Contract of donation of real estate in favor of relatives

The gift transaction, due to its gratuitous nature, presupposes the existence of a trust relationship between the parties. This kind of connection most often occurs between relatives.

Among them, it is worth highlighting close relatives, since the deed of gift in their favor has some features, for example, for tax purposes. So, among the close Art. 14 of the Family Code of the Russian Federation includes all first-degree relatives:

- children and parents (adopted and adoptive parents),

- grandmothers,

- grandfathers,

- grandchildren,

- siblings and half-brothers.

Spouses should also be included in this list, although they are not considered relatives and are only family members.

By concluding a deed of gift for real estate in favor of the specified persons, the donor transfers or undertakes to transfer to them an object that is his personal property: an apartment, house, cottage, garage, land plot, non-residential premises and other real estate or part thereof.

Since rights to real estate are subject to state registration, the property of the donee will become the property only at the time of registration.

Please note: the transaction of donation in favor of relatives has some peculiarities in terms of taxation, which we will touch upon later.

Property donation agreement

Home \ Services and activities \ Individuals \ Property donation agreement

Under a gift agreement, one party (the donor) gratuitously transfers or undertakes to transfer to the other party (the donee) an item of ownership or a property right (claim) to himself or to a third party, or releases or undertakes to release it from a property obligation to himself or to a third party.

If there is a counter transfer of a thing or right or a counter obligation, the contract is not recognized as a donation. An agreement providing for the transfer of a gift to the donee after the death of the donor is void. The rules of civil inheritance law apply to this type of gift. The recipient has the right to refuse it at any time before the gift is transferred to him. In this case, the gift agreement is considered terminated. If the gift agreement is concluded in writing, the refusal of the gift must also be made in writing. If the gift agreement is registered, refusal to accept the gift is also subject to state registration. If the gift agreement was concluded in writing, the donor has the right to demand from the donee compensation for real damage caused by refusal to accept the gift. Form of gift agreement A donation agreement for movable property must be made in writing in cases where:

- the donor is a legal entity and the value of the gift exceeds three thousand rubles;

- the contract contains a promise of a gift in the future.

In the cases provided for above, a gift agreement made orally is void. A real estate donation agreement can be concluded in simple written or notarial form. A real estate donation agreement is subject to state registration.

Prohibition of donation Donation is not allowed, with the exception of ordinary gifts, the value of which does not exceed three thousand rubles:

- on behalf of minors (under 14 years of age) and citizens declared incompetent, their legal representatives;

- employees of educational organizations, medical organizations, organizations providing social services, and similar organizations, including organizations for orphans and children without parental care, citizens receiving treatment, support or education there, spouses and relatives of these citizens ;

- persons holding government positions in the Russian Federation, government positions in constituent entities of the Russian Federation, municipal positions, civil servants, municipal employees, employees of the Bank of Russia in connection with their official position or in connection with the performance of their official duties;

Gift restrictions

- A legal entity to which a thing belongs under the right of economic management or operational management has the right to donate it with the consent of the owner, unless otherwise provided by law. This restriction does not apply to ordinary gifts of small value.

- Donation of property that is in common joint ownership is permitted with the consent of all participants in joint ownership.

- A power of attorney for making a gift by a representative, in which the donee is not named and the subject of the gift is not indicated, is void.

Cancellation of donation

- The donor has the right to cancel the donation if the donee has made an attempt on his life, the life of one of his family members or close relatives, or has intentionally caused bodily harm to the donor. In case of intentional deprivation of life of the donor by the donee, the right to demand in court the cancellation of the donation belongs to the heirs of the donor.

- The donor has the right to demand in court the cancellation of the donation if the recipient’s handling of the donated item, which is of great non-property value to the donor, creates a threat of its irretrievable loss.

- At the request of an interested person, the court may cancel a donation made by an individual entrepreneur or a legal entity in violation of the provisions of the law on insolvency (bankruptcy) at the expense of funds related to his business activities during the six months preceding the declaration of such a person as insolvent (bankrupt).

- The gift agreement may stipulate the donor's right to cancel the gift if he survives the donee.

- In case of cancellation of the donation, the donee is obliged to return the donated item if it was preserved in kind at the time of cancellation of the donation.

