Review of innovations

From January 2021, some points of Law No. 81-FZ “On State Benefits for Citizens with Children” of 1995 and Federal Law No. 418 of 2021 on monthly payments will change. Innovations were introduced by legislative act dated August 2, 2019 No. 305-FZ. The decree on this was signed by President V.V. Putin.

Previously, an employee wrote an application to the employer to provide benefits for children under one and a half years old. According to the new rules, in 2021 and 2021. it is necessary to apply for an extension of payments (on reaching 1 and 2 years).

That is, parents first ask for benefits for a child up to one year old, then up to two and three years old.

The calculation of the family budget has also changed. Instead of a 1.5-fold increase in the cost of living, a 2-fold increase was taken as the basis. Income will be analyzed every year.

From 01.01.20, a new benefit will be introduced, which will be paid to parents of children 1.5-3 years old. Low-income families will be eligible. The payment amount will be calculated for each region separately. It was equated to the subsistence minimum, which is required for a child.

New child care benefits from May 11, 2021.

On May 11, 2021, Vladimir Putin announced new measures to support families with children. If we briefly summarize what the President said, this is the bottom line.

New Presidential Decree:

- The payment is 5,000 rubles to everyone who was entitled to it before. Additional benefits will be received by families whose children were born from April 1, 2021 to July 1, 2021 (for each child under 3 years of age). The benefit will be for April, May, June of the current year.

- Also approved is the payment of 10,000 rubles to Russian citizens living in Russia for each child aged 3-15 years.

An application for receiving payments can be submitted to the pension fund until October 1, 2021 according to the usual scheme.

Who should?

The state will pay the new benefit for up to 3 years only to needy families with low-income status.

Until 2021, families whose income for each member did not exceed 1.5 subsistence minimums were considered low-income. From 2020, a new standard is being introduced - 2 living wages per person

. The increase in the need criterion is determined by amendments to the law on monthly payments to families with children. According to legislators, changing the criterion of need, along with other measures, will help overcome the demographic crisis and increase the birth rate in the country.

Increasing the norm from 1.5 to 2 subsistence minimums per person will significantly expand the circle of recipients of government assistance. The Russian government hopes that additional funding will provide an incentive to have a child for couples who are delaying this moment.

An increase in benefits to 3 years from 2021 and a revision of the need criterion will provide payments to almost 70% of Russian families who have had their first or second child. Currently, the percentage of recipients is significantly lower - according to Rosstat, it was 40-46%.

Who will be left without benefits for children from 1.5 to 3 years old?

According to the law, not all parents can qualify for government support. The right to receive it is lost:

- Families where the monthly income per person exceeds twice the minimum subsistence level.

- Parents who will not be able to confirm their income (with salary certificates and other official documents).

- Citizens whose children are supported by the state.

- People living in Russia but without citizenship.

- Guardians, parents, legal representatives in respect of whom there is a court order to deprive or restrict parental rights.

- Russian citizens who have left the country for permanent residence.

The law provides for the abolition of monthly compensation for non-working mothers in the amount of 50 rubles. From January 1, this amount will increase to the subsistence level for children in the area.

Monthly allowance for children of military personnel

How much they will pay for child care under 3 years of age in 2021 from work and from the state budget is now clear. What if the child’s father does not work, but is drafted into the army and is undergoing military service?

Conscripts are entitled to an allowance of 2,000 rubles, and married men - 4,000 rubles. But these funds are not enough if the child and his mother are left at home on maternity leave. Therefore, the government provides additional benefits for children of military personnel.

Now the benefit has increased to 12,219 rubles. This amount is valid from February 1, after indexation. The amount does not depend on the region of residence. Payments are due until the child reaches 3 years of age.

Benefits are planned to be increased further. In addition to the annual indexations in February, it is also planned to change the bills in the direction of increasing benefits.

Main conditions for receiving benefits for children under 3 years of age

The basic conditions for receiving a monthly allowance for caring for a small child are set out in Law No. 305-FZ and in Articles 1, 6 of Federal Law No. 418.

- The innovations apply only to the 1st or 2nd child born or adopted no earlier than 01/01/2018.

- The income of 1 family member per month is no more than double the regional subsistence level (calculated for the 4th-6th month of the previous year).

- The child and his parents or guardians must be Russian citizens and permanently live in the country.

The mother has the right to apply for government assistance. If she is deceased or has limited rights, the money is received by the father, adoptive parents or guardians.

Federal Law No. 418 does not provide for the accrual of benefits for a third child. However, in some regions exceptions are made for large families. Conditions for receiving money:

- The family must be low-income.

- The region where she lives should receive subsidies to help parents with many children.

The amount of the benefit in this case is calculated in the same way as for the 1st or 2nd child.

Will payments increase next year?

Every year, social payments are increased by a special factor, i.e. they are indexed. For the current 2021, indexation coefficients are established by Decree of the Government of the Russian Federation dated January 28, 2021 No. 73.

The amount of maternity capital in 2021 is 483,881 rubles 83 kopecks.

It is possible to increase the child benefit by changing the set of regional and municipal measures to support families with children.

The amount of child benefits, depending on the level of the minimum wage or the cost of living, increases simultaneously with the growth of these indicators.

Find out about the minimum wage in 2021 here.

From what funds will benefits be paid?

Previously, money for children aged 1.5 to 3 years was paid by the organization where the mother or her substitute (father, guardian, etc.) worked. The amendments made to the law exempt the employer from these expenses. New payments will be made from the state budget.

To apply for benefits for caring for the 1st child, the mother must contact the social protection department at her place of permanent registration.

State assistance for the 2nd child is assigned from funds issued under the maternity capital certificate. To do this, you need to have some free money left in your account. If they were spent on other purposes, no payments will be made.

“Putin’s” contributions for the poor

“Putin” or “presidential” benefits are special deductions for families with a low level of financial security. Assigned if the average per capita income is less than 2 subsistence minimums in the region. Payments are valid not only from 1.5 to 3 years. They can be received from the birth of the baby until he reaches 3 years of age.

For reference!

If the family income is less than 1 subsistence minimum per capita, then the payment of benefits continues from 3 to 7 years, but in a smaller amount. However, benefits for children 3-7 years old deserve a separate article, and in this material we will consider “Putin’s” deductions up to 3 years.

The benefit is assigned to families where the first or second child has been born since 01/01/2018. It is also available to adoptive parents. In the second case, the date of adoption will be taken into account, not the birth of the baby. For example, if a child was born on December 10, 2017, and was adopted into the family in 2019, the right to benefits remains.

Look at the same topic: What documents are needed to return 13 percent from the purchase of an apartment

In addition to low income and the baby’s date of birth, the family must meet the following conditions:

- the child is not fully supported by the state;

- parents are not deprived of parental rights;

- both the baby and his parents are citizens of the Russian Federation and permanently reside in the country.

How much will they pay for child care under 3 years old in 2021 for the first and second child? The amount of deductions is equal to the child's monthly minimum wage in the region of residence of the family. The amount is taken for the 2nd quarter of the previous year. There is no single size of “Putin’s” benefits; the number varies in each individual region. On average, cash contributions amount to 11 thousand rubles.

How much will they pay for child care under 3 years of age for a third child in 2020? Payments for the third child are not allowed as part of the “presidential” deductions. The family can only count on one-time payments - mortgage repayment in the amount of 450 thousand rubles, maternity benefits. Child care benefits are also paid, but only up to 1.5 years and according to the standard formula. Even if the family is low-income, once the baby reaches 18 months of age, funding will stop.

If the first baby is born, preferential funds will be paid by social protection authorities. The Pension Fund allocates funds for the second child, and they are taken from the maternity capital for him. In this regard, you cannot spend the certificate funds, otherwise you will not be able to receive monthly deductions.

Important!

Children are counted by mother (in case one or both in the family already have children from a previous marriage).

New amounts of other child benefits

New indexations of child benefits are planned from February 2020. The amounts will increase by 1.038 times. Young families will receive one-time payments from the Social Insurance Fund:

- For visiting an antenatal clinic before 12 weeks of pregnancy (Article 10 of Law No. 81-FZ) – 680.4 rubles.

- Upon receipt of a certificate of incapacity for work related to pregnancy and childbirth - 100% of the average salary (Article 8 of Federal Law No. 81 of 1995). Full-time female students receive a payment equal to the stipend, while contract employees receive a payment equal to their salary.

