Termination of an agreement

How to terminate a real estate gift agreement, including between loved ones? In legal practice, canceling a deed of gift at the request of the donor is allowed on the following grounds (Article 578 of the Civil Code of the Russian Federation).

- If the donee - the person who received the property - committed illegal actions - caused bodily harm to the physical condition of the donor or his close relatives, the health of his family members. Cancellation is carried out on the basis of a medical report.

- In the case when the individual who received the gift does not treat it properly and commits actions that worsen the condition of the premises (object). In such a situation, the property can be returned according to the court order by presenting evidence confirming the facts or testimony of witnesses.

- If the donor finds himself in a difficult life situation and his physical or financial condition has deteriorated significantly.

- The agreement between the parties included a clause for the donor that the property would be returned to the original owner in the event of the death of the donee.

The basis for termination of the gift agreement in the above situations is the corresponding court ruling. It is also possible that it can be canceled at the request of the recipient. Practice shows that the reasons can be very different. If the transfer of the object by the donor was registered, then its cancellation must also be officially documented. Almost always, a waiver of execution must be certified by a notary, even if everything went by agreement of the parties.

This is also important to know:

Gift deed for an apartment with lifelong residence of the donor

There are cases when a gift transaction is canceled by decision of government authorities. This suggests that the procedure was carried out in violation of the law.

As a result of termination of the deed of gift, the gift is returned back to the donor.

How to terminate a gift agreement

The gift agreement can be terminated voluntarily by agreement of the parties. This procedure requires notarization. The gift agreement can be unilaterally terminated only through the court. The grounds for termination of donation transactions are determined by law: general rules are regulated by Chapter 29 of the Civil Code, special rules are provided for in Articles 577 and 578 of the Civil Code.

If there are several grounds for terminating a deed of gift, it is preferable to use all of them. This will enable the plaintiff to more fully and convincingly prove the existing violations in court.

If the gift agreement was executed by a notary, then the cancellation must also be carried out by a notary.

If the deed of gift has not been certified anywhere, then you will not have to visit any authorities or institutions to cancel it. You just need to keep a copy of the gift termination agreement.

If one of the parties to the contract wants to terminate it, but the other party opposes it, then it is worth filing a claim with the court for subsequent termination of the transaction.

Grounds for canceling a transaction

In order to cancel an agreement and recognize a gift agreement as invalid, the grounds provided for by civil law are necessary:

- general (cancellation of donation, refusal of the donee to accept property, non-compliance with the terms of the agreement)

- or special (determined personally for each case, by the donor or recipient).

Let's look at the general grounds for terminating a deed of gift. Almost any contractual agreement is concluded bilaterally. And then property rights are necessarily subject to state registration. A gift agreement is no exception. Its termination is regulated by Articles 166-179 of the Civil Law, and is explained by the nullity or disputed nature of the completed transfer of the object of the contract. If ownership rights were transferred before the dispute, after termination the state registration procedure will have to be repeated, but to the previous owner.

A transaction, the invalidity of which has been declared by a court decision, is called voidable.

A transaction concluded in violation of the law is void and does not require cancellation in court.

The deed of gift is invalid in the following cases:

- if the agreement was concluded only on paper, and the parties do not plan to fulfill its terms (the transaction is imaginary or feigned);

- the donor is declared incompetent due to a mental condition or has limited legal capacity by a court decision at the time of conclusion of the agreement;

- if the contract contains a clause according to which the transfer of the object must occur after the death of the donor. Such an agreement is void (Article 572 of the Civil Code of the Russian Federation), since in this case a will must be drawn up, which by its nature involves the transfer of rights precisely after the death of the benefactor;

- the transfer of property was accomplished through the use of violence, threats, deception, etc.

- the agreement was not documented or applied to the persons specified in Articles 575 and 576 of the Civil Code of the Russian Federation.

This is also important to know:

How to draw up a deed of gift for a house

The general grounds for termination of a deed of gift apply in the vast majority of cases.

Fact

The court will recognize the invalidity of an agreement where there is a clause according to which the recipient accepts the property in exchange for a counter service provided for the donor.

At the initiative of the donor

Termination of a gift agreement is possible at the initiative of the donor, that is, unilaterally, and is provided for in 3 cases:

- if the donee caused damage to the health of the donor or his immediate family;

- careless attitude of the donee towards the received object of non-property value;

- death of the donee.

The donor may refuse to transfer the gift in the future if:

- the financial situation or state of health of the person has unexpectedly changed for the worse and these circumstances do not allow the transfer of property without a significant disruption to the lifestyle;

- the act specified in the first paragraph of Article 578 of the Civil Code was committed. If a donation is refused due to the circumstances contained in the article, the donee has no right to demand compensation for losses.

Fact

Also, a donation may not take place due to death, loss of the object of donation, or a ban on transfer.

Free legal consultation We will answer your question in 5 minutes!

Ask a Question

Free legal consultation

We will answer your question in 5 minutes!