Consequences of harm due to defects in the donated item

Damage caused to the life, health or property of the donee due to defects in the donated item is subject to compensation by the donor in accordance with the rules provided for in Chapter 59 of the Civil Code of the Russian Federation, if it is proven that these defects arose before the transfer of the item to the donee, are not obvious and the donor, although he knew about them, he did not warn the recipient about them.

Share on social networks:

Gift deed for real estate to a stranger

Although donations in most cases are made between relatives, there are exceptions. If a deed of gift for property is drawn up in favor of other persons who are not related or have family relations with the owner of the property, the transaction proceeds according to the general procedure. There are no exceptions.

By the way, a deed of gift for real estate between strangers is often drawn up to cover up a purchase and sale transaction. In fact, such an agreement does not contain conditions for the transfer of money to the donor, otherwise it will not pass state registration, but in fact, due to these circumstances, it will be feigned, and therefore void.

The initiator of the illegal registration of the sale and purchase is usually the seller, since this will allow him to avoid paying personal income tax on the proceeds from the sale. However, the donee, who in fact is the buyer, must pay it.

Procedure for drawing up a donation agreement

The agreement of the parties to the deed of gift on the donation of this or that property, by virtue of Art. 572 of the Civil Code, requires the conclusion of a gift agreement. Since the registration of a deed of gift for real estate contains a number of nuances, in particular regarding the re-registration of rights to it, for the agreement, according to Art. 574 of the Civil Code, a mandatory written form is provided.

To confirm the legality of the transaction, many practice notarization of the agreement, but it is not mandatory.

An analysis of contractual practice for donating real estate allows us to identify several significant stages of registration:

- Preparation of documentation. The thoroughness of this stage directly affects the outcome of the transaction.

- Drawing up the text of the contract. An equally important stage, since the legal force of the document depends on the literacy of its drafting. In addition to the standard ones, you should include mandatory details: the subject of the donation, the terms of the transfer, and so on. The drafting of the text should be entrusted to a lawyer. The agreement must be drawn up in at least three copies.

- Signing the contract. The document must be signed by all parties to the donation at once.

- State registration of rights. Carried out at the Rosreestr branch at the location of the property.

- Payment of income tax. Required only in the case of a gift between unrelated persons.

Specifics of the deed of gift

According to Art. 572 of the Civil Code, a deed of gift is a gratuitous transaction. It involves the transfer or promise of transfer of property, as well as the release or promise of release of the donee from some property obligations.

By receiving a gift, the recipient becomes its owner, and he does not have any obligations to the donor.

The recipient becomes the owner of the gift from the moment it is received, but in the case of real estate - from the moment the transfer of rights is registered in Rosreestr.

Another feature of a gift is that it does not form the common property of the spouses, which is especially important when donating in favor of a married person.

Basic requirements for a gift agreement

Since a deed of gift for real estate necessarily requires registration of the transfer of rights, a number of essential conditions and requirements regarding form and content must be met:

- the agreement must be drawn up in writing, otherwise it will not be able to register;

- the document must contain a number of traditional characteristics: names and passport details of the parties, the date and place of its conclusion, rights and obligations, and so on;

- essential condition, according to Art. 432 of the Civil Code, is a condition on the subject. This condition requires a detailed description of the gift itself, its characteristics, location, address, cadastral number and other metrics. Without specification, the contract will be void;

- the text of the agreement cannot contain counterclaims to the donee; a condition must be provided that the gift is gratuitous;

- no less important is the description of the method and moment of transfer of the gift, mention of the place of its transfer, the conditions for returning the gift, and other conditions;

- according to Part 3 of Art. 572 of the Civil Code, the contract cannot contain a promise to transfer a gift after the death of the donor.

Apartment donation agreement

An apartment is one of the types of real estate, therefore all the requirements specified above are imposed on the transaction of donating it. In addition, there are certain restrictions on donating apartments that are in common or joint ownership.

On significant shortcomings of the apartment, according to Art. 580 of the Civil Code, the donor is obliged to warn the donee.

To document the transfer of real estate, in accordance with Art. 556 of the Civil Code, it is advisable to draw up a transfer act. Find out more about what an apartment donation agreement is.

Garage donation agreement

Russian legislation does not contain specific wording for such a building as a garage, therefore we consider it a non-residential premises equipped for parking and repairing vehicles. The features of its design, location and quality of construction affect the nuances of its civil circulation, in particular, how a deed of gift for a garage is drawn up between close relatives.