- For a child born after February 1 - one-time RUB 18,143.96. (Article 8 of Federal Law No. 81).

- Pregnant women whose husbands are serving in the Russian Army are entitled to reimbursement of expenses in the amount of 28,732.85 rubles. (Article 12.4 of the same law).

- The amount paid under the maternity capital certificate will be 453,026 rubles. (Clause 6 of Law No. 256-FZ of December 29, 2006).

The size of regular payments will also change. For caring for children under 1.5 years old, officially employed mothers will receive 40% of the average monthly salary for 24 months. The maximum amount is no more than 27,984.66 rubles. For wives of conscripts, the benefit will be 12,314.07 rubles. Additional payments are provided for single mothers with low incomes.

Legal field

Leave granted to persons caring for children under three years of age is distinguished by features in the granting procedure and nuances in design.

The main ones are reflected in Article 256 of the Labor Code of the Russian Federation:

- You can take advantage of your vacation in full or in part;

- the beginning of a possible vacation period is the last day of rest after childbirth, and the end is the child’s third birthday (vacation can be taken at any time during this period);

- provision is carried out on an application basis;

- management is obliged to retain the position and place of work of an employee on leave;

- neither the provision of rest nor the receipt of benefits interferes with the employee’s work when it is carried out at home or with a reduced working day;

- The time spent on vacation is taken into account in the length of service – general work experience and in the specialty.

It is important to know that there is a condition that may affect whether parental leave is included in the length of service. As soon as a person on maternity leave receives the right to early assignment of old-age benefits, then, according to Federal Law 216 of July 21, 2014, the time spent with the baby will not be counted toward the pension period.

The insurance period includes only the paid vacation period, since during it the employee makes contributions to the social insurance fund. The rest of the time is counted towards the total length of service.

Until the child turns 1.5 years old, the employee can count on benefits in accordance with 90 Federal Law (06/30/06), in the future, until the child reaches the age of three 1110 Presidential Decree of 05/30/94 and 1206 Government Decree of 11/03/94 established monthly compensation in the amount of 50 rubles.

In addition, the municipality has the right to assign additional payments to families with small children.

It is advisable to take leave immediately after the end of the period of rest received during pregnancy and childbirth. The benefit, which is designed to support the family until the child turns 1.5 years old, is accrued only from the day the leave is officially granted.

How to apply for benefits?

To receive a new payment, you need to write an application and attach a package of documents to it. Parents can receive money:

- By bank transfer to an account or plastic card. You can receive money on the day of receipt.

- Transfer via Russian Post.

The accrual periods are specified in Article 17.2 of Law No. 81-FZ of 1995. Money transfers are made before the 26th of each month.

The following can apply:

- working women on maternity leave;

- mothers are military personnel and employees of the Ministry of Internal Affairs;

- university students on academic leave;

- employed women who were on maternity leave during the closure of the enterprise;

- unemployed women married to men, employees of the Ministry of Internal Affairs, Civil Defense and Emergency Situations, living in remote areas where there are no suitable vacancies for them.

Having received the application and a package of necessary documents, the social protection authority checks them. 10 days are given for review and acceptance. Social protection employees have no right to delay the resolution of the issue any longer. If the applicant is registered with the employment center, an interdepartmental request may be made. The law allows two days for this.

At the end of this time, social security or the pension fund department are required to notify parents that they have received benefits. In case of refusal, officials are required to justify their decision from the point of view of the law.

The money is accrued from the moment the child is born or adopted. Parents must contact government authorities within six months. If the application arrives later, benefits will be accrued only from the day the documents are submitted.

New benefit amount for BIR in 2020.

In almost every region of our country, the employer pays such assistance. Moreover, everyone knows about the need for such transfers, but they are still of a declarative nature.

In some regions, the FSS, as an experiment, launched a program for independently accruing and paying out this money.

Despite the fact that the project was launched quite a long time ago - in 2011, by 2021 not all regions are its participants.

To have an idea of payments under BIR, consider the following table:

| Employed women | salary (average) for the entire vacation according to BIR, namely: 140 days if the birth took place as standard, 156 days when premature birth is meant, 194 days if the pregnancy was multiple |

| Smallest transfers to employed people | 51918.9 rubles, 57852.49 rubles, 71944.76 rubles for each of the above cases, respectively |

| The largest amount of payments to employed people | RUB 301,095.89, RUB 335,506.85, RUB 417,232.88 |

| If a woman received a salary of 35,000 rubles | RUB 161,095.89, RUB 179,506.84, RUB 223,232.87 |

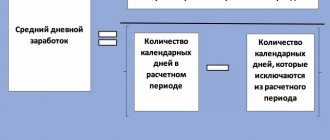

The calculation is carried out as follows:

- For a woman who wants to take BIR leave in 2021, the amount due will be calculated based on her salary for 2021 and 2018.

- These years are not leap years, which means the calculation base will be 730 days.

- Then they will calculate the total amount of payments for the 2 specified years (35,000 * 12 * 2 = 840,000 rubles)

- The resulting value is divided by 730 to get the average earnings per day (840,000: 730 = 1,150.684 rubles).

- The quotient is divided by the number of days that a woman is entitled to under the BIR (if 140, then 1150, 684*140=161095.89 rubles).

Payments to children under three years of age 2021: large families, low-income people, amendments dated March 25, 2020.

When calculating the maximum benefit, the limit on average daily earnings for 2021 and 2021 is taken into account. (755000+815000):730=2150.68493151.

We multiply the resulting number by the number of vacation days.

When calculating the minimum benefit, the lowest average daily earnings are used. 11280*24:730=370.849. It is multiplied by the number of maternity days.

Attention! Unemployed women will be paid only 655.49 rubles. Also, a working woman will not receive BIR benefits if she was not registered at the antenatal clinic. She will also have to be content with the specified amount.

The money must be transferred by the accounting department no later than 10 days after acceptance of the application or the next official payment.

To do this, a pregnant woman brings a sick leave certificate to the accounting department. If payments are processed through the Social Insurance Fund, the money arrives on the 26th of the month following the submission of the application.

If a woman works in two places, she will receive BIR benefits everywhere.

The amount of the new benefit for a child from one and a half to three years old

The amount of the new benefit is equal to the cost of living for the 2nd quarter of last year. The exact amount is set by the leadership of the region or region.

To calculate the amount of benefits, you need to take as a basis the year in which the application was submitted. An illustrative example: if a person applied in 2020, the subsistence minimum that was in effect in the 2nd quarter of 2021 is taken.

Families from Moscow who applied for child benefits in 2021 receive 14,329 rubles monthly (corresponding to the regional minimum in the 2nd quarter of 2021). This amount will be increased in the future.

Nuances of calculating the maximum benefit in connection with child care up to 1.5.

There are no restrictions in Russian legislation regarding the maximum amount of this assistance. But there is a limit on average earnings per day. But it is this indicator that affects the benefit in question.

The amount of average daily earnings must be less than the limits of the basis for calculating insurance transfers for the 2 years preceding the calculated one, divided by 730 days.

Based on the fact that the vacation will be in 2021, you can calculate the maximum amount of accruals.

For this:

- the size of the basis for calculating contributions is taken for 2021 and 2018. That is, 755,000 and 815,000 rubles, respectively.

- Therefore, the highest earnings are equal to (755000 + 815000): 730 = 2150.68 rubles.

- Then the resulting number (according to Federal Law-255) is multiplied by the average number of days in a year, namely 30.4.

- In the answer we get the largest salary in order to calculate the maximum possible benefit (2150 * 30.4 = 65380.82 rubles).

- This means that the parent will not receive a payment in connection with child care that exceeds 65,380.82*40%=26,152.33 rubles. It is this amount that must be transferred from the Social Insurance Fund.

The benefit is paid until the child is 1.5 years old or until the mother decides to go to work.

Payments are made by the employer or the Social Insurance Fund for the regions participating in the trial project. If a woman works in two places, she will receive a monthly transfer for up to 1.5 years in only one.

The assistance is calculated within 10 days. The transfer must occur no later than the 26th of each month. You cannot receive both a salary and a monthly allowance at the same time.

Circumstances under which benefits need to be recalculated.

Payment in connection with child care is calculated based on when the applicant went there.

If this happened in 2021, then when calculating in the case of the minimum wage, the indicator for the past two years will be used.

Thus, the smallest amount will be 4465.20 rubles. In 2019, there is no need to make any additional payments.