Ask a Question

Termination at the initiative of the donee

How is a donation agreement, for example, a land plot, canceled at the initiative of the donee? A person may refuse to accept a gift at any time before receiving it. Moreover, if the deed of gift was drawn up in writing and registered, the refusal of execution by the donee must also be drawn up in writing and registered.

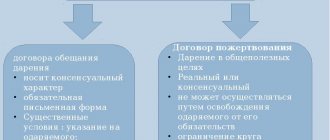

What form of gift agreement is appropriate in 2021

So, the form of deed of gift in 2021 directly depends on the following factors:

- transaction value, that is, the actual cost of the donated object acting as a gift;

- subjective composition of the parties to the donation;

- type of gift.

We remind you that the gift agreement today can still be concluded both in written and oral form.

In this case, most often, an oral agreement is used in transactions, the object of which is ordinary gifts of small value and property that does not require mandatory state registration, which, for example, includes real estate or vehicles.

In this case, the donation can be made both through the direct transfer of a gift from the donor to the recipient, and through a symbolic transfer (for example, transfer of documents for donated household appliances). Thus, the donation of movable property under a real contract can be made orally, if for this type of property the legislator has not established a mandatory procedure for registering the ownership rights of the new owner.

ARTICLE RECOMMENDED FOR YOU:

Donee under a gift agreement - rights and obligations

Exceptions may be cases when a legal entity acts as the giving party in a gratuitous donation transaction, and the total market value of the gift exceeds the threshold established by the legislator of 3,000 Russian rubles (according to the information provided in paragraph 2 of Article 574 of the Civil Code of the Russian Federation) .

Also, it is worth noting that the majority of practicing lawyers (including specialists from the Legal Aid website) consider oral deeds of gift to be problematic. This is confirmed by statistics according to which most of the claims related to the termination of gift agreements were concluded orally by the parties to the transaction.

Lawyer's Note

Based on the information specified in paragraph 3 of Article 574, as well as in Article 131 of the Civil Code of the Russian Federation, all gift agreements (both real and consensual) whose object is real estate must be concluded exclusively in writing. The reason for this is the fact that this type of property requires mandatory re-registration of ownership. In addition, according to paragraph 2 of Article 574 of the Civil Code, all gift transactions that contain a promise of donation must be formalized in writing.

If, by deed of gift, the donor transfers free of charge to the donee a transfer or claim of a debt (from the donor to the donee), then this transaction must be completed in accordance with the form indicated by paragraph 1 of Article 389 of the Civil Code of the Russian Federation for the assignment of a claim, or by paragraph 2 of Article 391 of the Civil Code RF for the transfer of debt obligations.

At the same time, a real gift agreement for debt forgiveness, the purpose of which is to free the donee from debt obligations to the donor, can be concluded in a free form.

Termination by law

How to terminate a deed of gift according to law? You can terminate in two ways:

- with the voluntary consent of both parties with the involvement of a notary;

- without consent - unilaterally, through the court.

Voluntariness of termination

To cancel a deed of gift, you may prefer a voluntary termination procedure. The parties need to draw up an agreement and have it notarized. If the procedure was carried out with registration of the transfer of an apartment or other property into the ownership of a new owner, then the registration must be done again.

This is also important to know:

How to issue a deed of gift for an apartment through the MFC for relatives

If an individual does not agree to accept the object, or the donor refuses to make the donation, then the transaction is canceled after a written statement from the relevant party.

Despite the fact that void transactions theoretically do not need to be recognized as invalid, practice proves that practically no one returns what they received voluntarily. Therefore, even in such a situation one has to resort to the help of the court.

Through the court

The deed of gift can be challenged unilaterally in court. Having legal grounds, the donor has the right to file a claim in a court of competent jurisdiction. These may be the reasons specified in Article 578 of the Civil Code of the Russian Federation, as well as certain special grounds that are determined to be significant for each specific case.

With the help of the court, the issue of the validity and objectivity of the reasons for the possible termination of the contract is resolved, since the parties are not able to resolve the dispute on their own due to different subjective assessments of the circumstances.

Both the parties who entered into them and interested parties have the right to challenge void or voidable gift transactions. For example, if the contract contains a clause according to which the item passes to the new owner after the death of the previous owner, the heirs and relatives of the deceased may challenge this agreement. Such an agreement is considered void, since in such cases it is necessary to draw up testamentary dispositions.

Deeds of gift executed by an incapacitated person or a citizen who at the time of the donation were in a limited capacity are considered invalid.

The procedure for the plaintiff to cancel the deed of gift through the court:

- Determine the basis on which the lawsuit will be filed.

- Find out the statute of limitations for the gift transaction - it must be more than 3 years.

- Collect evidence to substantiate the plaintiff’s case.

- Draw up a statement of claim detailing the circumstances of the case.

- Submit an application to the local judicial authority along with the relevant package of documents.

- Take part in legal proceedings until a final court decision is made.

Filing a claim

Recommendations for drawing up a statement of claim.

- Correct execution presupposes that all arguments must be supported by testimony or documents, and the requirements must have legal validity.

- Literacy and logic of presentation.

- Structure.

This is also important to know:

Features of drawing up a gift agreement between legal entities

The application must contain the following information:

- Parties' data.

- Description of the controversial situation.

- Evidence-based facts.

- List of attached documents.

- Date, signature of the plaintiff.

When filing a claim after registration, a state fee of 300 rubles is charged. Also, to represent the applicant’s interests in court, you need to hire a lawyer, the cost of whose services depends on his experience and professionalism.

The court is obliged to accept the filed claim for consideration. But sometimes situations arise when the judicial authority refuses to conduct a trial.

Reasons for refusal:

- filing a claim in a court whose jurisdiction does not include consideration of cases on the revocation of a gift;

- an incorrectly drafted claim;

- unreliability of facts and insufficient grounds for canceling the transaction;

- claims will lead to a violation of the law.

Limitation of actions

For gift transactions, the limitation period is no more than 3 years, the countdown of which begins from the day when the party to the contract or an interested third party learned about the transfer of the gift.

In some situations, it is possible to restore the deadline for filing claims against the contract. For example, causing physical harm to the person who made the gift.

Official termination of a registered contract is also not free. The higher the value of the property, the more expensive it is to cancel the transaction.

Consequences of cancellation of deed of gift

As a result of the cancellation of the contract, the previously completed donation is canceled, i.e. the gift is returned to the previous owner on the basis of clause 5 of Article 578 of the Civil Code of the Russian Federation.

If the object donated under the contract was sold, damaged, or lost, the donor must be compensated for the cost of the gift at the time of its receipt.

Peculiarities of cancellation of a real estate donation transaction

When terminating a housing donation agreement, there are some nuances:

- If the transfer of property was not registered by government authorities, then the transaction can be easily annulled. The deed of gift becomes valid only after its registration;

- if the transaction was registered, then its cancellation will have to be registered;

- termination of the contract is carried out in court.

This is also important to know:

Agreement on gift of funds between relatives, sample

Package of documents for cancellation of the transaction

Depending on whether the contract is terminated voluntarily or judicially, the list of documents required for the procedure varies. The main set includes the necessary documents:

- agreement confirming the fact of donation;

- passports of the parties;

- certificate confirming ownership of the property;

- documented facts of evidentiary nature for trial.

The legislative framework

What laws govern this? This very concept is contained in the Civil Code, which is quite natural for this legislative act, since it is he who is responsible for the description and regulation of transactions carried out on the territory of our country.

about donation and the nuances of the transaction in Chapter 32, namely, in Article 572.

But we are not interested in the system of carrying out the procedure, but in the situations in which it will be terminated . This issue is also regulated by the Civil Code, Article 578. Learn about the nuances of donating a share of an apartment to a minor child, in particular how to draw up an agreement for donating a share of an apartment to children, from our articles.

Cancellation of donation: difficulties

Controversial situations most often arise when real estate is given for free and it is difficult for the parties to reach a mutually beneficial agreement. Such an agreement can be terminated before the transfer of property in the following cases:

- mutual consent of the parties;

- refusal of the recipient to accept the gift. In this case, the donor may demand compensation from him for material losses;

- the donor's physical health or financial situation has deteriorated significantly.

After the property is transferred to the new owner, termination of the contract is permitted if:

- the donee received the gift illegally (deception, blackmail, etc.);

- the recipient of the gift treats it carelessly, which may lead to its irretrievable loss;

- the gift is not used for its intended purpose.

To cancel the transaction for these reasons, you must go to court.

Fact

If real estate is donated by a relative, then no tax is charged on it.

The process of canceling a deed of gift often ends not in the interests of the donor. The court may refuse to satisfy the claim, since the donee is able to challenge the claim by providing more compelling arguments and facts. Therefore, before presenting property to anyone as a gift, and later asking the question “is it possible to terminate the gift agreement,” you need to carefully weigh the pros and cons.

Grounds and reasons

The legislator identifies a lot of grounds that can become a reason for termination.

It would seem that what could become such a serious reason for cancellation?

But all these grounds were taken directly from judicial practice , which means they have the right to exist:

- The first reason is causing harm to the health of the donor or even an attempt on his life. This often happens when we are talking about a document in which one of the conditions is to receive housing as a gift only after the death of the donor.

- If there is a threat to the life of the donor’s family and loved ones from the donee, then this is also a reason for termination. Turning to judicial practice, we can find out that sometimes the donee, through blackmail, forces the donor to transfer the property to him. Blackmail often affects loved ones.

- If the contract specifies conditions for termination, then upon the occurrence of these conditions, it is terminated.

- Termination is also provided if the donee dies.

out how to challenge and terminate this agreement after the death of the donor from the video:

Read on our website about the peculiarities of the transaction of donating a share of living space between spouses, in particular how to draw up an agreement for donating a share to a husband or wife.