If the object corresponds to the characteristics specified in Art. 130 of the Civil Code, it can be considered real estate, otherwise – a movable thing.

The main criterion that will determine a garage as real estate is a strong connection between the building and the ground, which can be realized through a foundation. If it is an easily portable or dismountable metal structure, it is considered a movable thing.

Since this is extremely important, before you issue a deed of gift for a garage, clarify which of the objects of civil rights it relates to. If the garage is real estate, donating it will require technical documentation, adherence to strict form, registration of rights, and so on.

In addition, such a gift, according to Art. 35 of the Land Code, will require the transfer of rights to the land plot, which is located under the garage.

If this object is located in a garage-building cooperative, a deed of gift for the garage to the son, according to Art. 218 of the Civil Code, is possible only after full repayment of share payments.

Form of agreement for donation of movable property

If the party that donates movable property is a legal entity, and the property that it wants to donate in its amount exceeds 3,000 rubles, then this transaction must be formalized in simple writing, by writing a donation agreement. There is one more exception when the gift agreement must be concluded in writing: if the donor intends to donate any thing in the future (Article 574 of the Civil Code of the Russian Federation) or it requires state registration.

Additionally

In other cases, the written form of the deed of gift can be considered optional. The transfer of ownership of the donated item itself will take place from the moment when the donor handed over this item to the donee, or the documents for it.

Example

Relatives decided to give the newlyweds household appliances as a wedding gift. They presented the documents at the banquet. From the moment the documents were presented, the newlyweds became the owners of this equipment. The transaction was made orally, by expressing the will verbally.

To avoid various possible disputes in the future regarding a valuable and expensive gift , it is better to conclude a transaction in simple written form , indicating all the necessary details of the parties, and also describe the object of the gift in as much detail as possible.

give a vehicle orally; this is not prohibited by law. But in order to re-register it in a specialized body, as well as to avoid various questions from tax authorities regarding property received as a gift, the deed of gift should be drawn up in writing . You can contact a notary office, where specialists will clearly and competently draw up the necessary document and give advice, but this is not necessary; you can draw up the transaction yourself.

Registration by a notary has a number of advantages :

- confirmation of the authenticity of the signatures in the contract, because the document is signed by the parties in the presence of a notary;

- if the contract is lost, you can restore the document by contacting a notary for its certified copy;

- the notary guarantees the purity and legality of the transaction;

- At the request of the parties, the notary provides consultation on issues related to the upcoming transaction.

The deed of gift must contain information :

- about the place of drawing up the contract;

- about the date of compilation, in words;

- about the parties to the agreement (full name, passport details, addresses of their place of residence);

- about the subject of the donation, i.e. its exact name, model, or details.

Attention

The contract should provide for a specific method of transferring the thing: direct delivery of the thing, symbolic transfer of the thing (for example, transfer of a key, delivery of documents for the thing, etc.).

It is also possible to stipulate in the contract that the donor is legally capable at the time of execution of the transaction and is aware of the actions he is performing. This is necessary to ensure that a dispute does not arise in the future regarding the invalidation of the contract. The agreement is signed in two copies by the donor and the recipient and is considered concluded from the moment of its signing.

Required documents for donation

To formalize the agreement, the parties to the donation must have in hand:

- documents proving their identity;

- documents confirming the donor's ownership: certificate of ownership, purchase and sale agreement;

- state registration certificate;

- technical and cadastral passports;

- extracts from the Unified State Register and house register;

- peer review report;

- documents confirming blood relationship or marriage of the parties.

The list of documents is not complete and exhaustive - the specific package is selected on an individual basis.

Where to issue a deed of gift

The legislation does not oblige the parties to the deed of gift to take any special steps when registering it. Having a package of necessary documents in hand, the parties can draw up an agreement on their own. However, to ensure the legality of the contract, it is recommended to contact a lawyer or notary.

Personal income tax on gift

Receiving a gift in the form of real estate is equivalent to receiving income, which, according to Art. 210 of the Tax Code, is subject to income tax.

Tax on gifted real estate in 2021, according to Art. 224 of the Tax Code, is 13% of the value of the object, established as a result of an assessment by an expert.

Payment of tax, by virtue of Art. 228 of the Tax Code, requires them to independently calculate the amount of tax, submit an income declaration to the Federal Tax Service and then pay the tax.

Please note that the need to pay tax when donating real estate arises only for recipients who are not relatives of the donor: blood relatives and spouses are exempt from such obligation (clause 18.1 of Article 217 of the Tax Code).

This approach is due to the actual lack of income, since the gift remains within the family budget. In addition, the presence of kinship, according to Art. 22.1 of the Fundamentals of Notary Legislation is the basis for the application of a special tax rate. Notarization of such an agreement is not mandatory.

Procedure for transferring a gift

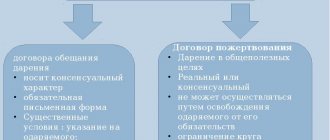

The procedure is significant in two cases:

- The transaction has a consensual structure;

- The agreement is not in writing.

When donating real estate, a transfer deed is not required - the donee becomes the owner at the time of state registration of the transfer of rights in the Unified State Register of Rights to Real Estate and Transactions with It (USRP), which is enshrined in Art. 223 Civil Code.

Additionally

A promise of gift gives rise to obligatory legal relations. To protect yourself, the donor should take care to document his actions with a deed of transfer, receipt, or receipt.

According to Parts 2 and 3 of Art. 158 of the Civil Code, an oral transaction can be concluded through the performance of implied actions that clearly indicate the intentions of the parties. Even silence can be an expression of will .

In the event of a dispute regarding the fact of conclusion and the conditions of an oral gift, the beneficiary can only refer to the transfer of the gift and testimony.

The transfer of a gift is possible by personal delivery of the thing, title documents, keys (Article 574 of the Civil Code); transferring them to a carrier or communications company for forwarding (Article 224 of the Civil Code).

If the property is already in the possession of the donee, it is recognized as transferred from the moment the agreement is concluded (Part 2 of Article 224 of the Civil Code).

The procedure for transferring certain types of property is established by special rules, for example: share in the authorized capital of a legal entity (Article 93); rights certified by securities (Article 146); debt obligations and right of claim (chapter 24).

Example

02.15.14 A. borrowed 12 thousand rubles. with relative T. The handwritten receipt indicates the date of return of funds - 07/15/14. On this day A. was unable to repay the loan. T. entered into A.’s position and forgave the debt, but did not draw up any documents on this matter. There was a family quarrel. On 06/20/15, referring to the receipt, T. filed a claim against A. for debt collection, compensation for the unjustified use of his funds from 07/15/14 to 06/20/15, and moral damages. A. opposed. He claimed that on July 15, 2014, an oral gift agreement was concluded between him and T.

The court satisfied the claim regarding the collection of the main debt and compensation for the use of other people's funds without sufficient grounds. He refused to satisfy the claims for moral damages.

In the text of the decision, the judge explained that the subject of the donation by virtue of Art. 572 of the Civil Code may indeed be the release of the donee from the debt to the donor. However, the legal relationship of gift stems from a loan agreement (Article 807 of the Civil Code), which was drawn up in writing by the plaintiff and defendant. By virtue of Art. 452 of the Civil Code, the agreement to terminate the contract must have the same form as the main transaction.

For the gift agreement, the existence of which the defendant claims, written form was mandatory. Its non-compliance by virtue of Art. 162 of the Civil Code entails the nullity of the donation. Thus, the primary loan agreement was not terminated.

Each party is obliged to prove the circumstances the existence of which it claims (Article 56 of the Code of Civil Procedure). The claims for moral damages were rejected due to the failure to provide the court with convincing evidence of its infliction.

State registration of deed of gift for real estate

Previously, all deeds of gift for real estate were subject to state registration, but Federal Law No. 302 dated December 13, 2012 abolished this norm for all contracts concluded after March 1, 2013.

Now only the transfer of rights to real estate to the donee is subject to state registration. To do this, the parties to the donation must contact the Rosreestr branch at the location of the property and provide the state registrar with:

- application for state registration;

- receipt of payment of state duty;

- identification documents;

- 3 copies of deed of gift;

- documents necessary for execution of the contract.

According to Art. 13 Federal Law dated July 21, 1997 No. 122, registration of the transfer of rights is carried out within 10 days from the date of submission of documents.