But there are also exceptions to the rules. For example, when a person interrupts the vacation in question, and takes it again in 2021.

In this situation, the benefit will be calculated according to the new values. The billing period will change. Instead of 2021, it will be 2021. This means that the amount of assistance will be different.

Does the amount depend on your region of residence?

The amount of the new child support benefit from 2021 depends on the region where the family lives. The average Russian required level of income to provide for children in 2021 is 11,004 rubles. In individual areas the amount differs greatly:

- In Moscow it is 15,225 rubles.

- The highest cost of living for residents of the northern regions is in the Kamchatka Territory (22,101 rubles), the Nenets Autonomous Okrug (20,584 rubles), and the Chukotka Autonomous Okrug (22,787 rubles).

- The lowest children's living wage is in the Belgorod region (9114 rubles).

When paying, the address where the family actually lives is taken into account, even if it does not correspond to the place of permanent registration.

Formulas for calculating “Putin’s” payments

First, the family needs to determine whether it is eligible to receive benefits. For this, the average per capita income must be below 2 PM. Basic rules for calculating average per capita income:

- Only parents and children (benefits for them) are taken into account; aunts and uncles, grandparents, and other relatives, even if they live in the same house, are not taken into account;

- the amount is calculated for the 12 months preceding the application for the benefit;

- income is taken into account before taxes;

- All payments (salaries, bonuses, social benefits, scholarships) are taken into account, with the exception of one-time payments due to distress (for example, due to flooding of a house).

Look at the same topic: Will a pensioner’s pension be indexed when he finishes working in 2021?

Income is added up monthly, then divided by the number of people in the family and compared with the monthly minimum wage in the region.

Example: the annual income of one family is 720 thousand rubles. This amount includes the husband’s salary, as well as benefits paid to the mother for caring for her second child up to 1.5 years old. There are 4 people in the family: mother, father and two children. It turns out that the allowance per person is 15 thousand rubles (720,000 / 12 months / 4 people).

The Petrovs live in Moscow, where the monthly wage for an able-bodied person is 20,195 rubles. Double PM – 40,390 rubles. Let’s compare: 15,000 versus 40,390. The Petrovs have the right to receive “Putin’s” payment.

How to calculate the deduction itself? It is equal to 1 PM per child in the region of residence. Some amounts for different regions of the Russian Federation:

- Moscow – 14889;

- Moscow region – 12540;

- Voronezh region - 9267.

For reference!

The highest deductions are in the northern regions. Thus, in the Magadan region they will pay 20,920 rubles, in the Kamchatka Territory - 22,101 rubles, in the Chukotka Autonomous Okrug (the highest amount) - 22,787 rubles.

The exact numbers for a specific region can be obtained from the social protection authorities.

Is the benefit taxable?

According to the letter of the Ministry of Finance of Russia dated July 3, 2012 No. 03-04-06/6-196, child benefits are not subject to personal income tax. An exception is payment for caring for a sick child if the mother takes out sick leave. This practice applies to employees.

If individual entrepreneurs and self-employed persons work under a simplified taxation system, they receive money for children from the Social Security Fund.

Is it possible to quit during this period?

You can quit your job at any time, including while on maternity leave. It is required to submit an application to the employer for voluntary resignation, receive compensation for unused leave, if any, and receive a work book.

Even if an employee has used her paid leave, she is entitled to a certain number of days during her maternity leave.

List of documents to confirm eligibility for benefits

Along with the application of the established form, a package of supporting documents is submitted to the MFC. This list includes:

- Birth certificates of children.

- Certificate of registration of the child at the place of residence.

- Passports of parents, guardians or persons who took the child into custody.

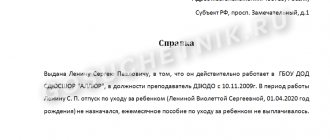

- Information about the income of the entire family for the last year. This includes certificates of employment, pension documents, scholarships for full-time students, and individual entrepreneur declarations. Part-time workers also provide certificates from their second place of work.

- Information from the employment center about receipt or non-payment of compensation if mom or dad is registered as unemployed.

- Details of the bank to which the funds will be transferred.

Adoptive parents and guardians may be asked to provide additional documents (court ruling on the appointment of guardianship and others).