.

Thus, upon dismissal by mutual consent, an employee can ask for the payment of some additional funds, but he does not have the right to make any specific demands.

And in the absence of salaries, even the labor inspectorate will not be able to help him - the Labor Code of the Russian Federation does not in any way regulate the payment of salaries in this case, and, as a result, the inspection will have nothing to rely on when conducting inspections.

So, most likely, you will have to count on the payment of one or two salaries upon dismissal by agreement of the parties.

Source: https://trudinsp.ru/uvolnenie-skolko-okladov-poluchaet-rabotnik.html

Important Terms

Along with the unconditional amounts that a redundant citizen will receive, there are a number of amounts that are paid only if specific conditions are met. So, he will be paid sick leave if the incapacity for work occurred before the official date of dismissal or within 30 days after. Amounts in the amount of average earnings must be paid at the enterprise until the fired person finds a new job.

The second and third salaries are paid if the former employee registered with the employment service on time, but was unable to find a suitable job.

How to get a third salary?

Contrary to the desire and erroneous belief of many redundant workers that they will receive three salaries immediately upon dismissal, in reality the payments will not be made at once, but after a certain period of time. When calculating, the dismissed person receives only severance pay in the form of one salary. Provided that he registered with the labor exchange and was not employed by the end of the second month, the former organization must pay compensation for the second month of forced unemployment. Transfer of the third salary is possible only at the request of the employment center inspector and the availability of the necessary documents.

How to quit: procedure for terminating the contract

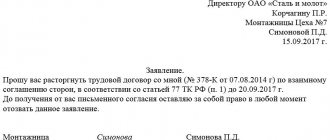

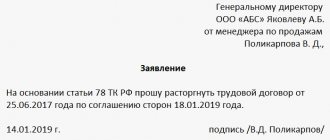

In order to terminate an employment relationship in accordance with Article 78 of the Labor Code of the Russian Federation, that is, by agreement of the parties, the parties need to come to such an agreement. First of all, the contractor or the employer must take the initiative to terminate the contract, for which:

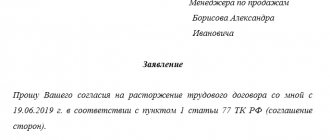

- the employee should contact the employer in writing with a statement expressing his desire to resign by agreement of the parties;

- or the employer needs to write a service letter to the employee with a proposal to terminate the contract.

In an application addressed to the employer, the employee may indicate that he is asking to be dismissed with payment of a certain compensation (if this condition is not specified in the local regulations of the enterprise). However, an indication of the payment of compensation in the application is not mandatory, since the main document regulating the legal relationship between the dismissed person and the head of the enterprise is the termination agreement itself.

After the employee’s application is reviewed by the employer and he expresses his consent to dismissal (by putting the appropriate visa on the application or by sending a response letter to the employee), the parties need to proceed to drawing up an agreement and indicating in the document being drawn up all the nuances of the upcoming dismissal.

A separate clause of the agreement should be devoted to the payment of severance pay, indicating its amount (provided that the amount of compensation is not defined in the collective agreement, wage agreement in force at the enterprise, etc.). The parties can immediately agree on payments and other conditions under which the contract will be terminated.

There is also the possibility that mutual agreement will not be reached immediately. In this case:

- the original dismissal agreement must be amended accordingly in accordance with the protocol of disagreements signed by the subordinate and the employer;

- an additional agreement can be drawn up with conditions satisfying both parties.

The dismissal agreement, as well as all changes and additions to it, must be drawn up in writing.

When a fired person is paid

When the last working day arrives for a laid-off employee, along with the documents required by the employment service and a completed work book, the citizen is given the basic amount of funds, which includes his salary, bonuses, compensation - everything that is paid by the employer in accordance with the requirements of the law. After the second and third months without work - the amounts that the legislator determined in the form of the second and third salaries. In a situation where management refuses to apply for a third salary, the employee can write an official complaint addressed to the inspector who “guides” him at the labor exchange, after which measures will be taken to restore legality.

Cases of dismissal without payment of compensation

The Labor Code provides for the following cases of deductions from the company without payment of severance pay:

- Repeated refusal to perform duties without good reason, in the presence of one penalty.

- Absenteeism - absence from work or shift for more than 4 hours without good reason;

- Being at work under the influence of drugs or alcohol. This fact must be certified by a doctor, witnesses, and a corresponding act must be drawn up by the manager and head of the personnel department. The culprit must sign the act; in case of refusal, it is necessary to draw up an act of refusal;

- Disclosure of state, commercial or other secrets entrusted by official position, including personal secrets of an employee; loss of trust (theft, embezzlement, false information, etc.);

- Amoral behavior.

Is termination compensation taxable?

Compensation upon dismissal by agreement of the parties in 2021 is not subject to taxation. Only wage payments are subject to taxation.

Who is bigger?

For laid-off workers who worked under normal conditions, the maximum number of benefits received related to a forced break in work cannot exceed three. Those who worked in the Far North and in areas equivalent to them can receive six payments. This is the amount of salary due during the period of employment after layoff, taking into account the already listed severance pay (Article 318 of the Labor Code of the Russian Federation).

The funds received by employees during layoffs are a social guarantee for the duration of the job search, which may extend. It is worth spending money sparingly, rationally calculating all your expenses.

What is executive compensation?

How much salary is paid during layoffs? Typically, a person is paid only 3 average salaries, which includes severance pay and compensation for the period of employment, if a new place is not found in the 2nd and 3rd months from the date of termination of the employment contract. This is possible if the fired person applied to the employment center, but they did not find him a new place. However, in addition to these compensations, there are other amounts that must be paid to the retrenched employee.

- How to resign with compensation

Severance pay in the event of a layoff is due to all those laid off, but in order to receive the remaining amounts, certain conditions must be met: