Sergey Rossol, legal consultant of Industrial and Commercial LLC

The purchase and sale of shares in a closed joint stock company is a very common transaction in business practice. Its participants are required to fulfill a number of legal requirements. However, legal practice has developed many ways to circumvent these restrictions.

The Civil Code defines a closed joint stock company as a company whose authorized capital is divided into a certain number of shares. In this case, shares are distributed only among the founders or other predetermined circle of persons (Articles 96, 97 of the Civil Code of the Russian Federation). A share is a registered security that secures the rights of its owner to receive dividends, as well as to participate in the management of the company and to part of the property remaining after the liquidation of the company (Article 2 of the Federal Law of April 22, 1996 No. 39-FZ “On securities market"). Thus, the activities of the CJSC are actually determined by the person who owns the controlling stake.

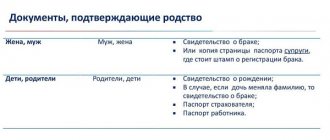

Donation of shares between relatives: degrees of relationship

From a legal point of view, the issue of family ties is of significant importance. The closeness of a group of persons' kinship is determined by degrees and lines. Thus, the family line formed by birth is divided into three main branches: ascending, descending and lateral. In accordance with the Family Code of the Russian Federation, relatives who make up the ascending and descending line are considered close. Degrees of relationship are divided into:

- I degree - mother, father, husband/wife, natural and adopted children;

Note that the spouses are not blood relatives, however, they have a degree of kinship, which implies a relationship between two persons through official marriage.

- II degree - half-sisters and brothers, grandparents;

- III degree - aunts and uncles, step-sisters and brothers;

- IV degree - great-grandparents;

- V degree - great-aunts, grandfathers, grandchildren and granddaughters.

Donation of shares between relatives: stages of transaction and registration

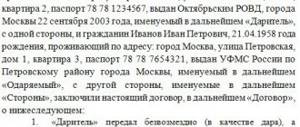

The procedure for the gratuitous transfer of shares is carried out in the presence of all parties to the transaction and a notary, in accordance with the norms of the legislation of the Russian Federation. The procedure for completing a transaction is regulated by Article 574 of the Civil Code of the Russian Federation.

Important! If a notarized document is lost, it must be restored.

Registration of a share donation agreement includes the following steps:

- Conclusion of an agreement according to which shares are transferred to the donee. The agreement takes legal force from the moment it is signed by all parties and the notary.

- Preparation of related documents.

- Completing the application form in accordance with the recipient’s passport.

- Making amendments and registering in the register of shareholders about a change in the owner of registered securities.

The drawn up agreement for the donation of shares is registered by the state registrar and after this, the rights to own the securities are completely transferred to the donee, this fact is confirmed by the issuance of the corresponding certificate of state registration of ownership. All changes are made by the registrar of the shares of the relevant companies in accordance with the provided gift agreement, transfer order, written consent of the parties to the agreement (Article 8 of the Federal Law “On the Securities Market” No. FZ-39, adopted in execution on April 22, 1996).

The procedure for transferring ownership of shares

By concluding a gift agreement, the donor transfers to the donee, along with the shares, the property rights contained in them. But the methods of transferring such rights vary and depend not only on the type of shares (certificate or uncertificated), but also on their classification. Depending on the subject of rights certified by a particular share, they are divided into registered, bearer and order.

The transfer of rights under documentary shares is provided for in Article 146 of the Civil Code. Thus, documentary bearer shares can be donated under a gift agreement by simply delivering them to the donee. order papers are served free of charge , only a special endorsement .

The rules established for the transfer of bills of exchange apply to this case. If registered shares a personal endorsement is made on them or the same procedure is applied as established for assignment (assignment of a claim).

For your information

The greatest difficulty arises when donating registered shares. Since the transfer of rights to the donee specified in the shares is carried out at the time of making the appropriate note in the accounts, which is entered on the basis of the transfer deed. In this case, both parties to the gift agreement or one of the parties must be present if the deed of transfer is notarized.

The uncertificated form of shares affects the mechanism of their transfer from the donor to the donee. First, the shares are debited from the account of the person who alienates them (donates them). Further, by his order, the shares are credited to the account of the person accepting them as a gift. The rights to uncertificated shares, as well as the rights that they certify, are considered transferred to the donee after making a credit entry on his personal account in the register of securities owners. For this purpose, the registrar is provided with a transfer order and other documents required by law.

The transfer order is not a document equivalent to an agreement. It only expresses the above-mentioned order of the donor to write off a certain number of shares owned by him from his personal account in the register and credit them to the donee’s account (clause 3.9 of the Procedure for opening and maintaining by holders of registers of securities owners personal and other accounts, subclause 3.4.2 of clause 3.4 of Regulation No. 27 on maintaining the register). In other words, the transfer order is, as it were, a preliminary conclusion by the parties of a share donation agreement.

Donation of shares: required documents

The procedure for the gratuitous transfer of securities (shares) between individuals (relatives) involves a certain package of documents, which must be prepared individually in each individual case. The list of basic documents required to formalize a gift transaction includes:

- original documents identifying both parties to the transaction;

- personal information of each participant (full name, place of residence/location);

- taxpayer identification numbers of persons who are parties to the transaction under the share gift agreement;

- a certificate confirming ownership of the securities that are the subject of the gift agreement;

- transfer order signed by the shareholder himself, certified by a notary or an authorized person appointed by the registrar.

Also, if necessary, the following additional documents may be required:

- consent of both parents or guardian - if one of the parties to the transaction is a minor;

- consent of the guardianship and trusteeship authority - if the conclusion of a share donation agreement is made in favor of a minor;

- consent of the second spouse - if the shares were acquired jointly by spouses who were officially married at the time of concluding the securities purchase and sale agreement.

Features of donating shares in CJSC and OJSC

Shares are securities that confirm the right of their owners to participate in the life of a joint stock company (JSC) and receive income from its activities.

Shares can be donated under a gift agreement (hereinafter referred to as DD), taking into account several features:

- Shares can be either documentary or non-documentary. In the first case, it is enough to transfer them to the donee; in the second, it is necessary to draw up a written DD.

- When donating registered shares, a personal endorsement is required.

- If uncertificated shares are given, the rights guaranteed to their owner are transferred to the donee.

- The DD cannot indicate the transfer of papers to the donee after the death of the donor - the transaction is considered void, it is better to draw up a will (Article 572 of the Civil Code of the Russian Federation).

Important! Shares can be transferred either after signing the agreement or after some time. The law allows for the execution of a contract of promise of a gift, the execution of which begins on a certain date or event specified by the donor.

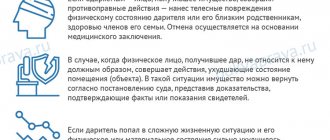

Are shareholders given priority rights when making a gift to a third party?

According to Art. 41 Federal Law No. 208-FZ dated December 26, 1995, when alienating securities, other shareholders must be notified in the prescribed manner, and they are given a pre-emptive right to purchase.

This rule applies only to paid transactions. The donation is free of charge, so other shareholders will not be able to take advantage.

Some, instead of a purchase and sale agreement, draw up a deed of gift to transfer shares to a third party, bypassing the remaining shareholders.

It is important to take into account that such a transaction may be considered sham on the basis of Art. 170 of the Civil Code of the Russian Federation, i.e. concluded to cover up another transaction.

Legal advice: if you need to sell valuables, it is better to draw up a purchase and sale agreement and not try to deceive others. If an interested person learns of a violation of his rights to pre-emptive purchase, it is possible to challenge the transaction in court, but he will have to prove the fact that the donor received the money.

Elena Plokhuta

Lawyer, website author (Civil law, 7 years of experience)

Complete the survey and a lawyer will share a plan of action for a gift agreement in your case for free.

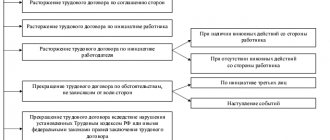

Share donation agreement

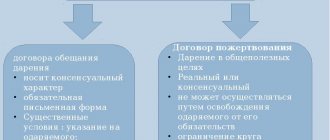

A donation agreement for registered securities is an agreement on the gratuitous and irrevocable transfer of shares into the ownership of another person. All subjects of civil law can be parties to the agreement, and the transfer of shares between individuals is carried out subject to official confirmation of the donor’s legal capacity.

According to Art. 576 of the Civil Code of the Russian Federation, legal entities have restrictions on the gratuitous transfer of securities. The legislation also provides special guidance regarding transactions where states and other subjects of civil law act as recipients (Article 582 of the Civil Code of the Russian Federation).

A person acting as a donee has the right to refuse the gift until the agreement is registered with government agencies. Refusal of the gift must be made in writing.

The rights of the donee do not pass to his heirs, except in cases provided for in the gift agreement. In turn, the obligations of the donor may pass to his heirs (unless otherwise provided by the terms of the gift agreement). In our case, the subject of the gift agreement is shares, that is, the full characteristics of registered securities. The cost and term of the share gift agreement are not essential terms of this agreement. The form of a standard agreement for the donation of shares is determined by clause 2 of Art. 574 of the Civil Code of the Russian Federation, which provides for the procedure for drawing up real agreements, where the donor is a legal entity, and the cost of which is more than 3 thousand rubles.

The legislation of the Russian Federation does not allow the donation of registered securities (shares):

- legal representatives of minors and incapacitated citizens;

- commercial organizations;

- employees of state educational and medical organizations, as well as employees of social services, including those working in institutions for orphans and children without parental care, citizens undergoing treatment and support, as well as their spouses and relatives;

- persons holding public positions in municipal organizations, the Bank of Russia, in government agencies, in connection with the performance of their official duties.

The share donation agreement is accompanied by an additional agreement, a protocol of disagreements and a protocol of reconciliation of disagreements.

Third Parties - Law - Restrictions.

The topic of acquiring shares in a Closed Joint Stock Company has always been relevant, since the transaction itself is associated with compliance with a number of formalities and legally important points.

It's no secret that closed joint stock companies are much larger than open companies, and therefore the distinctive characteristics of these, at first glance, similar organizational and legal forms are quite large.

When establishing any joint stock company, the first thing that focuses on is the ability to dispose of shares. Shares have recently become one of the most common types of equity securities, which could not but affect the practical side of the disposal of this type of property.

Federal Law of December 26, 1995 N 208-FZ “On Joint-Stock Companies” establishes that shareholders of a closed joint-stock company have a preemptive right to purchase shares sold by other shareholders of this company at the offer price to a third party in proportion to the number of shares owned by each of them, if the company’s charter no other procedure for exercising this right is provided.

The company's charter may provide for the company's preemptive right to purchase shares sold by its shareholders, if the shareholders have not exercised their preemptive right to purchase shares.

In an OJSC, it is not allowed to establish the preemptive right of the company or its shareholders to acquire shares alienated by the shareholders of this company. The purchase and sale of shares in a closed joint stock company, as can be noted above, is always associated with the use of preemptive rights, which are given a special place in resolving controversial issues.

There are not many regulations governing the activities of joint-stock companies, and the rules regarding the application of pre-emptive rights in companies are either strictly limited or not clear, which is why judicial practice related to disputes regarding the application of pre-emptive rights today is confidently gaining ground and is a widespread phenomenon .

And yet, let’s try to establish whether a shareholder of a closed company can sell his shares to a third party, that is, not a shareholder of this company, and what he should pay attention to.

From the wording of the article of the Federal Law it follows that closed joint stock companies have a pre-emptive right to purchase shares sold by other shareholders of this company at the offer price to a third party in proportion to the number of shares owned by each of them, unless the company's charter provides for a different procedure for exercising this right.

At least three questions immediately arise. The first question: “If the shareholders exercised their pre-emptive right to purchase shares in proportion, but the shares still remained, how and to whom should they be placed next, the company or a third party?”

Question two: “If all the shareholders of the company decided to exercise their pre-emptive right and redeem the alienated shares according to the law in proportion to their shares, what to do if there were not enough shares and the proportions could not be maintained, what will be the procedure for satisfying applications from shareholders?”

Question three: “Is it possible in the charter to provide for the procedure for the acquisition by shareholders of shares alienated by the company to third parties. Does the company itself have the right to acquire unclaimed shares and sell them to third parties?”

There may be significantly more questions, but is there any point in asking them if the current legislation of the Russian Federation does not provide comments on controversial issues that often occur in practice, but only answers with one wording, for example, “... unless the charter provides otherwise.”

However, Federal legislation establishes the following: “a shareholder of a company who intends to sell his shares to a third party is obliged to notify in writing the other shareholders of the company and the company itself, indicating the price and other conditions for the sale of shares.

Notification of the company's shareholders is carried out through the company. Unless otherwise provided by the company's charter, notification of the company's shareholders is carried out at the expense of the shareholder who intends to sell his shares.

If the shareholders of the company and (or) the company do not exercise the preemptive right to acquire all shares offered for sale within two months from the date of such notification, unless a shorter period is provided for by the charter of the company, the shares may be sold to a third party at the price and on the terms and conditions communicated to the company and its shareholders.

The period for exercising the preemptive right provided for by the company's charter must be at least 10 days from the date of notification by the shareholder intending to sell his shares to a third party, the remaining shareholders and the company.

The period for exercising the preemptive right is terminated if, before its expiration, written statements on the use or refusal to use the preemptive right are received from all shareholders of the company...”

Thus, we received an affirmative answer to the question of whether it is possible to sell shares to third parties. It is much more difficult to carry out this transaction without violating either the rights of shareholders guaranteed by law, or the rights of the participants in the share purchase and sale transaction themselves.

It is obvious that it is impossible to provide answers to all situations in laws, which is why in closed companies it is possible to determine in detail the methods and stages of exercising the preemptive right by shareholders by introducing additional provisions into the company’s Charter.

The company's charter can provide for the terms and methods of payment for alienated shares, as well as the procedure for the acquisition of shares by the company itself and third parties, the procedure for notifying shareholders and reimbursement of expenses related to this notification, indicate the procedure for convening a general meeting of shareholders, at which the issue of selling a block of shares will be discussed and other points.

Let’s say that if a shareholder owns thirty percent of the shares, according to the Charter, he will have the right to convene a general meeting of shareholders, the quorum for making a decision must be 100%. The General Meeting of Shareholders must be accompanied by the presence of the sole executive body, in the person of whom the Company itself is notified.

All these conditions will make it possible to prevent conflict situations between shareholders in the future and to legitimately carry out transactions for the alienation of shares. If the company's Charter does not contain information specifying controversial issues, when selling shares in violation of the preemptive right of acquisition, any shareholder of the company and (or) the company has the right, within three months from the moment the shareholder or company learned or should have learned about such a violation, to demand judicial transfer of the rights and obligations of the buyer to them.

We should not forget about the prohibitions dictated by our legislation. Sale of fewer or more shares than was indicated in the notice, sale of shares at a price different from the offer price in the notice, violation of the procedure for the alienation of shares, as well as their sale after the expiration of the established period, etc. are grounds for declaring such a transaction invalid in court.

Shares may not be sold or otherwise transferred until they have been fully paid for and state registration has been completed. State registration of the issue of shares is carried out only by the Federal Service for Financial Markets.

Donation of shares: taxation

Article 572 of the Civil Code of the Russian Federation determines that an agreement for the donation of shares is a gratuitous transaction; accordingly, the property that is the subject of the agreement is transferred to another person absolutely disinterestedly, which is the basis for eliminating the need to pay state duty. If a share donation agreement is concluded between relatives, the recipient is exempt from paying personal income tax, however, the tax return form 3-NDFL must still be submitted to the territorial tax service within the period established by law (Article 217 of the Tax Code of the Russian Federation) .

In cases where the donation of shares is made in favor of a commercial organization, and the completed transaction will not be contested by third parties in the future (which may be possible due to its insignificance due to the commission under the influence of a threat, delusion, confluence of difficult circumstances, Article 179 of the Civil Code of the Russian Federation), then income that was received in the form of a share or share under a gift agreement will be non-operating income for the recipient organization (Article 250 of the Tax Code of the Russian Federation). In this case, apply the provisions of paragraphs. 11 clause 1 art. 251 of the Tax Code of the Russian Federation is impossible, since a transaction under a gift agreement certifies the property rights of the participant in the agreement. In cases where a share donation agreement is drawn up by a commercial organization in favor of an individual, the cost of securities for the donor will be considered an expense that does not affect the amount of taxable profit (Clause 16, Article 270 of the Tax Code of the Russian Federation).

The income of an individual received by a taxpayer in the form of the value of a share from a legal entity worth no more than 4 thousand rubles is not subject to personal income tax (clause 28 of Article 217 of the Tax Code of the Russian Federation).

If the donee, being an individual, has any partnership with the donor, as a result of which the taxpayer received cash income, then the donor is obliged to pay the calculated amount of tax from the funds withheld from the taxpayer (clause 4 of article 226 of the Tax Code of the Russian Federation, clause 6 Article 226 of the Tax Code of the Russian Federation). Otherwise, in the absence of a mutually beneficial relationship between the donor and the recipient, the latter must independently calculate the amount of tax and pay it within the established time frame (Articles 225-226 of the Tax Code of the Russian Federation).

At the same time, the donor acquires the obligation to provide information in writing to the territorial tax authority within 1 month about circumstances that have arisen that make it impossible to withhold tax in the amount of the taxpayer's debt (clause 5 of Article 226 of the Tax Code of the Russian Federation). The fact of occurrence of circumstances is determined by the calendar date of actual receipt of income by the person who received the securities as a gift.

In cases where the gift of shares occurs between two individuals, the recipient must independently calculate the amount of tax and pay it to the appropriate state budget. In accordance with clause 18.1 of Art. 217 of the Tax Code of the Russian Federation, income that was received as a result of donating shares is exempt from taxation if the parties to the agreement are family members (including close relatives), if there are documents confirming this fact.